Jul 7, 2024

Can 5,000 Cr Bira91 Build Buzzy Brand Into Big Business?

Profile

Retail

Brand

B2C

Series B-D

Last fortnight, Bira raised 400 Cr, valuing the company at 5,000 Cr, as it looks to cement its scale as a new-age alcohol brand.

Bubbling Up

Born an 80s kid in Delhi, Ankur Jain went to the Illinois Institute of Technology, Chicago, in 2002.

Ankur completed his master's in Computer Science and engineering. After working for Motorola briefly, he started Reliant MD, his first venture in healthcare revenue management.

At the time, Jain wasn’t much of a beer drinker himself. He usually preferred single malts or wine for the touch of sophistication.

His office in New York at the time was conveniently close to Brooklyn Brewery, a prominent microbrewery selling craft beer in the US. He developed a taste and love for craft beer as he frequented the brewery for a chilled one every Saturday afternoon.

Through many samplings, tastings, and open houses, he began to discover a whole new world of beer flavours he had never imagined. He was officially ‘converted’ to craft beer.

Ankur sold his startup for an undisclosed amount to a healthcare provider network and returned to India in 2007. He initially worked at Reliance Industries for a year before turning his passion for beer into a business.

Becoming a beerpreneur in an Indian household at the time wasn’t easy.

The business landscape apart, his father, an architect at the Central Public Works department, didn’t speak to him properly for about 5 years after learning about the beer plans!

Ankur studied the Indian beer market and travelled to Europe to learn about the variety of beers available and the technical nuances of brews. Craft beer is produced in smaller batches by ‘micro’ breweries in the traditional or non-mechanized way, with unique flavours and brewing methods.

There was much to learn, but he was passionate about knowing everything about beer.

Observing the clear lack of craft beer options in India, he launched Cerena Beverages in 2009 to import beer from Belgium and Germany. The company established its first unit in the Flanders region of Belgium, utilising a local distillery for contract beer manufacturing.

With 20-30 types of beer being imported, Ankur was learning about the preferences for lighter flavours and wheat beers currently unavailable in the Indian market.

By 2010, Ankur's beer was available on tap at 10 bars and restaurants in Delhi. It was an instant success, and sales volume jumped 25 times.

Ankur observed young urban Indians seeking new and unique experiences, including their beverage choices. There was a demographic shift towards more premium and flavourful products, away from the standard bottled beers.

A change was brewing.

Brewing Business

Between 2009 and 2014, Ankur focused on market research and understood consumer preferences in the Indian market.

Selling imported craft beers was an essential phase of experimentation and learning for the team.

At pubs, it allowed them to gauge consumer reactions, understand how people made choices and identify distribution challenges in India’s complex market.

As a curious engineer who never settled for second best, Ankur was highly dissatisfied with how beer was made and consumed in India. Beer was a top seller in Western markets, especially Europe, but it did not get the same love in India.

Something was amiss in the Indian market.

He felt no beer worth drinking—it was frothy and heavy instead of light, flavourful, and crisp. He solved this problem by importing craft beers like Chimay, Duvel, and other Brooklyn brewery beers to sell in India.

The team navigated regulatory and logistical challenges to import and sell beer in India. These experiences were valuable learning experiences that prepared them to overcome the complexities of establishing a local brewery.

By May 2014, Ankur had transformed from an importer and distributor to a manufacturer, crystallising his vision for Bira 91.

The brand would occupy the space for high-quality craft beers and adopt a unique Indian identity in its persona and flavours.

The name ‘Bira’ did not mean anything literally, but colloquially it is what North Indians would use to address a brother or friend. It would also sound similar to Beer. 91 represents India’s country code.

The transition from importer to manufacturer was a significant milestone. It allowed the company to control quality, tailor the flavours to local tastes, and more effectively navigate the intricacies of local distribution.

The formal launch of Bira 91 in 2015 culminated in years of first-hand learning, fieldwork, planning, and anticipation in the Indian beverage market.

They finally had a product made in India for the Indian market.

Birthing Beverages

Bira 91 embarked on an ambitious journey to establish itself as a prominent player in the Indian beer industry.

It wanted to increase production, strengthen distribution networks and become recognised as a nationwide brand.

At this time, Bira 91 came in two variants: Bira White Ale and Bira Blonde Lager. Ankur continued to use a Belgian brewmaster to assist him in developing the formulas.

