Mar 6, 2022

Will India Stack Enable a Global Fintech Superpower?

Payments

Lending

Finance

SaaS

Series E-G

B2C

B2B

Technology

Last fortnight, Nepal became the first country outside India to adopt UPI, hot on the heels of the announcement of a digital heavy budget.

Night is Darkest Before Financially Inclusive Dawn

As India entered 1991, the government was about to go broke.

The foreign exchange reserves were just 2 months worth of imports. Faced with a do or die situation, India had to move.

The liberalization of 1991 would be an epochal moment in the young country’s financial journey. Dropping all the shackles of the License Raj, the State dropped its requirement as the arbiter of what happened in the market.

From controlling who could build with, to what the value of the rupee was, everything was now open to the market.

The result was immediate. FDI went up from $132M in 1991 to $5.3B in 1995, an eye-watering 50x jump. As the economy turbocharged, the GDP went from ~$270B in 1991 to ~$500Bn in 2000.

India was ready to fly. The early 2000s were the golden years for the Indian economy as the effects of liberalization finally began to show.

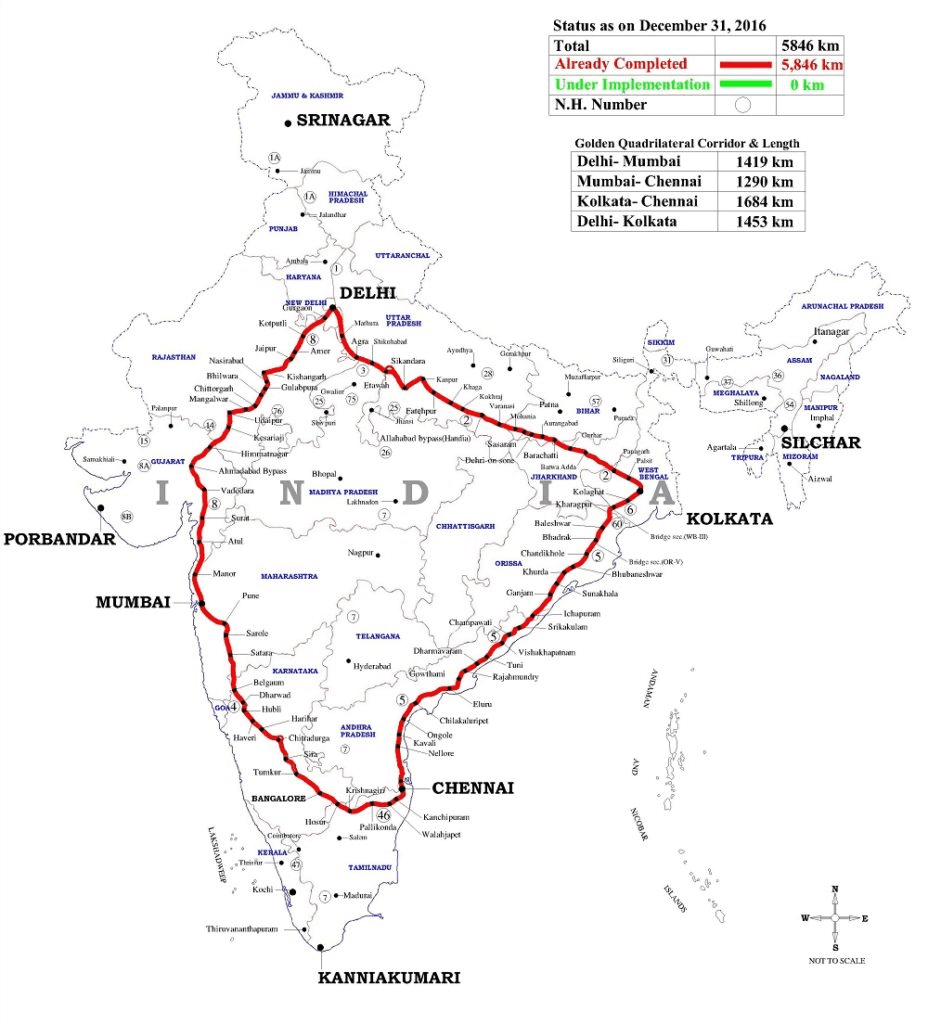

In true hockey stick fashion, the GDP doubled from 2000 to 2006, as India became a close to $1Tn economy. Enabled by the building of physical infrastructure, the hallmark of this transformation was the Golden Quadrilateral.

The physical “rails” would become the nervous system for the movement of goods and services. But as the economy exploded in every manner, the flipside of growth began to rear its head.

Inequality widened, the wealth of the richest expanded significantly. India suddenly had a challenge to ensure its most vulnerable are not left behind.

Growth shaped the agenda, and would become the surprising reason for birthing India’s “digital rails”.

As governments changed and India entered 2006-7, “financial inclusion” became a key unifying plank across the board. The immediate goal to begin with was the provide every Indian with access to credit.

India rapidly ramped up bank branches and ATMs. From 65K branches and ATMs, the number almost tripled to 150K as India exited the financial crisis of 2008.

