Aug 22, 2021

Is this India's Crypto Moment?

Cryptocurrency

Finance

Platform

Aggregator

B2C

Series E-G

Last fortnight, CoinDCX became a unicorn, putting Indian crypto firmly back into the spotlight after years of wilderness.

Building Behind The Curtain

In the 1960s, the US Department of Defense began communicating between machines.

Called ARPANET, it allowed multiple computers to communicate with each other on one network. This application was slow to take off, but by the 1990s it was being used in households across the world.

Called the Internet, the world found a faster way to initiate communication.

For the first 20 years, the internet was used by people to provide information through static pages. Essentially, it was a one-sided interaction.

People wanted more and so they turned their attention to the internet again.

The early 2000s witnessed the rise of social media and e-commerce. Social media democratized opinions in addition to faster communication.

e-Commerce touched every aspect of human life, from ride sharing to food delivery to vacation stays.

However, the one thing that continued to be missing was trust. Due to trust issues, internet usage was minimal wherever the money was involved, which required immense trust.

Banks take care of trust issues as they take the entire risk of transferring the value of money from one hand to another.

But again, the internet came to the rescue and provided a solution.

The answer lay in “decentralization”. That is where the roots of cryptocurrency are laid.

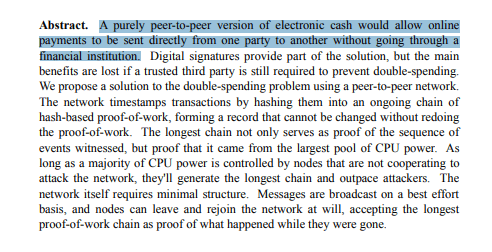

Satoshi Nakamoto first penned down the concept of peer to peer transactions. The complete validation would be done without any intervention from a traditional financial institution.

The idea was simple. All transactions would be digital and non-reversible so that third-party verification was not needed. The benefit was that it saved a lot of time for everyone involved i.e. the seller, buyer and the third party.

Bitcoin was the first digital currency but the idea behind was far more powerful. The idea captured the imagination of multiple people.

Including a particular Canadian with Russian origins.

A 17-year-old programmer named Vitalk Buterin heard about Bitcoin from his father and wrote a paper for the Bitcoin community. He argued that Bitcoin and blockchain could benefit from other applications besides money.

He also realized the applications needed a more robust language.

In the Ether

In 2014, Vitalik founded the Ethereum project.

Ethereum was a platform that allowed anyone to deploy permanent and decentralized applications onto it, with which others users can interact.

It started a revolution. Individual developers could now create their own currencies. As the network they built on was cryptographically secured, these would be called cryptocurrencies.

With this new foundation for trust on the internet laid, people started building games, marketplaces, financial products or whatever else they could think of.

Known as ICOs, startups could raise money for their projects by selling their own currencies.

Vitalik built Ethereum as a community project. They set up a process for anyone to submit improvement proposals.

Known as ERCs, ERC20 became the standard for most of the new cryptocurrencies.

Like with Bitcoin, Etheruem rewarded miners who maintained the system with its own currency - ETH - the second most valuable cryptocurrency in the world today.

The mechanism by which miners maintained the system, or validated transactions, was called a consensus mechanism. It’s how all decentralized participants come to an agreement.

The consensus mechanism that Bitcoin relied on and Etheruem built on was inefficient and consumed a lot of energy. As a result, Ethereum was only able to process 15 transactions per second.

Many other platforms have emerged with newer more efficient consensus mechanisms and will continue to but Etheruem was still the preferred platform due to the standards that it had built up.

While the world was innovating in 2014, India was waking up to the promise of crypto.

BharatCoin Begins

In 2014, the exchange Unocoin first allowed Indians to transact in Bitcoin.

In the same year, Bitcoin moved from $100 to $1,000. This would only be the beginning of memes on times when people could buy just a pizza with a Bitcoin.

In the same year, RBI warned the general public to stay away from trading in cryptocurrencies as any assets do not back it.

The value of bitcoin (the most popular currency at then) remained essentially unchanged, hovering around $600 to $1,000. The interest from the general public remained subdued.

