Feb 9, 2020

Is Shopee the Unicorn Reinventing Asian E-Commerce?

Profile

Fashion

Electronics

Beauty

Mobile

Entertainment

Aggregator

IPO

B2C

Retail

Last fortnight, Shopee was ranked the most positively discussed brand in Malaysia, beating the likes of WhatsApp and competitor Lazada to cap off an epic 2019.

Build, Forrest, Build

In 2009, Forrest Li started a small gaming startup called Garena, a mash of “global arena” in Singapore.

The idea was simple. The platform wanted to allow people to discover, download and share games. For 5 years, the company rapidly built games. Gaming, as we had seen earlier, is an incredibly profitable business and Garena simply wouldn’t stop growing.

In these 5 years, South East Asia was rapidly evolving driven by the internet and the smartphone. A young, large population base with increasing disposable income, increased internet penetration and rising smartphone access spelt opportunity.

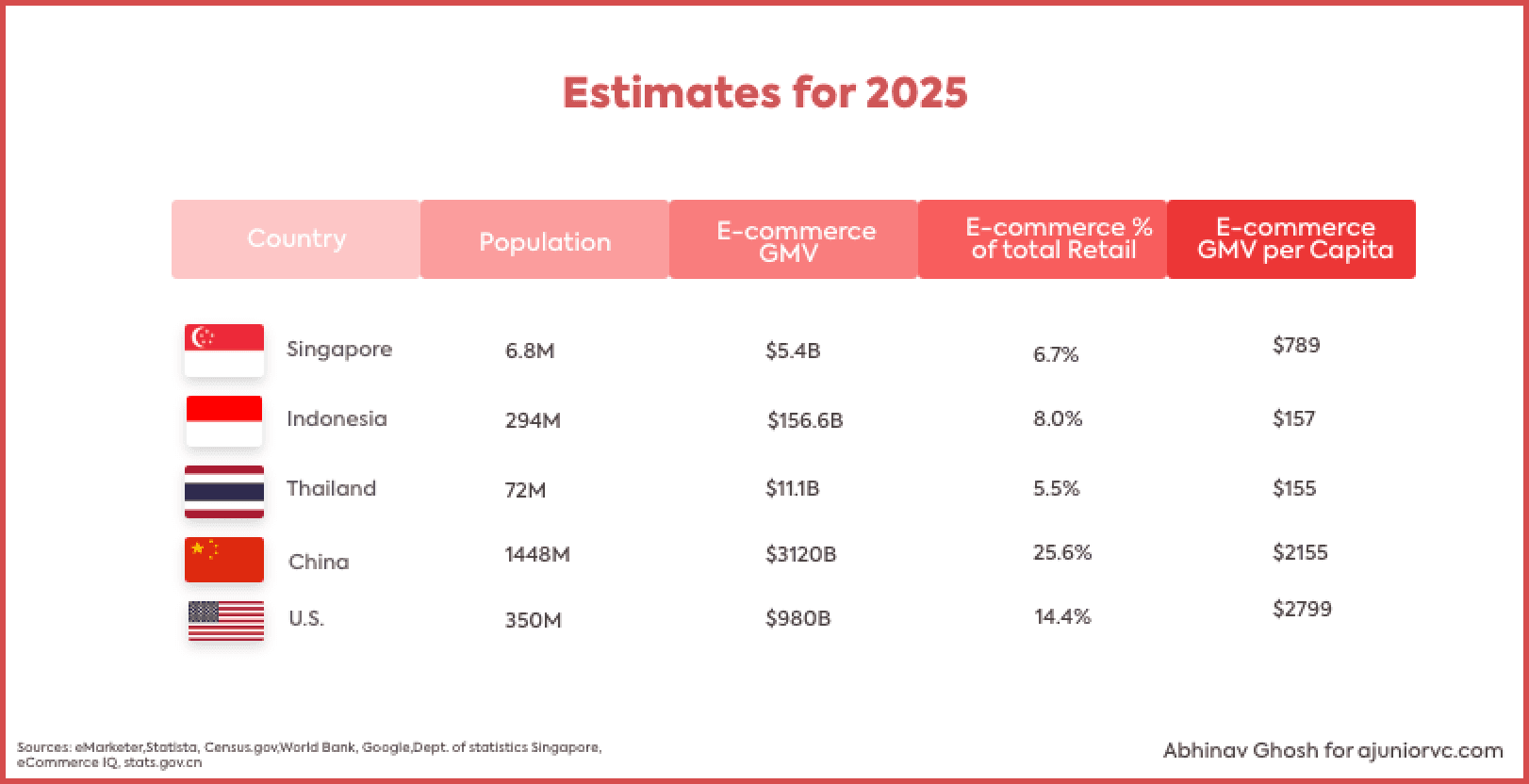

By 2015, the SEA e-commerce market was becoming increasingly competitive and existing players (Alibaba, Lazada, JD) were stepping up their game. The golden age meant a double digit growth in a market where <1% of sales happened online

