Jan 21, 2024

Can 7,000 Cr Country Delight Herald a Fresh Indian Revolution?

Profile

Groceries

Retail

Food

Brand

B2C

Series E-G

Last fortnight, Country Delight raised $20 million at a valuation of $820 million to knock on the doors of India’s unicorn club.

Milking First-Hand Experience

Chakradhar Gade and Nitin Kaushal met at an IIM and completed their MBA by 2007.

They took the path that most people take after an MBA, a job in finance or other fields where they can apply their business acumen to grow businesses. They were data-focused and knew the concepts of depreciation too well not to see a key insight.

If one buys a car, it depreciates over time, but if you buy cattle, it multiplies over time!

It may sound naive. Most of us may dismiss the idea of cattle farming and selling milk as it involves complicated operational challenges of managing cattle, milk perishability, and a complex supply chain.

Chakradhar and Nitin had different ideas.

They did not have any background in cattle farming, so in 2011, they decided to take it up as a part-time business in Delhi, bootstraped with INR 1 crore as capital. As they say, outsiders to a business sometimes become the best disruptors.

They started the business by buying 50 cows which they hoped would become 500 in two years based on the Excel sheet they had prepared.

That Excel had more rows and columns that projected the daily milk supply would increase from 200 litres a day to 5,000 litres within 2 years. Around 70 lakh litres of milk was sold daily in Delhi and they aspired to sell 1 lakh litres per day eventually.

However, as with most Excel models, reaching 5,000 litres daily would be a 3x longer journey.

The path from air-conditioned rooms to cattle farming was full of surprises. First, they had just a couple of weeks to find land where they would keep these 50 cows and soon the additional cost of buying two bulls they needed if these 50 cows had to become 500.

Being a bootstrapped business, the founders were patient and resourceful enough to learn the most important customer insight they got during these initial years of business.

Customers want fresh and unadulterated milk for their families at an affordable cost. By 2015, Chakradhar and Nitin were ready to solve this problem for customers.

4 years later, Country Delight was born.

$26B Dairy Gaps

Country Delight started with milk as its core product.

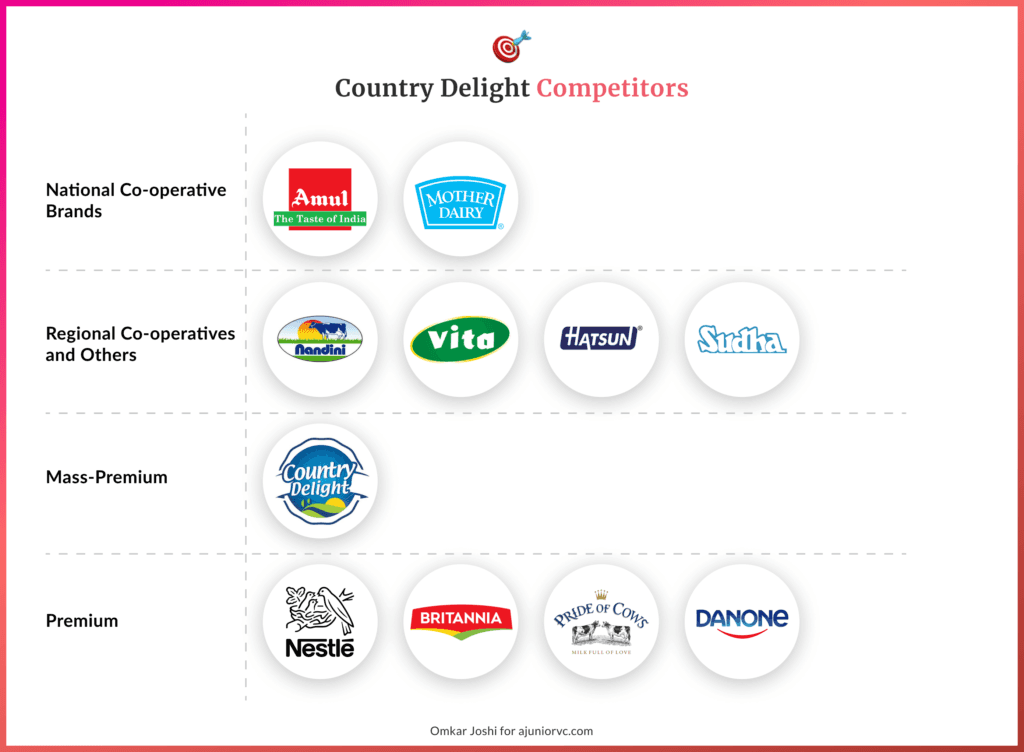

There were sizeable organised players like Amul and Mother’s Dairy. Upstart peers like MilkyMist, AkshayKalpa, Sid’s Farm and many unorganised players or small cattle farmers also operated in this space.

