Nov 1, 2020

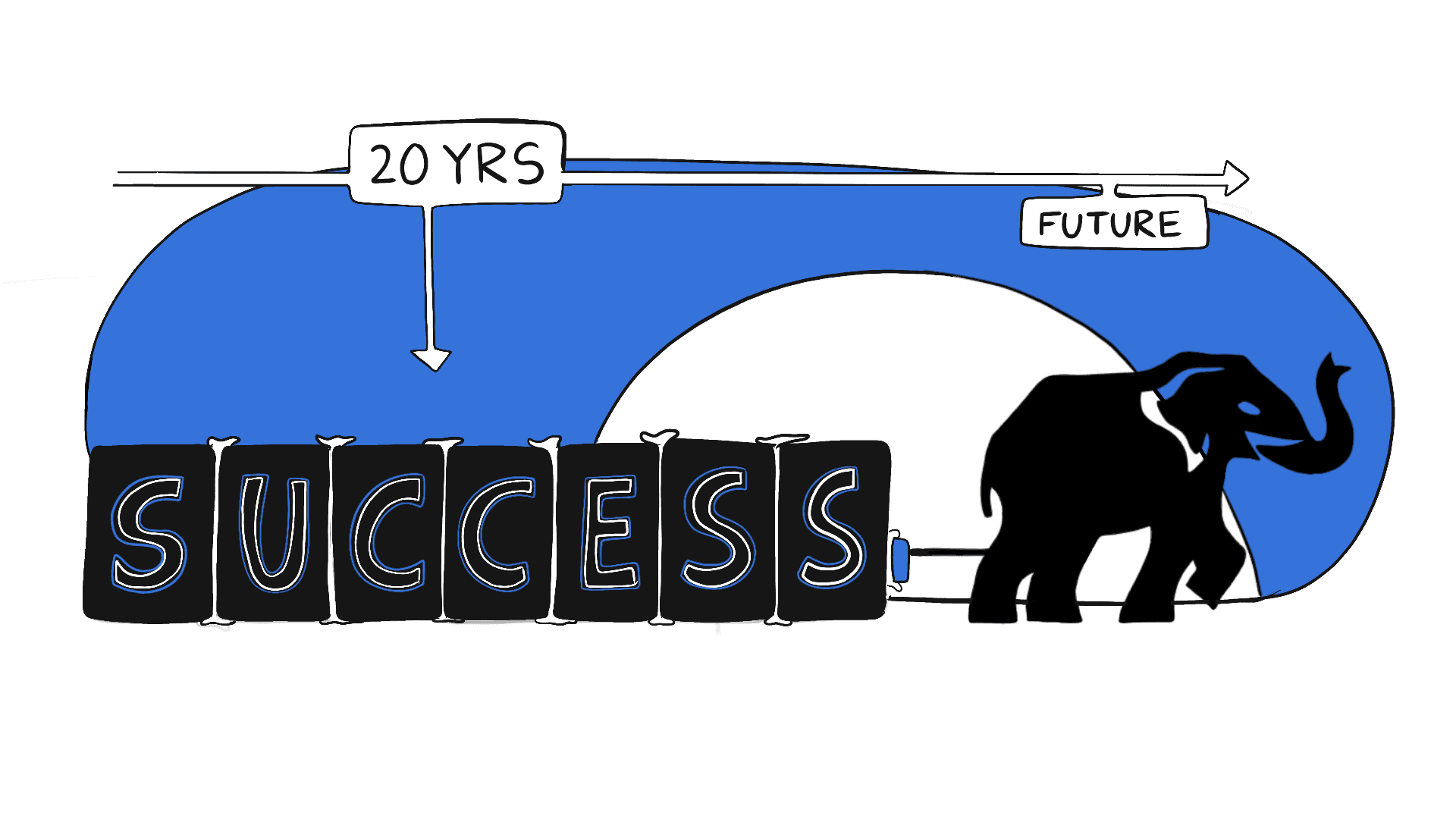

Can Fevicol Stick To Trusted 20 Year Building?

Profile

Retail

Real Estate

Brand

IPO

B2C

B2B

SME

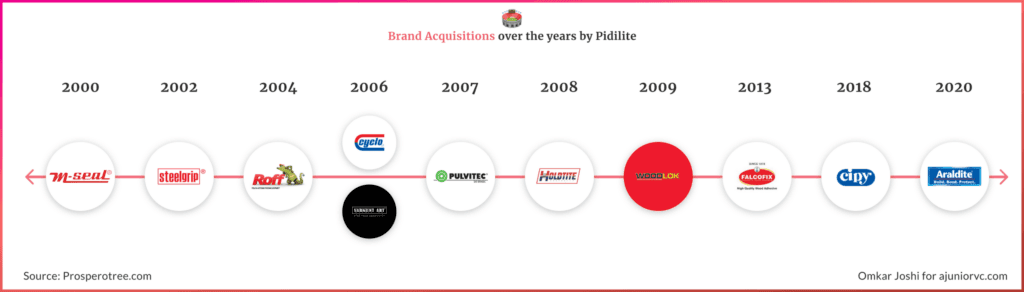

Last fortnight, Pidilite bought the maker of Araldite for 2,100 Cr ($300MM), adding to its long list of acquisitions to strengthen its position.