Singapore was the leader in the B2C e-commerce sales in the region with strong infrastructure, high internet penetration and well-developed payment networks. However, growth was tapering in the market in terms of new user addition

Other markets such as Indonesia, Philippines and Vietnam were viewed as the next growth frontiers. The same demographics which had shaped Singapore in terms of a young population, sizable online shopping base, well-developed infrastructure and support network for e-commerce were beginning to take wings in these markets.

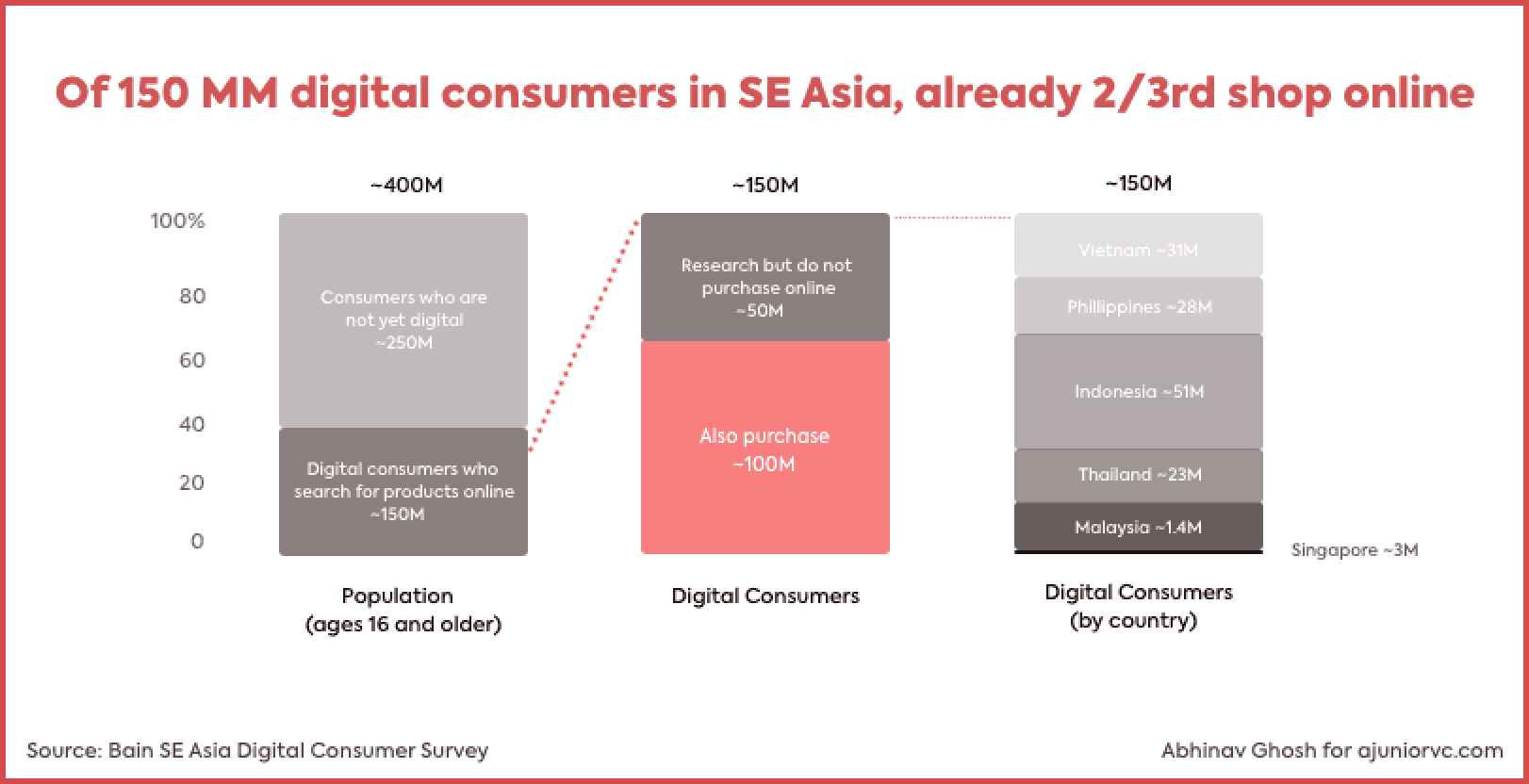

With more than 250MM smartphone users a dominant consumer characteristic was the eagerness to learn and use smartphones. Of them 100MM had purchased digitally. However, what was more interesting was the remaining 150MM which had researched products or engaged with sellers online.

The initial green shoots predicted in statistics were becoming visible on ground across South East Asian markets.

Building on The Social Network

Mobile phones were being used by the vast majority to go online in Indonesia. In Malaysia more than 33% of online purchases had come from cross-border sales in 2014.

Strengthening trust and creating awareness in terms of online purchase were the two crucial pillars for new and existing players but the battle would be tightly fought

In Indonesia, Lazada went all out with the return of its previous CEO. JD launched with JD.id, aCommerce Indonesia surpassed Thailand in order volumes and MatahariMall (aka Flipkart of Indonesia) all launched in 2015!

What made this time exciting was the confluence of various business models right from P2P (Olx), C2C (Rakuten, Tokopedia, Shopee), B2C (Lazada, Zalora, MatahariMall) all at once. This meant that the linear evolution of e-commerce models as witnessed in the US, China and India would instead play out as a Darwinian game of natural selection in SEA.

Consumers also skipped the PC to smartphone journey directly coming onto smartphones.

By 2015, Garena was already a unicorn, and Singapore’s largest tech company. What would an ambitious internet organization, with a detailed understanding of social behaviour through gaming do to scale?

Get into social e-commerce, of course.

The Dark Knight Rises

Garena, now the SEA group, had more than $200MM in capital and the resources to enter.

What SEA needed was the team to setup and scale this business from scratch, and looked for an experienced veteran to turbocharge the “startup’s” growth journey.

