Jun 9, 2024

Is Bajaj Finance a $50B Fintech Masquerading as an NBFC?

Lending

Finance

Brand

IPO

B2C

Profile

Last fortnight, Bajaj Finance subsidiary Bajaj Housing Finance filed for a 7,000 Cr IPO to make inroads in the hot housing space, as it planned to relaunch Bajaj Chetak

Humaara Bajaj

Coalition governments were a feature of how different the 90s were.

One thing that motivated every Indian in the ’90s was a TV ad “Buland Bharat ki Buland Tasveer, Humaara Bajaj”

The third son of Kaniram and Birdibai, Shri Jamnalal Bajaj was born into a poor Marwari family. A rich merchant of Wardha, Seth Bachhraj and his wife later adopted him as their grandson.

Under the guidance of Seth Bachhraj, Jamnalal Bajaj got involved in the family business and acquired the know-how of being a tradesman- keeping strict accounts and buying and selling commodities- excelling in his work.

In 1926 he founded what would become the Bajaj group of industries.

Shortages of food, power, raw materials, technology, and foreign exchange, upheavals in the banking system, and the introduction of the License Raj were just some of the challenges the country and its entrepreneurs faced from the 1940s to the early '70s.

In 1942, the Bajaj Group had sales of approximately Rs.1 Crore, under 200 employees, a few ginning and pressing mills, and an unwavering ambition to grow. By now, Jamnalal Bajaj’s son- Kamalnayan Bajaj, was actively managing the business.

Bajaj Auto- the jewel in the crown, came into existence in November 1945 as M/s Bachraj Trading. Initially, it imported and sold two- and three-wheelers in the country. During partition, the group lost almost one-third of its assets. Kamalnayan Bajaj started afresh. Over the next three decades, he built sixteen factories and acquired five.

Bajaj Auto started manufacturing two-wheelers and three-wheelers in 1959. That year was also an important year for the company, as it went public. The Pune-based company was cruising.

The first Vespa 150 was launched in 1960 under the license of Piaggio, Italy. The name Vespa prospered for over a decade then.

By 1965, the Bajaj Group was the 19th largest business house in the country. It was time for Rahul Bajaj to take the driver’s seat for the next exponential growth phase.

In 1970, Bajaj Auto celebrated a significant milestone by rolling out its 100,000th vehicle, marking a period of substantial growth in the emerging automotive market.

The following year, in 1971, Bajaj Auto introduced its first three-wheeler goods carrier. This innovative vehicle was crucial in supporting India's burgeoning industry and entrepreneurship, providing a reliable and efficient means for small businesses to transport goods.

By 1972, Bajaj Auto launched the iconic Chetak scooter, revolutionising personal transportation in India. The Chetak quickly became an enduring symbol of aspiration, resonating with generations of Indians who sought affordable and dependable mobility.

In 1981, Bajaj launched the M-50, but it saw little success. Five years later, the upgraded M-80 became one of Bajaj's flagship products.

Bajaj Chetak soon became the largest-selling scooter in India. However, the Permit Raj of that period capped its production. As a result, demand continued to shoot through the roof year after year. At one point, the two-wheeler had a 10-year waiting period.

Even second-hand Chetaks were hard to come by and those available cost a bomb.

Financing Aspirations

Bajaj Auto with over two decades in manufacturing, knew the Indian market well.

While cars like the Maruti 800 or Padmini remained out of reach for most Indians, a two-wheeler became necessary for every Indian middle-class household.

Rahul Bajaj could see the biggest hurdle to Bajaj Auto’s growth was the problem of getting financing for the 2 or 3-wheelers.

In the '80s, India was dominated by government-owned banks. These entities lent to the government or to those who indirectly benefitted the government, like farmers. These banks were not interested in financing two-wheelers.

Citi Bank at that time sensed the opportunity and reached out to the Bajaj Auto team for financing their 2-wheelers. Rahul Bajaj liked the idea and needed some validation before making an important decision that could disrupt the NBFC space in India.

Like a startup, a pilot was run to test the idea. A three-day financing camp was set up at Tata Motors' worker canteen, where they sold 2,000 scooters on auto finance from Citibank!

There could not be a better validation of a product market fit. Rahul Bajaj was not going to miss this.

So, in 1987, he decided to start Bajaj Auto Finance to provide financial services and lending solutions. Initially, it focused on financing the purchase of 2W and 3W manufactured by Bajaj Auto. This move aimed to make it easier for customers to purchase Bajaj vehicles, thereby boosting sales and customer loyalty.

It took off, and so did India.

After a major crisis, the Indian market was opened through liberalisation reforms in 1991. Business and trade across all industries started picking pace, and everyone was hungry for working capital.

By 1992, it expanded to bill discounting to cater to the short-term financing needs of Indian business owners and Bajaj Auto partner and dealer network.

In 1994, Sanjiv Bajaj, son of Rahul Bajaj, joined the family business. He held various positions while working at Bajaj Auto. He brought many changes and made the organisation more dynamic. He adopted General Motors as a model to introduce American-style supply chain management to Bajaj Auto.

In 1994-95, Bajaj Auto Finance Limited went public through an initial public offering (IPO).

Over the next few years, BAFL diversified into other consumer durable product financing by partnering with companies. The partnerships were at all levels like Daewoo's in Punjab, Voltas in Andhra Pradesh, Sharp in Maharashtra, and Carrier Aircon in Gujarat, some of which could be upgraded to national tie-ups.

It even came up with a PC financing product in 2004. Having perfected its playbook in 2W financing, it was replicating it across other segments in a credit-hungry India.

De-Merge to Re-Emerge

2007 was an eventful year for Bajaj Auto.

