Feb 5, 2023

Can HealthifyMe Transform Health from India to the World?

Profile

Fitness

Healthcare

Platform

B2C

Series B-D

Last fortnight, HealthifyMe released its campaign with Mandira Bedi, hot on the heels of its campaigns with Farhan Akhtar and Sara Ali Khan, as it doubled down on celebrity marketing

Takes Guts to Start a Business

A small experiment can lead to a life-changing insight.

Tushar Vashisht, an Ivy League alumnus, and a Wall Street banker decided to come back to India to work with Nandan Nilekani on the UID project.

During his stint at the UID project, an interesting group of professionals and entrepreneurs inspired Tushar to take up the path of entrepreneurship.

He and his roommate, Matthew Cherian, started having conversations about the issues around them and the type of venture they would like to create.

AJVC Behind the scenes: 10 min video summary of the story

Not only did they want to build a business that makes money, but also it has to have a second bottom line of social impact.

Health and education were two sectors that could fit well into their definition.

They were curious to learn more about India and how poverty can impact an individual's health. They devised an experiment by subsisting for a month on what the average Indian does - just 100 rupees ($2.04) a day.

The maths was simple.Rs 4500 (per capita income) was the total, where they kept one-third for the rent and the rest for food and other necessities.

They started collating and sharing the findings in a blog and applying basic analytics. They did a further experiment when they tried a similar experiment but this time just for Rs 32!

These experiments not only led to significant weight loss for Tushar and Matthew, they also gave them deep insights into health and nutrition.

One critical insight was the excel sheet that they created to document the nutritional value of Indian food was something that did not exist, and everyone they met asked for a copy of it.

User demand followed their experiment, and a new idea was brewing.

Healthify was born in 2012 as an effective and easy-to-use tracking tool for nutrition, focused on India.

Passing the Large Market Test

Around 2012, diet and fitness-related diseases were growing to epidemic proportions.

There were 60 million diabetics and over 150 million hypertensive people in India. Most of the problem came from a lack of awareness of what people were eating and how much energy they burned daily.

Healthify tried to solve this problem by providing ways to measure calories intake to calories burnt. As one measures these aspects of their lifestyle, they become more aware of what is good for them and what is not.

To make this a habit, a tougher problem in the health & fitness industry, the solution has to be easy and relatable to the audience it caters to. That’s why portions of food intake on Healthify were in katoris, which is an easier way to measure the food intake for most Indians.

It also has the largest catalogue of Indian food from Puris to Rasgulla, which mades it easier to log the calorie intake with just a click.

On top of these tracking activities, Healthify helped its users by assisting with diet and fitness plans through a network of trained coaches and experts.

Healthify started as a website or a blog in 2012, and by 2013 they launched their android app and an iOS app shortly afterwards.

It was a slow, but sure start. Like many startup journeys, a blog became a website, which became an app.