Shopee followed the same playbook when it appointed Chris Feng as the CEO in Dec 2015 to begin building a social e-commerce platform for SEA. Chris had previously helped scale Zalora and Lazada under Rocket Internet’s umbrage, which is known for its ‘move fast break things philosophy’. If regular readers remember, Zalora was co-founded by Go-Jek’s founder Nadiem Makarim.

Founder-market fit was established, and Chris realized that ‘professionalism’ was the strategic weapon to deploy in its fight in an intensely fought e-commerce market in South east Asia.

Around 2015, e-commerce and m-commerce had broken to become mainstream in Singapore. According to a study by PayPal last three years had seen 2.7MM online buyers with an average yearly spend of $1,860

Lack of trust, low touch and feel and limited product discovery were the top concerns cited by early users in the market and these needed to be resolved or minimized

Singapore was the natural choice to start because of its well-developed infrastructure. The online shopping market was expected to reach ~$3.5Bn by 2015 with the transition of retail sales from offline to online. There was optimism for the market to reach 15% of total retail volume similar to seen in the US and Europe.

73% of the 5.4MM population was online with 58% of them shopping once a month. Moreover according to a study by Visa, 50% of them would be keen to do all their shopping online.

156% mobile penetration vis-à-vis the global average of 121% made it possible for m-commerce to be a key driver. A well-oiled payment infrastructure, its rating as Asia’s top performer in logistics and one of the highest social media penetration at 59% were the other key factors which made Singapore a natural entry choice.

But why was Shopee leaning to social commerce as the answer?

Entering the Fight Club

Social commerce was beginning to take root in these markets due to a variety of factors.

As we discussed earlier, the SEA markets did not have the standard commerce evolution model, and brand loyalty was a myth because there were no big brands. An extremely fickle customer base existed where no retail platform held a sizable share.

In Singapore at least 12 platforms served 90% of the market. This meant that a more closed loop trust-forming interaction model via social media could help improve consumer loyalty

Moreover, more than 80% of consumers were already using social media options such as Instagram and Line to connect with sellers. Particularly for these users, experience (60%) and choice (61%) mattered more than price (45%)

Shopee’s late entry to the space provided it with the strategic advantage to understand and leverage the best practices of different e-commerce models, i.e. Rakuten, Alibaba, Gumtree, Classifieds, and create a ‘true marketplace model’.

