Nov 29, 2020

What Happened to Urban Ladder?

Profile

Furniture

Retail

Platform

Brand

B2C

Series E-G

Last fortnight, Urban Ladder was acquired by Reliance for INR 182 Cr, at a steep discount from the 1,000 Cr it had raised.

Mind Boggling Furniture Difficulties

The year was 2012.

Two business school friends Ashish Goel and Rajiv Srivatsa had got together to discuss a business plan.

During their college days, the two were neighbors and had spent enough time with each other. Being ambitious and wanting to start a venture together, both often discussed plans during college cultural events.

Post their MBA, Aashish joined consulting, and Rajiv joined a technology firm. Although high achievers in their professional careers, they were itching to start something of their own.

The duo met again when they were renting a house in Bangalore for work, and destiny made them neighbors again.

They weren't able to find furniture online and were disappointed by the retailers. They had to sleep on the floor for about 15 months.

The urban legend about starting Urban Ladder was from a furniture-less floor.

At the time, over 90% of India's furniture market was fragmented and unorganized. Only 1% of the $10B market was on the internet.

Rajiv and Aashish convinced VCs that India lacked a specialized e-commerce business in the customized furniture sector.

It was then Urban Ladder started as a 10-member team operating out of a house in Bengaluru's Marathahalli area and soon got $1 million (around ₹ seven crores now) to start the business.

In the initial days, the founders decided not to manage inventory and sold fast selling and small products across India.

With the fresh capital, they decided to set up a bankable customer service infrastructure, building the technology and scaling the operations all over India.

The selling fast and cheap strategy proved successful initially as they were clocking 5x as projected in the first month of sales.

They were hitting nearly 50 orders/day with the ticket size around INR 10K – 15K. (~$150-$200)

For a new furniture company, they were flying.

Avoiding the Snakes, Going up The Ladder

Every founding team has to make big trade offs as a young company.

Growth versus profitability. Sales versus customer experience. Experience versus youth. The trade-offs of these decisions come back to seek their dues sooner or later.

The tradeoff of the big fast strategy would be that Urban Ladder was unable to meet the demands operationally. Customers started complaining of delayed delivery and damaged products.

Furniture was a long term purchase with deep deliberation, and India was a challenging market to appease consumers.

Despite having money in the bank, Urban Ladder was struggling to maintain a lasting connection with vendors and attract new customers. They had to do something.

Urban Ladder reduced their product offering to 35 products and three cities in search of solving the customer experience problem.

Making a trade-off of customer experience for growth would start to become core to Urban Ladder’s ethos.

Unlike their competition, which was just a marketplace for furniture, they were building a brand.

Urban Ladder had to change the Indian consumer mindset. The consumer lacked trust that buying furniture online was possible. Adding to the lack of trust was geography and customization.

People wanted a more customized design, material, and quality. Each state differed in its choices.

For instance, North Indian states preferred solid wood and carved furniture. In contrast, the south Indian states preferred lightweight and modular furniture.

UL invested heavily in data analytics to understand each geographical preference. They started customized and categorizing products for a specific geography.

The intersection of data analytics and a personal brand began to win. Consumers loved it and would soon purchase what they see.

To delight their consumers more, they started delivering the product by themselves and did not involve any 3rd party logistics. They reduced the delivery time and made sure the products were in good condition during delivery.

Urban Ladder was evolving into a full stack player to solve for customer experience. At that moment, the customer experience trade-off was working, and justified capital.

Buoyed by customer love, in 2013 they raised $5MM for Series A.

Entering a Customer’s Life

Over the coming months, Urban Ladder focussed on setting airtight processes to strengthen three pillars it identified as core to their value proposition.

These pillars would be design thinking, product design and customer experience.

In terms of supply, Urban Ladder did not aim to just become a marketplace connecting furniture sellers and buyers.

Instead it developed a curated marketplace collaborating with ~15 suppliers from Rajasthan & Bangalore and closely monitored the production lifecycle, from quality of raw material to final product design.

