Mar 31, 2024

Can 6,000 Cr PocketFM Be India’s First Global Consumer Platform?

Profile

Entertainment

Entertainment

Platform

B2C

Series B-D

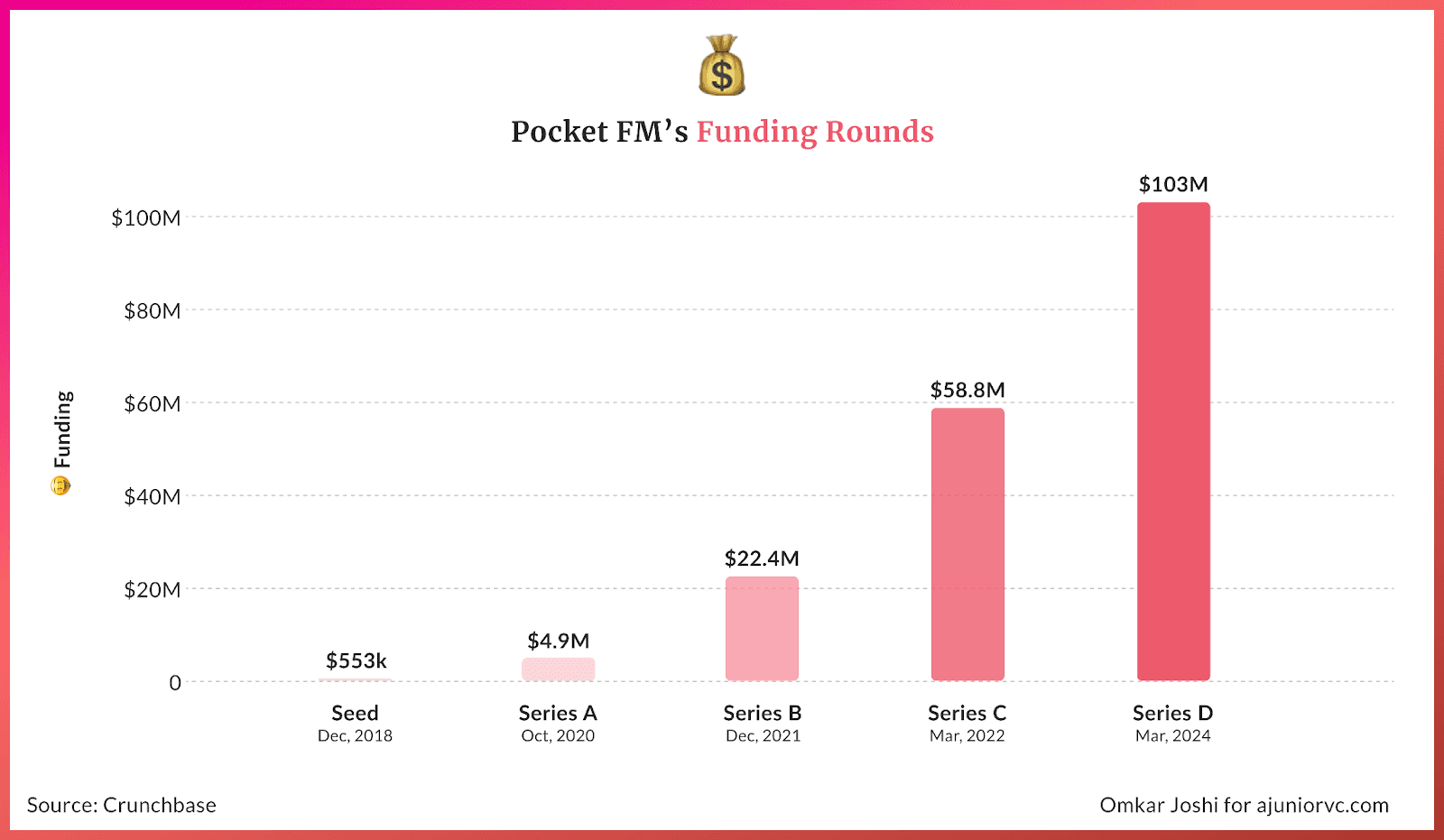

Last week, audio entertainment platform Pocket FM announced a $103M fundraising at a $750M valuation.

Having an ear for content

Rohan Nayak graduated from IIT Kharagpur in 2014 and joined an investment bank.