In tandem, India finally ended up launching the MNREGA scheme, another massive move in the direction of financial inclusion. MNREGA would provide direct deposits for ensuring rural livelihood.

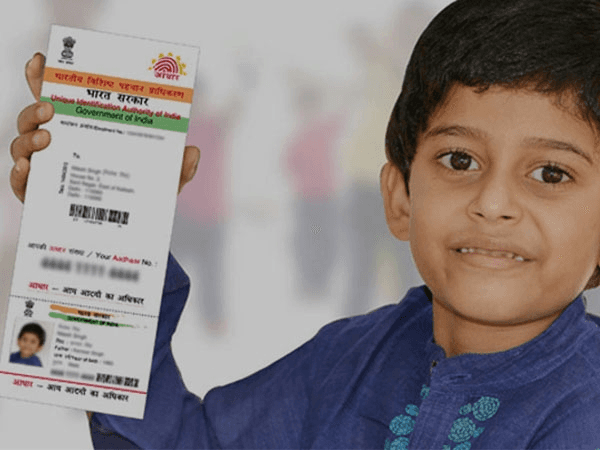

One massive challenge was to establish the identity of the owners of these new bank account. In the background, a solution was gathering steam.

The foundation of the India Stack was being set.

If You’re Good at Identification, Do it For Free

In 2009, only one in 5 Indians had a bank account.

Given this backdrop, the government launched an abnormally ambitious project. The goal was to give a digital identity to Indians, a country that was yet to develop.

This project would be called Aadhar.

As is with such large projects, Aadhar was met with widespread scepticism and criticism. A vocal group believed that executing a project of such magnitude was impossible. Another group believed that privacy was going to be a myth.

As UIDAI was established in 2009, it began the project in earnest.

At the time, just 5% of India had the internet and just 20% had a bank account. The gargantuan task ahead of the team was to digitize and identify such a large population. Undeterred, the UIDAI went about recruiting personnel and partnering with large firms such as SBI.

In 2011, 40,000 people were employed. By 2012, Aadhar began to be linked with direct benefits, and the government support enabled distribution.

Just like a budding startup, Aadhar used a variety of hooks to get the job done. Enrolment grew from 42L in 2010 to 30Cr in 2013, an enormous 100x increase.

The UIDAI would also be a jumping board for the foundation of iSpirit, which would start to attract talented volunteers enabling India to become digital.

Soon enough, the technical wonks of the programme began to think of what more could be done.

As Aadhar rocketed even further, reaching the psychological mark of 100Cr in 2015, India began to think of it as the first piece of the digital puzzle.

With identity solved, a wide variety of applications could be built on it. The most straightforward use case was KYC, or knowing your customer. In tandem, an Open API policy was conceived in 2015, at a time when even the most seasoned technical founder was still figuring it out.

The farsightedness of a government in enabling such a foundation would reverberate for years to come.

The India Stack was born

Let the India Stack Games Begin

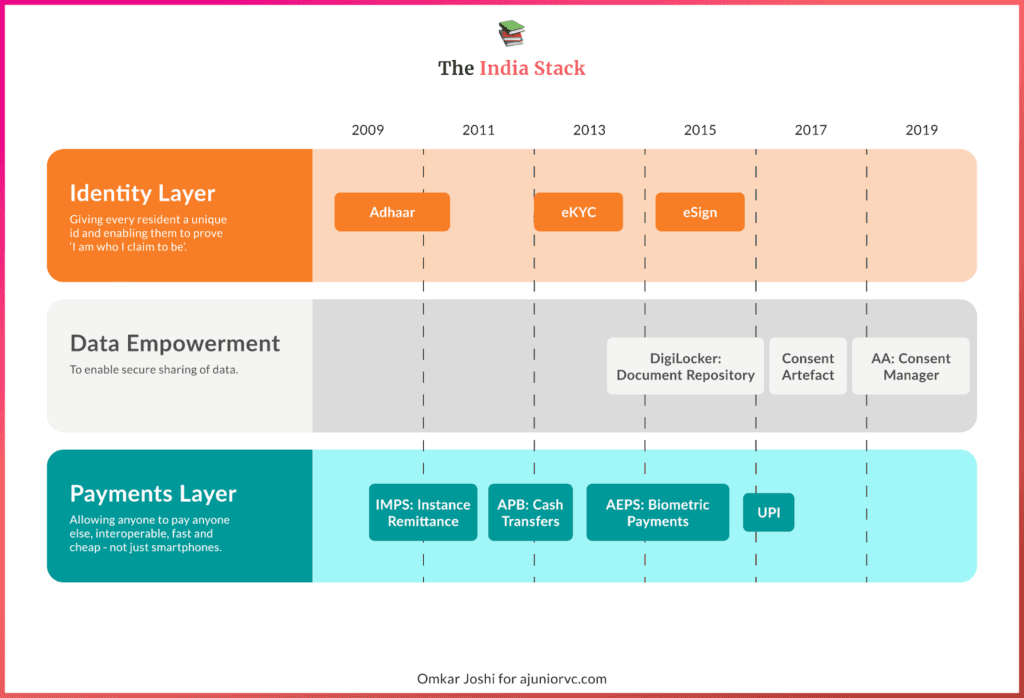

India Stack would be envisioned as a collection of APIs.

