Apr 2, 2023

Can Pine Labs Empower Asia's $1Tn Digital Payments?

Profile

Payments

Finance

SaaS

B2B

Series H+

Last fortnight, PineLabs saw a 3x jump in monthly transaction volume just after getting its account aggregator licence.

Budding Idea of a Pine Lab

Lokvir Kapoor was graduating from IIM Bangalore when India opened up.

The Internet was still crawling in India. While some large companies and government organisations began to use the internet for communication. Most consumers had no internet access, and online transactions were uncommon.

The Reserve Bank of India (RBI) began to explore the potential of electronic payments in the mid-1990s. Progress was slow due to the lack of internet infrastructure and consumer awareness.

During this period, cash and checks were still the primary means of payment for most transactions in India.

In 1997, the RBI established the Electronic Funds Transfer (EFT) System, enabling electronic funds transfer between banks.

But the game-changing moment was some banks' introduction of debit and credit cards in the late 1990s.

The use of debit and credit cards for payments grew slowly but steadily in the late 1990s and early 2000s. Low card penetration, lack of merchant acceptance and concerns about security and fraud limited the growth of cards.

The retail petroleum industry struggled to provide customers with secure and efficient payment options.

Rajul Garg and Tarun Upaday, saw an opportunity to use smart card technology to create a solution. Having spent time with Schlumberger in financial services, Lokvir met these two ambitious young IIT Delhi graduates.

As dotcom went wild in the US, the two graduates were bitten by the startup bug from 10,000 miles away

In 1998, Rajul and Tarun founded Pine Labs to develop smart card-based payment and loyalty solutions for the industry. Lokvir joined the young grads as a founder-investor, the two were probably the only graduates leaving to start a company.

Smart card-based payment solutions provide customers a more secure and efficient way to pay for fuel purchases. Before introducing these solutions, many customers paid for fuel using cash, which could be time-consuming and pose security risks for both customers and merchants.

Smart card-based payment solutions eliminated these concerns by allowing customers to pay quickly and securely using a smart card.

Smart card-based loyalty solutions helped retailers to build stronger relationships with their customers by providing incentives for repeat business. These solutions typically involved the smart card that people could use to earn and redeem loyalty points or rewards, such as free fuel or other merchandise.

Pine Labs’ solutions helped retailers to streamline their operations and reduce costs. These solutions could be integrated with various backend systems, including inventory management and accounting systems, to provide real-time data on transactions and sales.

Pine Labs was quickly becoming a trusted partner for merchants across India. Pine Labs was getting started, but the founders had other plans.

Branching Out

Within 2 years of starting the company, Tarun and Rajul started another company,

Global Logic, which would be a pioneering IT services company in India’s BPO boom. Tarun left PineLabs in 2000, just two years after starting. Rajul followed suit and quit in 2003.

Lokvir would go from investor to CEO. He recognised the need to invest heavily in developing its technology infrastructure and expanding its product offerings.

Pine Labs wanted to be a software company rather than just a payment company. The thought was not random and had merit to it.

As 2003 started, there was a significant boom in the Indian payment ecosystem.

The Reserve Bank of India (RBI) introduced several initiatives to promote electronic payments during this period. One of the most significant developments was the introduction of Real Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) in 2004.

These systems enabled customers to transfer money electronically between bank accounts in real time, making it easier and faster to make payments.

In 2005, the RBI introduced the Payment and Settlement Systems Act, which provided a legal framework for electronic payments in India. The act helped to establish rules and regulations for the payment industry, ensuring that transactions were secure and reliable.

In 2006, the Indian government launched the National Payments Corporation of India (NPCI) to promote the growth of electronic payments in the country.

It was evident that there was push from the Indian government to move towards a more organised payments ecosystem.

To keep the momentum going, in 2006, Pine Labs made a strategic move into point-of-sale (POS) services. Beyond their smart cards, this enabled merchants to collect debit and credit card payments directly at the point of sale.

The move to POS services was an essential element of Pine Labs' strategic goal of evolving into a software company that could offer merchants a full suite of financial services.

Pine Labs developed a cloud-based payments platform to achieve this goal that could integrate with various merchant systems and provide real-time transaction processing and reporting.

This platform enabled Pine Labs to offer various value-added services, including analytics, marketing, and loyalty programs.

The investors were impressed and handed Pine Labs the first-ever funding cheque of $1m in 2008. It took an incredible ten years to raise its first round, signalling how nascent India’s ecosystem was.

The nascency showed how deep the problem was.

Banks are Fintech’s Roots

By 2010, Indian merchants faced several challenges in accepting digital payments.