From Mumbai With Love

In 1942, Balvant Parekh found himself amidst a maelstrom of geopolitical activity.

The Soviets had successfully defended the city of Stalingrad against German advances, marking the beginning of a turning tide towards the Allies in the Second World War.

The British had colonised and occupied India for 334 years. Mahatma Gandhi has just launched the Quit India Movement, and passionate patriots from around the country were collecting in Mumbai to fight.

Among these was Balvant Parekh, a law student at the time who left his studies midway to participate in activities close to the heart.

A few years after participating in various social activities, Balvant would complete his education in Mumbai. He decided not to pursue law, instead opting to work at a printing press and later a wood trader’s office as a peon.

Both roles require hard work and resourcefulness, which would help Balvant in his future business adventures, even if he didn’t realise it then.

Soon after, Balvant teamed up with an investor to start an importing business, primarily focused on nuts and paper dyes.

By 1954, he was trading and manufacturing industrial chemicals and pigment emulsions through a partnership with a German firm called Fedco.

Seeing a gap in the market, he had the idea of an easy-to-use replacement for glues and fat-based adhesives for India’s furniture industry.

But Mr. Parekh would have an insight that would become a pillar for his fledgling company.

While competitors would focus on pleasing middlemen and wholesalers, Balvant’s company would go directly to carpenters and educate them on the longer term benefits that came with a high quality product.

It didn’t hurt their cause that other glues on the market required boiling prior to application, whereas Balvant’s differentiator was his glue’s ease of use.

Before long, Balvant’s product overtook competition and cemented itself as the adhesive of choice for India’s carpenters.

Fevicol was born.

You Only Stick Once

By 1969, Balvant had grown his product portfolio beyond Fevicol to Fevibond, Fevigum, Pidifix, Pidivyl and Acrolise.

Operating in a relatively unstructured way for the next 20 years, he continued to grow beyond Fevicol into adjacent products and services for his target markets.

This brings us to 1990, where Balvant established Brand Pidilite to set the stage for expansion beyond their marquee Fevicol product. This diversification opened the doors to an eventual listing on the BSE in 1993 and excited investors for years to come.

But Pidilite wasn’t done with Fevicol. They wanted Fevicol to be more than a tool for carpenters.

Until their public listing, Fevicol’s success as an industrial adhesive could be attributed almost entirely to word of mouth publicity.

As it set sights to become bigger, Pidilite had bigger plans for its anchor brand.

They approached Ogilvy and Mather, the advertising agency that handled accounts as big as Rolls Royce, and that’s when the magic really began.

Few advertisements have conveyed a brand’s values as effectively as Ogilvy’s managed to, with Fevicol.

The message of an unbreakable bond was delivered by taglines that really stuck.

Beginning with the “Dum lagake haisha” ad in 1989, followed by the likes of “Fevicol ka mazboot jod hai, tootega nahi” and “Pakde rehna, chhodna nahi”, phrases popularized by Fevicol’s ads were finding their space in colloquial language as synonyms for “the ultimate bond”.

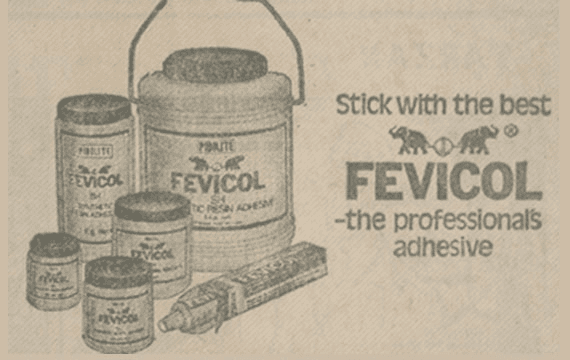

The early 2000’s were when the product line underwent a contemporary makeover and began sporting the unmistakable logo - two elephants struggling to tug apart a piece of wood stuck together with, you guessed it, Fevicol.

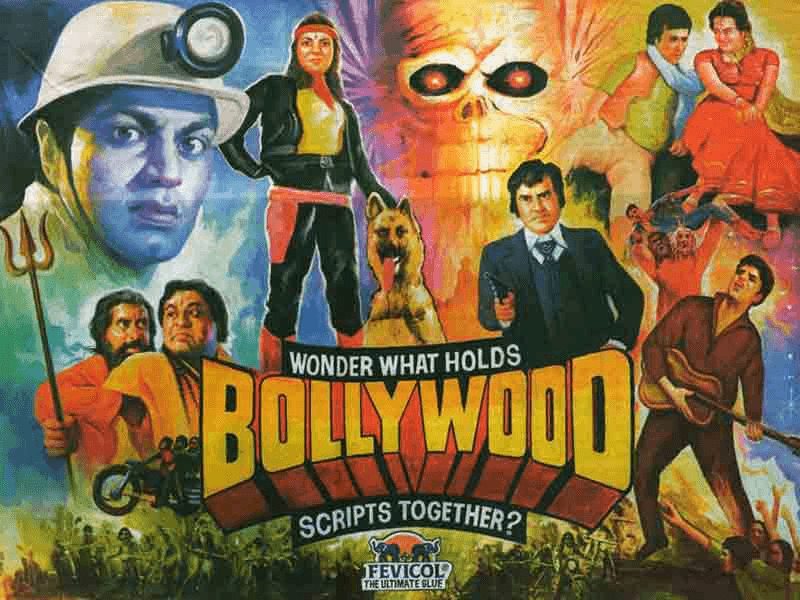

Fevicol’s ads were also keeping up with Indian pop culture at the time, with some lesser known yet brilliant print ads in its archives.