These would be of different technologies starting first with identity verification and signing digital documents.

It was only logical since any transaction starts with having an identity, verifying that identity and then using that identity to enter into contracts. All these operations need to be digitally native.

Correspondingly, the first layer of IndiaStack was the identity layer of which includes Aadhar, eKYC and eSign.

After verification of Identity, the next step that IndiaStack approached was ensuring seamless instant payments for all Indians at a low cost.

As compared to the Western nations, the Indian banking system was technologically superior.

By 2015, the country already had a payment system that provided facilities of instant clearing as well as settlement. Known as Immediate Payment Systems (IMPS), this was present with other payment systems such as the National Electronic Funds Transfer (NEFT) and the Real Time Gross Settlement (RTGS).

However, for low-value transactions the IMPS was the only real time payment and clearing system.

Moreover, for making a P2P payment a customer had to log in to the internet banking portal with their username and password. This allowed the customer/app to have unparalled access to the banking services which could be potentially misused.

The banking regulator was not keen to enable regulations that allowed non-banking entities to have unrestricted access to the complete banking functions. At the same point of time, there was also a need to provide the modern consumer with an interface that would be easy to use, easy to understand especially for the purpose of digital payments.

P2P digital payments would be initiated by a user multiple times in a day and hence the user-friendliness of the application was paramount.

At this point in time, the banking regulator had already provided licenses for startups such as PayTM to enable wallets.

In a wallet, the user would load his money into the wallet which he would transfer to other wallets. The user growth of PayTM and PhonePe proved that startups would be much more capable of converting users into digital natives.

However, the security of the banking system had to be maintained. If only, there was a way to decouple payments from regular internet banking so that a customer could provide authentication only for the solitary purpose of sending/receiving payments.

Enter the UPI piece of India Stack

Payments are Like Gravity, All it Needs is a Push

As a new revolution was taking place with immense fanfare in Dec 2015, Jio would overshadow the quiet launch of another quiet change.

The UPI system launched in April 2016 was a 5 party P2P transaction system based on the IMPS payments network.

The 5 parties here would be the UPI app of the sender, the sender’s bank, the receiver’s bank, the UPI app of the receiver. The NPCI, or National Payments Corporation of India server coordinated among all 4 parties.

This 4 party system freed up the consumer from the design limitations of the traditional banking services.

These financial rails would unlock and enable anyone to start a payments service, not limited to banks.

Suddenly, the consumer had access to the UI/UX of specialized firms such as PayTM, PhonePe, GPay, WhatsappPay. This allowed consumer-facing firms to innovate on the design and the features while freeing them of the necessity to build the payment backend.

All that any firm had to do was to use the API standard openly available, register with the regulator and they could access the domestic payment network

The acid test for UPI came in Nov 2016, when the country announced the demonetization of currency notes overnight. Citizens had to use online payment networks to transfer money for the usage of goods and services.

The first reference implementation of UPI, the BHIM or Bharat Interface for Money was launched in December 2016 to alleviate the cash shortage and provide the citizens to provide payment services.

In addition to the above forces, the advent of Reliance Jio and its cheap and fast data plans played their part in the popularization of digital payments.

The speed of the network meant that users would be able to download the apps from the app store. There would be much fewer abandoned transactions due to a lack of speed on the user's mobile device.

The biggest hook for India Stack had taken off.

All these changes meant that digital payments in the country were sitting on a cusp of change, all ready for a breakout.