According to a report by the Reserve Bank of India (RBI), less than 10% of merchants in India accepted card payments in 2009 due to high transaction fees, complex payment systems, and a lack of awareness about the benefits of digital payments.

Pine Labs had problems to solve while becoming a matchmaker for two key stakeholders.

The payments industry has two critical stakeholders, merchants and banks. If the collaboration with the merchants and banks is successful, adoption will be much faster.

Banks will be interested in adoption since they make money via card payments. If the POS system works appropriately, more people will utilise cards to pay.

If more businesses start using point-of-sale systems, that's good news for retailers. Other features, like stock management and sales statistics, are like icing on the cake.

Pine Labs went after banks first.

The rationale was straightforward. Banks already collaborate with businesses (merchants) and customers. Pine Labs would ultimately become crucial if banks adopted them.

Pine Labs acquired retail customers through the bank route without spending an obnoxious amount on acquisition. The company became unit profitable early in the days.

On the other hand, merchants placed a high value on exclusive partnerships with banks.

Merchants could conduct unique offers and promotions in conjunction with a particular bank through solutions offered by Pine Labs.

Pine Labs first went after banks like State Bank of India, Kotak Mahindra Bank, HDFC Bank, ICICI Bank, Axis Bank around 2008.

With banks in the bag, it onboarded big merchants like Shoppers Stop, Big Bazaar and airport lounges. Pine Labs opted to absorb the cost of POS machines to accelerate adoption and eliminate friction.

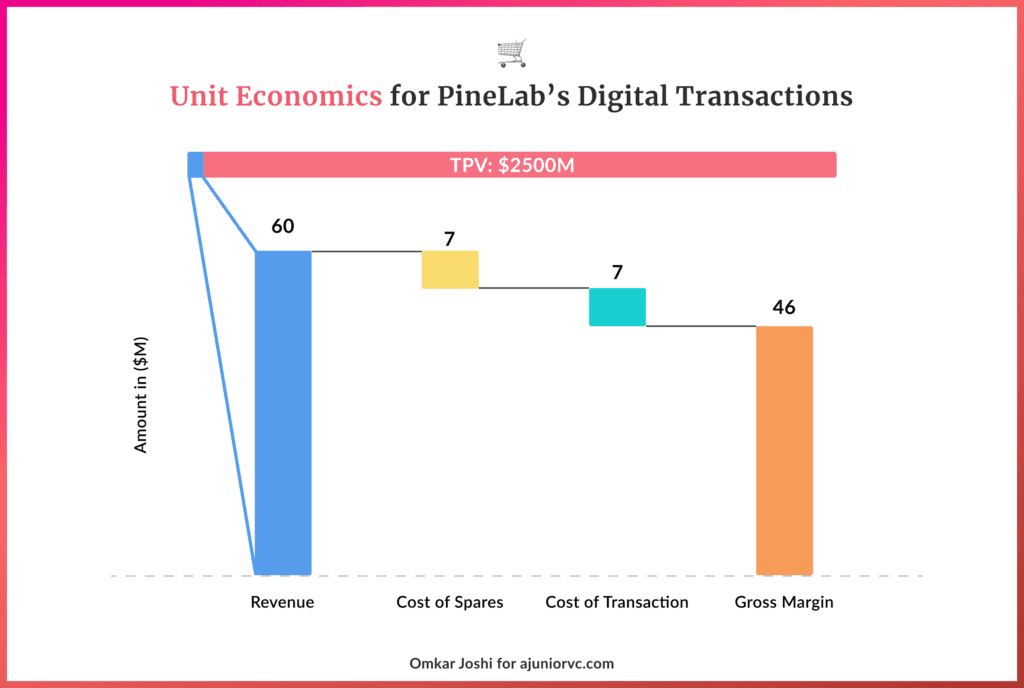

For revenue, Pine Labs charged merchant and bank monthly/yearly fees for the machine. Merchants were also charged a payment processing fees.

Despite its acquisition push, Pine Labs didn’t lose focus and continued developing last-mile retail transaction technology, consumer experiences, and data analysis.

For merchants, the solution and the machine were beyond just accepting payments. They started using it for inventory analysis, sales analysis and customer analysis.

Pine Labs was slowly developing into more than just a card processing equipment firm.

Logging into 3x Growth

By 2011, the company was building its financial stack.

With the rise of the middle class, more consumers were opting for electronic payment options such as credit and debit cards.

Debit and Credit cards in circulation had exploded from 150 million in 2008 to 400 million in 2012. There was a growing need at the merchants' end to provide various payment solutions to customers.

With the growth, there was an increasing concern about card security in India.

