Oct 6, 2019

Can DailyHunt Beat Facebook in India?

Profile

Social Network

Entertainment

Aggregator

Series E-G

B2C

Last fortnight, DailyHunt was in the midst of closing its $30MM+ funding round to take it north of a $500MM valuation.

Connecting Indian People

“If you talk to a man in a language he understands, it goes to his head. If you talk to him in his language, it goes to his heart” - Nelson Mandela

There used to be a time when Nokia phones were the hottest thing on the market.

In 2007, Nokia phones made up more than 50% of all cellphones in India, but it was during this hey-day that two of their employees, Umesh Kulkarni and Chandrashekhar Sohoni decided that they had other plans.

The soon to be founders of NewsHunt realized that there was a major market inefficiency in India. People wanted to consume news in their vernacular language and on their fingertips, but the functionality to do that simply didn’t exist.

The reason was that the internet was built for English speaking users.

English language content accounted for 56% of the content on the internet and Indian languages accounted for less than 0.1%.

To solve this problem, NewsHunt was created for Symbian and Java operating systems - a challenge at the time because these OS’ didn’t support vernacular fonts.

At inception, NewsHunt was a fantastic idea that was simply before its time.

India was in connection-infancy, and lacked a critical mass of people who used their phone for anything other than making calls. However, there would soon be an industry and company announcement made by a tiny OS provider called Android owned by a slightly larger internet company called Google.

In late 2008, the operating system Android was announced by Google. This would change the mobile ecosystem forever.

The announcement created a ripple effect of telecom operators putting in more money into network development and phone manufacturers focusing on hardware while licensing software.

NewsHunt suddenly had a platform that they could build their app on and a market innovation that would soon put a smartphone into the hands of over 400 million people.

NewsHunt was on the map.

Targeting the Untargeted

NewsHunt in its original form was a regional language news aggregator.

It aggregated content from over 100 newspapers in 12 languages across India. The company was app-focused and mobile agnostic.

The market they were targeting at the time was much larger in volume and more effectively targeted than what bigger pocketed and international players like Facebook had in mind.

NewsHunt hypothesized that building a platform solely around blanket ad monetization will not work in India like it might have done before in the US and Europe. The result was thousands of users flocking to the app.

It was no surprise that they were a prime acquisition target – and were bought by Verse Innovation, which was primarily involved in job classifieds alerts. Subscription businesses in India had been struggling with growth and regulatory issues, and saw the mobile web as a massive customer acquisition channel waiting to be exploited.

The Verse-NewsHunt marriage made all the sense.

With the acquisition, Verse’s CEO Virendra Gupta took over DailyHunt, and Umesh Kulkarni continued as a co-founder. Chandrashekhar Sohoni moved to start another company in the video content space.

NewsHunt's vernacular focus, though, was an interesting problem.

The diverse demographic mix of India has often posed challenges for most businesses as they struggle to make their product appeal to people from different socio-cultural backgrounds.

However, Gupta used this complexity of the market to build NewsHunt.

Masters of the Uni-Verse

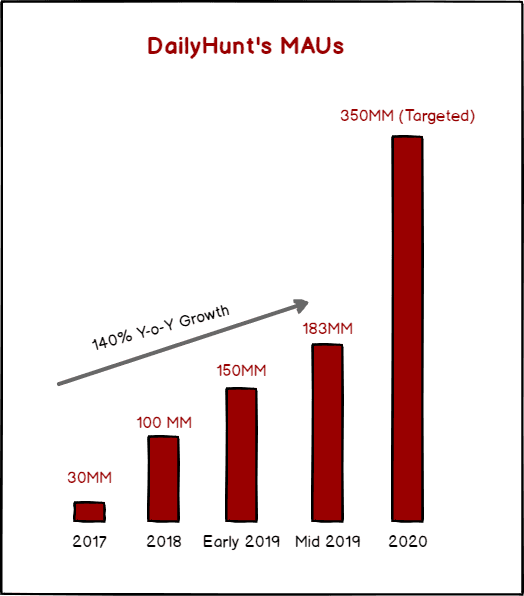

In 2011, when Verse acquired NewsHunt, it only had 800,000 monthly active users (MAU).

Little did Gupta know then that NewsHunt would soon become the face of Verse. Post-acquisition in just two years, the local language news aggregator grew 8X.

The reasons for such rapid growth are market-driven, as the founders of NewsHunt had realized.

Vernacular literacy far exceeds English language literacy (74% versus 10%) in India. The vernacular print market witnessed a CAGR of 11% versus a meagre 5% for the English print market. This, when combined with the backdrop of increasing mobile internet penetration, explained NewsHunt’s quick rise.

