Sep 29, 2024

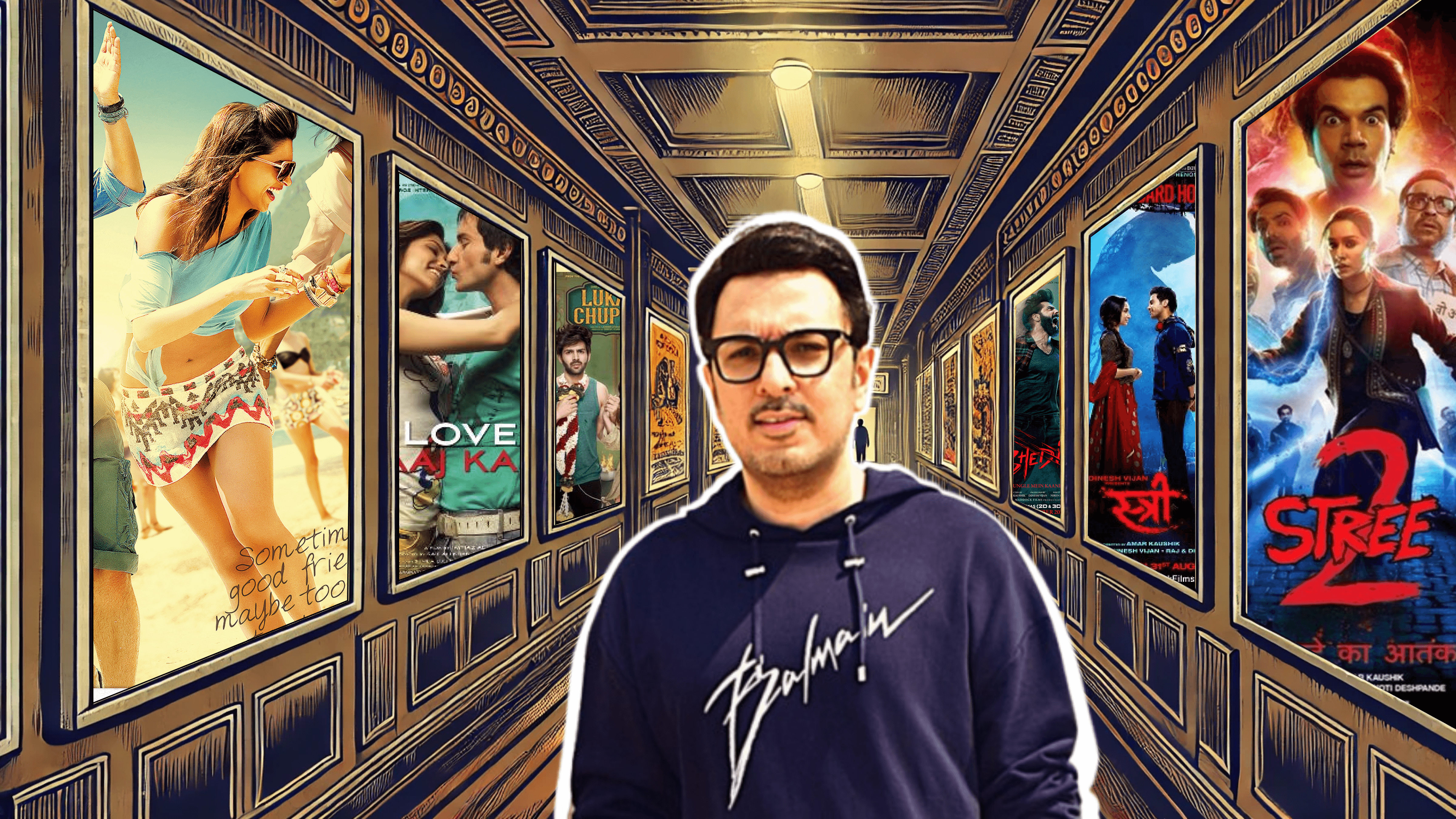

Can 1,000 Cr Maddock Films Disrupt Bollywood?

Entertainment

Entertainment

Profile

Last fortnight, Maddock Films’ Stree 2 smashed close to 900 Cr at the box office, making it the biggest hit of the year, hot on the heels of 130 Cr from Munjiya and 140 Cr Teri Baaton Mein

Banking into Bollywood

Dinesh Vijan's early life and career path reflect a significant shift from conventional expectations to the creative world of filmmaking.