The RBI had issued guidelines to ensure the safety and security of card transactions, and merchants were required to comply with these guidelines. The guidelines demanded secure and reliable payment solutions that could meet the RBI's standards.

Pine Labs stood out amongst its peers to onboard merchants for multiple reasons.

Its speed in introducing innovative payment solutions that offered advanced security features and compliance with RBI guidelines was phenomenal.

It also focused on delivering an end-to-end payment solution that included hardware, software and services to merchants to understand their consumer spending patterns in a better way.

Pine Labs was also a pioneer on multiple fronts. It was one of the first companies in India to introduce mobile payments and QR code payments, which helped to expand the range of payment options available to merchants and consumers.

Another differentiating factor was its ability to have strategic partnerships with banks, retailers and other stakeholders

By 2012, Pine Labs had partnered with Axis Bank to launch an innovative payment solution for merchants. Plutus Smart, enabled merchants to accept payments from multiple channels, including debit and credit cards, mobile payments, and online payments.

It was one of the first of its kind during that period.

Under the partnership, Axis Bank provided payment gateway services, while Pine Labs managed the hardware and software aspects of the solution.

Pine Labs deployed its proprietary Plutus Smart terminals at merchant locations integrated with Axis Bank's payment gateway. The Plutus Smart terminal was a single device that could accept payments from multiple channels, including magstripe and chip-based cards, mobile wallets, and online payments.

The partnership had a significant impact on the Indian payment ecosystem.

It provided merchants with a reliable and secure payment solution that could accept multiple payment channels, reducing the need for various payment devices. The solution simplified the payment process for merchants and improved customer experience.

With these solutions, PineLabs became the payment service provider for merchants across industries. It was evident with its increasing customer base across retail, hospitality, healthcare and e-commerce.

In 2013, Pine Labs raised US $14 million in a Series B funding round on the back of its innovation

Pine Labs had become the OG of the Indian digital ecosystem, having started as slowly as the Indian payments ecosystem.

The company was looking at a huge market.