By 2013, NewsHunt was receiving more than 6.5MM monthly users who browsed 650MM pages each month. The app was downloaded more than 20MM times.

Providing regional content on the go from 100+ sources in 12+ languages, NewsHunt had tapped into an ignored, big market opportunity.

In 2014, NewsHunt went beyond Flipboard-type news aggregation and added ebooks, free and paid, to its platform. Soon it started flirting with m-commerce (or mobile commerce) by offering personalized purchase recommendations to consumers based on their preferences.

But, there was a monetary problem that NewsHunt could not ignore.

Hunting with Click-Bait

News Hunt struggled to find sources of revenue, despite their large reader base and initial attempts at ad-based monetization.

With Series B funding in late 2014 came the capital to invest in partnerships, monetization plans, and new products. It was a welcome investment for a purely loss-making company.

As it expanded to other segments, in 2015, NewsHunt rebranded itself to DailyHunt to reflect its future direction. Gupta saw the platform becoming a ‘daily touch point’ for its users, where they not only hunt for relevant news, articles and books but also for other items of daily content needs.

Though DailyHunt led the online vernacular revolution in India, its growth needed to eventually lend itself to profitability.

Monetisation in the content space has been far from a piece of cake. This is especially true in India where low per capita income implies limited or no willingness to pay for content.

Sajith Pai, Director at VC firm Blume and prolific commentator tells us “I am not very confident of advertising growing sizeably. Perhaps a few players such as DailyHunt or TikTok will be able to grow their ad revenues, but I don't think it will ever approach the U.S. or China scale."

"We are a poor country and typically ad-led models successfully play out in richer countries. I am a big believer in in-app payments/purchases led approach such as we see with Bigo Live in India or even TikTok in China where viewers pay for beans or buy goods.”

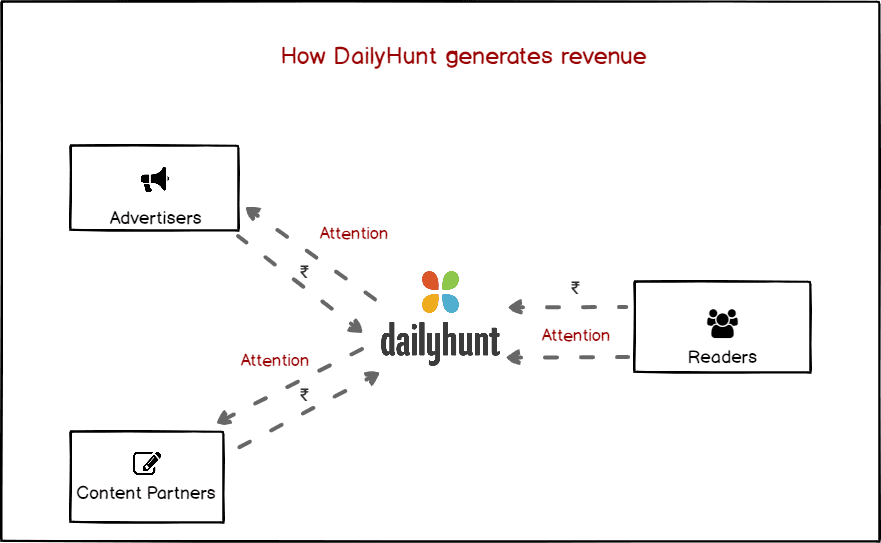

As Mr. Pai points out, DailyHunt focused on revenues through ads, the lion’s share (80%) of which is currently dominated by Google and Facebook. DailyHunt looked to create a niche for itself by offering localized advertising solutions, making it an attractive proposition for SMB’s wanting to target small areas and towns.

Attention is the currency DailyHunt was hunting for its advertisers.

India’s digital advertising market is pegged at $2 billion, compared to $70 billion in China and $104 billion in the US, but it is growing at a fast rate of over 30 per cent per annum. As digital ad spend is projected to reach $2.8Bn in 2021 with mobile ads accounting for over 60% of the total spend, DailyHunt can claim a bigger share of this growing pie.

DailyHunt wanted to create a local language newsfeed where users have access to everything they need in their local language. Creating this newsfeed would help it serve ads more effectively.

There was a flood of data that was going to arrive to help make this happen.

Flooded with Data

The Jio revolution provided an unprecedented growth spurt to mobile internet usage in India.

India was put on the course to become the world’s largest consumer of mobile-phone data. The country was adding half a billion users to its smartphone user base and these users would be local language users.

