Oct 16, 2022

Can Shiprocket's Rocketship Propel India's Brands to the Moon?

Profile

Retail

Logistics

Aggregator

B2B

Series E-G

Last fortnight, Shiprocket announced its partnership with ONDC, just a few weeks after turning unicorn and acquiring Pickrr for $200M

First Startup Problems

Saahil Goel was twiddling with technology even before he started his professional career.

The entrepreneur in him was determined to run his own business sometime in the future. What that business would be, he didn’t yet know. He realised that it would be difficult to connect the dots looking into the future.

He decided to learn as much as possible about business and technology while working at Max Life Insurance, New York. It was 2006.

Reliance Infocomm had just renamed itself to Reliance Communications. The world had not seen a financial meltdown. India had not experienced Jio.

But Saahil wanted to experience everything about enterprise technology, software and product development. He’d spend nights learning about Linux, tech stacks and cybersecurity at data centres.

Servers used to be in-house on-premise back then, and Sachin and Binny had just started selling books online.

For the next five years, Saahil kept his learning hat on. He was more interested in strategy and business models and learning the width of every organisation he worked with.

All this while, he toyed with the idea of starting up with Gautam Kapoor - his friend from undergrad.

Gautam was working with his father, running their family business of distributing automation parts. His business represented India’s burgeoning MSME and SME segment.

India had millions of such small-scale sellers who had no one to help them go national. There was no marketplace available to give them widespread visibility. No tech allowed them to go online. These MSMEs had to fight discovery, payment collection, distribution and logistics.

They were hamstrung for growth.

Amazon had just tasted success in the US. Flipkart was new. Online sales and e-commerce were unheard of in India back then.

Saahil, however, had experienced the explosive growth of Shopify. The mature US eCommerce market allowed sellers to create their brands and reach out to their consumers directly. Shopify allowed these sellers to open their online storefront in a matter of clicks.

Shopify made going online easier than opening a retail store. India was not there yet, but it showed every sign of catching up soon.

Saahil and Gautam knew they had to latch onto this wave when it hit the Indian shores. They knew what they wanted to do - build a Shopify for India.

Kartrocket was born in 2012

Keep Building and Carry On

Saahil and Gautam were so convinced of their thesis that they didn’t reach out to any incubators.

The D2C segment was waiting to blossom. But when? Nobody knew.

During the first year, Saahil built customised websites for his initial few clients. This process was not scalable since every client would have their own needs

But the revenue allowed to pay for rent and salaries of the initial few tech hire who focussed on building a scalable product - the shopping cart.

Within six months of starting up, Saahil and Gautam met Vishesh. Vishesh was acting as a consultant to build Shiprocket’s business. His sales prowess made Saahil take notice of him. Soon, the company of a few engineers and two cofounders found its third co-founder.

It took a year to build their product. Another, to reach 100 paying customers. This milestone validated the product market fit. The founders had tasted success while staying 100% bootstrapped. Venture capital in India wasn’t prominent back then.

In 2014, they met their first angel investor - a founder who had come seeking their services as she waited to start her D2C brand.

But Kartrocket’s answer was still not clear. The goal to disrupt and enable Indian e-commerce was still miles away.

After two years in operations, the founders felt the need to pivot. At that time, the SMBs in India did not want to pay.

Jiofication had not happened. Kartrocket had to convince the sellers to consider selling online, every time they called their clients.

Indian retailers had not had the courage yet to break their shackles. Saahil and Gautam, in their haste to replicate the success of Shopify, realised that they were early to the market.

Kartrocket’s B2B SaaS playbook did not work out as intended.

Pivot and Don’t Chill

The pivot was evident in retrospect.

Rapid growth needed the B2B customers to come on board as paying clients as individuals would with a consumer app. This would be without months of the human-intensive sales process.

India’s smartphone penetration was catching up in tier 2 /3 cities. Data was cheap and widespread. Consumers who want to build online would like to build a website for online sales through apps, too.

Kraftly, to take the service of building websites, mobile was started.

