Jul 9, 2023

Can $1Bn WayCool Plow India's Supply Chain to a Fresher Future?

Profile

Agriculture

Series B-D

Last fortnight, Waycool was reported to be raising $50M to become India’s first agritech unicorn, possibly being India’s first unicorn of 2023.

Sowing The Seeds

Sanjay Dasari always considered himself an entrepreneur.

It was 2015 and he was a recent graduate of Babson College in the US, and had returned to India to explore the new world of business opportunities.

As a millennial and foodie, he was very excited by the food industry and considered opening a food trucks franchise in India.

As part of his research, he visited a prominent vegetable vendor in Chennai’s prime open market to discuss sourcing for his business.

He was shocked when he saw the unhygienic levels inside the market and how disorganised and chaotic everything was. On further enquiry, he learnt that this vendor claimed to be selling vegetables to some of the top-end hotels and restaurants in city.

Taken aback by that visual, he figured that more people like him must want cleaner, fresher, and better products. Many other food entrepreneurs had become uncomfortable with the traditional food supply ecosystem's need for hygiene and transparency.

He was slowly convinced that this was where his focus should be, in the restaurant supply chain business.

His father, Vinod Dasari, the managing director of Ashok Leyland, talked to his colleague Karthik Jayaraman about Sanjay's project.

Karthik had an extensive journey in the automotive industry, beginning as an engineer at Tata Motors. A project manager at Timken and most recently at Ashok Leyland, where he ran the MD’s office, managed network expansion, dealer development and corporate development strategy for the company.

He also had a five-year stint at McKinsey, where he consulted on the automotive and assembly industries.

During his two-decade-long career, Jayaraman closely viewed how the auto industry perfected supply chain management. He felt applying these basic principles to less organised sectors could create large efficiency benefits.

He met Sanjay and, impressed by his idea, joined hands to start a retail venture called SunnyBee. They began on mobile food trucks to enter apartment complexes and IT buildings, directly selling hygienically sourced fruits and vegetables to end consumers and small hotels and restaurants.

SunnyBee were using a B2C model to vet a fragmented supply chain before they would revolutionise it.

