Dec 11, 2022

Can IndiGo Turnaround in Indian Airline Turbulence?

Profile

Airlines

Brand

IPO

B2C

Transportation

Last fortnight, Tata announced the acquisition of Vistara, as IndiGo reported an expanded loss of 1,600 Crore in a rapidly growing airline market

The Joy of Starting to Fly

Air travel ran in Rahul Bhatia’s blood.

His father, Kapil Bhatia, was a sales manager of the International Air Transport Association (IATA) agency. In 1964, Kapil started an airline agency Delhi Express Travels, grew it to become a group of travel-related organizations and served as its Managing Director for 25 years.

Eventually, he fell out with his partners, and Kapil had to start all over.

By this time, Rahul had returned to India from Canada and had initially planned to set up a telecom venture. When that plan did not materialize, he continued the tradition and joined the family business.

Rahul Bhatia established InterGlobe Enterprises with a small core team in 1989 to venture into travel businesses. Under the umbrella, InterGlobe Air Transport served as a General Sales Agent (GSA) or a ticketing partner for many airlines.

In a few years post-launch, InterGlobe Air Transport spread its wings to reach for global ambitions. By 1995, it had offices in London and subsequently became the sales agent in India for international airlines such as Delta, Virgin Atlantic and China Eastern Airlines.

The same year, Air Corporation Act allowed private operators to take to the skies. Till then, Government controlled Air India, and Indian Airlines were the only airlines operating in India.

Jet Airways and Air Sahara started in 1994, and Air Deccan entered the space in 2003, post-liberalising the sector.

With rising demand for business and leisure travel propelled by healthy GDP growth, Air Deccan set out to make air travel affordable for the masses.

Popularized by airlines such as Ryanair in Europe and Southwest in the US, they operated on a ‘low-cost model. This entailed eliminating the ‘frills’ associated with flying - they cut out free food, water, and entertainment and only focused on providing point-to-point travel at never-before prices.

In 2005, InterGlobe Enterprises expanded to the travel commerce domain and set up InterGlobe Technology Quotient.

With travel bookings gradually moving online, they provided vast inventory options and data intelligence to travel agents. They also started to venture into e-ticketing, real-time flight information, and other back-office services.

However, along with helping to sell tickets, something else was brewing

Go IndiGo

InterGlobe wanted to take off, literally

In 2005, they placed an order for 100 A320 aircraft worth over USD 6 billion - the biggest order in Airbus history.

InterGlobe Aviation was born, and the airline was called IndiGo.

Rahul Bhatia’s co-pilot on the IndiGo venture was Rakesh Gangwal, his friend and a seasoned airline executive whom Rahul had met in the US.

Rakesh pursued a career in the aviation business from the 1980s. He went on to be the CEO of the US Airways Group and later worked at United Airlines in strategic planning.

IndiGo was a joint venture with InterGlobe owning a 51% stake and Rakesh’s Virginia-based Caelum Investments owning about 48%.

While Rahul set the vision and helped navigate the regulatory environment, Rakesh was the silent implementer and negotiator. He leveraged his US airline experience to squeeze out margins in the most competitive times and convinced Airbus to sign a big order with a company that hadn't yet taken flight.

IndiGo received delivery of its first aircraft in July 2006. While they were ready to take off, the actual test of persistence in a high-mortality airline business was about to begin.

On 4th August 2006, the airline operated its first flight from New Delhi to Imphal via Guwahati. This flight turned out to be the first of many over the years.

By the end of 2006, the airline had six aircraft and added nine more to the fleet in 2007.

In a tough aviation market populated by price-sensitive customers, high fuel prices and taxation, IndiGo was beginning to define a niche.

Along with IndiGo, Spicejet and GoAir also started operations around this time. This increased competition in the skies and compelled these low cost carriers (LCCs) to deepen their focus on cost and efficiency.

However, the Indian airspace was not without airlines providing premium, full service too. Paramount Airways and Kingfisher also started operations in 2005.

This massive influx of seat capacity brought down fares and converted many train and bus passengers to air travelers, increasing the frequency of air travel.

Over the next ten years, the combined fleet of scheduled flights (excluding charters) increased from 162 to 402 and the number of departures grew 2.7 times!

Despite the growing competition, IndiGo continued to grow and gain market share.

The airline focused on on-time performance, low fares driven by low operating costs and network growth. It was picking up new planes and gradually outpacing the other startups.