The young, urban Indian consumer was quite welcoming of the brand. While modest, Bira’s sales jumped from 150,000 cases in 2015 to 700,000 cases in 2016 (1 case is 24 bottles). Bira kept the bottle accessible to a large population by pricing at Rs. 90 for a 330 ml bottle.

The company relied on product appeal and quirky, contemporary packaging to create a brand. Because direct alcohol advertisements are prohibited in India, it focused on distribution instead of surrogate techniques.

They made their brand accessible to a few bars and aimed to get a more than 30% share in the premium sector in big cities. Point of purchase (POP) displays of the eye-catching Bira monkey were used to create awareness about the product.

By 2016 the company was able to raise funds to fuel expansion. The market opportunity, differentiation and early penetration convinced prominent investors and angels to pour in $6 million in the ‘imagined in India’ craft beer.

This enabled the company to ramp up production at its brewery in Indore, Madhya Pradesh to meet growing demand. It also expanded its footprint by partnering with distributors and retail outlets in NCR, Mumbai, Bangalore and Pune.

In September 2016, the marketing team launched ‘Hot Stuff,’ an eight-episode series that garnered 4.5 million views. It featured food enthusiasts Rocky and Mayur, who searched for the hottest chilliness in Indian cuisines in the country.

The company also partnered with popular online radio ‘Sawan’ and started playlists like the ‘brew playlist by Bira 91’ and the Bira hip hop channel. This featured original programs by some of the top Indian hip-hop stars.

On the product side too, the company created more variations to cater to different market segments and consumer tastes.

Bira Boom, a strong beer variant launched in 2016, aims to provide a stronger and bolder tasting experience compared to the lighter Blonde and Ale. Subsequently, the Bira IPA (Indian Pale Ale) launched in 2017 is known for its robust bitterness and citrusy aroma.

Armed with differentiated products and a strong brand presence, Bira 91 gradually transformed from a promising startup into a recognised player in India’s beer industry.

A youthful, premium craft beer option that had a bigger market to take.