UL paid close attention to the needs of their target segment. They conducted online surveys and carefully-curated a product catalogue which reflected their client needs and preferences. Catering to the needs of a large proportion of customers in urban cities, a part of their product catalogue was dedicated to smaller homes and multipurpose furniture.

To further take their product offering up a notch, Srivatsa deployed data analytics to improve customization by understanding city-specific product demand.

With Facebook reaching 100M users by 2014, UL leveraged Facebook ads to run targeted marketing campaigns for acquiring new customers and cross selling products.

Furniture delivery also came with its own set of challenges. First there was the high logistics cost as multiple orders could not be clubbed in a single delivery run as could be done in other retail categories.

To ensure customers didn’t receive damaged goods, special packaging teams were set up in all their 10 warehouses and each product was packed with at least five layers of foam sheets.

By controlling the supply chains, they ensured that they reduced the damages to nearly 0.3%, which were previously as high as 25%.

All this increased the logistics cost and limited the maximum deliveries, but this was a price Urban Ladder was ready to pay for upholding their value proposition.

In the quest for customer experience, the trade-off would be higher costs.

All these changes looked like they were moving UrbanLadder in the right direction, as it claimed that it was atop the online furniture market.

With over 4,000 products and 35 categories, by the end of 2014, they expanded to 12 cities.By the end of 2015, UL planned to expand its presence to 30 cities.

Post the initial hiccups, it was firmly establishing itself as a loved and trusted online furniture brand.