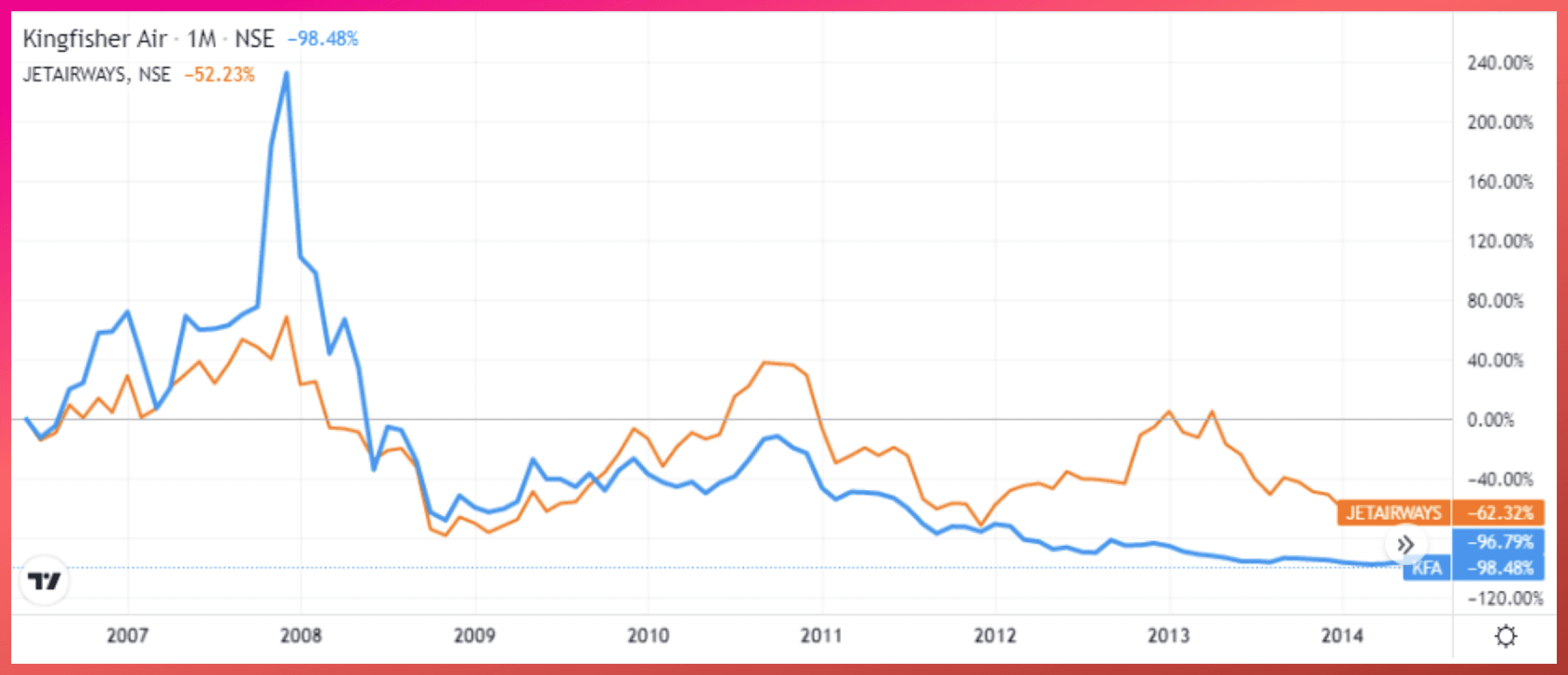

While the airlines invested in ramping up capacity, the recession of 2008 exacerbated the prevailing challenges of the sector. Combined with rising fuel costs, airport charges and taxes, the seat addition grew faster than the demand resulting in lower-than-breakeven occupancy.

Moreover, the entry of multiple airlines had already resulted in price wars between carriers.

In 2008-09, the industry carried losses of close to Rs.10,000 crore with Air India, Kingfisher and Jet Airways carrying debt of Rs. 30,000 crore on their books.

By this time the sector had also seen some consolidation. Jet merged with Sahara, Kingfisher took over Air Deccan and Air India combined with Indian Indian Airlines. These mergers, however, did not resolve the airlines’ troubles.

By 2013, Kingfisher, Air Deccan (now Kingfisher Red) and Paramount had been grounded. While the Government continued to bail out the national carriers, they also eased some norms and allowed foreign direct investment that proved to be a breather for Jet Airways.

The dynamics were shifting towards the LCCs, airlines with tight control over costs and focused on efficiencies. While the full-service carriers had started operating low-cost subsidiaries, this wasn’t sufficient for long-term survival.

While all the pack of airlines fell, IndiGo was flying at a different altitude.

In 2011, the airline ordered another 180 Airbus aircraft with USD 15 billion. After five years of operation, they also acquired the rights to fly international routes.

They were most definitely at cruising altitude.

Fly Smarter than Other Airlines

IndiGo’s ability to emerge unaffected amidst the wreckage and prosper among the troubles seems to have little to do with chance.

In addition to increasing market share, IndiGo was what most airlines were not. Profitable.

According to some reports, IndiGo’s net profit grew more than five times to Rs. 550 crore in 2009-10. With 7-8% of the market seat capacity, IndiGo had 16.4% revenue share.

This spoke of highly efficient operations. The aircraft had a 80% load factor - the percentage of occupied capacity - across all routes.

The airline also used other levers that made it truly low-cost.

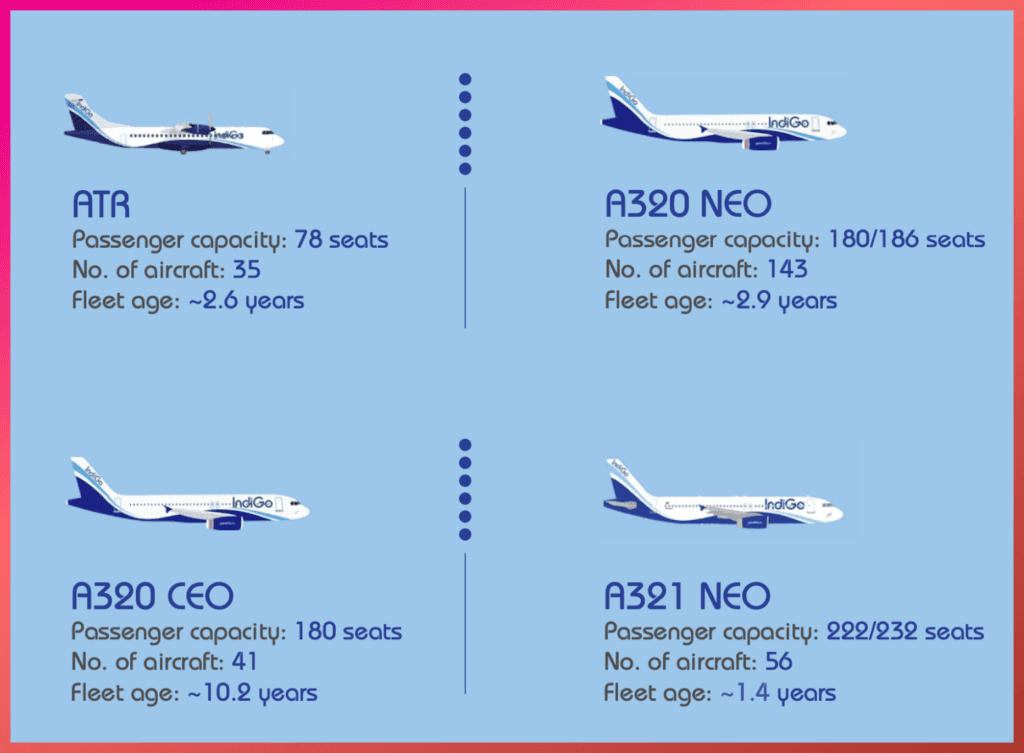

The single-model fleet of only Airbus A320 aircraft required less variety in engineering and maintenance staff resulting in the higher machine and staff utilization.