Born in 1981, Vijan grew up in a large Punjabi family, which was crucial in shaping his worldview. His family's history is marked by resilience; his grandfather moved to Mumbai during the Partition, setting the stage for future generations to pursue diverse paths, including Vijan's eventual foray into cinema.

In 2004, at age 23, he quit his banking job after the first six months and ventured into filmmaking, driven by a passion for storytelling and cinema. Initially, he had no connections or experience in the industry, which made his entry challenging. However, he relied on his instincts and gut feelings to navigate this new terrain.

He started as a producer with Homi Adajania's Being Cyrus (2005). This film introduced him to the intricacies of production and established a lasting partnership with Adajania. Their collaboration would later lead to successful projects like Cocktail and Finding Fanny.

Vijan's early experiences shaped his understanding of the industry and were characterised by steep learning curves. He often described his first ventures as guided by instinct rather than knowledge of industry norms.

His banking background provided him with analytical skills that proved beneficial in managing production budgets and logistics, but the creative aspects of filmmaking required a different approach altogether. He learned the nuances of production and storytelling through hands-on involvement.

He co-founded Illuminati Films with Saif Ali Khan in 2008, and Vijan gained further insights into the industry dynamics. His vision was clear: to create films that blended commercial success with artistic integrity.

Bollywood had storied families that produced, directed and acted in films over decades. Plagued by the nepotism moniker, Vijan was an outsider who had to compete in an insular, closed industry,

The foundation laid during his earlier years equipped him with the skills necessary to navigate the ultra-competitive landscape of Bollywood effectively

Illumaniti Films’ vision was rooted in the belief that cinema should reflect society, capturing its complexities and nuances.

The studio aimed to tell unique, universal stories that appeal to many audiences. This vision was evident in its diverse filmography, which spanned various genres, including romance, comedy, horror, and drama.

Dare to be Different

Between 2009 and 2013, Indian cinema underwent a notable transformation.

The movies moved away from the traditional formulaic Bollywood films towards more content-driven cinema.

Films like “3 Idiots” (2009) and “Peepli Live” (2010) tackled pressing social issues. “3 Idiots,” directed by Rajkumar Hirani, critiqued the Indian education system and its emphasis on rote learning. At the same time “Peepli Live,” produced by Aamir Khan, highlighted the plight of farmers and the media’s role in sensationalizing their struggles.

Movies such as “Wake Up Sid” (2009) and “Zindagi Na Milegi Dobara” (2011) focused on themes of personal growth and self-discovery.

The period also saw a rise in unconventional love stories that broke away from traditional romantic tropes. “Love Aaj Kal” (2009), directed by Imtiaz Ali, juxtaposed modern and traditional views on love, while “Barfi!” (2012), directed by Anurag Basu also did the same.

One key aspect of Illuminati Films’ storytelling was its focus on character-driven narratives. The production house became known for its innovative approach to genre-blending, creating films that defied conventional boundaries and offered a fresh perspective.

A pivotal moment in Vijan’s journey was when it made its mark with films like “Love Aaj Kal” (2009) and “Cocktail” (2012). “Love Aaj Kal explored the complexities of modern relationships through a dual narrative structure, while “Cocktail” delved into the dynamics of friendship and love in a contemporary urban setting.

“Love Aaj Kal” was a commercial success and a critical darling. It was praised for its innovative narrative structure, relatable characters, and timeless songs. The movie broke the then hard-to-break 100 Cr mark, hitting 120 Cr worldwide.

The success of films like Love Aaj Kal (2009) solidified his reputation as a producer capable of delivering commercially viable content. However, setbacks—such as the challenges faced during Agent Vinod—taught him invaluable lessons about supporting directors and understanding audience expectations.

Each of these films brought something new, whether it was exploring complex human emotions, blending horror and comedy, or portraying strong, independent characters. Illuminati had become a master at identifying the needs of cinema-goers and producing content around them.

Vijan wanted to move beyond his relationship with Saif Ali Khan to the next level. He would soon start his new production house, making Illuminati its subsidiary.