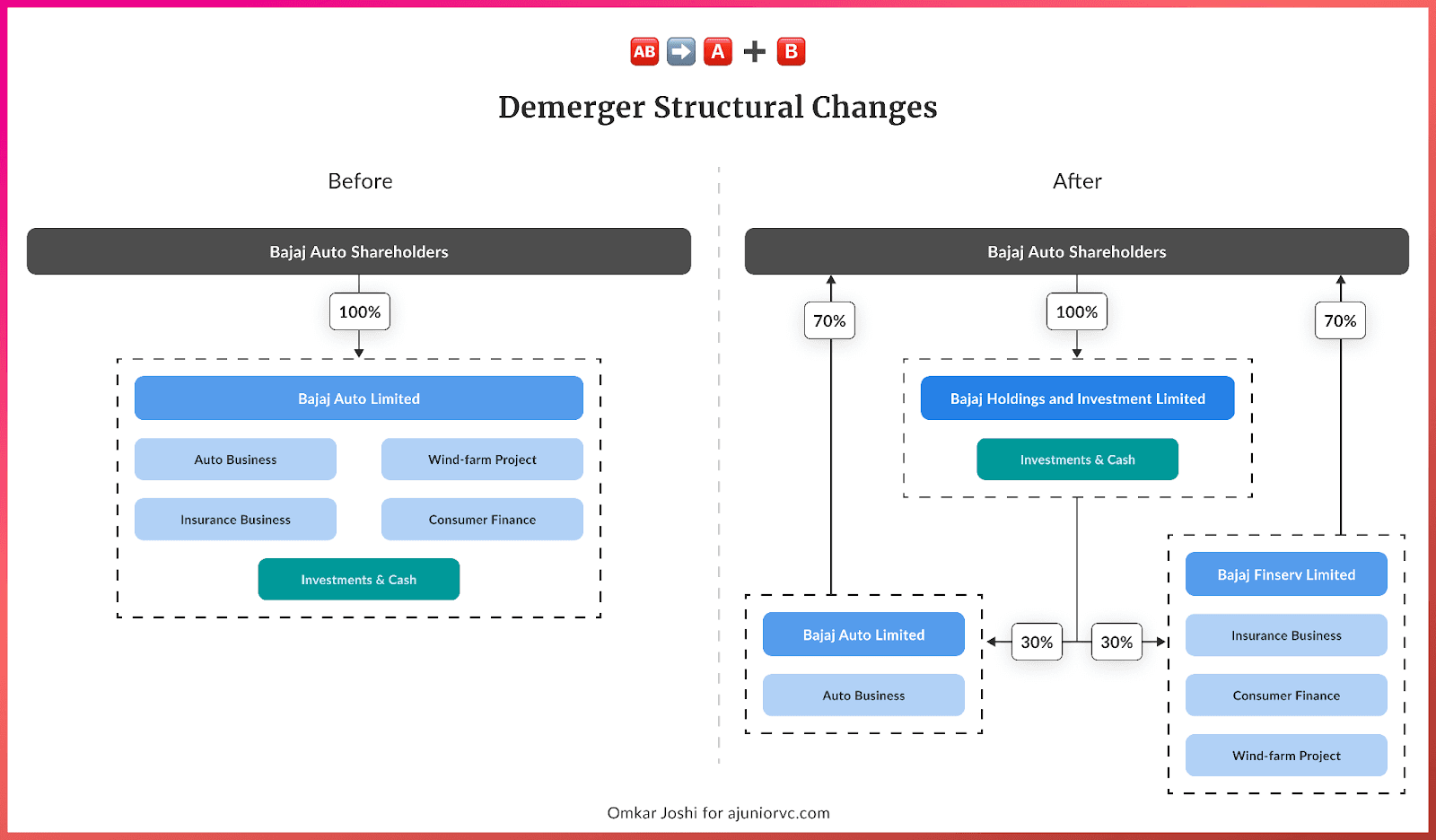

The chairman split the business into three entities: Auto, Finance, and BHIL, the holding and investment arm.

This move wasn't just about organisational structure; it was a corporate masterstroke to navigate potential family tensions while positioning it as a decision to unlock shareholder value.

Enter Bajaj Finserv, with Sanjiv Bajaj at the helm.

This holding company manages the Finance division, which includes Insurance (Bajaj Allianz), Consumer Finance (Bajaj Auto Finance, which was renamed Bajaj Finance), Wealth advisory (Bajaj Financial Solution), and Wind energy business.

With this restructuring, Bajaj Finance was in a prime position to explore new territories beyond its traditional focus on auto loans.

Sanjiv hired Rajeev Jain as CEO of Bajaj Finance in 2007 to make the vision a reality. Jain had previously worked as Deputy CEO with AIG India.

Rajeev has experience building businesses from scratch. He was amongst the first ten employees of GE Money, the finance arm of Global giant GE, and was the first employee of AIG in India.

However, the timing of Bajaj Finance's incorporation proved to be both a challenge and an opportunity.

As the Global Financial Crisis (GFC) sent shockwaves through economies worldwide, Bajaj Finance also suffered. The RBI's tightening grip on monetary policy and dwindling consumer demand and escalating defaults created a turbulent landscape.

Bajaj Finance’s loan deployment declined by ~10% between FY07-09, and its PAT plunged by ~60% from INR 472 Mn in FY07 to INR 201 Mn in FY08 and recovered to INR 339 Mn in FY09 mainly due to an increase in NPA

The 2008 Great Financial Crisis also affected Bajaj Finance. Its lending partner, Citibank, decided to stop lending in India. In addition, Bajaj Finance’s nonperforming assets increased from 2% in 2007 to 12% in 2009, a 6x jump in merely two years. This meant that the ROE fell from 25% to 1% in 2009.

In moments of adversity, Sanjiv Bajaj, recognising the need for expert guidance, summoned Nanoo Pamnani, his maternal uncle, a seasoned hand from CitiBank, to mentor the team.

Under Pamnani's guidance and the dynamic leadership of Sanjiv and Rajeev, a recalibration began. In 2010, Bajaj Auto Finance Limited(BAFL) was renamed Bajaj Finance to expand its offering.

The ethos of the company underwent a huge transformation.

Bajaj Finance set its sights on a more enduring goal: a share in profitability and not chasing market share only. Also rooted in the aspiration of serving Indians while maintaining profitability, a new narrative emerged.