Shoppee aspired to be a regulator than an executor with minimal interference in the interaction between buyers and sellers as possible.

They understood the pain points which consumers on other platforms were having and introduced features such as built-in payments, transaction management, review and chats.

Customer obsession is a principle exemplified by the world’s largest e-commerce company, and Shopee infused this culture right from the beginning.

Shoppee knew that the quality of sellers on the platform had to be excellent and institutionalized the process. Seller’s onboarding involved phone number and bank account verification. It followed it up with a seller rating system based on reviews and response rates and an in-house content team which flagged suspicious users.

It also realized well in advance that last-mile delivery could become the biggest bottleneck to e-commerce growth in the region due to the fragmented and broken delivery infrastructure.

It partnered with a logistic partner NinjaVan to ensure that the major headache in order fulfillment was not borne by the seller.

Providing the necessary plumbing to sellers in terms of infrastructure and support allowed them to onboard good quality credible sellers and allow them to do what they are the best at. Over time its Live Chat, strong logistical support and safe payment system have truly stood out as the differentiating factors.

The features that differentiated Shopee began to show in numbers.

The Wolf of Orchard Road

Shopee’s GMV grew from $41MM in the last quarter of 2015 to reach $3.4Bn in 2018’s last quarter.

Just after 3 years of launch, it completed 2018 with a $10Bn GMV mark. Unsurprisingly, it had become the market leader of the South-East Asian E-commerce economy. An economy, which doubled year on year between 2015 and 2018 and is expected to $100bn+ by 2025.

Shopee has a revenue model like any other e-commerce platform. It consisted of two distinct streams, marketplace revenue and product revenue.

Contributing 80% to the e-commerce business, marketplace revenue included advertising fees charged to sellers in all markets for performance-based advertising tools, seller commission charges in certain markets and fees for value-added services. The remaining 20% comprised revenue from sale of private label goods.

In the quarter ending September 2019, it recorded a revenue of $257MM, up from $71MM over the same period last year, signifying year-on-year growth of more than 250%. Within this, the marketplace revenue grew 4x from $50MM to $208MM and product revenue more than doubled from $20MM to $49MM.

Gross orders also doubled during this period reaching ~320MM for the full quarter. This amounts to 3.5MM orders per day (OPD). We begin to appreciate this hyper-growth when we realise that e-commerce in India records ~3.5MM OPD. Imagine a single platform, catering to a population of 600MM+, matching up to the total e-commerce demand for the second largest country in the world.

Given the demography in South-East Asia, the average order value (AOV) for Shopee is ~$14 (~INR 1000), about double the AOV for e-commerce in India.

However, large and growing GMV without looking at the losses is an incomplete story.

The Godfather Garena

Shopee’s sister company, Garena was a money printing machine that effectively subsidized Shopee.

SEA as a group is rapidly cutting losses, with a $31MM loss in Q319 compared to $180MM in Q318, driven by a very profitable Garena. Shopee remains in the red, with it making losses on every order today.

Shopee incurs a total cost per order (CPO) that is twice as high as the revenue it earns per order (RPO). In Q2 2019, its RPO was ~$0.8 and it recorded an EBITDA loss per order of ~$0.8. However, the loss per order is down by 40% from ~$1.4. In other words, during the same period last year, Shopee’s CPO was more than 4 times its RPO.

While revenue has grown by leaps and bounds, total losses increased by a meagre 18% between Q2 2018 and Q2 2019. It reduced its burn from -300% to -98%.

Overall, Shopee has proven itself to be that rare e-commerce player that has grown aggressively while reducing losses. Founder, Mr Li, regards losses as a necessary step in this business to achieve scale and reap the benefits of operating leverage.

Luckily for him, the gaming business generates substantial profits to subside Shopee. The asset-light strategy of marketplace helps him avoid the risk of managing inventory, unlike Lazada that has 30+ warehouses across South-East Asia.

Its command over the market is evidenced in not just its growth but also the kind of markets it has been able to successfully scale in.

Shopee is the market leader in Indonesia, the largest economy in South-East Asia, in terms of number of orders. Indonesia accounts for more than half of the e-commerce business in the region and Shopee has been quick to capitalise on this trend.