The family of ads not only had a consistent message revolving around the nature of the adhesive’s bond, they also addressed Fevicol’s roots by retaining a scoopful of desi humor in every ad, going forward.

Ogilvy and Pidilite were recognised for their efforts, and aptly so, when the Fevicol Bus TV Commercial clinched the Silver in the Household Maintenance Products category at the 2002 Cannes Awards, which are widely regarded as the Oscars of the advertising world.

Over the same period, they were awarded the title of the “Best Continuing Campaign” at the ABBY awards, with their ads winning across a myriad of categories.

The buzz around each of its ads, and the excellent execution over the years justified the big budget appetite Pidlite had for them.

Fevicol had gone from being an industrial adhesive for carpenters and woodworkers with no relation to the average Indian household, to a common name that the same household couldn’t do without.

The folks at Pidilite did not intend on quitting while they were ahead, they intended to stay at the top for a long time to come.

Brands Are Forever

As Pidilite started flexing in the early 2000s, Parekh looked to bolster its organic growth using a move that would raise the entry barrier.

The goal was to take care of any potential competition across other related avenues, as well as take care of existing ones.

The method was product acquisition.

Pidilite’s Fevi-seal was the number two player in the sealant segment, second to Mahindra & Mahindra’s M-seal. The latter was an industry favorite, with Ciba Specialty Chemicals India Limited showing interest in acquisition as early as 1998.

Later that year, however, Ciba released a statement reading "The acquisition of M-Seal now would not be in line with our business strategy."

This would work out in Pidilite’s favor.

At the turn of the new century, in what was a mammoth of an acquisition, Pidilite acquired Mahindra Engineering & Chemical Products Ltd’s adhesives and sealants business, consisting of the brand M-Seal and Mr. Fixit.

M-Seal had a market share of 60% in the INR 32 Cr sealant segment and with this acquisition, Pidilite emerged as the segment leader.

This wasn’t the only acquisition on Parekh’s mind. Pidilite bought IDI’s fabric whitener brand called Ranipal, and also picked up Bhor Industries’ Steelgrip, which enjoyed the leadership position in the electricals business, for INR 8.5 Cr.

Together with their own sticking tape brand Prime, Steelgrip would allow the company to enter the electricals business, an area relatively new for Pidilite, with almost 50% of the market share.

Even with all the new acquisitions, Mr. Parekh ensured that Pidilite retained its number one position in each segment it had entered and dominated over the years.

At its core, all of these would be new ways to stick to new customers.

For example, Mr. Fixit got his own persona - he was now Dr. Fixit, and he enjoyed perks like a dedicated ad campaign and frequent makeovers to keep up with the times.

Pidilite was not only winning a loyal consumer base with each new product, it was also actively engaging with and investing in them.

With ventures such as the Fevicol Furniture Book and the Building Blocks magazine, it built the trust of professionals.

The carpenter was at the heart of it.

Pidilite gained well deserved recognition within the country as well as overseas for all these endeavors.

It made it to the top 15 Indian brands identified by FE Brandwagon Year Book in as early as 1997, and was steadily climbing up the ranks in The Economic Times’ “Most Trusted Brands” list in the period between 2000 and 2005.

Pidilite was becoming stickier as a product.

The World Is Not Enough

By the mid-2000's the company decided to spearhead a global expansion and undertook a series of acquisitions.

It was time for Pidilite to expand stickiness beyond India.

It acquired Pulvitec do Brasil Industria e Commercio de Colas e Adesivos in 2007 which was in the business of adhesives, sealants and construction chemicals.

The acquisition helped it enter the high potential LatAM markets. It also acquired the business of branded sealants and adhesives from Hardcastle & Waud Manufacturing Co.

By the end of 2008, it had 13 overseas subsidiaries with significant sales and manufacturing operations in the USA, Brazil, Thailand, Singapore, and Dubai.

It also aimed to build manufacturing plants in Bangladesh and Egypt. It invested INR 84 Cr in overseas subsidiaries. A debt free balance sheet with strong operating cash flows helped pick quality assets globally.

Exports was looked at as a long term play as the company generated less than 10% of its revenues from it in 2008, which was expected to move up.

It also strategically expanded in markets where it sensed the next growth opportunity. It expanded to Kenya attracted by its booming construction industry to serve small and medium construction projects.

While it was diversifying internationally, it also sharpened its focus on the consumer segment in India.

Its backbone would be distribution.

Shareholder and Customer Royale

To ensure stability of raw material supply, Pidilite became backward integrated.

In 2010, it moved to acquire the fixed assets of an international specialty chemical company. With an annual capacity of 20K tonnes the plant was expected to be ready by 2012.

The results of all these efforts were visible in the investor confidence. As the global recession clobbered the stock market, Pidilite remained the safest bet for investors to park money with no major competitors.

