Mar 7, 2021

Will BharatPe Become Bharat’s Lending Tap?

Profile

Payments

Lending

Finance

Platform

B2C

B2B

Series E-G

Last fortnight, BharatPe raised $100M to reach within a touching distance of becoming a unicorn, within an incredible 3 years of founding.

Man on a Mission

Ashneer Grover always wanted to do something different.

Ashneer’s first job out of business school was at an investment bank where he was part of various IPO deals across sectors ranging from Retail and Oil & Gas to Manufacturing and Real Estate.

He moved to Amex in 2013, after spending seven years at Kotak, having worked on 10+ deals with over US $3bn in transaction value. At Amex, he spearheaded the payment and fintech coverage in India, as well as a Series B in MobiKwik.

At a time where Flipkart and Snapdeal were gaining fame and popularity with their startup stories, Ashneer felt the urge to do something different. He joined Grofers, an online grocery delivery service, working alongside the founders to build the team and fundraising.

The experience proved invaluable as he gained exposure to the startup ecosystem and met a vast network of investors. Ashneer’s experience at Grofers, although only for a few years, would set the stage for what he was to build down the road.

Ashneer’s association with payments continued later as he joined PC Jewellers to lead the digital transformation of the retailer. He enabled new business development in payments enabling multiple new payment options such as PayTM, PhonePe and PineLabs across the country.

At the same time, in 2018, Shaswat Nakrani, an engineering student, was working on an idea that could revolutionize the fintech space.

Ashneer visited his alma mater thinking that the startup would be a good angel investment opportunity for him.

The meeting with Shaswat though, convinced Ashneer to join the team full time. He sensed that UPI would become a force across India and saw immense potential in the idea.

BharatPe was born.

I Don't Need No Complication

At the time, various fintech platforms were scaling rapidly.

Customer-focused companies like PayTm, Amazon and Flipkart wanted payments to happen within their own closed networks.

What this meant is that Paytm users can only use the app with merchants who accepted Paytm, and likewise for PhonePe and AmazonPay. This led to merchants requiring QR codes of multiple companies for them to accept payments from different apps.

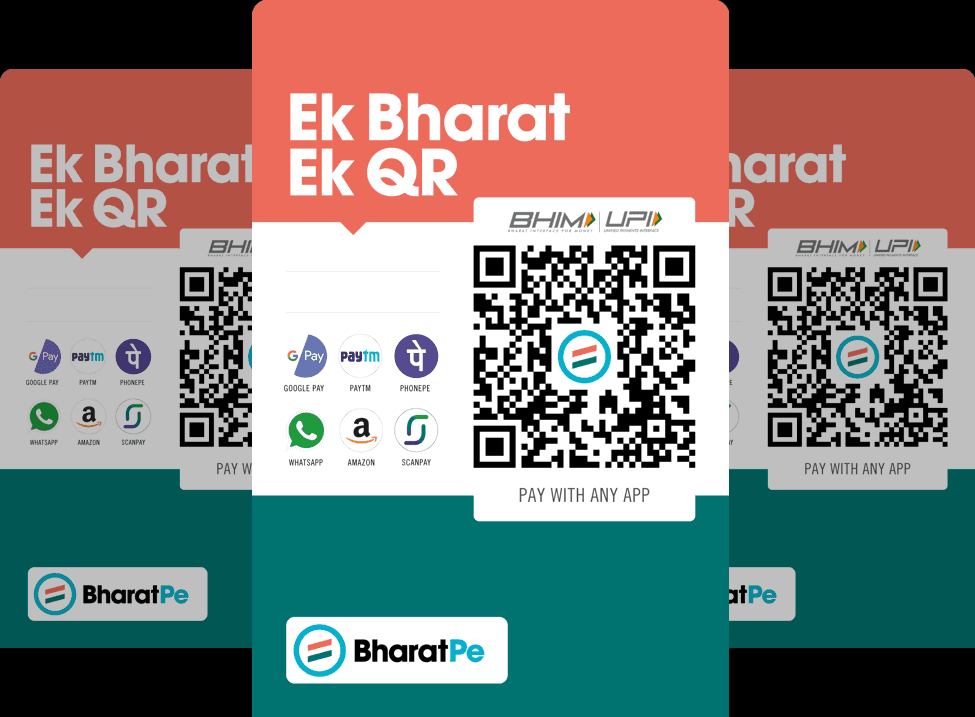

The idea behind BharatPe was to do exactly what all the big names were reluctant to do - make things easy for the merchant with a standardized interoperable QR code.

