Nov 13, 2022

Can PhonePe Become India's Fintech SuperApp?

Profile

Payments

Insurance

Finance

Aggregator

B2C

Series E-G

Last fortnight, PhonePe was raising $700M at a $12Bn valuation, joining the rarified air of Indian decacorns

Power to the Founder People

Sameer Nigam and Rahul Chari met in college.

The duo were rivals in the initial few years, against each other in the same student body. As in all stories, the rivals became friends over the next three years.

Both Rahul and Sameer then independently moved to the US.

After his Masters, Sameer ended up working with Shopzilla, where he served as the Director of Product Management. Rahul was with the Data Center Business Unit at Cisco Systems, where he was part of the team that developed the market-changing MDS 9000 family of SAN switches.

Post these stints, they co-founded MIME360

Mime360 was an online platform which connects content owners and publishers. The platform tied up with content owners and provides APIs for publishers to securely stream media to customers.

The primary focus for Mime360 was the music industry, with its secure API Feeds helping prevent piracy and allowing many publishers to sell the licensed content globally.

Flipkart acquired Mime360 in October 2011, and the 12-member team got absorbed by the Indian eCommerce giant, Flipkart.

This would be Flipkart’s first acquisition of the two.

Rahul and Sameer had met their 3rd co-founder, Burzin Engineer, while they were building MIME360. He set up their web services, Internal-IT, Application Engineering, Storage Networks and Configuration Services.

They say founders always remain founders, and the itch to start didn’t leave them.

Sameer and Rahul launched Flyte, a music-downloading platform, while working at Flipkart.

However, the venture didn’t pan out as expected. Flipkart had to shut down the business owing to the lack of solutions for payments and micro-transactions.

When the payments system and gateways failed during the Big Billion Day of 2014, the trio realised the need for a financial platform to solve this.

A new big idea was brewing.

UPI’s Feedback is Appreciated

Rahul and Sameer had worked with each other for a long time across projects and knew each other’s strengths well.

While working at Flipkart, they started finding problems with the music platform they had launched. The biggest of these was monetisation.

During the Big Billion Day, the two kept encountering the payment gateway problem the organisation was facing. Much before internet penetration and Jio, this was a real challenge.

UPI had barely begun. More of a concept on a whitepaper, there wasn’t any solution to handle payments. The three saw a gap and left Flipkart to start a payment handling solution.

This solution would be launched in 2015 and called PhonePe.

Their core motivation was to solve payment gateway problems and enable digital payments within the country.

The founders realised the need for digital payments while travelling through the streets of India, especially in Tier 2+ cities. Although the trend was a novel one, it had potential.

The idea of the organisation was to build a payment solution on IMPS. But as in all startups, the timing would play a crucial role.

UPI was all set to launch in 2016, which was an opportunity for PhonePe to build towards the changing revolution.

Nobody knew how big it would be, but PhonePe’s transition to enable UPI would be a game-changer.

The entire thesis behind starting PhonePe was to utilise technology. It was to create a product or an offering where tech was not being used as an enabler but was the reason for its existence.

The team was building out the product, expecting to build it over a few years. But history was going to repeat itself most strangely.

The return back would be faster than even the team expected.

Let that Acquisition Sink In

In 2016, when Flipkart acquired Phonepe with a valuation of $10-20m, Phonepe did not even have a product.

This would probably be the only team in Flipkart’s history to be acquired by them twice.

A valuation that high for a pre-product startup seemed crazy then. It was as if Flipkart had already predicted the future.

The more likely reason was the e-commerce giant’s then-biggest rival, Snapdeal, acquiring Freecharge for $400M inspiring Flipkart to acquire a digital payments arm. Added was the benefit of working with Phonepe founders who were ex-Flipkart veterans.

For Flipkart, the acquisition of Phonepe in early 2016 could not have been timed better.

Within months of the deal, the central government-led demonetisation created an urgent need for digital payments.

PhonePe, the pioneer in adopting the government-backed UPI platform, had already partnered with Yes Bank in August 2016 to launch their UPI payments app.

Consistent cash infusions from Flipkart kept the ball rolling. The company swiftly tied up with several internet services as a payment mode and onboarded offline merchants at a break-neck pace.