Just before this, Akshay Ghulati joined as their fourth co-founder. The idea was to leverage Akshay’s expertise in leading international at Amazon to build an iconic e-commerce enabler.

In building Kraftly, the founders focussed on building third-party logistics aggregation. Along with the core product of selling the shopping cart, which allowed customers to check out from the listing page, the logistics product was bundled.

Kraftly decided to act as a technology-enabled aggregator that brought the logistics companies (Bluedart, Ecomm Express, FedEx, etc.) into a market that needed heavy capital investment to set up its logistics and distribution channel platform to compete for business.

The tech layer allowed order flow management to a delivery partner, facilitated order pickup and last-mile delivery and allowed consumers to track their packages.

They got so good at this bundled product that within two years, 30-40% of customers came back to Saahil requesting integration of the logistics services of Kraftly onto their existing Shopify/Magento platform.

The logistics product’s inbound viral demand led to the final pivot. Kraftly was discarded, and Shiprocket was born in 2017, 6 years after the company started.

Why it was making so much sense would suddenly be apparent.

That’s what D2C Said

Indian e-commerce was a different beast compared to the US.

Unlike the US, Indian sellers unlisted on Amazon/Flipkart had found a way to sell their products online via Facebook, Instagram and WhatsApp.

Shopify triumphed in the US at a time when Facebook and online communities did not exist. Sellers were forced to open their online stores for their consumers to have an opportunity to interact with them.

When the time was ripe for Indian sellers to come online, they found online communities as a tool to circumvent the monthly subscription fees charged by Shopify. Online communities allow sellers to engage with their clients.

The buyer-seller negotiations could happen on WhatsApp/Messenger chat, and Google Pay / Paytm would allow payment collections.

The missing piece was eventually shipping the product to the consumer.

This crippled everyone who was not selling on Flipkart/Amazon. While the eCommerce giants allowed delivery and tracking, they charged enormous take rates. Directly dealing with logistics providers would be economical but inefficient to track.

Enter Shiprocket.

Shiprocket started with the very basic idea of providing shipping solutions to thousands. Along with delivering goods, the idea was to offer it cheaper, more effective and faster than any other channel.

Shiprocket did not want to become a pure-play logistics company.

Instead, it wanted to be the tech-stack layer that allowed merchants to focus on selling their product, while Shiprocket took care of everything else beyond the “Buy Now” button.

The market that Shiprocket went after was just beginning to open up. Ecommerce in India was finally starting to take off.

Of this pie, direct-to-consumer would form only 15% in India. In the US, this cut is upwards of 40%. This shows the potential of India's D2C outpacing the growth of horizontal players in a market that is only expanding.

India's D2C could be a $40B market in the next five to seven years. When that moment arrived, Shiprocket would be a leader facilitating the rise of this tide. They were at the cusp of rapid growth. The numbers didn’t indicate otherwise.