It allowed small merchants like shopkeepers, street food vendors, tea sellers etc. to accept payments on any UPI app (PhonePe, Google Pay, PayTM etc.) without needing to download those apps.

They did it by generating a single QR code, with all the merchant’s information encoded in it. BharatPe used the merchant’s mobile number, account number and bank IFSC code to generate a VPA (virtual payment address) to embed in the QR.

It was a simple and affordable process, with additional security built in. Multiple UPI apps were condensed into a single sticker, simplifying the payment system ten-fold.

What was truly revolutionary was that BharatPe did not ask for any setup fees, nor did it take a cut of the transaction fees.

Once the payment had been made by the customer, the amount was immediately credited into the merchant’s bank account without a delay, as there was no hassle of fees.

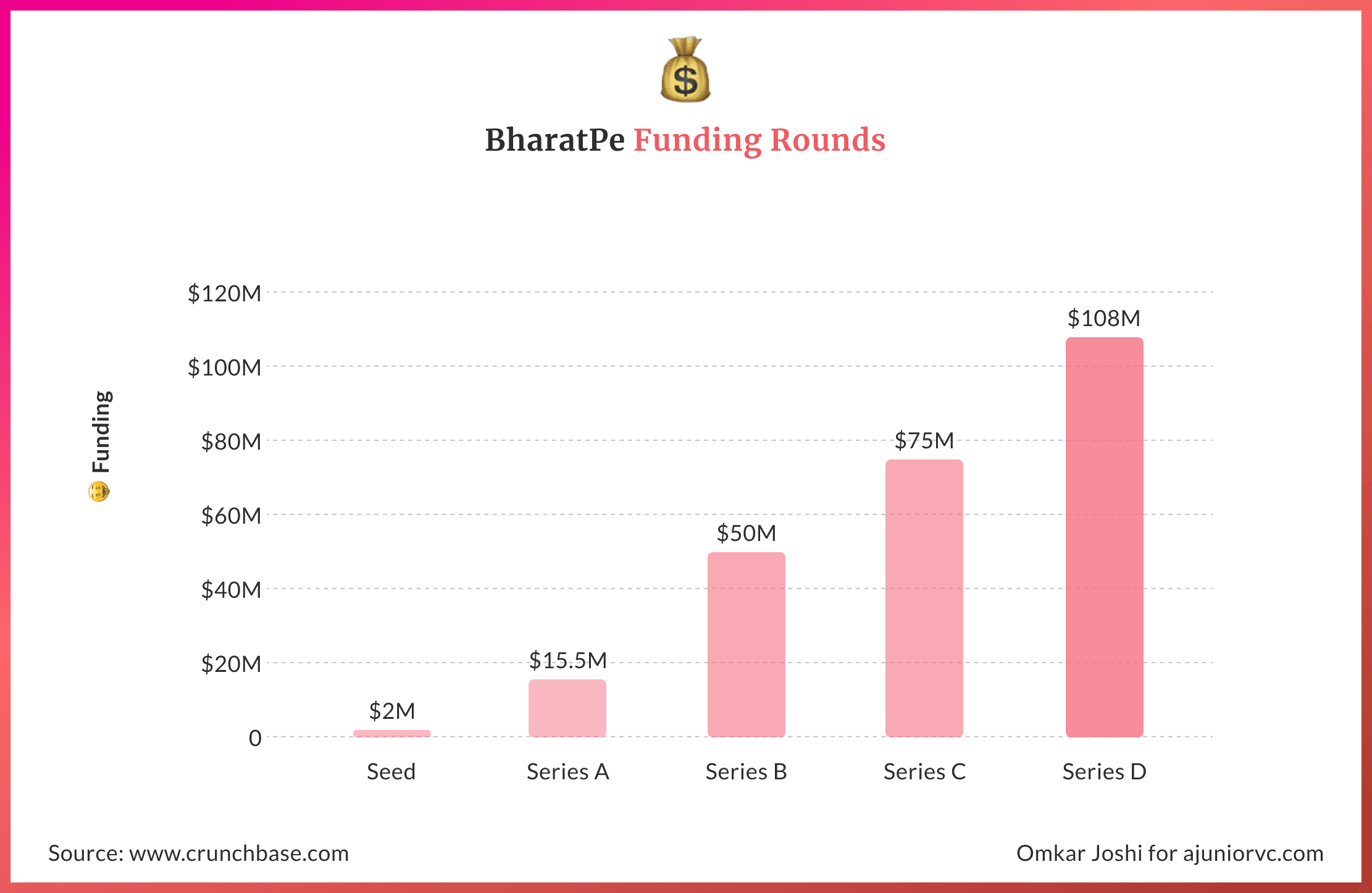

Riding the coat-tails of the massive adoption of their QR codes by over 1MM merchants in 2018, BharatPe raised $2M in seed funding in 2018.

A Mountain of Opportunity

While India emerged as the second-largest internet market with 560M users, it was still rapidly digitizing and growing.

Making up a big chunk of those new to the internet are the small business owners - merchants running tea stalls, shopkeepers or kirana stores in the country.

In October of 2019, UPI achieved a historic feat by reaching one billion monthly transactions.

BharatPe was the key enabler to get these merchants online, and was playing a key role to boost India’s digital economy. Lending was the golden tap it wanted merchants to drink from.

BharatPe’s QR may have been free, but it was only the hook.

Along with providing a QR code to the merchant, they also helped him track all his transactions on the app. With all this data on their hands, they planned on offering small ticket loans to merchants via their app.

According to an IFC report, a whopping 85% of credit demand of MSMEs is met through informal sources. The big gap is where BharatPe along with digital lending fintechs were planning to corner. An estimate of the credit gap for MSME’s in India pegged it at $380Bn.

Improvements in regulations for data protection, along with continued digitisation in India especially for the long tail segment such as merchants make digital lenders like BharatPe prime candidates to address this credit gap.

The market looked to be ripe for the taking for BharatPe.