Fields Of Fortune

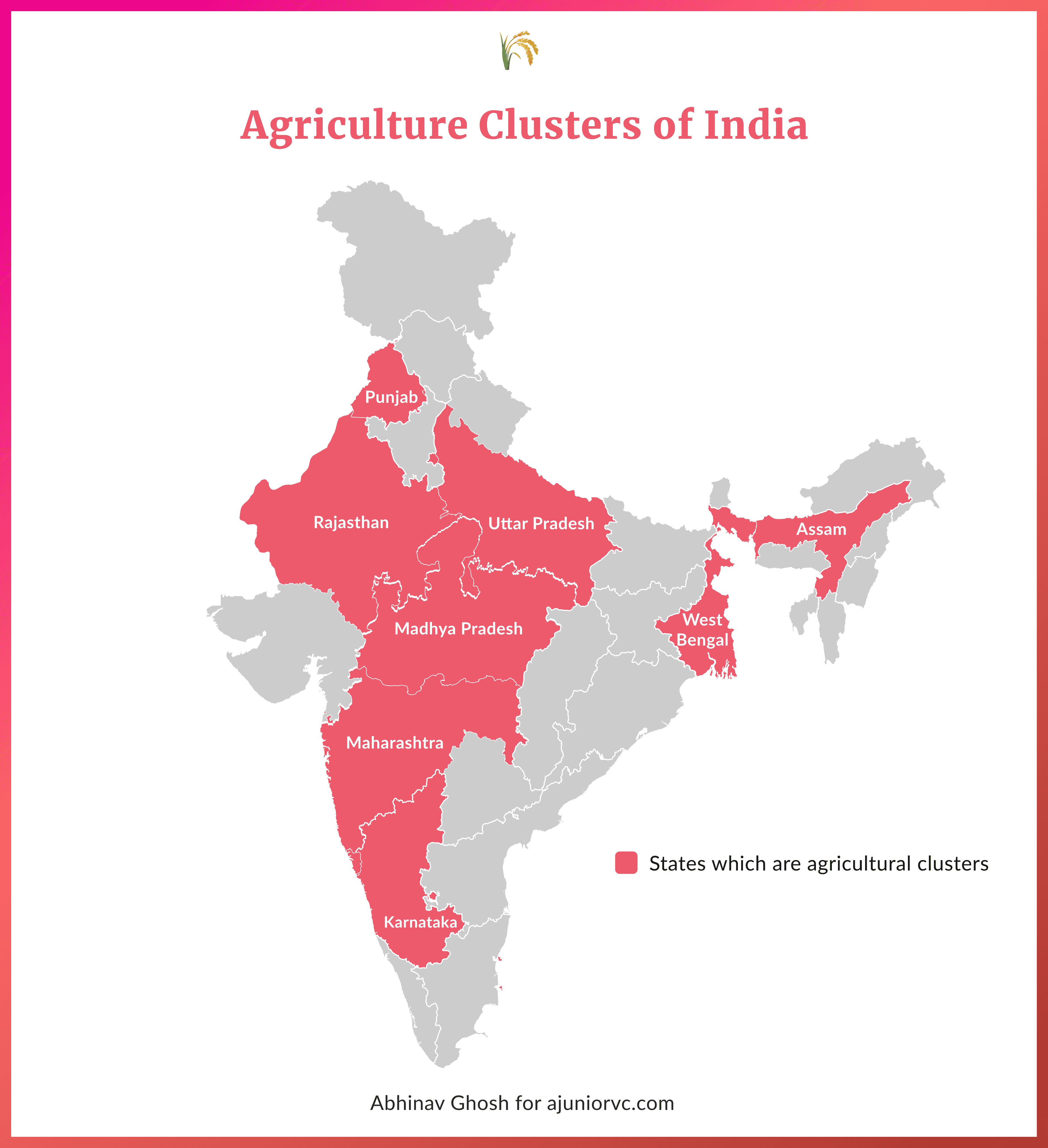

India's reliance on its agriculture sector is an old tale

The reliance is easily identifiable as a direct product of the vast amounts of arable land and tropical climate available to the country. The sector has been crucial.

It has thus seen different eras of evolution, with changes ordinated in the colonial period influencing much of how these supply chains persist today.

The concept of agricultural market regulation in India traces its roots back to the British Raj when the sector saw vast production sizes.

India's first regulated market, Karanja, was established in 1886 under the Hyderabad Residency Order. It operated towards ensuring a steady supply of raw cotton at reasonable prices to the British rulers for the textile mills in the UK.

This market regulation model was subsequently adopted in other parts of the country. However, progress in this area was made only after India gained independence from the British.

During the 1960s and 1970s, most states in India implemented and enforced the Agricultural Produce Markets Regulation (APMR) Acts, which encompassed all primary wholesale assembling markets, bringing them under regulatory measures.

But this left a large part of the agri-supply chain ecosystem entirely in the public sector or strongly linked to it.

The GoI then enacted the APMC Act in 2003 with good intentions.

The idea was to establish an open market for farmers to sell their produce while safeguarding consumers from excessively high farm-to-retail prices, providing minimum support prices (MSPs) for a few crops.

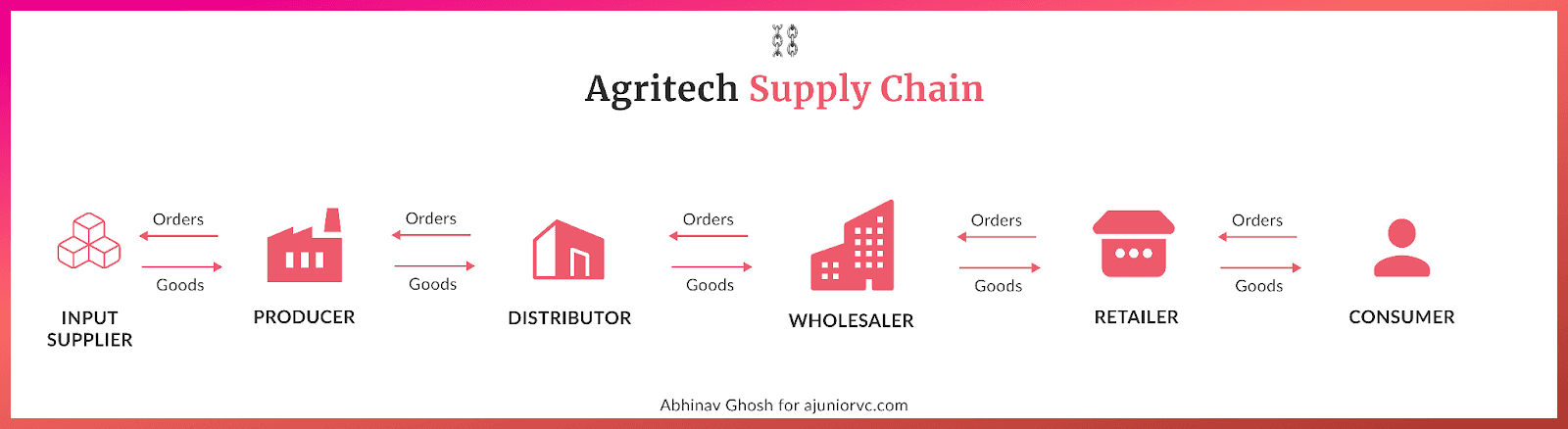

However, in the absence of adequate infrastructure in certain pockets of the supply chain, intermediaries emerged as substitutes, many of whom contributed no apparent value to the agricultural produce.