Crafting Change

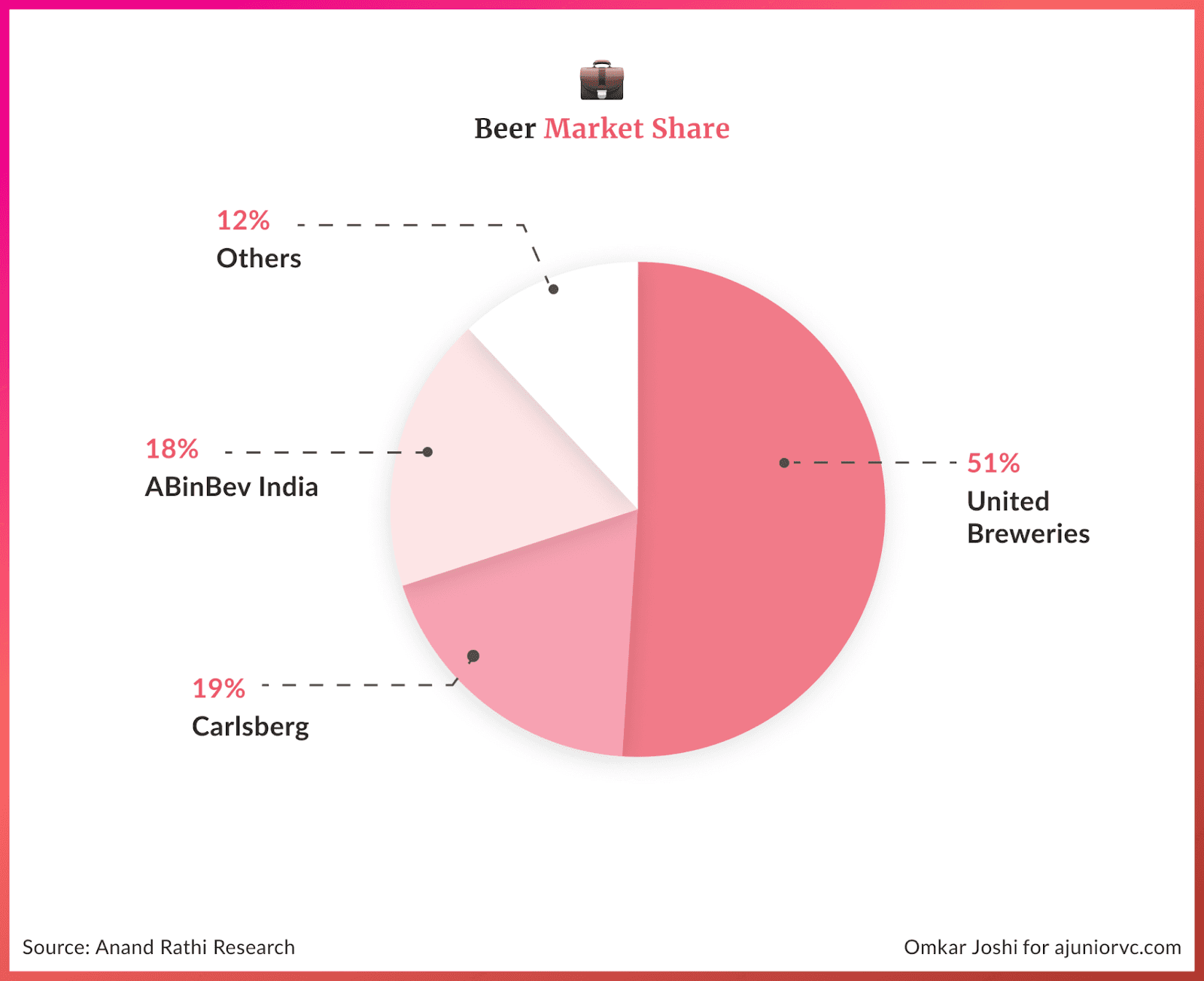

Globally, beer usually dominates alcohol sales, but in India, the scenario is different.

Spirits—whiskey, vodka, rum—command a 70% market share, while beer only manages 30%. Craft beer was virtually unknown in India until Bira stepped in.

The global craft beer market was set to reach $30 billion in the US by 2030, and although smaller, India’s market was projected to grow from $3 billion to $12 billion by 2028. In 2017, craft beer's slice of this market was just 1-2%.

This modest market share belied the significant potential driven by demographic shifts within India.

Younger consumers, particularly in urban areas, were increasingly seeking diverse and premium beverage options that align with their tastes and lifestyles.

Additionally, more women entering the workforce has broadened the consumer base, introducing preferences that favour unique, quality-driven products like craft beer. These trends expand the market and enhance the cultural acceptance and demand for craft beer, positioning it as a trendy and aspirational choice.

Craft beer enjoys profit margins ranging from 25% to 35%, significantly higher than those in the mass market, which range from 10% to 15%.

Seizing this advantage, Bira initiated local production, partnering with breweries in Indore in 2016 and Nagpur in 2017 to meet the growing demand.

This strategic shift from relying primarily on imports to establishing local manufacturing was driven by the surging domestic demand for craft beer.

However, Bira's journey was fraught with challenges.

Demonetisation, a liquor ban, and changes in the goods and services tax significantly impacted operations by increasing operational costs.

Demonetisation abruptly reduced consumer spending power; the liquor ban restricted sales in key markets. GST revisions removed input tax credits, escalating restaurant costs and Bira’s promotional expenses.

