Jan 9, 2022

Inside MapMyIndia’s Epic Drive to IPO

Profile

SaaS

IPO

B2B

Transportation

Last fortnight, MapMyIndia had a blockbuster IPO, becoming a $1Bn company as it listed after 3 decades.

Building the Data Frame

The year was 1994

Rashmi and Rakesh Verma, a husband-wife duo had just returned to India after spending several years working in the US.

Rakesh had worked for many years at General Motors after finishing his MBA from Eastern Washington University. As fate would have it, Rashmi also happened to complete her Masters in Operations Research and Computer Science from the same university at the same time.

Credits: https://yourstory.com/2021/12/mapmyindia-grew-customer-first-business-digital-maps/amp

When they moved back to India, they were driven to do “something unique, something different, that could make a difference to India in general, and also could bring out some innovative things for the country”.

As they explored what to do next, they found that India’s geographical maps repository had not been updated since the Colonial times, in 1931.

As they spent more time thinking about digital maps and their applications across industries, an idea slowly started to form.

“Our belief was strong that 90% of any data would have a location component,” Rakesh said in an interview. With that belief, they took on the challenge of digitally mapping all 3,287,263 square kilometres of India and developing navigation products.

Rakesh and Rashmi were signing up for a herculean task. India’s vast and varied geographical and topographical diversities made any sort of traditional mapping solution challenging.

The Vermas began digitizing maps long before Google Maps came around and revolutionized web cartography.

So how did they do it?

By doing things that didn’t scale.

They used whatever paper maps were available and traced them digitally using tablets and other IT and electronic devices. Where that wasn’t feasible, they got creative.

The company had a team who practically walked down the streets and by-lanes of the country and conducted physical field surveys. The findings of the surveys were then passed to Rashmi who would then digitize them into digital maps and develop measurement tools.

MapMyIndia had a dream to digitize India, and they had found their start.

Every Map Needs a Legend

By the early 2000s, as the company matured, it gained substantial experience.

It began to possess good knowledge of the regional as well as nation-wide characteristics of India’s topography.

Thus, their database began finding multiple applications. Mobile operators strategized based on maps, where their telecom towers needed to be built.

India had the world’s second-largest road network after the USA spanning over 6.4 million kilometres.

This road network was used to transport more than 64% of all the goods in the country and 90% of the total passenger traffic commutes using this road network.

Adding to the complexity are the dynamism and complexity of the Indian landmass can be understood from the nature of its urbanization.

Cities expanded, and new cities had mushroomed. India’s addressing system was also complex and completely non-standardized.

Administrative boundaries changed regularly with redistricting and new state and union territories being announced. Names of cities/localities and roads changed regularly too.

This made digital mapping very challenging and important in India.

All these challenges are further exacerbated by the lack of any government based centralized data on roads. This made MapMyIndia’s (MMI) data even more important.

As the GDP grew and disposable incomes increased, enterprise solutions became critical for companies to service the growing demand.

As the retail industry in particular, which was more than 97% unorganized, began organizing with new chains emerging with the goal of putting in place organized retail formats Geographic Information Systems (GIS) became more important than ever before to establish store locations and manage distribution networks.

A Geographic Information System (GIS) was a software program that helps people use information that is collected by GPS satellites that orbit the earth. It helped to integrate location data (where things are) with all types of attributes (what things are like) at the location.

As affluence increased so did mobile and internet penetration.

In the mid-2000s India was adding 5 million new mobile subscribers per month. The lack of well-planned cities meant that few people knew where any new location was and had few options on how to find places except to stop people on the street and ask for directions.

The opportunity to integrate with mobile providers and in personal navigation devices was another huge opportunity for MMI.

The fact that no one else had as comprehensive a base of GIS data made MMI’s data and product offerings invaluable.

Initially, the company focused on the B2B market.

One of their earliest wins came in the form of onboarding Coca Cola as their customer. Coca-Cola India, began its engagement to locate its national network of bottlers and distributors.

This was important for Coca-Cola India which over the years used vague markers such as “by a river” or “next to a highway” to describe the locations of their partners. That relationship expanded into geo-locating and mapping its retail network, and then its transport and logistics partners.

