Jun 23, 2024

Is 80,000 Cr InfoEdge India's First True Internet Conglomerate?

Profile

Real Estate

Human Capital

Platform

Aggregator

IPO

B2C

Weddings

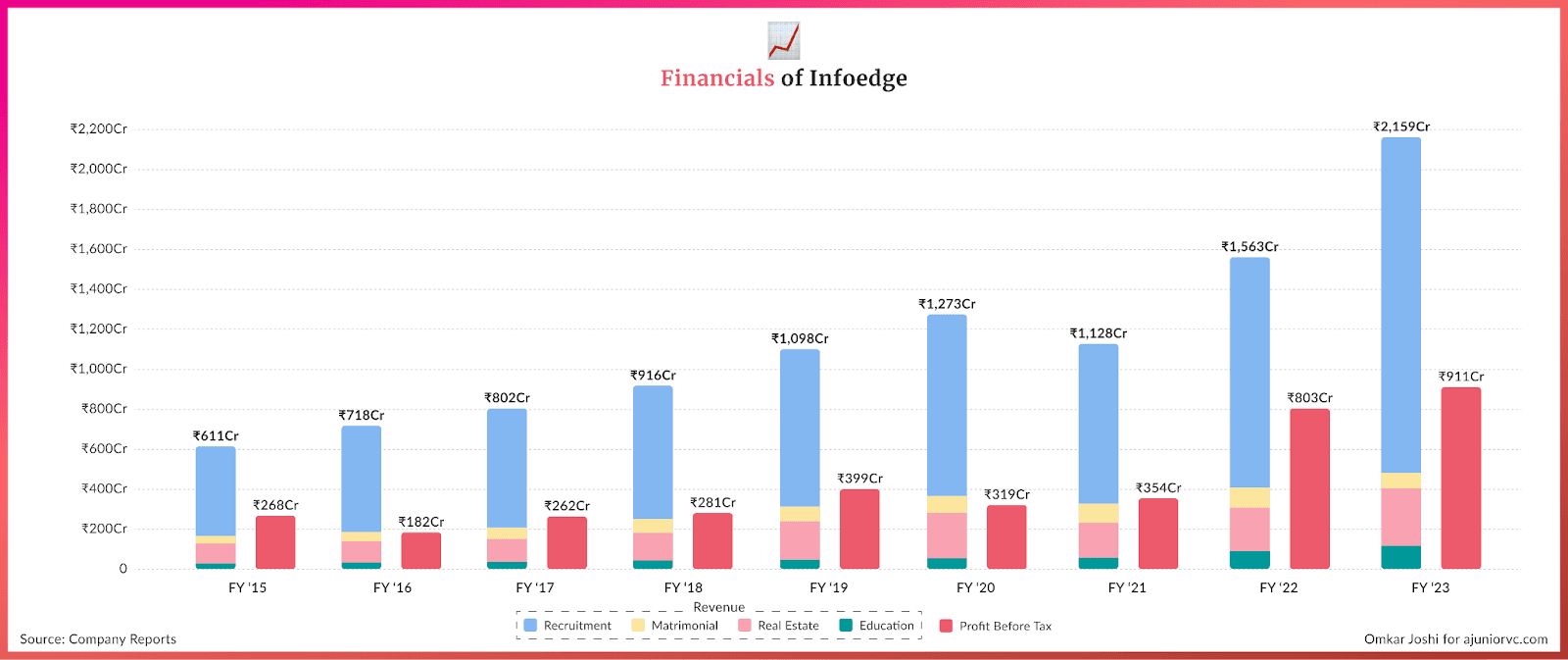

Last fortnight, InfoEdge crossed the 2,500 Cr revenue mark making a 500 Cr profit, to breach a market cap of 82,000 Cr.

Leaving a Naukri to Begin Naukri

Sanjeev Bikhchandani grew up in a resource-scarce environment

Sanjeev’s father was a government doctor. After earning a degree in economics from St. Stephen’s College in Delhi, he pursued his MBA at IIM Ahmedabad.

After graduating in 1989, he took a marketing job for Horlicks but soon realised that climbing the corporate ladder wasn't for him. Seeking independence and creativity over short-term success, he quit his job in 1990 without a concrete plan.

