Feb 19, 2023

Will India's 60 Year Semiconductor Struggle Finally Yield Chips?

Electronics

IPO

B2B

Technology

Last fortnight, Foxconn-Vedanta looked to tie up with STM, as India looked to tie up with 4 fabs and upskill 90,000 semiconductor professionals.

An Electrifying Start

John Fleming and Lee De Forest were experiencing some major static.

At the turn of the 20th century, the world was buzzing about wireless telegraphy. Fleming and Forest had other issues.

The duo’s main challenge was improving technology to make radio communication possible.

They were improving radio receivers to make them selective to better distinguish between radio signals and reduce static interference.

Eventually, their work would spark a revolution in communication that would change the world. Vacuum tubes were the solution.

In 1904, John Ambrose Fleming invented the first vacuum tube, which he called the diode. As many engineers would know, he also developed Fleming’s right-hand rule.

However, vacuum tubes had their issues.

For one, they were bulky and consumed a lot of power. Furthermore, they were unreliable and had a short lifespan. Imagine carrying a 200-pound computer around like a briefcase.

Enter semiconductors. Well, almost.

Lack of understanding hindered the development of semiconductor materials for decades. In the 1920s, research on semiconductors finally took centre stage.

Researchers continued to study the properties of materials like germanium and silicon, which exhibited semiconductor behaviour. The need for more knowledge about the underlying physics of semiconductors hindered progress.

Then came the breakthrough.

In the 1930s, Russell Ohl developed a new solid state device called the "PN Junction”.

This would be the eventual basis for modern semiconductor technology. Ohl discovered that a piece of silicon could become a better conductor when treated with certain impurities.

The process was called doping

Semiconductors posses the power to act as both a conductor and insulator, hence named “semi”-conductors. Semiconductors thus became ideal for controlling the flow of electricity in electronic devices.

The transistor built in Bell Labs in 1947 would implement doping

William Shockley, John Bardeen, and Walter Brattain built on Ohl's work. The transistor was a tiny semiconductor that could amplify and switch electronic signals.

The fact that it started a revolution was an understatement.

Computing devices, earlier built on vacuum tubes, could perform the same functions as before, but with less power and space.

It was a "magic wand" for electronics.

In 1957, William Shockley, one of the co-inventors of the transistor, left Bell Labs and returned to California to start his own semiconductor company. Shockley Semiconductor Laboratory aimed to develop new and innovative semiconductor devices

Due to Shockley's difficult management style, many key employees left the company.

In 1958, eight of these employees, known as the "traitorous eight” started their own company, Fairchild Semiconductor.

Fairchild would be the beginning of an explosion of the industry.

Amplifying Intelligence

The integrated circuit (IC) invention in 1958 was transistors on steroids.

Electronics became smaller, faster, and more reliable. By the 1960s, ICs were in various products, from military equipment to consumer electronics.

One of the first landmark products to feature ICs was the 1964 IBM System/360 mainframe computer, which was a small car size and contained over 20,000 ICs

This new change was exploited by none other than Fairchild. As Fairchild scaled, its members started plotting their separate paths.

Before the PayPal mafia, there were the Fairchildren, who eventually created almost $2Tn of market value. The founders of Intel, Kleiner Perkins, and Sequoia Capital began to spin out of Fairchild.

Intel was founded in 1968 by Robert Noyce, a co-founder of Fairchild Semiconductor. Robert noticed that ICs had their limitations in computing power.

Ths started in 1960s when was tasked by a Japanese calculator manufacturer, Busicom, to design a set of chips for their calculators. The project was assigned to a young engineer named Ted Hoff, who came up with the idea of integrating all the necessary circuits onto a single chip.

With the power of an entire central processing unit (CPU) on a single chip, this integration of ICs was called a microprocessor.

Intel developed the first single chip microprocessor, revolutionising the computing industry.

Hoff's design eventually led to the creation of the Intel 4004, the world's first commercially available microprocessor, which was released in 1971. The 4004 had 2,300 transistors and could perform up to 60,000 operations per second. Intel initially used it in calculators, but the world soon realised its potential.

4004 debuted in cash registers, industrial controllers, and even the Apollo spacecraft.

The success of the 4004 led Intel to develop further microprocessors, including the 8008, 8080. Eventually it created the 8086, which became the basis for the IBM PC and the modern x86 architecture.