Losses are For the Bravehearts

BharatPe’s route to rapid success was keeping everything simple.

BharatPe’s product philosophy revolves around making things simple for the merchant and uses P2M transactions as the hook to build other offerings.

What started as a minimum viable product using tools like IFTTT, Google Sheets, and Twilio, and relied heavily on the BHIM app for the payments, led to a full fledged product managing 750 million transactions annually.

Core to this success was the simple QR code.

A single QR that can accept payment of all the competitors may look simple for a customer and a merchant but it is quite a complex task for the tech and product team.

BharatPe’s tech was built understanding this complexity in mind. Everything they built was built inhouse giving them closer insights on merchant needs and an agility to iterate quickly whenever there was a change on the banking or partnership side.

A solid tech foundation and a great product thinking gave them the muscle to process 60M transactions per month with a 99.6% success rate!

The next challenge was to figure out a business model for BharatPe.

As we mentioned earlier, BharatPe does not charge merchants any setup or transaction fee so the core offering - payment collection through QR codes, is actually a loss leader for BharatPe.

It has to incur a significant cost managing those servers that process millions of such transactions everyday. But, that also gives BharatPe access to merchants who love their product and take to their offering without any second thoughts.

Creating stickiness has allowed BharatPe QR to become a viral sensation in the world of small merchants and helped keep the merchant acquisition cost significantly low. That matters when it is competing with the big giants that include Google and Whatsapp in the market.

Once it got a foot in the door of India’s vast offline merchants it could start selling ancillary products like short term loans, business cards, PoS machines using an NBFC/bank as the financing partner.

By May 2019, it partnered with Apollo Finvest to start pilots in merchant loans. The tap was open and for the millions of merchants who had been deprived of it, it was nectar

Masters of Scale

With the business model taking shape, it was time to press the foot on the gas.

BharatPe had to scale and reach a customer which is largely offline. In a country where merchants do not believe in DIY concepts, it had to build a large FoS (Feet on Street) presence.