Partnering with Kapil Verma, they started two partnership firms: Info Edge, which conducted salary surveys, and Indmark, a trademark pharmaceutical database. The early days were tough, with the company unable to pay its founders.

Sanjeev took on teaching, training, and writing gigs and even lived off his wife Surbhi’s salary for the first three years.

Initially, Info Edge sold salary reports for 5,000 to 10,000 INR, operating out of the servant’s quarter in Sanjeev's home.

In 1991, they submitted a business plan for videotex services to the Department of Telecom (DoT), which was shortlisted but ultimately cancelled. Sanjeev and Kapil parted ways in 1993 over the setback, with Kapil taking Indmark while Sanjeev retained Info Edge.

Once the business became profitable, Sanjeev could finally pay himself but remained hungry.

At an IT fair in Delhi, he learnt more about the Internet. With the help of his brother Sushil in the US, they hired a server for $25 a month. This marked the beginning of Info Edge India in May 1995.

In 1996, the recession hit, and the company suffered losses. Sanjeev sought help from his friend Anil Lall, a software engineer, who offered him a 7% stake to create a website. Another friend, VN Saroja, handled operations and received a 9% share.

Naukri.com launched on April 2, 1997, with 1,000 jobs collected from 29 newspapers. Positive reviews from business magazines, newspapers, and word-of-mouth followed.

As jobseekers learned that job searches on Naukri were free, traffic steadily increased.

Building Relationships

As Naukri.com, gained traction, Sanjeev realized the potential of the Internet for classified ads.

Connecting job seekers and employers was just the beginning. The Internet's reach would far surpassed that of traditional newspapers.

In October 1998, Sanjeev launched a matrimonial website developed by Anil Lall, now the head of Info Edge's technology department. The services were free in the initial years to attract a user base.

While bootstrapping Naukri, Sanjeev took a part-time job as a journalist at the Pioneer Newspaper, where he served as a consulting editor for the carers supplement. This role provided a steady income and valuable experience.

The newspaper's editor wanted to execute a management buyout and enlisted Sanjeev’s help due to his management background. Sanjeev led a team of 800 people, playing the role of CFO and raising funds from large financial institutions. This four-year stint honed his financial and leadership skills, crucial for running his own companies.

Teaching at business schools around Delhi further developed Sanjeev’s ability to communicate effectively with large audiences. He found that teaching management concepts deepened his understanding more than studying them had.

During these seven years of exploration and learning, Sanjeev acquired diverse skills that would prove invaluable. From 1997 to 2000, he bootstrapped Naukri, making the most of limited resources. He did not draw a salary for six years in his first decade as an entrepreneur.

From 1990 to 1993, the business was not generating enough revenue to pay salaries. From 1997 to 2000, he reinvested profits into growing Naukri and Jeevan Sathi, sustaining himself through journalism.

In April 2000, Info Edge raised venture capital from ICICI Ventures.

After a decade of frugal building, the funds would allow them to grow, but it came with conditions. ICICI Ventures advised them to shut down the matrimonial site, Jeevansathi, and focus solely on Naukri. Additionally, they required Info Edge to switch to one of the big five auditors.

Sanjeev had to part ways with their long-time auditors, brothers Amit and Rohit Tandon. He personally thanked them and learned that they were planning to leave their chartered accountancy practice to start a dotcom. So Sanjeev sold Jeevansathi to them, keeping a 35% stake in the business.

The business plan they submitted for the fundraise projected a turnover of Rs 12 crore in five years. Sanjeev would later discover that he had significantly underestimated this figure.

The first decade of his journey was slow. No one could have predicted what was in store for the next decade.

Don’t Move Fast to Break Things

Sanjeev and his team were averse to external capital, but the emergence of competition made fundraising necessary.

The primary competitor was an upstart named Jobsahead.com, launched in 1999. For starters, it offered a more seamless user experience back in the early days of the Indian internet.

It was more tech-savvy and carried a trendier perception among job-seeking youth.

Most crucially, it had raised INR 11 Cr. in 3 rounds and seemed poised to move fast and disrupt the nascent job search space.

In contrast, Naukri’s sustainable pace seemed slow compared to the former’s aggressive growth. A few weeks after ICICI Ventures wired INR 7.3 Cr. to Info Edge, the dot-com bubble burst.

