Jun 28, 2020

Is EdTech India’s Next Global Export?

Education

Platform

Aggregator

Series H+

Series E-G

B2C

B2B

Technology

Last fortnight, BYJUs raised to push its valuation above $10Bn, while also being close to acquiring Doubtnut, capping a heady few months for EdTech accelerated by a lockdown.

Building High Hopes

To fully understand how integral education has been to India’s history, you would perhaps need to go back to Nalanda in 5 CE.

In the spirit of keeping this read digestible, we start our journey in 1991, at the onset of Indian liberalisation.

After building a stockpile of debt from the IMF in the 80s, the 90s saw a wave of deregulation with the aim of reducing fiscal deficit from 8% to 4% as a % of GDP. The New Economic Strategy put the impetus on the private sector to build in India and drive the country forward into the new century.

In 1991, Narasimha Rao injected market-friendly reforms into the country, successfully spurring economic growth from the low single digits to 7.5% from 1994 to 1997.

At the same time, India’s population growth and relative underinvestment in education was becoming apparent. In 2000-01 relative to 1990-91, the number of Indian colleges as well as the enrollment in those institutions doubled.

But rather than a push towards education from the people, this was more so driven by the pull of a growing movement towards formalised jobs. The ‘Indian Dream’ was no longer limited to the youth following in the footsteps of the previous generation and being restricted to what they were familiar with.

The Indian IT industry was going through a renaissance led by TCS, and the demand for educated individuals was growing at a rate never seen before.

Educational hubs started to expand around the country in cities like Delhi and Mumbai, leading to a consolidation in the areas where companies could hire top talent.

Due to all this, the return on education increased for the average Indian. The premium for education was almost 50% towards the late 90s.

Liberalization accelerated a major shift towards education and literacy. The 90s added as many as 300MM literate people, more than that of the previous two decades combined.

As lower skilled jobs continued to stagnate in terms of income growth, more and more of the share in the growth of the Indian economy was captured by those with a formalised education.

With technology continuously developing, automation and increased sophistication of relatively ‘menial’ tasks led to an increase in educational requirements for the same role. Standardised testing, and thereby the need for preparation with those tests, continued to grow.

Institutions like IIT and IIM gave aspiring college graduates a north star to work towards, with the promise of lucrative jobs at the end of the line.

India was growing, and so was its hunger for education.

We Don’t Need No Education

Despite the boom in Indian education and economic growth in the late 90s / early 00s, the average Indian was not ready for EdTech.

Even in 2005, less than 5% of the country had access to the internet, so the prospect of creating a solution for the Indian consumer just didn’t make sense.

However, the mid 2000s did see the start of Indian EdTech. Ironically enough, the first Indian EdTech companies were actually building for the rest of the world.

It was 2005, and K Ganesh from Bangalore had an idea to create a platform that lowered the cost for American students who couldn’t afford local tutoring help (often over $40/hr), but still had a need for quality personalised help with their schoolwork.

TutorVista was born.

Mr. Ganesh played around with multiple business models and landed on an all-you-can-eat model for $100/year, with unlimited access to tutors on the platform for a variety of subjects.

He raised seed money to fund his venture and went about hiring tutors across India. The journey was not an easy one. Finding quality tutors who would be willing to work within time zone limitations and purely via the internet was hard.

But Mr. Ganesh persisted and built the platform to a point where they were recording over 6 million monthly visitors.

Over time, they would acquire Edurite to expand into the Indian market, build relationships with school owners where TutorVista would manage the day-to-day operations, and eventually enter the test-prep market through a partnership with UK based Pearson.

At around the same time, another technically led education company EduComp would start. Its rapid growth in 2005 would result in an IPO. The company would end up selling smart classes globally, with 1000s of crores of reported revenue.

TutorVista and EduComp would sow the seeds that today’s Indian EdTech behemoths are reaping the benefits from.

By the end of the decade, the roads for the two would soon start to diverge rapidly.

Uncomfortably Numb

In 2011, Pearson would acquire TutorVista, while EduComp would start seeing its revenue collapse.

The stories of the two pioneers were not played out yet, but they had identified a bigger story, and a bigger problem.

Education needed fixing.

In the Indian context the two challenges faced by education were ‘access’ and ‘quality’. Every year 200MM students enrol in the K12 segment and around 10MM students prepare for competitive exams.

While this created a potential demand for educational institutes, the supply of good quality resources lagged far behind.

Education costs had been rising without a corresponding and uniform increase in quality.

Within the existing institutions, emphasis was often placed on test scores at the expense of developing critical thinking and basic soft skills. Further, uncompetitive teacher wages had resulted in a dearth of qualified teachers and student-teacher ratios as high as 1:35, as opposed to 1:14 in the developed world.