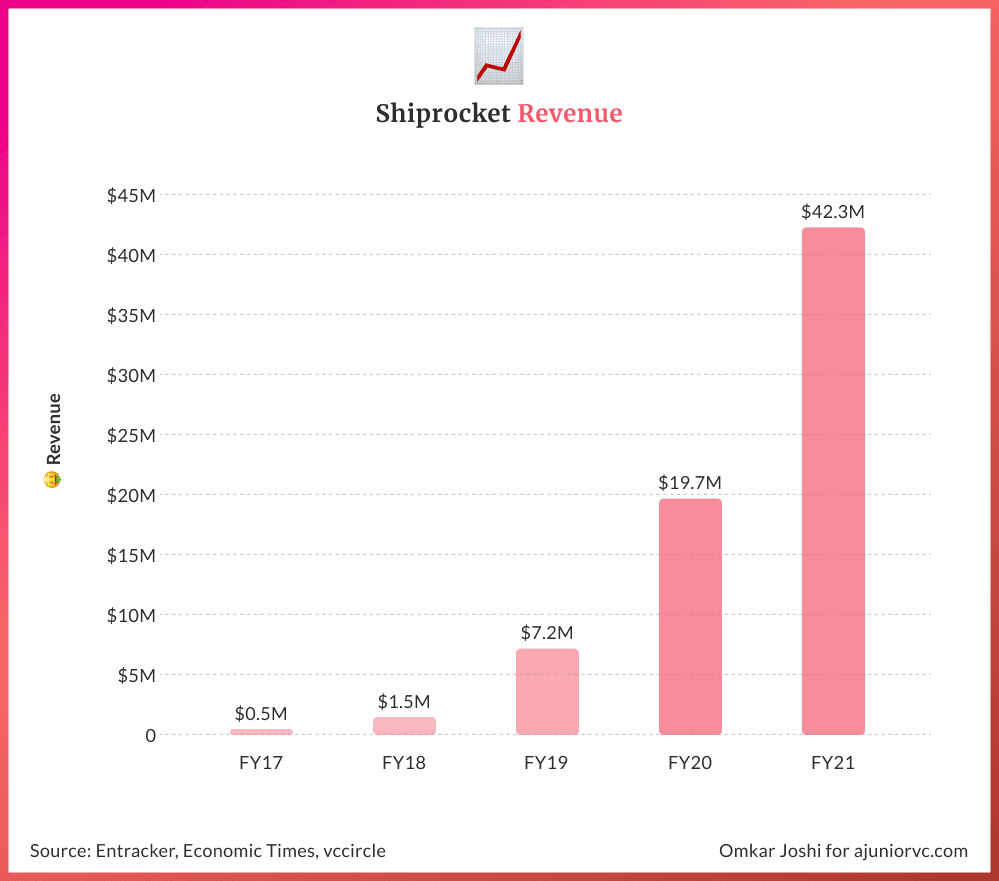

In 2017, the first year of Shiprocket’s operations, it had 2000 merchants. It grew 4X the next year to reach 8000 merchants by 2018.

In 2019, Shiprocket grew 3X, exploding right off the gates after 6 years of pivots.

Ur Growth Mad Bro?

Signs of PMF were amply visible in numbers for Shiprocket.