Sanjeev’s stint as The Pioneer’s CFO had taught him a thing or two about running the ship tight and keeping its budgets tighter.

Siding with his prudent leanings, he parked the bulk of the proceeds in a fixed deposit and continued with his profitability-minded approach.

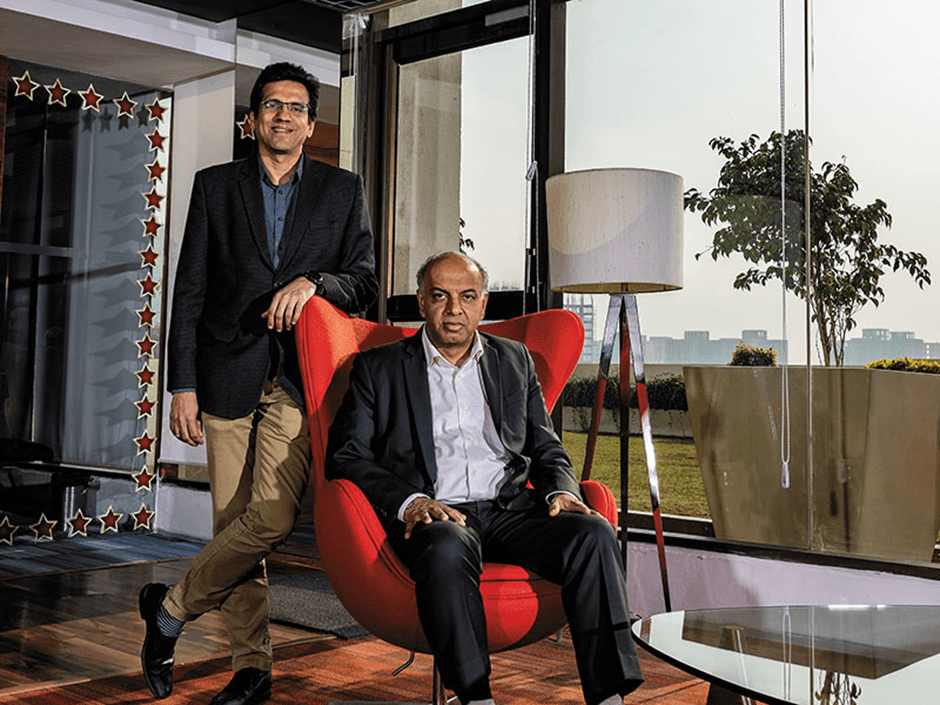

Around that time, Hitesh Oberoi, a 27-year-old IIM-B graduate, joined the company from Hindustan Lever. Ambarish Raghuvanshi, a veteran banker, followed soon after.

Until then, Naukri had relied solely on direct mailers to grow to an annual turnover of INR 36 lakhs. They sent out brochures with job forms and asked for cheques in advance.

Hitesh realised that most HR managers were not equipped to use the Internet to hire and needed to be educated about the product.

He leveraged the commercial knowledge from his previous job to hire seasoned salespersons from heavyweights such as Xerox and Thomas Cook. They were tasked with meeting prospective clients and boosting Naukri’s online sales.

The move worked like a charm.

Within 3 months, every salesperson was generating a monthly revenue of INR 50K against a fully loaded cost of INR 22K. Given the upside of INR 28K, Naukri decided to keep growing its salesforce till every incremental salesperson could generate a marginal surplus.

The team grew to 240 in two years, covering 11 cities. Despite its online orientation, Naukri successfully transitioned into a tech-enabled, albeit sales-driven organisation.

The sales team collated customer feedback into a Yahoo group, turning it into a funnel of ideas for refining existing products and introducing new ones.

By 2003, revenue had grown to INR 101 Cr, a 30x jump from 2000. After over a decade of false starts, Naukri seemed to have found its footing.

Public Dreams Privately Held

Naukri’s competitors, particularly Jobsahead.com, faced vastly different fortunes.

As money dried up after the dot-com bubble burst, followed by the shocks of 9/11, it was forced to reduce its burn rate and lay off employees, many of whom moved to Naukri.

Jobsahead.com then merged with US-based Monster.com before integration issues dulled its prospects further.

Naukri used its internal accruals to upgrade its website and invest in over-the-line marketing. It was one of the first to use the scrolling advertisement on TV and bagged 8K seconds of ad time during the 2000 Olympics for INR 3.5 lakhs.