During the 18-month stint, he realized that his leaning for product craftsmanship outweighed his number-crunching chops.

In November 2015, he moved to Cube26, a tech startup that built operating systems for homegrown mobile handset manufacturers such as Micromax, Karbonn, and Lava.

While commuting from Gurgaon to Cube26’s office in Delhi, he consumed 3-4 hours of audiobooks and podcasts weekly.

Paytm acquired Cube26 in June 2018 to add social engagement features to its product suite.

This allowed Rohan a bigger canvas to operate while shifting his place of work from Delhi to Noida.

The 3-hour daily commute naturally made him look beyond self-help and learning content and search for audio entertainment.

It soon dawned on him that while video entertainment ranged from ephemeral clips on TikTok to long-form options such as Netflix, Amazon Prime Video and Hotstar, audio entertainment as a category barely existed.

Rohan sensed a vacuum, and he went down the rabbit hole.

Looking up YouTube, he discovered creators with a million-plus views who were compelled to impose a stock image as a thumbnail on a 40-minute sound clip. The hack was done only to meet the platform's requirements.

These ‘videos’ were, in fact, fictional audio content, albeit forcefully repackaged as audiovisuals. He understood that the supply of audio entertainment existed, just that it was not aggregated.

Further, he came across users in the comments section of these videos asking the creators to share the audio files with them, which could be played even while their phone screens were locked, unlike YouTube.

Some of the creators responded by linking the files in the video description.

Rohan soon discovered that most of these creators ran large WhatsApp groups to make the original audio clips available to patrons.

This validated that demand for audio entertainment also existed, just that it was uncatered.

What needed to be added was distribution via a platform.

Like many other entrepreneurs, Rohan set out to solve his personal needs. Given the size of his ambition, he needed partners.

He teamed up with his IIT Kharagpur batchmate Nishanth Srinivas, who came with hands-on streaming experience at JioSaavn. Nishanth’s former colleague at Flipkart and Grofers, Prateek Dixit, joined the duo as the head of tech.

Pocket FM was born.

Creating the playlist

The trio launched a minimum viable product on the Play Store.

PocketFM combined Rohan’s early learnings, Nishanth's savvy with personalisation and Prateek’s tech expertise,

Back then, non-music audio came with limited baggage and thus, minimal reference points.

Twitter, LinkedIn, and Facebook had made most of the written word, YouTube transcended everything from cat videos to online lectures, and 6-year-old Instagram had taken the world of images by storm.

But no storyteller ever considered audio even as an option, let alone as the preferred medium.

It was clear that Pocket FM’s product could not be scaled further without deeper user insights. The best way to pick up user insights was to build a scaled platform.

It was the classic chicken-and-egg problem.

To get started, the team focused on fundamentally understanding the user from scratch. This zero-based approach would require capital.

The founders’ pedigree, network, and prior startup experience helped them raise a seed round in January 2019. The average user engagement was under 5 minutes daily.

With the fundraise secured, they entered a phase of serial experimentation. The team conducted up to four weekly trials to explore content formats and genres, refine product onboarding processes, and uncover recurring user behaviour patterns.

The emphasis was moving fast and figuring out what works, which could be channelled and built on to grow the user base.

On the supply side, the platform identified aspiring authors and web series scriptwriters with compelling stories looking for a launchpad.

Getting onboarded on Pocket FM came with almost no entry barriers for these creators. This was unlike the hurdles of securing a contract with a publisher or having your screenplay greenlit by a movie production house.

Moreover, the novelty of the platform allowed creators far more control over their product. It enabled them to have a direct interface with their audience, as compared to the rigours of the algorithm on YouTube.

Pocket FM nurtured and expanded its creator community as it transitioned from user-generated content (UGC) to professionally user-generated content (PUGC). The trade-off was sacrificing speed for quality and consistency.

For the creators, the platform served as a training ground where they honed their craft before pursuing bigger opportunities. It was a win-win.