Accordingly, the company shifted focus towards sectors promising high returns, such as consumer durables, HNI, and SMEs, and started reducing the exposure to low-margin and riskier infrastructure business.

The lending wizard now wanted to weave its magic into newer segments. Over 20 years, the business had built a playbook to replicate.

Solid Underwriting, Prudent Lending

A sound lending business is built on four key pillars - cost of capital, customer acquisition, quality of underwriting, and collection capabilities.

The Global Financial Crisis adversely affected the latter two, putting Bajaj Finance in a spot of bother. The way out was to double down on the former two.

To address the first lever, the company raised equity of INR 750 Cr. in July 2011 to recapitalise the business. The NBFC’s deposit-taking license and the promoter family’s reputation enabled it to secure debt at competitive prices in a hostile, liquidity-deprived market.

On the second, the leadership understood that Indian banking’s lending was guided by biased reasons and perceived flaws. Notably, there was a significant trust deficit towards self-employed borrowers, with a strong preference for the salaried class.

Moreover, retail underwriting decisions primarily relied on CIBIL data as the metric of creditworthiness.

Bajaj Finance realised the need for a nuanced approach to identify high-quality borrower classes that had previously been overlooked.

It set out to develop an informed, scientific lending model that could stratify borrower profiles into risk buckets based on diverse variables. Loans could then be priced accordingly

The company had started to create a big data machine, entirely powered by mathematical models and technology.

Bajaj Finance began by experimenting with samples of 10K dentists and doctors. Its proprietary model ensured that an AIIMS alumnus was preferred over her counterpart from a dubious medical college.

A practitioner from an affluent locality would be offered much lower rates than one operating in a more nondescript part of the town. Similarly, an oncologist could offer better terms than a general physician, and so on.

Data coordinates were sliced and diced to form 600 distinct borrower profiles and to identify borrowers whose incomes were arguably more predictable than individuals holding traditional jobs. The underwriting engine that Bajaj Finance built would become its biggest moat.

The acquisition engine was built on working capital to this archetype of strong borrowers at sub-10% rates, significantly lower than the banking system. Relatively weaker borrowers were not shooed away but offered less desirable terms.

As the former stayed loyal to Bajaj Finance for all its banking needs, the latter often gravitated to other NBFCs offering better rates.

This sounds exactly like how a finance technology company operates, except Bajaj Finance was not known for it.

Bajaj Finance was only happy to ‘lose’ these borrowers to adverse selection as it minimised its risk of both omission and commission. It now had a perpetually self-cleaning book of small-ticket loans and an automated underwriting process, leading to low delinquencies.

By 2013, the flywheel was taking shape. Bajaj Finance was no longer just a lender. It was a tech company that just happened to lend compulsively.

It soon extended its playbook for doctors to include architects, chartered accountants, lawyers, and others, becoming the largest lender to white-collar, self-employed professionals.

It was innovating at the velocity of a startup.

0% EMI 100% Growth

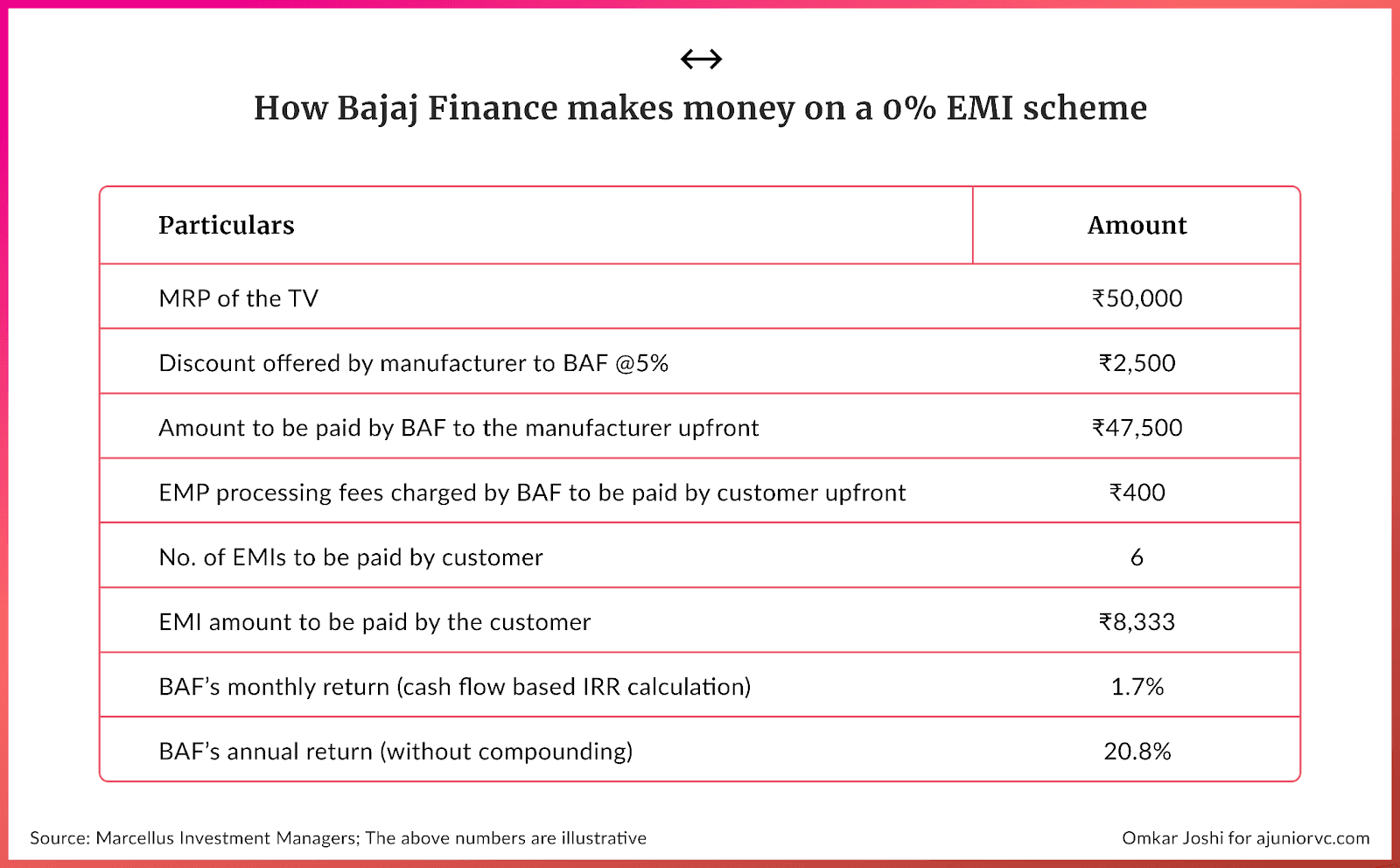

Bajaj Finance’s rocketship was fueled by its star product.