Not only was the market concentrated in Tier 1 and few tier 2 cities, these institutions charged exorbitant fees.

If education was not accessible, inequality would never go away.

To solve accessibility, the Government had been spending significant money on education which led to programs like Operation Blackboard, the Mid-Day Meal programme, and Sarva Siksha Abhiyan.

While the Government had been making efforts to improve the ‘access’ to education, technology had not been a sufficient component of these efforts.

EdTech was thus unable to unleash its potential as a lever in improving efficiency and delivering value at scale.

This was the time when a teacher for the CAT was burgeoning his reputation, teaching in stadia and large classes.

Raveendran Byju started off with teaching a few aspirants but by 2012 the number quickly grew to 1000 students. By that time he had been travelling to different cities to conduct classes and soon realised that the current approach significantly limited his capacity to scale.

As the thought of creating online content to scale himself was sown, there was another sector that was showing how to really scale.

The Dark Side of the Internet Moon

During the next few years India saw an unprecedented growth in its e-commerce sector.

The growth shown by homegrown players such as Flipkart and Snapdeal displayed immense market potential. With the entry of foreign players like Alibaba and Amazon, the competition in the sector pushed to innovate and optimise constantly.

By 2014, the sector had grown by 34% each year to touch 16.4Bn USD. Increasing internet penetration was one of the leading factors behind Indian retail sector leapfrogging to digital.

In order to ride on the growth in digital adoption in the country, traditional coaching players like FIITJEE and Aakash Institute also began experimenting with online classes. A successful online intervention would give them access to additional Tier 3 and Tier 4 students.

To their surprise, Indians were ready to buy retail items online but they still preferred getting educated the old fashioned way.

The failure of online education had multiple trends and challenges at play.

The underserved population in Tier 3 and lower cities still did not have access to digital channels to avail online classes. In order to replace the current brick and mortar institutes, edtech companies also needed to improve their online content significantly.

It simply wasn’t going to be solved by just moving education “online”.

Trust and credibility were the most critical factors to solve here. While a bad purchase from an e-commerce site could disappoint you for a day, a bad teacher could potentially affect a child’s future.

The stakes were truly high.

Another limitation of simply migrating to online platforms was the lack of personalization.

While the success of an e-commerce website lay in the high level of standardisation it can achieve, education lay on the other extreme end of the standardisation spectrum.

There is no one-size-fits-all formula here which can define a student's learning prowess. It is the continued interaction and feedback cycle between a student and the teacher which forms the foundation of a child’s growth and development.

Teachers, who acted as the gatekeepers of education-related decisions and awareness for parents were being bypassed on digital platforms.

The essential ‘human element’ of interacting with a teacher or peers leading to the development of interpersonal skills was missing. With repercussions of a wrong decision being so high, consumers were not ready to shift to the digital platforms yet.

EdTech remained in the shadows of the glow of e-commerce for the early 2010s.

Coming Back to Life

The lukewarm response to online classes was a warning for the next edtech founder.

The solutions in the Indian market demanded higher sophistication. The challenge included finding a viable business model catering to a multitude of stakeholders.

With these learnings in mind next generation edtech startups were launched. Each of these startups were tackling specific problems in education in their own different way.

Vedantu (tutoring), Toppr (learning) and Unacademy (video lessons) focused on K12 and the competitive exam preparation segment. Simplilearn (certifications), Upgrad (upskilling), InterviewBit (interviews) would focus on the “post” K-12 end of the spectrum.

The biggest player, Byju’s, had been in stealth for 4 years while it had been developing its core B2C learning product for K12 and competitive exam preparation.

"Before I was a Unicorn"

The founders of these companies looked at solving the systemic issues that had been apparent for years.

The belief was that the education system had promoted memory based learning driven by fear of exams as opposed to promoting inquisitiveness. The value proposition of new business models lay in tackling these problems by engaging highly trained teachers and curating effective online content.

These startups were also looking to replicate necessary schooling elements like personalized service, feedback and counselling as part of their product offerings.

With a high degree of overlap in the primary education curriculum across countries, many K12 content platforms were creating world class content.

EdTech startups had finally started to take off.

But even with such rapid innovation, edtech was still finding it difficult to truly scale like its ecommerce peers.

Internet penetration and access would be critical to take these offerings beyond metros and tier I cities, which already had much better access. Quality could be solved if someone built the pipes for accessing the country.

That someone had already been planning to do so for years.

Learning to Fly

2016 was the demonetization moment not only for fintech, but also edtech.

Instead of the giant organization known as the government, it was enabled by a giant organization executing a pivot into a big tech company.