We All Wear Aggregator Masks

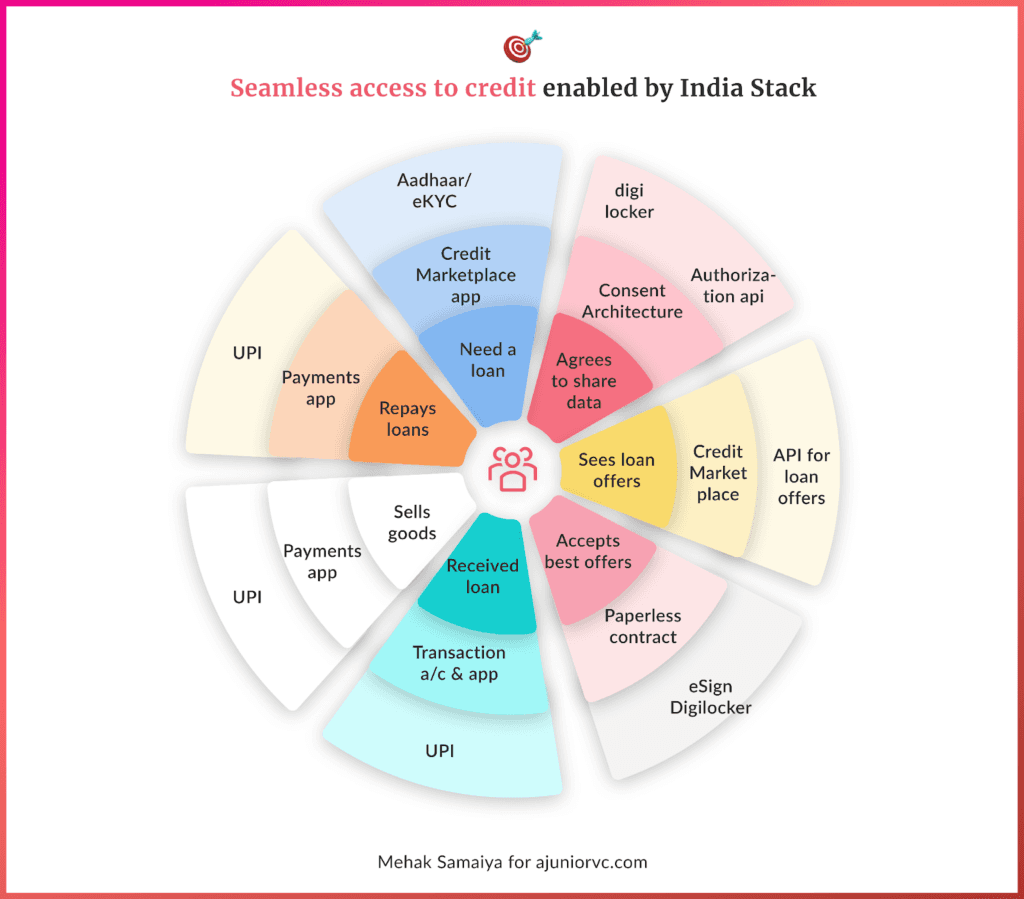

With the second layer of the IndiaStack complete, the focus shifted to the third layer of IndiaStack which enables secure sharing of data by users.

In this world where data is oil, individuals ought to have full control of their data. Under the premise that individuals are the eight judges of the “right” uses of their data, the Data Empowerment and Protection Architecture were launched in 2017.

This problem was more important for Indians as unlike Western countries they are “data-rich” even before they are “economically rich” .

For Indians, economic prosperity could be possible if they get the benefits of the data they are generating in their interaction with the umpteen digital services they are using.

The Account aggregator is the first implementation of a “consent artefact” as defined in the DEPA Act. In common language, a consent artefact is an entity that records and stores the consent given by the user. This consent is given to any firms/services which require the user data to provide a service that makes the individual better off.

The account aggregator is the first implementation of this consent artefact which maintains the history of the consent given by the user to share his financial data. Subsequent consent artefacts are planned for use-cases such as health (PHR)

The account aggregator is an entity regulated by the central bank which acts as a bridge sharing the financial details of the individual with the Financial Information User (FIU) such as a loan provider, expense management or a wealth management app. The data is provided by the Financial Institutions with which the user has a current financial relationship, such as his bank, mutual fund, depository account, broker.

However, the AA stores only the consent of the user and is never able to “see” the user data

The implementation of the AA system has the potential to provide a sharp fall in the costs of processing as well as monitoring loans. Timely authenticated updates from the FIPs based on the user consent can bring tremendous efficiencies in the loan disbursal process.

These efficiencies could make it economically viable for a lender to provide loans of smaller ticket sizes. Just like UPI did for micro-payments, AAs could do for micro-loans.

Just like a large use case for the blockchain, these could enable credit like never before.

The large processing costs mean that only loans of larger ticket sizes were financially viable for banks which leads to a large section of the population being denied access to financial services.

More importantly, the implementation of the consent artefact sets a practice where an individual can demand access to his data stored in silos of private firms.

In a hat tip to the erstwhile leaders championing financial inclusion, this could enable widespread loans.

The enablement of a system that allows such sharing is likely to upgrade our thought process regarding sharing data stored inside the walled gardens of tech firms.

By 2018, India was suddenly a financial revolutionary, unlike anything the world had seen.

India is the Hero that the World Deserves

10 years after the launch of Aadhar as a project, the India Stack was beginning to be hailed as an early model of digital success.

Just like the physical rails in the early 2000s, it was sound economic logic that financial infrastructure was to be created by the government.

Infrastructure improved the quality of life, generally had a long gestation period, was risky, and the benefits accrue to the entire society. For long, the western economies and China focused on government spending on physical infrastructure.

One could can argue that their economic prosperity was precluded by their substantial infra investments. However, for some reason, there was a complete lack of effort by the same countries in creating public digital infrastructure.

In the absence of government intervention, digital infrastructure was outsourced to private megacorporations such as Google/FB. These corporations adopted a walled-garden approach to the data stored inside their systems as their business model was dependent on successful data monetization.

It was no surprise that the western approach to banking innovation centered on blockchain and DeFi which leads to the creation of a walled garden in which the individual user suffers the most problems.