The country now accounts for more than 40% of its total orders. Such penetration is remarkable given that Indonesia is made up of 10,000 islands making logistics a real challenge in the market. As we had seen in Zilingo’s rise to become a unicorn, it is a complex problem.

Though Shopee caters to only SEA markets of Indonesia, Vietnam, Thailand, Philippines, Malaysia, and Singapore, as well as Taiwan, it unboxes the opportunity for a large number of sellers in China and Hong Kong to sell to this region.

Not surprisingly, the company estimates Shopee’s revenue to reach ~$900MM in 2019. In the process, it went onto do something that nobody had expected a gaming company to do.

The Prestige

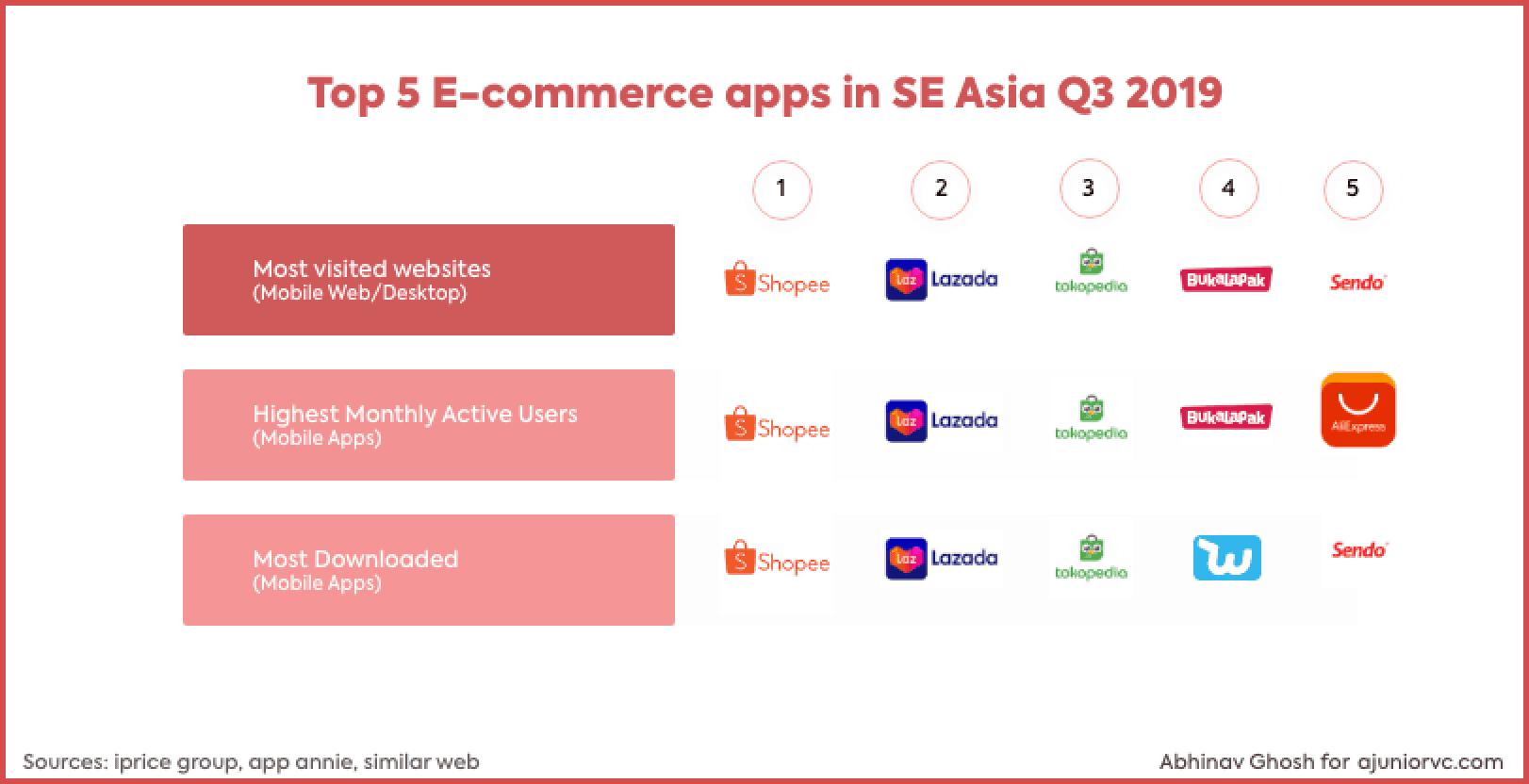

By the start of 2019, Shopee was the clear leader in Southeast Asia’s E-commerce mobile shopping

