Dec 8, 2024

Can 2,000 Cr SEDEMAC Make Tech in India for Global Auto?

Profile

Electric Vehicles

Deep Tech

B2B

Series B-D

Earlier this year, SEDEMAC Mechatronics, an auto parts and powertrain controls manufacturer, raised $100M.

From Campus to Combustion

Shashikanth Suryanarayanan, a professor at IIT-Bombay, returned to India.

He returned after completing his PhD at the University of California, Berkeley, and working for six years in the United States.

His professional stint included time as a control systems engineer at GE, but a deeper motivation called him back to India in 2004. He joined IIT-B as a professor, determined to build something meaningful out of his homeland.

Upon his return, he cracked on realising his dream. He immediately began trying to secure industry-sponsored projects for students on campus.

Students on campus got wind of his efforts.

Three enterprising students, Manish Sharma, Pushkaraj Panse, and Amit Dixit, approached Shashi to collaborate with him. Shashi obliged, and soon, they began working on academic and industry projects, which involved designing automotive components for OEMs.

The team got a break when TIFAC (Technology Information Forecasting and Assessment Council) asked them to build a fuel injection system for two and three-wheelers.

The Central government agency gave INR 1 crore to the project. They designed an injection control system that reduces emissions in 2-wheelers by 95%

This early success gave them the confidence to commercialise their work.

In 2007, they founded SEDEMAC Mechatronics, an acronym for Separating Decision Making from Actuation, the operating principle behind mechatronics - the technology combining electronics and mechanical engineering.

Their idea was simple: build a suite of electronic systems regulating small engines to improve fuel efficiency and reduce emissions. In the first year of operations, they secured INR 25 lakh worth of business from a two-wheeler OEM in India.