Moreover, the IndiGo fleet consisted of new, fuel-efficient aircraft with contracts on engine repairs and warranties that further drove down maintenance costs. According to some estimates, IndiGo’s maintenance cost per unit was ~15% of that for Jet Airways.

Fuel efficiencies are also gained from flying the aircraft's light - no fancy cutlery or heating equipment on board, strict policy on free luggage - and optimizing fuel usage during taxing and flying.

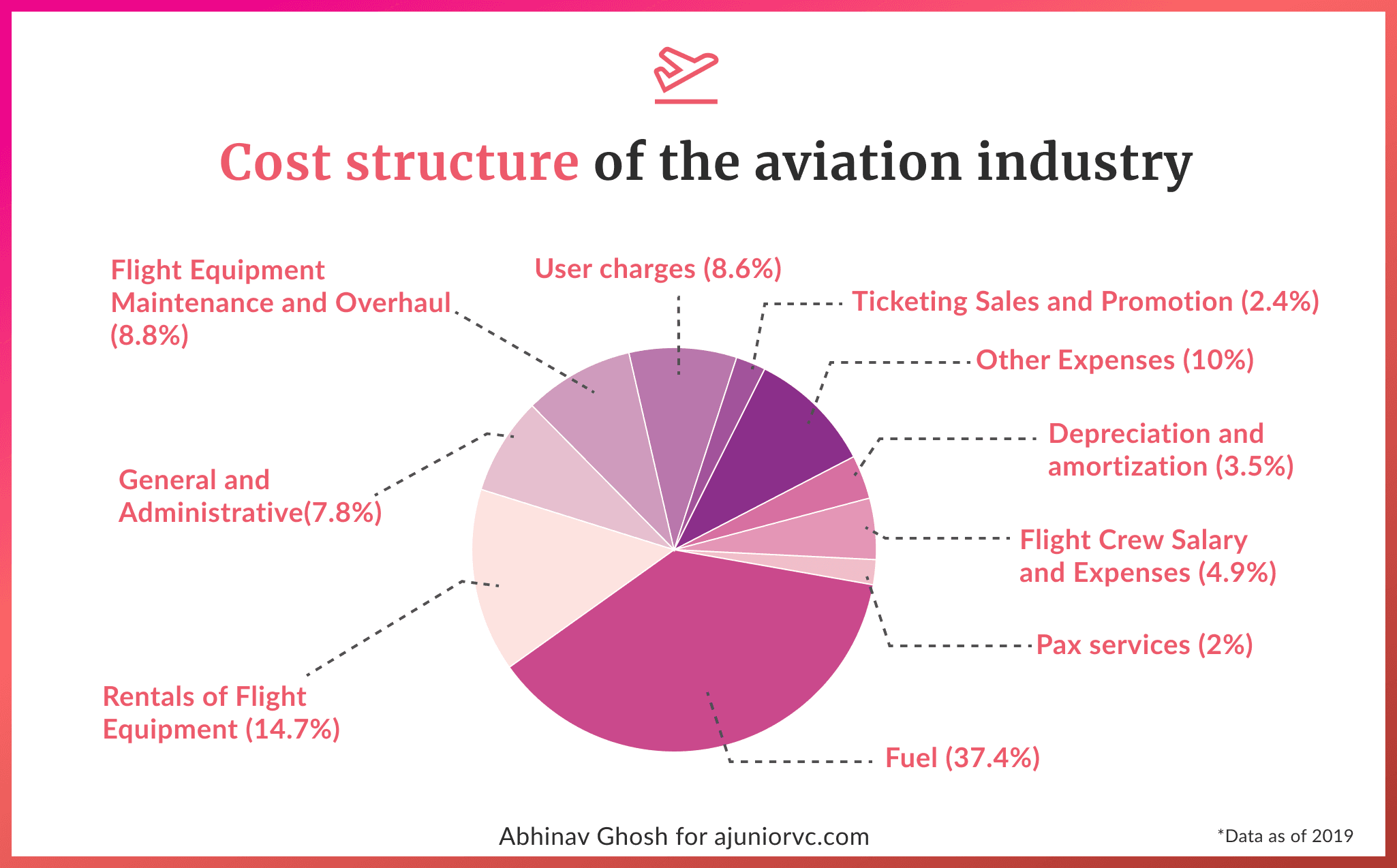

The small changes lead to big savings considering fuel is usually about 40% of operating cost.

The airline also derived low-cost efficiencies from route planning and aircraft utilization. It flew to fewer destinations with higher frequency and added routes only when aircraft utilization made economic sense.

For instance, IndiGo’s aircrafts flew an average of 11.5 hours a day, compared to an average of 8-10 hours for the industry. They flew simple point-to-point routes where the aircrafts would turn around quickly and spend minimum time standing at an airport - about 25 to 30 mins!

To stay consistent with these efficiency measures, IndiGo avoided inking any codeshare agreements that might result in delays or inefficiencies from other airlines.

Apart from efficient operations, analysts believed that IndiGo’s profits came from the company’s sale-and-lease-back agreements. Once delivered, the aircraft was sold to a leasing company at a markup.