Oceans away, a newly independent country dreamt of space, technology and electronics.

The Indian government established the Electronics Commission in 1964 to promote the electronics industry's development, including semiconductors.

The Indian government established several public sector companies to manufacture electronic components, including semiconductors. Some of these companies included Bharat Electronics Limited (BEL), Semiconductor Complex Limited (SCL), and Electronics Corporation of India Limited (ECIL).

In fact, Fairchild thought of setting up its first semiconductor plant in India, but got dissuaded due to excessive government regulations. India’s companies were primarily focused on producing low-end products and needed the technology or resources to compete with larger international players.

Companies on the other side of the world were eager to start using this technology.

In the early days of the microprocessor industry, Intel had a significant lead in design and manufacturing capabilities, allowing it to dominate the market for several years.

Thanks to semiconductors, world was about to change for the better.

Charging Ahead

Microprocessors changed everything, from personal computing to video game consoles and cars.

The Altair 8800, introduced in 1975, was the first microprocessor-based personal computer that users could assemble.

In the space of 2 decades, the world had gone from struggling to compress electronics to a personal computer.

Apple, founded in 1976, was one of the pioneers of the personal computer industry. The Apple II, introduced in 1977, was one of the first commercially successful personal computers.

As a student named Bill dreamt of putting a computer everywhere, competing with another young man named Steve, India started to go deeper on semiconductors.

In the late 1970s, the Indian government initiated the Technology Policy Statement, which aimed to promote the development of indigenous technology, like semiconductors.

The Semiconductor Complex (SCL) at Mohali was established in 1983 as part of this initiative to produce high-quality semiconductor products for the Indian market.

Establishing SCL was a significant step for the Indian semiconductor industry. The company aimed to design and manufacture semiconductors, including microprocessors, within India.

In the late 1980s, SCL advanced quickly from the 5-micron process technology to a 0.8-micron process. This rapid progress was impressive and a proud moment for the Indian semiconductor industry.

However, like any other industry the late half of 1980s witnessed a setback. Like the tension of today, tension brewed between the US and Japan.

The Semiconductor Industry Association (SIA) and the Advanced Electronics Association (AEA), led by Robert Noyce, lobbied Congress to prevent Japanese "dumping" of semiconductors into the American market.

The lack of dumping protections and easier access to capital rendered US firms unable to compete.

As Japanese companies saturated domestic and foreign markets, prices plummeted by 60%. Within a year, the chip industry collapsed.

Micron filed anti-dumping complaints, along with National Semiconductor, Intel, and AMD.

This culminated in 1986's Semiconductor Trade Agreement, which allowed US firms greater access to the Japanese market.

This effectively restricted dumping by Japanese enterprises, allowing American businesses to gain a 20% market share in Japan.

Texas Instruments and Micron, the only two American companies still operating in the Memory industry, reaped enormous profits in the second half of the 1980s.

As the world of semiconductors remained, India had a deadly shock.

A massive fire that destroyed SCL. The fire was a huge blow to India's efforts to develop an indigenous semiconductor industry.

To fight the loss, the Centre for Electronics Design and Technology (CEDT) was established in Mohali in 1990 to support the design and development of semiconductors. CEDT was a crucial initiative that provided a platform for researching and developing cutting-edge technologies that could be commercialised in India.

Struggling, India would enter a lost decade that would be a generational boom for Asia

An East Asian Circuit

While India was dousing fires, elsewhere in Asia, Taiwan was rising.

The Taiwanese government and the multinational electronics manufacturer Philips were setting up a joint venture for a semiconductor wafer manufacturing plant.

Enter, Dr. Morris Chang.

Known as the “Father of Semiconductors”, he was a Texas Instruments veteran. Dr. Chang was recruited to lead the plant.

This industry defining plant was later known as the Taiwan Semiconductor Manufacturing Company, or TSMC.

Over the early 90s, TSMC exploded. Dr. Chang was a visionary. He pioneered the idea of pricing semiconductors ahead of the cost curve, sacrificing early profits to achieve manufacturing scale that would later result in long-term profits.

The semiconductor manufacturing industry, to date, follows this model. He kept TSMC at the top, with repeated investments in improved silicon nodes and expansion of manufacturing capability with a dedicated focus on quality.