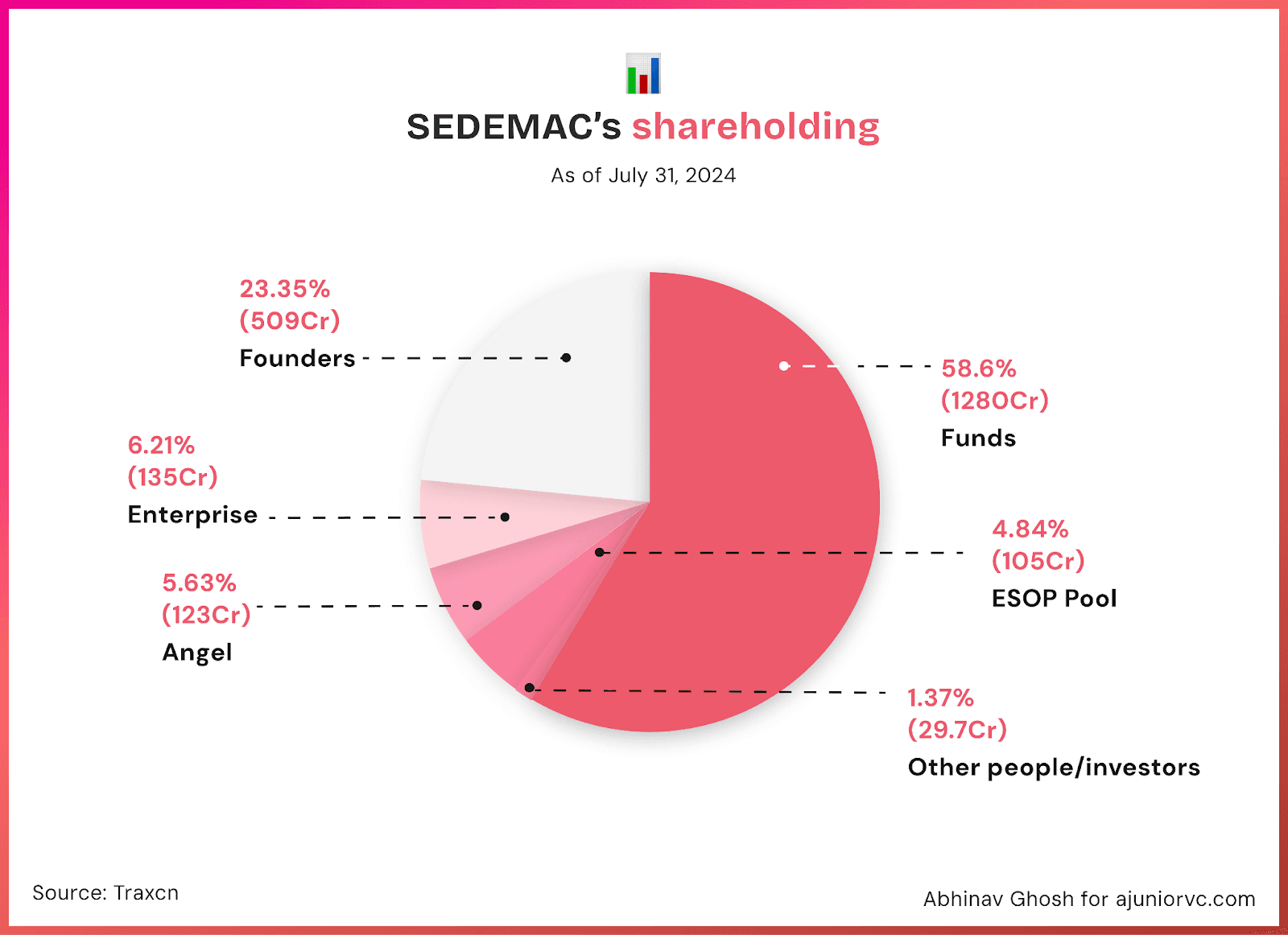

Since startups developing cutting-edge hardware technology were rare in the past, raising capital would have been tough. Investing in edge technology was unheard of. However, given the team's background, a few investors took a bet of $3.2M in 2008 after they started up.

The team focused on refining their products and expanding their offerings for the next two years. They introduced a successful diesel engine variant, earning the trust of heavy-duty vehicle manufacturers like Kirloskar and Mahindra & Mahindra.

Armed with these early wins and a growing portfolio of innovative solutions, they were on the cusp of charting a transformative path forward—ready to make their mark on India’s evolving automotive landscape.

Revolution Under the Hood

By 2010, despite the initial successes and growing interest in their technology, breaking into the top tier of Original Equipment Manufacturers (OEMs) remained a formidable task.

Sourcing components from a newcomer without established client references was risky for large automotive manufacturers. They were accustomed to relying on tried-and-tested suppliers and typically considered adopting new control systems only when there was a substantial advantage—improvements in emissions, safety, cost, or a combination of these factors.

The team recognised this challenge early on and focused on building a truly differentiated offering.

One of their breakthrough products was the “electronic governor,” a device designed to enable variable-speed engine operation, allowing engines to run at optimal fuel efficiency. By efficiently regulating the engine speed, their electronic governor delivered robust performance and reduced emissions, catching the attention of several potential customers.

Early adopters found it more compelling than international brands like Woodward and GAC, which, although established, came at two to three times the cost.

As the product began to win admirers, potential clients still put SEDEMAC through a rigorous evaluation process. Every department within the OEM—from R&D to procurement—scrutinized the product for originality, technical efficacy, and long-term support capabilities.

The team’s dedication to engineering excellence and customer-focused support helped them clear these hurdles. Their efforts paid off when a two-wheeler OEM, impressed by the technology’s performance and cost-effectiveness, became their first significant customer.

This initial deal validated SEDEMAC’s approach and became a valuable reference point, softening the initial resistance at other OEMs’ boardroom tables.

A key reason for their growing appeal was that Western companies had largely overlooked markets like two-wheelers and gen-sets in India. These segments were relatively niche for global players compared to their core markets. SEDEMAC recognised this as a blue ocean opportunity—an open field where they could establish themselves as a go-to provider without direct competition from large international brands.

They maintained a robust pipeline of a dozen new products to capitalise on this, each addressing specific pain points in small-engine and genset markets.

By 2011, the team had grown to 30 employees and had set up a manufacturing facility in Vikhroli, Mumbai, ensuring tighter control over production quality and supply chains. With a solid order book for thousands of diesel engine controllers and the imminent launch of their fuel injection systems, confidence was running high.

Their roster of early clients included marquee names such as TVS Motor Company, Bajaj Auto, Mahindra, and Kirloskar. Having overcome early scepticism, SEDEMAC was on the cusp of rapid growth.

Shashi and his team now had their eyes set on scaling the venture to the next level. Their ambition was clear: they aimed to build a thriving business worth $100M within the next five years—an audacious target that seemed ever more achievable given the strong foundation they had laid.

Finding Gold in Old Engines

As the world was recovering from the financial crisis, SEDEMAC conducted an exhaustive market study that would prove prescient.