$2Tn Nut to Crack

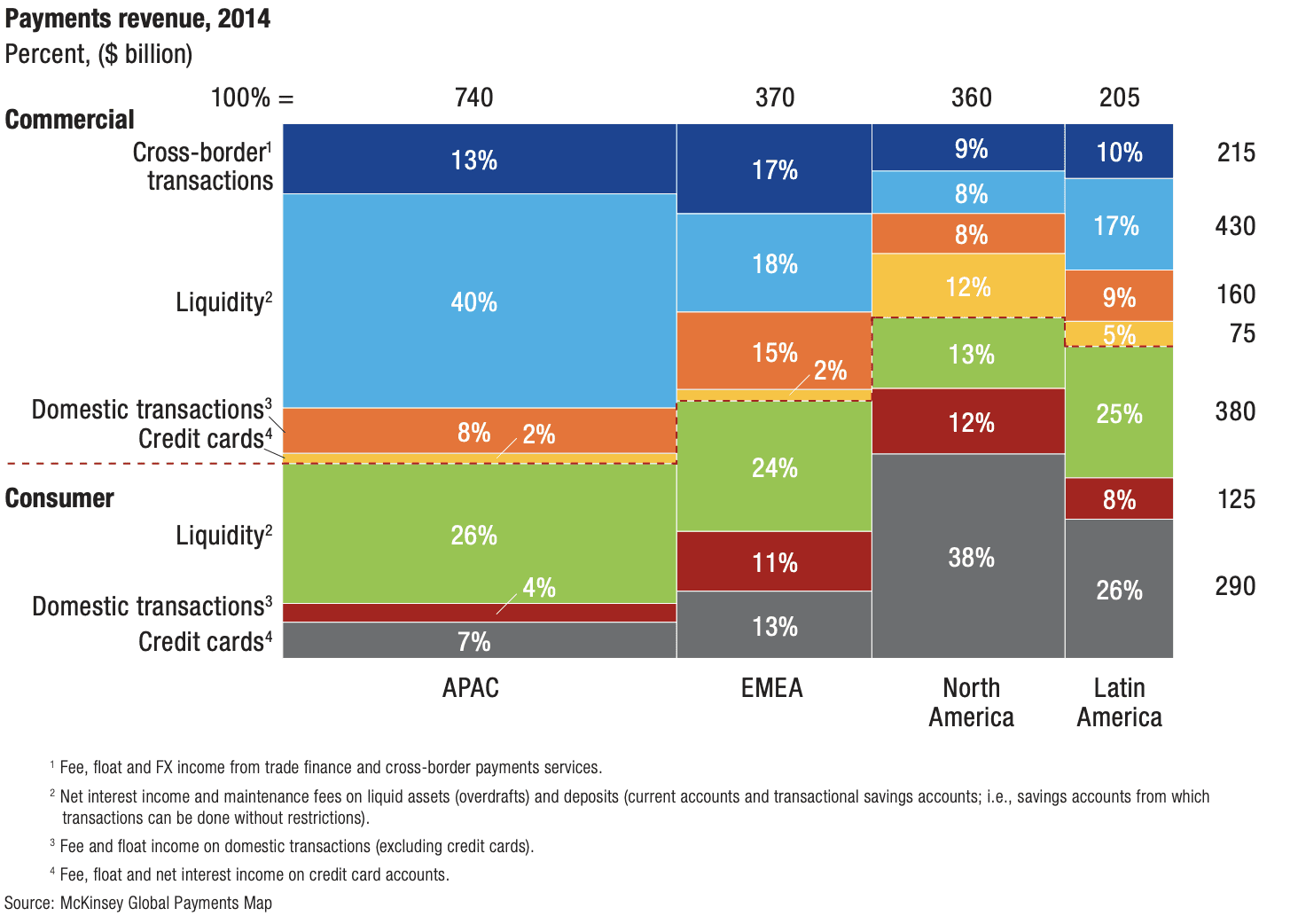

The total revenue of the global payment industry in 2014 was an incredible $1.7 trillion.

People expected APAC to contribute 40 per cent of the anticipated growth between 2014 and 2019.

PineLabs sensibly focused on India, which was part of this growing region.

It concentrated on enabling domestic offline merchants to accept card-based payments. In this offline push, they had great room to grow the market.

However, the market of many small merchants was a tough nut to crack. It took a lot of work to scale this market overnight as the merchants would subscribe and stick with a service only if they saw consistent value.

PineLabs knew its strength was in creating finance software solutions. They understood the needs of this target segment of consumers and proceeded to develop software solutions and integrations which would make their life easier.

The PineLabs POS had unique integrations with inventory management, tax, vendor relationship, and loyalty program software.

The software suite made the Pine Labs solution attractive to existing brands with a nationwide retail presence.

A brand like Reliance Retail, with stores nationwide, would find the PineLabs software helpful solution. The solution ensured consistency in the payments experience at all stores.

Using Pine Labs would mean significantly less manual intervention in payment reconciliation across its various stores and integrations with existing software systems.

The strategy of doubling down on large retailers thus made perfect sense.

The countrywide retail stores were a vital segment in the offline payments market. These stores desperately needed a solution that integrated seamlessly among all their existing systems.

The chains would also be more interested in purchasing a POS device which solves all their problems. Many stores meant higher device sales for PineLabs and higher transaction volumes.

Focusing on this market initially was a good strategy that gave them dividends in a challenging market.

Away from startups' noise, PineLabs was doing an impressive Rs 4000 Cr per month in transaction volume.

Building Business Rings

As is often the case, an idea's success or failure is determined by its timing and Pine Labs seemed to have timed their efforts perfectly.

In 2013, the Reserve Bank of India (RBI) mandated a personal identification number to complete a debit card transaction. RBI also capped the Merchant Discount Rate (MDR)—the fee retailers pay card companies on each transaction to 1% of the transaction value.

Debit cards exploded further with this, registering a growth of 64%. By October 2015, there were over 615 million.

As debit cards became more popular, offline merchants, taking after their online peers, began taking an interest in improving the payment process. Merchants wanted to understand consumers' spending, payment patterns, and details. They wanted integrated security and wanted to sell better.

The PoS machine for offline merchants now needed to do more than accept payments. It was needed to help collect and collate information and give discounts.

This is when the cloud-based payment platform replaced the bank-centric PoS terminal.

On the back of this innovation and as an early entrant in the PoS terminal market, Pine Labs had become the largest PoS player in the country. Large enterprises like the Future Group and Shoppers’ Stop were already customers, and it integrated with every big bank.

The launch of UPI in 2016, followed by demonetisation in 2017 helped the next phase of development and growth for Pine Labs.

As customers took advantage of the convenience of digital payments, Pine Labs launched several products to help their merchants.

It started with ‘myPlutus’, an app to help merchants. The app gave them real-time access to sales transaction data, payments related insights, and customer analytics. Then there was BusinessPlus that give merchants real-time marketing tools and automated customer engagement programmes to help them increase sales and drive repeat buying.

Plutus Smart was the next one - an android-based smart transaction machine that allows merchants to process an entire sales transaction using a single hand-held device.