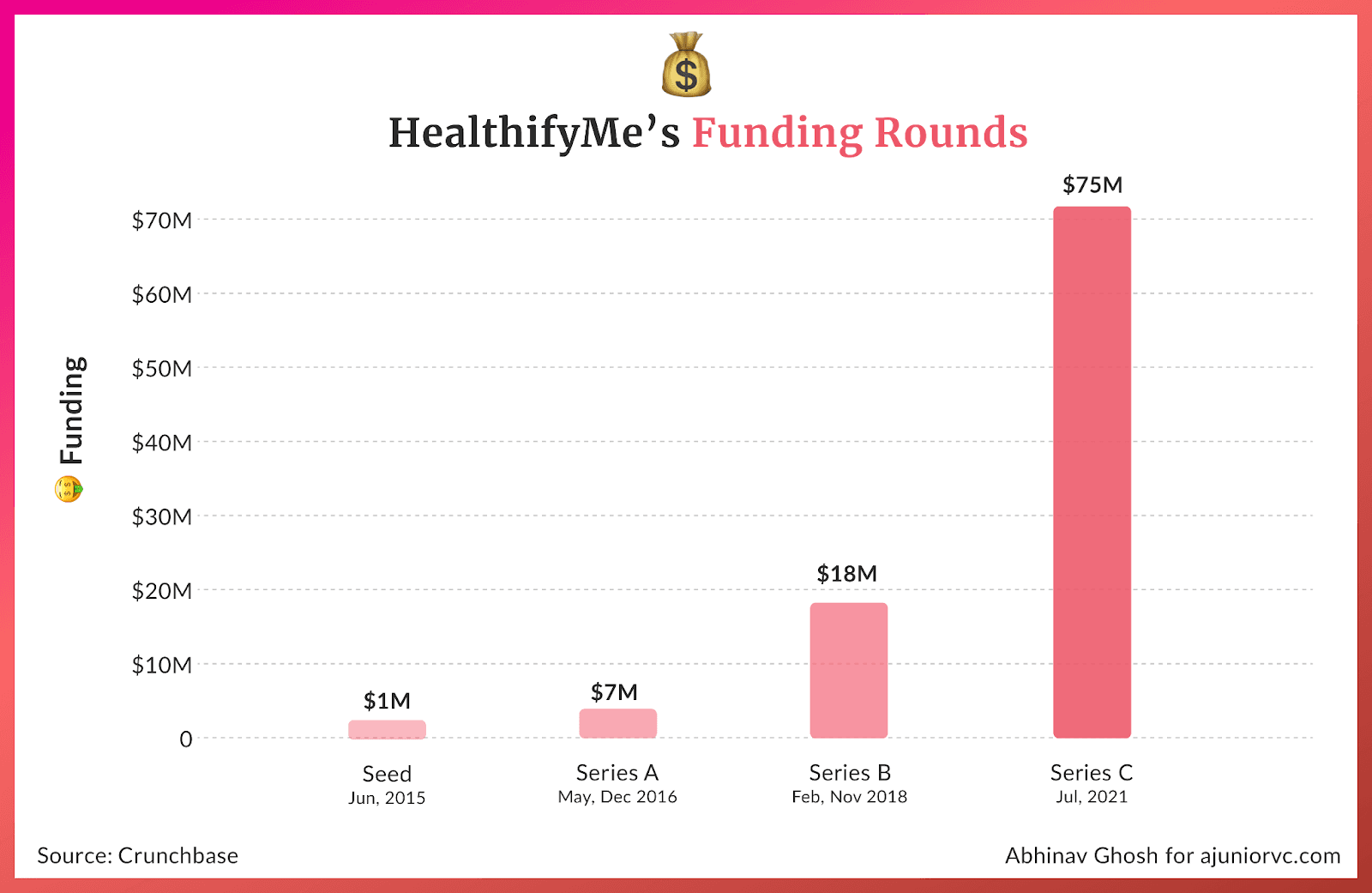

By 2014 it had around 1,00,000 users, and it closed its angel round of $1 million.

Healthy Growth

The traction and purpose were interesting to get attention from renowned names as they would like to partner and make India healthier.

With a core team of 16 members and a team of 30 nutritionists, Healthify launched a campaign- HealthifyIndia or ‘SwasthBharat’.

This was a campaign where Healthify partnered with Godrej Nature’s Basket, Manipal Hospitals, Medanta - The Medicity and other large health networks.

As part of this campaign, partners offered Rs 100 crore in products and services to anyone who takes their pledge on the Healthify app. Once users took the pledge, they got Rs. 1,000 worth of products and services from the industry partners to achieve that pledge.

This led to a significant jump in userbase for Healthify, and its userbase crossed 5,00,000 by end of 2015. In 1 year, it had grown 5x, seeing exceptional growth.