They found niches as either marketing channels, transport links to faraway mandis, or buyers of non-MSP crops. This cocktail of inefficiencies resulted in unfavourable outcomes for producers and consumers, leading to cost inflation of ~250% in some cases.

Added to this was the skewed distribution of capacity and inadequate infrastructure for storage, which was a whole different problem.

Seeing this severe problem, SunnyBee secured its first round of financing in 2016 through seed funding from angel investors and impact investors supporting agricultural development, leading them to expand their tech capabilities.

The problem would only worsen as the SunnyBee team scratched the surface.

Shelf Life

Most of the perceived wisdom about food storage and logistics came from the West.

Culturally, in the West, people store and consume food over extended periods. Conversely, India is more of a high-speed supply chain, where the time gap between growing, harvest and consumption is much smaller.

The US has about 2 million farmers, each with an average of 440-acre piece of land. Meanwhile, the 150 million farmers in India have 2.5 acres each on average.

Each farm thus produces a relatively small quantity of food, and aggregators are needed to consolidate the production and make it an economically transportable unit. Each unit needs to be broken down again as most vegetable purchases happen in Kirana stores which store small quantities of food.

Furthermore, each Kirana store has small amounts of different staples like onion, rice and tomato, so there are multiple layers of disaggregation. This adds direct cost to the supply chain, repetitive transport and handling commissions of each player, and physical product loss or damage.

But the more significant effect is that demand information needs to be communicated to the producer.

The reason is the farmer produces according to their local inputs, such as what the seed seller is telling them, what the neighbouring farmer is doing and what their parents are doing. They need to understand what the broader market for their product looks like.

This means food production is inelastic.

While demand from the consumer end may vary a lot, the information doesn’t trickle to the farmer in time, leading to an issue of a push supply chain.

That’s based on the principle that people produce, and the supply chain conveys it to the user and pushes the product onto the user. If the production is not aligned with what the user wants, there will be a surplus and wastage or shortfall of supply.

This is simply unaffordable in a country currently the second-largest gross agricultural producer globally.

In a pull-based supply chain, the demand is predicted, captured, or aggregated, and production and supply happen based on this aggregated demand. If a tech player could get enough data on consumer demand from retailers, it could then accurately forecast the market and provide sure-shot information to the farmer partners so they can produce without uncertainty.

SunnyBee began to see a deeper problem, much bigger than their initial path.

Consuming Leftovers

SunnyBee had focused on South India, directly selling fresh produce to consumers via their mobile food trucks.

Over time, as they increased consumer traction, they started servicing larger clients in the HoReCa (Hotels, Restaurants, Cafes) space.

The aha moment was when they saw demand, margins and pull greater from HoReCa. SunnyBee decided to pivot into the B2B model.

SunnyBee would become Waycool.