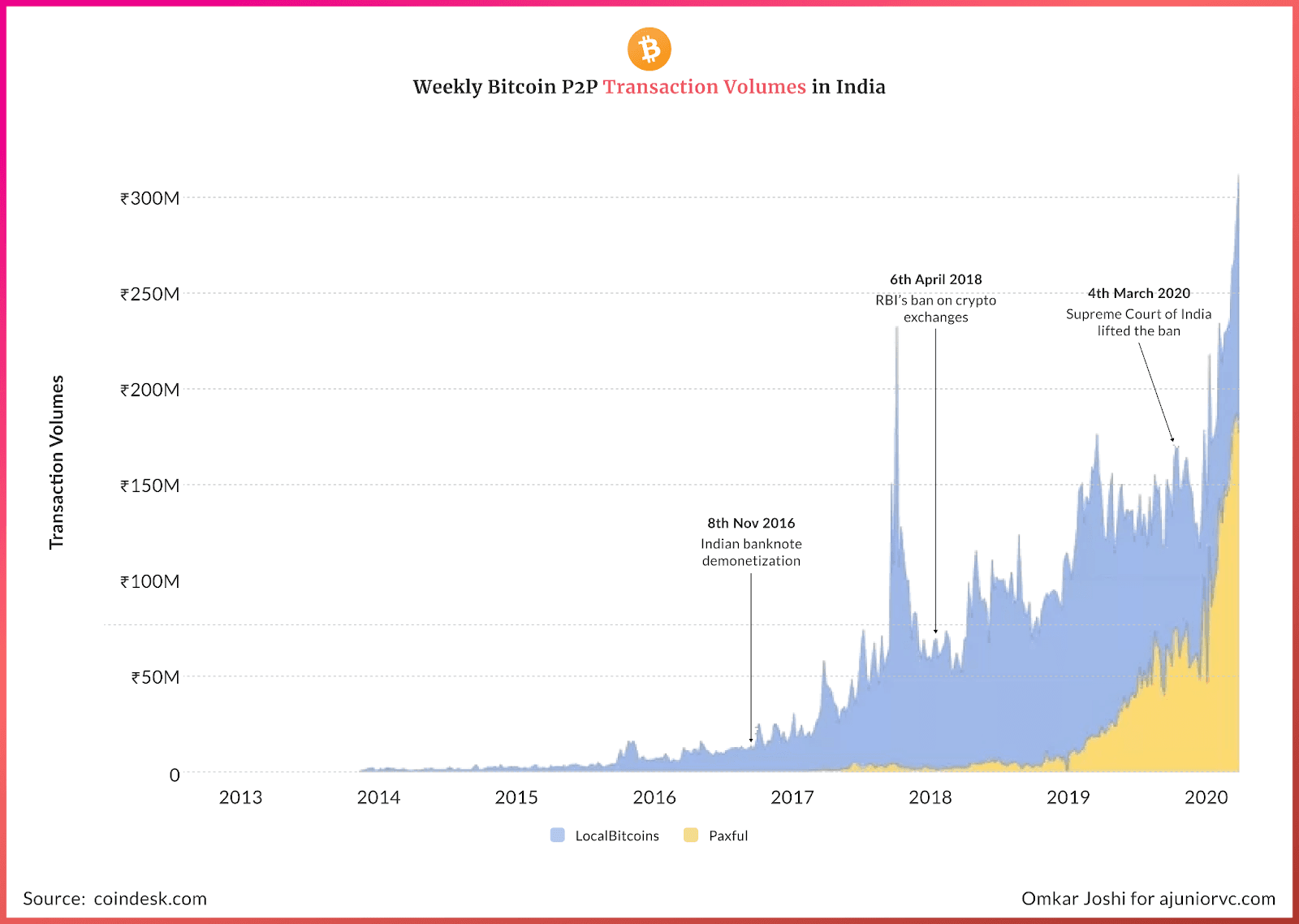

Then demonetization happened in 2016. What it essentially boiled down to was that the government didn’t live up to the sovereign promise of currency.