The IndiaStack experiment was is the first and probably the only example worldwide where Government entities created digital public goods. It is no wonder that this approach finds a lot of praise worldwide.

In 2019, India would become one of the founding members of the DPGA alliance which aimed to promote the creation of digital public goods for countries across the globe.

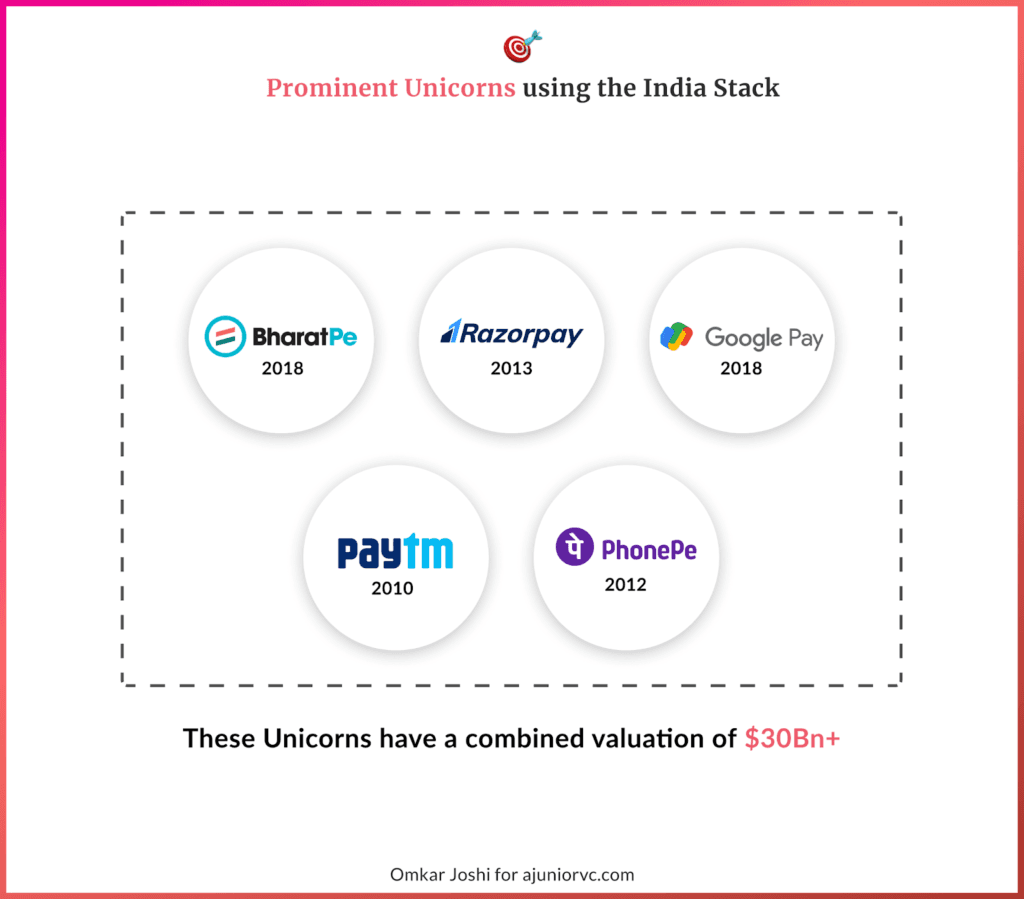

The open framework and rails provided by the India stack would end up giving Indian startups all the firepower they needed. Not requiring to build deeply expensive digital infrastructure, the India stack enabled the creation of fast growing Indian unicorns.

These could be built rapidly without deep capital investments, very much how Amazon had built the digital infrastructure for web services, or physical infrastructure for e-commerce services.

BharatPe, RazorPay, PayTm and PhonePe would explode, primarily using the payments rails provided by UPI.