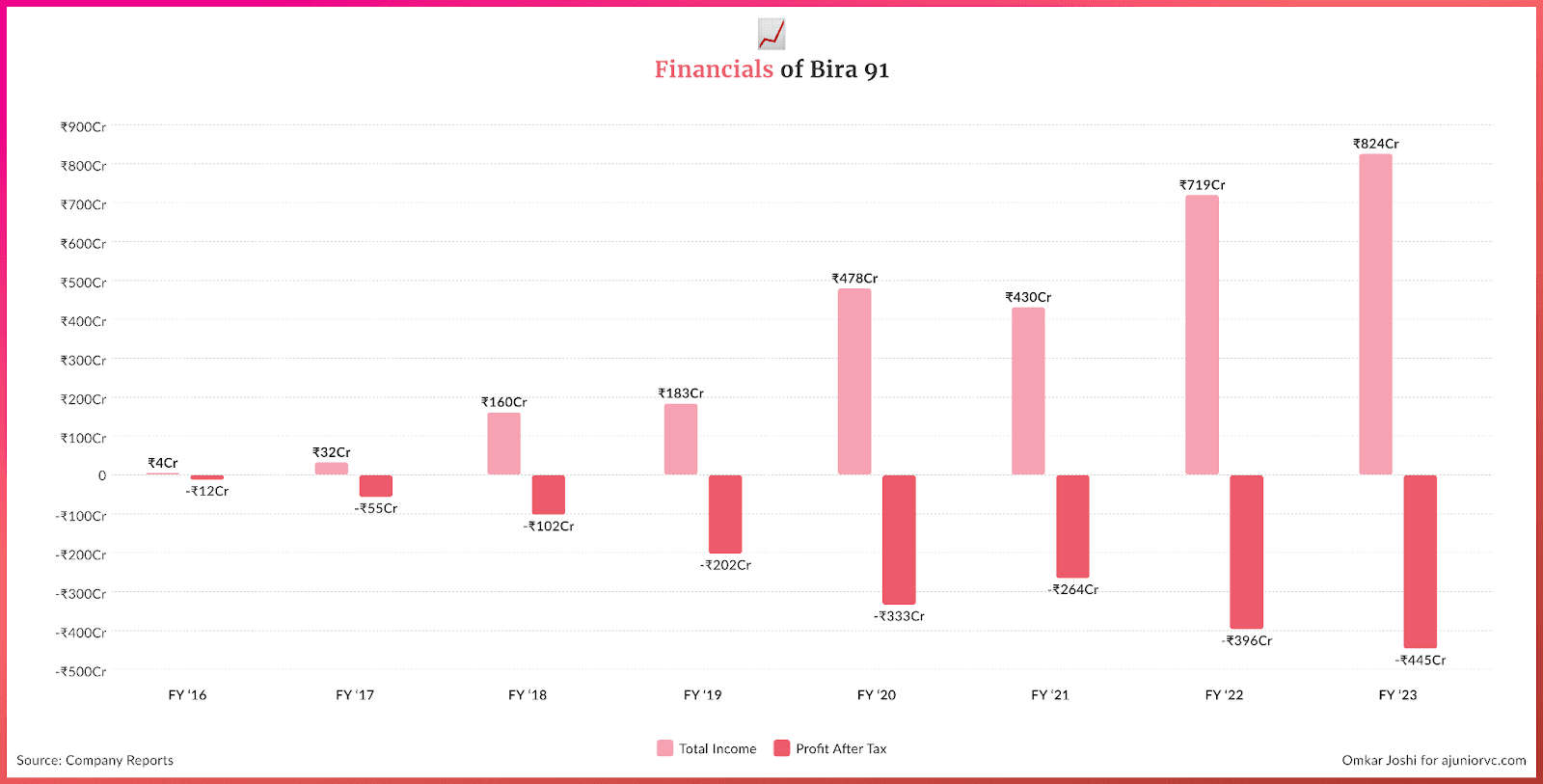

This resulted in a deepening of losses, ballooning from INR 12 cr to INR 55 cr. This happened even as revenue surged sevenfold to INR 32 cr. in March 2017, up from INR 4 cr. the previous year.

Despite these hurdles, by 2018, Bira sold 3 million cases annually, capturing close to 1% of India’s beer market. Owning to this success, Bira also raised $50M to fuel the next phase of growth.

Bira not only adapted and thrived but also carved out a significant niche.

One Pint at a Time

Bira's initial success sparked a trend.

New brands like White Rhino, Simba, and Arbor emerged, diversifying India's craft beer scene. Then United Breweries entered with Kingfisher Ultra Witbier, shaking up the market dynamics.

As the largest beer maker, their move signalled a shift, challenging newcomers. The success of an alcoholic beverage hinged on acceptance and effective distribution.

Bira initially captivated urban millennials with its innovative flavors and branding, gaining widespread acceptance.

The real test, however, was distribution—expanding beyond the cosmopolitan cities to Tier-2 and Tier-3 markets, where brand presence and availability are crucial for capturing market share.

Expansion into Tier-2 regions meant navigating the complex economics of on—premise consumption—restaurants and bars, where most beer is sold.

Promotional activities here are substantially more expensive than off-premise—selling bottles in stores.