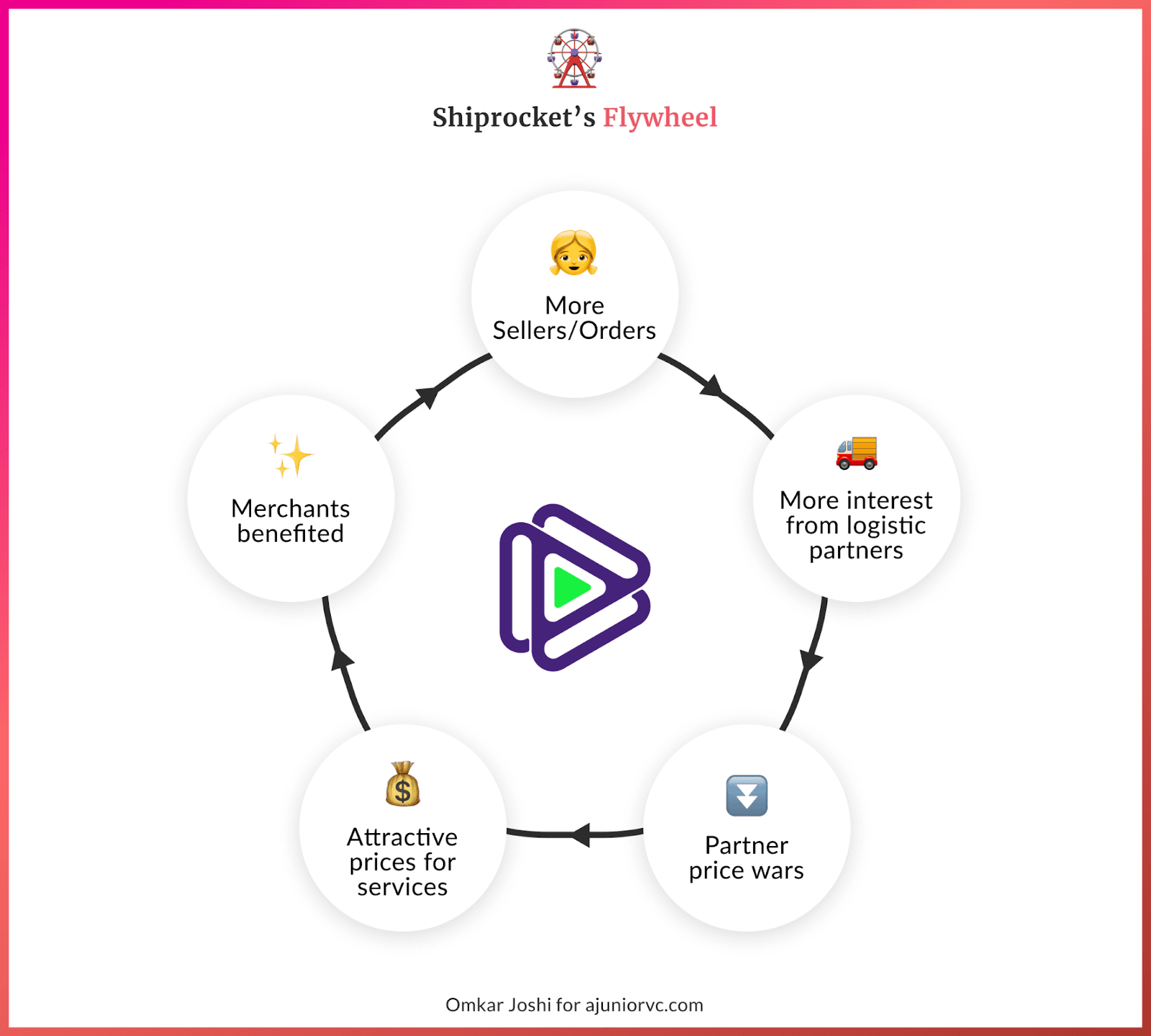

As Shiprocket got more sellers and orders, their negotiation power with logistic partners like Delhivery and Xpressbees, which were also e-commerce focussed, increased significantly.

They asked for better pricing as Shiprocket became one of the critical accounts for these logistics partners. Competition between logistics providers that Shiprocket aggregated was increasing, and it helped them get the best possible price and services.

Once Shiprocket negotiated to price, they would pass on the benefits to their merchant base, which would build a growth loop as merchants found more value and referred Shiprocket to more and more sellers.

As this network effect kicked in, Shiprocket accelerated at a pace where escape velocity wasn’t looking that far.

But the entry barrier to this space was low. APIs to integrate these logistics players were available, and many new names came up.

Startups like ClickPost, Vamaship, ShipKaro, Shyplite, and many others, started fighting for their market share.

Everyone knew it was a winner takes all market. The fight for market share was on.

But Shiprocket was not only the first mover but always a step ahead. With its focus on customers and efficient execution capability, it was way ahead of others regarding orders and active merchants.

Economies of scale then acted as a moat for Shiprocket to fight its competitors. This was not the market where deep discounting was required; hence, margins were intact for Shiprocket.

Given this was a B2B SaaS business, there was no substantial operational cost or customer acquisition cost like B2C business, which made Shiprocket's business model a low-burn company.

This time, tailwinds favoured the Shiprocket founders as the D2C wave picked up steam.

By early 2020, they were not only growing fast, but they also turned profitable with a net profit of little over Rs 10 crore as per their FY-20 filings.

Dabbing to Success

After a fabulous 3-year growth journey, Shiprocket witnessed something that nobody had anticipated.

Covid stuck us, and by March 2020 there was a complete lockdown in India. Shiprocket and its merchants were severely hit as their business reached a standstill.

However, this turned out to be the game changer for Shiprocket.

Customer behaviour changed due to the lockdown when more and more customers started searching and ordering online. This created substantial unmet demand for online brands.

The lockdown allowed many budding entrepreneurs to build their businesses online. Many offline sellers, be in fashion, food & beverage or other category sellers, opened up to the idea of selling online to de-risk the impact of such lockdowns.

Investors also understood that the rocketship seat was something they couldn’t miss.