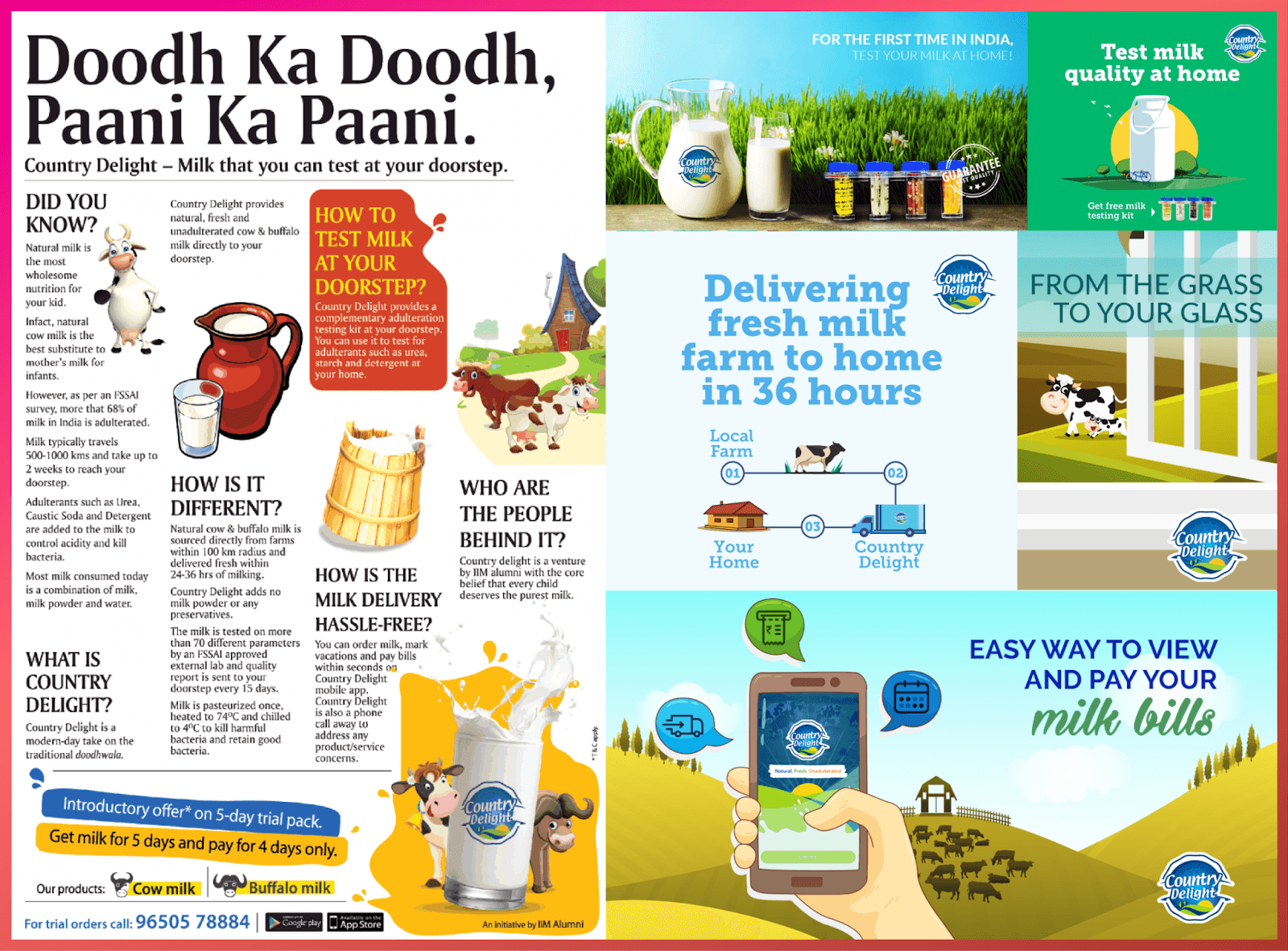

The problem with organised players was it often took up to 2 weeks to deliver milk to end customers through a cold supply chain network. Milk travelled 500-1,000 km. This meant customers were not getting fresh milk, which may be checked for quality. Moreover, many big players also had to use milk powder in the milk packets, which meant the milk was unnatural.