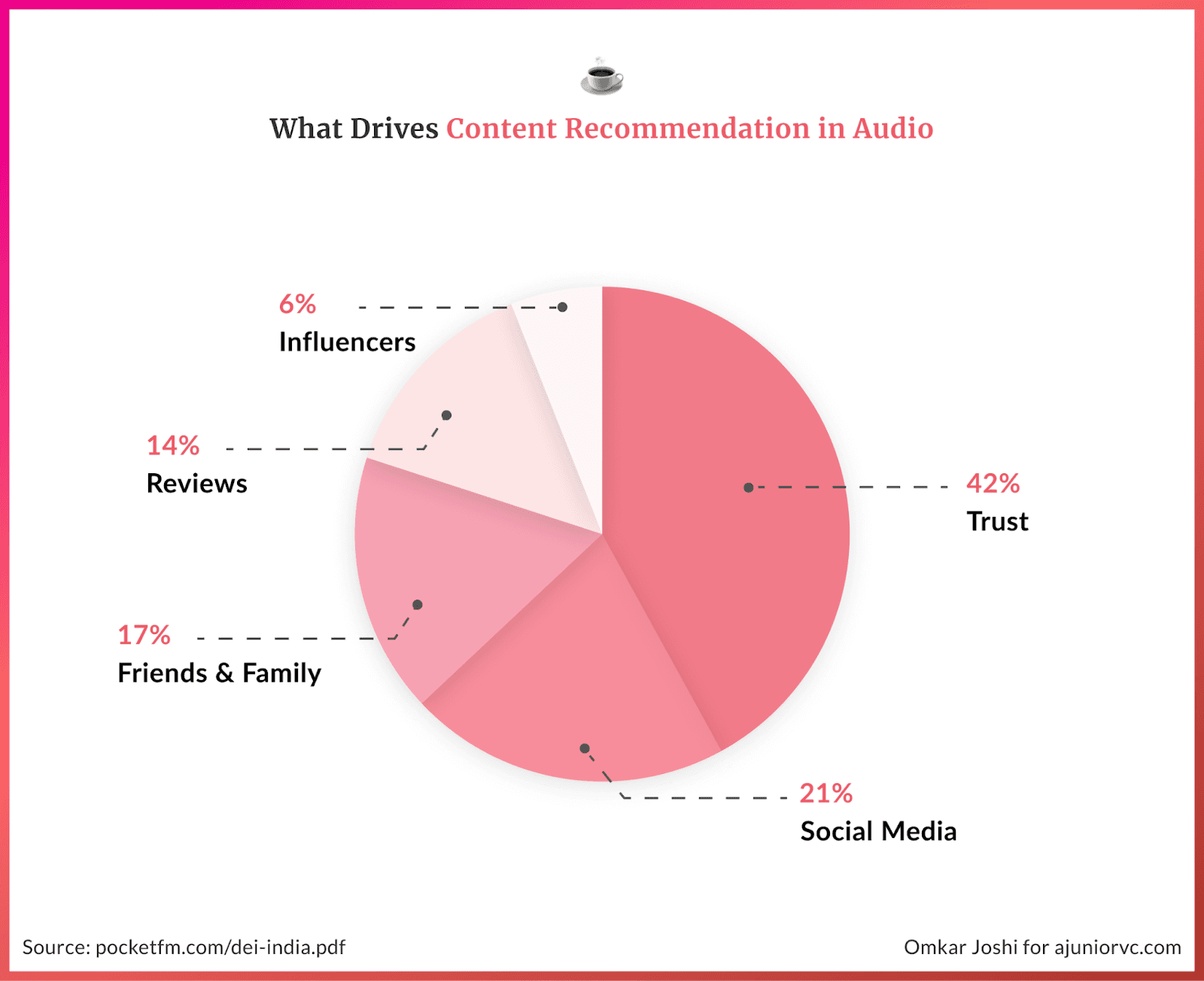

On the demand side, as user cohorts stabilised and the product exhibited initial signs of a market fit by late 2019, the team focused on identifying the optimal growth channel.

The challenge was to gain high-quality users at a sustainable acquisition cost. The absence of legacy in fictional audio content made it even more challenging.

A look at their user activation metrics would throw up answers.

Adding to the queue of listeners

Pocket FM’s fledgling internal MIS reports showed that the 1-hour mark was the inflexion point for user engagement and retention.

Once a user crossed that threshold, there was no looking back. The heat map of daily user activity showed more interesting patterns.

By late 2019, Rohan, Nishanth, and Prateek believed that commutes, morning and evening walks, and household chores were the major pockets of time when users tuned into the shows on Pocket FM.

They were right, albeit partially. The graph showed two more spikes at around 3 PM and the other after 10 PM.

Customer interviews revealed that those peaks were attributable to the post-lunch hour and the time before bed.