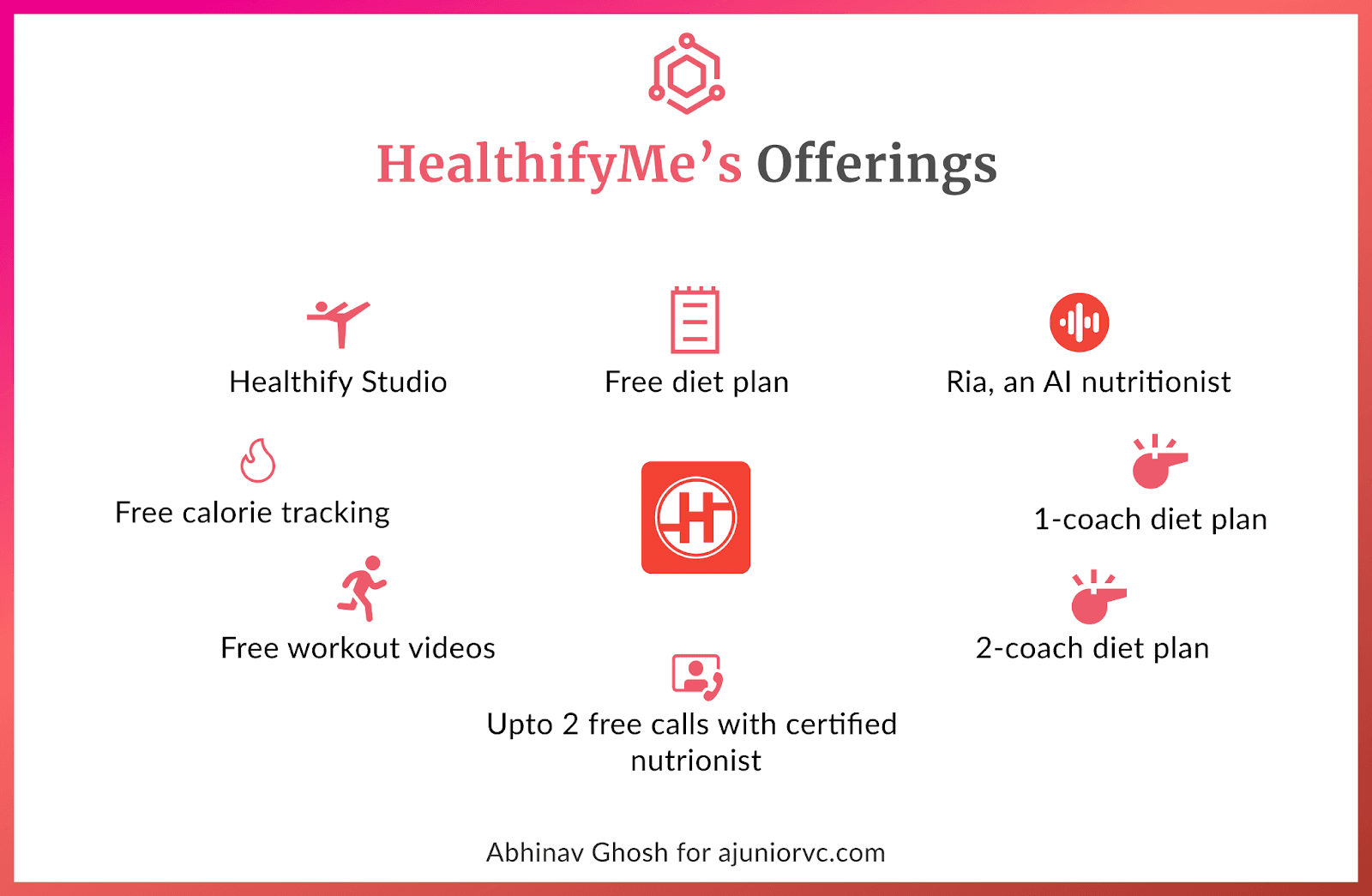

By now, it had experimented and finetuned its freemium model. Basic tracking features were free on the app and coaching or customised plans were available by paying a monthly subscription fee.

With good traction and a sound business model, Healthify got a healthy valuation and closed its $ 6M Series A round in early 2016.

They were attacking a large, hard problem that many wanted to crack

Root of the Indian Problem

HealthifyMe was positioned as a health and fitness app focused on weight loss, which made for a large business opportunity.

The wellness industry in India was valued at $6BN, dominated by weight loss and beauty treatment services. There were 4.8 million fitness seekers across Mumbai, Delhi and Bengaluru.

As India grew and her GDP/capita increased, the incidence of lifestyle diseases was expected to increase in line with what has been observed across markets globally.

We were already guilty of several poor habits as a populace. These included – irregular meal times, lack of exercise, and nutrition. India is home to over 77MM diabetics, 200MM patients suffering from hypertension, and 245MM overweight people.

We were witness to a growing demand for nutritionists and other healthcare professionals, these professionals had historically faced a tough time connecting with customers. On the other side, customers who wish to connect with healthcare professionals don't have an easily accessible platform. A growing problem needed urgent solving, and HealthifyMe believed they had the right tools.