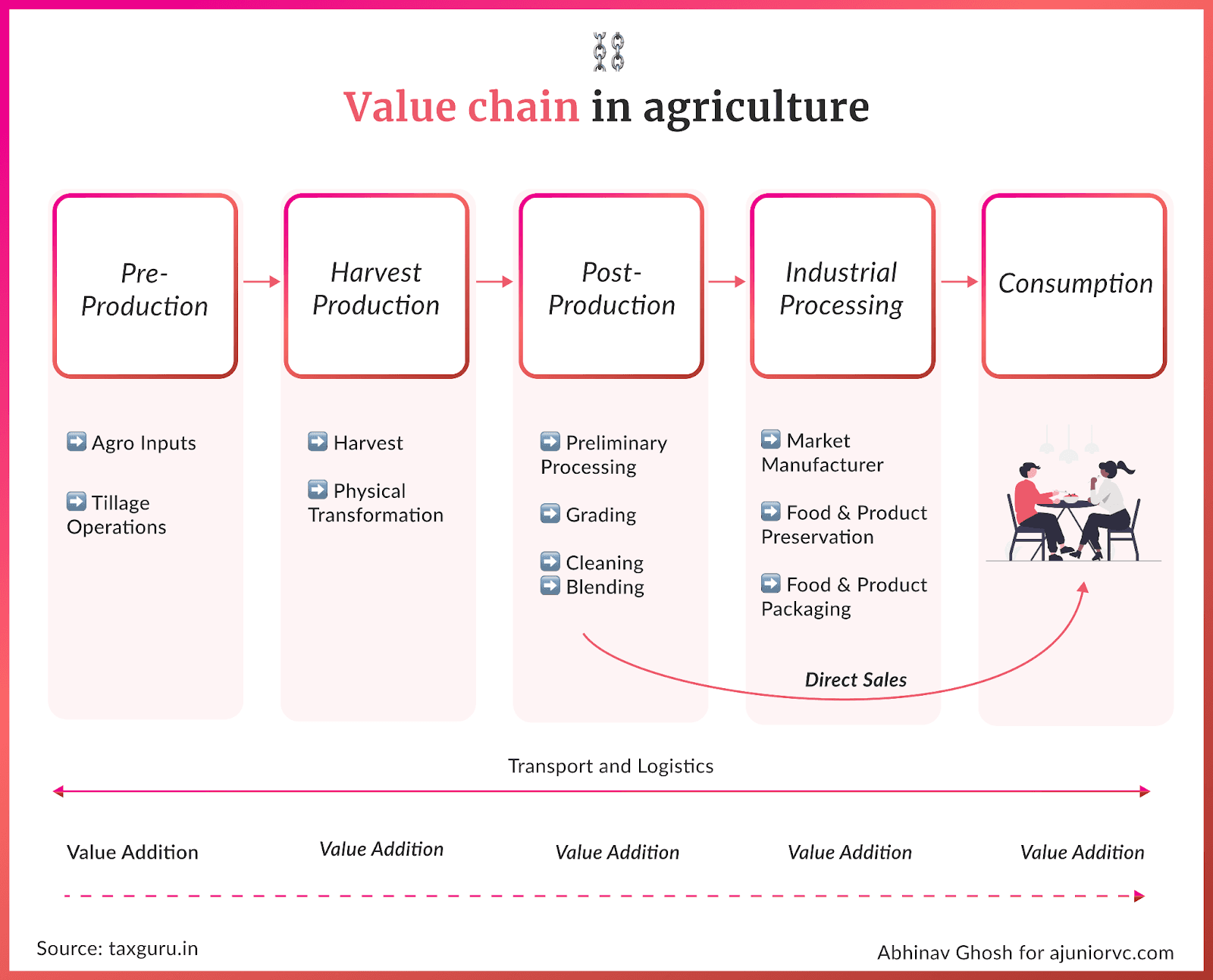

Waycool operated in the “farm to fork” space. This consisted of three essential layers - procurement at the farm level, supply chain from farm to cities, and a robust inter-city distribution network.

This was a B2B model with the farmer on one end and the HoReCa Restaurant / Retailer on the other. The Retailer and Restaurant cared about consistent quality and timely delivery, and the Farmer cared about getting a fair price for their produce.

Due to the lack of transparency, farmers need more information to decide what plant to sow at what time of the year. Waycool, being integrated into this supply chain, could also help.

In the meantime, the aim was to eliminate the multiple layers of middlemen who plagued the market.

Food products pass through anywhere from 7 to 15 different intermediaries before reaching the end consumer, compared to two intermediaries in the WayCool supply chain.

Waycool was operating in the biggest market there was in India.

The Indian agricultural sector, which encompasses farming, forestry, livestock, and fisheries, plays a vital role in India, with a recorded GDP of $244 billion in FY17.

It continued to experience growth, and the sector was projected to expand further, reaching USD 350 billion by 2023 and was expected to reach USD 450 billion by 2028. This growth signifies a compound annual growth rate of 5% during the forecast period