Playing the Game of Furniture Monopoly

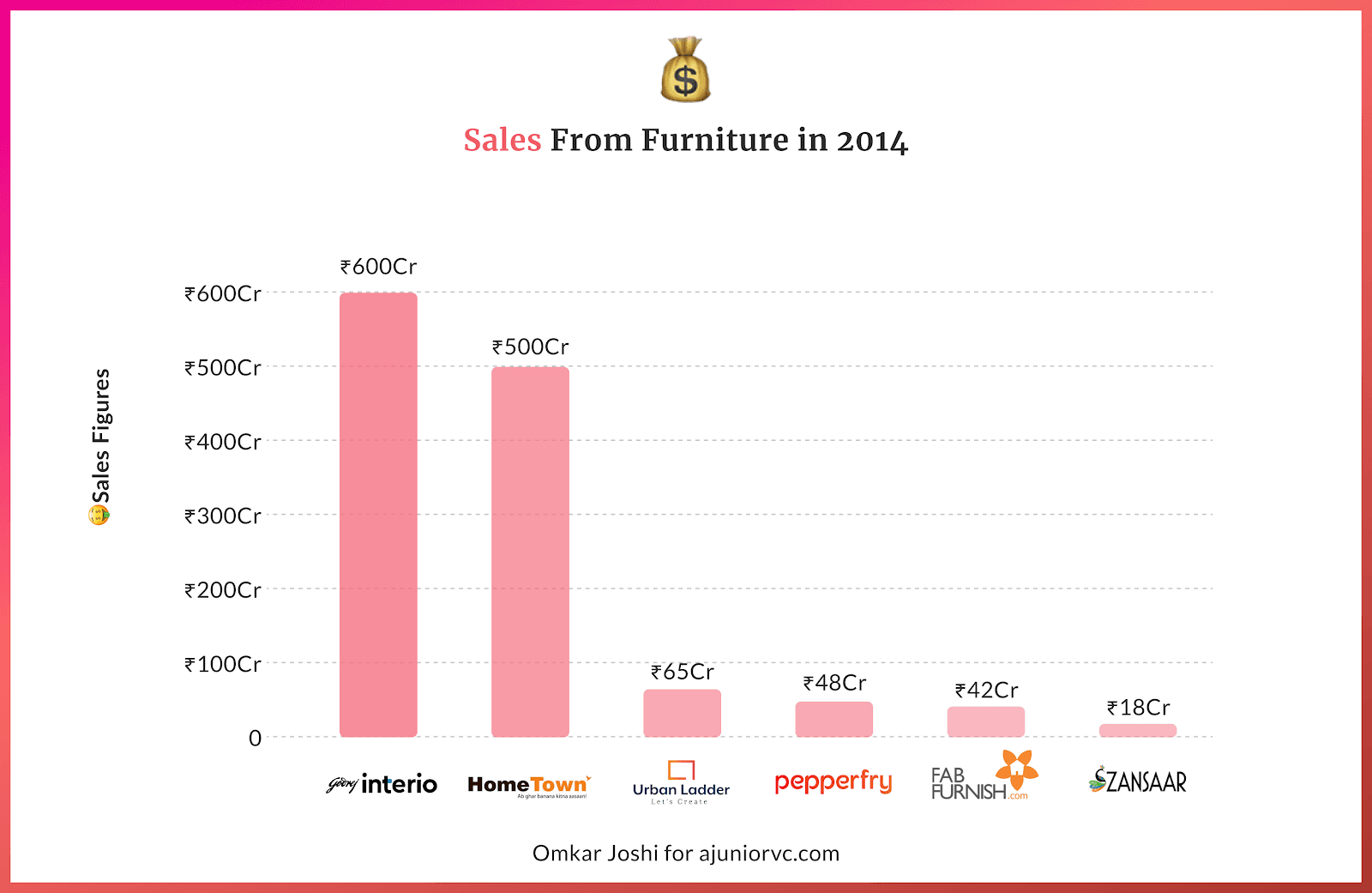

While UL was planning expansion, it was not the only player in the online furniture market.

One year before Urban Ladder was established, Ambareesh Murty and Ashish Shah had quit their jobs from the ecommerce giant eBay and founded Pepperfry in Mumbai in July 2011.

In the US, six months into his course at Wharton, impressed by a visit to an IKEA store, Vikram Chopra took a leave of absence from the Wharton Business School to come back to India and start FabFurnish, in March 2012.

The other players to enter the market were Furlenco (rental furniture), Nestopia and Liv Space (interior design marketplace), and Home Lane (furnishing market).

Why were so many players gravitating to the category? As discerning AJVC readers know, it was large, disorganized and ripe for disruption.

The entry and growth of these players in the $20 billion Indian furniture market showed promise that was ripe to undergo a digital overhaul.

What remained to be seen was how these founders evolve and scale up their business models and operations to cater to the needs of the market.

While similar in many aspects, Urban Ladder, Pepperfry and FabFurnish had different approaches to reaching their target segment.

Urban Ladder wanted to be the one stop destination for selling its own branded furniture while Pepperfry on the other hand wanted to be the largest marketplace for home and décor and in addition to its in house brand sold multiple external brands as well.

Furniture was a long tail business. Buying a mobile was very different from buying a sofa which had unstandardized offerings. In a residential building of 50 flats while people can have similar phones, no two flats have a similar collection of furniture.

In order to cater to this varied demand, both UL and Pepperfry were racing to increase their variety and reach.

In terms of variety while UL had close to 4,000 items with various price-points ranging from Rs 3,999 to Rs 1.5 lakh, Pepperfry had curated 80,000 items spread across furniture, furnishings, kitchen, appliances and lighting.

As far as reach was concerned, by 2015 Urban Ladder was present in about a dozen cities while Pepperfry which was catering to 100 cities was leading the segment. Both deployed in-house logistics to scale up operations. In contrast, FabFurnish was using a hybrid model of delivery. They were present in seven cities using their specialised logistics service FabOne, and in 100 more cities using third-party logistics.

To cater to customers who are uncomfortable buying online, FabFurnish also created an offline presence by opening four showrooms: two in Bangalore and two in the national capital region (NCR).