It then leases the aircraft for a five to eight years, thus reducing debt and tax liability as the lease paid is an operating cost. Ownership is transferred back to the lessor at the end of the lease period.

While this model may not contribute to all of IndiGo’s profits, it is surely a cherry on top of the operating model.

More importantly, IndiGo created a 6E edge over its rivals. Using provocative messaging, tongue in cheek marketing and a cool vibe, it felt premium despite being a low cost airline.

The LCC strategy has also proven to have more than just low-cost benefits for the airline.

In the face of intense competition and over-capacity, the ability of airlines to command a premium for frills that customers less value decreases significantly.

Moreover, consistently doing the simple things right - on time, reliable service - efficient operations might led to higher pricing power and market share.

IndiGo was truly beginning to take flight.

Your Low-Cost Palace in the Sky

IndiGo’s mantra of ‘Being on time is beautiful’ and ‘Low fares don’t mean low quality assisted it to continue gain market share

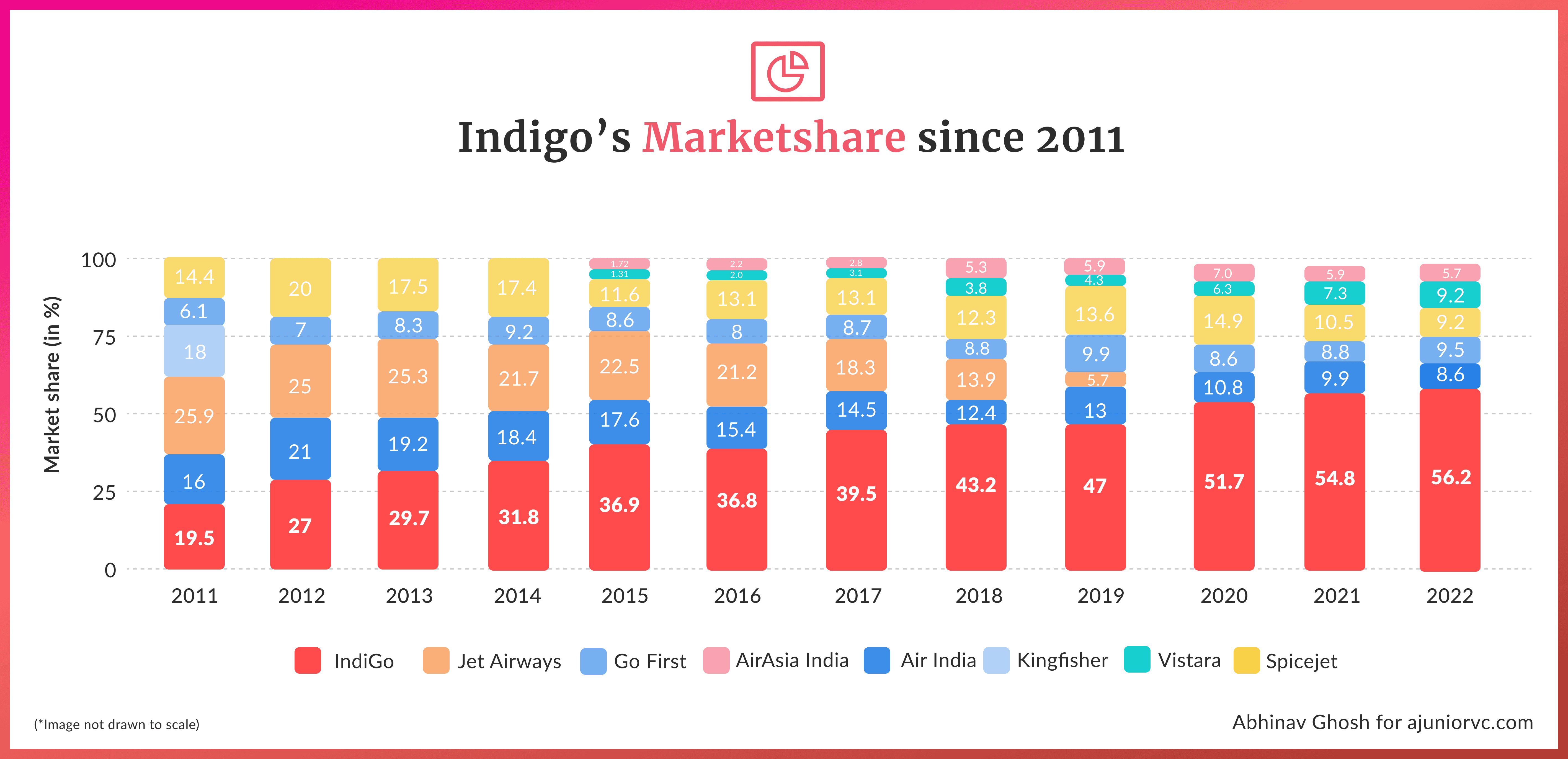

By Dec 2011 it became the second-largest airline carrier in India, overtaking Kingfisher Airlines.

But IndiGo wanted the crown and was not satiated. It kept expanding its fleet and added its 50th Aircraft by February 2012.

As more planes joined the fleet, low-cost travel became more accessible from new hubs and increased passenger traffic.

This intensified competition for full-service airlines, which were struggling with huge losses. On one hand, Jet Airways and Kingfisher Airlines were cutting down on costs, downsizing fleet size and consolidating businesses to survive. On the other, the government funded Air India’s losses.

The airline sector was bleeding, and it needed a saviour.

As expected, IndiGo surpassed Jet Airways and became the largest Indian carrier by Aug 2012. It did this within six years of operations while continuing its profitable streak for more than four years.

This was a commendable feat in a sector notorious for blow-ups and bankruptcies. It was an incredible feat for such a young organisation.

And as it blitzscaled, IndiGo continued to shatter records. In January 2013, IndiGo became the second-fastest-growing low-cost carrier in Asia, next only to Indonesian airline Lion Air.

