May 16, 2021

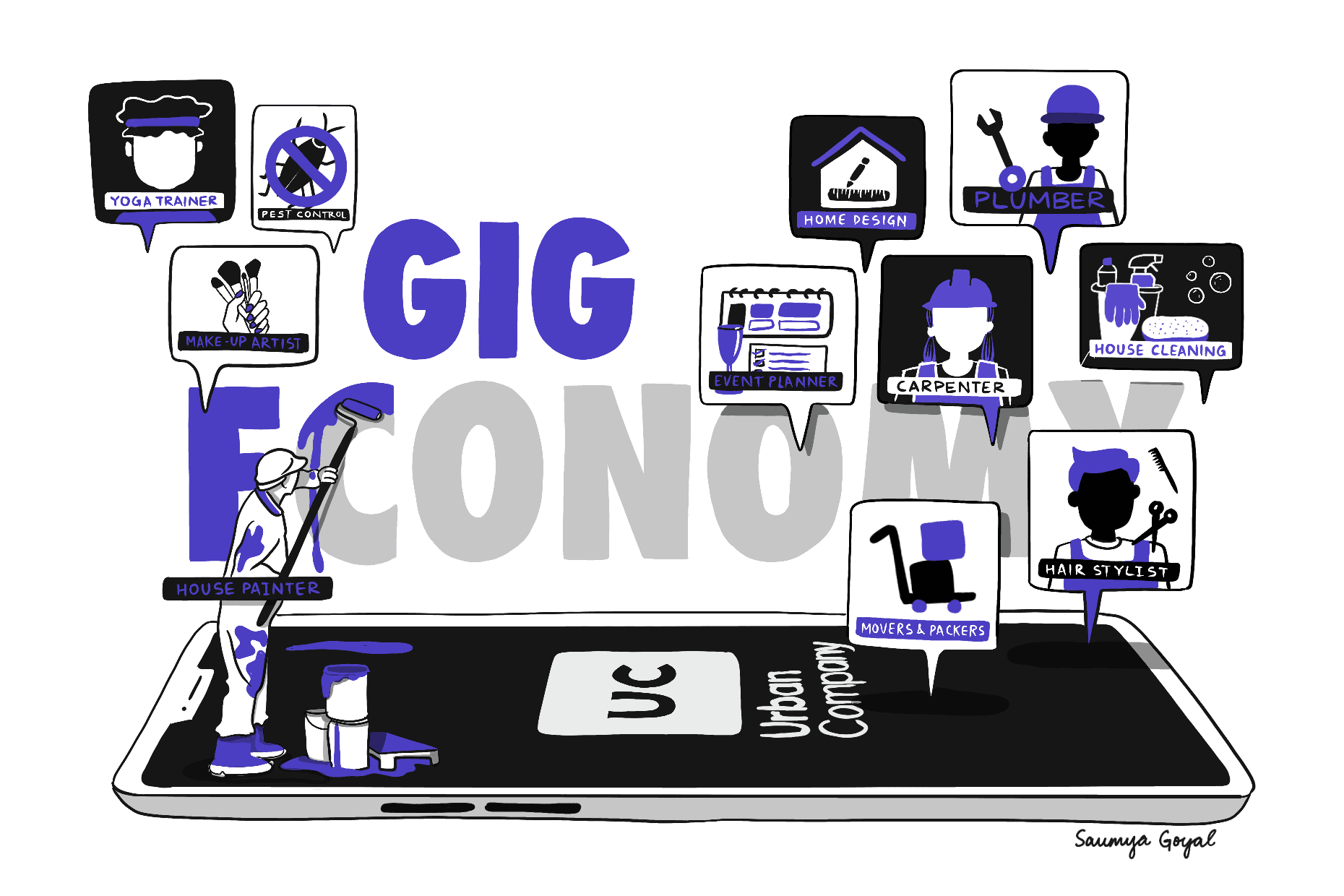

Can Urban Company Give India’s Gig Economy A Makeover?