The race to win customers was intense. UL seemed to be winning with a category high NPS of 60+

Attempting the Offline Risk

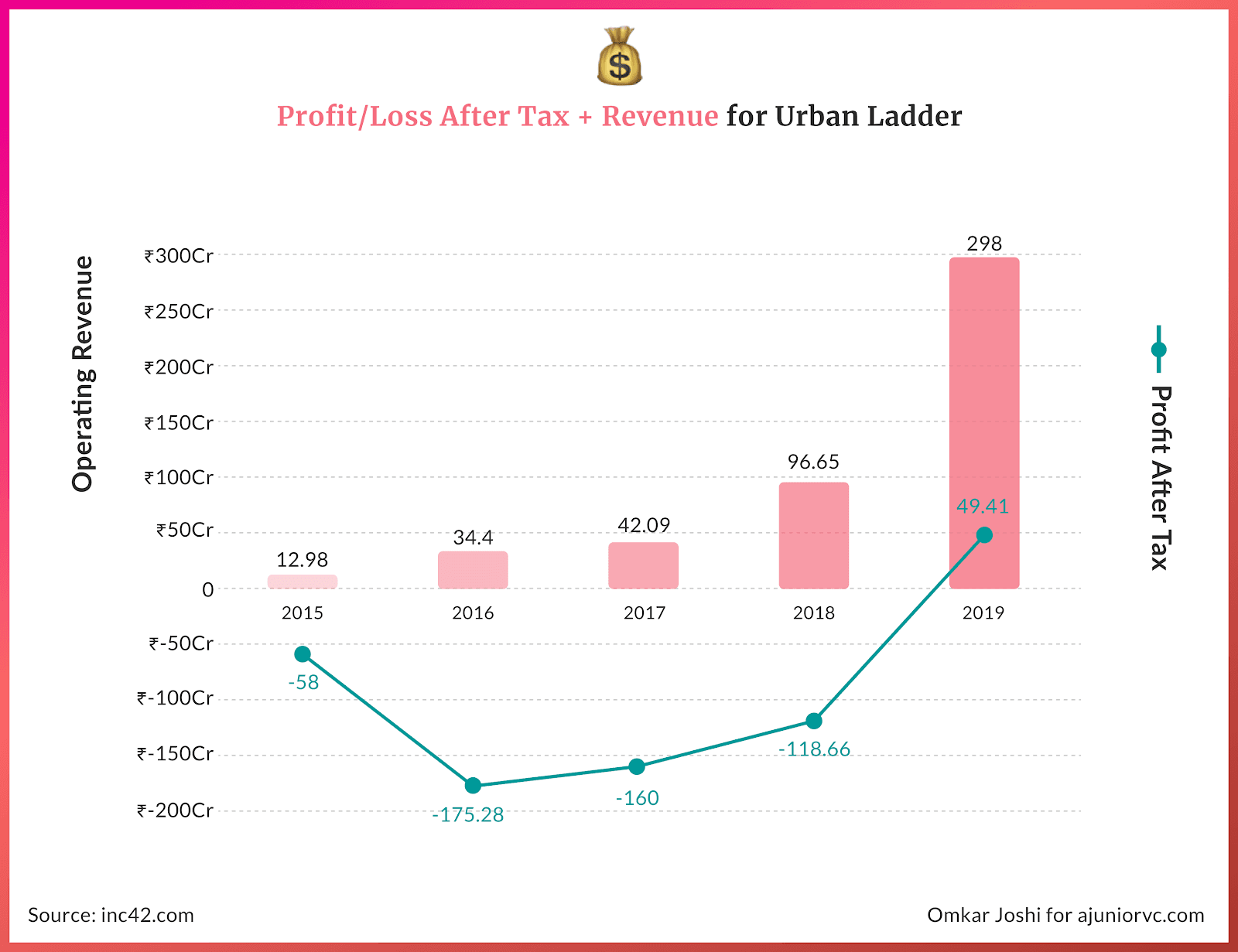

Owing to this spending spree to acquire more customers in 2015, Urban Ladder registered eight time higher losses than previous year.

Its total losses equalled INR 59Cr and Pepperfry saw its loss widening by almost three times to Rs 88 crore.

But the capital requirements, and the rush to win had begun to show the true nature of the online furniture market. There might not be a place for many to survive.

The reason for this anchored in the nascence of the online market, and the furniture buying behaviour. The online market was a sliver of the overall furniture market, people loved the touch and feel, and most importantly, furniture buying was a one time activity.

It is a niche segment with low frequency of purchase and very high average order value. In such a case, it is but natural that customers like to experience the product before putting cash on the table.

