Oct 13, 2024

Can 3,500 Cr Theobroma Transform into a Global Bakery Brand from India?

Profile

Food

B2C

Last fortnight, Theobroma, the popular bakery chain, was said to be in the final stages of being acquired for more than 3,000 Cr, 20 years after its founding.

A Chef by Choice

Sometimes, life takes unexpected turns that lead us to where we’re meant to be.

For Kainaz Messman Harchandrai, her journey to creating Theobroma was a series of unplanned but perfectly timed events.

Growing up in a home where the kitchen was always buzzing, Kainaz and her sister, Tina, developed a love for baking alongside their mother.

What started as a hobby for the sisters soon became Kainaz’s career.

After studying at Le Cordon Bleu in London, she landed a dream job as a pastry chef at Oberoi Udaivilas in Udaipur. Everything was going well until 2003 when a serious back injury forced her to reconsider her path.

While recovering, Kainaz’s father, Farokh, and Tina began discussing opening a bakery. It wasn’t meant to be a grand business—just a way to continue doing what they loved.

With no real plan but plenty of passion, Kainaz, at just 24, left her job and leapt into the unknown.

Little did she know that this setback would soon lead her and her family to start something truly special—a little bakery called Theobroma.

Their first big decision? Location.

They chose Colaba Causeway in Mumbai, a bustling area close to their home and their grandmother’s flat, which would become their kitchen. The location was convenient, with good footfall, making it the perfect spot for their modest bakery.

Farokh invested ₹1.5 crore to get the bakery off the ground, half of which went toward acquiring the space through the pagdi system and the rest to buy essential equipment.

But as first-time entrepreneurs, they faced some hard lessons.

When designing the bakery's layout, they didn’t realize how critical workflow would be in such a small space. What looked good on paper didn’t always work in practice. Figuring out how staff and customers would navigate the tiny area was a daily challenge, but they adapted and learned as they went.

Naming the bakery was a challenge, too. Theobroma, suggested by a friend of Tina’s, came from the Greek words for "food of the gods."

It was a unique choice—far from the usual "cookie" or "brownie" names you’d expect from a bakery.

At first, people didn’t get it.

They found it hard to pronounce and didn’t understand the meaning. But over time, that uniqueness became an asset. People had to learn the name, remember it, and eventually, they couldn’t forget it. What started as a quirky, unconventional choice became a name that stood out in Mumbai’s crowded dessert market.

In October 2004, Theobroma finally opened its doors.

It was a tiny space with just four tables, but it quickly became a local favourite. Customers loved their rich brownies, decadent cakes, and other desserts.

Signature items like chocolate chip brownies, truffle cake, and mawa cake became instant hits. What started as a small family-run bakery in Colaba was turning into something bigger.

Kainaz’s injury in 2003 may have felt like a setback, but it turned out to be the beginning of something extraordinary.

Elevating Mumbai’s Taste for Artisanal Desserts

When Theobroma opened its doors in 2004, Mumbai’s bakery scene was far from what it is today.

At the time, there was a noticeable scarcity of premium, high-quality bakeries that offered authentic European-style desserts and pastries. Most dessert options were limited to star hotels or small local bakeries that didn't prioritise ingredient quality.

There was a clear gap in the market for something more elevated—something that could deliver international standards of taste and presentation but at a more accessible price point.

Theobroma entered the scene to fill this gap. Their value proposition was simple yet powerful: to offer gourmet desserts made from the finest ingredients.

In an era where shortcuts were common, Theobroma distinguished itself by using high-quality ingredients like Belgian chocolate, real butter, and natural flavourings.

The company's commitment to quality extended beyond taste to the texture and appearance of its products, ensuring that every item it sold felt luxurious but approachable.

One of the most significant contributions Theobroma made during these early years was popularising items like brownies.

While now a staple in most dessert menus, brownies were not mainstream in India in the early 2000s.

Theobroma’s rich, fudgy chocolate brownies quickly became a fan favourite, introducing many customers to artisanal baked goods. Their ability to balance indulgent flavours with authenticity made their products stand out.

Beyond brownies, Theobroma also introduced customers to European-style desserts—mousses, tarts, and cheesecakes—largely absent from Mumbai's food scene.

Each new product wasn’t just an addition to the menu but an education in the art of premium, handcrafted desserts. Theobroma's offering of these new flavours played a pivotal role in changing how Mumbaikars perceived baked goods.

The result?

By 2008, Theobroma had firmly established itself as not just a bakery but also a trendsetter in Mumbai’s food culture, leading the charge in bringing high-quality, artisanal desserts to the masses.

