Apr 4, 2021

Will Nazara’s 20 Year Gaming Empire Dream Come True?

Entertainment

Platform

IPO

B2C

Profile

Last fortnight, Nazara debuted with a strong IPO, being subscribed 175x times and setting the stage for Indian tech IPOs.

Trial Through Fire

The year was 1995.

A 16 year old Nitish Mittersain found himself in cahoots with the bollywood mega-star Shammi Kapoor.

Nitish would bunk college to listen to Kapoor. Kapoor also happened to be the chairman of Internet Users association in India- yes it existed that time. They would talk about the confluence of entertainment and the internet as a business.

Cut to 1999, India had just around 200,000 internet users. However, tailwinds in the western market were showing rapid increase in internet penetration and players like Nintendo & Sony made major advances in gaming. Sega released Dreamcast that year, the first console of its kind to facilitate online gaming.

Nitish was ready to take a bet on the online gaming industry in India. He would set up Nazara.com, a new age gaming and entertainment website, years ahead of its time.

However, like most internet companies operating at the time, Nazara found itself at the center of a dotcom crash. A 21-year-old Nitish accumulated a debt of a whopping Rs 3 crore (~$660,000 at the time) as the business nosedived.

As the saying goes ‘What doesn’t kill you makes you stronger’, Nitish stood his ground and dabbled in multiple businesses unrelated to gaming. He even sold bulk SMS packs in a bid to stay afloat and repay Nazara’s debts.

In the process, he became deeply sensitive to metrics like profitability, cash flow and revenue. These would be early lessons which would stay ingrained for a lifetime as he built out his vision to build a large gaming entity from India

In 2004, when feature phones began appearing in India, Nitish saw a chance to give mobile gaming another shot. Nazara soon launched pay-per-download Java games with telcos such as BPL and Hutch.

This timed perfectly with the onset of home computers in India.

Nitish wanted to rope in legendary cricketer Sachin Tendulkar as the brand ambassador of Nazara’s mobile cricket game for 3 years.

However, when Tendulkar demanded $1 million, Nitish managed to talk him down to just $10,000. It was hustle that heavily boosted Nazara’s brand in the mobile gaming segment in India.

The powerplay had begun.

Thinking Ahead of Time

By 2005, with Sachin as the face of their mobile games, the company was firmly on the radar.

What followed was its first round of investment and the company raised a seed round of $1.5M bringing in much needed cash into the coffers.

A key aspect of Nazara was its ability to adapt to the zeitgeist. Whether it was selling SMS packs when they were out of money or making flash games to coincide with the adoption of home computers.

Tellingly, when feature phones became a necessity, the company decided to shift their focus on mobile first games through Value Added Services (VAS) offering.

The premise of VAS was simple. Nazara had to partner with mobile operators, which then billed their users for the games consumed. This meant that to become mobile first, the company had to court the telcos to build out its distribution pipes.

While approaching telecom operators, Nazara offered them a deal they could not refuse.

Nazara positioned itself as a company that would develop a range of branded and original mobile content for telecom operators’ culturally diverse consumer base in the country.

Additionally, Nazara would build out complete solutions for the development, deployment, targeting and tracking of promotional campaigns on emerging mobile platforms.

The icing on the cake for the telcos was the fact that margins in gaming VAS were as high as 40% compared to other emerging space like music, ringtones where it was around 5%.

Soon enough, big telecom players such as Tata Teleservices, Airtel and Vodafone jumped onboard the rocketship to help Nazara launch mobile games on their platforms as Value Added Services picked up steam. It also helped them improve their connect with users

Targeting VAS was good business for Nazara because revenues kept flowing in, and it would even get the company to profitability.

In 2006, Nazara swept the competition away further when they signed M.S. Dhoni’s rising star for an exclusive contract to represent their brand.

The helicopter had taken off.

Watch the AJVC team discuss the piece Behind the Scenes

Riding on the Shoulder of Giants

In 2007, good news came knocking on Nazara’s door as it received its second round of investment.