In 2015, IndiGo confirmed an order to buy as many as 250 Airbus Group SE A320 neo single-aisle jets worth $26.6 billion at list prices, giving the plane maker its biggest order by volume.

An Indian and not a US or European airline company placed such a huge order was laudatory.

In 2015, IndiGo planned to file for an IPO. Before that, IndiGo had raised external funds in 2005, US $20 Mn to kick off their airline operations.

Since then, because of their unique sale and lease back model of airlines, IndiGo had managed to keep their balance sheet light, attain profitability since third year of Operation and could fund their business through internal cash flows itself.

Interestingly, in 2015, Company paid ~US 160Mn to its promoters. Hence, maximising Company’s value was the prime reason for tapping public markets.

In Oct 2015, IndiGo filed for IPO but the track record of airline segment on Indian bourses had remain poor. Whether it was Jet Airways or Spice Jet, Airline IPOs had hurt investors significantly in the past. IndiGo wanted to restore investor confidence.

IndiGo planned to raise ~US $ 400 Mn (INR 2,500 crore), valuing its company at about US $4 Bn (INR 25,500 crore), whereas its peers, Jet Airways and Spice Jet were valued at US $ 494 Mn (INR 3,200 crore) and US $ 172 Mn (INR 1,100 crore) respectively.

Brokerage houses, trade pundits and research analysts unanimously gave a ‘Thumbs Up’ to IndiGo’s IPO, considering its leadership position, business track record, sector dynamics and reasonable valuation of 12-13 times FY16 earnings multiple.

IndiGo’s IPO received a great response and got oversubscribed by 6x. It also generated listing gains of 12% for investors.

IndiGo became the 4th most punctual airline globally in 2018, hot on the heels of a more than punctual IPO.

Indian People: They Make an Airline

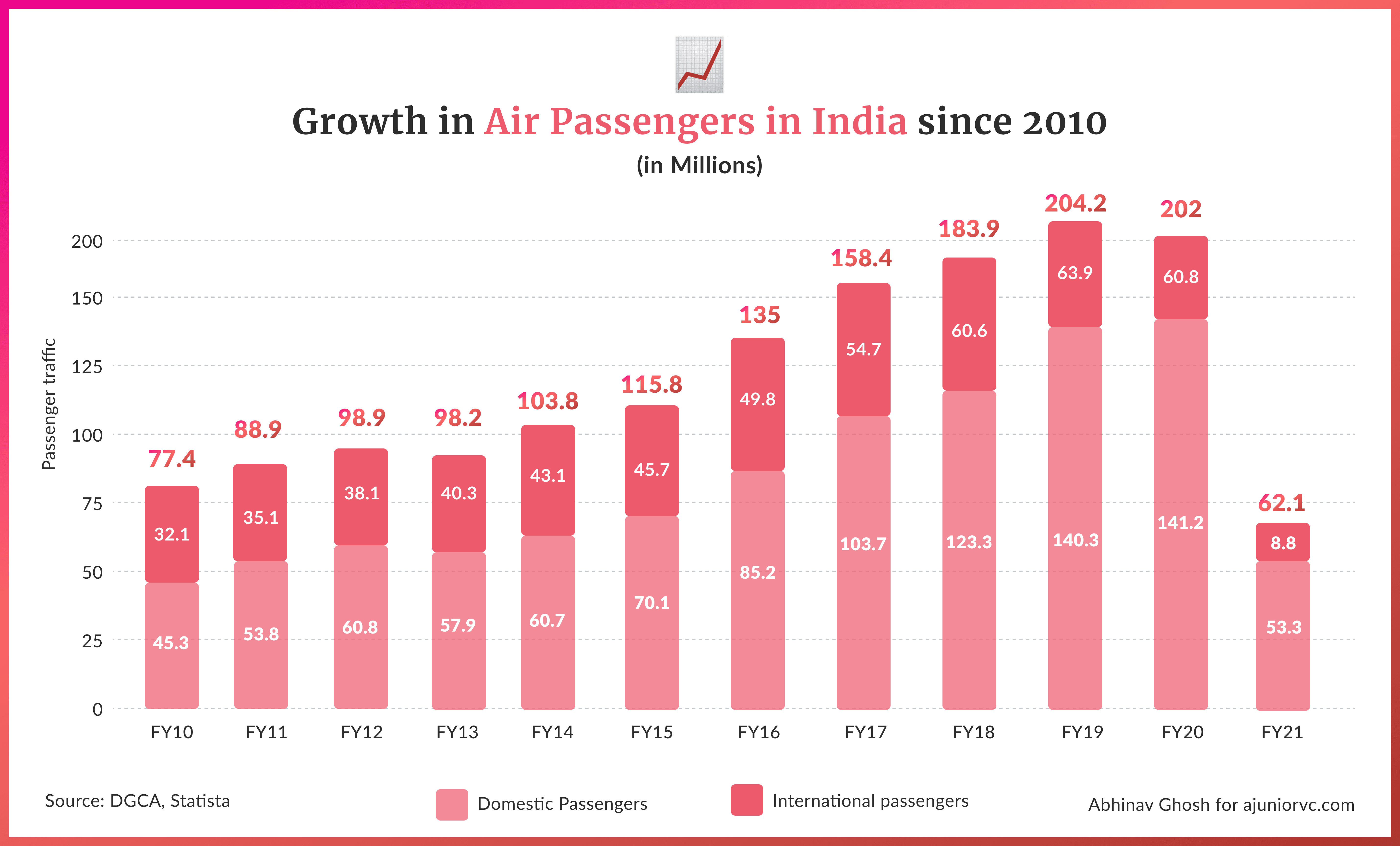

By 2018, India's airline market size was significant and growing

Despite the country's large and rapidly growing population, only 6% of Indians held a passport and just 7.5% of the people traveling by air. This signalled a significant untapped market for air travel in the country.