That company was Reliance, of course.

The Jiofication which led to a massive surge in data use gave a booster shot to edtech by finally solving the access problem.

With 850M mobile phone user’s majority of which were youngsters, India was ready to make mobiles the classrooms of tomorrow. Online education was made easier and convenient than ever before.

But moving to learn online was a massive behavioral shift and efforts had to be expended to make the market ready to adjust to such a shift. Startups realized the inherent challenges associated with online learning.

Driving engagement through gamification, personalized learning, peer learning and outcome measurement became the factors for competitive differentiation.

The share of video consumption to total internet traffic was expected to rise from 58% in 2017 to 77% in 2022. Educational content would be the biggest beneficiary beside online entertainment

With access solved, the next big problem edtech had to solve would be the dearth of faculty, or the “quality” problem.

Over 40% of teaching positions in schools and colleges remained vacant with an even bigger issue being the quality of faculty. Falling data costs with rising smartphone penetration meant that students who were committed and yearned to learn could now do so.

The constraints of geography, poor quality teachers or lack of mentors which restricted the academic potential of students in Tier 3,4 markets were slowly dismantling.

The core reason for this rapid adoption was none other than aspiration to be as good as the best, which had become the hook for education 20 years ago.

Various competitive entrance test platforms (Byju’s, Vedantu, Toppr) began to penetrate deeper into these markets while specific platforms focused on Govt. job entrance prep (Testbook, OnlineTyari) began to be birthed.

As workplaces and job markets also began to demand new and rapidly evolving skill sets, various models emerged to support the transition from schools to college to jobs.

The offline traditional education system which remained slow to innovate was being reimagined.

Not Another Brick in the Wall

India’s huge $100Bn education market now had the right conditions for technology to enter.

The massive market allowed the proliferation of all kinds of players. From companies such as BYJU’s which produce their own content by hiring people on their payroll, to companies like Unacademy which onboard star teachers and helps them create content, to players like XSEED that enable classes to run their own setups, India now had the depth to support its proverbial breadth.

Global players like Udemy, Coursera & Khan Academy making their presence felt in India, although with a very niche audience.

By 2018, over 4500 EdTech startups were launched in India. Each startup could be looked at by its delivery model (infra, platform or content) and its customer focus (K12, competitive, higher education or upskilling)

The overall K12 education market would be the largest, pegged at ~ $46Bn. This was served directly by the traditional players — schools (government, private, etc.). The online test prep (competitive, entrance exam) market would be the most lucrative segment after the much spread out K12 segment.

A key selling point for a lot of EdTech players to break into these markets would be the low cost of content delivery.

Once the content has been created, the cost to deliver that content to students even in the remotest corners of the country with reliable internet connectivity would be low.

This lower cost of delivery further helped them in balancing the LTV/CAC equation. The LTV for a player in the K12 segment ranges from INR 20K to INR 90K ($300 to $1,100), justifying a fairly high CAC.

Many smaller players would also utilise YouTube to create, upload and share their educational content and monetise via ads. The ARPUs in such cases remained low but would be a pathway to deeper engagement and higher revenues down the line.

The real filip provided to these edtech companies would be provided by India’s growth in spending on education.

India would be the fastest growing education market in the world, beating even China. From a base of $20Bn in 2000, it had surged to $70Bn by 2018, with huge headroom for growth.

A massive market, access enabled, with talented entrepreneurs building was ready to explode.

Shine On, You Crazy Diamonds

An incredible variety of startups began to raise capital as 2019 began.

Parents were consciously realizing the need for activity based learning (Flintobox, Magic Crate), of making kids creators than consumers (White Hat Junior, Camp K12) and driving a community model which emphasizes holistic than rote exam driven learning (Openhouse).

The nodes between education to jobs would also be strengthened with pay after placement models which aimed to fill the knowledge gap and make students skills industry relevant (Pesto Tech, Interview Bit, AltCampus)

From K-12 and test prep, the entire industry spectrum would see interesting models emerging in skilling, LMS, employment & continuous learning and pre-school.

The shift would drive schools and colleges to outsource core services (Edunext, Genius Education Management), move classes to the cloud (Simplilearn), come online (ClassPlus, MegaExams) or create labs to drive next-gen immersive learning (Veative Labs).

The regulatory and Govt. support will also drive inclusivity through Digital Literacy Program and initiatives like Swayam and Sankalp. The introduction of 12 new TV channels to increase reach of educational content to Tier 3,4 markets will unlock a new market who will become comfortable with e-learning.

As EdTech startups proliferated, BYJUs would become the flag bearer for EdTech in India.