In 2004, it repurchased Jeevansathi.com from the Tandons. After the integration, the company positioned itself as an internet classifieds company rather than just a job search platform, opening newer avenues to leverage its early mover advantage.

In a chance interaction, its shareholder and advisor, Sharad Malik, advised Sanjeev to launch a real estate portal. Sharad had personally gone through an ordeal while selling a piece of his family property in Delhi.

The opacity of the market and the absence of an existing player in India made it a lucrative opportunity. In 2005, Info Edge launched 99acres.com.

In another instance, Sanjeev's banker friend from Hong Kong informed him that the then-largest online job search in China, 51job, had recently listed and insisted that Info Edge, too, should go public.

After evaluating the proposition, Sanjeev delegated the day-to-day running to Hitesh and worked with the CFO, Ambarish, for 11 months to get the company IPO-ready.

The company closed FY06 with a topline of INR 84 crores and launched a ~INR 170 Cr. public offer in October 2006, valuing the enterprise at ~INR 750 Cr.

The issue was 55x oversubscribed, and the stock price jumped to INR 628 on the first day of listing, as against the IPO price of INR 320. After decades of struggling, InfoEdge was about to really take off.

Like earlier, Info Edge kept the IPO proceeds in bank deposits for want of immediate business needs. It would create iconic ads long before catchy marketing was a thing for startups.

Revenue grew to INR 147 Cr. by the end of 2007 as Info Edge launched NaukriGulf.com for the Middle East job market, FirstNaukri.com for campus placements and Shiksha.com for education and student engagement.

Personally, for Sanjeev, the IPO was a thumping vindication after years spent wondering whether he was the ‘worst off’ from 1989 batch of IIM Ahmedabad.

He was modest enough to realize that his success was not entirely his and was equally attributable to the hard work of his talented proteges (Hitesh and Ambarish), accidental benefactors (the Tandons, Sharad Malik, and the Hong Kong banker), and the plain luck of being on the right side of market cycles.

He knew that it took a village to raise an entrepreneur.

It was about time to pay back and raise new ones like him.

Investment Information Edge

Info Edge’s prospectus stated that part of the funds raised would be used for inorganic growth.

However, when the team looked for acquisitions, they had a tough time finding an interesting asset at a reasonable price. This is when they decided to invest in companies rather than acquire them.

This was the birth of Sanjeev Bhikchandani, the investor. Between 2007 and 12, Info Edge invested in 7-8 companies, including two little companies, one selling insurance and another food listings website.

As Yashish planned to launch Policybazaar, he met Sanjeev at an event. As they talked, Yashish challenged Sanjeev that he was overpaying for his insurance.

Sanjeev was surprised, as he had bought a standard policy from a public-sector insurer. He asked Yashish to show him alternatives. Yashish returned with 8 quotes, the lowest of which was 40% lower than Sanjeev's paying.

Sanjeev was convinced.

The Zomato investment came from his and Hitesh’s use of the Foodiebay platform, which they found super useful. As a result, they reached out cold to Deepinder.

During this time, life came full circle for Sanjeev, from being an entrepreneur himself to investing in other entrepreneurs. It was during this time that Sanjeev stepped aside as the CEO of Info Edge and was replaced by Hitesh Oberoi, who had been COO up until then.

Sanjeev didn’t believe in chasing IRR (internal rate of returns) as much as he was excited about backing good people. As a risk-averse person, even in good times, Sanjeev kept pointing out things that could go wrong.

As an entrepreneur, he realized that building a business was never a straight line. Thus, he supported his companies in downturns and always tried to help his portfolio companies.

Unsurprisingly, Info Edge was the only institutional investor in the four rounds Zomato raised from 2010-13, investing INR 86 Cr. In what would eventually be prescient investment savvy, Info Edge was simply staying true to his ethos of investing.

This was a clear departure from the norm in a world where VCs are wary of continuously backing companies without external validation.

While Sanjeev remained bullish about his investments, he got some pushback from the board, shareholders and analysts alike. InfoEdge had to pause investing in new companies.

Like the earlier advice he had got from investors on divesting JeevanSathi, this would again prove Sanjeev was right in the long term.