Listeners asserted that they used platforms like Netflix or YouTube to actively unwind and relax rather than to kill time during mundane tasks passively.

Encouraged by the feedback, the team doubled its content play by creating playbooks and tutorials for its growing community of creators.

The easier the creators could monetise their content, the better the quality and the higher the likelihood of creating more content on the platform.

To enable monetisation, the team kept its ear to the ground, ran fast iterations, established clear markers for quality and set up short feedback loops.

All the fictional content on the platform was episodic, with every subsequent episode produced only after analysing user traffic data for the previous one.

Audio had a clear advantage over video here.

The relatively smaller investment and quicker turnaround in audio content further allowed creators to be nimble. Creators could tweak their content almost in real time based on actionable inputs.

Every user comment was turned into a data point, mass user drop-offs were dissected and assimilated with the creators, and every passing trend was codified as organisational learning.

A giant insights machine was being put in place. It took an army to create a category, and Pocket FM mobilized one quickly.

The flywheel had begun to take shape, and platform effects were becoming evident. The core team was getting good at this.

If you are good at something, you do it at scale.

Increasing the tempo

By 2020, India would witness a boom in consumption across all types of audio content.

India was estimated to have more than 150M daily listeners, making it the world’s third-largest podcast market.

Why this happened seems like a mystery, but the reality was that Indians had grown up heavily exposed to audio content. It was called radio, which PocketFM’s name did a hat tip to.

The delivery on mobile internet would be novel.

Increased smartphone penetration across urban and, more importantly, rural India, combined with the affordable mobile data offerings from Jio, enabled providers to offer a wide range of on-demand audio content across genres, languages and moods.

As the pandemic struck in early March and the ensuing lockdown was imposed, India saw massive shifts in smartphone usage trends. This would be a boon for content platforms, audio and video alike.

Smartphone usage increased by 11%, from 4.9 hours to 5.5 hours daily, from March 2019 to March 2020. It grew by 25% to almost 7 hours daily in the first month of the pandemic.

Indians were spending more time on their phones for working from home, and OTT platforms such as Netflix and Spotify saw a 55% increase in time spent on their platforms from the months before the pandemic.

But a few months later, the hype slowly faded as fatigue from consuming large amounts of video content set in, leaving people unprepared for spending such a long time in isolation.

A huge opportunity for podcast and audio platforms would present itself. At heart, podcasts are non-intrusive and give people company during daily routines. This also made it a more personal experience and created a bubble of privacy for users.

Pocket FM went from 10,000 downloads in 18 months to 1 crore downloads in just 3 months of the pandemic. It also became the #1 app in the ‘Music & Audio’ category on Google Play Store.

Pocket FM worked on a “wait and listen” subscription model that allowed users to access a few episodes of a title for free before upgrading to view the remaining.

To increase engagement on the platform, users could also unlock further content by acquiring coins and completing various tasks. These could be as simple as following them on social media, completing a survey, or watching an ad.

July would see Pocket FM’s monthly active user count cross 10M for the first time since inception.

While market leader Pratilipi and competitors KuKu and Khabri picked up further funding to continue this unparalleled growth, Pocket FM would also see a 6X increase in its valuation as it raised its Series A of $5M. As 2020 closed, the vernacular audio marketplace had set up shop in India.

PocketFM was about to take a direction no other consumer tech platform had taken.