MapMyIndia was reaching escape velocity.

Finding the North Arrow

By the mid-2000s, satellite imagery became readily available in India.

This along with GPS equipment, mobile mapping, and 360-degree car surveys led to a lot of productivity enhancement. Collecting data became easier thus accelerating the digitization process.

That’s what enabled the company to launch MapMyIndia’s website in 2004. At launch, their website claimed to be the first interactive mapping portal of India. Within months, as reported by the company, the website was getting 5,000-6,000 unique visitors a day.

On the back of the launch of their website, the company was recognized by NASSCOM (a consortium of Indian IT companies) as one of the most innovative Indian IT companies.

To launch their website and the interactive map the company converted its repository of GIS maps into a navigable format that could be used by consumers and enterprises.

GIS information is based on geometry and the information around geometry. In this context, geometry means a line, which is the equivalent of a road; a polygon, which is the equivalent of a park; and a point, which is the equivalent of a landmark.

2004 also marked the entry of Rohan Verma, Rashmi and Rakesh’s son, in the business. Rohan was a Stanford engineering graduate. He was responsible for building the interactive portal that could be accessed by anyone for free.

The website offered customized, location-based services including assigning an e-location to existing addresses to enable last-mile deliveries. Companies such as MagicBricks signed up to the platform, while regular customers too undertook basic mapping activities.

In 2007 the company expanded its product portfolio with the launch of MapMyIndia Navigator, a pan-India GPS navigation tool that it sold to automobile manufacturers. The new product was installed in cars and provided users with turn-by-turn assistance in real-time to their destination.

The launch of the GPS product was an important moment for the company, as it was a big growth driver. The GPS product also allowed the company to expand its relationship with telecom providers such as MTNL and Blackberry.

MayMyIndia was mapping a big journey.

Scaling Dimensions

By the early 2010s, renowned manufacturers such as Ford, General Motors and BMW licensed MayMyIndia applications and offered touch-based navigation as an added accessory.

As India entered a new decade, 3.4 million passenger vehicles (sedans, hatchbacks, SUVs) were sold in India. With 272 million total on-road vehicles projected by 2020, and an average of 22 million vehicles sold each year, the industry provides growing scope for digital maps and navigation solutions.

The growing trend of electric vehicles in India further expanded the market to telematics devices (communication services onboard a vehicle) for both enterprises and end-users.

The growth of connected car services, real-time traffic information, parking services and weather information services will drive future software advancement in the sector.

While the automotive sector became a big contributor to growth, by 2016 with increasing internet penetration, growth of eCommerce and digital penetration, the market for digital maps exploded in India.