While the investing portfolio charted its own course, the core business continued innovating. In 2012, Naukri entered the Mobile world, launching its first Mobile App designed for Blackberry, Android, and iPhone devices.

Soon, more than half of its traffic came through Apps and Mobile sites.

By 2013, Info Edge was India’s most profitable web business.

With 2,500 employees, it ran India's top job site, Naukri, and other websites related to real estate, matrimony, and education.

Founding Unicorns

In 2015, Info Edge finally turned into a billion-dollar publicly listed company.

Global investors who wanted to participate in India’s Internet story saw Info Edge as a safe bet. Investor interest was driven by a robust and stable business backed up by good corporate governance, aided by the performance of its investment portfolio, especially Zomato and Policybazaar.

Naukri.com continued to deliver as it looked at expanding its presence across the spectrum, from blue-collar jobs to executive search. India’s share of global IT spending would be a major determinant of its performance. About 44% of the online job portal’s revenue came from IT hiring.

While some online classifieds pioneers, such as Just Dial, saw their businesses upended by Big Tech, others, like Quikr.com, felt pressure to pivot to a higher-margin transaction-centric revenue model.

Info Edge survived such threats and resisted temptations — sticking to its core classifieds model and navigating competitive pressure from upstarts in some of its verticals.

In 2016, Info Edge recommenced its investment efforts. The second vintage of investments includes companies like Shipsy, Ustraaa, Gramophone, Shopkirana, and Bijnis.

While the core business was in good shape, their investment portfolio wasn’t doing too badly either. By 2019, both Zomato and Policybazaar had achieved the much-hallowed unicorn status.

Apart from these financial investments, Info Edge has a second investment strategy, which includes strategic investments—those under the aegis of the business it operates, such as jobs, real estate, education, and matrimony. This includes investments like NoPaperForms.

These were managed by a team that works with Hitesh Oberoi.

From investing from its balance sheet as part of its corporate development program, the company set up a separate fund named Info Edge Ventures in 2019 as an Alternative Investment Fund.

Info Edge and Singapore’s Sovereign Fund were 50/50 investors in the first fund. Alongside the launch of the AIF, Info Edge also witnessed a change in its investment strategy.

Info Edge Ventures became a co-investor rather than an anchor investor, and initial stakes became much smaller.

In five years up to the end of 2019, Info Edge’s turnover from a job (Naukri.com) and matrimony listing (Jeevansathi.com) grew 71% and 77%, while realty listing (99acres.com) revenue more than doubled. The competitive pressure in the realty segment was short-lived as VC-backed Housing.com, and Commonfloor.com bowed out quickly.

By 2019, Info Edge's investment roster comprised 22 companies with an aggregate book value of INR 11.5 B. Zomato and Policybazaar accounted for INR 1.5BN and INR 5.8BN, respectively. They had also provisioned investments of INR 3.3 BN across 15 startups.

The cash was coming thick and fast, but from one source.

Golden Goose

Info Edge’s business involves creating and developing domain-specific communities.

It has mastered the art of running online classifieds in India, where consumers don’t pay to use the platforms.

By 2019, Naukri alone had generated cash worth more than ₹2,500 crore since inception, while 99acres, Jeevansathi, and Shiksha were still in the red. This money-minting crown jewel of Info Edge powered the company's blockbuster investments.