Innovation was a key driver of transactions, with PhonePe launching the cheapest Bluetooth-enabled POS machine to onboard merchants to start accepting UPI payments.

Partnerships with 300+ consumer brands such as Redbus, Ola, Swiggy, integrating with their progressive web apps also helped them achieve phenomenal growth.

The app had over 1Cr users within 3 months of launch, one of the fastest in Indian history. Driven by Flipkart’s already existing huge base, customer acquisition was rapid.

The interface that facilitated ease of use and a faster transaction time also enabled them to overtake the Government’s BHIM app, which was then the market leader in UPI transactions in August 2017.

PhonePe became a major driver of UPI adoption in India in 2017. It crossed over 10 million downloads and achieved a milestone of 1 million transactions daily within the year.

The company’s explosion wasn’t expected.

You Get What You PhonePe For

When PhonePe started scaling, the digital payments space was already disrupted by wallets such as Paytm and Freecharge.

They had already gained traction with eCommerce integrations. Wallets facilitated day-to-day small ticket size payments at shops and kiranas.

Tie-ups with merchants like Uber made the day for apps like Paytm.

However, the timely recharge of these wallets to ensure enough reserve cash was a huge pain point. People were uncomfortable loading lumpsum amounts into their wallets at the cost of losing savings bank interest income.

UPI came with revolutionary tech that enabled effortless and faster payments. PhonePe bet on a transformation much more than

People no longer had to refer to long bank account numbers and wait several hours or even days to do a transaction.

UPI provided the comfort of keeping money in people’s bank accounts and withdrawing any amount readily to do a transaction.

The interfaces to make UPI payments became extremely easy to use and purely digital, unlike cards that require a physical POS machine to swipe.

UPI was also accessible to anyone with a smartphone and a bank account. On the other hand, credit cards were restricted to a niche set of individuals.

Merchant Discount Rate, or the cost of a transaction incurred by a merchant while accepting payments via a source, was zero for UPI payments.

This was charged to merchants for payment processing via visa or MasterCard-enabled debit/credit cards, with the rates going as high as 2% of the transaction amount.

This became a major driver of UPI, with merchants encouraging customers to pay via UPI instead of debit/credit cards.

To accept card payment, a merchant needed to buy a POS device which will cost them several thousands of rupees. But to accept a UPI payment, all that was needed was a QR code that could be printed on a sheet of paper.

The interoperability of UPI was a game changer in the truest sense.

Once a user becomes a registered UPI user, it doesn’t matter what app they’re on. They could send and receive money from anyone on the UPI network.