A “family owned, lala business” was ranked 24th among the Top 150 Indian brands which depicted the brand equity it has created.

It was the elephant in the room that everyone wanted to stick to.

Ask any investor and they would have their own favorites on B2B vs. B2C models and their scalability and profit potential. Tackling each requires a completely different mindset and approach across various functions in the organization.

It is hence remarkable that Pidilite has cemented itself in both its commercial (B2B) and personal (B2C) segments.

Pidilite has also been able to create a virtuous cycle where investments in either complement to make the core stronger. As it created its legendary campaigns and invested in brand building, institutional confidence was raised to secure and renew existing contracts.

Expanding distribution network and opening exclusive retail outlets has brought efficiency to bring down TAT, go deeper to increase consumer touch points. This helped create an image of ‘TINA’ in the consumer mind be it a business or a consumer like us.

Few of us know anything in adhesives beyond Fevicol.

While many of us know Pidilite through its famous brands, Fevicol, Fevikwik, Fevibond, Fevistick and others, if you’d recall, Mr Parekh started as an industrial chemicals company.

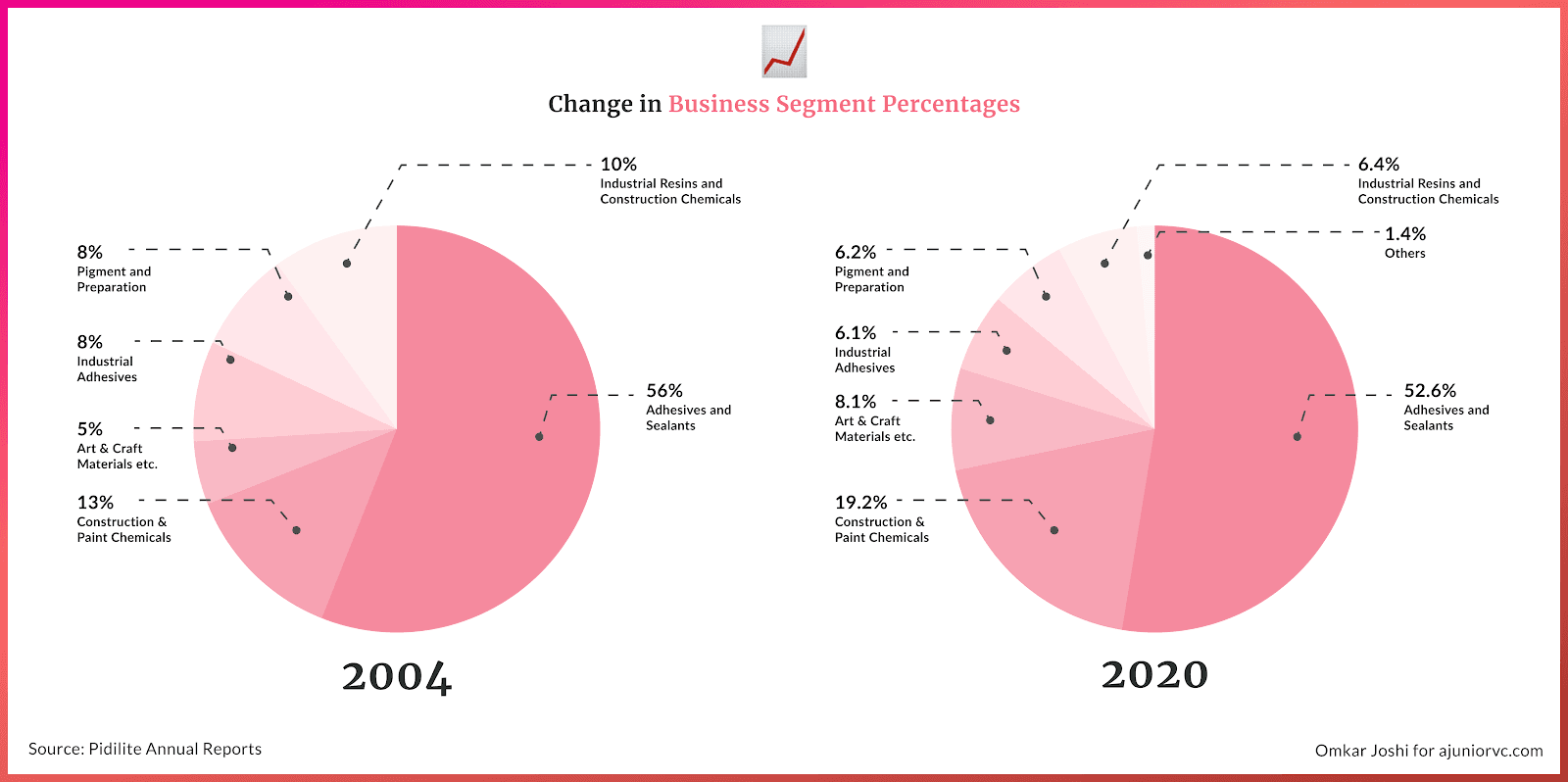

Its products can be segmented into branded consumer and bazaar products and specialty industrial chemicals. Its consumer products consist of adhesives & sealants, construction & paint chemicals, and art materials, and accounted for 76% of revenue.