Profile

Aggregator

Series E-G

B2C

Services

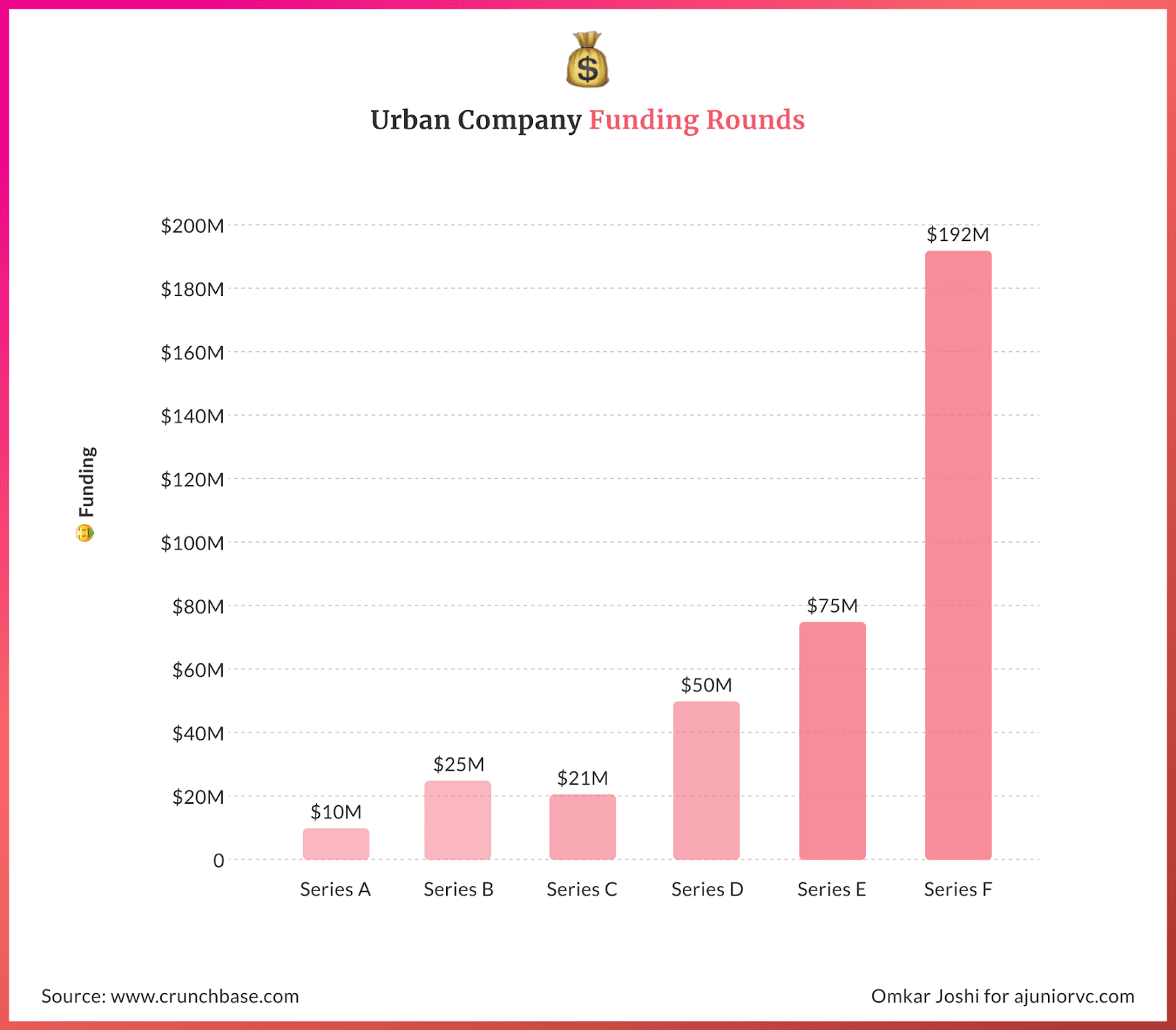

Last fortnight, Urban Company raised $190M, propelling it to become a $2Bn unicorn, a record breaking 13th for 2021.

Painting A Canvas

Varun Khaitan and Abhiraj Bhal were batchmates at IIT Kanpur.