Several factors drove the growth of the aviation sector in India.

The Indian economy was growing at a decent pace, with real GDP expanding by an average of around 7% per year. This increased the number of people who could afford to travel by air and is likely to continue driving growth in the sector.

IATA expected air passenger numbers from and within India to increase by 3.3 times over the next 20 years. This implies more than 500 million passenger journeys per year.

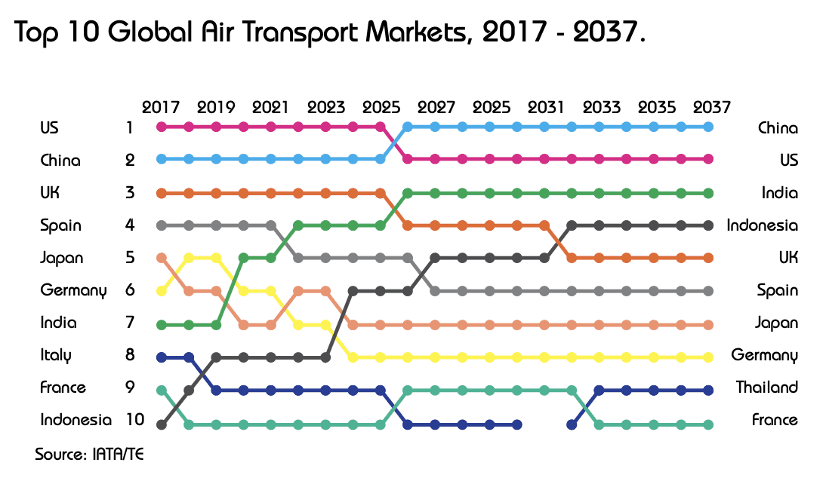

This strong growth outlook for air passenger demand will see India overtake Germany, Japan, Spain, and the UK within the next ten years to become the world’s third-largest air passenger market.

In addition, the Indian government was investing heavily in developing infrastructure, including airports and air traffic control systems. It also announced the regional connectivity scheme - UDAN to propel domestic demand.

Additionally, routes connecting the six metros: Delhi, Mumbai, Bengaluru, Hyderabad, Chennai, and Kolkata accounted for 41.6% of total domestic traffic in FY10.

However, due to the rising demand from non-metro routes, the market share of top six metros fell to under 30% by 2018. Traffic on metro-non-metro routes climbed at an annual rate of over 15% between 2008 and 2018. This growth was nearly twice the 7.7% yearly growth by metro-metro routes, demonstrating the under-penetration and potential of non-metro routes.

People of India have started to travel via air more frequently compared to what it was ten years ago. The sector was about to witness massive growth.

This was the opportunity for aviation sector players to make it big. IndiGo realized its potential and made efforts to be one of the most prominent players in the sector.

True to its motto to provide “low fares, on-time flights, and a courteous and hassle-free service” to customers, IndiGo focused on the service.

All the efforts continued to bear fruit.