Their blend of accessible luxury and commitment to quality created a loyal customer base that would only grow as the brand expanded further across the city.

Building Brand Loyalty

The Messman family, specifically sisters Kainaz Messman Harchandrai and Tina Messman, ran the business with only one outlet for six years.

They observed an increase in positive responses from their customers,, clearly indicating a rise in demand. This feedback encouraged Tina and her father to expand their outlets to more cities.

Theobroma’s funding struggles stemmed from the nature of its business model. In 2014, after much struggle, the founders secured a business loan of 5 crores with specific conditions and a commitment to the lender to be CEO until the loan was repaid.

Much of the investment was allocated toward expanding Theobroma’s physical footprint. As the brand's popularity grew, there was increasing demand for more outlets in critical metropolitan areas and the opportunity to tap into new markets.

Being in the gourmet dessert industry, the company faced substantial upfront costs related to product development, sourcing premium ingredients, and maintaining consistency in quality.

Theobroma had to contend with established brands and new entrants aiming to capture the growing demand for artisanal and premium food products, which was highly competitive.

Staying ahead of competitors required constant innovation in product offerings, customer service, and marketing strategies.

By 2015, the company had earned a loyal customer base, particularly among young, urban consumers who valued its premium quality and innovative approach to desserts.

The investment allowed Theobroma to strategically identify and open outlets in high-traffic locations where its target demographic, particularly millennials and urban professionals, frequented.

By expanding its presence in malls, high streets, and corporate hubs, Theobroma ensured higher foot traffic and greater visibility, increasing brand awareness and customer acquisition.

After the loan was exhausted, the founders also needed help getting a fair valuation on their business to raise more funds for the expansion.

The struggle for the iconic, hip, but small brand continued.

Gourmet Revolution

Between 2016 and 2017, India's food services sector, especially the bakery and confectionery space, witnessed rapid growth.

The market was driven by urbanisation, evolving consumer preferences, and an increasing appetite for convenient, high-quality baked goods.

Over a decade of serving customers in Mumbai, Theobroma had already established itself as a key player, catering to consumers seeking premium products like cakes, brownies, and pastries.

By 2016, Theobroma had expanded beyond its first Mumbai café, opening outlets in Delhi and NCR. This period marked a shift in consumer behaviour, with more urban Indians dining out frequently and experimenting with new cuisines.

The demand for international-style baked goods grew, and Theobroma’s offering of gourmet cakes, croissants, and brownies was well-timed. Their focus on quality and innovation helped them capture a growing segment of customers looking for indulgent treats in a market still dominated by traditional Indian bakery products.

The critical demographic driving this growth was young professionals in metro cities, who were increasingly drawn to premium experiences and ready-to-eat bakery items. With more disposable income, this segment sought out high-quality, artisanal bakery products, making Theobroma a popular choice.

Families, too, became important customers, opting for Theobroma’s cakes and desserts to celebrate special occasions. Expatriates and global travellers familiar with international standards found Theobroma’s products to match their expectations, further boosting its reputation in the market.

While Theobroma was focused on expanding its physical presence in major cities, the next wave of growth was set to come from Tier II and Tier III cities.

With their rapidly urbanising populations, these emerging markets began showing interest in premium bakery products. Theobroma’s affordable luxury model was ideally suited to tap into this demand.

At the same time, the rise of online food delivery platforms like Swiggy and Zomato created new opportunities for Theobroma to reach customers beyond its outlets, as these platforms made ordering food at home a habit for Indian customers.

By 2017, Theobroma had positioned itself as a premium bakery brand and a leader in online delivery.

Theobroma’s ability to deliver freshly baked products to customers’ doorsteps became a significant differentiator.

This expansion into delivery services allowed the brand to serve a larger audience, especially as urban consumers favoured ordering rather than visiting physical stores.

The food of the gods was getting democratised, while also starting to make money.

Recipe for Growth

Running a retail business is difficult, especially in a category where perishability is a crucial concern.

Managing inventory effectively while maintaining premium quality adds to the complexity, and running multiple stores across different cities for a demanding audience makes it even more challenging.

Theobroma cracked the code by building a solid operational playbook before bringing professionals to scale.

Around 60% of their business came from online orders, where commissions to marketplaces like Swiggy and Zomato reduce margins. The remaining 40% came from in-store traffic, driven by customers seeking cakes, gifts, or simply craving desserts after a meal.

With an average order value close to ₹300, Theobroma balanced quality with cost efficiency.

Despite premium ingredients like chocolate and flour accounting for around 33% of revenue, the company managed to maintain this ratio while maintaining quality.