While Nazara was earning sustainable revenues from its partnerships with telcos, the gaming industry in India wasn’t making any big money yet. The team was still working on different business models, but was yet to discover a model that would open the floodgates.

In 2008, EA Mobile, a subsidiary of the world’s largest game developer, Electronic Arts, wanted to launch its hit mobile games in India. To do this, they needed the distribution channels of telecom operators.

Who had existing tie ups with telcos along with a tech stack design to support game marketing, distribution and reproduction?

Nazara, of course.

Nazara ended up signing an exclusive wireless content distribution agreement with Electronic Arts giving them exclusive rights to market, distribute, reproduce, and sublicense its contents in India.

In return, EA Mobile leveraged Nazara’s telco relationships to launch 15 of its hit mobile games in India on Airtel and Vodafone. Learning from Nazara’s data, it also could start developing custom games for the Indian market.

This ended up being a true win win deal for both parties.

Nazara was still playing around with pricing strategies for games and wanted to target mass mobile internet users, comprising largely first-time mobile gamers. To facilitate this, it launched India’s first ever subscription-based model ‘Games Club’ with the help of RCom & Airtel in 2009.

Starting with just 26 games, Nazara registered Games club under Gclub.in and allowed content from multiple content providers. This helped telco users get access to a plethora of games and allowed game developers to monetise their games from day 1.

Meanwhile, technological infrastructure expansion initiatives helped rapidly increase Internet penetration steeply in other emerging markets such as South East Asia, Africa and the Middle East. Nazara realised that it had only scratched the tip of the iceberg with the Indian Market.

It was now ready to expand its ‘Nazar’ (ambition) beyond India into other emerging markets.

Strike when the Iron is Hot

In 2010 as the partnership with EA solidified, Nazara went further.

It entered into a tie-up with Electronic Arts to bring EA’s catalog of brands to 600M mobile phone users in Sri Lanka and Bangladesh.

But with its distribution moat, gaming content and strong tech stack built, Nazara was not satisfied with entering a few markets now

Through its wholly owned subsidiary based in Dubai, Nazara was managing mobile gaming solutions offered by carriers in the Middle East, including Etihad Etisalat, Saudi Telecom Company, Viva and Emirates Integrated Telco.

Its reach in the Middle East didn’t stop here. It partnered with aggregators, third party and retail channels as well.

Once EA chose to go with Nazara, the alliance proved to be mutually beneficial, immediately.

By the end of 2012, Nazara was signing deals with telcos in countries in the African subcontinent, and with EA’s evergreen flagships like Need For Speed (FZR 2000, anyone?) and FIFA, mobile games were now all the rage.

While Nazara’s primary focus was to generate revenue by selling mobile games to end consumers, they also added the choice of buying a day pass after spotting a growing trend among users. Many of them wanted access to a larger number of games by using day passes.

Embedded advertisements were adding to its revenue stream. Soon Nazara also entered into partnerships with handset manufacturers, wherein the agreement was to pre-install a certain number of EA titles on each unit sold.

The moat through distribution was being built slowly but effectively.

Home is where the Heart Is

Nazara was expanding, but that did not mean it would leave its competitors any segue.

Nazara thought it would be beneficial to invest in ventures building for the gaming space, and set up an INR 10 Cr fund in 2013, to help such startups grow.

One such venture that they identified was HashCube. Buying into HashCube was putting full faith into its MVP, the “Quest Model”.

The model boasted of being able to amplify the gains from the platform’s offerings by creating engaging informal games. It was a bet that Nazara was willing to take. They poured in INR 4.2 Cr to see HashCube's growth, in 2014.

With the prevailing momentum of its flagship titles like Sudoku Quest, and more than 3M players, the partnership with Nazara was the slingshot to propel HashCube into a whole new dimension.

Tasting success in the partnership, Nazara changed gears in 2015 to become a holding company, and marched on to find more such suitors.

Within a year, Nazara had invested an undisclosed amount in London based lifestyle games franchise TrulySocial. It acquired 26% of Mastermind Sports, another UK based gaming studio.