Its success showed in how it had diversified from its original business, the industrial chemicals, contributed 21% of topline.

A strong brand portfolio created through brands such as Fevicol, M-Seal, FeviKwik, Dr. Fixit, Roff, Fevicryl Hobby Ideas, Ranipal, Motomax etc enabled this healthy shift.

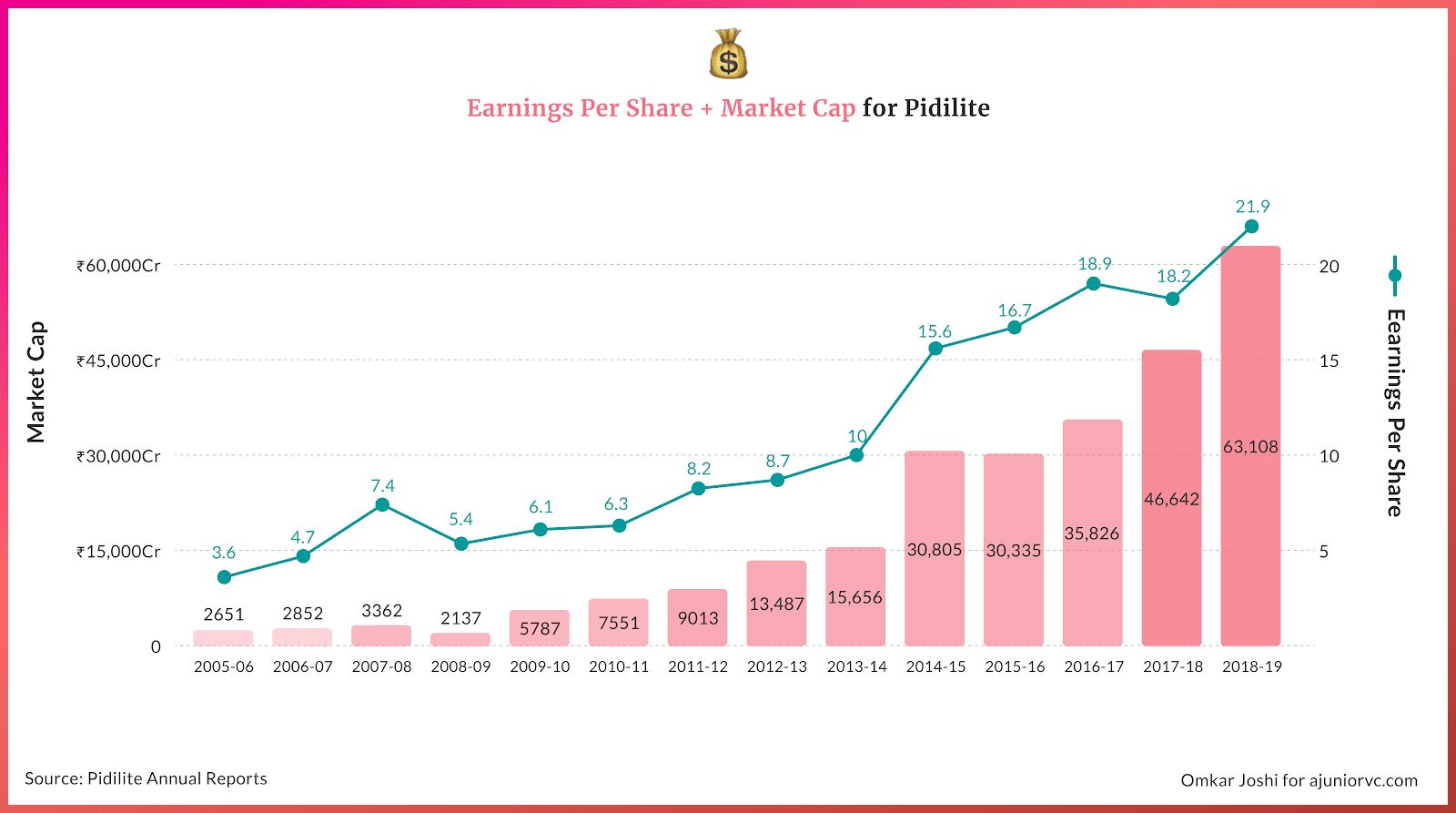

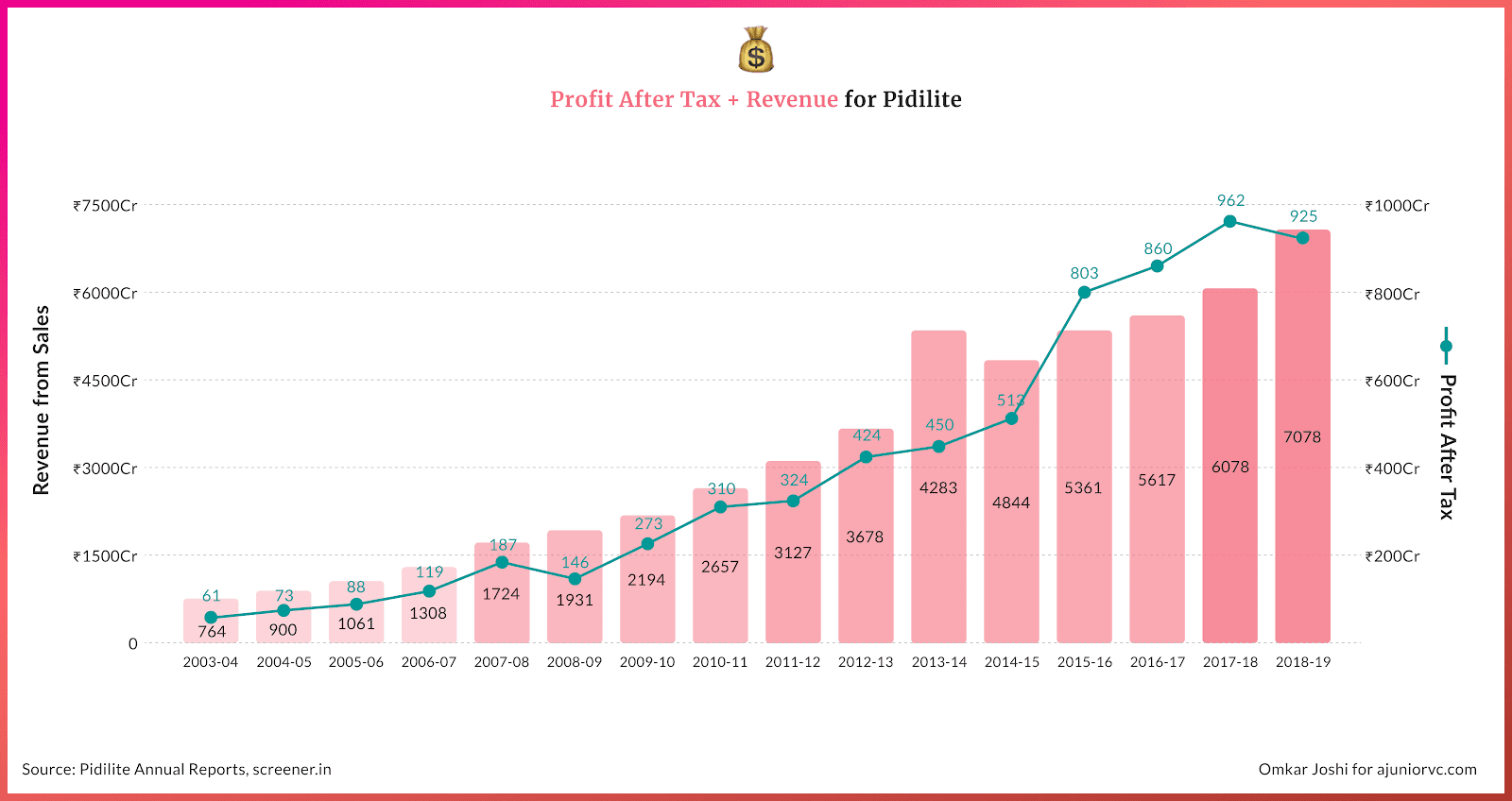

At the same time the company has had a strong balance sheet with high ROCE, stable dividend payout, strong cash flows which have all strengthened investor interest. Revenues doubled between 2007-12 while net profits more than doubled from INR 130 Cr ($26M) to INR 320 Cr ($64M) in the same period.

A sign of a truly remarkable company is being able to manage sustainable growth with profitability while rewarding investors in the journey.

While Pidilite remained in expansion mode during 2007-10, its dividends still grew at a CAGR of 19% (mimicking PAT growth). This allowed it to maintain an enviable payout ratio of 35%.

It has incredibly maintained this ratio for more than a decade now.

By 2011, the company had 19 manufacturing plants, 25+ job working units, 14 overseas subsidiaries. Fevicol had become the largest selling adhesive brand in Asia. In just a decade, Dr. Fixit contributed ~20% of the company’s topline.

Pidilite did face competition from global players such as USA’s Huntsman, Germany’s Hoechst, and closer home from regional players such as Chennai’s Anabond, Delhi’s Jubilant Industries, and Mumbai’s Desh Chemicals.

However, most were unable to match the brand value of Pidilite and its deep connections with its core customers - the carpenters. This also enabled it to enjoy higher pricing power vis-à-vis peers.

Bit by bit, it was also piecing together a castle.