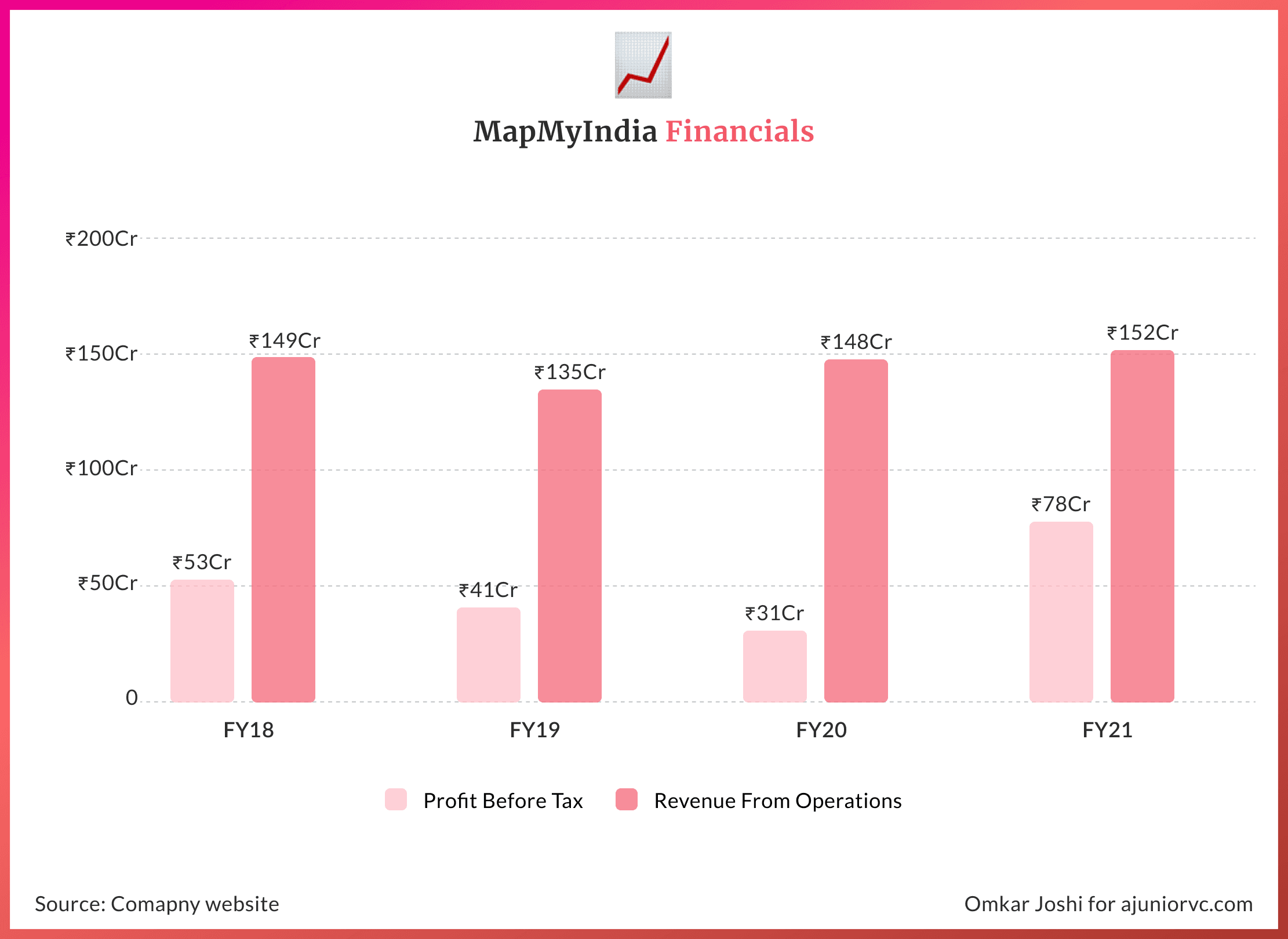

Unlike other funded tech players, MapMyIndia was content with steady, sometimes flat growth, resulting in both profitability and high retention.

This also allowed them to enter new markets with care.

E-retail and food delivery services began to leverage geospatial and hyperlocal intelligence for route planning, optimizing delivery slots and reducing overall service costs.

Digital maps grew to provide more real and life-like experiences with high accuracy. Software services such as integrating maps and location intelligence into existing apps via APIs and performing geo-spatial analytics are logical by-products.