The single time purchase behaviour of furniture was unlike other consumer internet companies, that could justify high acquisition costs with repeat. Furniture would have close to zero repeat rates, and high customer acquisition costs.

With losses mounting, FabFurnish’ investors decided to sell it to Kishore Biyani Led Future Group in April 2016.

It was a pyrrhic victory for Urban Ladder and PepperFry when FabFurnish folded.

Around the same time, the competition was intensifying with e-commerce giants Amazon and Flipkart adding furniture as part of their product portfolios.

Everyone was looking at the massive market, and by then the online players had just scratched 1% of the overall furniture market.

By October 2016, Urban Ladder decided to take a risky bet. Going offline.

That’s why “Experience Centre” became a much sought after demand which led to UL’s pivot from a pure-play ecommerce platform to an omnichannel furniture brand.

To fuel this, UL even explored debt funding and raised around $3MM in venture debt funding as it got ready for the capital intensive world of furniture retailing.

Here again, the trade-off for having a better customer experience was the requirement of capital. It had to juggle between cash flows, high operating costs and delivering growth.

The idea of an experience store, as per the UL founders, was to operate with a strong confluence of design and technology in their experience centres much like their websites. The key will be to leverage the cross-flow of their online and offline channels to create a fantastic retail experience.

That was Urban Ladder’s Omnichannel strategy and for that it planned to invest $10-15 million for its offline retail presence in the next 18 months.

The First Wobbles in the Jenga Tower

The pivot into omnichannel, however, might have been late.

Their competitor and the biggest industry player Pepperfry had already gone ahead and launched its first ‘offline experience centre’ in Hyderabad’s high-street location Banjara Hills in June that year.

By 2017, it unveiled its first flagship experience store in Bangalore. Designed by Urban Ladder's in-house team and leading retail design firm Restore, the contemporary space was spread over 7,500 sq ft and over two levels.

It soon became a landmark for 100 ft road in Domlur. UL was now pursuing an omnichannel strategy with customer experience at its core.

It not only needed a huge pile of cash to grow this exponentially but it also needed external factors to go it’s way. The customer acquisition cost (CAC) was high, at approximately INR 5K ($80). It also needed to improve margins.

Added to all of this was competitive pressure from all around. The m-o-m numbers started taking a hit

Startups get funded for potential and exponential growth. As UL delivered average growth in 2017/18 it became difficult for them to raise funds from external investors and had to raise funds through existing investors.

Customer experience would only get you so far, and growth was a factor of many things. The complicated orchestra of running a company

Worry crept in as the virtuous cycle of fundraising was now evolving into a vicious cycle of fund starvation. Stagnant growth meant lesser access to capital. To continue, they had to do cost cutting which typically starts with layoffs.

As we had identified earlier, trade-offs can come back and hurt you. Over-indexing on customer experience may have hurt other cylinders, due to which tough decisions needed to be made.

By late 2018, Urban Ladder had to let go of around 25% of its employees to manage cost pressure and low bank balance.

Urban Ladder was facing pressures from ‘well-funded’ asset light players (Pepperfry, Livspace) as well as e-commerce behemoths such as Amazon and Flipkart

But the biggest pressure was yet to come, all the way from Sweden.

Scrambling to Beat IKEA’s Pieces

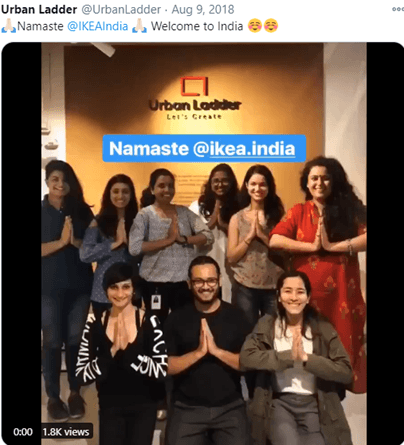

The sucker punch to Urban Ladder’s ambitions was not late 2020, but likely late 2018.

It would be delivered with the entry of a Swedish giant which after a 12-year struggle opened its first 400K square feet store in Hyderabad.