TSMC focused on just manufacturing, which Intel persisted with its full stack approach. In the 90s, Intel was the undisputed king, unperturbed by small fish in Taiwan.

But by the mid-1990s, TSMC’s growth was outpacing that of the world semiconductor market. This growth eventually led to TSMC being the first Taiwanese company listed on the NYSE.

Taiwan’s sudden surge changed the entire complexion of the Asian semiconductor market, with India feeling like it had fallen back an entire decade.

India’s woes were deepened because it had everything Taiwan did, most critically, labour. To understand why, we need to know how semiconductors are created.

Semiconductors are a highly complex yet lightweight product with a capital-intensive production and labor and skill driven assembly.

The lifecycle of a semiconductor chip can be broken down into several key stages, each of which requires specialised equipment and expertise.

The first stage is chip design, which involves creating the architecture and layout of the chip using specialised computer-aided design software.

Once the design is finalised, the chip goes into the manufacturing phase, where advanced equipment are used to create the actual physical chip.

The manufacturing process involves depositing and etching multiple layers of material onto a semiconductor wafer, which is then sliced into individual chips.

After manufacturing, the chips undergo rigorous testing to meet quality and performance standards. This involves using specialised testing equipment and software to measure various parameters, such as power consumption, speed, and temperature.

Once the chips have passed testing, they are packaged and assembled into final products.

This involves attaching the chip to a substrate, such as a printed circuit board (PCB), and connecting it to other components, such as memory, power supplies, and input/output devices.

After the final products are assembled, they are distributed to customers and end-users, who may use them in various applications. Maintenance and repair may be required to ensure the products continue functioning properly.

Each stage was starting to become multi-billion dollar markets in the late 90s.

The semiconductor supply chain was thus a complex network of companies designing, manufacturing, assembling, testing, and distributing semiconductor components. The supply chain is global, with different stages of the process taking place in different regions.

Taiwan, Korea and Japan were at the forefront.

Conducting Operations Globally

Despite growth, the semiconductor industry was still nascent.

The onset of personal computers becoming mainstream meant that the semiconductors would too.

The global industry for electronic goods was growing 10% Y-o-Y and by 1995 was valued at $750B. Computers accounted for 47% of worldwide semiconductor sales, consumer electronics at 23%.

The tech bubble collapse of 1999 would do little to stop the march of semiconductors, as electronics sales kept growing.

By the early 2000s, semiconductors were a ~ $200 B industry, organised into multiple product and geographic segments. Even with the globalisation of the industry, the basic sequence of semiconductor manufacturing remained the same across all product categories.

The design process was concentrated mainly in the US, Japan, and some parts of Europe.

Manufacturing was spread primarily in East Asia, with cheap labor being the key driver.

As the decade came to a close, vertical integration was becoming the theme in the industry. Manufacturers hoped to exploit economies of scale to combat the ever-growing demand.

With large fixed costs involved upfront, foundries producing wider product mixes would lower firms' financial risks and expand the range of end-user applications, enabling new opportunities for vertically specialised firms.

2010 saw Intel reign supreme, with Samsung and Texas Instruments closely behind. The top 10 claimed 50% of the industry’s revenues, firmly establishing dominance year after year.

But no good thing lasts forever.

The semiconductor industry was ridden with huge rising R&D costs and ever-prominent cyclicality. The constant effort to make more sophisticated chips to cater to the growing demand would take its toll.

The world semiconductor market grew only 0.9% in revenue, with tension regarding the macro economy. Driven by the financial crisis, consumers held off purchasing, governments refused to assume more debt, putting all expansion plans to the ground.

Inventories built up, and ripples were sent throughout the industry.

Larger companies with piles of cash vied for competitive positions, and smaller competitors were wiped out.

2011 was the year of consolidations and mergers. The most notable were $6.5B Texas Instruments–National Semiconductor, $4B Qualcomm–Atheros, and $3.5B Broadcom–NetLogic.

Technical evolution and the pursuit of smaller gate sizes (Moore’s Law), required an increase of ~20% each year in R&D expenses and design costs to maintain scale and competitiveness.

Intel would dominate microprocessor units, Texas Instruments integrated device manufacturers, TSMC in foundry, while Samsung and Toshiba focused on memory.

Most other players would either face negative or zero cumulative profits over the decade. Semiconductor players destroyed over $140B in value combined in the 2000s, an unbelievable number for the hot industry.