As per an FSSAI study, 68% of the milk sold in India was adulterated

Conversely, unorganised players in customers' neighbourhoods delivered fast, but customers did not know about the milk's purity. We will all recall childhood stories of your friendly neighborhood dairyman mixing mik with water.

This is where Country Delight's founders found a wedge to enter this large but traditional market.

They wanted to eliminate prevalent unscientific practices like testing milk by tasting it. This initiative was as much about educating consumers on the importance of pure, unadulterated dairy as it was about product assurance.

They could also understand that customers can pay more for a pure and fresh product. If Country Delight can innovate on the supply chain and build a trustworthy product,, they will be rewarded with good margins and an opportunity to cross-sell to this captive customer base.

The problem statement was clear, and Country Delight built the entire supply chain with innovative solutions and listened to how customers reacted to it.

By 2016, the biggest challenge in creating a new milk brand was trust.

Testing kits and subscriptions were added to show how they were unadulterated. Country Delight added “founded by IIM alumnus” on the packaging to add trust. It also offered traceability to the source, which inspired confidence in users.

The proven promise of purity was also delivered through an FSSAI-accredited lab report on 75 parameters every 15 days.

But the most important difference customers could notice is the difference in milk taste.

They could soon trust Country Delight as a brand that provides fresh, unadulterated milk at a slight 20-30% premium cost compared to the other organised players like Amul.

Country Delight was transforming into a fresh-to-home brand in which freshness and purity could be differentiated with taste.

Building this at scale was not going to be easy.