This spooked a lot of people and subsequently invoked an active interest in cryptocurrencies, especially bitcoin.

If this was not enough, then the prices of Bitcoin surged from $600 to $20,000 in the next two years, attracting many eyeballs from around the world, including India.

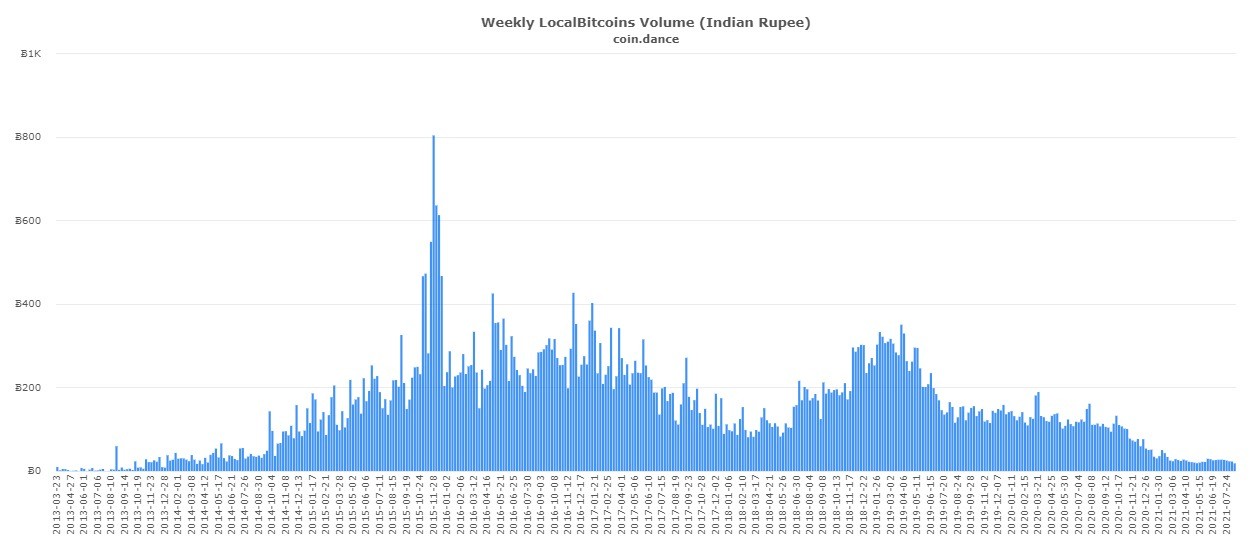

Cryptocurrencies exploded into the Indian scene.

Cryptocurrency exchanges rushed into the scene. By the end of 2016, there were more than 10 exchanges trading cryptocurrencies from all across the world.

The volume was so large that even some of the smaller exchanges were processing $100M of cryptocurrency in a month.

The Wild West of Crypto had arrived in the East. Weekly volumes galloped and there seemed to be no stopping crypto’s taking off.

The attraction to crypto was driven by younger investors looking for assets to invest in.

Investing to the Moon

To understand why cryptocurrencies were taking off, we need to understand Indian retail investors.

India had gone through a lot of changes in terms of how retail investors invested. The assets Indians chose to invest in were rapidly evolving.

Different asset classes had varying rates of return at different time horizons.

Depending on where people are on the spectrum of day-trader to long-term holders, options like equities, gold and FDs offered a compelling risk/return spread.

Our grandparents loved gold, parents couldn’t get enough of properties. Millennials were getting more involved in personal stock investing / portfolio management.

This chasing of higher risk/reward was driven by stock investing platforms that were simplifying investing.

Companies like Zerodha and Groww educated Indian retail investors. Investors jumped on the bandwagon of stock market investment through SIPs, IPOs, MFs and direct investments.

By 2017, a lot of millennials had got the taste of the high risk/reward investing in stocks.