The company would raise more than $1Bn from late 2018 to early 2020. It would become the world’s most valuable edtech startup, crossing a $5Bn valuation in 2019, and claim profitability.

The old horse TutorVista would be subsumed into BYJUs, while the old dog EduComp would go bust, completing an arc for the future of EdTech.

By 2020, EdTech was on fire.

EdTech would begin to see unexpected tailwinds as the world would be locked inside their homes with little to do.

EdTech players rushed to capitalise on their second ‘demonetisation’ moment and made their offering free, ironically demonetizing themselves. This move helped them acquire customers by the millions at an extremely low cost.

The online learning shift which would have taken 4-5 years had been accelerated forward by years. Teachers and students who had never taught or learnt online were forced to.

This only accelerated the move towards learning online, and forced teachers to adopt digital tools to communicate better with their students. It broke student/teacher barriers in unexpected ways, with incredible stories of teachers going above and beyond to teach.

This transformation not only forced a lot of ‘traditional’ players to adopt online solutions which they had been extremely reluctant about, it also showcased the importance of physical presence when it came to learning.

Teaching is hyperlocal, relationship based, and can’t be scaled. It is a lesson to be learnt for edtech companies that look to go increasingly global.

The Indian edtech upstarts have all the ingredients to do so.

Wish You Were There

If the 2010s were e-commerce’s decade, the 2020s could be edtech’s.

As we look at the last two decades of EdTech in India and compare it to e-commerce, it looks like the classic hare and tortoise story.

Edtech was slowly and patiently being built to cater to an evergreen market while e-commerce was being built on a heavy cashback fueled model where growth was rapid but unsustainable.

The journey of edtech has been a coming of age story starting with the meteoric rise and eventual fall of Educomp.

EdTech has truly democratized and levelled the playing field. From Gupta ji asking ki ‘Bittu ke board mai kitne number aaye’ to ‘Bittu ne aaj kaunsa naya app banaya’ we head into an exciting decade where knowledge and curiosity will triumph everything.

And the change will be driven not just in India.

While we do not expect teaching students in classrooms to go away because of the inherently personal nature of teaching, there will be fundamental changes in distribution of education.

India could become the center of global edtech, writing a bigger story than e-commerce, in a way last seen in the IT boom of the 90s that made education so lucrative.

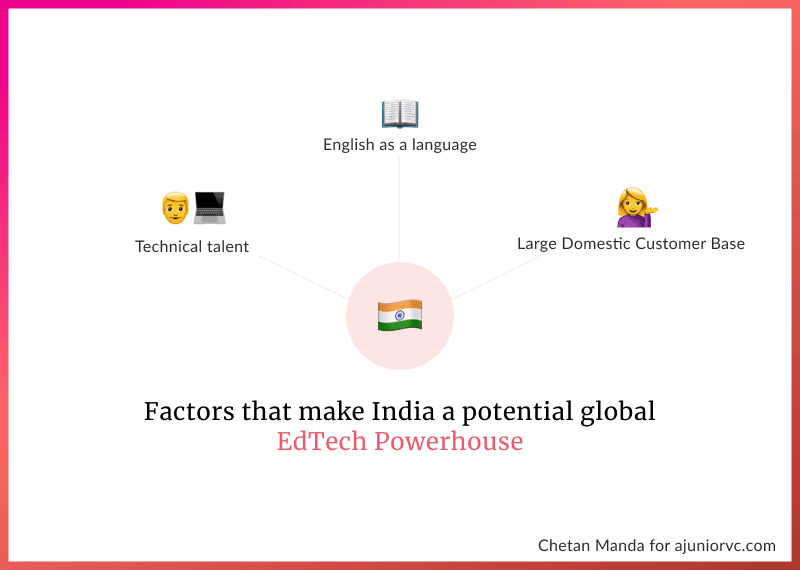

If we unpeel the layers and look at our extremely favorable talent pool, the largest English speaking base and one of the largest domestic markets to test products, India can serve Edtech to the world.

Unsurprisingly, these factors made India a terrific provider of services in the 90s.

The export of India’s latent but extremely potent talent is already happening to Silicon Valley with the likes of Pesto Tech, Byjus is replicating its successful model to US, UK and Australia while White Hat Junior is beta rolling its program in Singapore.

All these trends are early shoots of what is to come. After spending years building and tinkering from the sidelines, India’s edtech story is well placed to go global.

Decades in the making, EdTech could be India’s next global export.

Written by: Aviral, Chetan, Keshav, Mazin, Rohan, Shiraz

Audio Version: Behind the Scenes with AJVC

On request from the community for an audio version, we have done a behind the scenes format with the writers and host Mazin