The implications of this for the content landscape are significant.

Mr. Pai, who has spent more than a decade in media, suggests that Jio has been a “watershed moment” for the Indian content space, as it has created users that interact with the internet in a very different way.

He adds “These users are not comfortable with English, they don't understand icons such as the magnifying glass for search, and don't feel comfortable clicking on URLs or tapping on keyboards. They are comfortable with visuals or voice and vernacular and that is fundamentally the approach that the more successful new media startups from DailyHunt to Sharechat to TikTok have adopted.”

These "new" vernacular internet content consumers are projected to cover just under half of India’s population (~540MM) by 2021, with an incredible growth rate of 120%+ between 2016 and 2021. English language users are forecasted to grow by just 14% over the same period, reaching close to 200MM.

NewsHunt was simply riding this wave very well.

With a 45% YoY growth, NewsHunt had achieved 20MM MAU in 2015, giving 2.5 billion page views monthly. But with vertical expansion and rebranding to DailyHunt, monthly page views nearly doubled, reaching 4.5Bn by early 2017.

DailyHunt was part of many users’ first internet experience by offering them relevant content from their local publishers at fingertips

This was driven by a maniacal focus on the user.

The DailyHunt team was aware of the lack of technical knowledge of their content publishers in terms of getting their content online in a seamless way, so they designed an easy plug and play solution for them.

More importantly, their app was suited for feature phones and smartphones with data speed as low as 2G, which was quite important to thrive in the markets they existed in.

DailyHunt was becoming a high engagement machine.

Great Minds Think ... Ads

"The best minds of my generation are thinking about how to make people click ads." - Early FB employee Jeff Hammerbacher

Backed on its core strength of delivering engaging personalized content, Dailyhunt seems set for rapid user growth and retention. Just last year, it had an MAU base of 100MM (with a DAU of 21MM) which has grown to 153MM in Mar 19 and 188MM in Jun 19.

Evidence of its hooked-on user base lies in the fact that its users spent more time on it per month (120 minutes) than even YouTube and Facebook (20 minutes).

Creating informative content which is entertaining and insightful is a hard feat, and we definitely concur :)

DailyHunt leveraged its potential to create stickiness through a strong engagement loop. Interesting articles on DailyHunt include RBI scaling down INR 2,000 printing notes, 7 profitable new business ideas or even ICC trolling Pakistan for a second consecutive ODI washout.

As a content platform scales, ecosystem partnerships with handset makers, content creators, advertisers help create a strong moat over incumbents. Following a ‘big boy strategy for a big boy game’ DailyHunt tied up with players such as Samsung, Vivo, Oppo, Xiaomi, Honor etc.

As on Dec 18, the company’s plan was to triple the user base, double the time spent and release five times more inventory to be monetized through video advertising.

A lot of this was inspired by a similar upstart in our largest neighbour.