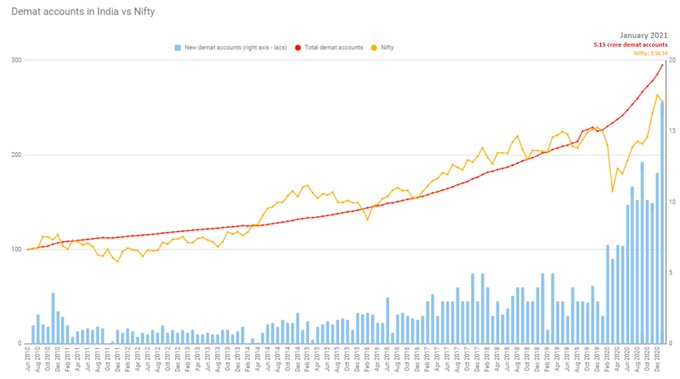

As Indian stock markets entered into a bullish phase, it led to a higher number of demat accounts being created. This led to excitement and new investors entering the space.

The impact at a behavioural level for Indian investors drove them towards even newer asset classes.

The older asset classes of their parents had falling returns, primarily because everyone was chasing them.

They understood there is a meaning in learning and investing in a new asset class. This also opened up the opportunity for greater returns than previous generations.

Users were also opening up to the idea of trying new platforms that can be trusted to make their investment journey easier and affordable.

This trust would be essential if they had to try something new like a cryptocurrency, which had the risk of regulations but at the same time had a reward that was multifold if it went well.

Crypto trading volumes in India soared, and by early 2018 India was one of the hottest crypto markets globally.

In this rush for the “new gold”, exchanges were minting by selling shovels.

HODLing is Illegal

As the cryptocurrency exchanges exploded on the scene, so did their scrutiny.

At the time, crypto was assumed to be a mechanism to launder money. With an Indian government that was hell-bent on going after evaders, crypto was already in their crosshairs.

In early 2018, two engineers would see the long term potential of cryptocurrencies. They would start a company that helped Indians access cryptocurrencies from anywhere in the world.

The company would be called CoinDCX.

Regulators cautioned about the inherent risks and compared cryptocurrencies with a Ponzi scheme citing that cryptocurrencies do not have any intrinsic value and will remain volatile.

This came to a head in early 2018, when the regulators tightened their stance on the trading activity with a complete ban on cryptocurrency trading.

The decision by the regulators was a body blow to the fledgling crypto ecosystem.

Banks decided to stop working with exchanges. People pulled their crypto/money out of the Indian exchanges. Chaos ensued.

Once the regulator decided to the crackdown, nobody was spared.

Within six months, the largest cryptocurrency exchange in India, Zebpay, decided to shut shop. At that time, Zebpay had close to 3 Million users.

The entire ecosystem crumbled. Trading volumes fell by 99%, and by August 2018, about 95% of jobs vanished.

Most assumed that the India crypto story was over. In the apocalypse, some exchanges held strong. The HODLers were CoinDCX and WazirX.

The two kept fighting with regulations to make the space accessible to everyone, but it wasn’t going to be easy.

You Can’t Doge a Tsunami

The regulations came as a swift blow to the cryptocurrency ecosystem, killing the ecosystem.

While the regulations were swift in closing out crypto innovation, they were equally slow in handling appeals for revoking the regulations.

A group of lawyers, policymakers, crypto founders took it on themselves to get these regulations repealed.

Globally, governments had inconsistent stands on crypto. Some countries like Estonia were incredibly open, others like China banned it completely.

By 2019, investors were clamouring for new and innovative investment options.

Crypto exchanges took this moment to build on the positive sentiment that stock market investors had towards a new asset class.

Cryptocurrency exchanges approached the Supreme Court of India asking to intervene and look into the matter.

Around the same time, WazirX started the Twitter campaign #IndiaWantsCrypto and demanded an acceptable regulation to regulators and the ecosystem participants.

The whole year went in drumming up support from all stakeholders to revoke the regulations.

After another year of back and forth, 2020 saw the Supreme Court of India release a landmark statement.

It quashed the RBI’s ban on crypto trading in India and allowed the industry to breathe a collective sigh of relief.