A no-cost EMI (equated monthly instalments) point-of-sale consumer durable loan that did not carry any interest, making it highly attractive to customers.

By 2015, it had partnered with offline electronics stores such as Croma, Vijay Sales, and Reliance Digital and e-commerce platforms like Flipkart and Amazon. The loan was offered through a subvention scheme, whereby retailers took a haircut on their margins and shared it with Bajaj Finance, creating a mutually beneficial arrangement.

Emboldened customers made aspirational purchases. Retailers increased sales volumes in return for a marketing incentive. Bajaj Finance pocketed a handsome return while acquiring customers with minimal friction.

The win-win-win proposition soon became Bajaj Finance’s hero product as it made its presence felt across 100K+ consumer durable stores and 10K+ auto showrooms.

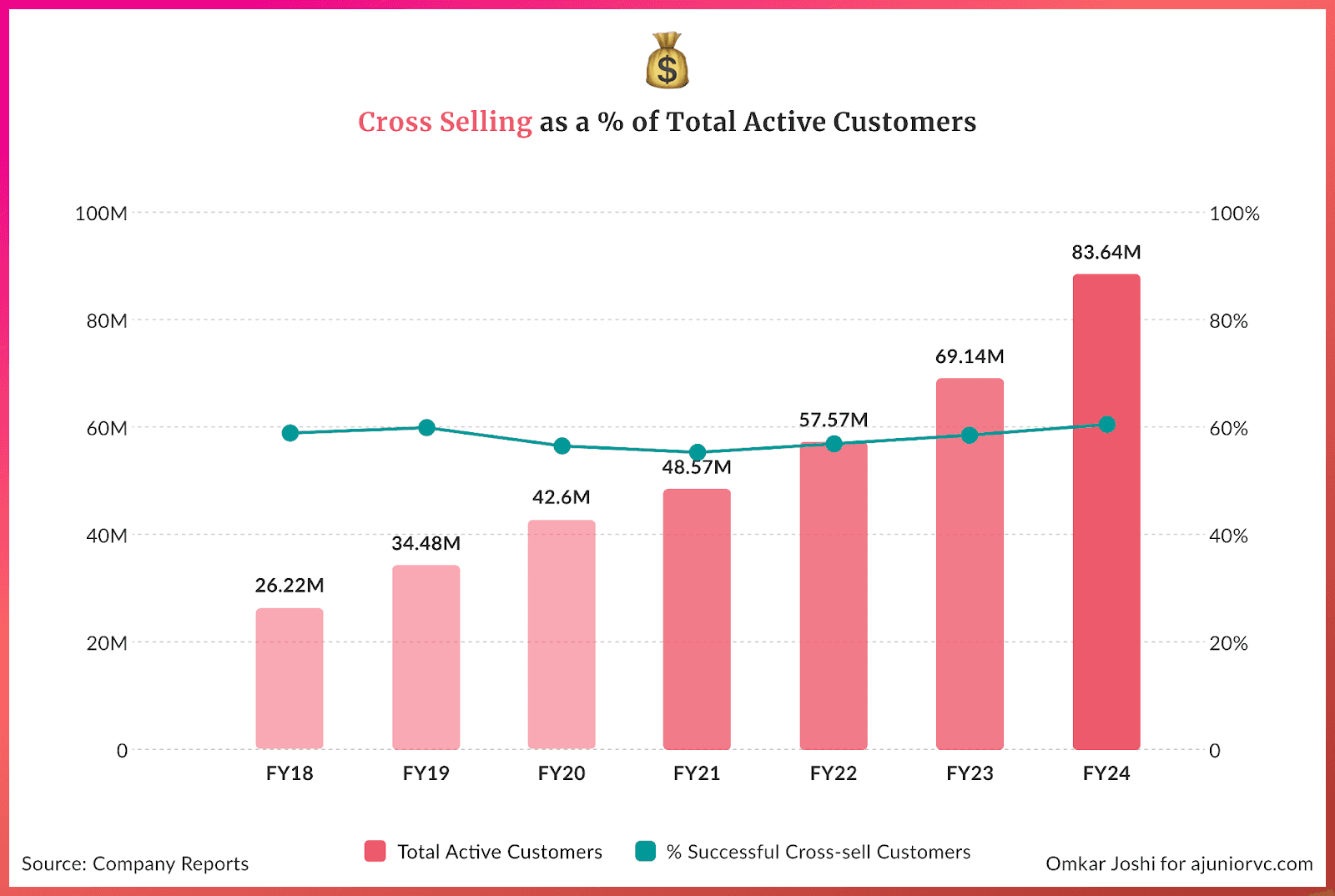

It would cross-sell and up-sell every borrower an astonishing average of 6 products. Repeat customers involve a third of the credit risk and only a tenth of the operating cost of a new customer.

Now you know why.

Bajaj Finance’s big data machine enabled fast, automated underwriting decisions within 90 seconds, while other financiers took up to 2 hours for the paperwork.

Customers preferred Bajaj Finance due to shorter processing times, novel post-sale offerings, and low upfront processing fees.

The company became indispensable to retailers, some of whom encouraged customers to borrow from Bajaj Finance in the hope of a superior customer experience that would lead to repeat purchases from their showrooms and platforms.

The virtuous cycle is only amplified with scale, reinforcing the company’s position.

