Mar 22, 2020

Can Unacademy Crack India’s Online Learning Riddle?

Profile

Education

Platform

Aggregator

B2C

Series E-G

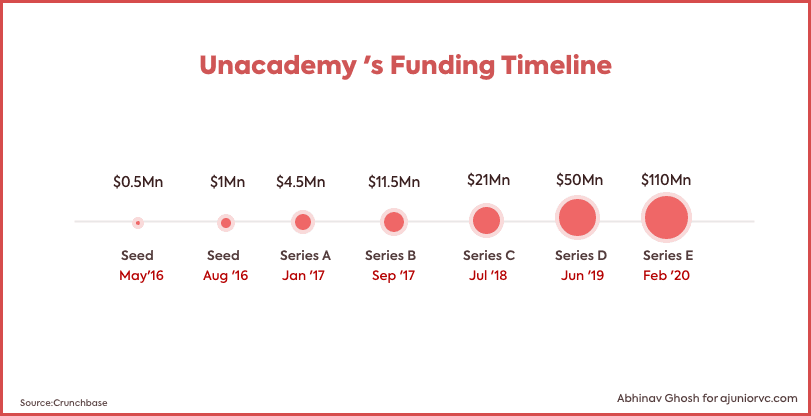

Last fortnight, EdTech upstart Unacademy disclosed details of its $110M Series E raise, being one of the few bright spots in a global economy ravaged by panic.

The Philosopher’s Phone

In late 2010, still as a student in college, Gaurav Munjal was tinkering with Youtube.

Armed with just a whiteboard and an understanding of Java, he decided it might be a good idea to record a lesson on “Variables” and put it up online.

A decade ago, with Youtube and a whiteboard

As you see a founder a decade ago tinkering with the idea, it may have been the genesis of a business he would found years later. With this idea presumably seeded, he went on to found Flat.to, a real estate listing startup.

Renamed Flatchat, it would be acquired by Commonfloor which in turn was acquired by the classified unicorn Quikr. Though Quikr decided to shut down the flat-hunting startup eventually, the experience would be instrumental in learning how to build a team and business.

In 2015, soon after exiting Flatchat, the video idea of 2010 would become Unacademy.

Perhaps a lesser known fact is that the origins of the team, and a product market test, would be on another massive learning platform - Quora.

After being joined by Hemesh Singh, the Unacademy team started to utilize their personal reputations that they had quietly been building on Quora. A heavily followed profile on was Roman Saini, who was already teaching many people online through Quora. Roman had burnished his reputation having cleared both AIIMS and IAS.

It is not difficult to guess that the story of the founders finding each other would first be available on Quora itself.

With Roman taking the leap of faith, dropping a potentially long and influential IAS career, the three set out to change the landscape of education. Their attempt at this transformation was cheekily named Sorting Hat Technologies.

The UPSC focused YouTube channel was soon going to be evolving into something bigger.

Entering the Chamber of Zealots

Marking the shift away from its YouTube classes, Unacademy officially launched in 2016 as Unacademy.com.

By April, over 100 educators had created content on the platform, including extremely reputed professionals, such as the 2016 IAS Topper and Kiran Bedi. 6 months post its official launch, it attracted an additional $1MM in mid-2016.

This begs the question of what was so special about the product. Let us start with the basics.

It started with a market that was well-established and operational for decades, as about 1MM students write the UPSC exam each year.

However, Unacademy had adopted a digital delivery approach, one that was largely unheard of in this market.

With BYJU’s making noise in the K-12 school segment, acceptance of online learning through recorded videos was increasing but had not yet penetrated the Mukherjee Nagar of competitive exam prep.

The incumbents in the markets were age-old offline coaching classes, run by passionate zealots. Their typical features include batch sizes of 150+ students in 2-3 hour-long classes, limited personalised support, and most importantly an average fee of over Rs 1 lakh.

Unacademy started as a YouTube channel providing free videos on important topics to students looking to clear their doubts and study at their own pace. The need for a democratised and convenient learning product in the market was so strong that its user base grew rapidly.