Maddock Films was born.

Funding Fanny

Starting with Finding Fanny, Maddock Films started in earnest.

Maddock Films’ commitment to unique storytelling was evident in its release in 2014. Directed by Homi Adajania, this film was a departure from the typical Bollywood narrative, offering a quirky road trip comedy set in the picturesque locales of Goa.

Deepika had become a recurring actor in Vijan’s prior films, starring in Finding Fanny. Having the same actor thread across movies would become a mainstay of Maddock's operations.

These films' critical and commercial success gave Dinesh Vijan the credibility to secure funding for future projects. The quality and originality of Maddock Films’ productions demonstrated Vijan’s ability to identify and nurture unique stories that resonated.

In 2015, Maddock Films continued to push the envelope with “Badlapur”, directed by Sriram Raghavan. This dark, gritty revenge drama starred Varun Dhawan and Nawazuddin Siddiqui, exploring themes of vengeance and redemption.

“Badlapur” showcased Maddock Films’ ability to handle complex, mature themes with finesse, further establishing its reputation for unique storytelling.

Maddock Films’ knack for creating memorable, quirky characters was evident in “Hindi Medium” (2017), directed by Saket Chaudhary.

This satirical comedy-drama starred Irrfan Khan and Saba Qamar as a couple navigating the competitive world of elite English-medium schools in India.

Another notable film during this period was “Raabta” (2017), directed by Dinesh Vijan. Although it did not achieve the same level of success as its predecessors, “Raabta” was an ambitious attempt at blending romance with the concept of reincarnation.

Like Deepika, who eventually starred less, the timeframe resulted in the start of collaborations with Irrfan Khan and Kriti Sanon.

These films' critical and commercial success gave Dinesh Vijan the credibility to secure funding for future projects. The consistent quality and originality of Maddock Films’ productions demonstrated Vijan’s ability to identify and nurture unique stories that resonated with audiences.

The credibility gained from these successful ventures enabled Dinesh Vijan to secure funding for future projects, ensuring that Maddock Films could continue pushing the boundaries of Bollywood storytelling.

After the commercial success of “Finding Fanny” and a series of successful films making an average of 90Cr per movie, Maddock was ready to take off.

Small is Beautiful

The market for media and entertainment (M&E)—a whopping INR 120,000 Cr (~USD 20 bn) in India—was booming.

In pure economic output, Indians consumed entertainment more than consumer goods—the M&E market was larger than the country's consumer durable industry, accounting for just under 1% of India’s GDP in 2018.

The scale was not surprising. Over 155 million households accessed cable and satellite. The theatrical box was the largest producer of films in the world and the fourth largest in terms of revenue.

What was surprising was the industries’ potential to grow.

As per capita income was supposed to rise, incremental expenditures shifted from necessities to non-necessities, like M&E, fashion, apparel, etc.

Consequently, M&E expenditure enjoys a non-linear relationship with per-capita GDP, often growing faster than per-capita income after achieving a threshold income level.

But even accounting for India’s per capita GDP, Indians spent less on entertainment than other countries. In per capita terms, India’s M&E industry size was one of the smallest in the world.

In Kenya, an average person earned USD ~1,000 and spent USD ~40 on entertainment. In India, an average person earned USD ~2000 and spent USD 15 on entertainment. China’s per capita income was 4x India’s, but per capita M&E spending was 9-10x.

There was money on the table - that the incumbents of the M&E industry were not able to earn.

Consumer behaviour was undergoing significant shifts. Access to cheap and fast data, along with an exploding penetration of smartphones (340mn in 2018 v/s 200mn in 2015), was changing how Indians consumed content and making their taste more discretionary.

Glitz, glamour, and star power were not the only things that mattered anymore. Indians wanted fresh, novel content with solid storylines and screenplays.

In 2018, movies with ‘big stars’ accounted for just 23 per cent of the box office collections, a sharp fall from 50% in 2015.

Of the 13 movies that earned more than INR 100 Cr, 5 were small-budget movies with (INR ~20 Cr) without a ‘superstar’ cast - Stree, Sonu Ki Titu ki Sweety and Badhai Ho. In 2016, only one such movie had crossed the INR 100 Cr mark.

A clear shift was underway in the theatre business, and the newcomers were breaking the mould.