Behind the scenes, the Sanjiv-Rajeev duo further invested in the organisation’s tech capabilities to stay ahead of the competition.

By 2017, they had hired an army of computer engineers and data scientists. Bajaj became the only lender in the world for whom Salesforce maintains an exclusive database!

The lending team operated as a tight ship, with a driven meritocratic work culture, incentivised by above-market monthly bonuses based on clear metrics tied to profitability.

Despite the fast pace of business and steep business targets, the work culture thrived. Employees served an unusually high average tenure of 6 years, with overall attrition hovering at ~15%.

You may think rejection may have hurt Bajaj Finance's morale, but not so.

Bajaj Finance was now a well-oiled machine, built on top of an iterative customer acquisition strategy and a moat fortified by proprietary data.

In its rapid pace of growth, the question was if it could remain immune to the business cycles of boom and bust

Building Resilience

Starting with the 2008 crisis, Bajaj built resilience.

The organisation would have to find a new way to do business to continue its sustained growth rate. After its first major crisis, Bajaj discovered the consumer durables marketplace and the pioneering zero-cost EMI business model.

These two changes set Bajaj Finance up for sustained success over the next 10 years. To power this, it implemented a key concept for building an organisation.

The classical problem in a business of this scale and size is capital allocation. Every fast-growing CEO of a vast business faces this headache.

Capital allocation is the decision to fund which lending products and whether to launch new products. A misallocation here can completely derail a company's high-speed growth.

Bajaj Fin found a unique solution to this problem.

It created 40 lending heads, each with significant autonomy over its business decisions. Each of these lending heads/divisions operates mainly like a mini-company. There are several lending products with their unique nitty-gritty.

For example, the dynamics of an auto-loan product are very different from those of a home loan product. Not all of these products do well simultaneously, further complicating the capital allocation decision.

Each lending head runs a single lending product and is responsible for the net interest income, fee income, ROE, and ROA. If a lending head can demonstrate success, she/he will get a higher capital allocation from the corporate centre.

However, this additional profitability cannot come at the cost of higher risk, as the risk metrics are also tracked centrally.

Internally the lending products are segmented into scale builders and profit maximisers. Scale builders are low-risk, low-ROE products. Profit maximisers are high-risk but keep the ROE high. Bajaj Fin has figured out an optimal mix of these two types.

By 2018, the next big shock hit the Indian Financial System and it would be the almighty test for Bajaj’s systems.

IL&FS, a leading NBFC in India, defaulted around September 2018, followed by the DHFL crisis in less than a year. These twin shocks to the banking system dried up the funding opportunities for NBFCs.

As most NBFCs were not allowed to take deposits from the public, many of them faced very tough times in keeping their leverage at a reasonable rate. This led to increased funding costs, which squeezed the NIMs for all financial institutions.

However, Bajaj Finance had no issues during this period as its funding source was already tied up. In 2014, RBI allowed Bajaj Finance to take deposits from the public. This meant that Bajaj Fin already had access to public deposits at a significantly lower interest cost.

Additionally, the organisational structure ensured Bajaj Finance had limited exposure to high risk.

During this period, Bajaj Fin's ROE remained almost unchanged at a healthy 20% or so. This proved that access to the right capital at the right price could be a competitive moat for lenders.

As 2019 ended and 2020 looked up, another body blow was coming.

Omnipresent Finserv

Bajaj’s main method of acquiring customers at a meagre cost changed drastically when Covid-19 hit.

With one of the most aggressive responses to the pandemic, India shut down immediately.

A lender with no marketing expense and meagre customer acquisition costs via the network of physical consumer durables stores was in dire straits.

However, like previous times, Bajaj Fin had already prepared well for this exam.

A few years ago, the advent of cheap data from Jio made Bajaj Finance realise that the online channel was here to stay. They had already created Bajaj Mall, an online store where one could buy durables, automobiles, and all manner of electronics.

One of three products on the mall had prices lower than those of the retail kings, Amazon/Flipkart.

Bajaj managed it by providing the auto companies with superior demand forecasting algorithms. Bajaj Mall can tell auto companies which kind of bikes will likely be sold in the next 30 days.

They share their projections with the auto company and ask for a price that is lower than what they offer anyone else. This demand forecasting method to negotiate a bulk discount allows Bajaj Mall to sell premium products at discounted prices.

In addition, at the height of the pandemic, they were able to create Bajaj Pay, a UPI payments app. Without marketing the app much, they got around 50 million downloads.

The Bajaj Finserv app contains payments, lending, the mall, and stock broking. This is another example of an attempt to create a super app, which Tata Neu also tried and launched with great fanfare.

However, the impressive number of app downloads was achieved without spending on marketing.

Bajaj Finance had started to evolve into an integrated financial giant with offerings running from lending to payments to stock broking and deposit-taking.

Bajaj Finance may be an NBFC, but it does offer all the gamut of services like a universal bank. The company is India’s largest fintech player masquerading as an NBFC.