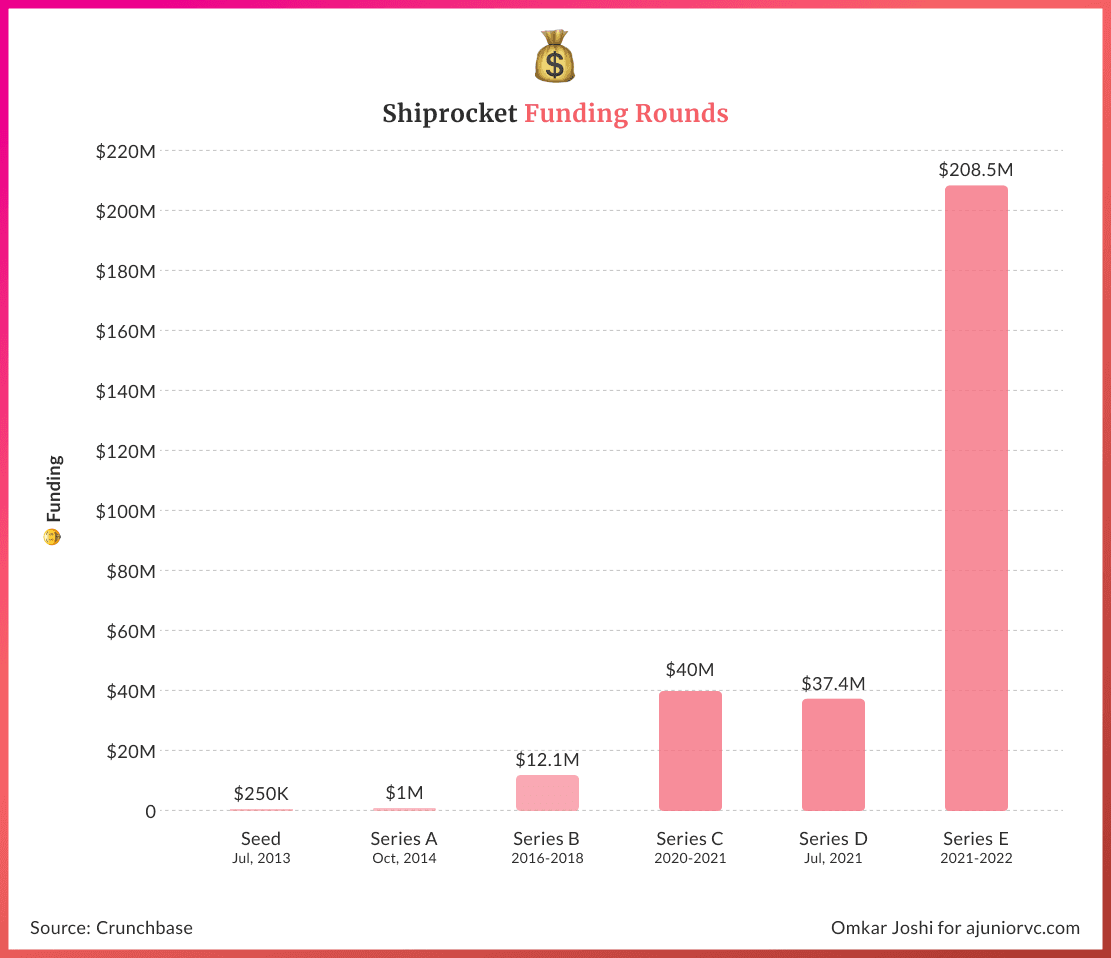

By May 2020, Shiprocket raised $13 Million, its biggest round so far, and it was ready to take off to newer geographies.

As India started opening up slowly, Shiprocket saw a 4X growth in its active merchant base. By September 2020, it had 41K monthly active sellers, up from 11K in September 2019.

The growth was so robust that Shiprocket saw a 511% growth in first-time sellers on its platform in March-September 2020.

In terms of financial performance, Shiprocket’s revenue more than doubled from $19.7 M to $42.3 M, including a couple of months of complete lockdown.

But why was this working?