While working at a management consulting firm, the duo had started exploring the “what and how” of startups on overseas weekend conference calls. Soon after, they quit their jobs and returned to Delhi to try their hand at entrepreneurship.

Their first venture was a movie streaming company called CinemaBox that enabled customers traveling for long durations to watch movies using WiFi networks on buses, trains and planes. While CinemaBox was a good lifestyle business, they realised it wasn’t a life changing one.

The market simply wasn’t big enough.

Meanwhile, Raghav Chandra a CS major from UC Berkeley, had quit his internship at Pre-IPO Twitter. He was working on his own startup, an auto-rickshaw aggregator called Buggi.com.

Buggi was a peer-to-peer ridesharing platform that required massive operational scaling for the venture to kick off. It was at a mutual friend’s party in Delhi that Khaitan, Bhal and Chandra’s worlds collided.

The three young entrepreneurs formed an instant connection and started meeting to brainstorm potential ventures. The theme of these sessions revolved around finding large sectors in India, which hadn’t yet been disrupted by large companies.

This was a time when consumer-facing internet companies, like Flipkart and Ola, were rapidly scaling and gaining a lot of investor interest. In the year 2014 alone, Indian tech companies had raised close to $5.2 billion in venture funding,

Home services, a highly disorganised industry, was estimated to hold an opportunity somewhere between $100 Bn to $400 Bn in size, which was the niche our young entrepreneurs eventually zeroed in on.

They noticed how an average household spends a lot on service providers but there existed a major lack of organisation in the market itself.

They named their venture UrbanClap because they wished to build a platform that would make urban lives more fulfilling and deliver their needs in a clap.

UrbanClap’s journey of revolutionizing the hyperlocal services market in India had begun.

Constructing a Business Model

The existing solutions in the market were not compelling enough for the Urban consumer.

The many forms of Yellow Pages just didn’t make the cut. The consumer’s dissatisfaction was well known.

While adjacent industries like e-commerce and hyperlocal delivery were leapfrogging with tech enabled innovation, the market was slowly picking up on this demand for at-home services.

Once the moment kicked in, there were more than 60 startups building for at-home services that were founded in 2014 alone, catering to as little as 6 and as many as 6000 services.

It aspired to be the go-to platform for consumers looking to make the moments of their urban lives a little easier, be it a trivial matter or a major life event.

Within a few short months, they were serving 500+ customer requests in a day with a strong supplier base of 1000+ professionals connected on their merchant app. They secured $1.6M in April 2015, as their seed round.

UC realised that the orders it was fulfilling could be bucketed under two broad categories.

One was blue collared services like plumbing and appliance repair. The other was white collar services like wedding photography and interior designing.

The former typically had much shorter purchase periods with largely standardised ticket sizes. The latter had varying and generally high order values and long purchase periods.

Both problems were drastically different and were tackled using different approaches.

For the white collar services, UC executed what it called the “Connect Model”. Here it would connect the consumer with a shortlist of relevant professionals, and leave it up to the consumer to decide whose services they wanted to employ.

For the blue collar services, it assigned and dispatched a service professional to the consumer’s house, and since it was servicing the consumer’s needs end-to-end, this was called the “Full-stack Model”

Implementing the full-stack model was largely straightforward, but the full-stack approach was a little convoluted. This wasn’t a simple supply-demand matchmaking solution that could be automated.

Catering to different customers with different preferences and budget constraints was the big problem UC chose to address.

Changing the Gig Economy’s Plumbing

By mid 2015, merely a quarter after raising their seed round, the team at UrbanClap demonstrated incredible execution.

This convinced investors to participate in their Series A funding, with another $10M coming in.

The founders did not see this as just an opportunity to introduce some form of order into the chaos.

They wanted to democratize the gig economy, by handing the power back to the vast number of service professionals that were currently taking home only a small fraction of the value of the services they were providing.

In fact, UrbanClap was actually building an empowered community of service professionals by paving the path to financial freedom.

For example, beauticians typically took home only about 15-20% of the earnings from providing services at local parlours and other chains, with the house keeping the rest 80%.