The film industry's traditional models were changing, allowing production houses like Maddock Films to find their niche—high-concept, low-cost films with novel storylines.

Hits Business ft. Stree

Before we dive deep into Maddock Film’s RoI, let’s understand how movie production houses earn.

There are usually four major revenue streams from films: box office collections, digital rights, satellite rights, and music rights.

The biggest is usually box office collections—earnings from the sale of movie theater tickets, which account for 65-70% of a film’s revenue. Of this, 80-85% are derived from Indian screenings, with the remaining from the international market—with the U.S., U.K., and the UAE being major contributors, owing to a large NRI base.

But a production house’ earnings may be very different from the gross ticket sales of a movie.

Three parties are involved in theatre screenings: the film production house, the distributor, and the theatre house. Distributors are middlemen who acquire distribution rights from the film production house for specific regions and hire theatres to screen the film.

Broadly, a producer can sell movie rights to a distributor at a high price and have no stake in the ticket sale collections—yielding less risk but less potential for high earnings if a film does well. The ticket sale revenue is split between the distributor and the theaters.

Or they sell the movie rights at a lower price but have a share in the ticket sale collections – high risk but lucrative in case the film does well.

The next biggest share (15-20%) is from digital rights—a revenue stream that has recently opened up with the advent of OTTs in India, exacerbated by the pandemic. Streaming rights are sold to platforms like Netflix, Amazon Prime, and Disney Hotstar without the need for distributors, thereby being more accessible on the bottom line.

The remaining revenue is generated from selling rights to television channels (6-7%), a significant income source, and music rights (2-5%), sold to major music companies like T-Series and Sony Music.

Merchandising and in-brand placements are other ancillary ways of earning revenues.

Maddock Films made INR ~50 Cr in FY2018 and double that amount – INR ~101 Cr in FY 2019 – on the back of Stree’s spectacular success.

To earn INR ~100 Cr, Maddock Films spent just ~INR 46 Cr in production costs and an additional ~4 Cr in administrative costs that year, yielding a whopping EBITDA of 50% and a PAT margin of 35%.

The spike in revenue and profitability indicated that the movie business was one of the hits. Just one significant outcome was enough to drive revenue and scale. A formula for hits would create a legendary production house, just like a VC firm.

Maddock’s margins were best in class when we compare that established production houses make an EBITDA margin of anywhere between 10-20% and a PAT margin of 8-15%

The winning formula for Maddock was cost-effective production, selecting the right talent at optimal cost, and focusing on strong scripts to attract audiences.

Scaling to Death

Between 2019 and 2021, Maddock Films underwent a significant transformation, expanding its portfolio in genre and scale.

Known initially for its romantic comedies, the production house ventured into new cinematic territories, experimenting with horror-comedy, dramedies, and socially relevant dramas. This expansion allowed Maddock Films to diversify its creative slate and contributed to its revenue and profit growth during this period.

The foundation was set with the 2018 release of Stree, a horror-comedy that redefined the genre in Bollywood. The film grossed over ₹180 crore globally on a modest budget of ₹20 crore, becoming one of the year's highest-grossing films.

Stree showcased Maddock’s ability to produce highly profitable, innovative films that blended commercial appeal with critical acclaim. The movie’s success gave Maddock the financial clout to invest in further genre-bending projects.

In 2019, Bala continued this streak of success. Made on a budget of ₹25 crore, the film grossed over ₹170 crore worldwide. This socially relevant dramedy addressing baldness demonstrated Maddock’s knack for combining humour with significant societal issues, resulting in financial and critical wins.

By venturing into socially conscious narratives, Maddock Films tapped into a niche that appealed to urban audiences while maintaining mass appeal, leading to sustained box office success. Films seemed to be

Meanwhile, Hindi Medium (2017) had already laid the groundwork for Maddock Films' venture into more serious, socially relevant content. With a budget of just ₹14 crore, the film grossed an impressive ₹322 crore globally, benefiting from the Chinese market. This financial success encouraged the production of Angrezi Medium in 2020.

Although impacted by the pandemic, Angrezi Medium still showcased Maddock’s resilience, performing reasonably well given the circumstances and reaffirming the brand's reputation for delivering quality content.