The Man with the Golden Product

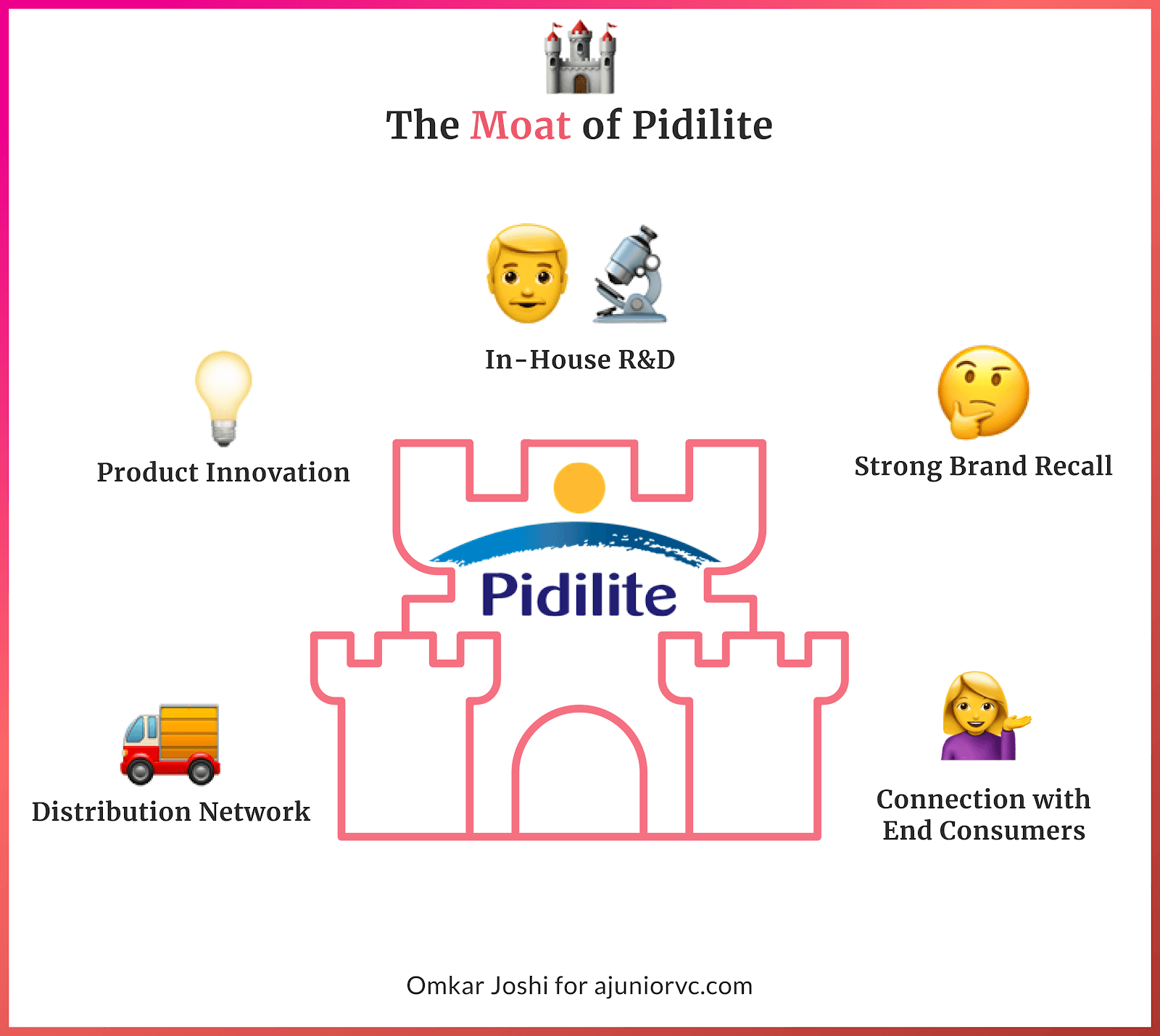

Pidilite created defensible moats through product innovation, in-house R&D, strong brand recall, distribution network and connection with the end consumers.

Product innovation, has led to a remarkable consistency of introducing new products by understanding the user needs and diversifying across segments and categories.

It launched Marine Fevicol which could withstand water while drying (an unheard of thing!) for industrial applications.

The new products have been fed through an in-house R&D which has helped maintain a competitive edge while improving product packaging and ease of use.

For example, when it launched Fevikwik the adhesive would harden and be impossible to use again.

Pidilite re-engineered the packaging and created a plastic packaging material which did not absorb ambient moisture and could hold small quantities of the adhesive. Fevikwik (‘chutki mai chipkaye’) is now the market leader.

It was also spending 5% of its revenues by 2014 on R&D and advertising

Its concerted focus on marketing to cement itself (yes, another pun) as the most reputed and trustworthy brand in the pigment and adhesive business.

Consumers were not exposed to these products and changing habits would be very difficult. But remarkable campaigns led by the ad veteran have stuck in consumer psyche for ages and evolved with the times.

It pushed products it marketed through its solid distribution network. By the end of 2014, the company had 2K+ distributors servicing 400K dealers and 4K industrial consumers. It remained one step ahead in visualizing and capturing demand.

Much before viewing ‘Bharat’ as an attractive opportunity became cool, the company had a sharp focus and penetrated deep into rural India.

By 2015, it realized that the next phase of its growth would be driven from tier 3-5 cities. It set up a ‘rurban division’ to distribute in the semi-urban regions and was in a position to win big in these markets as demand increased

What ‘glued’ all other drivers was establishing trust and confidence with the key influencers such as builders, architects, consultants and importantly, carpenters

Unlike peers such as Movicol (discontinued) which used hardware stores and timber marts to market their products, Pidilite went direct to establish a bond.

This was done by sending furniture design and books to carpenters each quarter and creating a ‘Fevicol Champion Club’ for its carpenter community.

It serves as a platform for woodworking contractors to come together and work for the betterment of their community, learn critical business skills and grow professionally and socially.

To bring this value to life, a Pidilite employee was renovating his home and hired a carpenter who bought Fevicol with him.

The employee asked him about their brand (globally a dominant adhesive) and the carpenter quipped that he could bring that product but could not guarantee if it would last long!