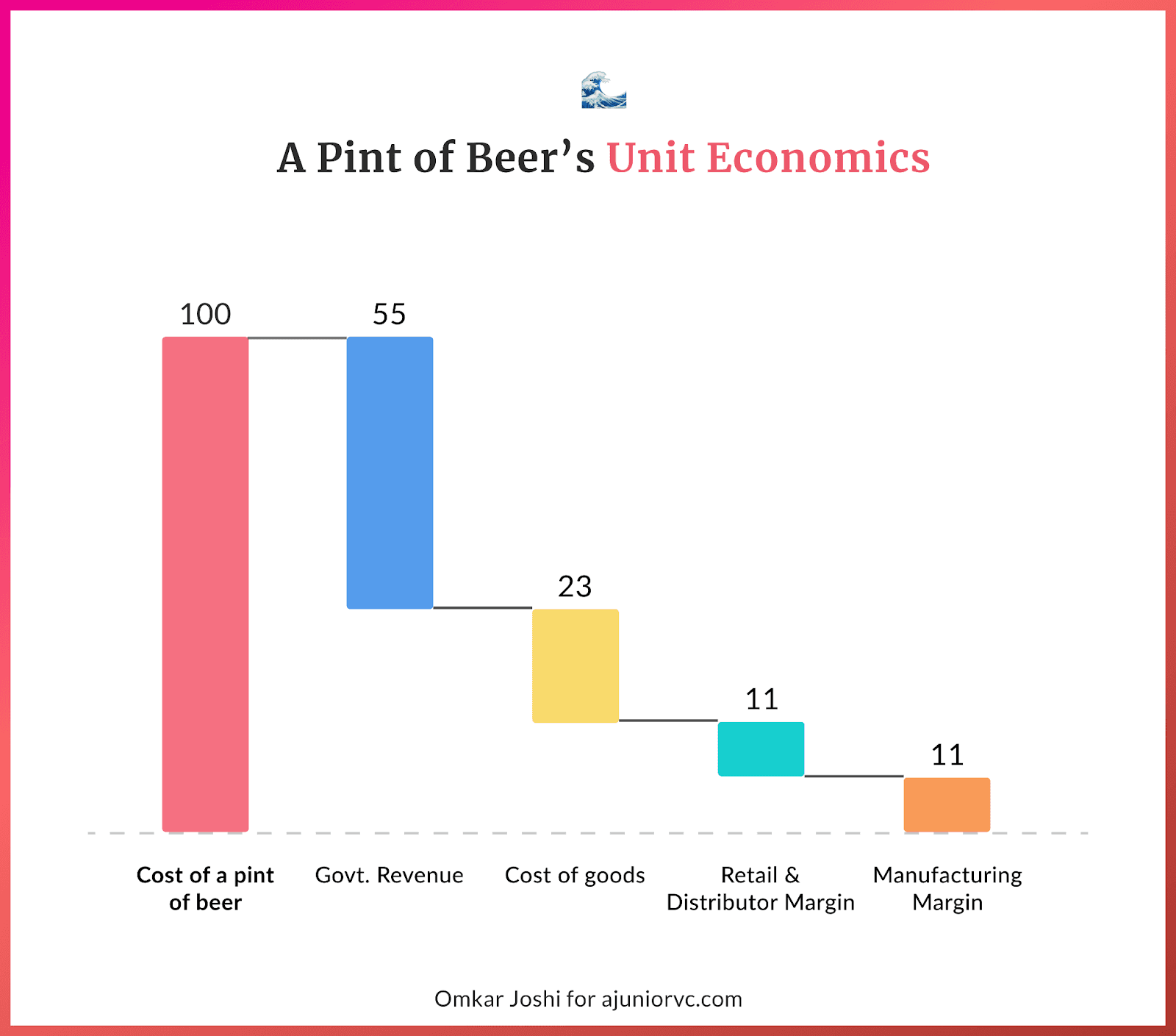

Breaking down the costs, up to 55% of a pint priced at INR 200 is taken by taxes. Production costs add another INR 40 to INR 50. This leaves breweries with a narrow margin.

While giants like United Breweries spend about INR 20 to INR 30 per pint on distribution and promotions, new entrants may shell out up to INR 60 or more, doubling the financial strain and hampering rapid growth.

High fixed costs compound the challenge.

Setting up a bottling plant demands INR 6-8 Cr, far pricier than other spirits infrastructure. Deep pockets are essential for those looking to make a mark in major cities. Bira had to rely on debt funding of $10M to push production and expand its capacity.

Despite aiming for a break-even in FY19, Bira's losses doubled due to heavy marketing and expansion drives. The leap to INR 102 Cr. from Rs 55 Cr. highlights the steep cost of scaling up in a competitive environment. For a startup to create a position is tremendously hard.

The quest for market share is not just about filling glasses but also about balancing the books.

Kingfisher Segment

Each year, 13M individuals in India reach the legal drinking age, with 3-5M of them choosing to opt for it.