The pandemic was almost a death knell for the movie business, which took over a year to recover. As people hunkered down, the opportunity to generate revenue from profitable theatricals was gone.

Like the VC business, Maddock leveraged a portfolio of genres to keep it going. Diversification would be crucial to keeping the business alive.

Medium Profits

Post-COVID, there was a growing narrative that the movie exhibition business was either dead or on a ventilator.

This was especially true for Hindi-language cinema.

Between 2020 and 2021, only around 150 Hindi films were released—a sharp drop compared to the usual 225 or more.

The reasons?

Weak storylines, a surge of quality content on OTT platforms, and an underlying question: Why go to the theatre and spend a fortune when you can watch great movies at the comfort of your home.

In response, production houses began to rely heavily on star power to draw crowds back to theatres.

The first big Hindi movie to test the waters post-COVID was Sooryavanshi in 2021. It was a massive hit, convincing producers that star-driven films were the way forward.

But this created a new problem.

Stars quickly realized the industry had become overly dependent on them, which led them to increase their fees–accounting for 40-50% of total production costs, driving up production costs.

This was risky.

Around 70% of a producer's revenue typically comes from box office collections, with the rest from digital, satellite, and music rights. So, let’s say a movie's budget is INR 100 crore, and INR 30 crore is earned from rights sales. The movie must generate INR 150 crore at the box office to break even, since 45 to 50% of collections go to the exhibitors.

That’s a huge risk. Soon enough, it began to backfire.

The cost of production for even an average story skyrocketed because of the high star fees. Producers were trapped—they couldn’t afford to release a movie with big stars only on OTT platforms, as the cost wouldn’t be recovered.

Akshay Kumar starrer releasing only on OTT? Not feasible. But one production house stood out: Maddock Films.

In 2020 and 2021, they avoided casting big stars, a strategy they’d followed for years. This kept their production budgets in check, avoiding the bloated costs that plagued others. It also kept its long actor lineup, collaborating regularly with Rajkumar Rao, Kriti Sanon, and Shraddha Kapoor.

They also experimented with OTT-only releases. Take Mimi, for instance—it was originally planned for theatres but shifted to digital due to COVID. Then came Dasvi, another OTT release.

Both received great responses on OTT and reviews from critics alike.

This approach allowed Maddock to learn and adapt. They figured out what worked on which platform and for which audience. That insight helped them better plan their projects and navigate a post-COVID film industry.

Supernatural Revenue

By this point, Maddock Films had figured out something important: audiences would flock to theatres, but only for a true spectacle.

The pandemic had shifted this taste, with clear differentiation in thinking for the two kinds of releases. They were willing to pay a premium for it.

The industry saw it happen with films like Pushpa, RRR, KGF, Ponniyin Selvan I, and Kantara. These were South Indian films, yet they became massive hits nationwide. Star power alone wasn’t enough to pull people in anymore.

Understanding this shift, Dinesh Vijan focused on delivering films that blended a strong connection to Indian roots with compelling storytelling and visually stunning spectacles.

This strategy was evident in Maddock's approach to the horror-comedy genre, a blend that had proven effective with audiences looking for both laughs and thrills—a formula reminiscent of successes like Bhool Bhulaaiya.

Their project Bhediya tested this understanding. Coming off the modest reception of Roohi, another horror-comedy released during the pandemic, Maddock Films aimed to elevate their game.

They prioritized high-quality VFX for the wolf character in Bhediya, aligning with Hollywood standards—a crucial move when audiences had grown weary of poor visual effects (Adipurush, anyone?) and weak dialogue.

The second thing Maddock did with Bhediya was even more forward-thinking: they started connecting their films, creating a universe of interconnected stories.

Sound familiar? The formula of success was expanding further, learning from the West.

The classic Marvel strategy is to build excitement, link the films, and create a universe where characters can evolve across multiple stories. The ones that resonate with audiences are developed further, while the weaker ones are phased out.

The suspense of the previous movie would drive excitement for the next. If audiences missed one part, they could not fully enjoy and understand the linkage with the next one, prompting them to see the previous one first.

It was a VC portfolio approach—stick with the stars, experiment with new ideas, drop the failures, and let the successes make enough money to fund new companies/projects.