UC came in and turned this model on its head. As platform provider, its take rate was 20%, which meant the beauticians would go home with 80%, essentially quadrupling their income assuming they would continue servicing the same number of customers per week.

This was something that UC was working hard to ensure.

It began with a humble 1000 service professionals in 2015, and earning their trust was the key in building this community. Few months after launch, it was servicing 7500 orders in a month, by offering 50+ services across 5 broad categories: home, health, events, lessons and other personal services.

It was delivering on its promise, and this was reflecting in the compounding numbers of service partners it had tie ups with.

It built a robust partner app that sent real-time business leads to professionals showing them the potential business it could bring for them.

Reducing the time taken for a professional to respond to a customer call was a key detail that helped it drive higher conversions.

All this progress was also translating into investor interest.

Only 5 months after its Series A, UC raised $25 million in its Series B. Its initial backers returning to make an investment in the venture for the third time.

UC was flying.

A Few Electrifying Partnerships

UrbanClap was treating their service partners as micro-entrepreneurs and taking pride in their wins.

The experience of being a UC partner spanned way beyond merely having access to the market.

Individuals who qualified to become service partners for UC were provided the training and inventory to do their jobs, along with insurance, credit access, and access to a fair playing ground.

All orders placed for a similar service would adhere to UC’s standardized pricing.

UC used extensive marketing through basic paid promotions and social media advertising. They kept the interests of the service professionals at the core of its business. This contributed to the propagation of word of mouth and led to new partnership opportunities.

The other leg of the platform, i.e. the service receivers end also depended largely on advertisement through popularly used channels and crisp UI to maintain engagement.

Starting out, the cost of acquisition of a new customer was pegged at INR 800. UC eventually brought this under INR 400 after the first year of operation. The average order size was around INR 1100 to 1200, with the commission ranging from 10 to 20% on each order.

Now focussed on diversifying their offerings to encompass the array of needs the average urban customer had, UC was looking at a variety of verticals to foray into.

Some of these already had players disrupting the market and consolidating their position.

HandyHome was India’s only platform in 2016 that offered appliance repair and servicing fulfilled by brand or OEM authorized service partners.Identifying the great potential that tie-ups with OEM’s held, HandyHome was approached with an offer it didn’t refuse.

With the hyperlocal bubble rapidly unwinding, HandyHome saw this as a win and joined forces with Urban Company in 2016.

GoodService, a Delhi-based hyperlocal services provider that focussed on the beauty segment, was another such acquisition made by Urban Company in the same year.

This time however, it was the technology that Urban Company wanted to leverage.

GoodService’s backbone had been its chat-app format, and UC had been working on implementing an algorithm to customize service offerings based on questions answered by the users.

As the hyperlocal industry went through a nuclear winter, UC consolidated its position.

Local Services, Worldwide

Wrapping up what was a very tense year for the industry, UrbanClap clocked only INR 80 lakh coming in from commissions, in 2016.

Its expenses on marketing showed, with operating losses growing from INR 59 lakh to INR 59 Cr for FY16.

The bottom line still was that UC had survived a year that saw many home service providers that had spent truckloads of cash to win the market, end up crashing and burning.

The road to profitability was long, and the founders were focused on growing and strengthening their base. Assuming the total volume of orders processed by UC in a day showed a S-curve growth with time, the investors had their eye on the profitability that would be achieved as steady-state was approached.

July 2017 marked the inflow of fresh capital from its Series C funding, a total of $21 million being injected into the venture in this round.

It would seem to the observer that with the funding wind in its sails, UrbanClap was now going to focus completely on keeping service quality in check as it was gaining momentum. In the background however, there was a lot more going on.

UC was already building another ship to sail to uncharted lands, and investors had gotten wind of this new development.

Within 3 years of operation, UC’s community had grown 15x since inception, now housing 15,000 service professionals. Their customer base was entering the exponential growth mode: in April 2018 alone, they had serviced 200,000 orders.

The same month also marked UrbanClap’s entry into the international markets. It set up its first overseas shop in Dubai, bringing a new dimension to the on-demand services market in UAE.

UC did not want to stop in India.