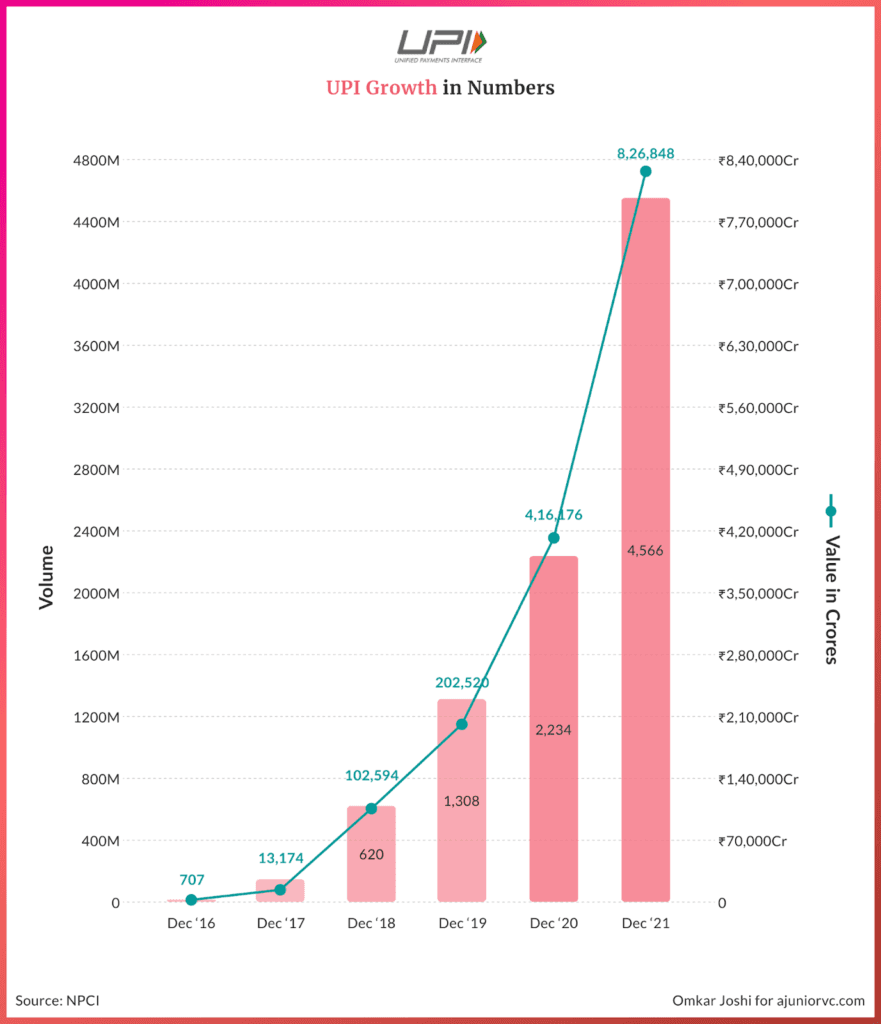

As we entered 2020, UPI began to show its massive promise.

UPI is What the World Needs it to Be

The ease of access in integrating with UPI played a major part in the blossoming of the Fintech startup industry.

Unlike western countries, a fintech startup in India did not have to reinvent the wheel when it came to develop the backend for payments to other parties. All they had to do was to integrate with the APIs and voila, they were able to transfer money. This led to almost instant traction.

UPI transaction numbers grew by leaps and bounds and the number of startups integrating with UPI also grew.

With the Covid-19 pandemic, handling cash became a health hazard for citizens. It should come as no surprise that post Covid-19, the usage of UPI reached stratospheric levels

The success of the UPI payments network meant that the Government also got into the act

Way back in 2014-15 it had already started a mission to provide every citizen with a bank account. The Pradhan Mantri Jan Dhan Yojana (PMJDY) along with a focus on JAM (JanDhan, Aadhar, Mobile) meant that subsidies could be directly transferred to the beneficiaries' bank accounts. Christened as the DBT (Direct Benefit Transfer), this policy used Aadhar Payment Bridge (APB) to electronically transfer Government subsidies and benefits into the aadhar linked bank accounts of the intended beneficiaries.

Continuing with its overall focus on financial inclusion, especially for the people at the bottom of the pyramid, the NPCI started with the Aadhar enabled Payment System (AePS).

AePS allows for online interoperable financial inclusion transactions at PoS (MicroATM) at any point of the country through the Business correspondent of any bank. The customer identified herself through the Aadhar authentication procedure (fingerprint/OTP on linked mobile). To undertake such transactions, the customer only needs to know the bank name, provide their aadhar number and their fingerprint.

By early 2021, IndiaStack also added the Open Credit Enablement Network (OCEN). This would creates a system where newer players (chiefly digital platforms) are able to play roles in the lending value chain.

For example, restaurants who are listed on Swiggy/Zomato could share their data with lending Financial Institutions. The OCEN system allowed the creation of a new entity named as Loan Service Provider (Swiggy) which acted as an agent of the borrower and enabled the borrower to access loans at a cheaper rate of credit

By 2022, India Stack was a leading light in financial infrastructure. India was clearly a giant, leaps an bounds ahead of every competing country in digital transaction volume. It was 2x China and almost 10x the US.

But just as with growth, the rapid adoption would also mean some misses.

You Die a Hero or Live Long Enough to Be a Privacy Villain

Every technology has its upside and downside, but the Public Digital Infrastructure is the closest to decentralized and interoperable building block to inclusive innovation.

The government built the infrastructure, not products or solutions, and made the world build applications on it.

When the iPhone was first released in 2008, only 17% of Indians had a bank account. We were at a lower spectrum by world standards. But by 2018, 80% of Indian adults had a bank account, and we leapfrogged decades.

What would have taken 46 years had taken about seven years of inclusion. The Indian government, regulators, private firms and ambitious individuals had built the largest public infrastructure project ever and took only six years.

As is with higher upside, we’d see a downside as well – slow processes, failure rates, and data leaks.

While building the infrastructure solves the problem, we have not built systems to maintain and run. Changes on the Aadhar take more than a week, that too has to be manual. The ability to run such large systems should be digitalized on tech channels.

The government should not leave behind the momentum of their technology being built.