IKEA was the king of customer experience in furniture, literally inventing the concept of an experience in furniture. It was the master at Urban Ladder’s strong suit.

Its reception was jam packed as curiosity piqued among people who had never heard of the brand partly because of the massive space in which it launched. The scale of its store was commensurate with the size of its ambitions for the India market.

An astounding INR 1K Cr ($130M) was invested in the Hyderabad store itself spanning 13 acres with a product range of 7,500+. A cracker of a battle was underway

And while David displayed a quirky side to welcome the Goliath, deep beneath it understood that it was up against the best and the most experienced.

The long wait only helped IKEA strengthen its entry playbook for India which showed its deep commitment to win in the country. World over, IKEA sold furniture through its DIY-furniture assembly model.

It upended that model and created an in-house furniture assembly team of 150 people (first in any country) realizing that Indians were accustomed to carpenters and repair persons assembling furniture.

It also realized that India is a price sensitive market and tweaked its product range to suit that. Of the 7,500 products launched 1,000 products were under INR 200 ($3) and 500 products for under INR 100 ($1.5). Most of the buyers shopped offline and IKEA adopted an omni channel approach

It also looked for innovative startups in India to partner with. In May 2019, it invested in online home décor startup Livspace

Not many would know that Ikea is also the world’s sixth largest food chain globally (no kidding!).

India loves its food delicacies and to resonate that spirit, IKEA launched India’s largest restaurant in Hyderabad. On the menu were items such as Biryani, Dal Makhani, Samosa among others (slurp!)

Under the burden of strong expectations, IKEA blasted off the gates to a fantastic start.

In just seven months of its first FY in India, it logged revenues of Rs. 407cr ($55M) selling goods worth Rs. 2cr ($270K) on an avg. per day. That set a record by any brand in India to report such sales from just one store and in its debut year.

Buoyed by the initial success, the India CEO remarked that they would open more than 25 stores (the initial target till 2025) in India. As its second store in Mumbai is currently under construction, it has already gone online in Hyderabad, Pune and Mumbai

The shots had been fired and Goliath was surging.

A Chess of Tables and Chairs

The success of Ikea meant that the space heated up further.

By Sep 2019, Flipkart was capturing 41% of the online furniture market. The market itself was leap frogging with a CAGR of 80-85% with expectation that it would reach $700M by 2022

In the race to scale with well funded competitors, the earliest player and its investors were getting exhausted. By 2019, it was in the midst of a storm which would be brutal.

It raised an internal round in 2018 but was unable to attract a new investor with existing ones having gone on to fund competing players. The capital needed to invest in growth and operations and to compete with the other players became hard to come by.

The realization was that there may not be even few standalone players in the niche of online furniture. Due to lack of network effects, high acquisition costs, large capital investments, and well capitalized horizontal players, there may just be one.

That one was not UrbanLadder.

In Apr 2019, its President and COO resigned. By Jun 2019, it fired 40% of its 1,1100 employee base in an effort to become lean and profitable and closed several verticals. The delay in paying vendors and the long wait also pushed vendors to ask for 100% upfront from the company

Things took a turn for the worse as one of the co-founders and the earliest investors on its board resigned on the same day in Oct 2019. All this while the company continued to look out for a strategic acquisition or buyout with other companies, but nothing was fructifying.

It desperately needed some light at the end of the tunnel. By Nov 2019, despite top management churn and limited funds, it reported a net profit of Rs. 49cr with a topline of Rs. 434cr for FY19 (almost the first 7 months of Ikea).

It also raised a bridge round of Rs. 15cr ($2M) in Nov 2019 from few of its existing investor and opened a new store in Chennai and Pune (a 4,000 sq ft. one at that).

As it entered 2020, furniture would be one of the categories seeing a surge in demand, especially online.