Fluid Quality Control

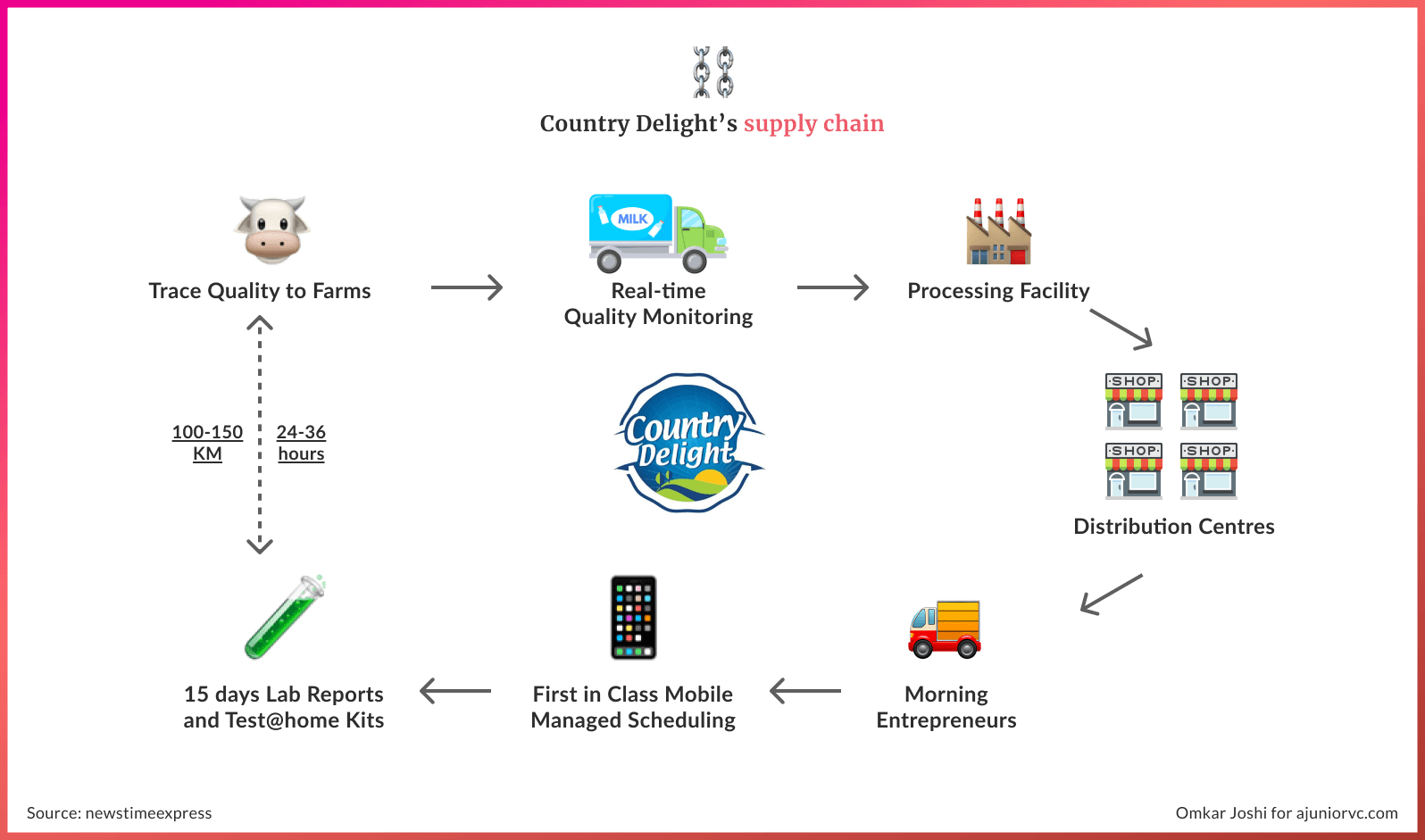

Country Delight had to build its supply chain to deliver on the promise of fresh milk in 36 hours.

This was an unexpected operational huddle for the bootstrapped company. Founders had to figure out the milk procurement, fix last-mile delivery, work on the arithmetic of customer acquisition, integrate the supply chain with technology, and build scalability.

Each of these was a large problem to solve.

Operational complexity would eventually become the moat giving them control over procurement, building loyal relations with farmers, using tech to reduce storage and logistic costs and offering trust and quality promise through last-mile traceability to consumers.

They burnt 70% of the initial capital, and to remain in the game with their dream of reaching 5,000 litres a day, they needed more.