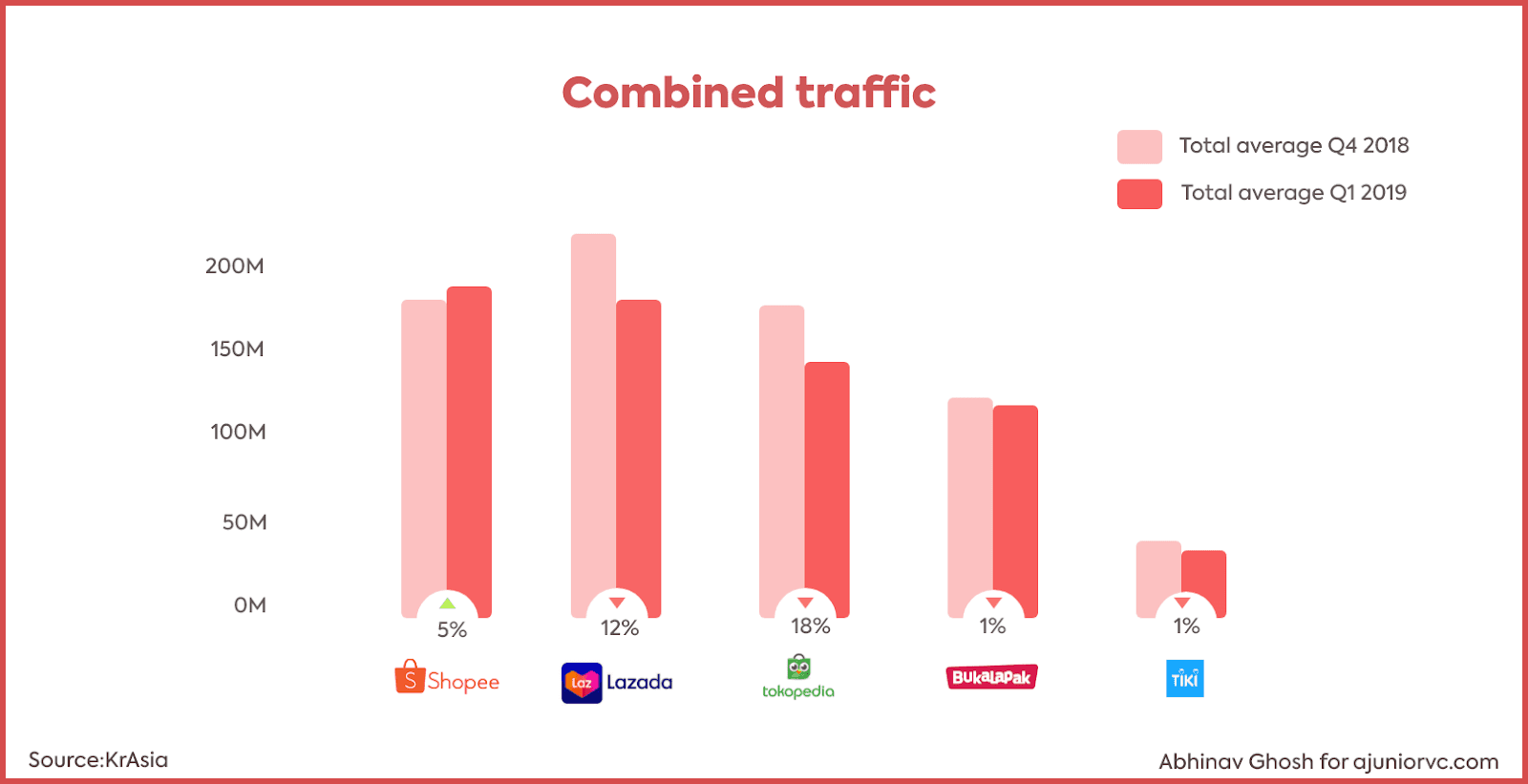

Despite entering the market significantly after Lazada and Tokopedia, Shopee has been able to rise in the ranks faster than any other player, and even eclipsed Lazada in site visits during Q1 2019 while being the only player to demonstrate an increase in views from Q4 18 to Q1 19 (shown below).