Since all stores are company-owned, Theobroma’s employee benefit costs ranged between 15% and 20%, reflecting the scale of operations and the company's commitment to service.

In addition to this, costs for depreciation, amortisation, and financing account for another 7-8%. Then, there are the usual suspects—marketing, commissions on online orders, rentals for prime retail locations, utilities, and other overheads—taking away 35-40%.

This leaves a pre-tax profit margin of 7-10%, which may seem modest, but Theobroma’s scalability and cost efficiencies make it attractive to investors.

The cost structure and profit margins improved over the years. While Theobrama's desserts may not be the healthiest food option, their growth rate was healthy enough for investors to notice.

Finally, in 2017, Theobroma raised its first round from ICICI Ventures.

Between 2017 and 2019, Theobroma raised multiple rounds to fuel this growth, all funded by ICICI. By 2019, ICICI owned 46% of the company, having invested 120 Cr. It was about to get one of the sweetest deals for the firm.

The fundraising was for store expansion and to fund the losses due to capex, which nudged them to jump from a linear to an exponential growth trajectory.

More than 15 years after it started, Theobroma was beginning to take off.

From a Family Bakery to a National Favorite

By 2020, Theobroma has become a well-known brand in the top metro cities.

The founders also did their bit of storytelling. Their book Baking a Dream: The Theobroma Story came out in 2020, which helped the brand gain more popularity amongst the highly active urban population that started sharing how good Theobroma was.

It was a great marketing stroke, and much free publicity was gained for Theobroma.

The book describes how Theobroma started out as a small, Parsi family-run bakery and cafe in 2004 and is today a national empire with 50 outlets, employing 1,000 employees across Mumbai, Delhi, and Pune, selling over 200 products to an ever-increasing 500,000-plus customer base.

By now, it was the market leader in the organised bakery space with lots of customer love and demand not only in metro cities but also the Tier-⅔ cities where consumers who have tasted Theorbroma at airports now wanted to have a Theobroma in the shopping malls of their towns.

The pull led to more store expansion, and Theorboma opened its stores beyond the Mumbai and NCR region.

Theobroma used to focus more on in-store sales until 2020, but the COVID lockdown changed their order splits and pushed the company to evolve a robust online model.

Theobroma managed to fight the COVID lockdown challenges and aced online order delivery by ensuring products are packaged carefully so that even if one consumes them at home, they still feel like the Food of God!

By 2022, it had more than 100 outlets. Then, it expanded to more cities like Chennai and continued to expand across the country. A few months back, it opened a store in Raipur.

By now, Theobroma has a validated playbook for understanding a city's demographics, finding hotspots like malls or high-income localities, expected footfall, and the menu and food items that work there.

The founders also hired a management team. The professional team focused on past and present data to triangulate the demand pattern and match it with a solid business plan to ensure the ship sails in the right direction.

It diversified the product menu to ensure growth through the opening of more stores and by capturing the wallet share of its existing customer base.

Theobroma expanded its menu to include savoury items, beverages, and breakfast options. This diversification attracted a wider range of customers and encouraged more frequent visits, making Theobroma a versatile destination for different meals and occasions.

Theobroma effectively utilised targeted social media advertising, creating engaging content highlighting its products. Influencer partnerships were critical to the success of new product launches, driving awareness and connecting with a broader audience. These campaigns helped boost visibility and reinforced the brand’s modern, customer-centric approach.

The little baking shop from Mumbai was now staring at a giant market.