In 2016 the company also breached a significant milestone with the launch of ‘Jarvis’, an AI tool to assist coaches in becoming more efficient by learning from their interactions with clients.

Jarvis was critical in helping their coaches become efficient as it allowed each coach to manage more paying users, thus eventually helping unit economics.

By 2017, the app was witnessing scale. In the first quarter of that year, the company breached 2 million downloads. The product seemed to be working.

Later that year, the company announced the launch of what they claimed was the world’s first-ever conversational Artificial Intelligence (AI)-enabled nutritionist – Ria. Before ChatGPT, HealthifyMe was having conversations with its customers.

Ria used key learnings obtained from HealthifyMe’s 150 million tracked meals (20 billion+ macro/micronutrients) and 10 million message exchanges (1 billion+ word) between coaches and clients to answer questions relating to nutrition and fitness via both audio and text.

But it did so at a much more personalised level based on the users’ lifestyle habits, and was available in 10 languages.

Ria was the logical successor to Jarvis, from assisting coaches to become more efficient, Ria was now replacing coaches. Ria began contributing a significant share of messages directly to users.

No AI Effort Goes in Vein

The launch of Ria was met with significant optimism.

Initial data was promising, Ria was handling around 80% of all queries directly instead of passing them on to humans. Ria’s ability to look at each user’s data daily and give opinions was working. Users were sending human coaches 2.5 messages a day on average, that number increased to 2.9 with Ria.

HealthifyMe intended to spin off Ria as a standalone service once its algorithm got stronger and more accurate. The service was bundled with its broader subscription program, which included a human coach.

Whenever Ria failed a human took over.

In a world where other funded weight loss apps were struggling HealthifyMe was showing signs of breaking out. Apps like Truweight and Obino had 50,000 and 500,000 downloads, respectively. By the end of 2017, HealthifyMe had 3MM users and 200 coaches and was confident that they would touch 5MM users in 2018 on the back of the growth from Ria.

Despite the growth in users and adoption monetization and unit, economics remained unproven. In FY17, the company reported INR 4 Cr. in revenue.

This was about to change dramatically as the company had scaled downloads impressively. In 2017, a subscription could cost anywhere from INR 999 to 1,699 / month.

While these numbers may not seem large in absolute terms, they added up over time. A user could pay as much as INR 8,000 for a 6-month subscription. This was necessary as the cost of running the program was high due to the involvement of human coaches.

This is where Ria was viewed as the silver bullet as it could help drive down costs, thus allowing the company to make their programs cheaper while ensuring they can retain decent contribution margins.

The other challenge the app had was the customer acquisition cost. Assuming a cost per download of INR 50 and based on a conversion rate of 1-2% as highlighted by Tushar in his interviews then, HealthifyMe was paying as much as INR 5,000 for an activated user. This meant that recovering their cost of customer acquisition would not be possible if they didn’t expand margins and ensure high retention.

The company closed FY18 with INR 24 Cr. in revenue and reported a loss of INR 28 Cr. up from INR 23 Cr despite the 6x increase in revenue YoY the year prior. At the same time, the monetization engine had kicked off, unit economics quite clearly remained challenged.

As 2017 drew to a close, the monetization engine started chugging along which resulted in the Series B round of $12MM NEXT was Samsung’s AI-focused fund, and HealthifyMe represented their first-ever investment in India.

In early 2018 the company had crossed a million MAUs and 4 million lifetime users.

The company had scaled to over 5 million users, and nearly 20% of them came from international geographies such as MENA, SEA, LATAM.

Customers Don’t Swallow Bitter Pills

The company sustained its growth over the next couple of years.

It grew revenue to INR 44 Cr. and then INR 55 Cr. in FY 19 and 20 as against losses of INR 34 Cr. and INR 37 Cr. each in those years.

Realising that their trainer packages were too costly and hence unscalable, HealthifyMe introduced “Smart Plans” in 2019.

These were preset diet plans customised according to age, weight, fitness goals, and pre-medical conditions. The Smart Plans cost INR 299 / month, a lot cheaper than a premium subscription. This contributed to 70% of the company’s paid subscriber base.