Syncing into newer territory

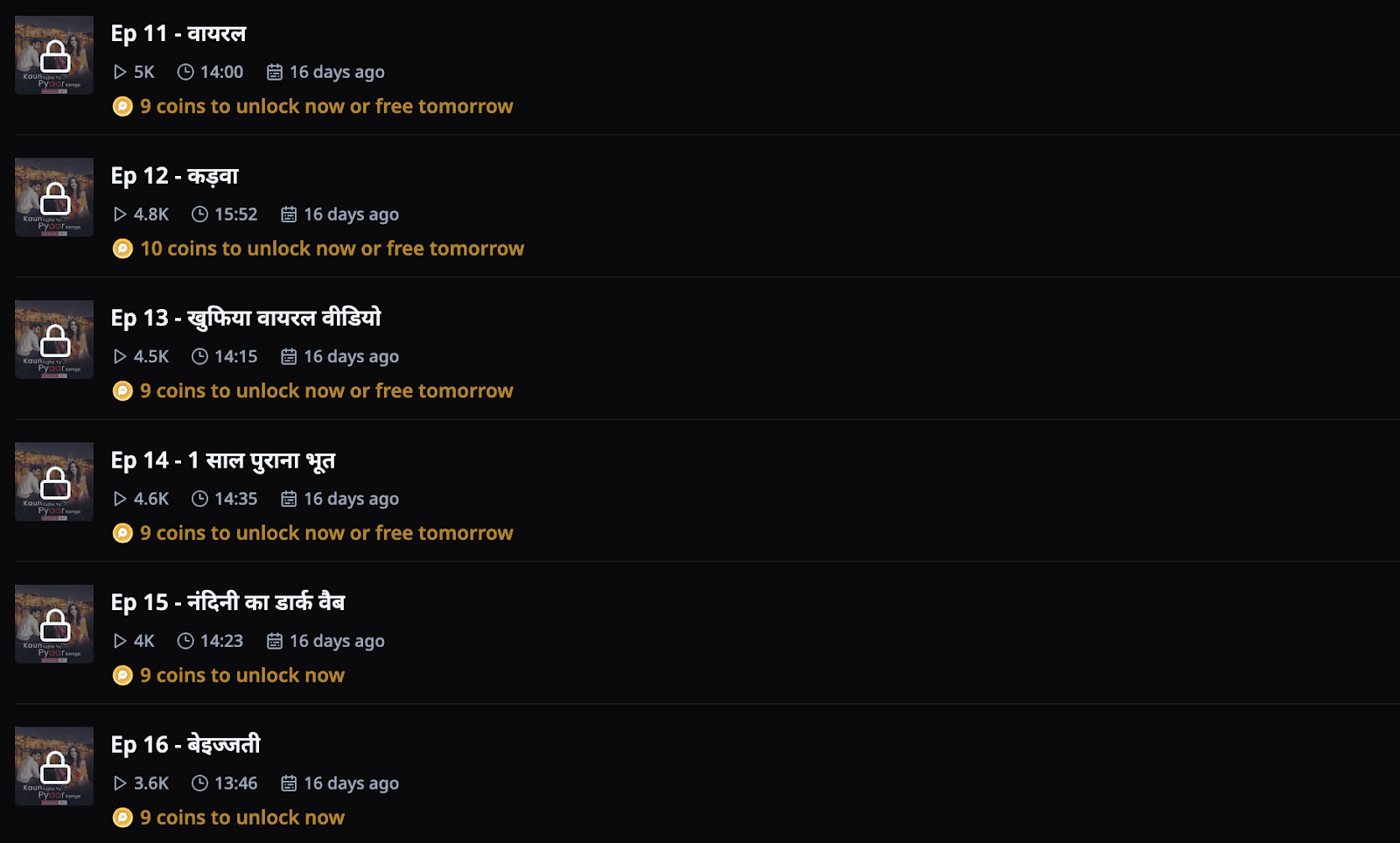

Pocket FM’s audio series would be its most successful format and pave the way for monetisation as it looked to continue its explosive growth.

Audio series were fictional stories divided into multiple chapters or episodes like television shows. With only 2-3 free episodes full of cliffhangers and twists, audiences were eager to purchase further episodes to unfold the rest of the story.

Pocket FM would enable users to purchase more episodes starting as low as INR 9 or accomplish a task from a host of options to earn coins that could be used to unlock episodes.

The tasks would also allow multiple agencies to partner with one another and advertise to the then large and diverse user base, opening up another avenue of monetisation.

As mid-2021 approached, Pocket FM was making waves—not just in India but also in regions abroad where it hadn’t even started a team or actively made the app available.

Pocket FM organically gained traction in parts of South Asia and the Middle East owing to the large Hindi-speaking population there.

This was a clear sign of early product market fit, and the team decided to take the hint and expand abroad. The US, the second-largest podcast market in the world and boasting a large population of Indian Americans, would be the perfect fit.

Pocket FM took its audio series to the US, where most Hindi-speaking Indians actively took to the product

One of the key metrics tracked, time spent listening (TSL) , reached 110 minutes daily in the US, compared to 90 minutes daily in India.

As more users from different communities frequented the app, Pocket FM expanded its catalogue to include more English titles, such as Rich Dad, Poor Dad, and Atomic Habits. It also made available English translations of its more popular audio series.