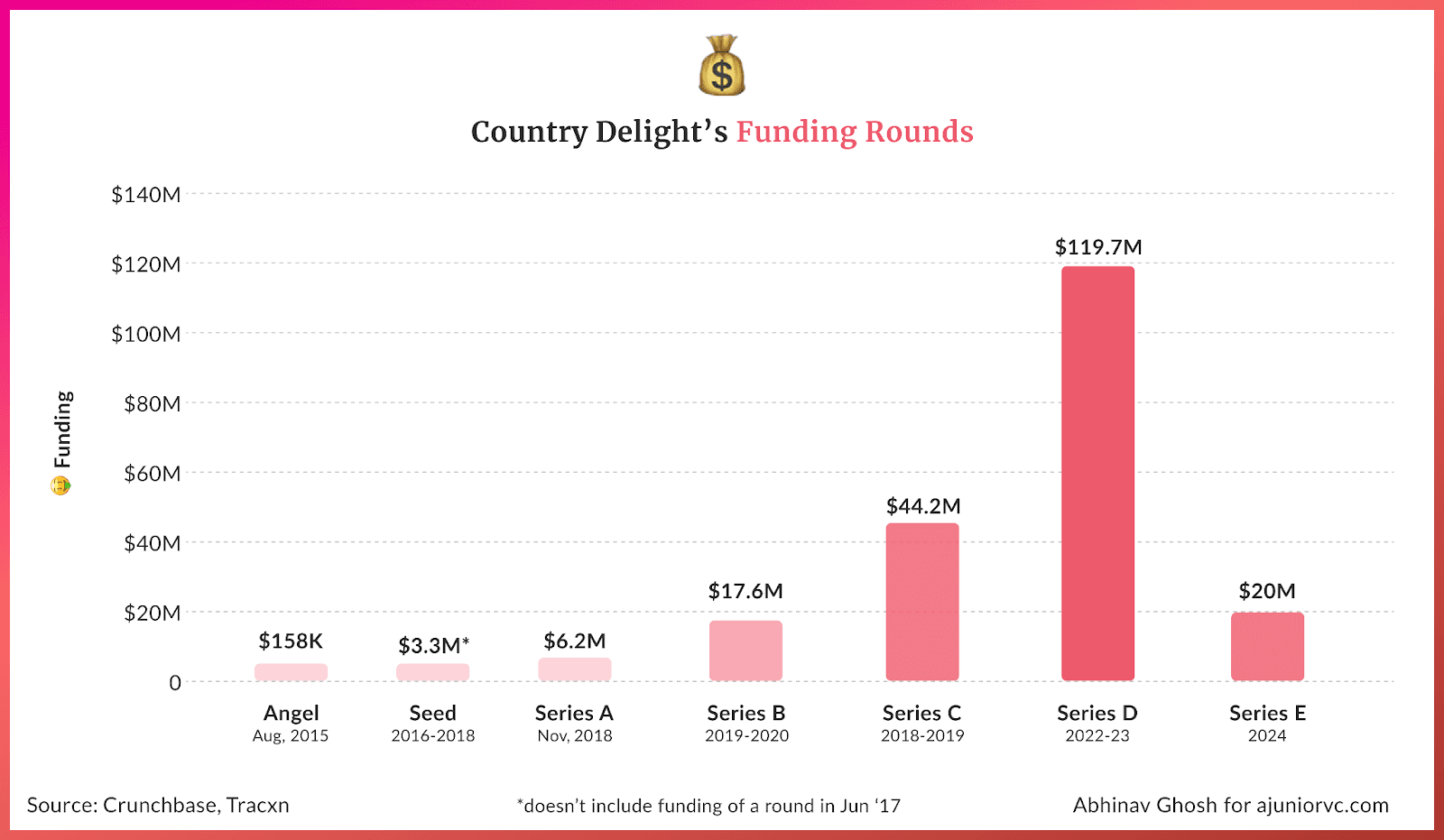

After 6 years of bootstrapping, Country Delight finally raised its seed round in 2016 by securing INR 3 Crore for a 10% stake valuing it over INR 30 crore.