In 2022, Vijan secured funding from Nepean Capital, a Mumbai-based fund Management company that acquired a 50% stake in Maddock Films, providing much-needed financial stability.

Maddock also understood that traditional paid marketing wasn’t always the answer, especially for smaller, more grounded films.

Take Zara Hatke Zara Bachke, for instance. It was a middle-class, Indian-rooted story that probably would’ve flopped if they’d gone the traditional marketing route. So, they took a different approach.

Instead of pouring money into conventional ads, they tapped into the power of social media. They used the film’s music to create Instagram Reels and encouraged others to do the same. The strategy worked, and the movie gained traction and became a hit.

Conversely, Maddock kept certain films strictly for OTT releases, like Sajini Shinde ka Viral Video and Murder Mubarak.

These were films with lesser-known actors and new directors but reasonably good stories. OTT became Maddock’s testing ground—a way to experiment with different kinds of content and gauge audience reactions without the pressure of box office numbers. Gauging what worked on OTT allowed them to take bolder risks on the big screen.

But the best was yet to unfold.

Shifting Gears

The allure of big stars doesn’t fade that easily, and Maddock Films is no exception.

Despite their earlier reputation for steering clear of mega-star projects, they’ve now announced Sky Force, starring Akshay Kumar, and Tehran with John Abraham.

This marks a departure from their perceived strategy of avoiding films that drive up production costs. But with back-to-back hits like Munjya and Stree 2, they’re in a position to take that risk and experiment.

Munjya smashed the box office with an impressive INR 130 crore on a budget of INR 30 crore, while Stree 2 was an even bigger hit, raking in INR 850 crore on a budget of INR 100 crore. Both films had a winning combination of strong Indian-rooted stories, top-notch VFX, and solid storytelling.

Maddock’s mantra is working.

However, they also know this winning streak may not last forever. There’s always the risk of audience fatigue, especially when sticking to similar narratives. We’ve seen it happen with Marvel—great stories can start feeling repetitive.

Maddock's response? Diversifying their portfolio.

In 2024 alone, they've tackled a range of genres from sci-fi twists in Teri Baaton Mein Aisa Uljha Jiya—which pulled a respectable INR 150 crore at the box office on a budget of INR 75 crore—to experimenting with OTT platforms.

Films like Sector 36 have allowed Maddock to test new waters with unconventional casts, such as Vikrant Massey playing a villain, proving OTT can be a fertile ground for creativity that might transition to big-screen success.

And speaking of big, they’re now diving headfirst into action and adventure films—a genre known worldwide for pulling in the big bucks if done right.

We have seen YRF execute it well with the success of its Spy Movies—Pathan, Tiger, and War—and now they are blending them all together with Tiger vs. Pathan next.

The upcoming Chhaava, a period film about Chhatrapati Sambhaji Maharaj, could shift how the industry perceives Maddock. Traditionally, Bollywood production houses have niches—Dharma is known for family dramas, YRF for thrillers, and Bhansali for historical epics with tragic love endings.

Maddock, however, is proving to be a chameleon, adapting and excelling across genres.

From indie roots with films like Being Cyrus and Finding Fanny to mainstream hits like Love Aajkal and Badlapur, and critical darlings on OTT, Maddock’s journey is one of constant evolution.

Their success with English Medium and Hindi Medium, both big-screen hits noted for their compelling stories and unique casting, continued to garner fans on digital platforms too.

Maddock’s strategy of not just following but setting trends, combined with a willingness to embrace different and risky projects, may soon position them as a new darling in Bollywood.

If they can infuse their unique flair into period dramas and super-star movies, as they have with horror comedies, Maddock could redefine what it means to be a versatile and innovative production house in the film industry.

The movie industry is supposed to be one of innovation, as audience tastes shift faster than you can say “movie”. Maddock has innovated in terms of business model, formula, and strategy.

As Maddock enters the end of 2024, it has had a massive year. From a 23-year-old newbie with stars in his eyes, Vijan and Maddock are now truly the kingmakers in India’s ever-changing movie industry 20 years later.

Built on a decade of success, failures, and about-turns, the 1,000 Cr juggernaut looks set to break moulds, and keep disrupting Bollywood.

Writing: Keshav, Chandra, Jayanth, Parth, Shreyas and Aviral Design: Omkar and Chandra