The closest competitor in the US was Audible, which priced its subscriptions at $8/month, something the majority of Indian Americans didn’t consider budget-friendly. This created a clear opening for Pocket FM’s micro-payment approach.

They priced their cheapest package at only $1.99 for 15 coins, which allowed users to access a couple more locked episodes of their favourite show at a fraction of the price offered on other platforms.

More importantly, this was still 20X higher than the cheapest package in India, INR 49 or $0.6 for 80 coins. This would lead to a huge revenue boost and pave a clear way to monetise and grow the product abroad.

Pocket FM would report a US ARPU of INR 3500, 3X the figure in India of INR 1000.

On the heels of its successful international expansion, Pocket FM would raise its Series B round of $22M. As the year ended, it would break milestone after milestone, crossing 40M downloads and 3B monthly listening minutes.

Just as 2020 ended with a funding round to fuel its growth, 2021 would finish the same way, signalling to India and the world that Pocket FM was here to stay.

Playing on loop

By 2022, Pocket FM had expanded its reach significantly.

The platform had over 80 million listeners and a large base of 500k creators. With over 100,000 hours of content and a library expanded by over 1500 audio titles, the platform reported an impressive 45 billion minutes of entertainment consumed.

The average listener spent about 110 minutes daily on the platform, while short-video platforms had an average of 45 minutes and video OTTs 70 minutes. The listeners were hooked.

The delta made sense. Audio required just the ear to be engaged, while video required eyes and ears. Audio was truly hands-free.

In March 2022, just 3 months after its Series B it closed another round of funding, raising $65mn. Pocket FM was not merely building an entertainment platform but carving out a niche as an alternative to traditional music streaming, OTT and social media.

The top 10 audio series garnered over 1.4 billion plays, leading to more than 10 billion minutes of streaming. Shows like ‘Insta Millionaire’, ‘Saving Nora’ and ‘The Return’ were big hits with each earning over INR 100 Cr (~$12mn) revenue, 15 other audio series crossed the $1 million revenue mark.

Insta Millionaire was the platform's first big success, a gripping narrative spanning over 800 episodes, each 15 minutes long with a suspenseful cliffhanger to end. 800 episodes running 200 hours would be unheard of in video, but it worked on audio.

The story gained a large following, even in the United States and other countries. Pocket FM now had the perfect playbook to monetise.

Initially, offer few episodes free to the user, after which, to unlock a new episode, you pay using Pocket FM coins or else wait a day to unlock one hour of free daily content. The overwhelming desire to uncover what happens next drove users to use more coins to continue listening.

Micro-transactions could entice users and reduce entry barriers while monetising the freemium users via third-party ads.

With the product and the model scrutinised to the Indian market, growth in the higher ARPU international market came far more efficiently, it had solved for generation at scale.

AI played a pivotal role in facilitating content creation by empowering writers. Through AI-driven voice conversion technology, writers were effortlessly transforming their stories into captivating audio series, choosing from a diverse range of over 50 AI voices.

This streamlined process revolutionised audio storytelling for them, resulting in a fivefold increase in the monthly publication of PUGC content, totalling an impressive 2000+ AI series per month.

They were growing fast; witnessing a 10X growth in revenue, exceeding $25M in ARR. This surge stemmed primarily from their international expansion efforts, contributing to 70% of the revenue despite comprising only 15% of the user base.

What began as an audio podcasting platform for Bharat had since transcended its initial vision, venturing into new territories that extended far beyond its small beginnings.

Taking stock of the charts

By 2022, headphones had become ubiquitous

Around a billion people listened to music, 500 million tuned into podcasts, and 250 million enjoyed audiobooks daily.

In India, the scene was even more vibrant. Around 80% of folks found their daily joy in audio entertainment. Music, with its quick and fun nature, was everyone's go-to.

Yet, the audio landscape was broadening.

Podcasts and audio stories began capturing hearts. Indian platforms like Kuku FM and Pratilipi FM were attracting a significant following, while Spotify was increasing its podcast offerings by acquiring production companies.

Pocket FM was not behind in India and had nearly 10 million monthly listeners.

To amplify their revenue, they experimented with in-audio advertisements and brand partnerships. However, this strategy didn't pan out as lucratively as hoped. Many brands were cautious, finding it difficult to see a direct correlation between the audio content and their target audience. This led to a less-than-stellar performance in direct brand partnerships.