Its online videos were receiving about a million views monthly that grew 5x by the end of the year. It finished 2016 with over 500,000 registered users consuming a variety of content across the YouTube channel and website.

Since it started on YouTube, Unacademy had already amassed a large community of user followers before its launch. This community translated into huge organic demand influx on the platform, minimizing the need for marketing spend.

With demand growth not being a worry, founders were able to improvise on the product and expand courses beyond competitive exams.

It bagged another $4.5MM in Jan 2017 in order to launch a consumer-facing app, expand the educator base from 200 to 2,000 and build out the suite of course offerings.

Unacademy was onto something big.

Accio Teachers

In terms of the business model, Unacademy started out as a pure educator marketplace.

It attracted teachers from all across India, with a majority coming from non-metro cities. Armed with the ability to earn better salaries, sitting at their homes or practically anywhere, the value proposition for teachers was quite strong.

It was no surprise then that it was able to rope in top teachers from some of the existing offline coaching institutions.

By bringing together demand and supply, it allowed the system to automatically filter out poor educators and provided strong incentives for curating the best content. Its platform approach ensured that consumption and production of content were light-weight, making it a highly scalable model.

Though Unacademy had created a dent in the competitive exam space, the opportunity staring at the team was much larger.

9 months later, it received $9.5MM in funding to scale to other categories such as personality development, new languages and job interviews.

By that time, the registered user base had doubled to reach 1MM, and with the YouTube channel being among the top 5 education channels in the country, it had become a household name in the test prep segment.

Exceeding its target numbers, it had on boarded over 4,000 educators by the end of the year with 25% of them being active.

Unacademy’s growth was no doubt spectacular, evident in its rising user base, strong brand recall and usage and retention metrics.

However, until this point, it was not translating into revenue growth.

The Goblet to Acquire

To fuel its growth, while figuring out monetization, the startup was seen fund-raising quite rapidly.

In less than a year from its previous round, it bagged an additional $21MM in July 2018. Later in the year, it acquired an online study portal, WifiStudy, that had a strong foothold in the government recruitment exams such as banks and railways and deep network in Tier 2 and 3 towns.

The synergies of the acquisition become evident when we note that WifiStudy has 70MM monthly video views and ~4x the number of subscribers on YouTube when compared to Unacademy, making it one of the largest education channels in the world!

In early 2018, the team also started small monetisation experiments with the launch of the Plus platform, offering private discussion forums and online “live” classes by the educators.

What started as a side-hustle YouTube channel was showing shoots of a flourishing business, and Unacademy raised a $21MM Series C to further drive the growth of educators on their platform.

By this stage, Unacademy was offering a wide range of courses but its most popular offerings continued to be preparation for important exams in India like the JEE and UPSC.

The continued funding was aimed to help build its strong foundation as an aggregator between teachers and students. On the teacher (‘supply’) side, it had an app that provided its 10,000 teachers with tools to build, professionalize, and effectively communicate their classes.

The demand came from its three million users, who used the Unacademy platform to access and track their progress on various subjects and courses.

In many ways, Unacademy had interesting parallels like some well-known matchmakers.

A Triwizard Procurement

In many ways, the way that Unacademy attracted and retained their teachers and students is similar to many massively scaled aggregators.

One comparison is the way a food delivery or ride-sharing app like Zomato or Ola creates a three-party transaction by attracting drivers and riders.

Drivers/teachers come to the platform because of the scale, technology, and access to consumers. Riders/students see value because they can get quick, convenient solutions to their problems.

While operating like a ridesharing company, Unacademy measured its metrics like the internet company it truly was. In the month prior to Unacademy’s Series C, it was attracting 3,000 monthly average educators to its platform and their lessons were being watched more than 40 million times

The company planned to grow its monthly active educators from 3,000 to 10,000, improve its live streaming technology and increase its presence in Indonesia, where it had more than 30 educators at the time.