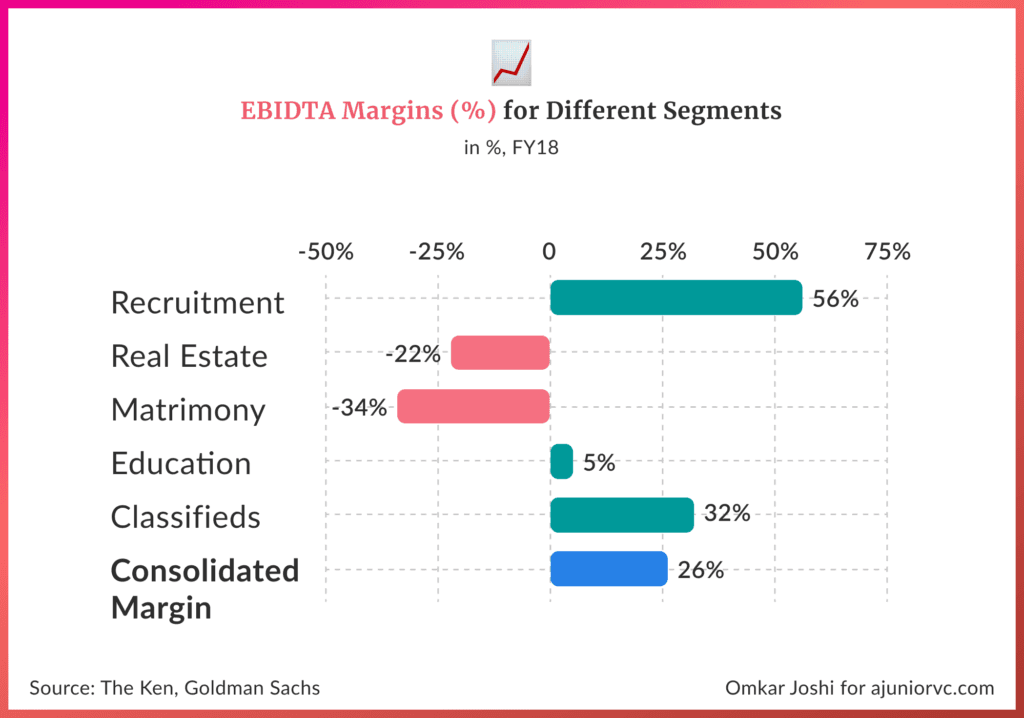

Naukri was a near monopoly, controlling over 60% of the market. It also operated at an EBITDA of 56%.

In FY 2019, Naukri generated ₹420 crore as EBITDA on a revenue of ₹780 crore, truly making it Info Edge’s cash cow.

While internet businesses were characterised by asset-light models and remote sales, as pursued by US peers Jobstreet and Stepstone, Naukri adopted the FMCG marketing and distribution model. It deployed an army of on-ground salespeople.

Naukri recruited graduates from small colleges. These graduates would approach prospective clients—recruiters and human resource managers—to pitch Naukri products.