Baking It Big

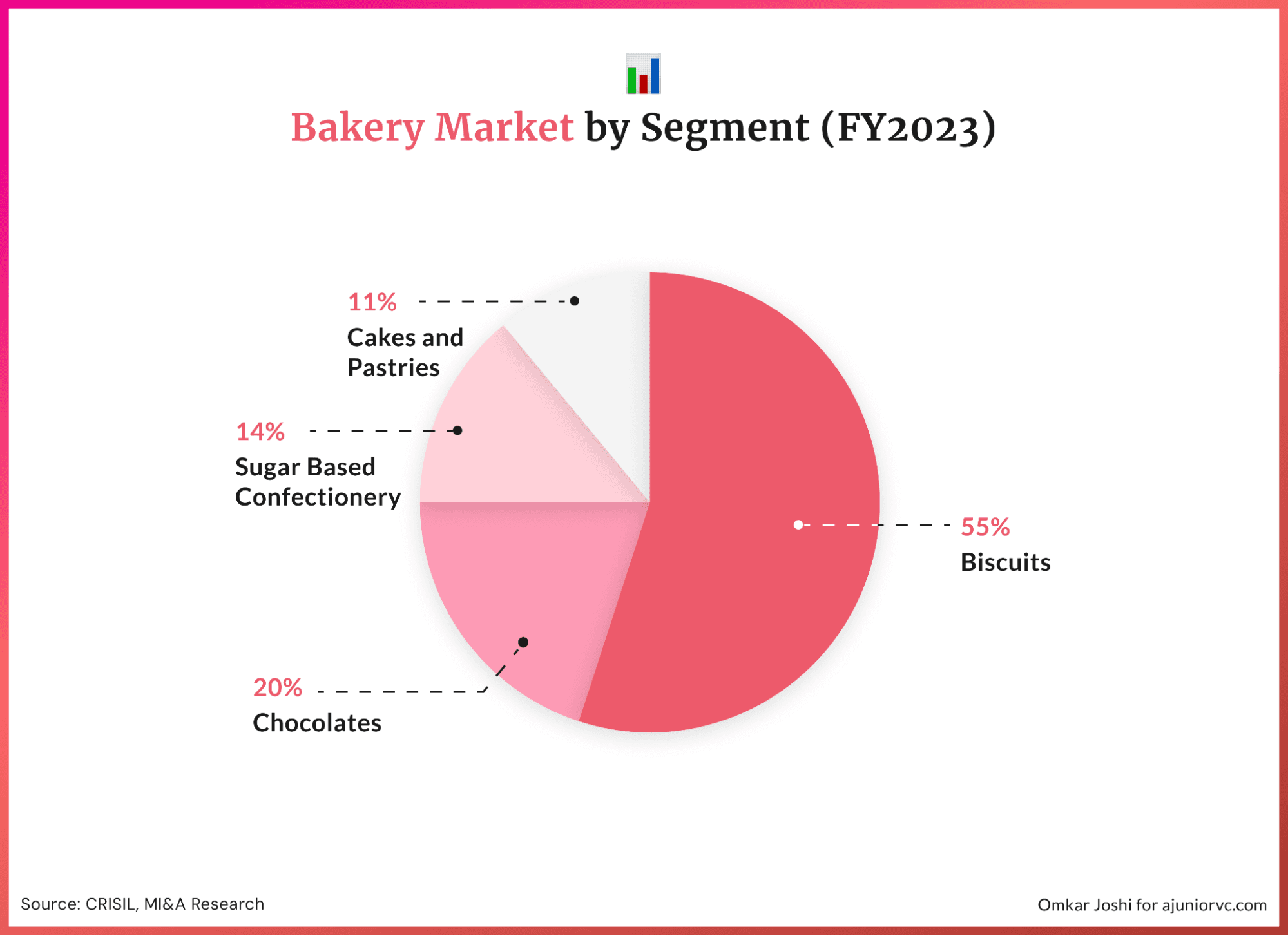

The Indian Bakery Market was valued at $11B in 2023.

The market grew at a healthy CAGR of 11% and was expected to reach $20B by 2028. This growth is driven by increasing disposable incomes, lifestyle changes, product innovations, and the gradual premiumisation of baked goods.

Rising rural penetration was also expanding the market beyond urban hubs.

In terms of market structure, biscuits dominated with a 55% share in FY23, followed by chocolates (20%), sugar-based confectionery (14%), and cakes and pastries (just 11%). Organised players have made significant inroads, capturing around 74% of the market share.

The organised segment accounts for just 30% of total revenue for cakes and pastries (including bakery snacks). However, the premium segment within this category is increasing, with a CAGR of 17-19%, far outpacing the 9-10% CAGR of the overall cakes and pastries market.

Theobroma is currently the biggest player in the premium bakery segment, generating ₹350 cr in revenue in FY23 from over 150 stores.

Theobroma's success has paved the way for many to follow the same model: establish a local presence before scaling nationwide.

Their central kitchen model, which ensures consistent freshness, has become a benchmark for the industry, allowing them to deliver quality at scale across multiple locations.

The bakery industry's low barrier to entry has led Theobroma to compete with numerous regional players across territories.

Zed the Baker operates out of a 12,000 sq ft central facility in Bangalore and can serve around 50 regional stores. They have achieved a revenue per store similar to Theobroma, demonstrating their capacity to scale through a focused regional model.

Flurys, a nearly 100-year-old Swiss bakery originating in Kolkata, has grown to 68 stores across cities like Kolkata, Delhi, and Mumbai, generating ₹40 crore in revenue. While its scale isn’t as large, it maintains a healthy 17% EBITDA, showcasing financial efficiency in a traditionally difficult space.

Meanwhile, Smoor, backed by Rebel Foods, is rapidly scaling through a cloud kitchen model. Already present in all metro cities and growing at 40% CAGR, it aims for ₹800 crore topline by 2028.