Nazara’s zealous expansion strategy may have made it sound like the intent was one sided. But with the empire they had built, they were the most sought-after choice for overseas game developers to break into India.

ZeptoLab, owned by the prodigal Russian Voinov twins, chose to partner with Nazara to bring their flagship physics-based puzzle Cut The Rope to India.

Even though Nazara now had a presence in more countries than the best of the wanderlust crowd, the Indian customer was still king.

The Indian cricket team had just defeated South Africa, the top ranked test side, at their own fort in Dec 2015. Captain Virat Kohli’s career was taking off. Nazara signed licensing deals with Virat Kohli and Hrithik Roshan, both of whom were crowd pullers with an unbeatable fan following in India.

Leaving no stone unturned, Nazara bagged exclusive rights to build and publish games starring Chhota Bheem, as well as the characters from the popular comic book series, Amar Chitra Katha. Nazara had just conquered the best of both the real and virtual world.

But storms were brewing which could threaten to topple the ship.

Jio is an IPO Pooper

Come 2017, the ecosystem was convinced that the gaming was on the path to reach $1B soon.

The events that unfolded in the last 18 years were testament to the fact that Nazara was not only the earliest, but also the biggest player in mobile gaming.

Mittersain and co were ready to make the move.

In mid 2017, Nazara technologies announced their plans to IPO in the upcoming fiscal year.

In the background however, a revolution was coming. Someone had been working on changing the way the average Indian audience used their mobile phone.

Reliance Jio had soft-launched its carriers towards the end of 2015. It made their LTE plans publicly available in September 2016.

Jio was offering 4G data at a fraction of the cost of other carriers, and its subscriber base went past 160 million by the end of 2017. This number was only going to get bigger.