Imagined in China

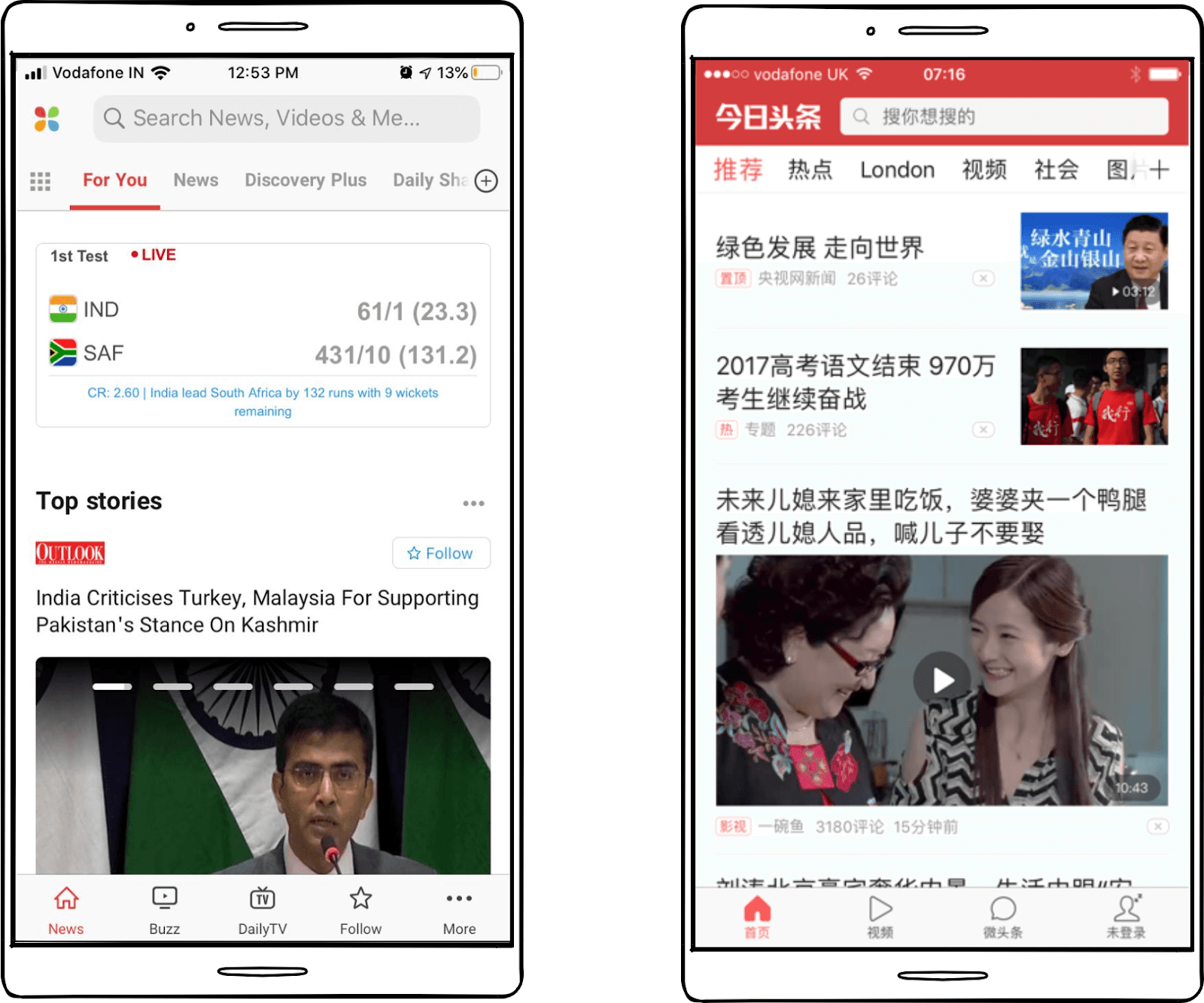

DailyHunt has taken a lot of feathers from Chinese news aggregator Toutiao’s playbook.

Both platforms started out as a news and information aggregators and heavily leveraged algorithms for extreme personalization to hook.

The moat for Toutiao was a content graph-based recommendation engine which keeps users hooked on an avg. of 74 mins per day. It also looked at a user’s geolocation and surroundings. For instance, if one is in a subway with a higher commute time it will push more long form videos to the user.

DailyHunt similarly monitored the user’s action and behavior on the app right from clicks and swipes to time spent and shares. It is no wonder 40% of its total users log in daily and spend an average of 27 mins on the app

Toutiao was also looking to expand to India as of last year which suggests the myriad interlinkages and heavy battles amongst platforms owned by the same giant unicorn.

Housing some of the most popular apps such as TikTok, Helo, Vigo, Buzz Video Bytedance boasts an incredible DAU of 800MM+ for its apps. It also aims to launch a fourth app focused on entertainment and invest $1B in 2-3 years in India.

A massive opportunity like the Chinese market a few years back is attracting them to India. Buoyed by the clear potential and keen to replicate its success playbook in the Chinese markets, Bytedance is looking to build on its successes.

ByteDance is aggressively scouting for acquisitions in the content space for players with the potential to become ‘big’ in India.

It is unsurprising that it invested in the DailyHunt in its Series D.

Standing Out

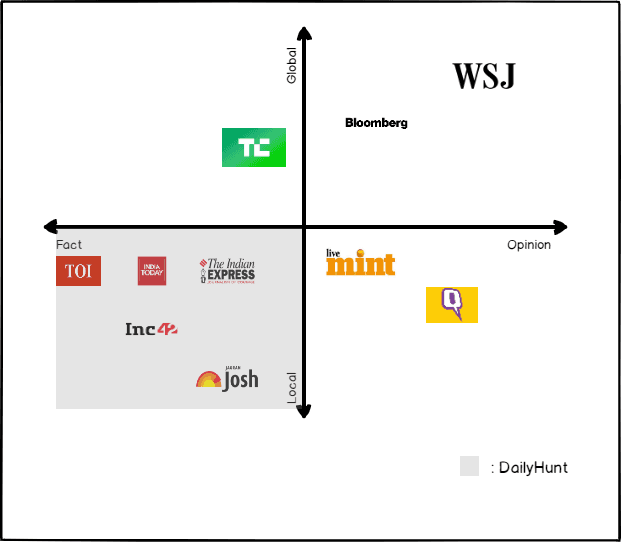

DailyHunt has to compete with multiple aggregators NewDog, InShorts, Glance and NewsPoint.