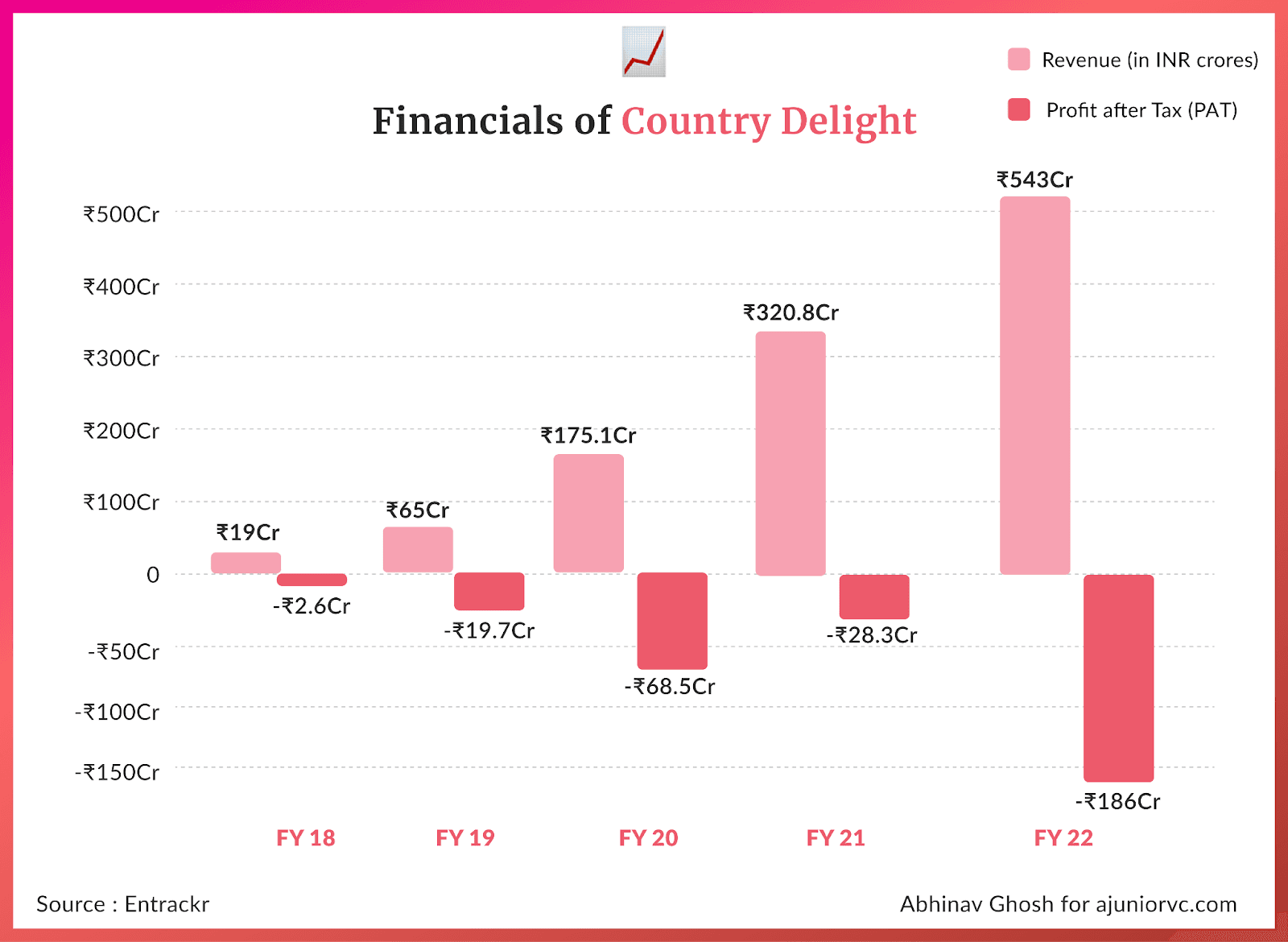

This helped the company to expand to more cities and adopt technology to scale its business, and by FY18, it clocked close to INR 19 Cr in revenue with a loss of around INR 2.5 crore.

By this time, Country Delight was present in three cities- Delhi NCR, Mumbai and Pune with a supply of 15000 litres daily.

But they were just getting started and had bigger ambitions.

They already had a foot in the door of Indian customers with a sticky category of unadulterated fresh milk. They had established trust amongst customers and a solid supply chain that connected them directly to customers.

You can even sell a refrigerator if you are trusted to sell milk.

It was time to expand from milk to dairy products like curd and paneer. The next categories it could explore were fresh vegetables and fruits, making Country Delight more than a milk company.

The direct-to-consumer brand was ready to go beyond milk and deliver freshness.

Juicing an Urban Phenomenon

As Chadrakhar and Nitin looked to the future, they recognised the immense potential in the urban dairy market.

This was more than just a business; it was a movement to redefine the dairy industry in India. Echoes of Amul’s transformation of India’s milk landscape came through.

They would take on giants by focusing on a niche. In 2018 and 2019, they began meticulously building a mass premium brand, focusing on tier 1 and metro cities.

The idea was straightforward yet ambitious.

The dairy market in India was estimated at approximately USD 18 billion and experiencing growth of about 7-8%. This robust growth reflected the increasing demand for dairy products in a country with a strong cultural connection to dairy consumption.

In the urban landscape, supermarkets were the primary choice for consumers seeking dairy products, followed by other retail formats like convenience stores and online platforms.

However, these traditional retail channels often faced challenges such as inconsistencies in product freshness, limited variety, and concerns over adulteration and quality.

Urban consumers, growing more health-conscious, were increasingly dissatisfied with these limitations.

Country Delight went deep here.

Unlike large dairy conglomerates like Amul, which operate on a mass production scale and distribute through traditional retail channels, Country Delight chose a direct-to-consumer model.

Amul, one of India's largest dairy brands with a 26% market share in the packaged milk market, had a vast distribution network. Amul catered to a wide range of consumers with a diverse product portfolio.

While Amul has a significant presence in urban and rural markets, its scale often means less control over the freshness of the product by the time it reaches the consumer.

Country Delight disrupted the urban market by focusing on a niche yet growing segment of consumers who prioritised product freshness and quality over a wide product range.

The urban market, with 35% of the population but higher disposable incomes, account for an estimated 50% of the $18B milk market. The urban market's density meant that Country Delight only needed to capture a small slice of this dense user base to build a large business.

Their model of sourcing milk from local farms and delivering it directly to consumers' doorsteps ensured that they could maintain the freshness and purity of the product. By leveraging technology for operations and customer engagement, they positioned themselves as a premium brand in the urban dairy market.

By building relationships with loyal customers they added other cities. Country Delight expanded across 15 cities such as Delhi, Gurugram, Noida, Bengaluru, Pune, Mumbai, Hyderabad and Chennai.

Country Delight built on its FY18 revenue to remarkably grew to 65 crore INR in FY19.The upstart was off to the races, expanding into more cities beyond its first 3 of NCR, Mumbai and Pune.

Fruits of Tech

By 2019, the founder had fine-tuned a farm-to-doorstep model that distinguished itself in efficiency and effectiveness.

The full-stack approach, taking control of the entire supply chain, was key in ensuring quality while reducing waste. Beyond efficiency, their model significantly uplifted the lives of partner farmers.

By eliminating middlemen, they saved about 15-20% in distributor margins — a substantial saving in a sector shared with farmer partners.