After the judgement, it was clear that trading in cryptocurrency was not illegal. The Supreme Court of India did mention a need for regulation, though, which while complicated for a ‘decentralised’ platform, was not insurmountable.

India crypto was back from the dead. With the green light from the Supreme Court, the space started heating up quickly.

Zebpay came back from the dead. WazirX and CoinDCX quickly gained market traction in the exponentially growing sector of crypto exchanges.

Unlike the BSE or NSE, which have almost no differentiating features for an average stock investor or trader, crypto was given its fresh start which led to creative entrepreneurs looking at the solution in different ways.

Each took their own approach in terms of design, offering, user journey amongst other things.

This was done to woo the new users who were trying crypto for the first time or the early adopters who were now looking for a new flavour and needed more than a 2015 era MVP to invest a significant amount of money.

Zebpay, the oldest brother, took the Tier 2/3 path by riding on the Jio revolution that has taken the internet to the masses of India. They started focusing on a niche of customers who did not have english as their preferred language but were keen to invest in crypto.

Even their homepage had a significant amount of Devanagari, helping its users understand how Zebpay is “Bitcoin की दुकान” (Bitcoin Shop).

But while Zebpay was the oldest, the real battle was being fought by WazirX and CoinDCX.

Finally UnTethered

CoinDCX and WazirX were frenemies, together in fighting the regulations, while competing for crypto users.

WazirX, a late entrant into space, innovated and came up with two in-house products.

If e-commerce companies' path to profitability is launching private brands (think Amazon Basics or Grofers HappyHome), what can a crypto exchange offer as their own private brand?

Yes, their own cryptocurrency. WazirX launched its own cryptocurrency - WRX.

With only a 1 billion WRX to be mined, soon it became the product that WaxirX started pushing. Users were coming to WazirX for Bitcoin and the DogeCoin and in the euphoria that we saw with crypto, they were happily purchasing WRX and the hundreds of other cryptocurrencies that were available.

Capitalising on the early success of WRX, they next built a mutual fund of cryptocurrencies called xMINT which would give new investors diversified exposure to the entire index.

They also launched an advisory company called Minting M which managed the fund so that customers’ were less exposed to the daily volatility of crypto.

The other horse in the race was CoinDCX, which had a slow start when it was started in 2018 amid a tough regulatory environment.

It bounced back strongly in early 2020 when the shackles were removed.

Their mission was clear - make the user experience of buying crypto as simple as conventional share trading.

To help novel investors adopt cryptocurrency as a potential asset class, they also launched CoinDCX Go - an app to invest in cryptocurrencies.

With the app, they opened up their platform to mass adoption among beginner investors in crypto, especially millennials, and aim to onboard 50 million Indians.

Finally, they focused on trust as their unique differentiator.

To do so, CoinDCX focused on one simple message. They were super-fast, safe, and trusted by millions of Indian users.

As the ban on crypto was revoked, global devastation was brewing.

A Global Coindemic

At the start of 2020, Bitcoin was trading at around 6 lakhs per Bitcoin and the price had been steadily rising.

Then, in just two days in March, the price plunged. Bitcoin lost more than half of its value. Experts speculated that due to the pandemic investors were moving towards the safety of cash.

Over the next few months, the conversation changed as Bitcoin prices quickly rose to surpass previous price levels. By May it had bounced back and was trading at 7 lakhs.

The year ended with an astronomical 168% rise in price in the 4th to quarter of 2020. The second-best performing year in cryptocurrency’s history.

The rise after the crash also kept innovations going.

New projects started to emerge that attempted to solve some of the problems with Etheruem. Each transaction now costs up to $10 on Ethereum and they are limited at 15 transactions per second. Scaling was a problem.

Many alternatives emerged and raised billions but the fact is that Etheruem is still the most actively used platform with over 90% of other cryptocurrencies being built on Ethereum.

Like traditional companies in the crypto space too, building a strong community has proved to be a moat.