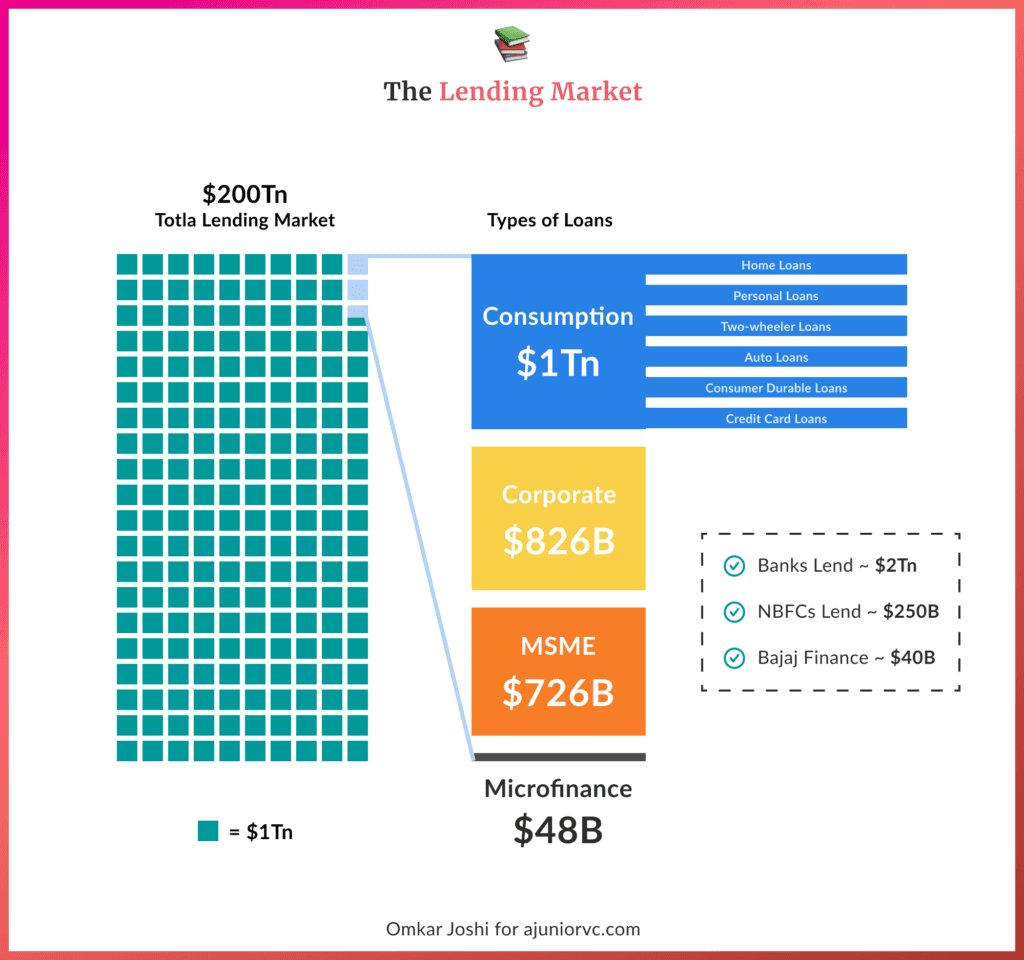

The total lending market in India is around 200 lakh crores, with a YoY growth of around 11%.

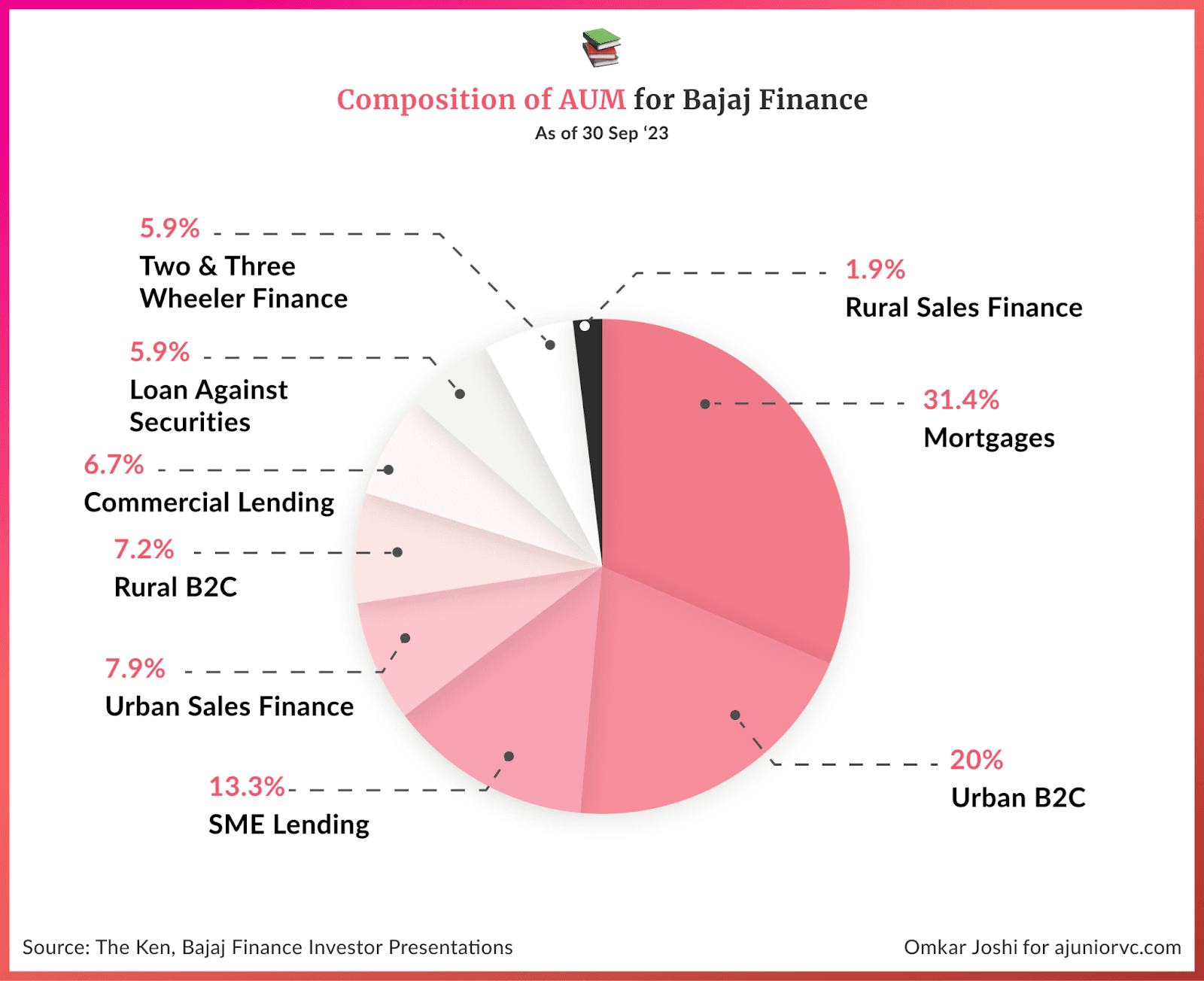

Out of these, 1 trillion USD are consumption loans, 826 billion USD are corporate loans, 726 billion USD are MSME loans, and 48 billion USD are Microfinance loans. Consumption loans can be divided into Home, personal, two-wheeler, Auto, Consumer Durable, and credit Card loans. Banks lend around 2 trillion USD, and NBFCs lend around 250 billion USD. Out of the NBFC pie, Bajaj Finance lends about 40 billion USD.