The company's researchers trudged through India's varied climatic zones—from the humid coastal regions of Kerala to the deserts of Rajasthan—to understand how different environments wreaked havoc on engine performance. This ground-level intelligence, gathered when most companies were retreating to their bunkers, would later prove invaluable.

The study revealed an unexpected opportunity: a vast, untapped market for retrofitting older vehicles. In terms of numbers, India's total vehicle sales in FY11 reached approximately 15.5M units, reflecting a robust growth rate of 26.17% from the previous year.

However, projections indicated that growth would moderate to around 12-15% in FY12 due to rising interest rates and increased commodity prices. This context underscored the potential for SEDEMAC's retrofitting solutions as consumers sought economic alternatives to purchasing new vehicles.

While competitors chased diminishing new vehicle sales, SEDEMAC spotted gold in India's aging fleet.

The market was messy—fragmented across thousands of local mechanics and spare parts dealers—precisely the chaos that deterred more prominent players. However, this fragmentation presented an opportunity for an agile startup to build relationships garage by garage, city by city.

Partnership building followed with mechanical precision. SEDEMAC cultivated relationships with automotive industry bodies and trade associations, turning potential gatekeepers into allies. These alliances provided more than just market access; they offered invaluable insights into industry trends and technical standards. The company's engineers became regular fixtures at industry conferences, not just presenting but, more importantly, listening.

In manufacturing, SEDEMAC zigged where others zagged.

While outsourcing remained fashionable, the company chose vertical integration, bringing design and manufacturing under one roof. This wasn't mere philosophical preference—it delivered concrete advantages. When suppliers tried to raise prices, SEDEMAC could credibly threaten to make components in-house. When quality issues arose, solutions could be implemented overnight rather than after months of supplier negotiations.

The adoption of just-in-time manufacturing raised eyebrows. Such systems were associated with Japanese giants, not Indian startups. Yet in India's capital-constrained environment, operating with minimal inventory proved crucial.

SEDEMAC's pricing strategy proved equally sophisticated. Rather than pursue the traditional Indian path of competing solely on price, the company introduced tiered pricing. Premium customers could opt for gold-plated versions with extended warranties, while cost-conscious buyers could choose basic models. This stratification allowed SEDEMAC to capture value across market segments while building a premium brand—a delicate balance few Indian companies had managed.

The broader automotive industry was wrestling with its demons.

Raw material costs were spiralling, labour costs were rising, and regulatory compliance was becoming increasingly expensive. Most companies responded with a traditional playbook—squeezing suppliers, automating where possible, and passing costs to consumers.

SEDEMAC's vertical integration approach and just-in-time manufacturing offered a different path that would prove increasingly attractive to industry observers.

From Local Workshops to Global Waters

By 2014, having proven its model in India's unforgiving market, SEDEMAC began appearing at international auto shows.

The company's booth stood out for its sobriety—there were no flashy concept vehicles or runway models here. Instead, crisp-sleeved engineers explained control systems and efficiency metrics to mesmerised audiences. The company sponsored technical conferences rather than Formula One teams, building credibility in the industry's engine rooms rather than its showrooms.

The expansion of customer service centres followed careful calculus.

Each centre was a support hub and a listening post, gathering intelligence about product performance and customer needs. Engineers were required to spend time at these centres, ensuring that theoretical knowledge met practical reality. This ground-level feedback loop proved crucial for product development, catching issues before they became problems and identifying opportunities before they became apparent.

Research and development took an ambitious turn during this period. Rather than merely refining existing products, SEDEMAC began exploring entirely new applications. The move into marine engines was particularly bold—the company discovered that solutions developed for cost-conscious Indian two-wheeler buyers could be surprisingly relevant for European shipping companies grappling with fuel costs and emission regulations.

Similarly, the expansion into stationary power systems opened new markets just as the automotive sector began showing signs of cyclical weakness. This diversification opened new revenue streams; for example, the global automotive retrofit electric vehicle powertrain market was projected to ~$66B in 10 years.

This diversification wasn't merely opportunistic; it reflected a more profound understanding that control system expertise could be valuable across multiple industries.

Rapid technological advancements and increasing consumer awareness regarding environmental issues characterised the broader automotive landscape during this period.

As global emissions regulations tightened, there was a rising demand for innovative solutions aligned with sustainability goals. SEDEMAC's focus on retrofitting older vehicles with electric powertrains positioned it favourably within this trend.