But Unacademy’s marketplace model would also have its own challenges.

Students complain that the platform is flooded with videos and that they have to try out a few before deciding the educator that works for them. In comparison, competitors such as BYJU’s and Vedantu streamline this process and provide a guided package.

Will Unacademy's approach trump BYJU's?

The test prep segment is large but the user does not have a high LTV when compared to the K-12 segment targeted by BYJU’s, Vedantu etc. The latter are able to capture a student early on in their journey and upsell strategically.

Despite these challenges, Unacademy would continue to fuel its rocketship.

A Great Hall of Content

In 2017, Unacademy’s Learning App had become the largest free learning platform in India. In 2018, Unacademy Plus became the largest online live learning platform.

By 2019, the EdTech market in India was heating up. With an increased number of students in Tier 2 and Tier 3 cities coming online, consensus estimates around the market size for online education in India had grown exponentially to $35Bn.

Byju’s, Unacedemy’s biggest competitor in the space, was worth around $4Bn with their most recent fundraise, and the ball was in Unacademy’s court.

It was around this time that Unacademy was discovering an interesting trend amongst their Unacademy Plus users - people were spoilt for choice! It was common for Unacademy to have multiple courses taught by different instructors - and their learners had to choose to pay for one or another while preparing.

Here’s where the beauty of their platform came to play.

In a similar vein to Netflix, that charges customers a monthly subscription for their catalog rather than one specific movie or TV show, Unacademy launched a subscription package for their educational categories.

Students could now have a monthly/annual fee and have access to all of the following related to a specific subject or exam.

This switch in business was a game-changer for Unacademy and provided three key benefits.

First, it reduced the burden on the learner and made the process more frictionless. All the student would have to do is subscribe to a package and in turn, they’d receive all the material they needed in a cohesive plan. This improved satisfaction, retention, and ultimately LTV.

Second, the buffet style service v/s a la carte meant that additional courses / interactions / tests provided to the student would add to the value a student received from their subscription. In the same way that Amazon Prime Video doesn’t compete with Amazon Music for a Prime subscriber’s wallet share, a new tutorial from multiple teachers increased their cumulative value rather than making one more attractive than the other.

Finally, this increased Unacademy’s unique proposition in the value chain. The educators could focus on providing knowledge, the student on consuming, and Unacademy would act as the aggregator layer in the middle to facilitate and curate the precise packaging that was required.

These innovative business model tweaks propelled Unacademy towards their Series D funding round in 2019, where they brought in an additional $50M to continue increased educator and learner volume.

Additional interest in the company was buoyed by the early adoption rate of Plus as 50,000 learners subscribed to Unacademy Plus in the first few months. The fact that more than 600 live classes were being conducted every day by the educators on Plus from all across the country added to it.

In just a year, Unacademy had jumped from 3,000 to 10,000 educators (a 233% increase) and matched this increase by driving learner count up from 3M to 13M, a 333% increase.

But was this growth going to translate into a viable business?

The Half-Blood Blinks

Started off as a platform which provided most of its content free, Unacademy’s Plus moved it strongly towards the monetization path around Mar 2018

In its original revenue model of Unacademy+ users could access ‘live’ classes for a pre-determined course fee. Its introduction of the Unacademy+ subscription model in Apr 2019 was a necessary step towards making money.

It is also an interesting move for a company where the founder mentioned four years back that it will ‘Never. Agreed. Never’ charge for its videos or courses.

For FY20, revenues jumped almost 6x to INR 120Cr ($16.2M) from INR 22cr ($3M) in FY19. It also neared 100,000 active subscribers in just 12 months of launch,

The subscription model demonstrates that patience while building a dedicated student base who are fans of the product does work. The biggest challenge while launching a free service is the ability to monetize at the right time and in the right pricing range which Unacademy has been able to crack from the initial numbers.

The transition from being a free platform to a subscription-based model is however fraught with challenges and users can nosedive especially in a price-sensitive country like India

The Plus subscriber platform will need to focus to leverage network effects. As more educators come onto the platform to deliver quality learning the value of subscription will rise and attract more users.