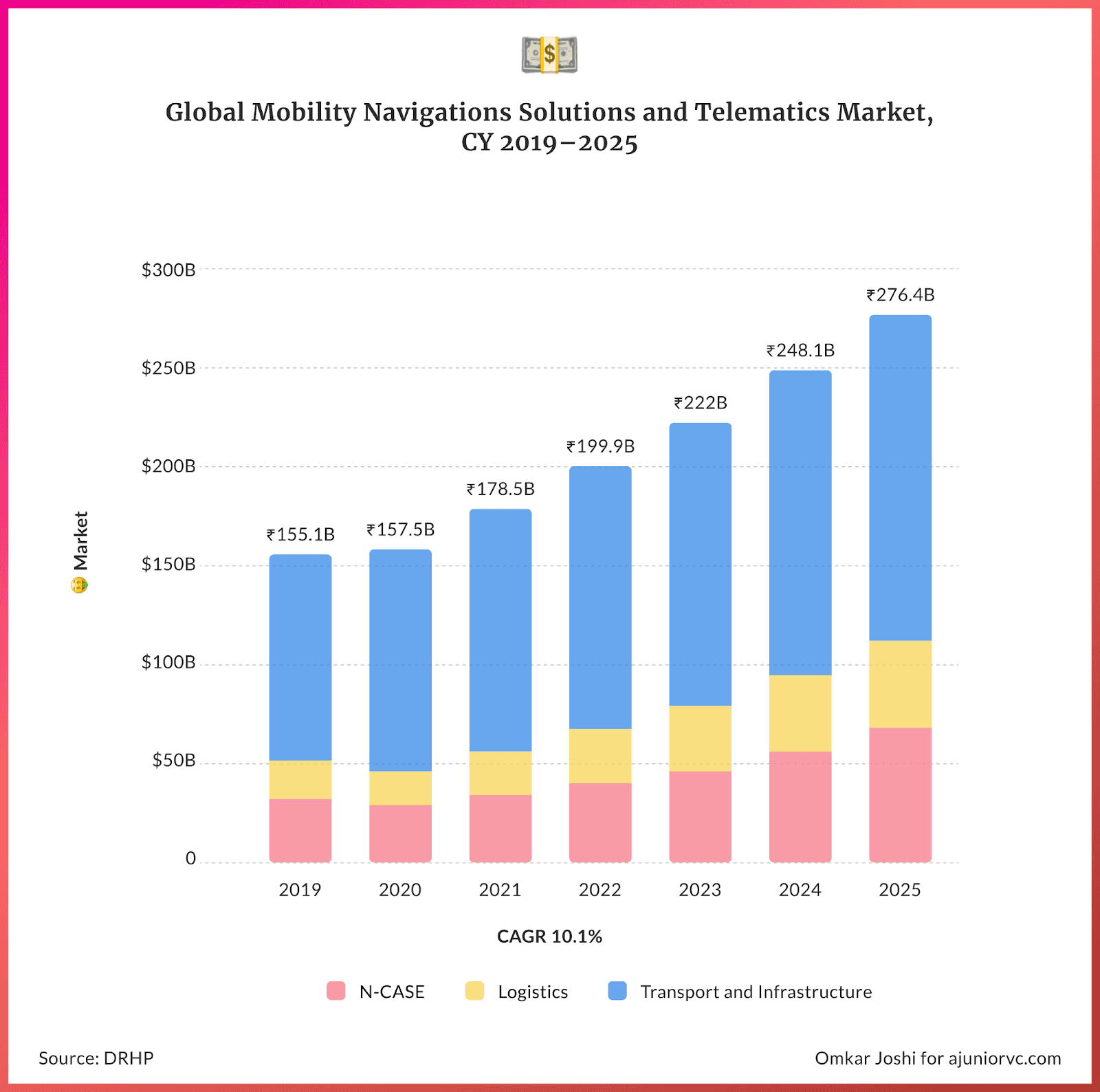

By 2020 the total market for navigation solutions and telematics was sized at USD 20.5 billion and expected to grow to USD 44.9 billion by 2025.

More than half of this is accounted for by transport solutions such as route optimization, traffic management and emergency response.

The decades-old company was going after a massive market and had now built an unparalleled mapping suite

Market Positioning System

By 2021, MMI had a wide variety of offerings.

The suite of offerings MapMyIndia had come to provide is almost universal in applicability across sectors. Fundamentally, the offerings overlay continuously updated geo-spatial map data on any other intelligence.

MMI started with the base mapping layer in the 1990s. This was then packaged in the form of maps (MaaS), software (SaaS) and platforms (PaaS).

Their digital maps cover 6.29 million kms or 98.5% of the road network in India with location, navigation and analytics for 7,933 towns and tens of millions of location points such as houses, post offices, hospitals, ATMs, hotels and malls.

400 million geo-referenced photos and videos in the form of 'RealView' maps provide actual on-ground views. 4D (time being the 4th dimension) and high definition features help to create real-time photo-realistic, ‘digital twins’ of a dynamically changing real world.

The applications however are very real.

The Central Board of Direct Taxes uses such maps to find the spatial distribution of taxpayers in the country or understand the geographical distribution of income.