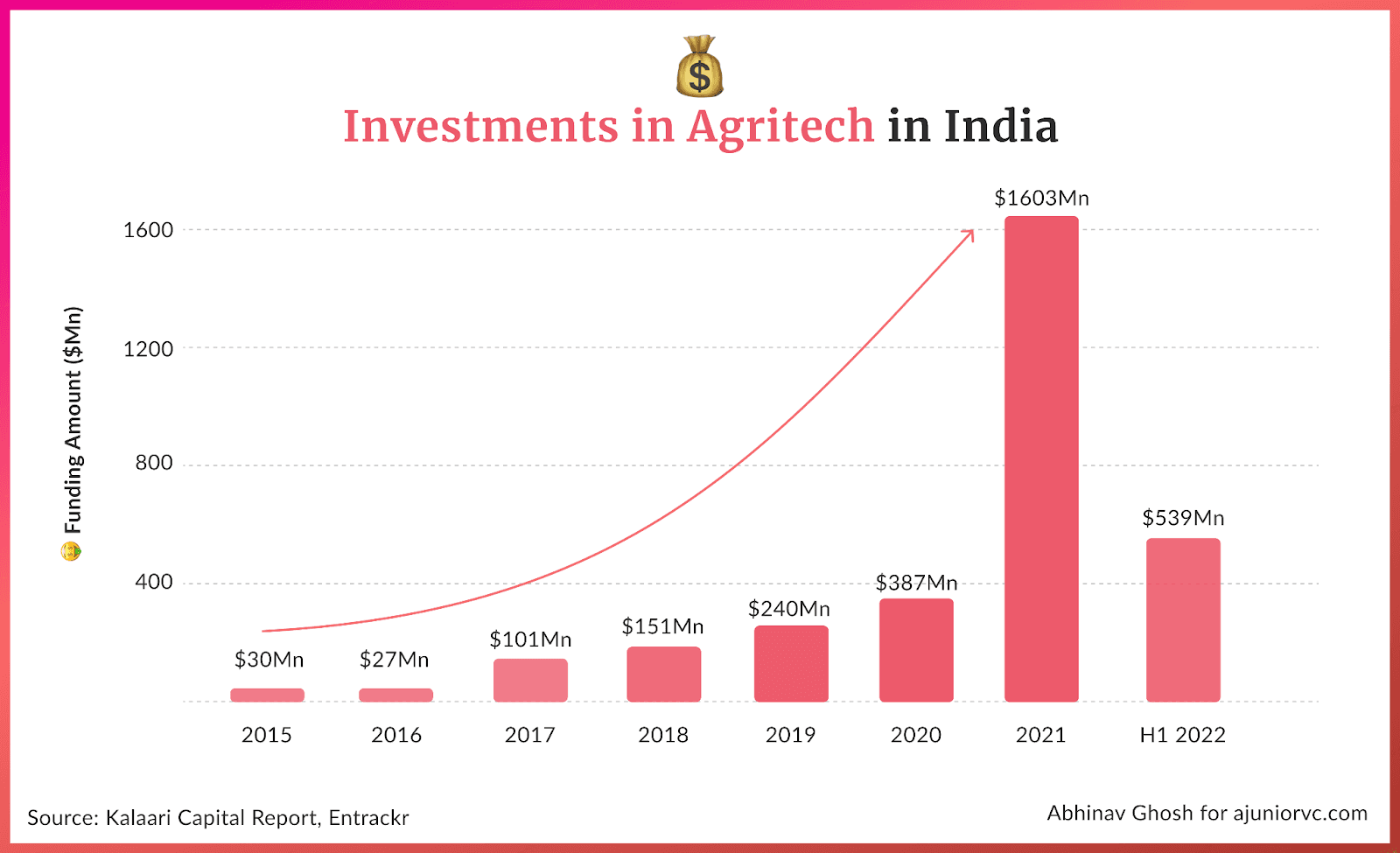

The potential market size for agritech in India is projected to reach $25 billion by 2025, of which only 1% had been achieved. Over $3 billion was invested in the agriculture sector worldwide in 2016, with 53 Indian agritech startups raising ~$30 million.

WayCool would become one of the first B2B agri-tech companies.

Cereal Chillers

WayCool emerged as a game-changer, "chilling" the food industry's problems.

The total preventable post-harvest losses of food grains amounted to around 10% of total production, equivalent to approximately 20 million metric tons. This was equal to Australia's annual production.

20% of the Indian population suffers undernourishment; such annual post-harvest losses seemed like a criminal oversight. WayCool implemented a direct supply chain model to fix this, consolidated on a single integrated tech platform, and reduced wastage to ~2%.

WayCool forged partnerships with Government Agriculture bodies, NGOs, and social impact NBFCs, establishing trust with the farming community and developing technology solutions for post-harvest storage. Its platform gained widespread adoption, leading to an annual revenue run rate of 30 crores by August 2017.

WayCool sets itself apart from competitors by integrating physical and digital technology in its supply chain operations. It focused on utilising cutting-edge technology to build a large food distribution business, fostering efficiencies, reducing information asymmetry, and integrating high-quality phygital assets into the supply chain.

It introduced several innovative methods to enhance efficiency, including intelligent cross-docking for dry groceries, AI-led grading of grains and pulses, and robotised handling of fresh produce.

These initiatives resulted in a remarkable 70% reduction in working hours, making WayCool 50% more efficient than industry standards.

The margins in the agri-food chain can be deceptive. The gross margin when buying tomatoes at ₹8 per kg and selling them for ₹16 may appear attractive, but many costs, such as trucking expenses, remain constant and cannot be reduced further.

With limited scope in reducing these costs, WayCool relied on harnessing technology so farmers could make better-informed decisions encompassing activities from planting and irrigation to harvesting and sales.

Farmers selling their produce directly to WayCool at the farmgate instead of wholesale markets started seeing the positive effects of the direct supply chain. They saw a 30-40% boost in incomes. Farmers also received immediate digital payments upon delivery to WayCool's warehouse by eliminating middlemen, avoiding commissions and payment delays.

These innovations contributed to WayCool's streamlined supply chain, reduced costs and ensured efficient operations.