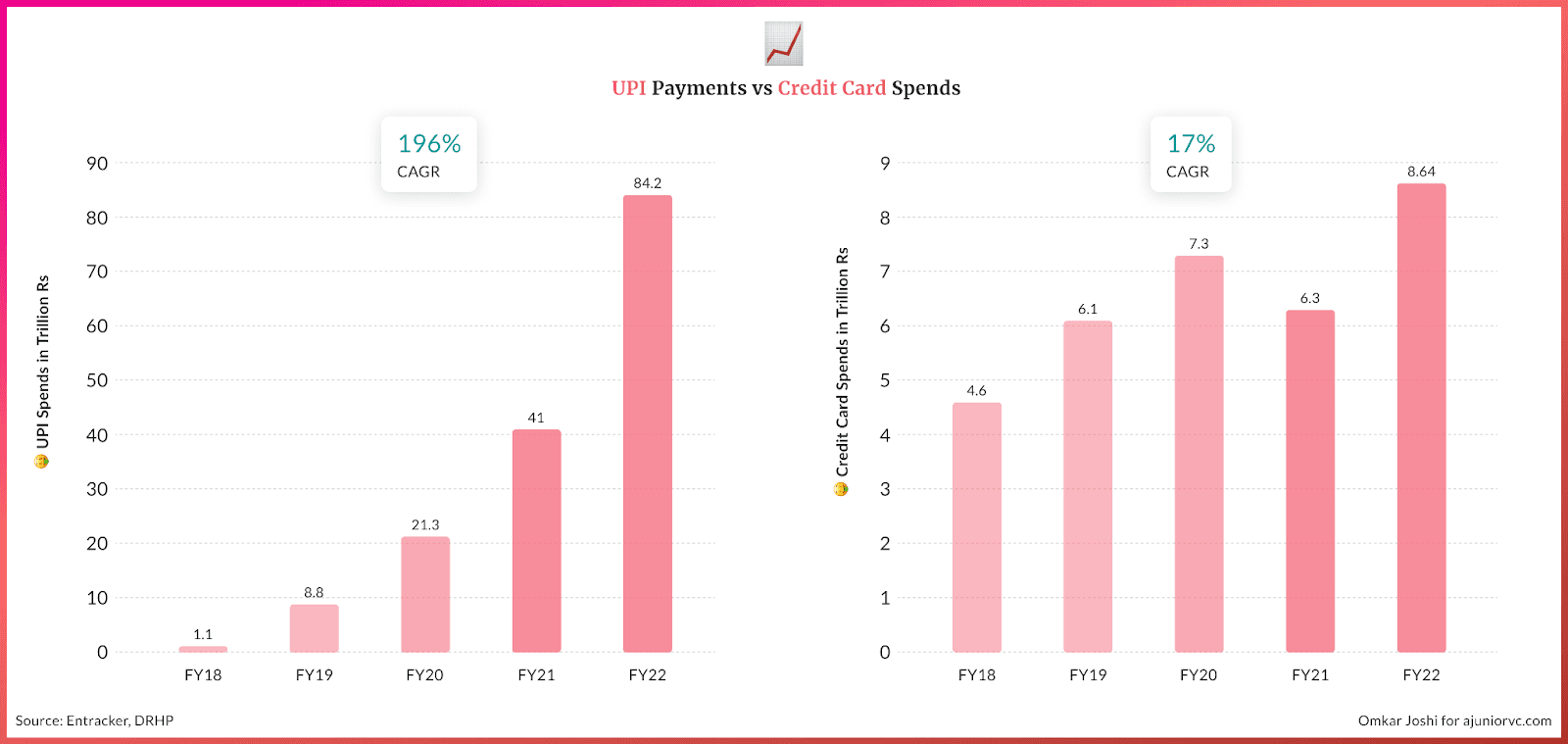

From 2018, UPI’s payments grew by a phenomenal CAGR of 196%, while the credit card market grew by a mere 17% in terms of the transaction value.

Enabled by UPI, while the other bigger fintech wasn’t focusing, PhonePe sneaked up .

By 2018, PhonePe was the fastest Indian payment app to get 5Cr downloads on Google Play Store. The company saw a growth of ~850%+ against the competitors, who grew by 88%.

But there were already existing elephants.

Attacked From Both Right and Left is a Good Sign

PayTm was the numero uno in the ecosystem.

While PhonePe raced to 10MM downloads rapidly, PayTm was already doing 1.5Bn transactions a year.

With $5Bn GMV, 200MM+ users and more than $2Bn of capital PayTm was the elephant in the payments ecosystem. In comparison, PhonePe was doing just $40MM of annualized transactions at the beginning of 2017, almost 1/100th of PayTm.

The pressing question and the real elephant in the room were which model would really succeed.

While both PayTm and PhonePe facilitated payments, their approach was entirely different.

Paytm is primarily a semi-closed wallet, with payments that can only be made from the wallet. PhonePe is primarily based on UPI and accesses bank accounts directly to make payments. Both have wallet/UPI features, but the distinction in incompetencies is important.

Wallets require you to add money, given they are not the primary "store" of wealth. Wealth is usually stored in bank accounts, and UPI directly draws from bank accounts. Wallets would need KYC, which UPI would not. Prima facie, UPI would be easier to use than wallets. PhonePe could potentially challenge PayTm.

But with 100x the volume and 200MM+ customers, PayTm could easily blow away PhonePe, even on the UPI game.

By 2019, the race was getting hotter. Google would throw its hat into the ring, and explode with the huge balance sheet that it had access to.

From 10MM downloads, PhonePe would scale to 55MM downloads, but the push through Flipkart would scale it beyond expectations. The transaction volume would grow 82x in the space of just a year, and from being a small player, it would soon be one of the largest.

Like the fable of the ant and the elephant, the "ant" PhonePe would challenge the "elephant" and end the year with $5Bn of GMV.

The company also began aggressively expanding its services and bringing more use cases onto the platform. They diversified their product to offer mutual funds, insurance, digital gold, and mobile recharges.