Outmaneuvering with Initiatives

In early 2015, SEDEMAC, known for its innovative engine control solutions, was surrounded by an increasingly competitive landscape.

Over the next few years, SEDEMAC focused on deliberate actions as rivals became more numerous and aggressive. When new players tried to catch up, the company had already built a strong, reliable foundation that kept it one step ahead.

SEDEMAC recognised that its breakthroughs in engine control technology could attract imitators. Instead of waiting for others to copy its work, the company moved early, filing patents to protect its core ideas.

These legal safeguards prevented direct imitation and reassured customers they were partnering with a true innovator. This initial step set the tone for the years that followed—SEDEMAC wouldn’t just create; it would protect what it created.

Its fundraising would be slow. In 2015, another IIT Bombay alum interested in technology would come knocking. Nandan Nilekani would personally invest a significant amount in SEDEMAC.

As 2016 rolled in, SEDEMAC shifted its attention to the people who delivered its products to customers.

Throughout 2016 and well into 2017, the company held specialised training sessions for distributors and technicians. These workshops went beyond basic installation procedures, covering troubleshooting techniques and long-term maintenance advice.

By the end of 2017, a once-standard support network had evolved into a team of knowledgeable professionals who enhanced the overall customer experience. Better service meant happier clients, which meant repeat business and a more substantial reputation. The marketplace was changing, shaped by evolving consumer preferences and stricter efficiency standards. SEDEMAC didn’t assume it knew best—it asked.

The company conducted regular surveys and engaged in open dialogues with customers and industry experts. These insights guided product adjustments and feature updates.

By 2018, SEDEMAC had fine-tuned its offerings to match emerging demands better, staying flexible and relevant even as the world evolved.

All these efforts—protecting its innovations, empowering its service partners, and staying alert to shifting market currents—have started to pay off.