It contained an in-built catalog that allowed detailed comparison of EMI offers for different banks and tenures, dedicated customer feedback mechanism and an in-built IMEI number/barcode scanner.

Like in the past, continuing to work closely with its merchants helped Pine Labs understand what these customers wanted.

Another key milestone in their journey came when the company began providing merchants short-term (0-90 days) financing and weekend credit to help them meet working capital and inventory needs. They didn’t have an NBFC license, so they tied up with third-party financiers to enable the lending.

Pine Labs also partnered with NBFCs to give retailers easy and collateral-free business loans. Merchants could repay these loans by choosing a flexible amount from daily card sales on Pine Labs’ PoS terminal.

The loan products were working like a dream, and PineLabs could dream.

Atmospheric Growth

In FY18, Pine Labs was on track to originate over $1 billion of instant loans at PoS terminals.

In late 2017, Pine Labs decided to look at international markets, and started building new services for different types of merchants and stakeholders in the financial services ecosystem.

Lokvir Kapoor had been at the company's helm for 15 years and was taking a more chairman like role. In 2018, Vicky Bindra, an ex business head at Visa was made CEO to execute on these plans.

Just like Lokvir had done in 2003, Vicky had moved from a board member role in 2016 to CEO

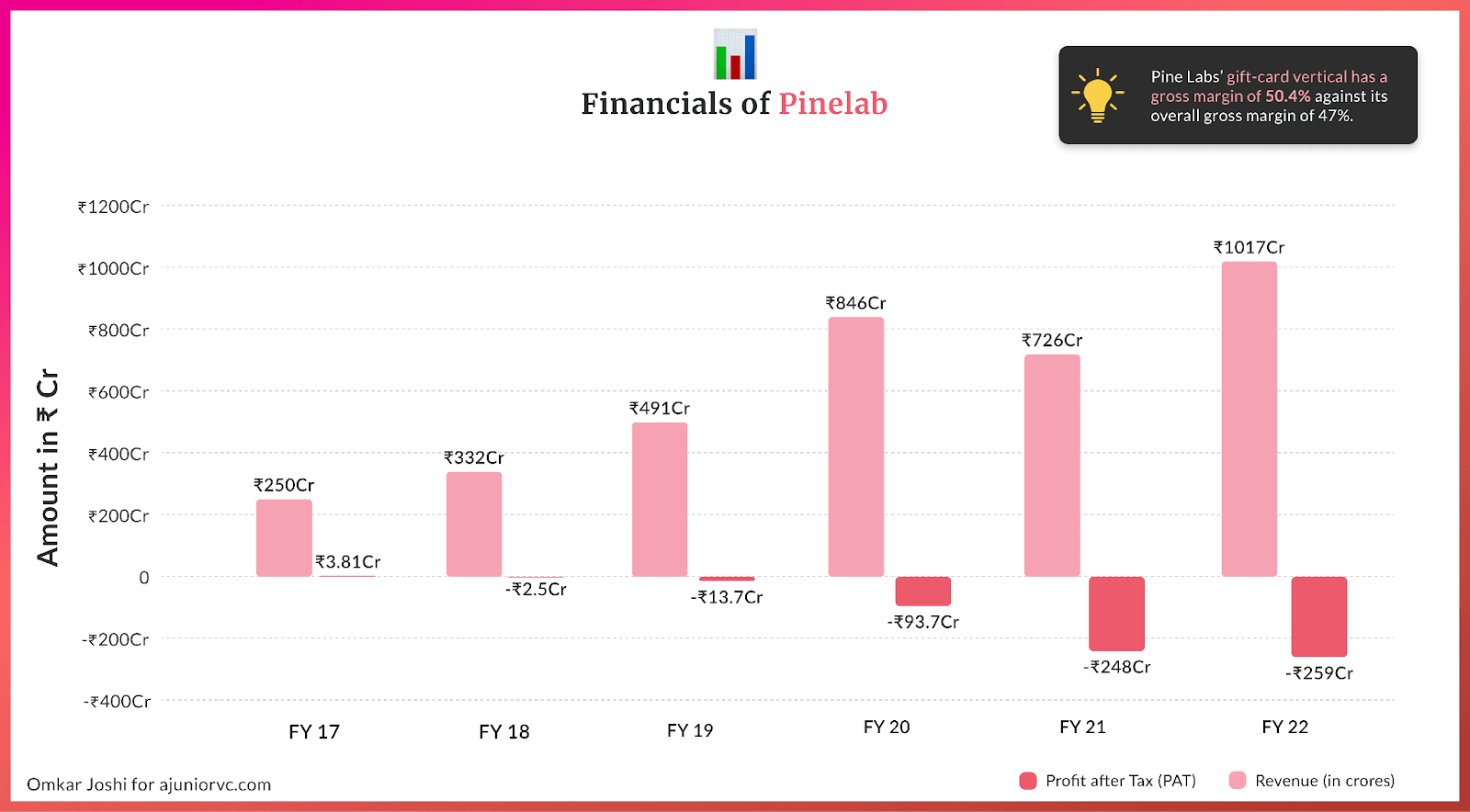

Pine Labs reported a 55% increase in FY18 revenue to Rs. 302 Cr. up from Rs. 195 Cr. in the previous year. However, the growth brought with it losses. Pine Labs reported a Rs. 2.51 Cr. loss in FY18 against a profit in the last year.

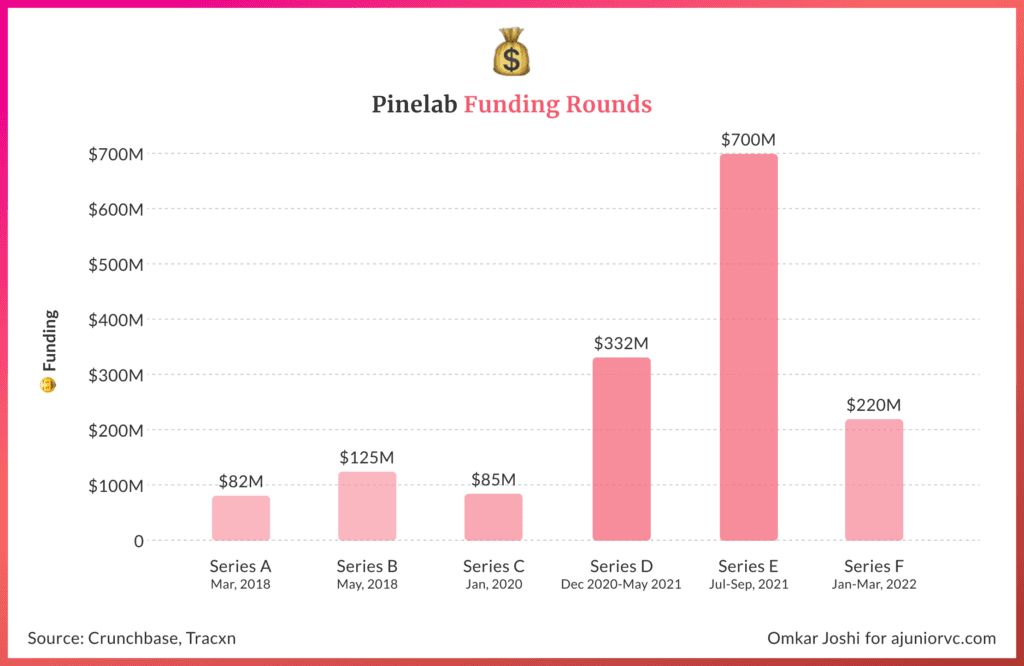

Towards the end of the fiscal year the company also announced an $82 million funding round.

Hot on the heels of the previous fundraising, the company announced, in May 2018, that it had raised $125 million and had touched a Gross Transaction Value of $15 billion on a base of 300,000 payments acceptance points.

Starting slowly, PineLabs had started to scale to the atmosphere

Pine Labs had started as a smart card-based payment and loyalty solutions program for Indian fuel retailers before shifting focus to PoS solutions.

‘Land and expand’ has been a strategy for most businesses selling software and services to Indian businesses.

As sales cycles are long and average contract values for a single service small, companies have preferred to cross-sell as much as possible into their existing customer base.

Pine Labs was no different.