Alongside, there have been high failure rates for applications built on the UPI, and the infra has little to no control to manage the failure rates. If the infra could support the payments systems, they may in the future figure out a process to reduce the failure rates.

Not a failure of the technology, but rather of the business behind it . Ever since the government has made it free of transaction for peer-to-peer and peer-to-merchant fees on UPI, it has cost the banks and payment companies quite a sum of money.

The government had to approve over 2000 crores for the FY 2022-23 for the banks which the government had made the MDR to zero in December 2019.

It would make more sense to do business for the banks only when they start monetizing on the credit products in the future.

The other challenge is maintaining data quality. Aadhar and data leaks go in history, there have been many, with the recent one of 300,000 Aadhar leaked directly from the government website.

Although we have realized much of the problems have been around operations, technology, and the business, some of the problems are bigger than that people seldom seem to realize.

Despite India Stack’s major challenges, there is a rainbow that beckons upon India and the future is ready for it.

Foundation Gives You Great Fintech Power

More than anything, the India Stack is taking control of our own hands.

It is a way to allow the big techs to participate in digital India, but not give control. As recently during the Russian-Ukraine war, it has been shown that tech firms can pull the plug on nations' wages by backing off. GooglePay and ApplePay could shut operations in any country.

But the founders of digital identity believed in infrastructure to be built on open-source networks, allowing the free market to prevail.

Payment applications built on UPI rails showcase that the ball is in our court. No payment company has control of the stack, they are only enablers.

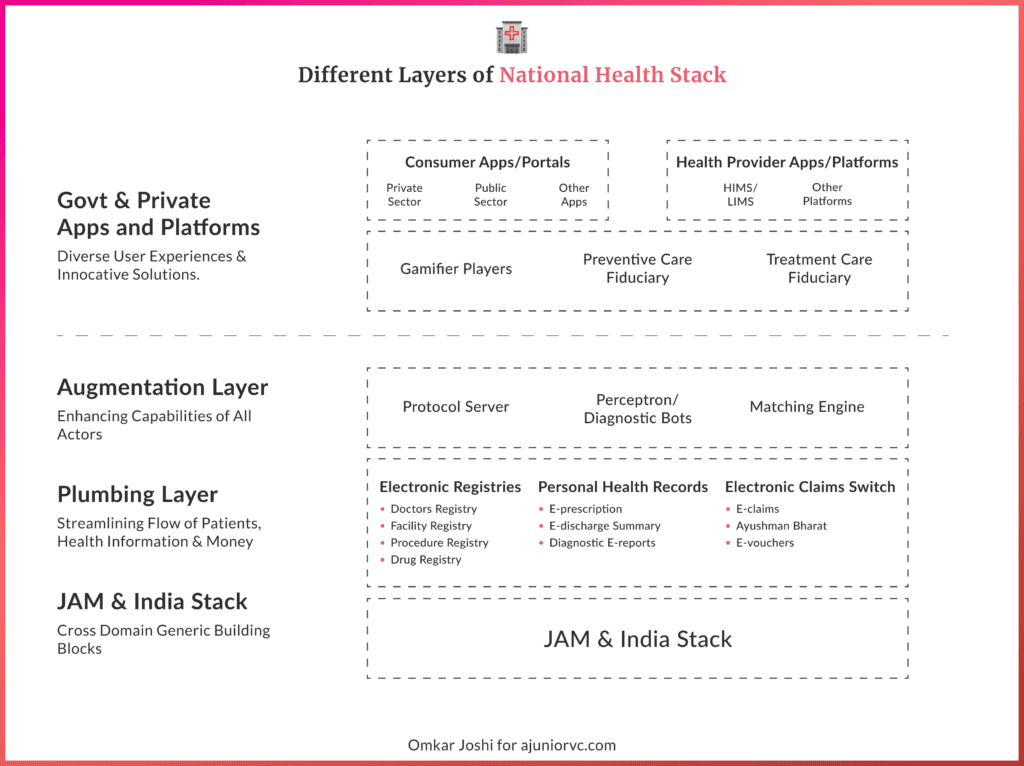

The next leg includes pursuing the same in other domains such as health and commerce.

The Health Stack is designed to bring a holistic view across multiple health verticals and enable the rapid creation of diverse solutions in health.

The scope of the National Health Stack includes integrating bring the inclusion of the Private Hospitals and Private Practitioners into the Primary and Secondary healthcare ecosystem.

More than 700MM rural people are believed to befit directly via inclusion.

The health scheme that would include are Non-Communicable Diseases (NCD); Disease Surveillance; Health Schemes Management Systems; Nutrition Management; School Health Schemes; Emergency Management; e-Learning Platform for health, LMS, Telehealth, Tele-radiology; Diagnostic Equipment; Health Call Centres.

We have got enough praise from world leaders to showcase the direction that India is moving on essentially. Much of America has not seen affordable health care.