After two decades in wilderness, Indian electronics was starting to come back.

Homegrown Silicon Valley

In 2012, the electronics market in India was at a fledgling $65B compared to the global market of $2T.

But the expansion of communications infrastructure in the country, the subsequent penetration of mobile devices, and the government's drive to extend IT to the grassroots of society put India in an envious position.

India was slowly transforming from a design hub to R&D and manufacturing to unlock the potential of moving from a service market to a product market.

India's ESDM sector grew from $ 65B in 2011 to $ 94B in 2015, as the market contribution of India to the global semiconductor market grew from 2.5% to 3.3% over the same period.

While India grew in chip design and electronic manufacturing, it struggled to set up Semiconductor Fabrication units.

A lack of infrastructure, skilled labour, and cheap labor in neighboring countries like China and Vietnam put India far behind. Intel, in 2014, stated no interest in setting up manufacturing facilities in India, a big blow.

Fab manufacturing or foundries were always challenging, necessitating huge upfront capital.

Moreover, India faced major hurdles with a single chip requiring over a hundred gallons of pure water in its manufacturing process.

Understanding India’s struggles in detail required a look at the competitive landscape, and how far ahead they were.

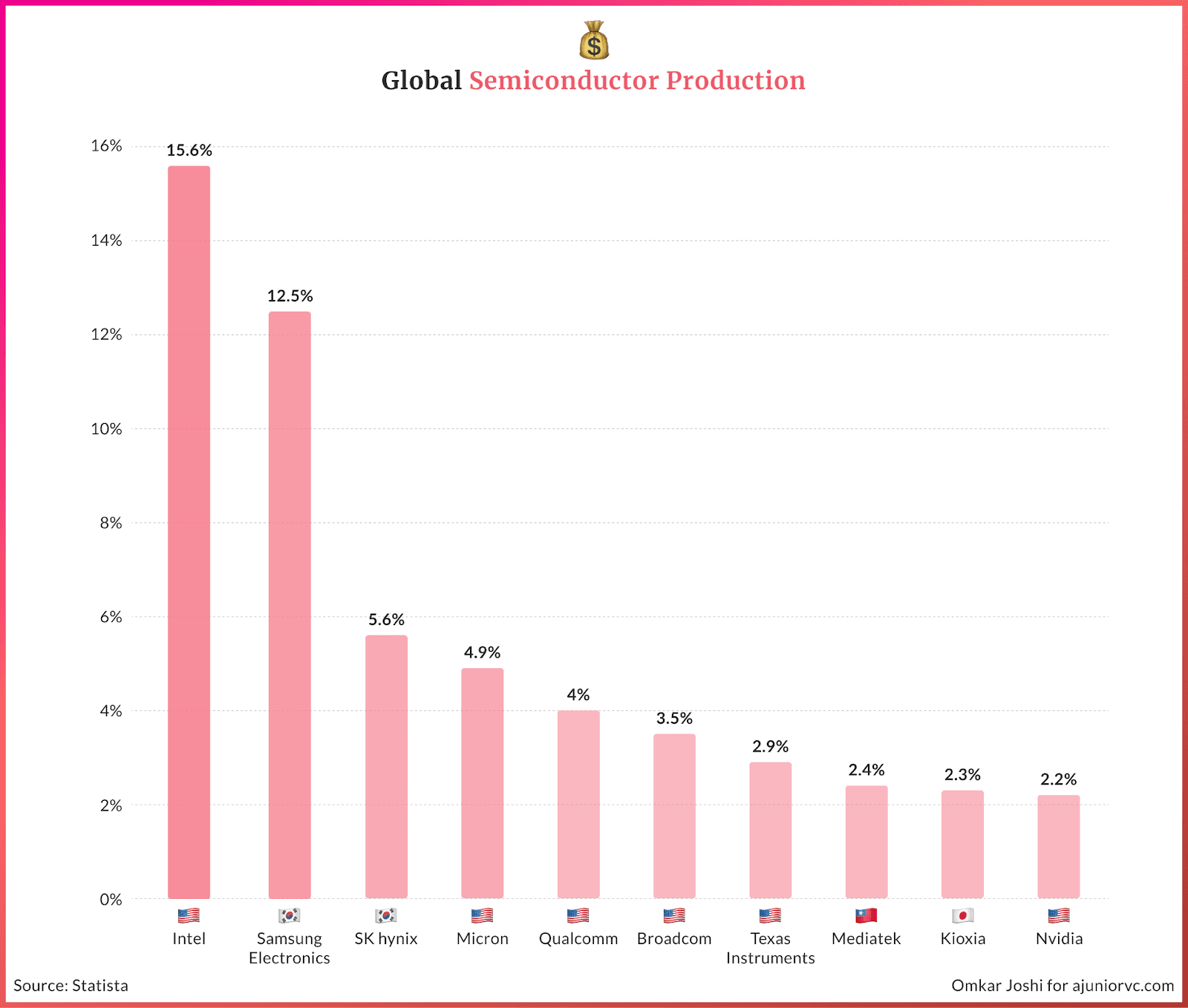

The global semiconductor industry was dominated by a handful of major players responsible for producing various chips and other semiconductor-based products.

Intel, the original gangster, created microprocessors end to end and semiconductors.

South Korean giant Samsung was renowned for its advanced manufacturing processes and technological innovations. SK Hynix were the major producer of memory chips, including DRAM and NAND flash.

US based Qualcomm was the leading producer of mobile processors and wireless communication chips. Broadcom produced chips for the data center, networking, and wireless communication markets. Nvidia specialised in graphics processing units (GPUs) used in gaming, data centers, and artificial intelligence applications.

But in manufacturing, the undisputed champion was Taiwanese

TSMC emerged as a dominant player in the manufacturing space due largely to its state-of-the-art manufacturing facilities and ability to produce high-quality, low-cost chips. Its relentless focus on just manufacturing made it huge.

TSMC had a 53% market share of the global foundry market.

By 2016, a new technology called AI had started to make waves. Special chips were being used in categories like gaming. In 2017, IoT devices started to become mainstream. Chips were now everywhere, including your fridge.