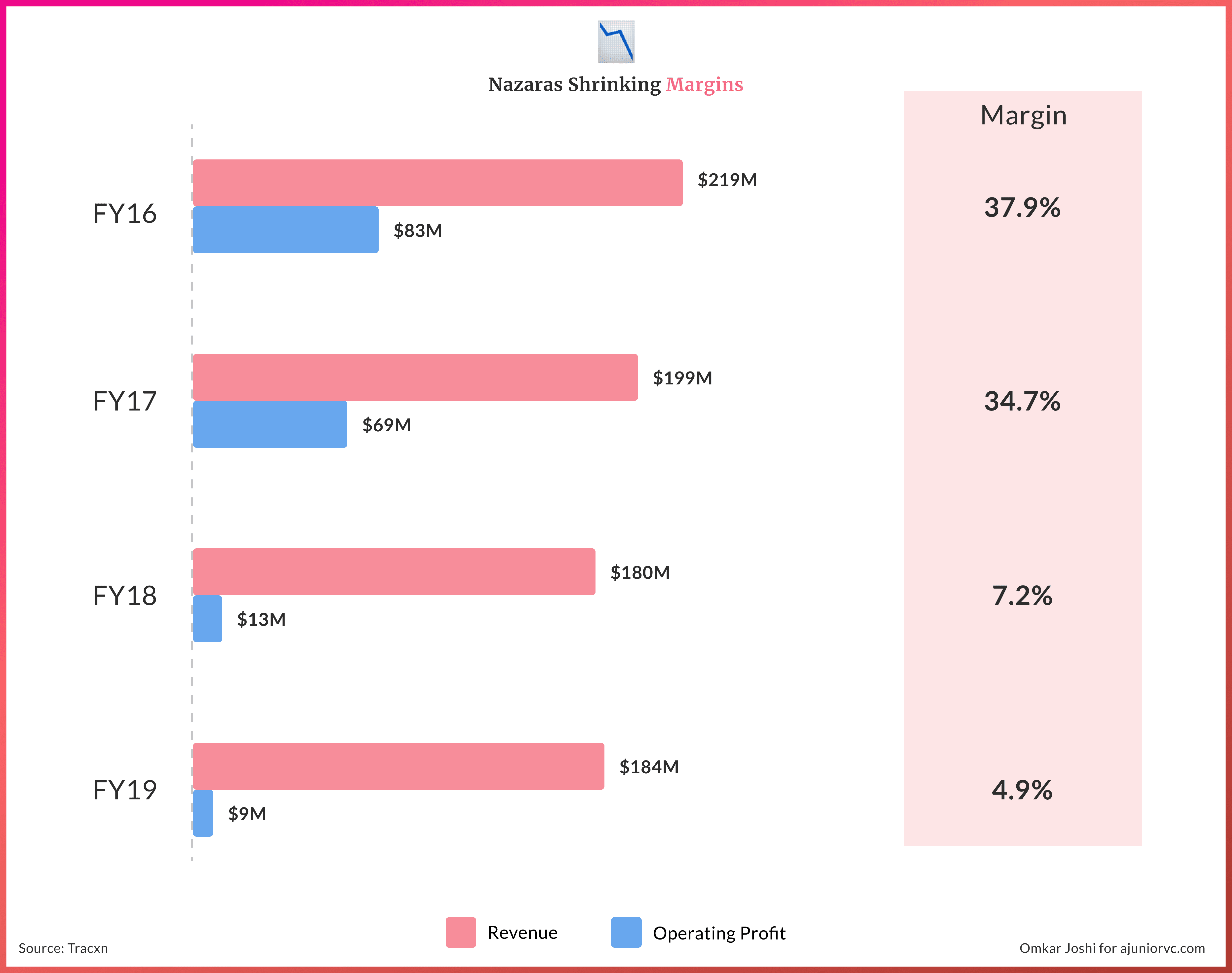

For Nazara which had built its revenues on the back of the VaS model, it realized that with falling data costs and rising internet penetration, Indians might be unwilling to pay to play going forward.

The collapse of the VAS model was inevitable.

Nazara’s management had to hold their horses. It decided to shift their focus back to building a galaxy of games beloved by their audience. Diversifying its empire and reducing its reliance on VaS was the next step.

In Jan 2018, it acquired a majority stake in NODWIN gaming, a gaming solutions company which was also an e-sport event creator. The four year old company had exclusive partnerships with the likes of ESL and Esports World Convention.

With this new addition, Nazara aimed to tap into the potential of hosting gaming tournaments in India and beyond.

It explored the possibility of introducing real-stakes gaming in countries which had the right regulatory environment as well as legal framework to support such a venture. Kenya, Cameroon, Nigeria and Ghana were on the list

Decades ago, Nazara had gone through fire but this time it wanted to soar like a phoenix

Building a House of Brands

Starting 2019, Nazara began to acquire gaming and content companies with an aim to build synergies and increase its dominance in esport

In March 2019, Nazara made an entry into Halaplay by investing $5.8M in their Series A round, which it converted to a majority stake by June 2020. Halaplay, founded in 2017, is a real money daily fantasy game and competes with Dream11.

In May 2019, it invested in Khichdi Technologies, the company behind Bakbuck, a vernacular social content platform focused on women as its target audience.

Bacbuck’s focus on women, helped Nazara target another 60M potential women users.

September 2019 saw Nazara acquiring a majority stake in Sports Unity, the creator of a multiplayer quiz called Qunami. It leveraged the insight that quizzing/ puzzle based games are the most preferred type of games in terms of minutes spent per day.

By October 2019 Nazara had acquired majority ownership of Paper Boat Apps, a Mumbai-based indie studio that published Kiddopia, an early-learning subscription based edutainment app. Kiddopia offers Nazara a chance to monetize its IP content for characters like Chhota Bheem and Birbal by building games.

Nazara capped its acquisition spree off by the acquisition of a majority stake in Sportskeeda in August 2020. Nazara aimed to extend its reach to Middle East and African markets.

The pandemic offered Sportskeeda a boost, helping it increase its daily active users 20x from 25K in April 2020 to 500K in August 2020.