Time to Re-model the Apartment!

Amidst all this action, UC raised its Series D round, bagging $50 million this time, in Nov 2018.

At this stage, the average ticket size had grown to about INR 1500, and the company had 2.5MM registered users, with a 75% repeat rate.

2018 was a phenomenal year for UC.

It had serviced 1.2 million orders, had brought its operating losses down from INR 67 Cr in FY17 to INR 56 Cr, and essentially quadrupled its operating profits to INR 47 Cr. The biggest contributors to UrbanClap’s success were the home and beauty segment (~25% of total orders) and appliances/basic home repair (~30% of total orders).

Owing to the successful launch in Dubai, UC announced the launch of its services in Abu Dhabi in June 2019. Abu Dhabi was another consumer heavy market where a majority of the local service professionals were yet to find a way to provide their offerings through an online channel.

It was now empowering 100+ partners within a year of operations. UC targeted to grow its UAE business 2x, month on month.

We spoke to UC's Raghav Chandra in our AMA

8 short months after raising Series D, UrbanClap took the market by surprise with an announcement of a $75 million Series E round in August 2019, propelling its valuation from the post Series D figure of $480 million to a colossal $933M.

It was just shy of being a unicorn, having survived in a space that saw almost all competition fade away.

All eyes on them, the management of UC thought it was a good time to re-evaluate their business model.

After closely studying the performance of each vertical, they found that their fullstack model had grown to be the customer’s favorite.

They acknowledged the fact that standardised procedures and pricing, their proficient squadron of service professionals and quality-assured customer service were playing out to be their strengths.

This led to the decision to pivot. UrbanClap would realign from this branched business model, to an entirely full-stack model. Any service that could not be migrated to the full-stack model was retired from the app interface, and archived as a blog.

From primarily being a connector, it had completely gone the fullstack way.

Rough Skies Make Good Pilots

In light of its ambition to charter global territories, UrbanClap decided to give itself a makeover.

UrbanClap rebranded itself as Urban Company in January’20. According to the founder’s, the new name gave the company a ‘universal appeal’, and was easier to recall across demographics and geographies.

We suspect it may also have something to do with negative associations that exist around the word ‘Clap’ in the West, but who knows.

Now an umbrella brand consisting of 6 verticals, Urban Company’s operations were carried out by Urban Beauty, Urban Spa, Urban Painting, Urban Repairs, Urban Grooming, and Urban Cleaning.

Out of these verticals, the beauty and wellness segment comprised 55% of reported revenue for FY’20, a 103% jump over previous year.

As UC was beginning to really skyrocket, there was still one company standing. Launched in the same year as UC, Housejoy also provided tech-enabled home and beauty services.

Houesjoy was trying to solidify its presence in the at-home and at-salon markets while UC is primarily working on improving and adding services and customer experience for the at-home market.

With regards to the home segment, the two players seem to have diverged in their path. While UC focused on services like repairs, painting and cleaning, Housejoy focused on technology based home renovation.

But as UC completed FY20, the pandemic threatened to completely destroy UC’s business. After becoming a fundraising machine, UC hadn’t raised money for a few years.

There were concerns about the model hitting scale. Profitability seemed very far away. As India entered the lockdown, UC’s professionals had nowhere to go.

Left to twiddle thumbs from April, it seemed like an impossibility that customers would allow strangers back in their home. Facing an almost existential crisis, UC’s revenue was down to close to 0.

The company went into overdrive trying to position itself as a safe alternative. It collaborated with celebrities to build trust.

It seemed like UC was back to square one, trying to build trust with consumers again. As the lockdown restrictions eased, UC’s technical strength, processes and trust started to show. Instead of going to individuals whose safety and hygienic standards they were unaware of, UC became the go-to company.

It would be an understatement to say that UC both imploded and exploded due to the pandemic.

The company rapidly grew, scaling faster than its pre-pandemic numbers by August 2020. By November, the company was already on track to scale 2x of its previous financial year.

Bear in mind that it was doing this after the first three months of the financial year were a complete washout. As UC began to get wings again, consumers flocked to it in droves.