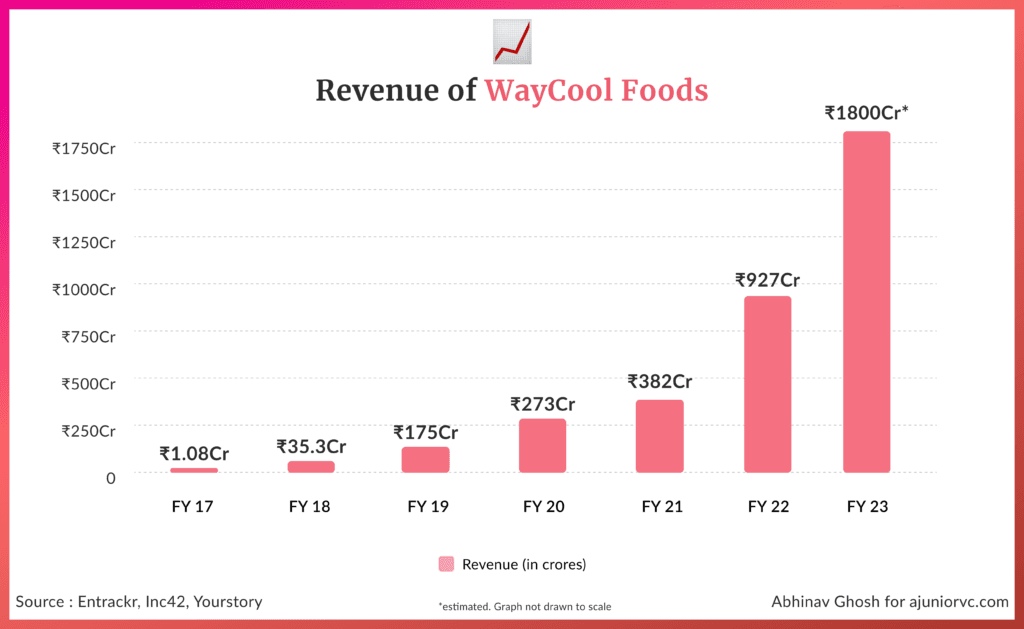

As the seeds of improving efficiency were sown, WayCool started reaping the financial fruits with an impressive annual revenue run rate of $35.2 million (INR 250 crore) by 2019. This was a remarkable 20-fold expansion since its last funding of $2.7 million in April 2017. In 2019, they raised $16.9 million (INR 120 crore) through equity and debt.

With this new round of funding, WayCool was poised to further explore and expand in the market.

Branching Out

Until now, WayCool had been tilling the fertile grounds of South India, planting the seeds of success and mastering the agritech trade.

With a strong foundation of success in South India, WayCool was poised for expansion into new markets. The company's confidence in its achievements paved the way for venturing into Western India and the Middle East.

By expanding its reach into these regions, WayCool aimed to replicate its success and establish a strong presence in untapped territories.

WayCool's strategic pivot from B2C to B2B has proven highly successful. The company generated nearly 90% of its revenue from the B2B channel, catering to clients such as Taj Hotels, Elior, Sodexo, and major national modern trade and online food distributors.

WayCool had established different channels, including food services (hotels, restaurants, caterers), processing and bakeries, general trade (kirana stores and local supermarkets), and modern trade (national supermarket chains and online distribution players) and supplied food items across intercities.

In terms of products, they created a diversified portfolio of fruits and vegetables and staples like rice and dal. Each contributed 40% of its revenue. Branded distribution accounted for 15% of revenue, while dairy products comprised another 5%.

With its "way" of excelling in different parts of the supply chain and distribution channels, WayCool gained a distinct advantage. WayCool became a master of the entire farm-to-fork journey.

It handled procurement at the farm, managed the supply chain, and ensured smooth inter-city distribution. Its direct interaction with farmers and consumers added an extra layer of effectiveness to its approach.

Despite experiencing strong growth, WayCool continued seeking new opportunities for collaboration and partnerships.

WayCool also pursued inorganic growth to fuel its expansion by acquiring companies in different supply chain segments.

For example, the acquisition of Benani Foods enabled them to connect their rice and dal farmers with the production of idli dosa batter. Similarly, the acquisition of Farm Taaza facilitated geographical expansion by utilising its warehouse in Hyderabad.