Pocket FM also ventured into the diverse pool of regional languages, launching content in Marathi, Malayalam, Telugu, Kannada, Tamil, and Gujarati. However, the Time Spent Listening (TSL) for these regional offerings was up to 30% lower than for Hindi content, which was the benchmark then.

The primary reason is that Marathi, Gujarati, and Odiya listeners often preferred Hindi series, and the Kannada audience faced content that didn’t quite resonate with their preferences.

Due to this lower engagement, efforts towards regional content were scaled back by early 2022. 2022 was a banner year for Pocket FM regarding revenue, but the journey was challenging.

Finding the right mix of content to please a diverse audience proved tricky.

Hitting pause, rewind, play

Audio series as a format was the sleeper hit in 2023.

They took off, especially in the US. The market for these stories you listen to grew fast—about 40 times bigger than just two years before.

People got into these audio series, even more than music. They were almost as popular as watching shows and movies online, which is saying something.

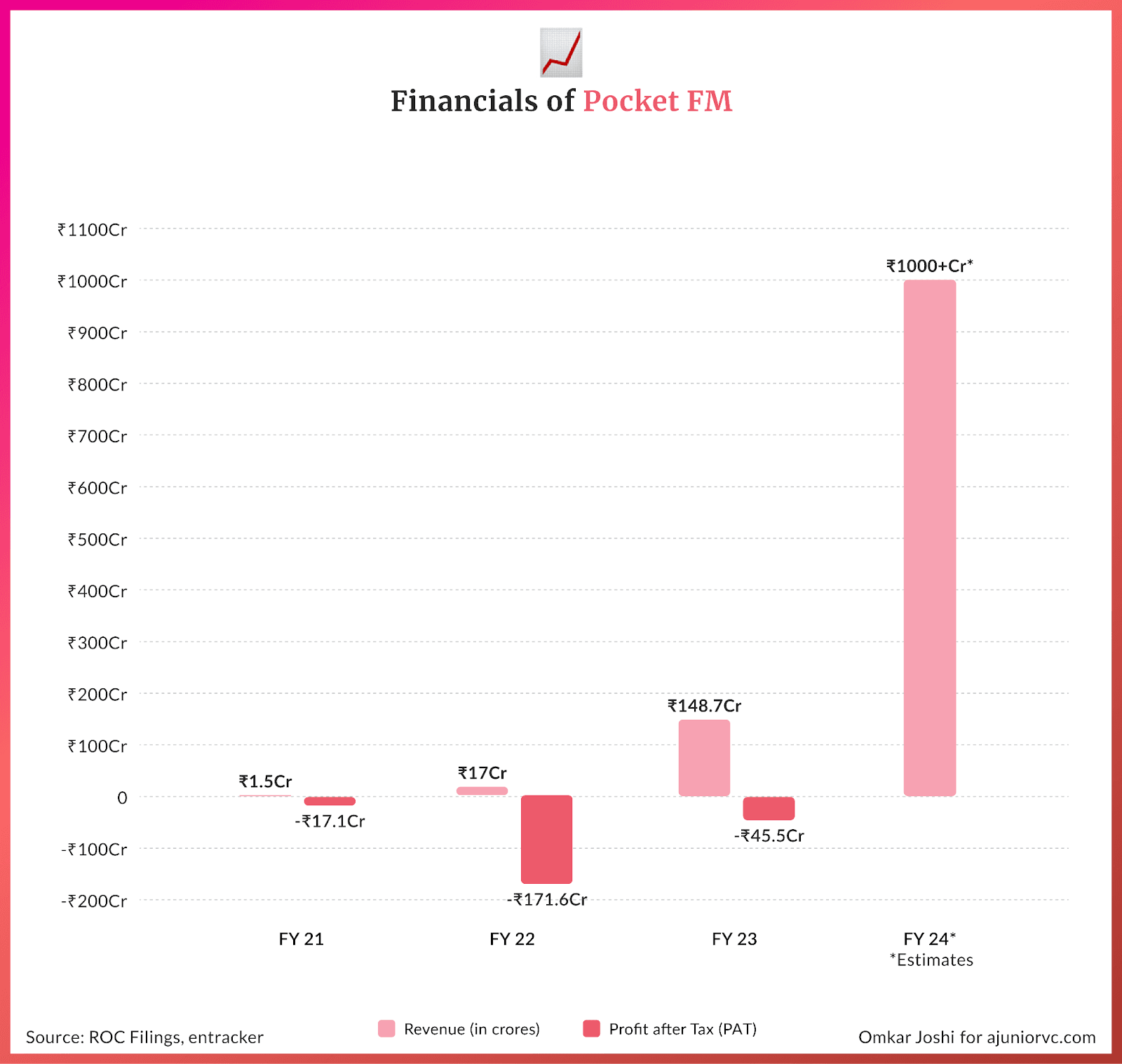

In FY 2023, Pocket FM's revenue reached INR 150 crore, marking a notable improvement in financial performance compared to the previous year.