As the company entered 2021, the rough skies were beginning to clear out.

An Upskilling Unicorn

In April 2021, UC became the latest addition to India’s unicorn rally in 2021.

With the latest funding, it wanted to onboard the next 20,000 SPs to meet the increased demand post lockdown. UC’s performance driven monetisation model combined with the mobile first approach played a significant role in differentiating it from its competitors.

Inching closer to their mission of empowering 1 million SPs by turning them into micro-entrepreneurs, UC now has 40,000 SPs on board.

Growing 100 times by 2023 from 15k in 2018 will require investing heavily in technology, operational efficiencies and training of SPs.

Employee benefits was the largest cost head in 2021, contributing to 68% of the total cost. Training of service partners is a costly affair.

UC currently has 200 full time trainers who train between 3000 to 5000 SPs a month. From June to November 2020, UC claims to have added 2,000 to 3,000 partners every month.

The agreement UC has with the Ministry of Skill Development and Entrepreneurship (MSDE) and the National Skill Development Corporation (NSDC) helps it issue certificates after the professionals clear the required tests. The MOU signed by the two parties also recognizes Urban Company as a strategic partner for Skill India Mission.

With the onset of the pandemic, Urban Company became an early adopter of training the SPs via Zoom calls, where they were taught about following techniques to ensure utmost safety while providing their services.