The move was driven to help PhonePe become an ecosystem, or as our neighbours called WeChat

It wanted to be a super-app.

PhonePe's Super App is Freed

The company’s supper app ambitions were revealed in mid-2019

Switch was a feature that allows customers to seamlessly switch between PhonePe and their favourite food, grocery, shopping and travel apps from within the PhonePe app itself.

In 2020 the stores featured made it possible for users to search for nearby merchants and order items for home delivery.

With a solid base, PhonePe started to diversify both product and geography. It invested in large pan-India marketing campaigns

One example was 'Tension-free'. It focused on category creation and driving consideration for motor insurance renewals on the PhonePe platform, the campaign inspired consumers to question how bike and car insurance is traditionally sold to them.

It uses creatives specially crafted for Hindi-speaking audiences in the northern markets starring Aamir Khan and Alia Bhatt.

In contrast, for the south markets of Tamil Nadu, Karnataka, Kerala, Andhra Pradesh, and Telangana, the campaign features Dulquer Salmaan.

The series of films highlights how, with PhonePe, consumers didn’t have to settle for unwanted sales calls, unnecessary add-ons, and other limited options. This was very different from just doing UPI.

The revenue diversification achieved by offering multiple services showed PhonePe its way forward. With the revenue from the primary wallet business not significant, PhonePe moved towards capturing all possible regular spending sources for the customer.

This “super-app” was first seen in apps like WeChat in China, which allowed multiple services in a single “super-app”. The ideal “super-app” should cover the customer’s online expenses, starting from e-commerce, food delivery, and financial spending.

The super-app attempts in India have primarily been made by organisations that had existing shopping facilities.

However, many of them did not see the traction they desired. Paytm's Mall was struggling by 2021, and others didn’t even merit being called a super app.

In contrast, PhonePe has not tried to venture too much into commerce-based products. It primarily focused on being a financial super-app.

PhonePe began to scale as a significant player in the insurance space. It tied up with several companies as its insurance distributor. Existing customers of insurance companies can pay their premiums on PhonePe. Once paid, the app keeps reminding them about the pending payment, ensuring that the policy does not lapse. In addition, customers can also buy new insurance policies on the platform.

As the pandemic raged, PhonePe began to offer its customers the ability to provide SIPs in mutual funds. Like a conventional investment app, PhonePe classified mutual funds based on their risk level and past performance.

PhonePe’s bet to fashion itself as a financial super-app had certain advantages compared to the other approaches.

Unlike e-commerce-driven super-apps, a financial product only had electronic delivery. The regulations in India ensured that the sudden demise of any intermediary in the value chain has lower effects on the viability of the products sold by the intermediary.

Equities and mutual funds are stored in the demat account and with KRAs, which act only as storage. Insurance policies were also linked to centralised storage. This has increased confidence in the system and the regulated market, which was reaped by distribution-focused players such as PhonePe.

As the product scaled, PhonePe finally evolved into a business

Revenue Won’t Let You Down, No Matter What

In 2021, Phonepe had revenue of 1646Cr.