As homes become workplaces, categories such as office furniture (3.5x growth), bean bags (2.2x growth), recliners (1.8x growth) have sold like hot cakes. As people have remained locked down but yearn for entertainment, newer categories such as gaming chairs have seen an upswing

The massive spends on discounts, cashbacks to shift consumer behavior to purchase online has been curtailed as people avoided going to stores to purchase products especially items such as furniture

Many corporates have also subsidized employee purchases for these items (buoyed by the operational savings on rent, food, electricity in office) which has further accelerated the online buying

Urban Ladder’s competitor Pepperfry rose to 120% of pre-lockdown levels.

Reliance’s Ludo

First time online buyers increased by more than 500%+ for Tier 2 cities and beyond during COVID.

To attract the new internet users, Flipkart added features such as search spell correction for users not well versed in English, geo-personalization to show products preferred by consumers in a particular region, 360 degree view and expert review sections, no-cost EMI

All this would mean a massive growth curve and investors doubling down on the dominant players, right? The demonetization moment for payments was here for online vertical e-commerce players. Dominant players would be welcomed with a ‘Golden Tap’

Strangely the opposite of that happened for Urban Ladder.

While UL had always been focused to craft the perfect experience by building its core pillars of design thinking, product design and customer experience it required huge capital to continue to provide that experience while penetrating deeper and expanding to newer markets.

Slowing growth with tough competition from all around left investors jittery. The capital to invest in growth, with the “full stack experience” never materialized and in its quest to stay afloat focused on becoming profitable, cutting out product lines, shutting in several cities.

Working capital and investment requirements would only increase with its scale.

Urban Ladder’s legendary NPS of 65 would prove to be its undoing, a reminder of how trade-offs prioritizing one parameter over another can be so crucial.

While it was profitable, also due to revised accounting standards that painted a better story, the capital intensity needed cash.

And if profits are the prince, cash is king.

It needed a deep balance sheet to continue challenging, and in the pandemic the strongest balance sheet in India was indisputably one.

Dedicated readers would remember our piece on RIL and its ambitions.