Within the beer market, the segmentation is clear: strong beers dominate with 72-73%, regular beers capture 15-20%, and premium beers, including craft options like Bira, make up 5-6%.

Although overall beer market growth hovers around 6-7%, the premium category is fermenting at an impressive rate of over 30% annually. However, for newcomers like Bira, growth often means financial losses on each pint sold.

To address this, Bira had go mass market.

In early 2020, Bira introduced Boom, a mass-market strong beer. This pivot aimed to stabilise the company's financials by broadening its consumer base and absorbing the losses incurred from its premium craft beers.

Boom represents Bira's foray into a sector where margins are thinner and profitability tougher to brew.

Bira needed to navigate a complex regulatory environment to enter this new venture. Each of India's 29 states has its distinct liquor policy, making distribution difficult and costly.

Boom now has to jostle for shelf space with behemoths like United Breweries, which controls more than 45% of the market with its Kingfisher and Heineken brands. To counter this, Bira decided to venture into more mature markets, with an idea to tap into the Indian diaspora to capitalize on brand equity.

Bira was launched in Singapore and is now selling in key US cities, including New York, New Jersey, Boston, and Philadelphia.

Mature markets embraced Bira.

Notably, at the Tribeca Film Festival in New York, Bira outperformed its usual sales in New Delhi within just two weeks, highlighting its appeal to two million Indian expats who crave a taste of home with a craft twist.

Back in India, Bira’s marketing strategies were bold.

A sponsorship deal with the International Cricket Council (ICC) costs $5-6 million annually. Still, it significantly raised the brand's profile, contributing to a 2.5x revenue increase from 2019 to 2021 while keeping losses in check.

With each pint and promotion, Bira was not just trying to fill glasses but also ensuring it didn’t get bottled up by competition.

Bira was fermenting its foothold in the race against the biggies, proving that there was always room for a fresh brew even in a saturated market.

But a bigger storm was coming, about to upend everything.

Pandemic Panic

As the pandemic hit in April 2020, the entire hospitality industry crumbled.

Restaurants shut, physical retail struggled, and everything threatened to go to zero. As the overall industry looked like it was contracting, Bira91 leveraged its capital base to keep afloat.

Many thought the new age brand would struggle even to survive the pandemic. They appeared to be right in the highly competitive industry that was already battered.

Yet, combining new product launches and aggressive sales promotion helped Bira keep revenue almost flat. As the market declined, Bira’s market share grew beyond the 5% it already had.

One of the things that helped Bira stand out from the competition was how they positioned the brand.

Bira wasn’t a beverage company but a lifestyle brand appealing to the aspirations and tastes of urban millennials, which is its primary target audience.

They focused on the emotional connection and cultural relevance of their brand. From the brand logo to its product packaging and merchandise, everything is quirky, eye-catching, and fun-loving.

The mascot was intentionally designed as a monkey because there is a monkey inside each of us who just wants to get out of his/her crazy self. Monkey shows the spirit of rebellion against conventional.

A reverse ‘B’ indicates the rebellion millennia’s anti-traditional attitude. The combination of B with a funky monkey just did the trick. On its official merchandise, the monkey was also used as a mascot to show moods and actions and as a funny character.

As the world started opening up, Bira 91 engaged in experiential marketing by organising events like music and food festivals to create a community around its beer. They avoided celebrity endorsements, preferring consumer-driven promotions through giveaways and social media.

Their taproom in Koramangala featured up to 20 beers on tap and won the People's Choice Award for best microbrewery/taproom. Feedback from the taproom led to the launch of "Imagined in India" limited-edition beers, each featuring unique, local ingredients.

The ‘Imagined in India’ limited-release beers will be available in 330ml bottles and 500ml cans across Delhi, Mumbai, Bengaluru, and Pune.

In October 2021, Bira launched its first 360-degree campaign, ‘Make Play with Flavors’, to strengthen its premium positioning and encourage consumers to be more ‘creative, playful and flavourful’.

This was based on the insight that beer as a beverage means different things to different generations.

The campaign highlighted Bira’s portfolio through seven animated films, each depicting a different occasion enhanced by a Bira 91 variant.

Bira 91 also collaborated with boAt to launch a ‘BOOM’ audio collection, featuring limited-edition headphones and Bluetooth speakers sold via Bira 91’s merchandise store and the boAt website.

By targeting urban millennials, positioning itself as a lifestyle brand, leveraging collaborations, digital marketing, and experiential marketing, Bira 91 successfully connected with its audience and established a strong presence in the craft beer market.