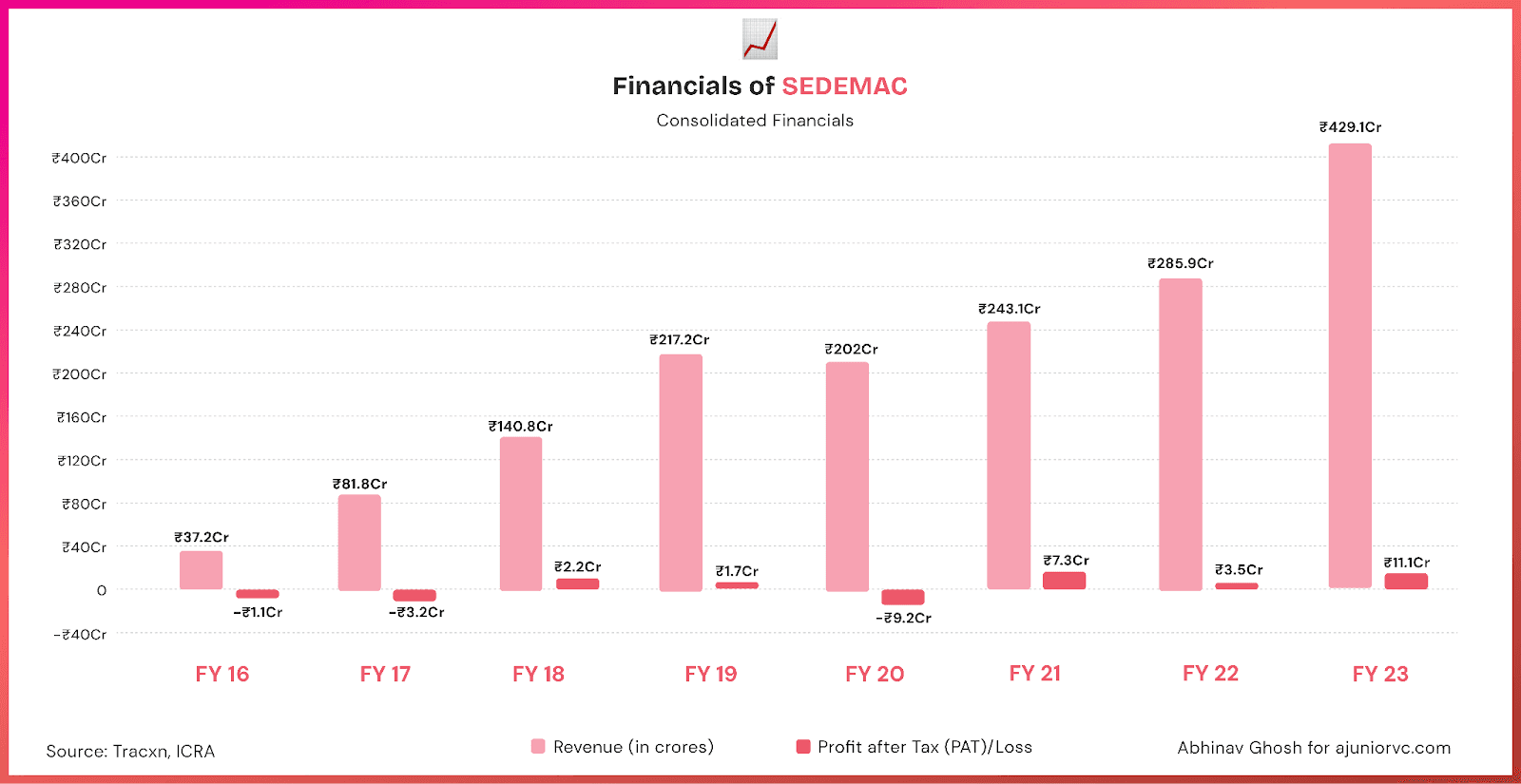

By the end of FY18, SEDEMAC’s revenue had soared from INR 37 crore in FY16 to INR 141 crore, marking an impressive 280% growth in just two years. Operationally, the company was also inching closer to profitability.

It was clear that SEDEMAC had arrived not just as a technology company but also as a business.

Charging Forward Globally

SEDEMAC’s efforts paid off, with its revenues doubling year-on-year.

Behind this fast-paced growth were a 320-strong team working out of a development centre and two manufacturing units with a combined capacity of 2.5 lakh units a month.

Two business lines fueled SEDEMAC’s growth – innovative ignition technology for two-wheelers and power train controllers for diesel generator sets.

SEDEMAC’s innovative ignition technology improved fuel efficiency & reduced exhaust pollution for two-wheelers. Companies like Kirloskar Oil, which used to import power train controllers earlier, started sourcing them from SEDEMAC, realising 20-35% cost savings while enjoying better performance and reliability.