For the long term game that BharatPe wanted to play, paying Rs. 20-30K a month to field agents, on basis of the number of merchants onboarded, turned out to be a game changer.

Soon, the flywheel started turning.

With a 3000+ strong field force to convince merchants across India to move to a simpler QR code, it wanted to make the combination potent and trustworthy.

In July 2019, it roped in Salman Khan as the face of BharatPe, to make it easier to crack merchants from tier-2 and 3 towns where Salman Khan had a huge following.

BharatPe Helps You Be Dabangg

The message quickly resonated with merchants who felt that someone was talking to them directly and wanted the “Dukandaar to be the King”.

This simplicity was also discussed by BharatPe’s Suhail Sameer on A Junior VC’s community, which you can join and learn from.

BharatPe is even understood via a Q&A

Like the product, the message was simple and impactful. Soon, merchants started recognizing BharatPe as a brand and appreciated the simple solution it built for them.

Even the name BharatPe gave it an authentic touch with some merchants feeling that it was associated with Government initiatives which further boosted credibility

As they planned to do a land grab, competition was close on the heels

Surviving in a Bloodbath

By August 2019, BharatPe had close to 1.5 million merchants on its platform which was growing rapidly as they planned to reach 5 million merchants within the next 1 year.

This was no small feat in a hyper competitive market with Big Tech giants (Google, Amazon) to the most valued startups (Paytm, Udaan) looking to paste their sticker on a Dukandaar ka Galla (Shopkeeper’s Vault).

It was incredible that trillions of worth of market cap went after the same merchant but BharatPe still managed to grow.

The major reason was that BharatPe kept it open and did not want to trap a merchant or a customer to use one particular payment method or app. They de-cluttered the space and gave every merchant and customer an option to choose whichever provider they or the customer liked.

Their razor-sharp focus on offline merchants helped them define a niche for themselves. With an innovative interoperable QR in hand, they also executed a winning strategy to onboard new merchants and inducted millions of merchants into the world of digital.

For years BharatPe served them by providing a zero-fee payment acceptance solution and helping them grow. This was a very strong USP that most of the competitors failed to recognize and by the time they could, things were moving fast for BharatPe.

But as it was going full throttle at a breakneck speed, the chinks in armour were showing up.

It Ain’t All Sunny Here

BharatPe does not charge merchants for universal QR code access due to zero merchant discount rate (MDR) rules.

Even if zero MDR rules didn’t exist, it is tough to make money in payments in India, as retailers operate at very low margins. Therefore, it was looking to make money by lending.

The company spent its first two years focussing on product building, getting customers on board, building a team, making merchants aware of the BharatPe system and other aspects of the businesses.

By Sep 2019, it planned to go heavy on the lending segment. However a spanner was in the works. There were chances of a possible scrutiny of the lending model by the central body.

With the recent growth of digital lending startups in the country across models including peer-to-peer, pay later, invoice financing, bank-led digital models, marketplaces, and more, RBI was concerned about unauthorized use of user data, customer protection and risk governance.

The central body had received complaints against several digital lending applications.

To study all aspects of digital lending activities and address concerns which have wider systemic implications, RBI set up a committee early this year to regulate e-platforms and apps offering and promoting digital lending.

Post the RBI red flag, Google started removing apps from its playstore

This could be a potential bottleneck for BharatPe’s revenue growth which was looking at lending as a major growth vector. This was true especially when payments were expected to remain the loss leader.

More scrutiny could mean higher compliance costs while slowing the growth engine

Add to this somewhere around this time, news of internal turmoil came out. Blaming the startup’s aggressive work culture, three senior executives announced their departure from the company.

While it was looking to build a rocketship, it had to first ensure that it did not set its house on fire.

Parrying a COVID Sucker Punch

As the BharatPe ship continued to hurtle, it needed to be steadied and set on a path.

By 2020 BharatPe started focussing on lending business and built an MVP for monetization. It began providing short term loans of about $500 for 3 months with a limit increase to $2000 as per merchant profile.

Within 7 months of MVP launch, BharatPe could disburse close to $14M loan to over 20,000 merchants. A validation and potential that made investors start pouring in money and by Feb 2020, BharatPe raised $75M valuing it over $400M.