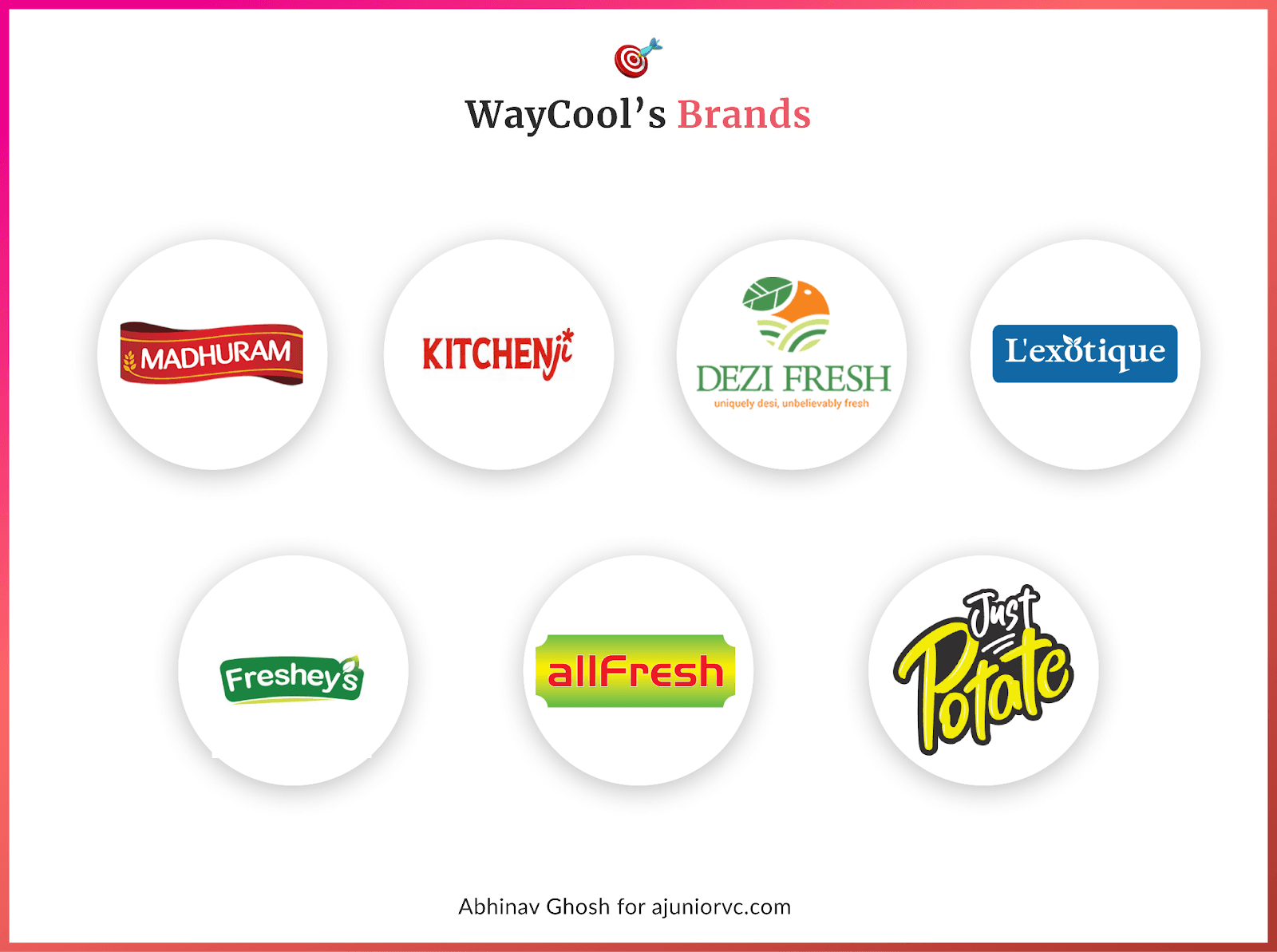

In addition to building its forecasting and analytics capabilities, it also noticed an opportunity in creating consumer packaged goods. It ventured into the space in 2018 through brands such as Madhuram (rice), Kitchenji (staples), and Freshey's (ready-to-cook). These were to increase maging.

With its robust sourcing networks and technologically integrated supply chain, WayCool positioned itself to meet farmers’ supply and consumers’ demands effectively.

But this increase in scale came with its challenges.

While WayCool managed to increase its revenue, the margins continued to decline. While its revenue increased by ~40% from 200 Cr in FY19 to 300 Cr in 2020 it posted an 81% increase in losses amounting to Rs 97.3 Cr. EBITDA margins worsened from -21.8% to -29.7% in FY20 during the same period.

However, WayCool realised that the agriculture industry couldn’t be changed overnight.

Patience was the key and they continued to find avenues to improve the agriculture value chain.

WayCool also recognised that farmers, crucial players in the supply chain, often face financial challenges. It took measures to increase productivity and income for farmers.

By 2021, it was the largest agricultural tech platform in the country, reaching 400 Cr of revenue.

Bearing Fruit

WayCool maintained a competitive edge through its streamlined supply chain.

Operating on an integrated technology platform, the company reduced wastage to less than 2%, resulting in higher gross margins and improved efficiency.

Despite growing competition, WayCool's revenue skyrocketed by 2.4X to 926 crores in FY22. This growth came with increased losses of 360 crores, reflecting the company's investments in expansion and innovation.

Its demand-led supply chain model accurately predicts client demand and aligns harvesting and production accordingly. With a solid commitment to efficiency, WayCool stands out as a leading force in the agritech sector.

Building on its success, WayCool raised its Series D round of 117 million dollars.

This funding round valued the company just shy of becoming the first agritech unicorn in India and represented one of the largest rounds for an agritech company in the country. The round comprised a combination of equity and debt to fuel the company's expansion plans.

With the newly raised capital, WayCool aimed to create a keiretsu of businesses.

The company aimed to deepen and widen its technological capabilities, enhance automation processes, and expand into new categories. Additionally, WayCool sought to strengthen its private-label brands and expand its footprint across different geographical regions.

Utilising the funds, WayCool embarked on a rapid growth trajectory through a series of strategic acquisitions.