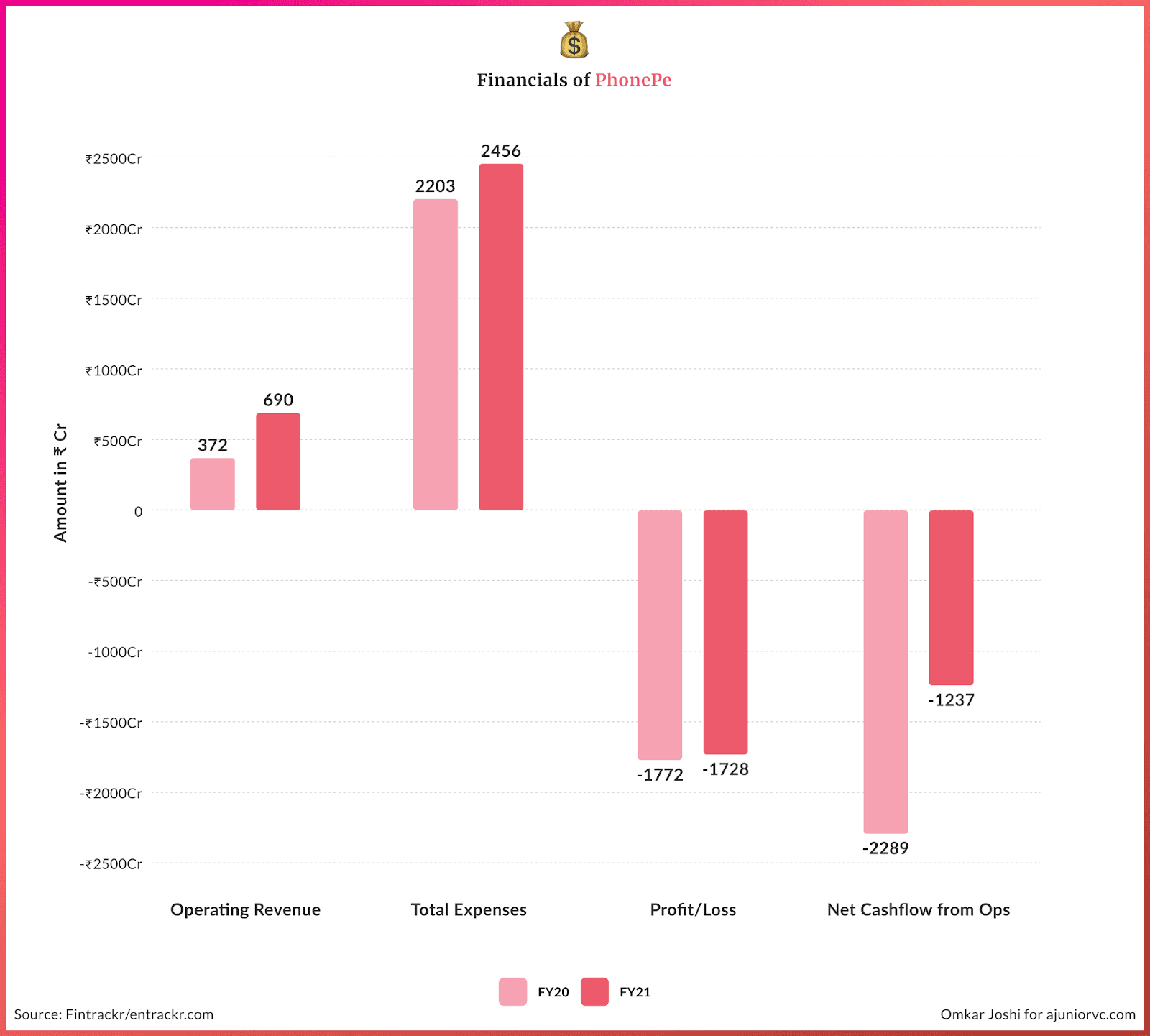

The revenue showed healthy growth from 690 crores in FY 2021 and 372 crores in FY 2020.

In FY 2022, the losses have narrowed to 671 crores, a reduction from the 727.87 crores of losses reported in FY 2021.

According to the latest data filed with the ministry of corporate affairs in FY 2021, employee costs for PhonePe were approximately 50% of the annual costs. The second largest expense head was Advertising and promotional expenses which were around 21% of the total expenses. This was followed by outside contracted expenses (approx 9.5%) and payment processing fees (4.5% of costs).

On a unit level, PhonePe spent 3.56 to earn every rupee for the year ended FY 21.

It is well known that payment tech is a tough market with shallow margins. This is primarily due to the decision of the Union government not to charge Merchant Discount Rate (MDR) on UPI Payments. MDR is charged to the merchant as a processing fee for credit and debit card transactions.

The MDR on credit cards is around 1-2%. Among other things, the decision to disallow MDR on UPI transactions was a major factor in the growth of UPI transactions in the country. However, a zero MDR regime ensured that startups processing UPI transactions had limited revenue.

The lack of revenue from the zero-MDR regime meant PhonePe had to search for other monetisation opportunities.

PhonePe earned limited income on P2P and P2M transactions on UPI, but it can charge a commission to other businesses which list on its platform. For example, it charges telecom providers to allow PhonePe users to recharge their mobile balances. A similar arrangement can be worked out with other periodic billers such as electricity providers, gas providers, broadband service providers, FASTTag etc.

Revenues from these sources allowed PhonePe to work on monetising its massive UPI-based user base.