By 2018, the overall semiconductor had grown to $420B, a category of epic size that refused to stop. Even though it faced cyclical issues, it was enormous.

As the world entered 2019, India was at a crossroads.

To Sell Like Hot Chips

Indian electronics imports had tripled in just seven years, a huge bill like oil.

Just as there was a push to manufacture, a supply chain destroying event occurred.

In 2020, the COVID-19 pandemic disrupted supply chains, leading to key component shortages. Despite the challenges, the industry showed remarkable resilience, with companies adapting quickly. Still, shortages abound.

Companies started to look for alternatives to Chinese supply chains. India had been given a lucky break after the disastrous fire. This time, it was more ready.

India now had rapidly growing electronics market. This increased demand for semiconductor components, attracting investment and spurring local semiconductor manufacturing and assembly capabilities.

India also had a highly skilled and tech-savvy workforce, including many engineers and developers. This helped the country become important in semiconductor design and engineering, with several Indian firms and research institutions specialising in chip design, verification, and testing.

The booming start-up ecosystem drove further investment and innovation in the semiconductor space, with companies working on emerging technologies such as AI and IoT.

India's government also significantly promoted the semiconductor industry's growth with initiatives such as the "Make in India" program, which promoted domestic manufacturing and aimed to reduce the country's dependence on imports.

Prime Minister Narendra Modi’s government in late 2020 unveiled a $10B incentive plan, offering to cover as much as half of a project’s cost, to lure display and semiconductor fabricators into setting up base in India.

This led to increased investment in manufacturing and assembly facilities, with several major companies, including Intel and Samsung, setting up operations in the country.

As the world emerged from the pandemic in 2021, India became the 2nd largest manufacturer of mobile phones worldwide. India had grown to 300M phones produced.

Value produced grew from $3Bn in 2014, to $30Bn in 2021.

However, even in 2022, there were still significant challenges facing India's semiconductor industry, including a lack of infrastructure and the high cost of technology and equipment.

India's manufacturing push, backed by favourable policies, was timely. The country was positioned strongly to grab a massive opportunity in the electronics hardware space amid COVID-induced supply chain disruptions and global trust deficit around China.

The Modi government program had four key schemes that cover setting up semiconductor fabrication plants in India, plants for producing compounds used in the process, assembly & testing facilities and design linked incentives.