In the automotive sector, offerings such as navigation, driver assistance, fleet management, and logistical optimization are embedded in the vehicle to help move people and goods faster, cheaper and safer.

Plug-and-play GPS devices such as 'DriveMate' offer real-time information on vehicle parameters such as battery condition, engine state, speed and route violations.

High chance that any touch-screen navigation system fitted in a car was made by MapMyIndia.

Currently, the MapMyIndia API stack provides a full spectrum of services. Developers use this to power their apps with functions such as navigation, tracking and geospatial analytics.

Software development kits (SDKs) easily integrate with apps to help track packages reaching your doorstep, find nearby ATMs or perform location-based digital advertising.

The company’s SuperApp for consumers, MayMyIndia Move provides maps, navigation, hyperlocal search and location analytics powered by ISRO’s Bhuvan satellite.

You can locate your friend’s doorstep using eLoc (short for electronic location), which is a 6-character unique digital address for any place that could replace the lengthy postal address and aid easy sharing and search. 20 million points had been mapped so far.

While the company had built out a useful suite of services, the key question for every business is how it made money.

Manifesting Mapping Monetization

MapMyIndia was a quintessential SaaS company, with its mapping suite as the product.

The freemium model allows the company to extend their reach and allow developers to adopt their APIs. The majority of their revenue comes from B2B and B2B2C enterprise customers.

MapMyIndia majorly provides licenses and usage rights to digital maps, platforms, API and software. It makes revenue by charging royalties, subscriptions and annuities in return.

Mapping data and analytics on a pipe.