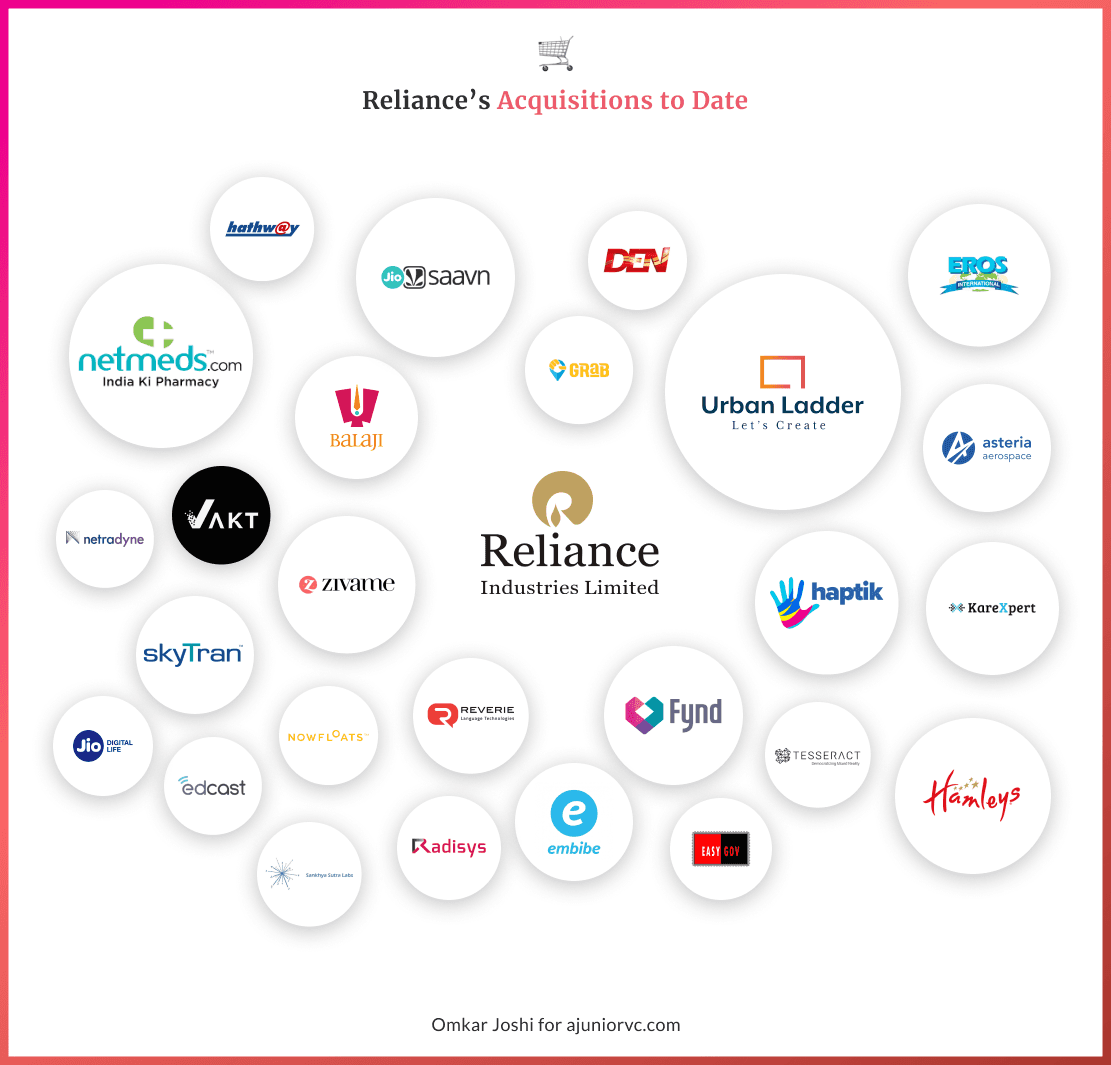

On 15th Nov Reliance Retail Ventures acquired a 96% stake for Rs. 182cr (~$25M), 42% of its topline in FY20. On 19th Nov, Reliance Retail completed its fund raise exercise and announced that it has raised Rs. 47,265cr ($6.4B) for a 10.09% stake. Dedicated readers would remember our piece on RIL and its Big Tech ambitions earlier this year.

With a deep pocketed set of investors in its cap table, Reliance adopted the Buy in the Build vs. Buy approach to accelerate digital adoption in the Indian retail sector. The timing to be on the hunt mode has worked out extremely well in the pandemic allowing it to pick quality assets at highly attractive prices

As it acquires No. 2 or No. 3 players in various sub sectors, its playbook to dominate the market of ‘Bharat’ is coming to life. With 11,784 stores in 7K towns and cities and 1,800+ Future Group stores now added to the kitty it has penetrated deep in Tier 2,3 cities and towns

As the new users come online, an omni-channel approach through collection of the best brand names in their respective stores, Zivame, Urban Ladder in 2,400+ fashion and lifestyle stores) could help establish a strong moat.

RIL has got a knowledge premium on these brands, their online users, supplier relationships, tech stack and digital knowledge while giving an acquisition discount to them.

It is clear what RIL bought was Urban Ladder’s brand, the one thing that is enduring due to its intense focus on customer experience. While startup journey’s are messier than just “one simple decision”, creating an enduring brand and a category is no mean feat.

For the remaining founder and team, RIL would help continue the brand they built and finance the realization of their dreams. While it may seem a faustian bargain to trade, achieving these dreams stand-alone for a “distressed” acquisition, surviving is a victory in itself.

Urban Ladder succeeded in creating a brand, and a category. While it may not have created the expected shareholder value, it did not go the way of so many companies that crashed and burnt under stress.

Urban Ladder’s dream of building a full-stack furniture company, perhaps to be furniture’s Flipkart may have been too capital intensive for its believers. The dream put customer experience front and center, and while it won the customer experience battle, it lost the business war.

Building a company is hard. Urban Ladder leaves an enduring legacy that even with all the hardships, you can still end up creating a shining light for future founders to build on.

By Abhinay, Keshav, Mitali, Saumya, Shreyans and Aviral

Audio Version: Behind the Scenes with AJVC

As usual, we have done a behind the scenes format with the writers and host Mazin