By the summer of 2022, the on-going Russia-Ukraine war exacerbated disruptions on the global supply chains of semiconductors caused by Covid. The warring nations were the major sources of two key materials used in semiconductor manufacturing: neon and palladium.

As Russia and Ukraine fought a physical war, another huge battle was brewing.

Current Conflicts

A deep Silicon cold war began

In late 2022, US president Biden banned the sale of advanced semiconductor chips to China. It also implemented a series of other rules that prevent China from making these chips on its own.

In a replay of US Japan in the 90s, US-China was playing out.

The US has been at the forefront of cutting-edge chip technology to persist in its dominance; it has controlled various parts of the supply chain.

Most of the assembly work of chips was shipped to China, dominating this end of the supply chain. This put China in a tricky position, they heavily relied on importing these chips from other countries.

To tackle this problem, China started to create a chip supply chain that wholly existed in China from Design to manufacturing and assembly. They successfully made some older generation chips but not the most advanced ones.

The supply chain of chip manufacturing is very monopolistic, with very few choke points.

Only 3 American companies make the software needed to design advanced chips. Then turning those designs into real chips requires a machine that’s only made by one company, ASML, but this machine requires equipment that’s only made in the US.

Finally, only Taiwan and South Korea companies can manufacture the most advanced of these chips.

China has been trying to copy these choke points. This challenged US dominance in the industry, and US-China relations turned more competitive, angered the US.

The US not only banned all US and global companies from selling advanced chips to Chinese companies, but also banned Chinese design companies from using US software and US equipment.

As the Silicon World fought, the semiconductor industry never looked so attractive.

The global semiconductor industry was projected to become a trillion-dollar industry by 2030, another doubling from its scale today.

As the impact of digital on lives and businesses has accelerated, semiconductor markets have boomed, with sales growing by more than 20 percent to about $600B in 2021.

Assuming EBITA margins of 25 to 30 percent, current equity valuations support average revenue growth of 6 to 10 percent up to 2030 across the industry

Semiconductor usage was now far and wide, in cutting edge fields.

The 5G market is projected to reach $667.9 billion by 2026. The AI market is expected to grow at a CAGR of 40.1% from 2020 to 2025. The IoT market is projected to reach $1.5 trillion by 2027. The electric vehicle market is expected to grow at a CAGR of 29.4% from 2020 to 2027, driven by government policies promoting the adoption of electric vehicles.

At their core are semiconductors, hundreds of billions at stake. India could take up a lot of this demand.

Bridging The Band Gap

India’s declared focus is solely on manufacturing of chips, like Taiwan’s in the 90s.