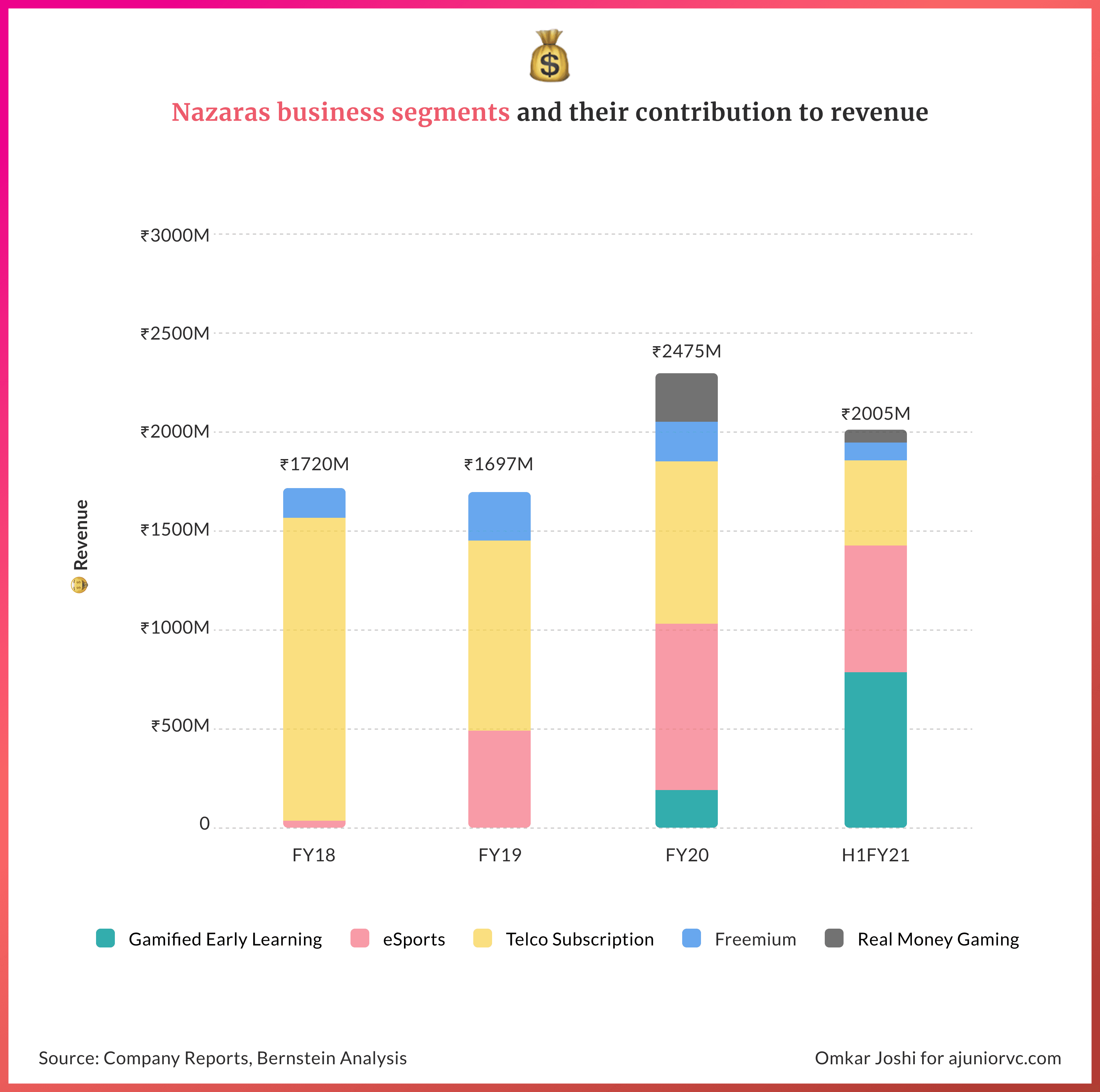

Through its big and small bets in the gaming ecosystem, Nazara had already clocked 80% of its FY20 revenues in the first six months of FY’21.

With its recent spate of acquisitions Nazara looked like it was mirroring an Easter Giant.

A Leaf out of Tencent

Tencent launched its first product - QQ in 1999.