But while BharatPe was gearing up for the battle the pandemic struck.

Businesses came to a standstill.

Contrary to other sectors, the pandemic provided strong tailwinds to the digital payments sector. Total transactions on the platform sprung back by Apr 2020, averaging around 1.2M every day, worth ₹65 Cr.

BharatPe’s growth could be attributed to its successful identification of a niche within offline merchants. Its differentiated financial services proposition focused on the merchant outweighs all other services being targeted by other digital payment players.

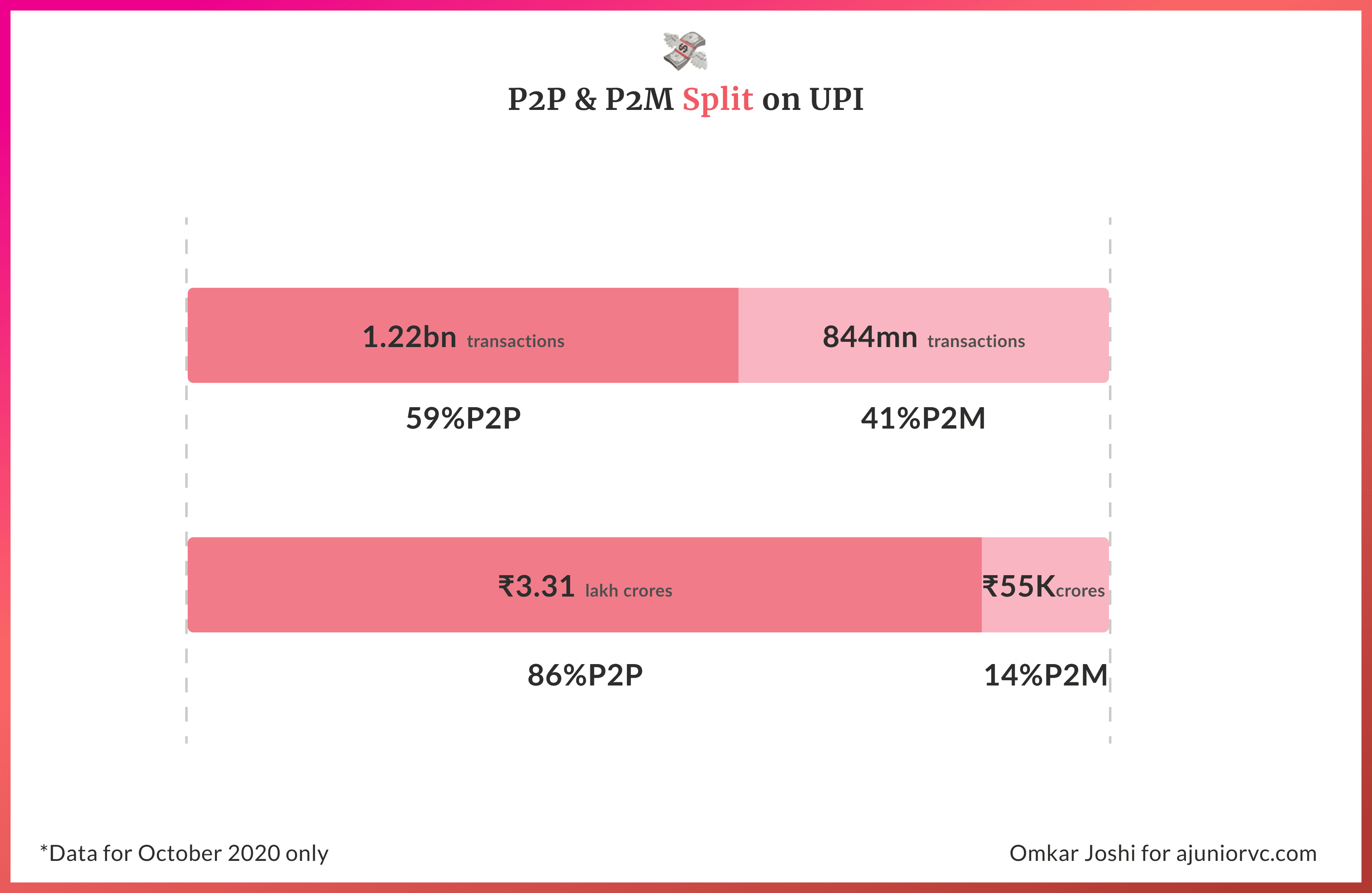

100% of their volume is through UPI P2M which is a small ticket vs P2P.