??? = Profit

To understand the fundamental business model of Shiprocket, one has to understand the different moving parts that come into play when we plan orders on any e-commerce website.

For a seller selling handmade pickles, there is an investment in terms of raw materials-vegetables, oils etc. There is a cost for packaging, labelling and storage. Then there is the labour cost to prepare the pickle.

All these are the costs one must bear even before the order has come. Let’s say the seller sells this pickle at Rs 500 for a 500 g pack.

Generally, the cost of raw materials was around 25-30% or Rs 150. But there are two additional costs that one has to incur to run this online business.

Customer acquisition cost, be it on their stores running marketing campaigns on FB/Google or as a margin to list on e-commerce players like Amazon/Flipkart. Depending on the brand and operational efficiency, this cost can easily be 15-30%.

After that comes the logistics cost for shipping these bottles from the seller’s to the customer’s location.

Generally, the shipping cost is per 500 gm in the B2C segment. It can be Rs 50 to Rs100 depending on the pin codes, type of mode selected and the business volume.

It can be another 10-15% of the seller's cost, leaving a margin of close to 30%.

But here is what makes selling online tricky.

Not all shipped orders will be delivered. Few will be Returned to the Origin, known as RTO, when the buyer does not accept delivery. This is pretty high for COD orders in India.

As the shipment returns to the seller, they have to incur not only the forward cost but also the return cost.

This makes the overall logistic cost high while they did not make any margins on that order. For returnable products like fashion and clothing, returns or RVP can be an additional headache for sellers.

In the entire operations, logistics companies, Delhivery or Ecom, have to charge in all the steps. Be it delivered/returned orders or Cash collection for COD order from customers.

But, logistic players have high fixed costs, leased transports, monthly payroll for executives, etc. To remain profitable, they need volumes and prefer large enterprise customers with very high daily orders.

Another problem is delivery pin codes. Not all service providers have service over all the pin codes which Shiprocket has solved by partnering with 17+ logistic partners.

But that even spreads the volume further across each logistic player.

Basis an approximate calculation, Shiprocket merchants, on average, give 10 shipments a day and spread into 3-4 logistic players basis Pincode and service quality.

Individual sellers in the D2C space are not big enough to negotiate the pricing directly with Delhivery or do not have the processes to minimise RTO/ returns cost.

They rely on aggregators like Shiprocket to help them optimise their logistics costs and bring in efficiency.

For sustainable growth of these small D2C players, they need a platform like Shiprocket.

Shiprocket aggregates these sellers and negotiates on their behalf to get the best pricing from service providers.

For this, they charge a subscription fee on different plans, which sellers can choose basis their scale and feature requirements.

Apart from the subscription fee, Shiprocket also makes a margin on each order, value adds services like Early COD, which form an additional source of revenue on top of recurring subscription fees.

For FY-21, Shiprocket made a revenue of close to 357Cr, while the cost paid to logistics players was close to 295Cr. This suggests a take rate of close to 20% for Shiprocket.

As there is no significant attribution to merchant acquisition cost, a good portion of new merchants might be coming through organic channels like SEO and direct traffic or an offline acquisition engine running, which gets covered in general expenses.

With a near 20% take rate and less than 16% cost on salary and other expenses, Shiprocket has found the unit economics to build a sustainable business for itself.

Shut Up and Take My Money

By mid-2021, Shiprocket was truly a rocketship.

They were serving the biggest D2C brands, from global brands like Samsung to homegrown brands like Mamaearth, their list of clients included all biggies, including Boat, Da Milano, Bira and MTR foods.

The tech-enabled logistics platform observed a 60% growth in sellers onboard its platform, passing over 1.5L sellers, and order volume skyrocketed by 80%. Over 80% of the total sellers had been onboarded after 2020, with about half of them from tier 2 & 3 cities.

All this growth came with a plethora of funding rounds; they raised capital four times in 2021, bringing a total of 280M$ in funding.

Their last and biggest round was $185M, putting its valuation at $950M, led by Zomato. The Zomato investment was strategic, wanting to take advantage of each other's infrastructure.