As more users come to the platform it will increase earning opportunities for educators and create a virtuous self-sustaining cycle.

As the gatekeeper of educator-student relationship, Unacademy has the opportunity to further monetize the value it is creating.

A Pensieve of Money

There are classic strategies to monetize, and then more omnichannel strategies.

The most common one includes ad-based revenues where it monetizes its free pre-recorded video lessons. The platform also could tie up with schools to offer content to its students and enter into a fee-sharing agreement.

Other ways include Unacademy events students are allowed to interact with educators, some of whom have developed a loyal fan base akin to celebrities.

Radical ideas could be offering ‘a slice of life’ experience for the courses. For instance for its IAS, IPS officer course it can actually allow students to experience a week in the lives of officers through shadowing them which can provide them excellent insights on the career.

On similar lines, it could offer masterclasses by prominent professionals in the space for niche courses such as wine tasting, pastry making, travel blogger etc. Interestingly it launched ‘Legends on Unacademy’ earlier this month where cricketing stalwarts such as Sachin Tendulkar, Brian Lara and Brett Lee became teachers.

Growth will also be driven by milking the subscription model. Adding more categories and building depth in existing ones through the addition of courses, educators and languages will help create a strong product moat.

Expansion to international markets will be the gradual next step.

It already has a presence in Indonesia. It also has global examples to learn from such as Yuanfudao which is a Beijing based online tutoring platform last valued at $3Bn or 17zuoye which is a K-12 online education startup and raised $250MM in Series E round.

Invariably there are challenges and some testing ones for Unacademy. Building and sustaining a paid model has been a sticky slope for many players who have tried and tested. Byju’s is probably the only example with 2.8MM paid subscribers and 30MM+ users at last count

But the opportunity is massive enough for many strategies to exist.

Mastering the Deathly Hallows

The paid user base for online education is expected to touch 9.6MM by 2021, which is just 5% of the 200MM+ students who prepare for exams in India each year

Unacademy understandably remains bullish and expects $250-300MM annual revenue on the back of rising paid subscribers in the next few year. With 90k active paid subscribers as of Feb 20, the company has already hit an ARR of $30MM.

The company’s goal is to reach a million in the next two years which will help 10x revenues. This essentially means a market share of ~11% which will be no mean feat with the propensity for students to look for free material/ courses.

The company has recently raised its Series-E funding giving it room to experiment. Adding top educators, creating quality content and attracting students is the trifecta for Unacademy.

Biswa makes a fairly entertaining Unacademy partner

Or as the company’s name would suggest, they are their Deathly Hallows.

It realizes that it will have to fuel up and offer an assortment of courses to reach the 1MM mark. With 32 exam services right now, it plans to launch a subscription for every single exam and offer 72 exam services by 2021.

Content should be easily scalable vis-à-vis other players. The same content created for IIM-CAT exams can be replicated and offered to 30+ management exams for states and private universities

The company’s vision is to build the world’s largest education platform and leverage technology to democratize access to quality education throughout India.

With India home to 19% of the world's youth it is also empowering them to equip themselves with real-life skills and take on the world bolder and smarter. Overall it is a remarkable impact story with 70% of users from Tier 2, 3 cities, 10K+ registered educators, 13M+ learners and 90K+ active paid subscribers,

Backed by a strong team, a fantastic product which users love, strong engagement and retention metrics and a first-mover advantage, these are exciting times for the soonicorn.

The lockdown due to the ongoing pandemic, and the company’s rapid and sensible response puts it in a good position to achieve its vision. Some students may irreversibly begin to seek online education as a part of their learning, and these responses will be critical.

Like a well-loved hero overcame a big Riddle, Unacademy could crack India's online learning riddle and cement the futures of its students, educators, and most importantly, itself.

Written by: Abhinay, Abhinav, Keshav, Saloni, Shiraz and Aviral