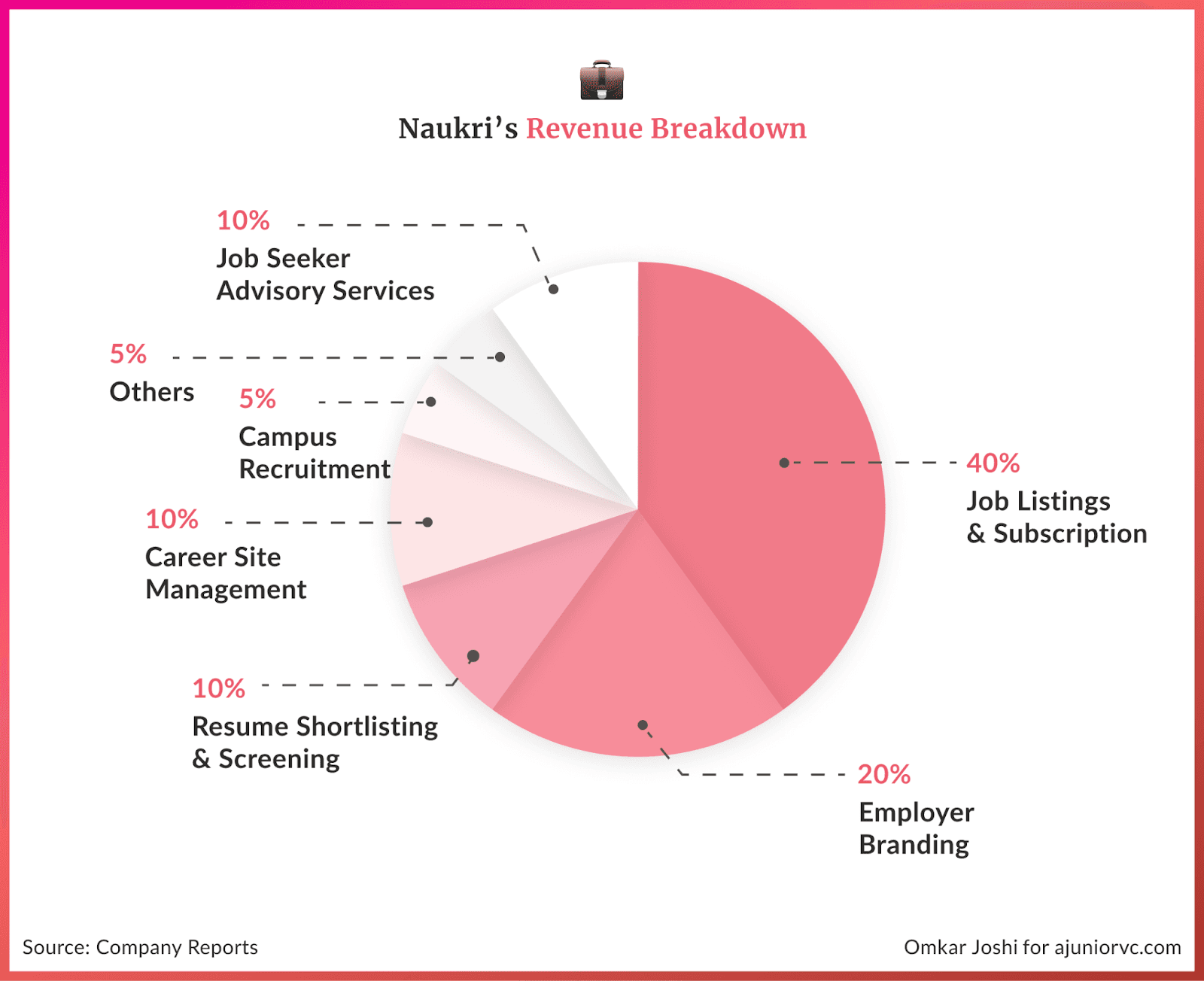

Naukri's major source of revenue was from recruiters, which accounted for around 90% of revenues. The business model was simple: charge businesses looking to hire a listing fee and earn more by helping them hire the best talent efficiently.

The listing and subscription fee business brought in 50% of recruiter revenue. The other half came from services like advertisements to show vacancies on top as the hottest jobs, dedicated branded pages for recruiters, résumé shortlisting and screening, campus recruitment assistance, onboarding new employees, and referral solutions combined.

They earned a small share from job seekers, about 10% of the segment revenues, mostly from its résumé writing business. For this service, it charged anywhere from ₹2,500 to ₹5,500 per résumé, with extra charges for faster turnaround time.

Infoedge made the online classified business in India attractive and lucrative.

99Acres, too, emerged as an industry leader, successfully surviving an onslaught from VC-backed startups like Housing, Commonfloor, Proptiger, Indiahomes and Indiaproperty.

As VC funding dried up, many of these competitors began to fold.

99Acres operated with a model similar to Naukri, charging property owners and dealers for listings and featured ads while keeping the platform free for buyers and renters.

Half of its revenue came from property listing fees, while the other half was generated from subscriptions for builders and brokers and featured ads to promote properties at the top of search results.

99Acres was guzzling cash, with losses of 220 crore in FY 19 and an EBITDA margin of -22%, supported by the other core businesses.

Infoedge’s Matrimony business, Jeevansathi, was the only business that charged the end consumers. Listing a profile was free, but users had to pay to unlock profiles and contact details.

Unlike its peers, who were the industry leaders, Jeevansathi was significantly trailing behind competitors Matrimony and Shaadi. However, it maintained a dominant user base in North India, where Matrimony had not yet established a presence.

Its education platform Shiksha was failing to monetise. Charging a listing fee was ineffective since the supply primarily came from government colleges. The major revenue source was advertisements from private colleges.

Unlike Naukri, which was head and shoulders above the competition, 99Acres, Jeevansathi and Shiksha were still scrambling for leads over their rivals.

But InfoEdge’s increasing role as India’s first true internet conglomerate was about to get its biggest validation.

Pandemic Pressure

In 2020, Info Edge’s quasi-venture fund play was validated most strongly.

Zomato got listed with its IPO, subscribed over 38 times, and the other PB Fintech started filing for its own listing.

2020 also illuminated some of Info Edge’s weaknesses, including its overdependence on its flagship vertical, Naukri.com, which drove its top-and-bottom-line growth.

Not only did it account for over ~70 per cent of Info Edge’s revenues in 2020, but Naukri.com also funded the losses of all of the other core verticals while providing Info Edge with the cash it needed to expand its investment kitty.