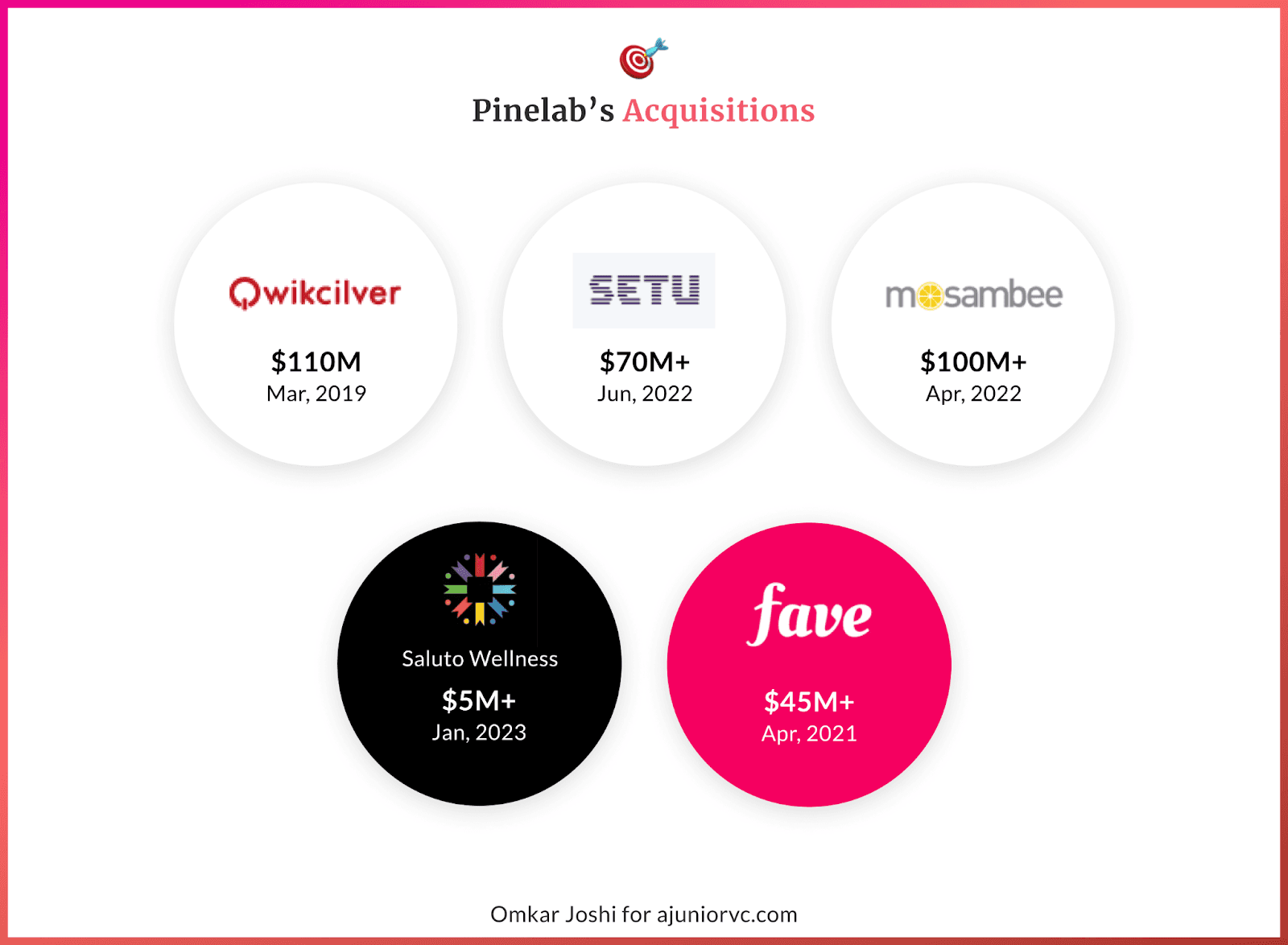

In keeping with that Pine Labs launched a gift-card business called Pine Perks in 2015. However, it was the $110MM acquisition of Qwickcilver which closed in March 2019 that provided this vertical with the necessary firepower.

In a year of the acquisition, Pine Labs’ revenue from gift and prepaid cards shot up $65 million up 4.5x YoY, contributing to half of the company’s revenue, which increased 88% to $130 million in FY20.

Pine Labs’ gift card vertical has a gross margin of 50.4% against its overall gross margin of 47%. The vertical has a customer base of ~250 merchants and ~1,100 companies, including several Tata Group firms, fast-food chain McDonald’s, tech giants Google and Amazon, and many Indian private-sector banks.

But all wasn’t smooth sailing. As FY20 ended, in February Vicky Bindra resigned as CEO.

This was the 3rd CEO to leave in PineLabs’ 20 year history. Then the pandemic hit, and offline payments went to zero.

Falling Leaves

FY20 was a significant year for Pine Labs.

Amrish Rau came onboard to take control of operations, bring in new investors and prepare for an IPO.

As Pine Labs struggled to find its feet, things slowly started to open up. Pine Labs also began explore new markets.

In July 2020, the company bought a stake in Singapore-based discounts-and-smart- payments application Fave for $45 million to enter Southeast Asia and set the ball rolling on organisational restructuring.

The company clubbed all its offerings into three key business segments: digital payments, issuing, and consumer apps.

The Fave acquisition also highlighted Pine Labs’ international ambitions. In partnership with Mastercard, who invested in the company, Pine Labs launched its pay later offering to the Southeast Asian markets.