It was an instant messaging software aimed to connect Chinese youth to find people with common interests to meet online. We were still five years away from the advent of Facebook.

Some industry experts suggest that Tencent buys gaming firms as it has limited gaming design capacity.

Money can’t buy everything, but it can buy a lot of video games.

Tencent also buys games globally because in-house games are not so popular in foreign markets. Bundling of services doesn’t work well in the US market where citizens are used to having a bouquet of apps.

As the China market saturates, they are using an acquisition led growth strategy to expand their global footprint. Tencent’s gaming acquisition works on a simple formula - build a community of players by combining social and gaming.

In doing so, Tencent also acts as a gatekeeper for companies such as Activision and Ubisoft who want to enter China.

Nazara acts as a publisher of games, inviting developers to build games on its platform leveraging its IP. It further provides developers access to foreign markets, something they couldn’t aspire to earlier.

The strategy looks very similar.

The gaming market in India is exactly at the point where China’s was in 2012-13, growing at 40% CAGR.

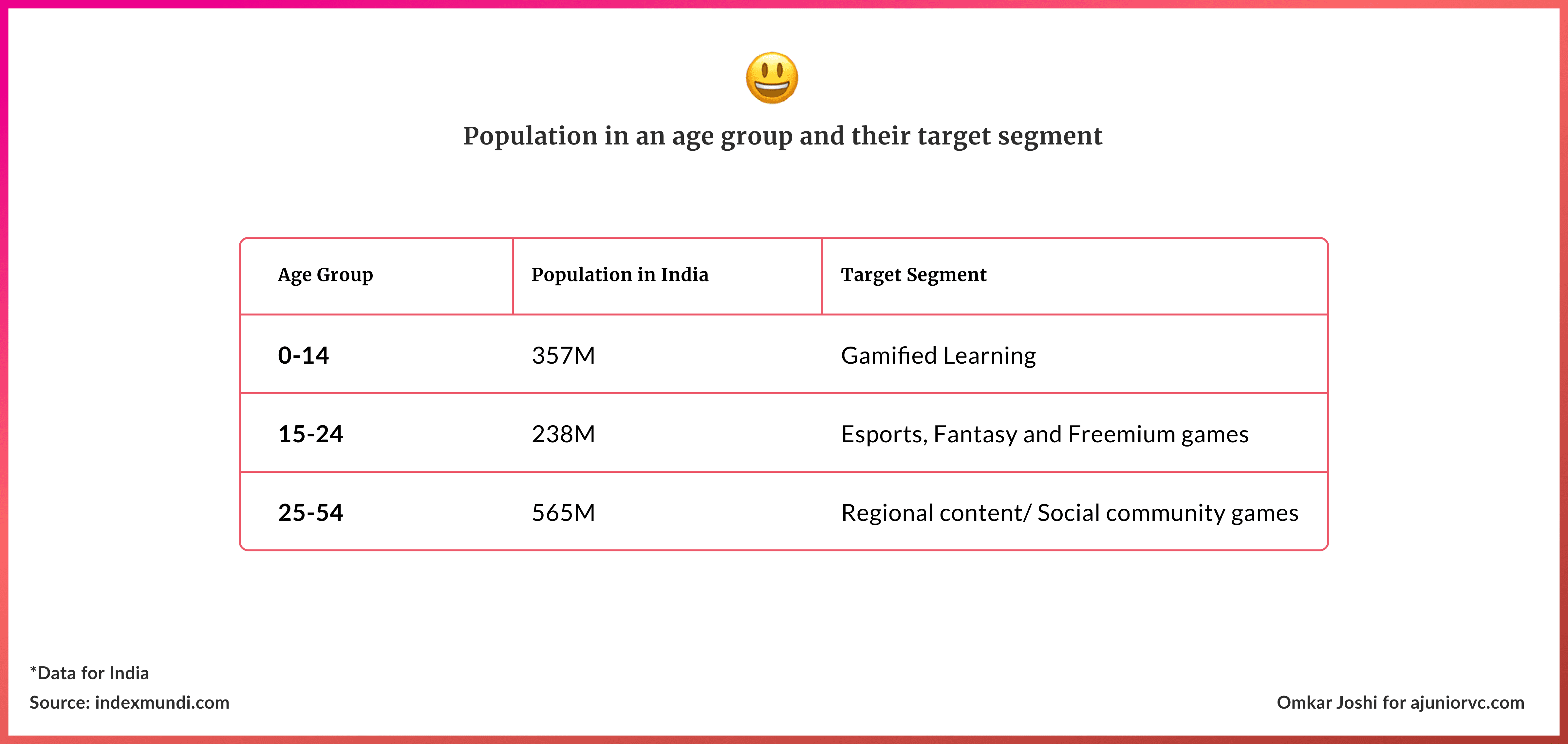

A recurrent motif in Nazara’s narrative is about how they want to target a large total addressable market (TAM). 50% of India’s population is below the age of 25 and 60% of gamers in India fall in the same age bracket. India had around 365 million online gamers in 2020.

The lockdown saw the time spent on mobile gaming per user per week increase to 218 mins from 150 mins before lockdown. The initial phase of the lockdown itself saw a 40% increase in time spent on gaming daily.

Add gamified learning and content in regional language, we have another 40-60% of the market from age groups 0-14 and 25-54.

The essence for Nazara then is to catch them young and become their gaming cum entertainment partner for life.

Nazara says they will continue to invest in esports, fantasy games and gamified learning. The goal is to create an ecosystem where instead of competing with each other, they can focus on creating good content.

By IPO-ing, it is setting the stage for a Indian tech to follow.

Let the games begin!

As the first gaming company to IPO in India, Nazara saw an overwhelming response.

One of the few listed pure play digital companies growing at a 30% CAGR has helped it command a scarcity premium.

Its IPO was oversubscribed a whopping 175x.