While P2P is a great indicator of digital payments adoption, the real growth & opportunity lay in P2M, an indicator of growth of retail business. This is especially true for India where the offline retail market is, in order of magnitude, larger than the online/ecommerce market and rapidly digitizing.

The niche segment of the offline merchant base has been driving huge numbers for BharatPe. In the past few months BharatPe has witnessed a steady phase of growth. It is rapidly heading towards becoming the largest UPI QR merchant acquirer in India.

In November, the platform recorded INR 3,334 crore (USD 479 million) in transaction value in a total of 61.5 million transactions monthly.

With this, the home-grown platform displaced the global behemoth - Google Pay and became the 3rd largest P2M UPI payment app.

Talk about a two year old startup matching the might of a giant with a warchest at its disposal in an intensely competitive space.

As it exploded in the transactions space, the digital lending market in India has grown from $33 billion in value FY15 to $150 billion in FY20 and may hit the $350-billion mark by FY23. BharatPe would be competing with leading players in the market like Lendingkart, Capital Float, Zest Money and Indifi.

BharatPe’s rapid execution was showing that it would be a worthy competitor to all of them

The Race has Just Begun

By the end of 2020, BharatPe reported serving over 50L merchants in 35 cities across the country with an annualized TPV (Total Payments Volume) of over $4Bn.

The company grew 4x over the course of the pandemic at a time when many startups focused on survive first to thrive later

If small merchant credit is a whitespace which was waiting to be tapped, BharatPe is leading from the front. The startup’s lending business grew by 10x in 2020.

It is sitting on a treasure trove of data from its digital payments business concentrated on offline merchants. This makes BharatPe strongly positioned to expand its financial services stack with working-capital loans, credit cards and other products on insurance, investment etc.

But while BharatPe had the early-mover advantage in P2M UPI, it is not immune to the competitive intensity.

In Sep 2020, Paytm launched Paytm Sound Box that would alert the merchants upon a successful transaction saving them from the hassle of waiting for an SMS everytime. Early this year, Pine Labs introduced a new app that would enable small merchants to immediately begin accepting payments on their NFC enabled smartphone.

The big gorilla Whatsapp also began to make its move.

With the recent launch of Whatsapp Pay in India the competitive landscape for BharatPe could alter significantly.

Despite its delayed entry into the UPI ecosystem, Whatsapp Pay is growing swiftly. In Dec 2020, it processed 0.81 million UPI transactions worth Rs 29.72 crore, a 100% increase in volume compared to November. It is well understood that Whatsapp has the best distribution in the world.

BharatPe responded to this competitive heat and tried to move fast.

In Dec 2020, as part of its strategy to aggressively grow its loan book to INR 5,000 Cr in the next two years, BharatPe submitted a joint expression of interest with Centrum Group to take over PMC bank.

While its competitors were busy trying to make transactions at the point of sale easy, it continued to go deeper on its loan book.With the latest round of funding which took the company’s total equity and debt investment to $268 million, BharatPe plans to further expand.

With the balance sheet well capitalized (more than $200 million in bank), BharatPe is now planning to deliver $3 billion TPV (total portfolio value) and build a loan book of $700 million with small merchants by March 2023

As it looks to make money by building the lending vertical, BharatPe has a head start here with the visibility to the merchant's business and cash flow.

Over the years they have become an integral part of the merchant's business and are much better positioned to provide customized lending solutions.

With merchant-to-merchant lending and retail financing they are looking to support their customers - small merchants. In this race to innovate, the winner is obviously going to be the underserved customers and small businesses.

BharatPe could win alongside them by providing merchants with a trusted lending tap.

Audio Version: Behind the Scenes with AJVC

We bring to you, AJVC behind the scenes podcast with the writers of the piece Raghav, Abhinay and Mitali.