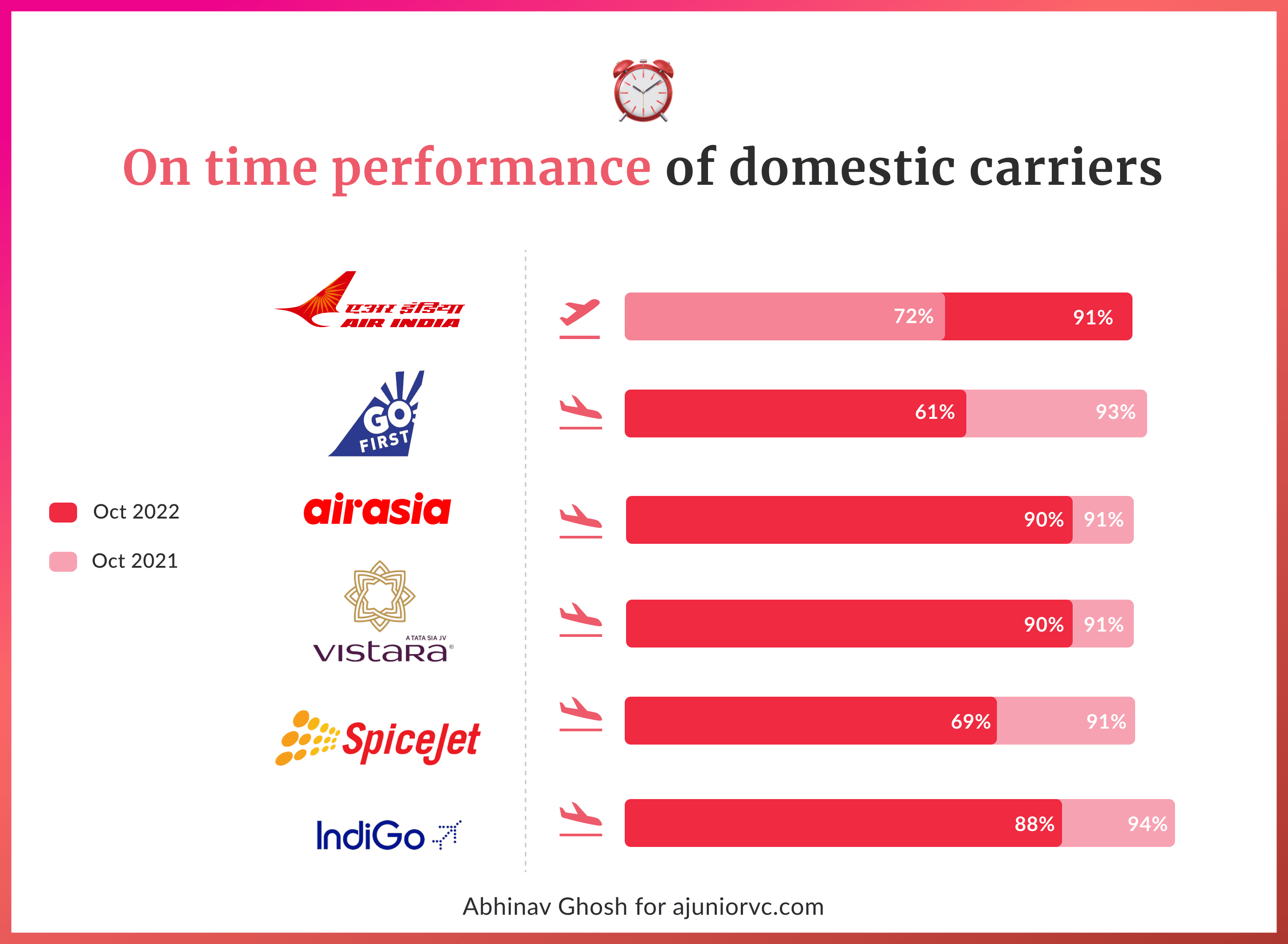

For the second time in a row, in 2018, IndiGo was ranked among the top 20 mega airlines globally in terms of On-Time Performance (OTP), based on data compiled by OAG. IndiGo was also the only Indian airline to make it to the list.

IndiGo was also ranked as the fourth most punctual airline globally in 2018.

This indicated that the company was well-positioned to capitalise on the growing demand for air travel in India and continue to be the market leader in the segment.

It was also making money in the process.

To Fly, to Serve Efficiently

Airlines are a tricky business because they rely on operational efficiency.

Simply put, the fixed cost per flight take-off is exceptionally high.

More than 60% of the cost is allocated to fuel, rentals, overhaul, and crew salaries (including pilots). These costs will not alter significantly whether the flight operates at total or half capacity.

Cutting costs isn't an option for an airline. They must maximise flight utilisation by attracting more customers and optimizing costs.

The importance of unit economics in the airline sector cannot be overlooked.

IndiGo has remained profitable and become the only airline in India to do so by focusing on its unit economics and implementing solutions to improve its operations.

For cost optimization, IndiGo relies on two core factors, focus on the fleet, and flight management and operations.

In 2018, IndiGo placed an order for 300 Airbus A320 aircraft, worth $33 billion, surpassing its record for the most significant aircraft order in Indian aviation history.

This has allowed the airline to negotiate with the carrier, expand its operations and increase its capacity, leading to increased revenue and profitability.

In addition, the re-engineered A320 neo made up 85% of the company’s narrowbody fleet. This is the highest for an Indian carrier with a fleet size of more than 100. IndiGo has India's most fuel-efficient narrowbody fleet.

One key factor in IndiGo's success has been its focus on on-time performance.

The airline has a reputation for being one of the most punctual airlines in India, with over 90% of its flights arriving on time. This has helped the airline maintain customer satisfaction and loyalty, increasing revenue and profitability.

But this has been achieved with the help of discipline maintained by the company regarding flight management and maintenance.

IndiGo has high on-ground efficiency, with a 25-minute turnaround time. It has accomplished this through specific processes like no free meals or picking up the leftovers before the flight lands.

These save time and increase the turnaround time for the aircraft.

As a result, IndiGo has been able to keep aircraft in the air for more than 12 hours a day, one of the highest in the industry. In October 2019, IndiGo became the first Indian airline to operate 1,500 flights daily, which has helped to increase its revenue and profitability further.

IndiGo was smart enough to understand that just reducing costs is not enough. The airline had to find ways to increase revenue too. But rising ticket prices were not an option for them.

To increase revenue, the company focused on increasing ancillary revenue through the services offered. Ancillary revenue includes cargo, ticket modifications, and in-flight sales Ancillary revenue represents a relatively low proportion of the total operating revenue for IndiGo. But the company is focusing on this to increase its share in the revenue.

The contribution of ancillary revenue to total revenue has increased from under 10% in FY 14 to over 15% in FY 19.

Additionally, IndiGo has won the title of the best low-cost airline in Central Asia and India for nine consecutive years until 2018. This has helped to boost its reputation and attract more customers.

The stage was set for IndiGo to take centre stage, be the leading airline in India, and make the best use of the growing market.

As it flew, others began to fold.

Keep Climbing Internationally

In 2019, Jet Airways ceased operations.

That allowed some small players to capture the market, but IndiGo went for the kill. IndiGo started to focus on international destinations.

This was a big driver for Jet Airways, and IndiGo stepped in.

IndiGo, in August 2019, overtook Air India to become the most prominent Indian carrier in terms of international seats deployed.

As much as 30% of IndiGo’s additional seat capacity in the first half of FY20 was for the global market.

In 2020, IndiGo moved from flying only narrow-bodied aircraft on international routes to inducting wide-bodied aircraft. One would see more mid-haul flights from the IndiGo airlines.

This helped IndiGo gain market share in the global markets

To retain its #1 market share in the domestic market, IndiGo focused on expanding its network and increasing its fleet size, offering attractive discounts and promotions to customers. It has also been leveraging its strong brand image and reputation for reliability and efficiency to maintain its market position.

But then the world was hit by a pandemic, which was a crushing blow to travel.

The impact of the pandemic on the Indian airline sector was significant. Revenue fell by more than 80%+ for many airlines.

For IndiGo, this could have been a death blow, but it turned the crisis into an opportunity.

Apart from standard cost cutting measures, reducing its passenger flight operations, and grounding its fleet, IndiGo made a few changes.

IndiGo converted its ten aircraft into freighters, resulting in higher throughput as the demand for cargo increased.

As passenger revenues tanked during the lockdown, IndiGo ramped up cargo operations due to the high demand for essential supplies. The sharp rise in the international cargo rates, from about $1,000 per tonne to $3,000 per tonne, further improved the viability of cargo flights.