In addition, PhonePe also figured out subsequently that working as an agent for insurance firms can also help it earn agent commissions from these firms.

Consequently, in FY22, PhonePe advertised heavily for its product launch in the insurance space. The scrap for incremental revenues in the payment space was the primary reason behind the reported scuffle between PhonePe and PayTM employees. The fight between the two started as David and Goliath now had roles reversed.

PhonePe eventually became the first app to reach the 1Bn transactions mark. It has managed to stay ahead of the competition to hit 1.5 and even cross 2B transactions before anyone else

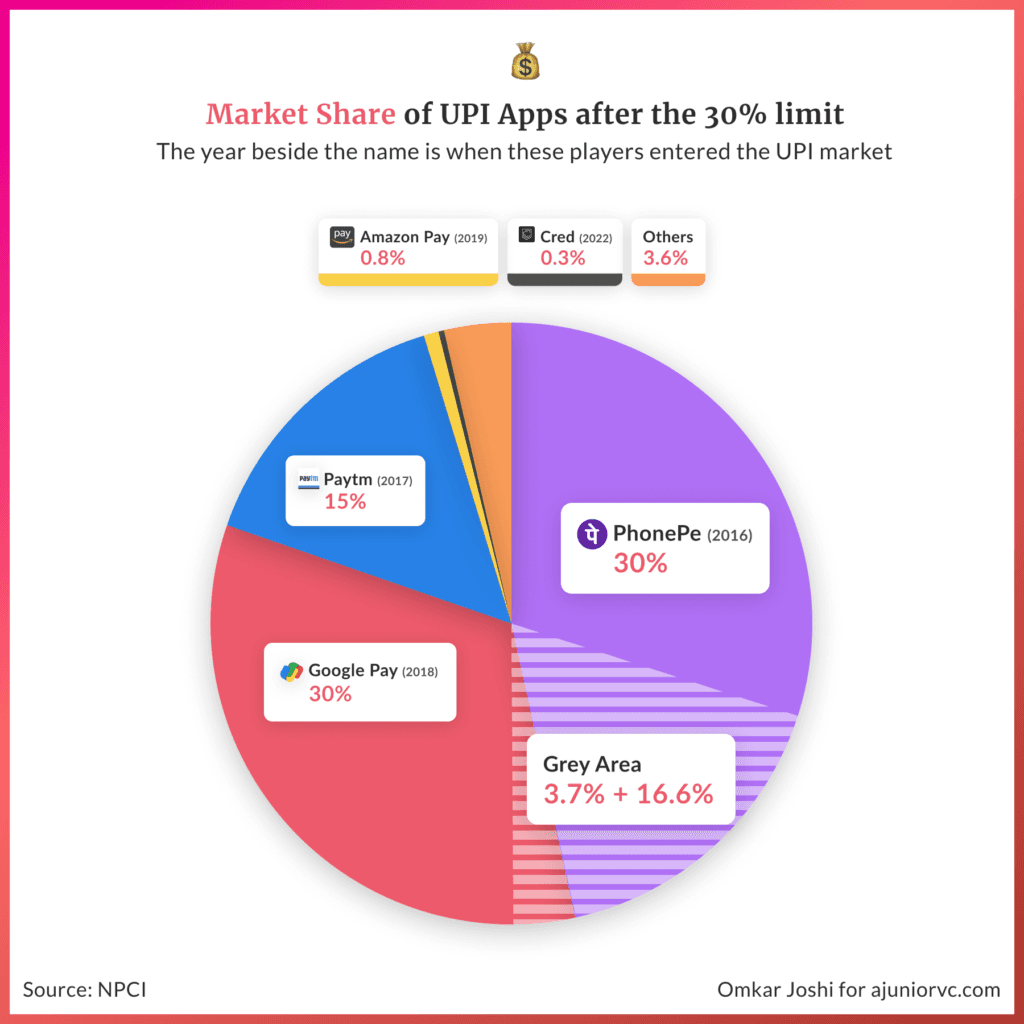

As of February 2022, PhonePe, with 212 crore transactions, was the most popular UPI app with 47% of the market. Google Pay, behind it with 152.4 crore transactions, had 33% of the market, while Amazon pay was only able to capture 1.4% of the 8 lakh crore market.

For a “division” of a large e-commerce company to get here was huge.