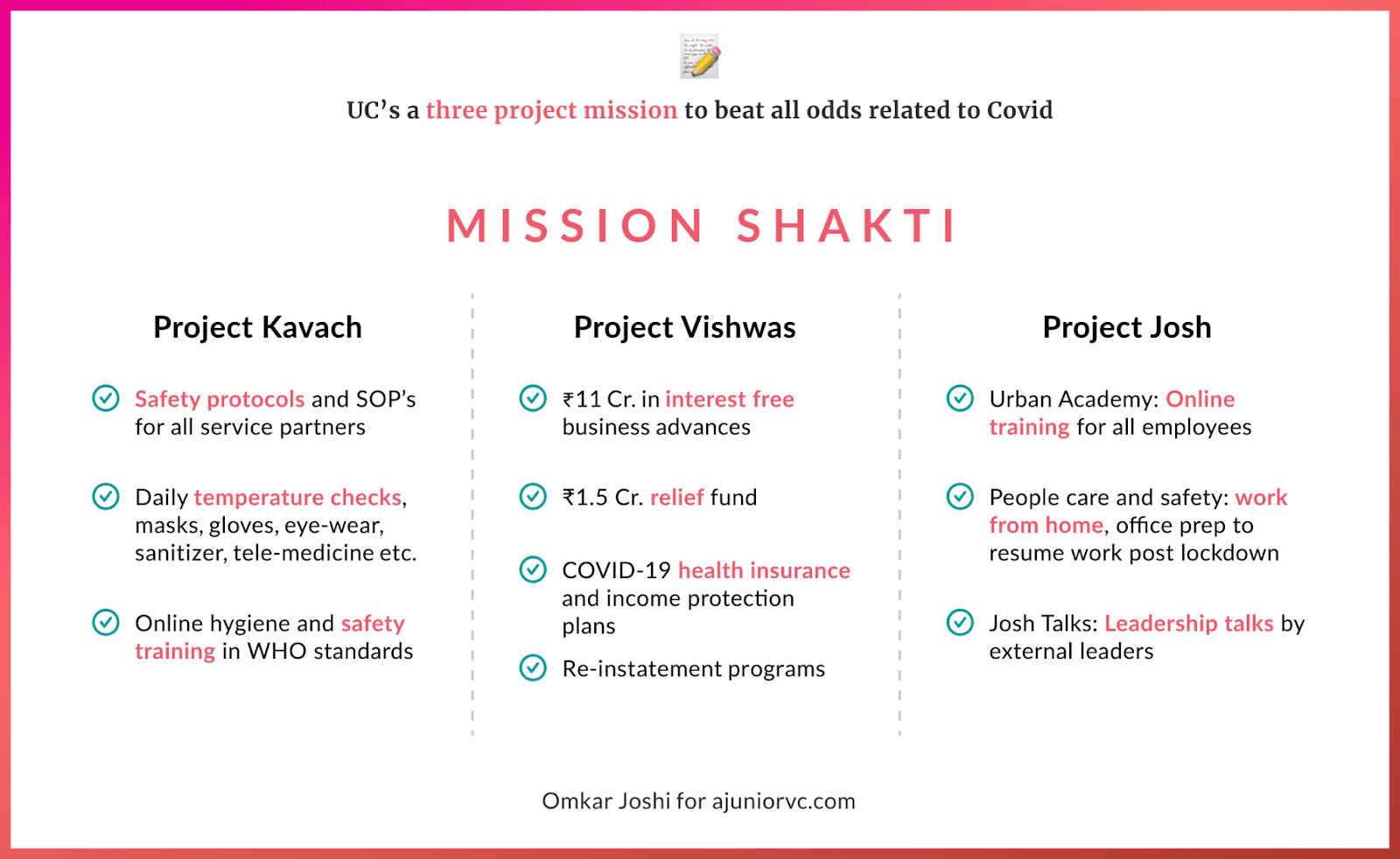

UC specifically launched Mission Shakti, a three project plan to beat the odds that Covid presented.

Project Kavach focuses on making the services safe by putting various measures in place. SPs were to conduct daily temperature checks and monitor health and were provided with PPE kits, sanitizing tools and single use sachets and disposables. They were also to undergo a certification program on personal safety and hygiene, PPE usage, SOPs etc.

Project Vishwas focuses on supporting the Service partners financially. One-on-one counselling was also provided to SPs to help them remain motivated, understand their concerns and provide an empathetic ear.

Project Josh focussed on ensuring well-being of the employees by adapting Work from Home, No layoff policy, honoring new hire commitments despite Covid.

If you think of it, UrbanCompany has become a quasi upskilling company, which few people, including the founders would have thought of. It shows how being true to a mission can open doors that you previously didn’t think even existed.

The collaboration with the Indian government would serve to put at an even stronger position going forward.

Gig Economy = Big Economy

UC has continuously been evolving, including with its name.

Going from horizontal to vertical to full stack, it has positioned itself uniquely for India.

Aiming to make its unit economics profitable before heading for an IPO, UC is planning to start a new revenue stream by selling private label products in the beauty segment.

They are now planning to go deeper within each category and building to cater to category specific needs. As an example, for appliance repair, an additional product feature would be to add diagnosis and revisit capability.

For the beauty category, it would mean providing customised beauty regimen recommendations based on previous services provided to the customer.

Since UC is catering to the international market as well, some product features are being planned to cater to needs by demographics. It is also looking at the possibility to add rebooking or scheduling features wherever applicable.

Another important direction UC plans to take is providing Training-as-a-Service.

The company foresees itself as a big training player in the next 4-5 years by creating job opportunities through skilling with its partnership with NSDC.

UC is looking at becoming the Linkedin for blue collar jobs by creating the largest workforce database. From screening and onboarding to training and providing employment, they intend to use technology to build these processes at scale.

While they are catering to category specific nuances, they want to build horizontal, cross category scalable systems. Their tech teams have been aligned to work under different horizontal areas like growth, marketplace, supply and platform.

With a presence in all Tier 1 cities and 22 Tier 2 cities, Urban Company has a long path ahead. With an ever-growing urban population, India still proves to be a highly lucrative market.

The tailwinds of adoption of internet services in Tier 2-3 cities might help them with expansion, but this opportunity would come with its own set of challenges.

The quality of supply, the level of demand, will all be challenges it will face in India and its overseas journeys. Having been built in India, it is a consumer internet company that is truly scaling to the world. Having setup successfully in Australia, UAE and Singapore, it’s eyes are on a truly global market.

The playbook it has built and honed in India will hold it in good stead as it scales.

With a mission to formalise a sector that has largely been informal throughout history, Urban Company is set to give gig economies around the world a makeover.

Story by Bhoomika, Manshi, Shelley, Shiraz and Aviral | Visuals by Omkar, Mehak and Saumya