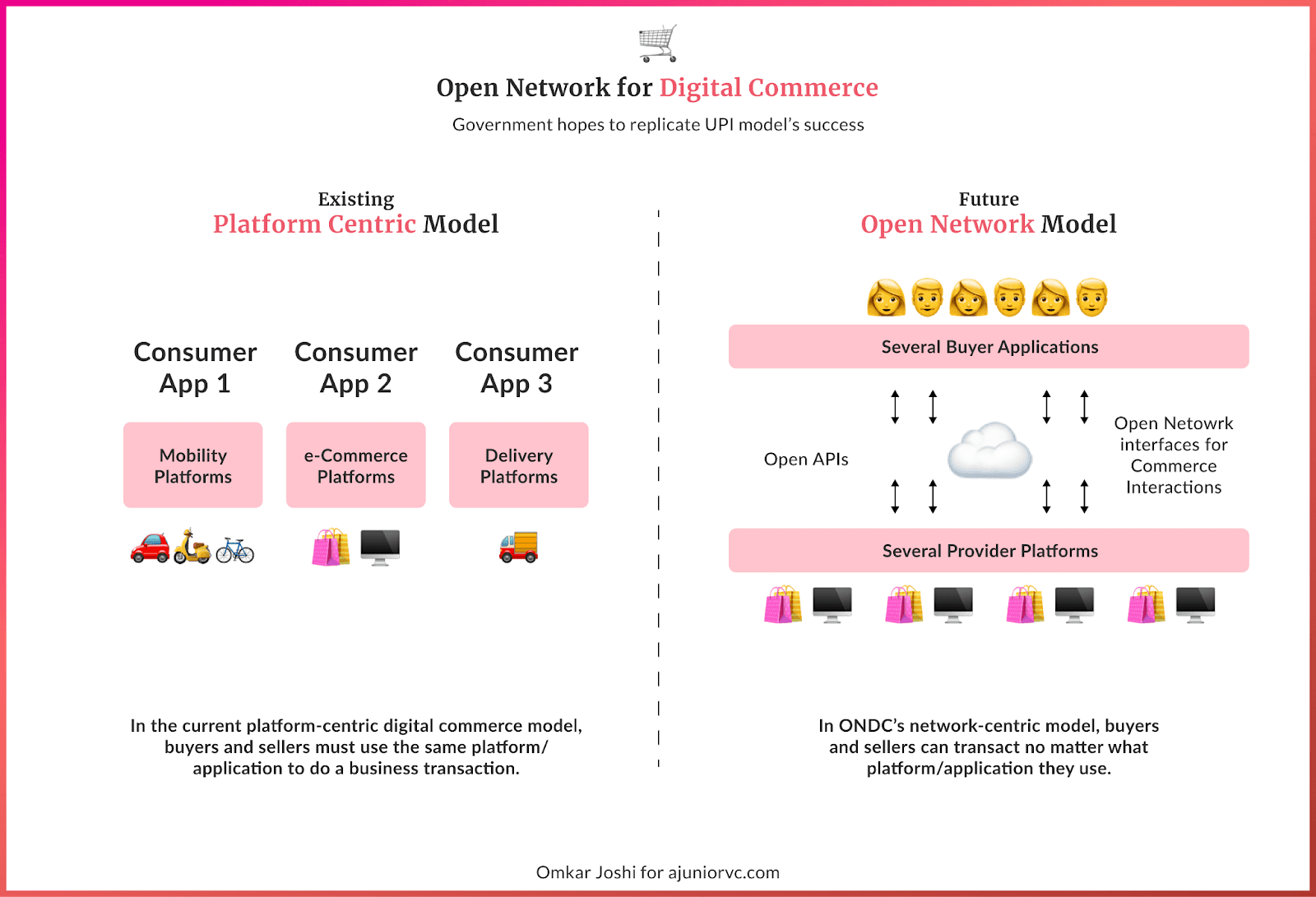

The same open network methodology could also apply to commerce.

The value unlocking for users is the availability of choice, unified experience of and ease of use, high levels of trust on various websites, and transparency of the sellers.

Only 9% of Indian retailers and MSMEs had taken their commerce online until 2020.

If one country can export in masses, in a decentralized and democratized manner, it’s India, and ONDC would propel it.

Again making it fair and not letting the big techs monopolize the Indian markets provides the SMEs a fair chance to thrive and eventually export to the neighboring nations.

As we expand the commerce, the success of UPI would be replicated overseas in masses.

America's private players took VISA and Mastercard to the world, India's government, regulators, and open APIs would be taken to the world.

Thereby making foreign exchange an archaic terminology, as we all would be transacting seamlessly on the same infrastructure, and would make for conversion of currencies interoperable and seamless.

We might well see India’s biggest export be the UPI in the next few years. UPI credit would open doors, thereby increasing the credit lines of millions of India, pushing the economy.

The rails created by the India stack has set the foundation for Indian fintech innovation. India raised a record breaking $8Bn for fintech in the last year. This infrastructure has a lot to do with that.

India has already become a global leader in digital finance. As the world wakes up to the possibilities, India already has the foundation to enable financial products like insurance, credit, payments and deposits.

The digital railroads provided by the India Stack put India in a strong position to become a global fintech giant.