Their subscription-based service was another masterstroke, cultivating customer loyalty and enabling a negative working capital model, a rare feat in the FMCG sector. The brand's packaging went beyond mere functionality. It was a statement of the brand's dedication to quality and innovation.

This meticulous attention to detail allowed them to command a premium price. Country Delight's cow milk, priced at around INR 85-100 per liter, more than 50% of Amul's pricing of INR 50 to 60 per liter.

However, Country Delight wasn't just delivering milk.

It offered trust, quality, and wellness straight from the farm. Their control over the supply chain laid the groundwork for expanding into fresh produce and milk products.

The commitment to high-quality milk led to higher procurement costs of about 45-55%, in contrast to the 40-50% typically spent by traditional distributors. This was a testament to their dedication to sourcing premium milk from local farms, even at the expense of larger-scale economies. The company realised that with scale, network density would allow the procurement costs to come down.

Country Delight also made significant investments in packaging and marketing.

Their packaging, tailored for direct delivery, and marketing strategies to build a premium brand resulted in marginally higher expenses in these areas, 5-10%, than what traditional players typically incur, around 3-5%.

Distribution and logistics costs ranging from 5-10%, were substantially lower than the 20-30% spent by traditional players.

This was possible because competitors dealt with multiple intermediaries before reaching supermarkets and convenience stores. Country Delight harnessed technology to streamline and scale its logistics, enabling it to market directly to consumers.

Processing and operational overheads remained consistent, around 10-15% for Country Delight and other players, reflecting the standard industry costs unaffected by the scale of operations or market strategy.

Creating the first full-stack model for milk was hard to set up and slow to scale due to the logistics and the intense competition from large traditional players.

With the foundation laid, Country Delight’s approach would give them a competitive edge in the form of loyal recurring customers, positive cash flows and healthy margins.

It would end FY20 at 175 Cr of revenue, 3x of the prior year. A disruptive storm was coming.

Pandemic Punch

COVID was a big boost to Country Delight as the whole world went direct.

The pandemic provided avenues for Country Delight to grow from an SKU standpoint and improve efficiency and tech back end.

The company received a $44 million Series C investment in April 2020, just as the pandemic hit.

This boost provided crucial ammunition for navigating turbulence. While many businesses floundered, Country Delight saw a surge in demand for online delivery of fresh dairy and produce.

Health had become paramount, with the upstart well positioned to capitalise.

Focusing on quality, freshness, and convenience, they were perfectly positioned to capitalise on this shift in consumer behaviour.

The milk brand successfully built a business model with trackable data from the farms. It was able to scale this effort during the uncertainties of COVID-19.

It used 17 apps integrating AI and automation to solve supply chain issues and ensure quality. The brand developed an in-house application called 'Nectar' for tracking milk temperature at each stage of its supply chain.

On top of it, the new-age milk brand monitors its processes with loT devices.

It helped the upstart deal efficiently with value-added products with a short shelf-life by ensuring that every deviation got flagged.

In an era of evolving customer needs, Country Delight looked to maintain the quality and efficiency of its products backed by its intensive technology and data while also expanding its product offerings to the entire kitchen essentials and staples segment.

By 2021, the brand will deliver customers fresh milk, fruits, vegetables, bread, and eggs within 24-36 hours. Once the channel of trust was built, it could sell multiple products.

To cover how the supply chain remained resilient even during COVID delivering on time and efficiently, which further won consumer trust

As the company expanded, competition was getting closer across categories and regions

Fighting Big Bulls

India’s dairy market was highly unorganised, primarily due to the perishable nature of the products.

2 major players ruled, Amul and Mother Dairy. The duo controlled over 30% of the dairy segment across all product categories. Technology was missing in the traditional model of delivering milk to consumers.

Country Delight took it up as a challenge.

The competitive landscape includes a large variety of firms. Country Delight competes with brands such as Akshayaklapa, Milkmantra, Milky Mist, and Parag Diary in the core dairy segment.

In broader food and grocery delivery, it competes with other brands and platforms like Otipy. The market size and competition make margin expansion and profitability a complex target.

While these challenges look tough to overcome for any other company, Country Delight is built differently by doing things uniquely.

Country Delight’s brand promise and value proposition is “fundamentally better and natural products”. This is backed up by its lock on distribution that it own end to end, allowing it to deliver timely and fresh products without intermediaries or trade channels. This builds consumer loyalty and trust.