They were using this money to keep the ignition on this growth. Deploy capital towards product expansion and R&D. They also started looking for inorganic increases via M&A to expand the stack further.

They were also looking to expand globally, and they chose the Middle East.

Logistics in the Middle East had been growing steadily, thanks to the e-commerce boom. With further infrastructure development, the logistics industry was set to further develop.

Shiprocket also began to use the funds to go on an acquisition binge.

They acquired around half a dozen startups and invested in others like Woovly, Eat Better, BoldCare, EvenFlow and Logibricks

Their biggest acquisition was Pickkr, acquiring 80% of one of their biggest competitors for 200M.

The acquisition helped Shiprocket strengthen its position; it completed the startup's capabilities as Pickrr had primarily focused on large commercial brands, and Shiprocket focused on SMEs and D2C brands. Through this acquisition, their total order volume was expected to increase by over 40%.

Rocketbox was another very strategic acquisition, it helped Shiprocket lower shipping costs and smoothen end-to-end customer experience on its platform. They also acquired Wizgo Tech, a customer data platform. The addition of Arvind’s Ltd. Omuni helped combine their retail stack with the Shiprocket ecosystem

Shiprocket has always tried to promote the D2C market in India, as its success is tied to the sector's growth. They started an accelerator programme for D2C brands called Rocketfuel for the same

It wants to become a tech-focus platform centred around logistics from a tech-enabled logistics platform.

In the middle of the funding winter, Shiprocket raised 32M$ from returning investors to become a unicorn.

They were the fourth logistic company after Delhivery, Rivigo and Blackbuck to become a unicorn.

That Company Escalated Quickly

By 2022, Shiprocket had delivered to over 80M unique users.

They are delivering over 2 lakh orders a day with over 29000 serviceable pin codes. Having partnered with over 17 courier partners, offering to over 200 nations across the globe and with over 45+ fulfilment centres spread across the nation, they were bringing the inventory closer to the customer to enable faster delivery.

Riding the D2C wave and push triggered by the pandemic, the Indian e-commerce market reached $70B by FY22 and is expected to grow to $215B by FY27. The total D2C market is expected to grow 5x to $60B by FY27

One of the significant contributors to this growth is the flow of new entrants in the ecosystem, from startups looking to disrupt the market to brick-and-mortar adapting to the new normal.

Ecommerce penetration is around 8%, and is expected to reach 15% by FY27. India will be home to 500M+ online shoppers by 2030. India’s eCommerce is growing at the fastest pace globally at an annual rate of 51%.

Logistics and last-mile connectivity are the key levers in the e-commerce market.

Shiprocket is placed in the correct position to rocket-fuel its growth, with its SMEs focussed approach it might be able to continue its high seller onboarding growth, growing its revenue.

Big brands with their leveraging power might shift from an aggregator to the actual transporter like Delhivery, but for SMEs, Shiprocket will be the obvious choice.

With such a vast number of merchants onboard, and most of them SMEs, they are looking to focus on more than just shipments, they are looking to add services like revenue-based financing and marketing automation.

They want to become one true SaaS brand, solving D2C for SMEs. Building together a stack of products that can help them solve all areas of pain for these businesses.

Through ShiprocketX, they want to take Indian D2C brands globally as export is already a huge market.

Indian products have been performing well on platforms like eBay and Amazon. They are looking to solve the logistic problem where homegrown Indian brands will be able to cater directly to the international audience.

By leveraging the fulfilment and logistics expertise they have built over the years, they are looking to solve logistics in nations in the nascent stage of the D2C wave,

There are still 1L+ pin codes that are not serviceable by Shiprocket, majorly rural, the growth opportunity here is still immense. In areas they are servicing now, they are trying to make deliveries faster from next-day to same-day within 3 hours.

By utilising Zomato’s huge delivery fleet across various cities, small and big, and with their network of fulfilment centres and warehouses, they will be able to solve the last-mile superfast delivery problem.

After multiple pivots and more than a decade of existence, Shiprocket is ready to take Indian brands to the moon.

Writing: Abhinay, Raj, Tanish and Aviral Design Omkar and Chandan