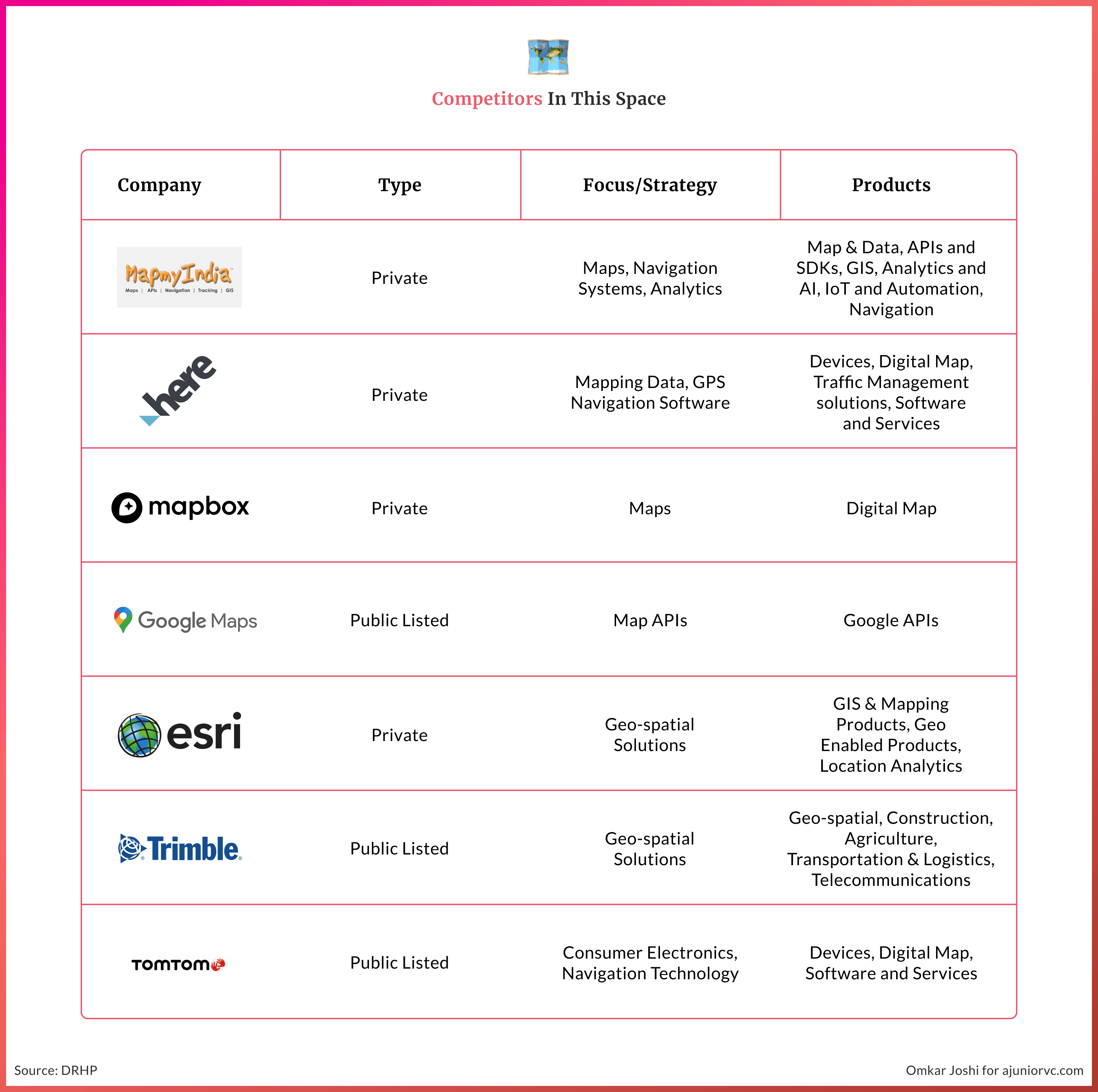

Compared to global competitors, these products are developed in-house at relatively lower costs in India and delivered over the cloud.

The low variable cost base translates to high margins - 83% contribution margins and 35% EBITDA in 2021.

Over 25 years, the company has developed proprietary technologies and full stack offerings to sustain multiple revenue streams. Moreover, revenue growth is driven by continuously enhancing technological capabilities and building products with changing market needs.

For instance, while COVID slowed down the revenue from automotive and mobility tech, the suite of products helped to increase the consumer tech and enterprise digital transformation revenue almost 3 fold.

It grew from 26.5 to 72.5 Cr INR between 2019 and 2021.

MapMyIndia had served 2,000 unique enterprise customers as of 31st March 2021. It had 500 customers across Saas platforms and has placed navigation solutions on 80% of all cars in India.

The approach to building strong relationships with enterprise customers, right from the Coca Cola days in 1995 has been simple yet effective. Initially service a single-use case requirement and gradually build deep and cross-sell to become a one-stop solution provider for digital mapping needs.

For the past three years, 90% of the top 80% of customers by revenue were retained year-on-year. Long-established enterprise customers have been critical to sustaining revenue growth over the years.

In addition to strong retention, MapMyIndia uses horizontal platforms (APIs, SDKs) to serve similar use cases in multiple industries.

Products such as workforce tracking designed for use in construction and logistics might now help to acquire new customers in food delivery.

This has allowed it to scale in India, as well as globally. With a global roadmap, it is almost impossible for it not to hit another giant.

Watching the Border

No discussions of MapMyIndia can be had without discussing the 800-pound gorilla in the room - Google Maps.

Both businesses have a flavour of their market.

While MapmyIndia (MMI) had started to build the digital mapping database in 1993, Google Maps had only started its operations in 2005, 12 years later.

While one has started so much later, each player has tried to replicate the better features over time.

The MMI data collection process was a manual and arduous effort of over 25 years. 400+ surveyors have travelled lakhs of kilometers to build the maps' infrastructure.

By the early 2000s, satellite imagery was available in the country. While Google Maps did do the same, both manual and satellite when it started.

Google Maps gave the consumers the privileges to make the maps, making it open source and giving the right – making the data lakes through the end-user itself.

The data collection led to the business now making the business lines.

MapmyIndia is a primarily business-to-business and business product, service-based product. Google maps dwell on a free consumer-first approach and serve a few businesses in India via its APIs.

They are in different lanes, with Google having eaten any early potential for MapMyIndia to build a consumer business

MapMyIndia is often forced to customize as per clients' needs by offering a business Software-as-a-Service, Maps-as-a-Service, and platform-as-a-service.

In terms of verticals, MapmyIndia addresses four key markets — direct consumers tech through free and paid app/maps, automotive (40% of revenue), mobile Internet (20%), and enterprises and government (40% of revenue).