The company acquired Gramworkx, a cloud-based intelligent farm resource management tool. This acquisition empowered farmers by providing guidance, optimisation, and monitoring water utilisation. Gramworkx quantified water consumption patterns and offered analytical insights across fields and soil types, providing valuable data support.

Another significant acquisition was SV Agri, a fully integrated player in Pune's potato supply chain ecosystem. WayCool leveraged SV Agri's robust supply chain network to enhance its capabilities in this sector.

Furthermore, WayCool acquired an 80% stake in AllFresh, a company specialising in sourcing and supplying apples and citrus fruits. AllFresh utilised innovative technology and processes to reduce food loss and extend the shelf life of these products. WayCool aimed to leverage AllFresh's capabilities and tap into its extensive network of apple and citrus growers in Himachal Pradesh, Punjab, Maharashtra, and Madhya Pradesh.

To fuel this growth, they raised another 40 million dollars in venture capital and another 6.5 million dollars in debt.

The company was ready to take off.

Soil to Sale

To deepen margins, WayCool went deeper on subscription businesses, marketplaces and building out a brand portfolio.

These would allow it to extract more from its already existing customers. WayCool launched Censa, a comprehensive tech stack as a Software-as-a-Service (SaaS) solution.

Censa provided an end-to-end solution for companies, addressing various concerns such as farm management, shop floor management, logistics management, and B2B or B2C services.

The solution encompassed farm, processing, distribution, and consumer tech functions. It also offered analytics capabilities for route optimisation and order forecasting, addressing supply chain-related challenges.

WayCool followed up by introducing WayCool 2.0, an online B2B marketplace for retailers across India. This platform facilitated the sourcing and delivery of vegetables and fruits from farms to kiranas and businesses nationwide.

Leveraging technology and an integrated supply chain, WayCool ensured the entire farm-to-store process was completed within 12 hours, guaranteeing the safety and freshness of the produce.

It noticed that farmers were earning low returns not because of market challenges but inadequate guidance on agricultural practices.

It addressed this by launching WayCool Outgrow, a multilingual app providing intelligence around crop-health management, soil testing and irrigation planning, with features like AI-based disease detection from just an image of the diseased crop and instant guidance on how to treat that crop disease.

It has been making significant strides in expanding its business across various segments. In line with this vision, the company launched BrandsNext, an entity dedicated to powering its fast-moving consumer goods (FMCG) business.

BrandsNext would serve as an umbrella encompassing all of WayCool's successful FMCG brands, aiming to enhance its consumer goods portfolio further.

The FMCG business has already substantially contributed to WayCool's revenue, accounting for approximately 25% of the company's 1800 crore revenue in FY23. WayCool has set an ambitious target of doubling this contribution by FY24.

WayCool envisions this segment will play an even more significant role in future revenue streams.

With a targeted income of Rs 6,000 crore by FY25, WayCool aims to increase the contribution from branded products and third-party distribution to 35-40% of the overall revenue.

This strategic shift highlights the company's focus on developing and marketing its products, moving away from the reliance on commodities sourcing and trading.

Money On The Table

WayCool has now positioned itself on the path to becoming the first agritech unicorn.

WayCool has also ventured into contract farming of vegetables, initially starting with a 3.5-acre farm in Hosur near Bengaluru. The company has ambitious plans to scale up this initiative to encompass 500 acres, further strengthening its agricultural supply chain and ensuring a steady supply of high-quality produce.

Expanding its reach beyond Indian borders, WayCool has established a distribution arm in the UAE. Through this arm, the company sells around 25 products and operates 30 warehouses across Southern states and Maharashtra, covering an impressive area of approximately 3 lakh square feet.

This expansion into international markets reflects WayCool's commitment to broadening its customer base and diversifying its operations.

WayCool's dedicated R&D arm has driven innovation in the agritech sector. The company has developed numerous farming tools, leading to the successful acquisition of six patents.

WayCool has filed another 30 patent applications

Building an integrated food ecosystem has secured an airtight position in a mammoth industry.

The pace at which Waycool is rolling is unprecedented in the agriculture sector. Its revenue has increased from INR 400 Cr. in FY21 to INR 1,000 Cr in FY22 to INR 1,800 Cr in FY23. The company plans to achieve a revenue of INR 5,000 Cr by FY25.

WayCool is on a mission to deliver 3 EBITDA positive quarters before it lists in public markets in 2025.

Operating in an unsexy industry, the company has exploded to the forefront. What WayCool has been able to build in less than a decade is way cooler than what meets the eye.

It is a billion-dollar company in making, a tremendous social impact in farmers lives by removing middlemen, better quality products for customers, reduction in food wastage with better demand estimation, targeting net carbon positive and many more.

Waycool could unlock India’s jammed supply chains for a healthier tomorrow as it continues its innovation.

Writing: Bhoomika, Ajeet, Chandra, Mitali, Tanish and Aviral Design: Abhinav and Chandra