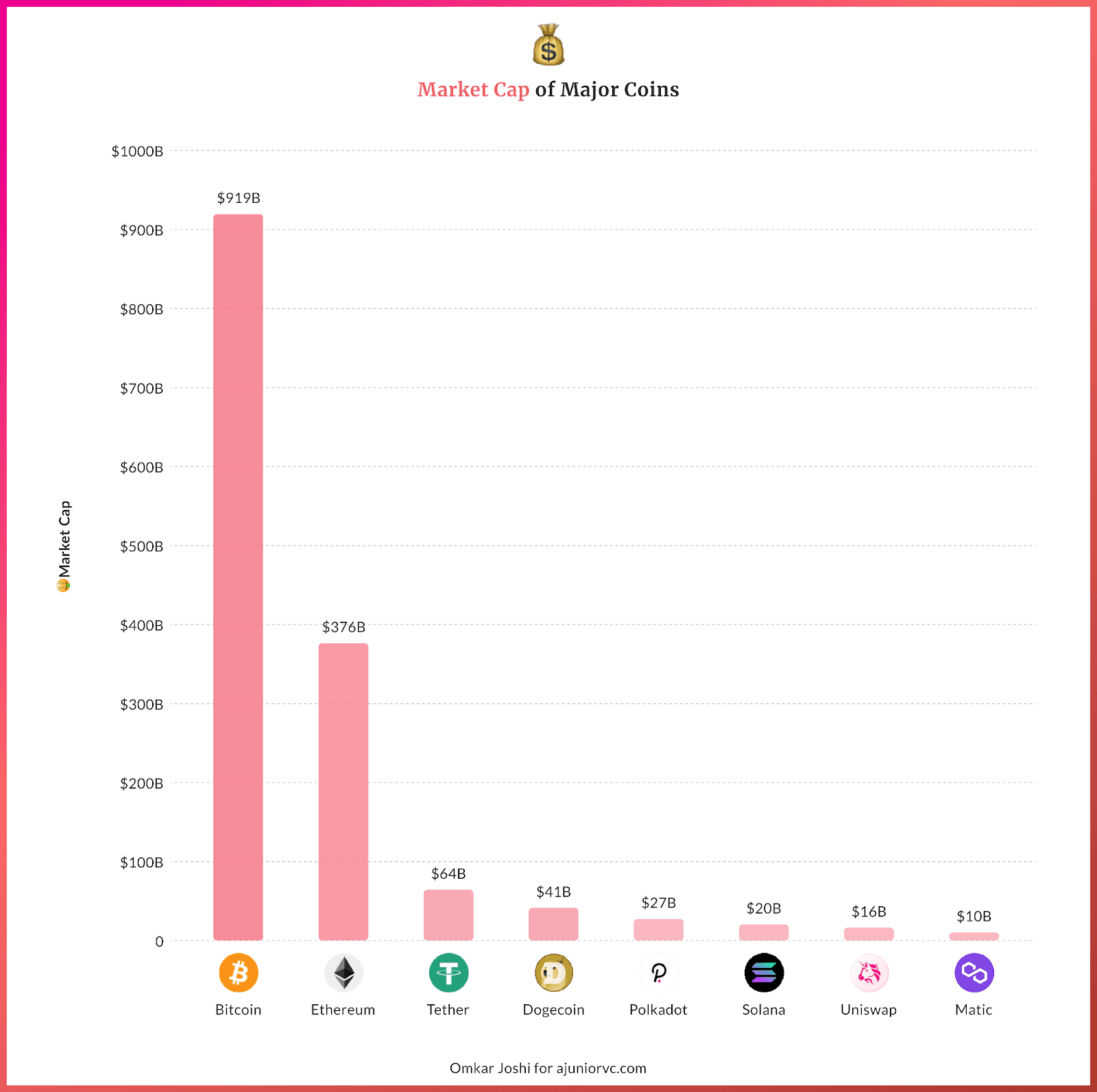

Ethereum, Bitcoin and other legacy systems are here to stay, said billionaire investor Mark Cuban as he announced his investment in the Indian blockchain startup Matic (aka polygon).

Venture capital interest in crypto and blockchain firms in India has only risen during the pandemic, 13 deals worth more than $170MM have been completed in 2021 to date (half of it going to CoinDCX), significantly more than the 10 deals worth over $44 million in the previous year.