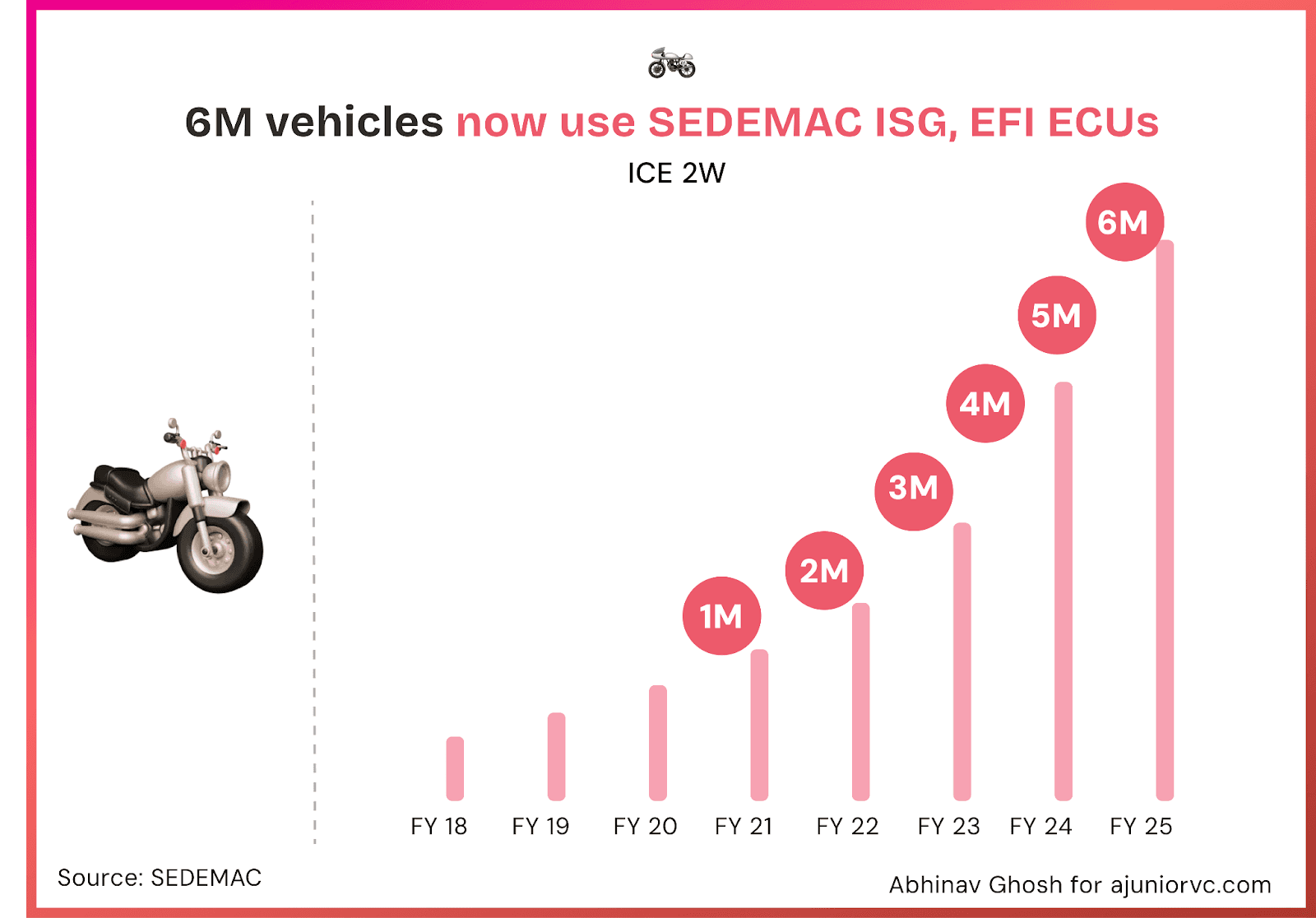

SEDEMAC had established an explicit right to win via its differentiated tech and had generated an impressive clientele list from scratch. At that point, every third two-wheeler in India used SEDEMAC’s innovative ignition technology.

Sedemec’s dominance in its space was evident, and the spaces were attractive. The Indian generator set market was projected to touch $4.5B, while the Indian two-wheeler market was the largest in the world.

Investors were eager to invest in a rare, fast-growing, profitable pure technology Indian firm that enjoyed a significantly positive reputation in the industries it served. It didn’t get the hype of larger companies.

SEDEMAC planned to scale up, diversify into other applications and expand into other markets. Hardware units for battery charging controllers, a left-right indicator, a voltage regulator, and headlamp intensity control were on the planning board.

It had set its sights on global markets like the US and China while already forming a distributor network in Africa and the Middle East. By 2018, things had started moving, and SEDEMAC had raised another round of 60 Cr.

Having established a strong dominance in two product categories and built up a war chest, SEDEMAC was eager for its next growth phase.

Momentum from Mechanics

True to its roots in IIT Bombay, SEDEMAC retained a strong culture of R&D and innovation.

In 2019, it developed the world’s first sensorless integrated starter generator (ISG).

Think of an internal combustion engine. It has two electrical machines – a starter motor, which supplies power to start the engine, and an alternator, which powers the car's battery when the engine is running.

An ISG combines both functions into one electrical device – it acts as a motor to start the car engine, and then as a generator to charge the car’s battery. While the technology was well established in four-wheelers, its use in two-wheelers was negligible.

SEDEMAC replaced sensors with intelligent algorithms, thereby significantly saving cost. SEDEMAC believed that the demand for ISGs was driven by end-user benefits—smooth engine starts without any cranking noises and enabling idle stop-start capability.

It would soon onboard three OEMs—a strong number given the oligopolistic nature of the work—and convince them to start incorporating sensor-less ISGs in their two-wheelers.

But while SEDEMAC was developing a promising new product line, one for its old products was facing a potential threat towards its long-term growth.

SEDEMAC’s smart ignition technology was designed for a carbureted engine. But in April 2020, India switched to the Bharat stage VI norms, which required OEMs to switch from carburetors to fuel injectors, as the latter were more fuel efficient.

Incorporating the innovative ignition technology with fuel injector-based engines was a challenge, given that the big fuel injection suppliers’ (Astremo, Bosch, Continental etc.) ecosystems were all based outside of India.

There was, however, a silver lining to the situation.

In 2008, electronic fuel injectors (EFI) control units were one of the first technologies a Professor Suryanarayanan-led research group, including Amit Dixit, had researched upon – which had translated into one of the first projects SEDEMAC had undertaken.