Bajaj Finance’s mind-boggling growth would also become a topic of discussion in the hallowed halls of great education institutes.

Lending Like a Boss

As we have now realized in lending, growth hinges on three critical elements

Acquiring more customers, excelling at cross-selling, and strengthening collection mechanisms to ensure low non-performing assets (NPAs).

Bajaj Finance knows this all too well, and managing these aspects, it’s not just growing; it’s expanding aggressively.

By 2023, their distribution network has grown by 30%. BF now boasts a presence in nearly 190,000 stores offering loans to customers. In the past five years, approximately 250 new locations have been added annually, expanding their service reach to over 4,100 locations. They are aiming to reach 5,000 locations by FY27.

But it’s not just about spreading wide. It’s also about deepening the roots.

Each store usually has ~375 to 450 active customers. Yet, Bajaj is pushing these numbers even higher with smart technology.

The Bajaj Finserv App, launched in FY22, is revolutionising how they connect with customers. In just one year, the app facilitated the acquisition of 368,000 EMI card customers, helped disburse over INR 9,000 crore in personal loans, and managed over 209,000 new credit card signups.

Cross-selling? They’re acing it.

Each year, ~55% of their customers return for more products, driven by a steady introduction of innovative offerings. From loans for pharmaceutical companies to medical equipment financing, Bajaj ensures there’s always something new.

From FY20 to FY23 alone, they launched several new products, boosting their products per customer from 5.0 in FY21 to 6.0 as of FY24.

Finally, the asset quality? It’s top-notch.

Bajaj has consistently maintained gross NPAs between 1.0% and 1.8%, showcasing its ability to manage risk even as it scales.

ParticularsFY18FY19FY20FY21FY22 FY23 FY24 GNPA1.48%1.54%1.61%1.79%1.60%0.94%0.85%NNPA0.38%0.63%0.65%0.75%0.68%0.34%0.37%

Source: Company Reports

The result is clear.