At the company’s 6th annual tech product conference in Feb 2020, the company also had a slew of new product features, including Smart Plans with fitness celebrities, partnerships with the food delivery and gym apps, and a foray into mental wellness as part of its ambitious growth plans for 2020.

The company roped in n Mahesh Bhupathi as a strategic advisor for building its new Smart Plan ‘HealthifySmart Legends Edition.

The company also launched strategic partnerships with food and grocery delivery apps like Swiggy and MilkBasket to deliver healthy food and groceries curated by HealthifyMe.

By Feb 2020, the company had breached INR 100 Cr. ARR mark.

While the new launches successfully expanded the top of the funnel, many users dropped off even before the sign-up process was complete. They found it tedious to fill out answers for the questions the app asked to suggest a personalised diet plan.

Changing customer behaviour is always hard, no matter what.

Companies across the board have sunk hundreds of millions of dollars to change behaviour. Thus, even after the users signed up, HealthifyMe was fighting an uphill battle, and it was evident in the drop off of users the app noticed at various stages, evidenced by the MAU / Download ratio.

But a storm was coming that would end up exploding engagement. COVID was a massive boost for the company.

In May 2020 the app saw a 50% growth in organic sign-ups and retention compared to the January-March quarter. May also saw the company achieve its highest lifetime revenue of US$1 million.

Seeing the increased traction, the company decided to pull the trigger on - HealthifyStudio. It was launched to add to the momentum the app had gained ever since the pandemic struck. COVID shuttered gyms, but that didn’t hinder fitness enthusiasts.

Some took to eating healthier, others to jogging, and many went online—straight into the arms of platforms like HealthifyMe. HealthifyStudio was a platform offering live group workout sessions to bank on its burgeoning user base during the lockdown.

At the time of the launch of HealthfyStudio, the app had 17MM users, out of which 1.8MM were MAUs.

But it wasn’t the only one benefitting from COVID’s tailwinds

Everyone Gets Pandemic Boosters

As COVID hit the world, health and fitness focussed startups blew up, competing with Healthifyme

Customers had many choices to stay healthy as new players entered the segment. A few key themes emerged.

The most prominent involved attending online workouts of coaches and celebrities. This was localised. Indian players competed amongst themselves.

Cure.Fit raised $400M on this theme. It combined coaching, diet and mental wellness following a subscription revenue model. Sarva Yoga raised $10M to build a Yoga dedicated platform. Mindhouse was started by Zomato co-founders for wellness, raising $10M.

Another big theme was monitoring calories and receiving expert-led personalised coaching.

HealthifyMe emerged as the frontrunner in India by providing India-specific features. But calorie management needs to be localised and can have global competition.

MyFitnessPal dominates the US market. It exclusively runs calorie databases with 300K food items. A large portion is user generated. MyFitnessPal was a massive outcome for its founders when Under Armour bought it for $475M. But the app was later sold to a PE firm at a loss of $345M, showing how tough the space was even for a leader.

In the same area was Noom - a giant that raised $700M, with profitability in control. Their main value prop is long-lasting change instead of reliance on a quick fad diet. Noom offers shorter realistic timelines to hit goal weights. This makes it more appealing for those trying to lose weight for a specific event.

All these health apps were focused on improving user outcomes, but many of them struggled with monetisation. The reason is that improving health is good to have and not a must-have for most.

When a solution is not a burning problem for the customer, making money is always a challenge for the business. The business creates value by remaining free but captures very little through monetisation.

HealthifyMe’s usage rocketed in early 2021, but its path to being a money-making business was still being discovered.

Eyeing Global Dominance

HealthifyMe crossed 25 million downloads in 2021, triggered by the pandemic as the digital health industry gained momentum.

While achieving a $25M ARR, HealthifyMe raised a series C of $75 M. With $100 M in total funding. HealthifyMe could double down on global markets.

Integrating AI early on, HealthifyMe replicated a similar model of entry of calorie tracking in Singapore, Malaysia, and North America.

Fifty local health coaches were consulted to understand dietary preferences and calorific values of local foods. Veteran researchers like Sridhar Narayan, a Stanford Graduate School of Business professor, studied the user-generated data.