SEDEMAC started supplying EFI control units to Indian OEMS and the North American market, taking advantage of the automotive controller & semiconductor shortage that had hit the world post the COVID pandemic.

During FY20, SEDEMAC clocked INR 200 cr in revenue and enjoyed healthy EBITDA margins of more than 10%. Three clients accounted for ~90% of its revenues: TVS Motor, Mahindra & Mahindra, and Kirloskar Oil Engines Limited.

The quiet innovator was about to explode.

Resilience Revs Innovation

By 2021, as the automotive sector rebounded from the pandemic, the industry grappled with severe supply chain constraints, particularly in critical components like controllers and semiconductors.

SEDEMAC’s prior investments in diversified product development paid off. Having already proven its mettle in EFI control units and ISGs, it stepped in as a reliable partner for OEMs struggling to secure essential components.

Its cost-effective, sensor-free designs offered immediate supply relief and gave OEMs more flexibility to optimise fuel efficiency and performance.

These advantages translate into robust financial growth. Between FY18 and FY23, SEDEMAC’s revenue tripled from INR 140 crore to INR 429 crore, with EBITDA margins hovering at an impressive 11%.

Yet, the company wasn’t content with just numbers.

In 2022, it took an unconventional step: it began hosting interactive investor calls. Far from a typical fundraising tactic, these sessions aimed to demystify the company’s technology and highlight its potential.

They served a dual purpose. The calls educated potential investors about the tangible value of SEDEMAC’s hardware innovations. They subtly marketed the company’s capabilities to attract new OEM partners who joined these calls out of curiosity.

The strategy worked.

In addition to traditional investors, the calls drew individual enthusiasts, private equity players, and prospective customers. By offering clarity on its deep-tech credentials, SEDEMAC bridged the gap between technological complexity and market opportunity.

Future Geared Up

In late May, SEDEMAC raised $100M at a valuation of $260M providing a successful exit for its early investors.

Early investors earned 15x returns by backing SEDEMAC.

They believed in SEDEMAC’s vision that India could build world-class, sustainable, and capital-efficient technologies at a time when such ideas were rare among rapidly growing venture-backed companies in the country.

With fresh capital in hand, SEDEMAC’s ambitions have grown even bigger.

Of the total amount raised, approximately $9M will be invested in constructing a new manufacturing plant. Beyond enhancing its production capacity, this strategic allocation provides a financial cushion as SEDEMAC pursues significant growth opportunities in India, the US, and the EU.

The company is now focused on expanding its reach into electric vehicles (EVs), particularly two-wheelers.

Their innovative sensorless motor controllers aim to solve a significant issue in hub motors—sensor failures, which often result in vehicles becoming immobile.

SEDEMAC claims that no other company globally offers motor controllers with sensorless commutation, putting them in a unique position to lead this market.

In addition to entering the EV space, SEDEMAC aims to substantially increase its footprint in the genset sector—compact, engine-and-alternator systems that supply electricity for backup or off-grid applications.

They aim to grow from powering one in every ten gensets to one in every four. Taking on industry heavyweights like Cummins, Caterpillar, and Generac is a tall order, but SEDEMAC’s track record suggests it’s prepared to rise to the challenge.

SEDEMAC’s journey highlights the depth of India’s engineering prowess and the potential for creating globally competitive, IP-led products in regulated sectors.

Rather than style itself as the “Bosch of India,” SEDEMAC stands proud as the “SEDEMAC of India,” defining its place in the world.

Armed with new capital, an ever-evolving innovation pipeline, and a growing roster of marquee clients, SEDEMAC is poised to rewrite the rules of deep-tech manufacturing and design—both domestically and abroad.

It has a unique trifecta in the Indian ecosystem. It is deeply technical, growing very fast, and profitable. Few firms can boast of one, let alone all three.

SEDEMAC had scaled to almost 600 Cr of trailing twelve-month revenue by September 2024. It had a crazy 100 Cr EBIDTA and a 36% CAGR. 5 million vehicles used its technology, and 1 million generators were deployed. For a startup in a lab, it had come a huge way.

SEDEMAC proves that technology startups can be built in India and, more importantly, be viable, real businesses. It could pioneer the development of deep technology from India to the world.

Writing: Parth, Ajeet, Chandra, Shreyas, Varun and Aviral Design: Abhinav and MidJ