Naukri was a true market leader with ~60 million CVs in its database.

For Naukri.com to continue being Info Edge’s golden goose, it had to fend off competition from challenger portals like LinkedIn Careers, Indeed.com, and Monster.com, which were gaining traction.

Being a market leader was insufficient; it had to innovate and stay ahead of the curve. To this end, it spent over 100 crores on technologies like AI, big data, and machine learning. It then spent some on acquisitions in an effort to transition from a jobs board to a full-fledged career platform.

But the universe had other plans.

The COVID-19 pandemic and the ensuing lockdowns hit Info Edge’s two biggest revenue drivers.

Recruitment went down across the board as companies froze hiring to conserve their war chests, and the real estate market went to a standstill. Naukri.com and 99acres.com, accounting for ~90% of Info Edge’s revenue, de-grew by 10 and 20 percent, respectively.

However, what looked like a short-term disaster turned out to be a long-term opportunity for Info Edge. The pandemic accelerated the world’s progress toward digital-first processes.

Post the pandemic, hiring rebounded as the market picked up.

Consequently, Naukri.com’s revenue more than doubled between FY21 and FY23, with profit margins mirroring this trend. The portal also took several steps towards its ambition of becoming a full-fledged career platform by developing a portfolio of recruitment-focused companies.

It acquired a set of brands focused on niche job-related markets, such as iimjobs.com (management recruitment), hirist.com (tech recruitment), firstnaukri.com (freshers’ recruitment), and jobhai.com (blue-collar recruitment).

In parallel, it developed its enterprise-side offerings by acquiring doselect.com (skill assessments), zwayam.com (digital application management system), and greythr.com (cloud-based HRMS payroll software).

Info Edge’s education portal, Shiksha.com, also saw a 2x jump between FY21 and FY23 and has remained profitable ever since.

Its real estate vertical remained lacklustre, and the matrimonial vertical grew till FY22.

The company’s revenues fell in FY23 due to strategic changes to its business model, which aimed to enhance customer acquisition and network effects by making some paid services (like chat) free.

But over 30 years, InfoEdge had fully completed its evolution from a scrappy bootstrapped venture.

No other sizeable Indian company had a constellation of tech businesses with such a variety, including crown jewels like Naukri, Zomato and Policy Bazaar.

Conglomerate Creation

Info Edge’s unusual identity as a multi-pronged listing business combined with a quasi-venture investor has allowed it to take on core and non-core business bets.

Its recruitment vertical continues to be its cash cow. It has launched various services for job seekers, ranging from Naukri Fast Forward, which helps job seekers build their CVS to Naukri 360, which offers additional add-on services like interview preparation.

Doubling down on more engines of growth for the future, Info Edge has also integrated skill building into its wider suite of offerings for job seekers through codingninja.com, a code learning platform. It has also invested in Adda 247, a vernacular test prep platform.

Naukri’s geographical expansion play, naukrigulf.com, saw a 26 per cent YoY growth, highlighting yet another potential engine of growth for the future.

Its investments in the space, like JobsHai and Ambitionbox, have started experimenting with monetisation models.

Alongside its efforts to expand its core offerings, it continues to make long-term bets on a varied range of startups through its AIFs, ranging from adjacent businesses like online dating (Aisle) and real estate intelligence (Terralytics) firms to completely new segments like Agritech (Gramophone).

Amidst many core businesses and investment decisions, a clear philosophy stands out: a long-term strategic focus on a tech and digital-first future.

InfoEdge is unique and unusual. One would not expect a 30-year-old warhorse to be forward-looking. Combined with this outlook, the company’s near-death experiences have given it a steely edge that is passed on to everything it does.

The company’s initial focus on expanding into other internet verticals evolved into becoming an important shareholder in iconic internet companies. The result is India’s first true internet conglomerate of real scale.

The strategy has given it real flexibility and an eye for opportunity. As the Tatas and Reliances have built conglomerates in the physical world, InfoEdge has built one digitally. Like the Tatas, InfoEdge has demonstrated real staying power.

As India becomes increasingly digital, InfoEdge looks set to be the shoulder on which multiple giants would be built.

Writing: Mazin, Nikhil, Shreyas, Tanish, Varun and Aviral Design: Omkar and Stability