This perception created in the market through their deeply community based campaigns was instrumental in building the brand that we all know and love today.

The Customer Who Loved Me

This customer obsession has been a landmark for Piditlite over decades.

Being “customer first” is cool today, but it has been the USP for the brand in a largely fragmented market where carpenters play a key role to determine which adhesive to use.

Pidilite changed the narrative in their industry by moving from a push to a pull-based strategy.

Resilience and the ability to patiently wait for the product to become big has been an important lesson for others to learn from. Sales volume for its white glue product was insubstantial for close to a decade. The steadfastness in vision has generated big dividends.

Focusing on a niche with limited competition to strengthen the core and continually add product offering has worked remarkably well. Imagine that Pidilite started with just two products with a core strength in specialty chemicals.

It also started to think long term, and professionally manage the gigantic “family business”

A transition from a family run business to a professional set up has provided depth and expertise for the next phase of growth.

In 2015, MB Parekh, who was the Chairman and MD, stepped down and Bharat Puri, the Global Category Director for Mondelez, was handed the reins.

Through this, none of the family members were now in operational roles.

Through product expansion, market expansion, acquisitions, and leadership changes, this enduring Indian brand has achieved a 16% CAGR in the last 14 years with a PAT CAGR of 18%.

Even as the economy witnessed a slowdown in the aftermath of the recession from 2009-14, Pidilite has grown at 15%.

This is especially remarkable since its products (Fevicol used to make furniture) is linked with the health of the economy. Slowdown would lead to postponement of home construction or improvement.

When demand for industrial adhesives took a hit due to slowdown in consumer activity, its consumer product segment turned out to be a savior in this period.

Its successful diversification was due to innovation in a category where it was unheard of.

Dr. Grow

Pidilite’s obsession with innovation is like Apple.

It has a dedicated division responsible for packaging and product design. In one instance, they learnt that women using their Fevicryl product were not particularly adept at using it.

Understanding that the same women were comfortable applying mehndi, Pidilite immediately designed an SKU with packaging same as a mehndi cone.

This urge to track customer needs and continuously adapt is what keeps it ahead of others.

Fevicol, Fevikwik and Fevi Stick are monopolies in their respective segments with >70% market share. However, in Pidilite’s case what stands out is not just the market share but ‘mind share’.

It’s deepening of mind share was because of its consistency in products, with adhesives being the anchor.

Besides being household names, its brands have become generic names for their segments. We all remember asking our friends for Fevicol at school instead of ‘glue’ or ‘adhesive’. This allows it to command premium pricing despite being a non-essential product.

Few other products have their brand as the way to describe their product.

Pidilite is nicely riding the wave of consumerism on one hand, and rapid growth in SMBs on the other.

It has managed to penetrate deep into non-metro cities with 35% sales coming from outside urban areas. With $690M in revenue in FY15, it closed FY20 at more than billion dollars in revenue.

If its dominant position in a high-growth segment delivers continual expansion in sales, its business model delivers benefits of operating leverage. Expenses as share of sales have moved down from 86% to 81% in the last 5 years.

Though it had modest revenue growth of 3% in FY20, PAT grew 20%, highlighting substantial cost savings.

But the test of every resilient business comes in a storm.

Live Another Day

This year, COVID 19 did not spare even the likes of Pidilite.

The bulk of the country stayed inside their homes, glued to OTT screens. Pidilite witnessed one of the worst quarters in its history. Sales were down by more than 50% and profit by ~90% on a year-on-year basis.

As consumers cut down on discretionary spending, the company might face short-term headwinds.

The dip in the performance might be temporary, but it raises the question of sustainability of Pidilite’s retail model. The world is moving towards greater e-commerce and the pandemic has accelerated that move.

Even though the construction and industrial sectors are relatively insulated from the digital wave, the consumer front is evolving.

On the consumer side, e-commerce platforms are disrupting the traditional wholesaler-retailer distribution model, even in segments such as home construction and furniture space. On the B2B side, tech startups such as InfraMarket, BulkMRO are changing the raw-material purchase and distribution space.

A company used to 2K+ distributors is increasingly becoming aware of a new D2C trend that is shaping up in India. As one would expect, Pidilite already started factoring in this rapid change in consumer patterns and distribution channels.

As opposed to meddling with its distribution network, it played smartly and let the new-age companies work for it. Last 2 years saw Pidilitie making a $40M investment in India’s leading e-furniture seller, Pepperfry, and a $30M investment into one of the top online home designers, HomeLane.

Both investments would allow Pidilite to gain access to hundreds of furniture sellers on the platforms of these startups. It is clear that despite COVID or the digital wave, Pidilite is here to stay.

The intangible value of its brand is massive and will deliver returns for years to come. The strong brand equity is backed by an extensive distribution network and innovative marketing.

Pidilite’s core has been building trust with the ecosystem, especially the carpenter. This has cemented its position as the go-to brand for anything that sticks.

As Pidilite continues to innovate in the new era, it looks set to continue its trusted 20 year building.

By: Bhoomika, Omkar, Keshav, Saumya, Saloni, Shiraz and Aviral

Audio Version: Behind the Scenes with AJVC

As usual, we have done a behind the scenes format with the writers and host Mazin