The expense-to-revenue ratio improved, dropping from 10.78 in FY22 to 1.58 in FY23, indicating a more efficient allocation of resources and better financial management.

The revenue generated for every rupee spent on content increased from INR 2 to INR 7. This improvement reflects two key developments: a more strategic utilisation of content and reduced production costs attributed to acquiring expertise over time.

Notably, with 70% of its revenue originating from the US, Pocket FM stood out as the first Indian consumer platform to achieve considerable scale in the US market.

But even though they were doing well, things in the podcasting universe were shifting.

Spotify implemented a strategy of securing exclusive contracts for certain podcasts to attract a larger audience to its platform. This approach didn’t significantly impact revenue. Despite this, Spotify continues to command a significant portion of the global podcast market, holding approximately one-third of the market share.

Conversely, Google chose to discontinue its dedicated podcast app, noting a shift in user preference towards accessing podcasts on YouTube. The company strategised to streamline podcast consumption through YouTube Music, aligning with user behaviour patterns.

Entering and expanding in a market dominated by such established players presents considerable challenges. Global growth in the competitive audio content industry requires strategic innovation and differentiation.

Pocket FM focused on content production innovation, leveraging artificial intelligence to enhance its content creation processes.

With AI's help, they could create new story pilots 10 times faster than before. They also became really good at knowing which stories people would like—three times better.

AI also helped cut down the money they spent making these pilots by half. That means they could try out lots more stories without wasting cash. Because of this, every month, they find out which stories would be big hits 300% more than before. PocketFM had become a supply generation machine.

The company was always ready to tell the story the world wants to tune into next.

Streaming to the world

Pocket FM has a treasure chest of stories, with about 2,000 audio series and over 400,000 episodes.

They create many of these stories themselves, but they also have a corner where fans can create their own, and they license some stories, too. They’re also not working alone; with a huge freelance team of over 250,000 writers worldwide.

Their audience is huge—130 million listeners across ten countries, with the US being their biggest fan club. They've got big dreams: In 2024, they plan to bring their stories to even more people in Europe and Latin America.

In just a year and a half, they have also added $100 million in revenue run rate.

All this success meant they could get more money to grow—$103 million more, potentially worth over a billion dollars.

Think about how cool it would be if there were a TV show on Netflix based on one of Pocket FM’s hit audio series. It’s like when comic books become blockbuster movies—just look at all the Disney and Marvel films.

This path is not a dream, but a fairly doable reality. The cost of producing audio is low, allowing to test for audience love before converting it into a more expensive format. Gaslit, Dropout and many other shows were first audio.

Then there's the new kid on the block, Pocket Novel.

Just launched in 2024 after a year of testing, it lets writers share their novels and get paid. Readers can buy chapters for as little as ₹9 using the same small payments that made Pocket FM popular.

Pocket Novel gathered 150,000 writers and built a library of 250,000 novels during its test run. People loved it, making over a million transactions to buy their favourite chapters or whole novels.

By 2025, Pocket Novel wants to have a million writers and 2 million novels and aim to make $100 million each year.

Pocket FM is bullish, having invested $40 million on this new adventure.

When it comes to making money from all these stories, Pocket FM holds the keys to the kingdom—their IPs or story rights. It will be exciting to see how they turn these into more gold.

Micro-transactions, ads and IP would contribute to a strong flywheel of monetization. The goal?

To make INR 1,000 crore in 2024. The question isn’t if they can do it, but how quickly they can cross that finish line. From a deep insight in 2018, the company had taken a story of its own. From the sleepy towns of India, it had become the first Indian consumer tech platform to scale globally.

With stories to tell and new worlds to explore, Pocket FM is spinning tales into gold, one chapter at a time from India to the world.

Writing: Nikhil, Parth, Raghav, Tanish and Aviral Design: Omkar and Chandra