As a result, IndiGo's share in the domestic cargo market increased from 27% to 40%.

IndiGo showed courage by announcing that it will not be announcing any dividends to boost its cash flow. IndiGo knew it had to be done, even if it might hurt market sentiment.

But there was a deeper storm brewing at IndiGo, which had nothing to do with the pandemic.

Fly the Turbulent Times

As IndiGo began to recover from the pandemic in 2021, on time performance declined and losses widened

The root cause for trouble is a feud between Rakesh Gangwal and Rahul Bhatia, the co-founders of IndiGo. The dispute between the two businessmen had just begun a year earlier when Gangwal raised concerns about corporate governance at the company and alleged that Bhatia was misusing his dominant position to his benefit.

The conflict between Gangwal and Bhatia centred around their differing views on how IndiGo should be run.

Gangwal, who held a 37% stake in the company, called for more transparency and better governance practices, while Bhatia, who had a 38% stake, defended the company's current practices.

By 2021, this was evolving into a large-scale co-founder blowout. The feud led to several legal battles between the two co-founders.

Gangwal filed a complaint with the Securities and Exchange Board of India (SEBI), alleging that Bhatia had violated corporate governance rules by interfering in the company's operations and making decisions without consulting other board members. Bhatia, in turn, filed a lawsuit against Gangwal, accusing him of spreading false and defamatory information about the company.

The conflict has also led to a rift within IndiGo's board of directors, with some members siding with Gangwal and others with Bhatia. This has caused uncertainty and instability within the company, leading to concerns about its future.

To add to the uncertainty in the company, In May 2022, it was announced that the then Chief Executive Officer of KLM, Pieter Elbers, would succeed IndiGo’s outgoing leader, Ronojoy Dutta, who was looking to retire after guiding the low-cost carrier through the turbulent pandemic period.

The succession was scheduled for September 30th, but Dutta ended his tenure earlier after a mutual agreement with IndiGo.

Mr. Elbers has some big shoes to fill as he takes the reins at the helm of India’s largest airline.

Today, IndiGo commands an incredible 57% of the Indian airlines market, with 1,600 daily flights to 101 destinations. IndiGo is India’s largest carrier and the 6th largest airline worldwide by passenger volume.

Given his successful career of developing international hubs and connectivity, the board of IndiGo has high expectations of Elbers. He was head-hunted for how he restructured KLM during the pandemic.

As the fourth Chief Executive Officer of IndiGo, Elbers will face many challenges.

Unstable fuel prices and inflation affecting the Indian rupee continue to pose a consistent threat to IndiGo, especially in guiding the airline through more significant and quicker expansions into the international market.

But the biggest challenge will be to recover the startup magic that IndiGo brought to airlines. For the first time in years, competition is turning up the heat.

IndiGo won’t be able to say Tata to competition easily.

Hello, Troubled Tomorrow

As the airline industry has picked up, the governance issues have plagued IndiGo since the pandemic.

Despite the efforts of mediators and regulators, the feud between Gangwal and Bhatia shows no signs of ending. Gangwal resigned from the board of directors, and has begun to offload his stake in IndiGo slowly.

As IndiGo reaches an all-time high in its market cap of 76,000 Cr, it is reaching all-time lows in on-time performance and profitability. Since March 2020, it has failed to post a profit for 2 years, the first time in its public history.

On-time performance has declined to 88%, showing that its storied metric is also struggling. There is no denying that a change in leadership from the founders has coincided with competition in the industry intensifying as post-pandemic air travel picks up, IndiGo is still in a dominant market position. But it is now facing its stiffest competition, not from other budget carriers, but an old-school conglomerate, Tata, that has a long history of running full-service carriers.

Tata is slowly consolidating through its owned entities. Vistara and Air India hold around 9% of the market each, with AirAsia adding another 5%.

Vistara began the year with a 7.5% hold on the market behind Go First and SpiceJet. Having launched operations just seven years ago in 2015, the carrier is a joint venture between Tata Sons and Singapore Airlines

In fifth place is budget carrier Air Asia India. Launched in 2014, the company was floated as a low-cost carrier with Tata Sons having 51 per cent stake, while AirAsia Berhad owned the remaining 49 per cent.

Due to legal complications over ownership and effective control, the joint venture ran into rough waters.In the pandemic, Tatas acquired 83.67 per cent by buying out 32.67 percent of AirAsia India for an amount of Rs 286 crore.

In June this year, the Competition Commission of India approved Air India's proposal to buy the entire equity share capital of AirAsia India to become a single airline.

But the big brand for Tata is its baby that left home.

Tata Airlines was started in 1932. Under the Air Corporations Act, of 1953, Nehru nationalised nine airlines. The entity became what we know as Air India, the national carrier.

68 years later in the January of 2022, the Tatas took possession of Air India. Turning around the money-losing Air India will be an uphill task for the Tata group

But early signs are positive, as the three Tata airlines report both strong growth and significantly improved on time performance.

In comparison to IndiGo’s nearly 60% of the market, the three domestic airlines under the Tata brand – Air India, Vistara, and AirAsia India – have a combined total share of 23.4%

Due to the intense competition. IndiGo must go deeper into domestic routes and bag new, more profitable international routes. The market leader will need to take advantage of their scale and size in to streamline operations and retain the price advantage that has helped them get to this dominant market position.

However, management transcripts from its first investor call for Pieter Elbers, the new CEO highlighted growing net losses despite a higher than pre-covid capacity.

IndiGo started as brand new startup airline, eventually absolutely dominating the market. It still does hold an incredible foothold in the market.

But as the Indian market begins to take off, it needs to turn itself around to take advantage of this position. India’s most successful startup airline is facing challenges in management, operations and business.

If it is able to turn all three around, IndiGo could become one of the world’s largest three airlines.

Writing: Ajeet, Keshav, Mazin, Parth, Rajiv Design: Abhinav and Chandra