Enterprises also require offerings integrated with the maps. Automotive and trucking companies often require new-age IoT solutions in their consumer and logistic services.

Governments have worked intensively with maps, and its go-to vendor has been MMI.

While maps' accuracy remains a touch lower than Google Maps has made it consumer data-driven; therefore, the ability to pinpoint the location on the 2D is far more superior.

But as we move up high altitude, MMI's promise of the topographic solutions play an integral role in the accuracy.

Google maps started as purely 2D structure maps and over time moved to 3D and satellite, terrain, traffic, transit and the recent street view.

MaymyIndia focused on 2D and 3D with topography maps from their first contract. It had to collect the topographic data for its first vendor, Coca-Cola.

The former allows users to visualize the data, while the latter allows users to analyze the geo-demographic data with tracking, telematics, and location-based analytics.

Both the companies Google Maps and MapmyIndia, have existed for a long time together as they have a majorly different business model and end-user.

MMI may have looked easy to disrupt. It’s deep relationships with clients, data depth, and enterprise focus has helped it stay ahead of the curve, and stand strong with competition.

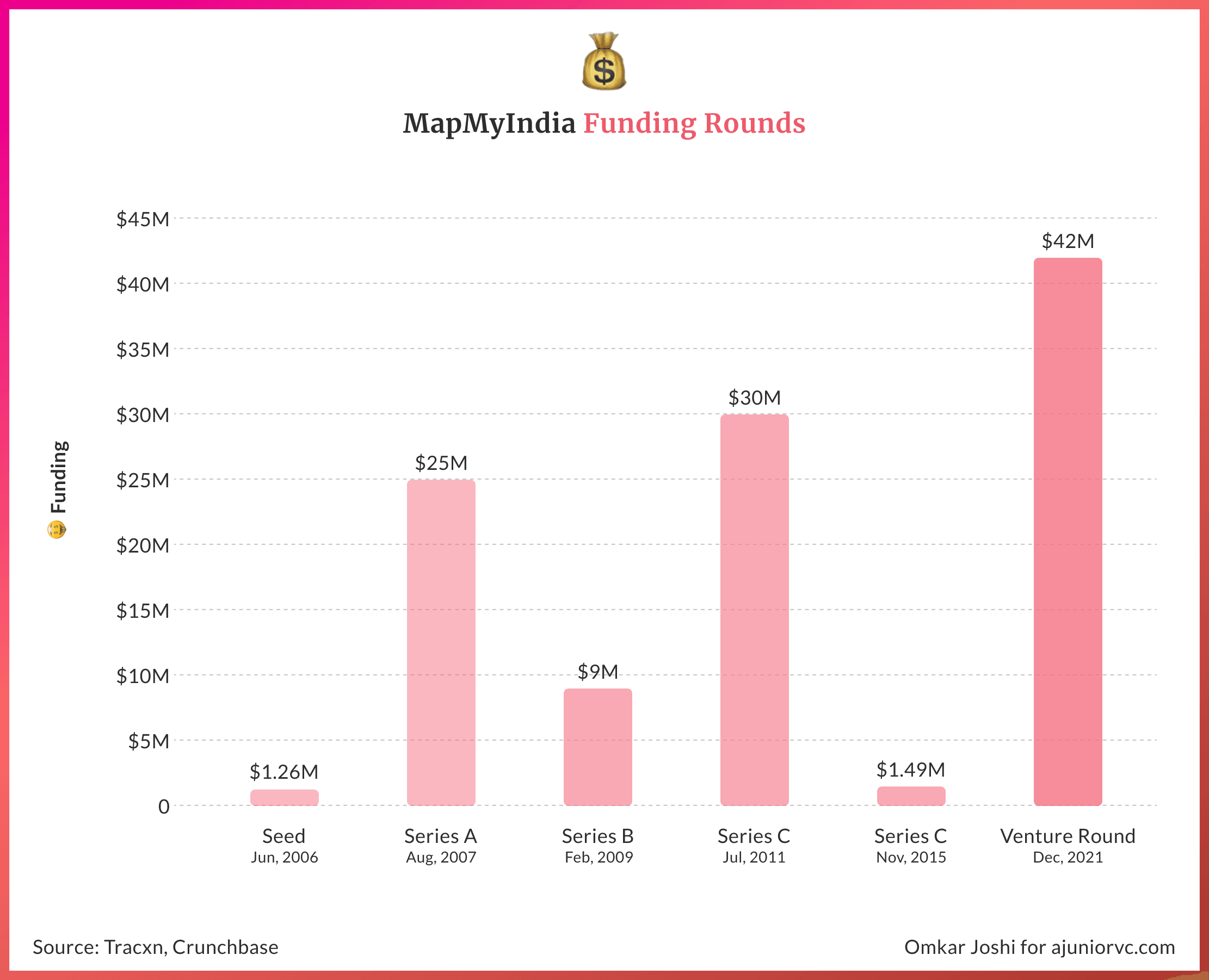

By late 2021, MapMyIndia would decide to go public.

No Journey is Without Contours

When MapmyIndia planned to list, no other listed company in India had a similar business.

Their offering is the most unique to the Indian context. The underwriter priced the IPO on a higher band ~5500 crores, at an issuing price of 1000-1033 INR.

While the company share value has increased nearly 10x in the last five years, the valuations seemed higher despite the high growth opportunities.

Despite that, the stock was subscribed 154.71 times overall. This is the promise that MMI has given to its investors.

On the business front, the company generates a significant amount of its revenues from a limited number of key customers.

MMI generated 80% of its revenues from 18 & 25 clients in FY-20 and in FY-21 respectively.

Any loss of a critical customer or reduced demand for products and services from its customers may adversely affect business and financial conditions.

Inability to protect its intellectual property or any third-party claims concerning infringement of intellectual property rights (IPR) in the future could adversely affect its business and cash flows and the stock price.

There have been certain instances of lapses on account of inadvertent factual errors, including concerning certain regulatory filings for corporate actions taken by the company in the past.