There was a clear shift after COVID, when businesses saw increased online demand. With Theobroma also doing 60-70% of its volume online, Smoor’s model allows for better EBITDA margins.

This change has been hard for Theobroma, which has always believed in the “look-and-smell” model for its baked goods. Its iconic stores, built in the Colaba Causeway meets Paris model, made it the hip bakery that was supposed to remain small.

L’opera, a high-end authentic French pastry shop, was founded around the same time Theobroma raised money in 2019. With the strategic backing, they plan to expand their luxury salon-style bakery to 200 stores from 20.

Theobrama’s success has paved the way for other brands to follow a similar approach: establish a stronghold in a specific region, leverage central assets like kitchens, and expand into larger cities.

By 2024, Theobroma had firmly established itself as a mass-market brand.

Staying Ahead

Theobroma has established itself as a profitable brand

It has grown to 225 stores across 30 cities and steadily increasing revenues. In a market where international giants like Au Bon Pain and Dunkin Donuts have struggled to establish themselves,

Theobroma is on track to generate a remarkable ₹600 crore revenue this fiscal year.

Their recent store launches in Ambala, Haryana, and Anand, Gujarat, have shown strong demand in these emerging markets, proving there’s room to grow beyond metro cities.

However, expanding into tier-2 cities presents new challenges. To keep up the momentum, Theobroma must rethink its central kitchen model, as scaling efficiently with fewer stores in smaller towns can be tricky.

Their focus on operational efficiency, a strong supply chain, and a tech-driven approach has worked in their favour—something CEO Gour has been pushing for several years.

The company has transformed its tech enablement across supply chain, distribution, and sales from 5% to 95%. This shift has cut production costs by 12%, boosting profitability in an industry known for its short shelf life and high operational costs.

Theobroma isn’t just defending its position against regional players—it’s constantly innovating to stay ahead.

They’re branching into new categories like packaged goods sold through e-commerce and quick commerce channels. The firm is exploring cloud kitchens to optimize delivery and lower costs. They’ve even developed products with a longer shelf life, perfect for online sales, and are tapping into the gifting market with their iconic brownie boxes and festive treats.

With Diwali approaching, Theobroma is rolling out a dozen new SKUs to capture the festive demand. It will join competitors like Smoor and L’Opera in offering seasonal specials.

They’re also making strategic moves into the biscuit and chocolate segments, which comprise 75% of the bakery market.

Theobroma is embracing the trend as health-conscious consumers become a bigger part of the picture. "Free" no longer means free samples but sugar-free and gluten-free products, appealing to a growing crowd that craves healthier alternatives.

Theobroma’s ability to innovate while staying true to its legacy has ensured it remains a dominant force in the ever-evolving bakery market.

From new product lines to smarter operations, the brand is ready to take on the future—and it’s looking brighter than ever.

Scaling Up or Staying True?

When it comes to a premier eatery like Theobroma, the big question on everyone’s mind is how big it can get.

Theobroma is no different.

For a dessert place where the average bill size is around Rs. 300, its target market is relatively limited. That’s just the reality of being a premium brand in India—growth can seem restricted to a smaller, more affluent customer base.

But things could be shifting.

The planned exit to a large PE player could be a big shift. If that happens, it could completely change the game for Theobroma.

When a brand is founder-led, the focus is usually on quality and steady, sustainable growth. But when a private equity firm steps in, the mindset often shifts to rapid growth and maximizing returns. And with that shift, there’s always the concern—will the quality take a hit? Will the desserts we all know and love remain the same?

It's possible. But there’s another scenario that could play out, too.

Look at Carlyle's history—they invested in Tirumala Foods in 2010, and Chrys Capital is already in advanced talks to acquire Belgian Waffle.

Private equity investors like these are building portfolios in the food space, potentially streamlining production and marketing while maintaining separate brand identities. That could help Theobroma scale up even more while keeping its unique charm intact.

Other international brands, such as Tim Hortons and Pret A-Manger, have had some success in India.

Why can’t Theobroma leap in the other direction?

With a large Indian diaspora in places like the Middle East, the UK, or even Canada, an international move could work. With the founders potentially stepping back, this could become a reality sooner.

Whatever happens next, one thing is sure: Theobroma’s future looks exciting. The journey has been incredible from its humble beginnings as a family-run bakery to what it’s poised to become—a potentially global brand. If it does go international, that will be a proud moment for all of us who have been loyal customers from the start.

The food of gods will no longer be restricted to India, but to the world.

Writing: Parth, Abhinay, Jayanth, Tanish and Aviral Design: Omkar and GPT