Winning is Not a Digital Simulation

PhonePe has become India’s largest digital payment platform.

More than 350 million registered users transact with over 200 million businesses using the app - 1 in 4 Indians now use the app

UPI now operates in 9 countries, and with their international expansion, PhonePe is poised to capitalise, having already launched in Singapore, PhonePe will continue to expand globally.

Post the pandemic, along with mutual funds, interest in direct stock investing rose, as evidenced by the significant increase in demat accounts.

Their pan-Indian campaign for auto insurance was just the start as they tackle wealth management with the May 2022 acquisitions of Wealth desk for $50M and OpenQ for $25M, allowing them to expand their offerings to millions of users quickly.

Along with acquiring WealthDesk, PhonePe has also applied for a mutual fund license in Jan 2022.

It acquired OpenQ in May 2022, a smart beta wealth management platform. Several market analysts anticipate that the smart beta funds could be very popular within the next 2-3 years. The acquisition of OpenQ is a clear hint for the kind of mutual funds that PhonePe could launch once it receives its license.

By connecting users to interoperable systems like UPI and BBPS, PhonePe users can even subscribe for IPO mandates on platforms like Groww, Zerodha and Upstock and receive updates and reminders in the app.

Given their super app attempt with switch and hyper-local discovery feature stores, it should be no surprise that Phone has allocated $15M to invest in ONDC to be deployed over 18 months

They plan to launch a separate consumer app specifically for ONDC while keeping switch and stores running.

It will compete directly with fellow Walmart-owned Flipkart as it looks to build a buyer app on an open network created to end Amazon and Flipkart’s dominance in Indian e-commerce.

The company’s track record for adopting and multiplying with government infrastructure like UPI is impeccable. Less than two years after it launched, they cornered nearly half of BBPS transactions.

Bharat Bill Payment System (BBPS) is an integrated pull payment system that allows users to use any app to pay for any recurring service. PhonePe helps over 28M customers process over 4,000 CR payments to billers like Airtel and Paytm and banks like HDCF.

The Future is Not Nonsense

Sameer has previously stated that he plans to take PhonePe public once the core business is profitable.

They expect to get there by the end of 2023. PhonePe recently shifted its headquarters from Singapore to India, which has fielded IPO speculations

PhonePe is also in talks with investors to raise a large fundraising round at a $12B valuation, making it the most valuable FinTech company in India.

However, regulation seemed to have complicated their plans and probably accelerated the pivot to e-commerce. A cap of 30% of the market share of UPI transactions will go into effect in January 2023.

What will happen when we get to that date is still to be seen with PhonePe filing for a 3 year extensions and Google is expected to follow but Paytm insists on sticking to the agreed dates that were announced in 2020.

To make matters worse for PhonePe, this comes at a time when Swiggy and Zomato are planning to make an entry into UPI as a third-party payments app. The NPCI, the organization that governs UPI, has a crucial decision to make and is in talks with the government and industry stakeholders.

With an astounding 47% of the UPI market, PhonePe must find new ways to grow.

PhonePe hopes that their $15M bet on the new e-commerce app will help them quickly reach and serve 500M customers

PhonePe hopes to become a one-stop shop for every Indian to spend, earn, pay and invest their money. With a quarter of the country already on the platform, they might be able to pull it off

Building India’s super app remains an elusive goal for many that have tried, including the Tata’s with their app Neu joining UPI earlier this year but failing to get any traction.

PhonePe has developed a unique approach to building a super app with interoperable made-in-India technology like UPI, BBPS and ONDC

They have a great product that people all over the country love and a brand they can relate to. They have made some good bets and adapted as new opportunities emerged but incoming rule changes can rock the boat.

As history has shown us, competition is better for consumers, it’s better for the economy and for innovation.

The government’s goal is to make e-commerce a level playfield. They tempered the dominance of supper apps like Paytm and next will take on platforms like Flipkart and Amazon. Have they replaced an old giant with a new one?

With domestic and international competition heating up, forcing them to compete head to head with the giants yet again, PhonePe has enough battle stories to point to.

As India’s digital payments enter a new era, PhonePe could stake its claim as India’s fintech Super App.

Writing: Arjun, Keshav, Mazin, Nilesh, Samarth and Aviral Design: Omkar and Chandan