The company also extended its “institutional acquisition” strategy overseas by tying up with local banks to grab a share of the merchant payments market in Malaysia, Singapore, Vietnam, Thailand, and the Middle East.

Unfortunately for the company, the new CEO’s arrival had been followed quickly by the pandemic.

In his first full year at the helm of the company revenue declined more than 30% in FY21. However, revenue bounced back close to pre-pandemic levels in FY22.

Pine Labs revenue grew from 490.57 cr in FY19 to 948.58 cr at the end of FY22. For FY19 and, more particularly for FY20, the growth from the sale of devices stood at 128.45 cr and 235.59 cr, respectively. However, in FY21, the revenue dropped precipitously to 50 cr and even lower to 30 cr in FY22.

This indicates that the demand for Pinelabs devices fell significantly after the pandemic.

It may also indicate that PineLab’s desire of not competing on price points as far as payment devices are concerned has reached its limit in terms of Total Addressable market.

The revenue from sales and services grew from 351 cr in FY 2019 to 733 cr by the end of FY22. Excluding employee expenses, depreciation, and amortisation costs, PineLabs had a margin of around 52% for FY19-FY22.

PineLabs foray into the online world, developing its Plural platform and acquisition of Setu paved the way for immense future growth.

The firm has already worked on the much more difficult offline payment space for all its history. In India, UPI is the dominant mode of payment, and its acqusition Setu’s UPI Verse stack gave it a lead.

While revenue growth may have lagged expectations for reasons beyond Amrish’s control, he delivered on bringing in new investors.

Riding the funding wave boom in 2021-2022, Pine Labs raised funds in three major rounds, raising almost $1Bn.

PineLabs valuation jumped from under $1 billion in 2020 to $5 billion in January 2022, while it became a large business.

Pining for a Public Offering

While Pine Labs had raised up rounds, the next target was to deliver on the IPO.

To deliver this, the vision for Pine Labs was centered around four key verticals.

A merchant commerce platform built on its network of point-of-sale devices, a payment gateway powering both offline and online merchants, a consumer payments app specializing in vouchers and prepaid gift cards and a loan platform for small merchants and offline businesses.

The point-of-sale devices remain the core of the business today.

Pine Labs serves over 100,000 merchants in India, Malaysia and Dubai, powering nearly a million point-of-sale devices. Through its ubiquitous smartphone-like devices, the company provides solutions to accept payments, create invoices and facilitate EMI options at the point of purchase.

Pine Labs is also the top issuer of prepaid payment instruments (PPIs) in India, with over 185 million gift and loyalty cards as of November 2022

Pine Labs launched Plural in 2021 to take on the likes of Razorpay, PayU’s Billdesk, and CCAvenue. During the last 18 months, Plural has recorded a run rate of ~US$300-400 million monthly in terms of dollars processed on the platform.

The company also received its payment aggregator license in 2022, a critical milestone in pursuing a public listing.

To help achieve its four-pronged vision, Pine Labs pursued inorganic growth opportunities aggressively. It was putting the cash it raised to work.

In January this year the company acquired loyalty-programme-management company Saluto Wellness. It was the company’s fourth buy in the past 12 months.

The other companies were payments-infrastructure provider Setu, payments-solution company for small enterprises Mosambee, and Mumbai-based online-payments startup Qfix. In a world where the mainstay, digital-payments vertical at Pine Labs faces severe headwinds from the growing prominence of UPI, these acquisitions were critical to diversify revenue.

The share of debit- and credit-card transactions in digital payments had slumped to 2.6% and 2.5%, respectively, as of December 2022.

Pine Labs, which generates ~90% of its revenues in India, geographic diversification is expected to be a key driver of revenues going forward.

The other hope with these acquisitions and diversification efforts will be to reduce losses. In FY21 and FY22 the company lost INR 248 Cr. and INR 256 Cr. respectively.

For an IPO in India to come to fruition, several things should fall in place.

The existing market conditions, triggered by tumbling tech stocks, must improve. Pine Labs must become a profitable business. The firm needs to shift its domicile from Singapore to India.

As the company enters its 25th year, it is almost as old as Google. Through multiple leadership transitions, Pine Labs has grown with India.

It is now ubiquitous in urban India, and many South East Asian markets. A revenue of 1,000 Cr in fintech with healthy gross margins in not easy. A much clearer path to profitability than many Indian startups, Pine Labs looks poised for a bright future.

With resilience, perseverance and innovation it looks set to power Asia’s $1Tn payments economy led by 10M merchants.

Writing: Ajeet, Nilesh, Parth, Varun and Aviral Design Omkar and Blair