Next, the delivery capabilities that they have built allow them to scale new products faster and price them more competitively since the larger milk business pays for delivery and distribution anyway, uniquely leveraging the tech that they’ve built to run supply chains across 11 states in a very capital-efficient and distribution-efficient manner.

From customer insights, they realised that convenience in customer shopping would allow them to charge a premium for their products. Country Delight remained narrow in its focus to a few cities, targeting the premium segment of the population, and built on a seamless customer experience that allowed them flexibility in ordering, receiving delivery, and scheduling orders.

While Country Delight products are 15-20% higher than their competitors, Country Delight benefitted from this unorthodox strategy through a proprietary supply chain. Through this, they could introduce other grocery items and reduce customers' average turnaround time with other platforms.

As it entered 2022, it had breached an impressive 300 Cr.

Fresh Food Flood

Country Delight emerged as a key player in India's dairy and fresh food essentials sector.

While it started focusing on dairy, it has significantly expanded its reach and product line. The business model emphasises quick delivery, with a fully integrated supply chain ensuring deliveries within 36-48 hours, facilitating a vast scale.

In August 2023, it served over 1.5 million customers in 18 cities across 11 states in India. It made almost 10 Mn monthly deliveries to more than 5 Lakh subscribers across all the cities it operated in

As it entered 2023, Country Delight reported a revenue of Rs 543 crore in FY22.

The same period saw a substantial expense increase, leading to a loss of Rs 186 crore. The cost of procurement was a significant factor, accounting for 49.3% of total spending and reaching Rs 362 crore. Advertisement and promotion costs soared to Rs 125 crore, with employee benefits and contract labour charges rising steeply.

This increase in expenditure reflected the company's aggressive expansion and marketing strategies.

The company's product range now goes beyond milk to include items like ghee, paneer, pulses, oils, yogurt, and healthy smoothies, catering to a broader consumer base.

Country Delight's strategic expansion into various food staples categories such as rice, wheat, pulses, grains, jams, and pickles, as well as health-focused offerings such as probiotic yogurt, lactose free milk highlights its ambition to become a comprehensive D2C food and grocery provider.

As Country Delight gears up for its next journey stage, it’s building a substantial war chest.

It raised a $108 million Series D funding round in May 2022, and a further $20 million in 2024 for a total of a total of $300 million in funding

The next phase of growth is both exciting and challenging.

Delicious Future

Country Delight’s core offering milk segment operates on relatively thin and hard to improve margins

The conventional wisdom is that expanding market share in this segment against established mass-market brands requires strategic investments in marketing and promotions.

The company is continuously evolving, with new product launches and category evaluation as a key area of focus.

Looking towards the future, Country Delight plans to diversify its product offerings further, exploring options in sustainable packaging and plant-based, health-focused alternatives. This aligns with global trends towards environmental sustainability and health consciousness.

Strategic partnerships, particularly in the health and wellness sector, are in the pipeline, aiming to provide personalised nutrition solutions. The company's foray into kitchen essentials like pulses, cookies, oils, and wheat flour is set to broaden its market reach.

Today, roughly 40% of the business comes from non-milk product revenue, which Country Delight aims to grow to 60-70% over the next few years. This will happen if the company keeps increasing the number of households transacting.

It also plans to reach a 10-15% market share over the next three years across markets in North India.

Country Delight aims to continue improving product quality in the supply chain and further engage with its network of farmers.

All of these initiatives end up with a flywheel effect.

The more milk Country Delight sells, the more subscriptions it manages to get, the more it gets customers to engage with the rest of its SKUs and offerings, and since it has the distribution infrastructure to get it to them quickly and fresh at a competitive price, it creates a virtuous flywheel effect for rapid growth.

Country Delight claims to have crossed the Rs 1,000 crore revenue mark in FY23 and is targeting profitability by FY24.

With its plans to go public by FY25, along with a lofty target of one million paying subscribers across India, Country Delight is positioning itself for long-term growth and market dominance, with the ambition to be a vertically integrated D2H private label company and expanding into all categories of food essentials.

Country Delight could delight customers, investors and team members if it executes as advertised.

Knocking on the doors of being a unicorn, it is a fresh story that shows you can build a massive business in India despite intense competition. The upstart will necessarily inspire many new founders to start fresh.

All you need is a dream, an Excel model and a few cows.

Writing: Keshav, Abhinay, Chandra, Samarth, Vishal and Aviral Design: Abhinav, Blair and Omkar