Matic raised funds from a global market through an initial coin offer (ICO). And made the founders India’s first crypto billionaires.

Matic is one of the first companies in the world to be able to scale Ethereum. By grouping transactions together and minimizing the data stored on Ethereum Matic was able to successfully build a layer two solution that could execute 65,000 transactions per seconds compared to Ethereum’s 15, for a fraction of the cost.

What made Matic special is that it was built on top of Ethereum. Project could just move over to Matic in a matter of days while still using the same tools that developers were used to.

Back in the early days of Web 1.0, the co-founder of Intel Gorden Moore observed that the number of transistors on a microchip doubles every two years, though the cost of computers is halved.

Known as Moore’s law, the phenomenon proved to be true for over half a century and now is expected to finally come to an end in a few years.

Web 3.0 is not driven by data and our ability to process it faster. Rather by better algorithms, more efficient consensus mechanisms and architecture that stores less data on-chain.

What’s different this time around is that code must be published. Ideas are shared more openly and each new company can plug into this growing ecosystem.

With Matic leading the way, India was finally innovating globally in crypto. As the world entered 2021, there were going to be some more wild swings.

Long India Crypto

At the start of the new year, Tesla announced that they had purchased $1.5B worth of Bitcoin as they prepared to accept payments in Bitcoin.

Elon Musk too spoke publicly about his support for bitcoin and prices continued to surge to over 35 lakhs per Bitcoin, crossing a trillion-dollar market cap by mid-February.

Rising Bitcoin prices were reflected across cryptocurrencies. Elon zeroed in on doge coin, a currency that started as a joke.

A single meme propelled the cryptocurrency to a market cap of $54B. Now experts were talking about Bitcoin as an alternative to gold.

Just how it started, a one-word tweet sent prices crashing.

An extreme reaction to the extreme volatility was the Chinese, which banned mining and trading. Stating that it infringes on the safety of people’s property and disrupts the normal economic and financial order.

The long term future of Bitcoin might be in question. Regulations will evolve but the underlying blockchain technology is here to stay.