Consumers Maps have got a network effect; as more of the maps are used, the quality of the maps gets better. Despite being late in the consumer play, this IPO allows them to build on the current stack.

While hitting the IPO may have seemed right in hindsight, only time would tell if this was a master move or not, but certainty is for sure on the technology front.

King of the Road

Maps are now an integral part of our lives.

While we interact with many applications, we seldom realize that maps are sourced from mapping companies like MapMyIndia.

Many enterprises are refraining from providing their crucial data points to Google due to privacy and data usage. MapmyIndia is dominant in India's mapping and geospatial technologies area as enterprises ditch Google Maps due to these very concerns.

Today, over 50% of MapmyIndia's business revolves around Automotive and mobility applications.

This will be an important segment of the business as enterprise and consumer adoption of IoT continues to go mainstream.

With Drivemate, MMI already offers accurate real-time information on vehicles viz. location, speed, battery condition, engine (idling or killed), route violations etc.

The ability to connect multiple devices with the internet and be driven by maps is a bright future.

More solutions for the start-ups ride-hailing, mobility companies see promise from the delivery to navigation perspective.

With an eye to the future, MapmyIndia recently announced the acquisition of Bengaluru-based pioneer in VideoMaps, VIDTEQ, which allows a user to view a video clip of the complete route from any source to any destination within a city.

These synergies MMI's ability to provide one step ahead and serve their clients with static maps is another form of mapping.

Nations safety is dependent on mapping built on indigenous solutions. The partnership with ISRO satellite imagery and earth observations data will grow and support government agencies.

MMI strength of topography data and density tracker is the solution that drone companies seek. With MII geospatial data, the ability to synergise the data could propel future drone delivery.

With a foothold in India, and many global markets, MapMyIndia has the base ready. Its growth opportunities are building out a robust consumer product, working for deep last mile logistics and partnering with deeply technical delivery solutions.

While MapMyIndia has had a journey to remember for the past 20 years, the future of geospatial services will require the company to remain on the forefront of the latest technologies.

If the past is any indication, MapMyIndia looks set to pass the driving test with flying colors.

Authors: Shiraz, Rajiv, Varun, Shreyans Design: Omkar