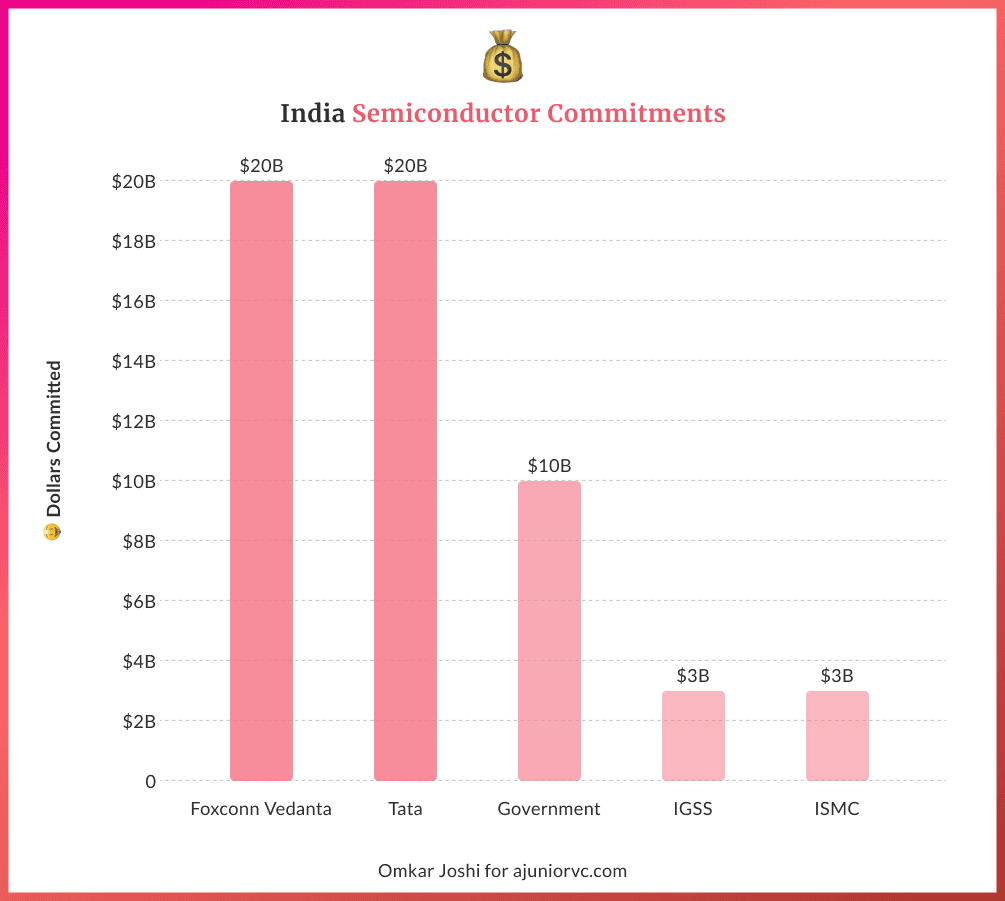

In early 2023, Indian government doubled down on its $10B plan to woo chip makers, providing subsidies up to 70% of the project's cost.

Foxconn and Vedanta partnered to set up the first semiconductor plant in Gujarat by 2025, investing 20B$. WITH subsidies in initial capital investment, the state government has also offered subsidised land, electricity and water.

Singaporean group IGSS Ventures has also signed a memorandum of understanding for a 3B$ semiconductor plant in Tamil Nadu. It will be producing wafers ranging from 28nm to 65nm.

ISMC Analog, a consortium between Mumbai-based Next Orbit Ventures and Israeli tech company Tower Semiconductor has also availed government subsidies to set up a 3bn$ chip-making plant in Mysore, which will create 1500 direct and 8500 indirect jobs.

Karnataka, rightly home to the Silicon Valley of India, has been in the forefront of India’s semiconductor manufacturing ambitions. Already home to 85 fabless chip design units, the state contributes to 50% of India’s electronic product companies and 40% of electronic design firms.

Karnataka already had a semiconductor policy in place from 2009, which set up initiatives to attract companies looking to set up assembly, testing, marking and packaging (ATMP) plants.

Reliance and HCL also want to enter Silicon by investing in ISMC.

Dixon Tech, the biggest contract manufacturer of electronic goods in India, with revenue over 10,000 crore rupees, also entered into a JV with Japan-based Rexxam. It focused manufacturing printed circuit boards(PCBs) under the government's Production Linked Incentive(PLI) scheme.

The Ministry of Electronics and Information (MeitY), under its Design Linked Incentive (DLI) Scheme, is looking to incubate 100 domestic companies, start-ups and MSMEs. The scheme has three components – Chip Design infrastructure support, Product Design Linked Incentive and Deployment Linked Incentive.

With almost $50Bn in capital investments in place, we can approximate what the market could look like.

TSMC Capex of ~$36Bn yearly yields revenue of ~$70Bn, $1 invested at scaled yields $2. If India invests $6Bn per year, gets to $12Bn of revenue. The foundry market is ~$200Bn, putting India in a healthy 6-7% position to win.

The DLI scheme aims to nurture at least 20 domestic companies involved in semiconductor design and facilitate them to achieve turnover of more than INR 15 billion in the next five years.

GoI wants to offset the disabilities in the domestic industry involved in semiconductor design to not only move up in the value-chain but also strengthen the semiconductor chip design ecosystem in the country.

India already has an exceptional semiconductor design talent pool, which comprises up to 20% of the world's semiconductor design engineers. Moreover, almost all the top 25 global semiconductor design companies have design or R&D centres in India.

It is estimated that India's consumption of semiconductors will cross $80B by 2026 and $110B by 2030. This requires a domestic ecosystem that can sustain supply without depending on the volatile global supply chain.

Starting in the 1960s, India’s slow slog for semiconductor dominance finally looks like it could take shape. If it cashes in, it could be transformational for tech and India.

Writing: Bhoomika, Mazin, Parth, Raghav, Samarth, Tanish and Aviral Design: Chandra and Omkar