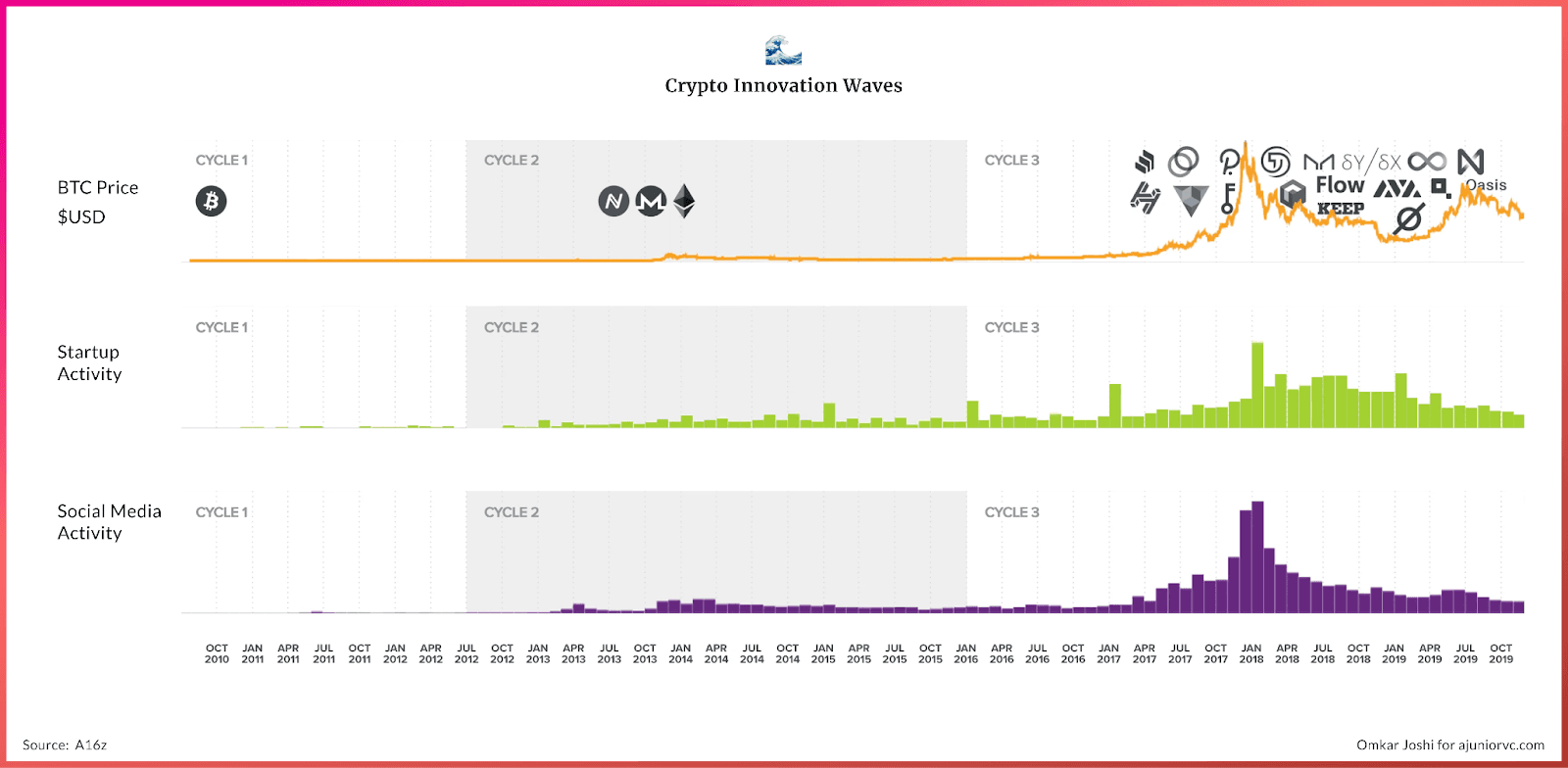

What’s interesting is that, unlike traditional startups where the price is a lagging indicator, in the crypto space price, startup activity and interest seem to be correlated.

Creating a sort of feedback loop, where higher prices lead to more social media and developer activity, leading to more startup activity pushing prices even higher.

Evolutions with infrastructure will continue and likely accelerate.

Unlike traditional businesses, crypto infrastructure has no boundaries. Without central banks or the need for any physical presence, blockchain companies are built for global scale from day one.

The past could give us a good framework to look at what’s to come as Web 3.0 evolves. Early platforms like Ethereum have built a moat with their strong developer community.

General-purpose platforms are likely to consolidate towards common standards as has been observed with the rise of NFTs that can now be stored on multiple blockchain platforms but viewed on a single exchange.

Platforms that have improved on Ethereum such as Cardano, EOS, Cosmos and Polkadot have grown in popularity. Specific purpose platforms such as Iota, Ripple and Flow will continue to emerge.

Several Indian companies have already started contributing to building this infrastructure.

EPNS is a company that sends blockchain platform-agnostic notifications to any wallet address. Instadapp is a startup that is building infrastructure for decentralized finance - think savings and loans without a bank involved. With code as the intermediary.

Others such as KoineArth, are building layers that act as bridges so enterprises connect to the Web 3.0 applications seamlessly using the Web 2.0 APIs they are familiar with.

Many more Indian companies are just getting started, working on user-facing applications.

If there is anything we have learnt from Web 2.0, this is the final layer that’s where most of the action will be in the years to come.

The next layer of user-facing applications is just starting to emerge, and it’s likely to grow rapidly. Localized applications can cater to small groups of individual users to enable commitments online.

Indian crypto might be late to the party but the future is bright for the companies that can focus on solving real problems and keep up with rapidly evolving regulations.

Just in this year, CoinDCX became a unicorn, Polygon exploded and WazirX handled record volumes. Indian crypto innovators have had an incredible year, after years of struggle.

As we enter the new decade, India’s crypto moment is finally here.

Authors: Shiraz, Mazin, Abhinay, Aviral Design: Omkar