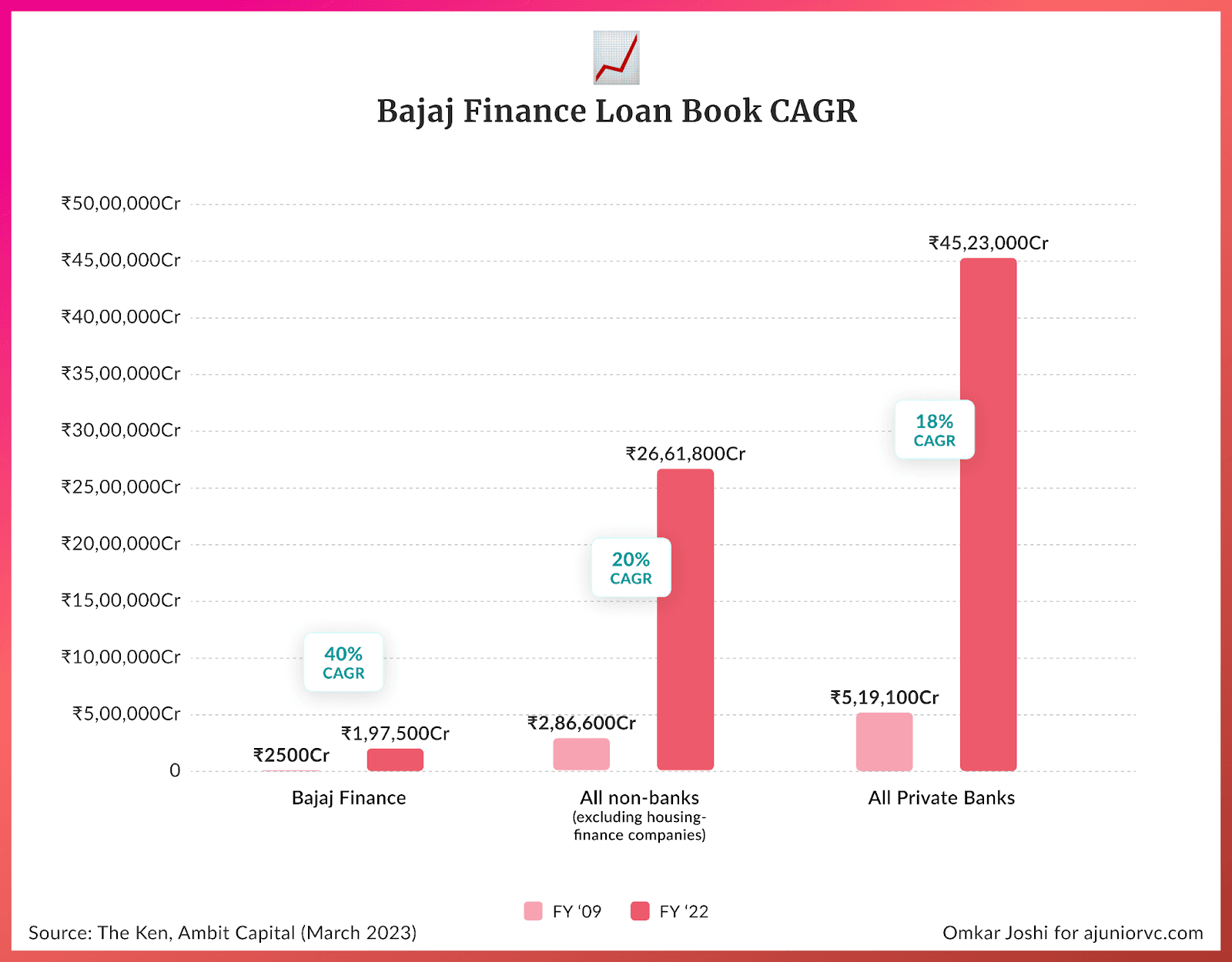

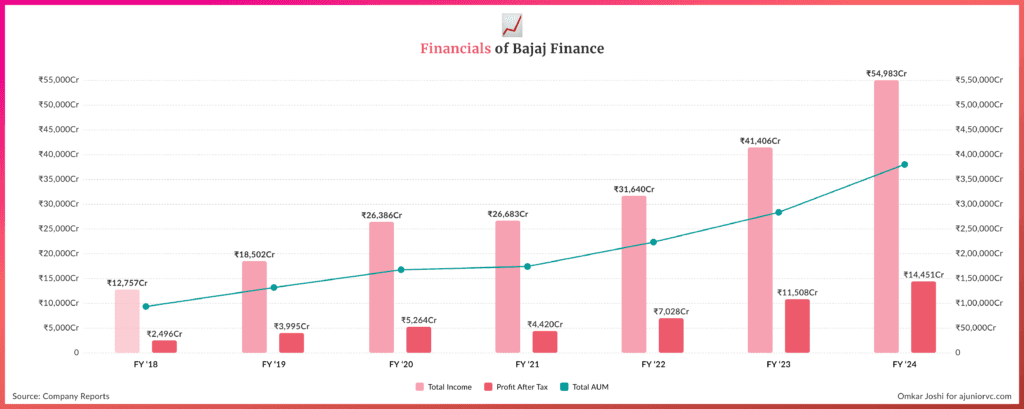

Bajaj Finance's market cap increased from $0.5B in 2009 to $50B in 2023, a 100x increase. It has over 40 lending products and an average yearly growth rate of 25% in PAT.

With an AUM exceeding $40B, the company accounts for about 60% of India’s consumer durable loans and 20% of the overall NBFC lending market. Currently serving over 80M customers, Bajaj Finance is on a clear path to reach 120M customers within the next three years.

The financial metrics speak volumes: the share price has increased 1000x over the past 16 years, and the company has achieved a consistent loan book compound annual growth rate (CAGR) of 30% and a profit after tax (PAT) CAGR of 50%.

As of FY24, brokerages are still skeptical about the stock's performance, with the stock having grown only 2% in the past year.

As it continues to identify new S curves to accelerate its growth momentum, what new segments or loan products can it introduce?

Next Bajaj Finance is?

Every business contends with its own set of risks, and Bajaj Finance is no exception

The company is currently facing three challenges: regulatory environments, leadership transitions, and intense competition in new product segments.

Recent regulatory adjustments by the Reserve Bank of India have significantly tightened the norms around consumer loans and introduced a ban on issuing loans through e-commerce platforms and Insta-EMI cards.

These changes directly threaten Bajaj Finance's existing business model, particularly impacting its lucrative partnerships, such as the one with RBL Bank for co-branded cards.

Previously, these partnerships were instrumental in driving Bajaj's revenue, with distribution fees from co-branded card agreements contributing 40-45% of its total fee income. However, the RBI's new regulations curtail these activities, thereby removing a substantial revenue stream and introducing considerable financial uncertainty.

Another significant concern is the impending leadership transition.

By 2025, CEO Rajeev Jain is slated to step down from his executive role and move into a non-executive position. Although a successor has been selected internally, the details have not been disclosed, adding a layer of uncertainty about the company’s future leadership dynamics.

Leadership changes are often watershed moments for companies, and while Bajaj Finance has historically managed such transitions adeptly, the inherent risks cannot be overlooked.

In response to these challenges, Bajaj Finance is actively diversifying its business. Like a large innovative fintech, it continues to use technology, process and product chops to build anew.

The company is making significant strides in the payments space, deploying 21.5 million UPI handles and 2.7 million QRs across merchant points of sale, tapping into a market ripe with growth opportunities.

Moreover, Bajaj Housing Finance Limited (BHFL), established as a separate entity in FY18, is strategically positioned to capitalise on the mortgage business.

With access to low-cost borrowing and a dedicated team, BHFL has not only outperformed its peers but also maintained the lowest gross non-performing assets (GPNAs) in the industry at 0.25%, reflecting a robust growth trajectory with a 40% CAGR from FY19-23.

Bajaj Financial Securities (BFSL) commenced operations in 2019 and has broadened its reach significantly, offering a diverse range of investment services.

The division has seen considerable growth in its Margin Trade Financing book, which stood at ~INR 3,000 as of FY24. Despite stiff competition, BFSL's aggressive client engagement strategies have ensured its strong position in the market.

Bajaj Finance is strategically expanding its secured lending portfolio, leveraging its vast distribution network and enhancing underwriting algorithms with insights from Bajaj Housing Finance Limited (BHFL).

By utilising its expansive reach into diverse markets, Bajaj is poised to efficiently roll out new secured lending products across its numerous branches.

Additionally, the company is set to refine its risk assessment techniques by incorporating data-driven insights and advanced machine learning methods that have already proven successful in BHFL. This approach ensures robust and scalable growth in its secured loan segments.

By FY24, these newer segments, including gold loan finance, tractor finance, microfinance, and other secured lending areas, have accumulated a loan book valued at $5B.

Bajaj Finance’s journey shows a knack for turning challenges into growth spurts. As fintechs emerge to take leadership, you’re wondering who’s the next Bajaj Finance in the finance world.

The answer is Bajaj Finance itself.

Bajaj Finance remains ahead of the curve with its well-built strategic moat and a knack for inventing when required. While we may not focus on Bajaj Finance due to its legacy roots, it is a gigantic and almost unparalleled machine that has literally been built from scratch in 30 years.

It’s an inspiring story of building and enduring a lending powerhouse across multiple business cycles, and it provides timeless lessons to fintech and financial institutes alike.

Bajaj Finance is clearly a $50B fintech continuing to build disruptive businesses under the cloak of an NBFC, one that looks set for another giant decade of growth.

Writing: Keshav, Abhinay, Ajeet, Nikhil, Nilesh, Parth and Aviral Design: Omkar and Chandra