How was this relative upstart able to out-compete well capitalized and dominant market players like Lazada and Tokopedia?

Localization and engagement.

History is testament to many successful consumer focused companies that have mastered the art of thinking globally while acting locally.

McDonald’s painstakingly researches local markets before offering burgers that uniquely mirror local taste. Try ordering a McAloo Tikki anywhere else in the world!. Hotstar dominates the Indian OTT market through ad-supporting and live TV viewing and has beaten out competitors like Netflix, who tried to apply Western subscription models to an Indian viewer who is used to watching ad-supporting television.

Getting back to Shopee, the company is able to provide a customized online shopping experience to both buyers and sellers across different markets.

Each market that Shopee operates in has unique characteristics in culture, language, user behavior, purchasing power and technological maturity, leading the company to leverage data science in an effort to grow sustainably.

This is where engagement comes in, which Shopee has innovated for the South East Asian context.

A Beautiful Find

What online retail gains in convenience and price, it loses in the personal relationship a customer can build with a seller at a physical store.

Shopee’s solution - Shopee Live, which allows real-time conversations between sellers and shoppers through the Shopee application. Sellers can conduct live product demonstrations and reviews while customers ask questions through the chat function, taking the online shopping experience to a completely new level.

To help prepare sellers for this increased end-market opportunity, Shopee in 2016 introduced Shopee University, a series of in-depth tutorial modules crafted by Shopee to aid local entrepreneurs and businesses in setting up their online businesses, and helping them succeed in an increasingly competitive eCommerce environment.

Online shopping in Southeast Asia will never be the same. Shopee even hired Ronaldo as their brand ambassador, and as this ad testifies it can make anyone break a leg.

But you would realize that a chat application only goes so far, so Shopee also offers a host of interactive experiences on its platform like Shopee Quiz and Shopee Shake which consumers can play to earn coins and eventually spend on items on Shopee’s platform.

This strategy has clearly worked - over 1 billion plays were recorded on Shopee’s wide range of in-app games in 2019.

This engagement is taken a step further with ShopeeTV, Shopee’s own video channel, which buyers can watch on social media channels like Facebook, Instagram, and YouTube.

Shopee has optimized the entire customer lifecycle so that buyers and sellers keep coming back to the platform. It has built and innovated for the ecosystem, beating the likes of Alibaba backed Lazada, Amazon and Tokopedia.

Could there be something to learn for the e-commerce “rebels” of Meesho and Glowroad taking on the “empire” of Amazon and Walmart?

Building E-Commerce’s La La Land

We’ve spoken before about GoJek, Grab, and the making of a super-app.

India has long been on the hunt for a platform that can serve as the WeChat equivalent for Indian consumers with a few candidates like PayTM and Whatsapp leading the race.

Shopee provides an interesting case study for Indian E-commerce to learn from. Meesho and GlowRoad showed that there is a considerable appetite for a grassroots movement in social commerce, but where can they go next?

As we had seen with Meesho, the company is tapping the micro-sellers who are too small for Amazon/Walmart to tap into. Armed with Whatsapp, and using their social networks, Meesho/GlowRoad are the challengers.

It isn’t only these two that have added social engagement as a layer for better experiences.

This might look like the Zomato Premier League, where food delivery users predict the outcome of cricket games while ordering dinner to get 30% cashback on their order. Or maybe it’s similar to Make My Trip, which launched a weekly game show every Sunday to ask users trivia questions about different travel locations and win the chance to win on free trips.

As Shopee shows, though, the future of commerce is social.

Shopee's GMV run rate is ~$18Bn, higher than even Flipkart and Amazon. While it has a much lower take rate - or revenue as a % of GMV, it tells you the size of the opportunity it is tapping through a different model.

Through live feeds, interactive shopping, and increased engagement, winning the Indian E-commerce consumer will come down to who can provide the immersive end-to-end experience. By tapping into the ways locals sell in Asia, Shopee has replicated the noisy “bazaars” on users’ mobile. It has reinvented e-commerce in South East Asia, and after being a challenger, it may very well be the winner.

Shopee has set the gold standard for immersive engagement around the world, and will reinvent Asian e-commerce.

Written by: Aviral, Keshav, Saloni, Shiraz