The key differentiator is the focus on partner-generated than user-generated content vis-à-vis peers which lead to higher scalability and credibility of the content.

With a focus on local fact-based news, entertainment and sports, that is likely to result in more clicks and attention, DailyHunt has positioned itself as a high engagement daily destination.

By being a hyperlocal focused aggregator, it syndicates only certain kinds of content. It also has 1,500 publishing partners churning out 250K+ articles and videos daily to offer a gourmet of choices across lifestyle, news, entertainment, sports, Bollywood, divinity etc.

A razor-sharp focus on video, deeper personalization and wider distribution are the three key pillars. It is shifting its ad platform to in-feed auto play video advertising. 1Bn videos are played per month with auto play of videos creating a repeat loop. It’s creating 5k+ videos a day to cater to the content hungry market.

Video is a big part of the future of content, and DailyHunty is scaling to capture the digital ad market.

Even if it scales to capture 10% of the digital ad market, pegged at $2Bn it can potentially capture upto $200-$250MM in revenue annually.

From $18MM in revenue in FY18 it has been adding revenue rapidly clocking $40MM in FY19 with a target to reach $100MM in revenue in FY20.

Its latest funding round could value it at $650MM which would be 6-7x its current run rate. User growth, retention and engagement rates and monetization options will be the crucial factors in the valuation and startups able to fire on these will likely attract a premium.

To justify this premium, DailyHunt has its sights set higher at a gigantic, digital advertising machine.

Winning the News Feed

DailyHunt is moving closer to becoming Facebook, and it has the ingredients to do so.

While it may seem counterintuitive, both DailyHunt and Facebook are in essence interest based networks (“aggregators”). Facebook started off as a social network, but added a blockbuster feature very explicitly named the “newsfeed”.

As Facebook brought on publishers to its network, it was able to understand people’s interests better. A big reason of its rapid scale as an effective ad network was its data driven delivery of content in its “newsfeed” and understanding consumption.

With the rise of Instagram and Whatsapp, people moved their “social” activities and networks to these two from Facebook. In what will probably go down as the two best acquisitions in the history of tech, Facebook re-captured its old users who were creating new social graphs on Whatsapp and Instagram.

Facebook is now even more of a “newsfeed” or “interest” network, as its two sub-products focus on being the “social” networks. Unsurprisingly, an astounding 50% of Facebook users get their news from Facebook, and 74% don’t even know how well FB knows its interests.

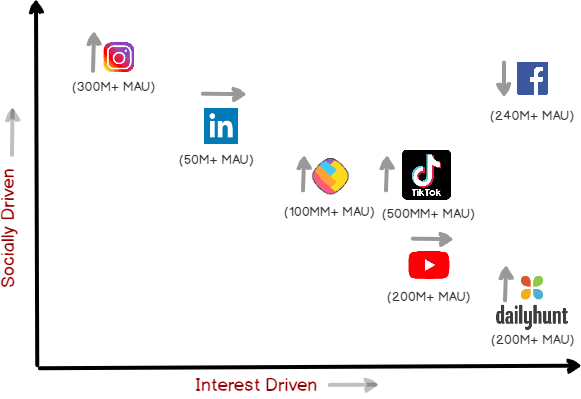

As you can see in the below visualization on aggregators, Facebook is moving towards being less social driven. Socially driven aggregators are those that populates content based on your social network (e.g. friends, connections), while interest-driven are those that populate content based on your interests (e.g. standup comedy, sports)

It is little wonder that DailyHunt’s President points out that they are not competing with other news aggregator platforms but with Facebook. Guess what DailyHunt’s President did prior to his present role?

He was the head of Facebook India, of course.

By creating a vernacular “newsfeed”, DailyHunt is building an interest-driven network for ads. With local knowhow that it has created and embedded in its product for a decade, it is at a unique advantage for brands targeting the next billion.

As I elaborated earlier that Facebook’s fall could be Indian vernacular’s gain, DailyHunt is stepping up to build a localized newsfeed for India. With data costs falling and advertisers looking beyond global platforms to reach vernacular users, DailyHunt could fill this gap. Its 200MM+ MAUs are testament to its ubiquity.

With its substantial localized knowhow and scale, DailyHunt could challenge Facebook in India.