The top 10% lost more than 20 pounds, validating the accuracy of the program. Following this success, the HealthifyMe health management portfolio expanded

HealthifySmart Legends Edition. It introduced veteran tennis player Mahesh Bhupathi by organising AMA sessions on their diet and fitness plan through Ria. HealthifyStudio launched after the first wave of the pandemic to offer group workout sessions.

Fitpicks launched in collaboration with Swiggy which picked up 12 million users ordering from 700 Swiggy-partnered restaurants curated by HealthifyMe experts. Chronic disease management systems were also introduced for diseases like diabetes. HealthifySense augmented its mental wellness segment to make counsellors and psychologists accessible.

All these expansionary plans and product launches expanded HealthifyMe's revenue twofold during FY2022, hitting INR 185.25 Cr.

In January 2022, it crossed the $50 M revenue run rate aiming to cross $500 M revenue by 2025. With a potential IPO by 2024, HealthifyMe targeted a complete AI-enabled and personalised health and wellness platform for emerging digital health markets.

That year also saw a breakthrough release of CGM (continuous glucose monitor) sensors and body monitors to understand and improve the body's metabolic health.

In May 2022, the upstart launched the HealthifyPro plan. HealthifyMe coaches and Ria would deliver personalised diet plans and choices using health data collected from BIOS, companion sensors, and body monitors.

The data collected via Bluetooth from HealthifyMe's Smart Scale would inculcate personalisation through factors like weight, fat percentage, and muscle mass. It helped take a larger step towards making the company “future-ready”.

It kept making further strides into North America, with a fourth of its revenue coming from countries outside India within APAC in 2022.

The company evolved into an entire health ecosystem starting from a calorie counter. It reached the esoteric $100M revenue rate, a rare feat for the health ecosystem.

It was staring at a healthy future. But it needed to lose weight to fly

Bleeding Money to Win?

While HealthifyMe was targeting an ambitious plan of clocking $200M of ARR, it also took the brunt of the ongoing funding winter and macroeconomic conditions.

In late 2022, it announced a layoff of 15-20% of its workforce across non-operational roles to stimulate profitability. In the ongoing funding winter, the company's losses were reported at INR 157 Cr. This figure was a 10x jump from INR 19 Cr in 2021.

The major cost of INR 133 Cr was from advertisements and promotions expenses. HealthifyMe burnt INR 1.85 to earn a single unit. Its healthcare consultants got 80 Cr out of 116 Cr coaching revenue, 70% instead of 50% the prior year. This was likely done to attract more coaches.

It grew from 25M to 30M users in FY22, on a marketing spend of 133Cr. That is a customer acquisition cost (CAC) of ~266 INR or ~$4. It hit 25M users and reached a revenue run rate of $100M. It makes $4/user

With 40% revenue back to coaches, it is ~$2.5 in gross margin, needing to recover $4. 18 months of payback would have this make sense.

It wasn’t extremely healthy.

The reason was evident, as HealthifyMe got stuck in a strange conundrum of being useful but not valuable. Most users heavily used the app, but did not see merit in paying for it.

Adding hardware like the glucose monitor and smart scale is a method of capturing more value. Users are willing to pay for monitoring. They believe they can improve themselves for free, so coaches tend not to be taken up.

The company was operating in a $5Tn global health and wellness market. It would be best if you were a painkiller, but HealthifyMe was a vitamin.

Its expansion into global markets was driven by trying to become a painkiller. The first rationale was getting customers who valued their health, which was more likely in western markets. The second was getting a higher average revenue per user.

The heavy losses can be explained only if the company expects customers acquired to be retained.

The ability of the company to advertise with celebrities is a plus, implying that it has economic means. It has been around for a decade, with controlled execution trying to win. These are positive indicators in a category that has been excellent for users but a bloodbath for businesses.

The hard way to make money here is finding those customers who want to improve their outcomes but lack motivation. The top health performers don’t need HealthifyMe, the bottom health performers will churn out because they don’t care.

It is the large middle that can be monetized using the ecosystem.

The ecosystem play will allow HealthifyMe to capture more customer value while also being able to scale its user base significantly. Its goal of building health from India to the world is aspirational because it is rare for a consumer product to be exported from India.

If it can improve its economy, HealthifyMe could be a force to reckon with, taking health from India to the world.

Writing: Abhinay, Ajeet, Anisha, Bhoomika, Varun and Aviral Design: Abhinav and Saumya