Growth Pegs

Post-COVID as consumers started returning to bars and beer shops became functional, Bira 91 experienced significant growth, doubling its bottle sales.

This surge was driven by an expanded product range, strategic marketing campaigns, increased consumer demand for premium beer, and stronger distribution networks. The brand's focus on innovation and quality resonated with a market craving unique and refreshing beverage options.

Recognising the green shoots, Bira91’s leadership had to move fast to service the increasing demand while maintaining quality standards.

On the one hand, it acquired Beer Cafe, which was extremely savvy. This acquisition enhanced Bira’s front-end selling points and provided a unique consumer experience.

This seamless integration of product availability with a vibrant, beer-centric atmosphere has expanded Bira’s retail footprint and deepened brand loyalty among consumers seeking novel and engaging experiences.

It also bolstered its production capabilities and reach through organic and inorganic activities.

It quickly acquired Chhattisgarh Distilleries and Kaamkhya Beer and Bottling. In 2022, it inaugurated the Gwalior factory to ensure a steady supply chain and access to new regional markets, positioning Bira to meet increasing demand while maintaining high-quality standards.

To fund its ambitious growth plans and turn the IPO into a reality, Bira 91 strategically raised funds through a mix of equity and debt. It raised USD 130 Mn from various investors within 1.5 years.

This helped fortify Bira’s growth trajectory, ensuring it has the resources to innovate, expand its market presence, and remain competitive in the dynamic beer industry.

While Bira’s revenue grew substantially in FY22 to 719 Cr, its valuation remained flat at about 4,000 Cr. A combination of market competitiveness, a higher valuation achieved previously and losses made investors wary about raising the company’s price.

Bira91 needed to grow into its valuation.

By 2023, Bira91 also had Japanese Beer Maker Kirin Holdings as its largest investor. The 100-year-old company was valued at $10B, which would be a stable strategy to help Bira achieve its ambitions of becoming a 1,000 Cr revenue company.

A few years ago, Kirin slowly built a stake in the company. Kirin’s presence helped it expand into global markets while helping it better understand the beer market.

As Bira entered 2024, it sought to build on its foundations that started in the pandemic.

Chasing Champagne

Driven by India’s urban demographic factors and rising disposable income, the beer industry is expected to grow 9% CAGR to INR 62,000 Cr by 2026.

Within the beer segment, Craft beer continues its rapid expansion. It was expected to grow at a 20%+ CAGR, driven by evolving consumer preferences among urban millennials and health-conscious individuals seeking diverse, all-natural, and locally brewed options.

The growth story of Craft beer is akin to the growth story of the specialized coffee segment and wine segment.

As coffee and wine enthusiasts appreciate the nuances of single-origin beans or terroir-driven wines, beer drinkers are exploring diverse brewing techniques, ingredients, and regional styles offered by microbreweries.

This cultural shift is driven by a desire for authenticity, quality, and the exploration of new sensory experiences, which significantly departs from mass-produced alternatives.

Bira 91, with its recent fundraise, looks set to keep building on its almost decade-long journey. Bira 91 has aggressive plans to drive growth in both domestic and international markets.

It is strengthening its distribution in the domestic markets, opening more taprooms to attract millennial consumers inclined to experimentation and quality, and sprucing up its manufacturing capabilities. In international markets, it intends to grow its distribution and leverage the knowledge of its strategic partner Kirin Holdings.

One of the company's critical challenges has been its bottom line. Despite being a stated goal, profitability has taken a back seat as the company has focused on funding growth.

Bira 91 reported a PBT loss of INR 445 Crores in FY23. However, to be listed on Indian bourses, the company needs to improve its bottom line as well.

The company is choosing to go public, including more public reporting and a focus on strengthening the bottom line. Building a brand in a market as competitive as beer takes unusually long.

Bira has demonstrated that a brand can be built in a market as competitive as beer and as niche as craft beer. Using craft beer as a wedge, it is now well-positioned as a brand with the muscle to distribute products.

Bira is now India’s 4th largest beer company, just behind Heineken, AB-Inbev and Carlsberg. It is now present pan India and in 20+ countries. The journey has been one of building a real brand.

Bira now has to build an enduring business capitalizing on its 5,000 Cr base.

Writing: Bhoomika, Ajeet, Parth, Rajiv, Ritika and Aviral Design: Chandra and Omkar