Nazara is betting on an acquisition-led growth model post listing with its primary focus lying on three areas: esports, early-learning markets and fantasy gaming. It aims to de-risk itself from VAS.

Nazara’s Esports revenue share has increased from 2% to 33% in the same period as VAS has declined. Nazara claims that it has 80% market share.

Value in esports is created through IP, branding and sponsorships. Realising this fact, publishers are now organising leagues and tournaments on their own instead of relying on external parties.

This helps Nodwin, which is projecting itself as a one stop shop for everything esports.

Sportskeeda which is the largest esport news website in India, caters to esports news and sports news including WWE, Cricket, Football, Olympic games etc.

For early learning, Kiddopia contributed to 41% revenues of Nazara in H1FY21 while selling to the North American market only.

Nazara believes that propensity to pay will increase with time in the Indian market where its subscription is priced at Rs. 249 a month, less than half of what a Netflix subscription costs.

The third big bet on fantasy gaming, still has a long way to go before it starts showing any results. Fantasy gaming due to the inherent network effects, is a winner take-all market with Dream11 having 90% of the market share.

For growing in this segment, they can leverage in-house capability of Nodwin to develop more games similar to what MPL has done. With their focus on IP and locally relevant content, Halaplay could end up becoming a GTM channel for upcoming game developers.

In the public market, it will have to balance its fast growth with improving profitability and cash flows. It has sacrificed margin as it has pushed to grow and pivot its revenue streams.

While the comparison calls with Tencent grow louder, it might be a bit premature given the India market and its depth. League of Legends, a popular multiplayer game brought $1.4B in revenues for Tencent in 2020. In comparison, the total gaming revenue from India is projected to grow to $1.2B by 2023.

Nazara’s dreams to build a gaming empire in India will bank on its acquisitions, how well they derive synergies and its ability to cut losses fast from the weak ones.

Shifting trends in consumer preference for gaming and digital media consumption as a mode of entertainment and education is setting the stage for gaming to eat everything.

While the world is eyeing India for its soaring gaming industry, India has its eyes on Nazara.

By Bhoomika, Chetan, Omkar, Saumya, Shelley, Keshav, and Aviral

Audio Version: Behind the Scenes with AJVC

We bring to you, AJVC behind the scenes podcast with your host Mazin