Apr 19, 2020

Is Zomato Evolving to Win FoodTech's Hunger Games?

Profile

Groceries

Food

Aggregator

Series H+

B2C

Last fortnight, Zomato was reported to be buying grocery delivery upstart Grofers for $750MM, as the country’s lockdown saw a surge in groceries and a collapse in eating out.

Hunger is the Mother of Invention

Most enduring startup journey’s usually start with solving a problem faced by the founder.

Deepinder Goyal had noticed that he and many of his colleagues used to queue up at the pantry to look for menus to order food. This insight gave him an idea to create an online directory of food menus.

Deepinder with his friend Prasoon Jain started a little online directory called Foodlet. However, in the times when running a startup was as best a side business, Prasoon moved to Mumbai and left behind Foodlet as a venture.

Deepinder didn’t give up on the idea. He teamed up with Pankaj Chaddah, a junior of his from IIT Delhi when they were working at a consulting firm.

To collate the menus for their consulting friends, they launched FoodieBay.com.

Goyal used to work on the website on the weekends along with his wife and her younger sister. Since all of them had full-time jobs, they would drive around the city over the weekend, collecting menus from different restaurants, scanning them and putting them online.

The website was made live on 26th January 2008, which also happens to be Goyal’s birthday.

Goyal and Chaddah bonded over foosball and a chance gtalk status update by Chadah — ”go check out foodiebay.com” — gave Goyal’s weekend project the much needed traffic boost and a cofounder to boot.

Foodiebay would henceforth celebrate 10th July 2008 as its birthday.

With menus of about 1400 restaurants, FoodieBay became the biggest restaurant directory in the Delhi NCR region by late 2008. The free service was taking off.

Such was the customers’ enthusiasm with the venture that customers even gave them feedback about various restaurants and their food. When the team contacted McDonalds after one such incident, McDonalds gave them a prompt reply appreciating them.

Listening and building for the customer would become core to Zomato’s DNA.

Zomato Seeds

By 2010, Zomato had firmly established as the market leader for online listings in Delhi-NCR.

Having raised a seed round, they started building a presence in other cities like Pune, Bangalore, Chennai, Hyderabad and Ahmedabad as well.

Like all helpful VCs, it was an investor who told Goyal and his team how the last four letters of Foodiebay alluded to another prominent internet company. Changing its name now would get rid of any potential trademark issues down the line.

Goyal and team concurred and over the next 6 weeks, FoodieBay became Zomato. The word Zomato was taken as it rhymed with tomato, and was nonsensical at the same time.

The young founders eventually did shell out a nifty $10K for Zomato.com after their investor offered to personally buy it for them. Goyal and team couldn’t initially bring themselves to spend that amount of money for a domain name.

In November 2010, one day when Chaddah and Goyal were having lunch at a cafe in Ambience Mall, Gurugram it dawned on them that most people visiting the mall did not know about all of the eating joints on the mall’s fourth floor.

The co-founders leapt into a discussion as they dug into their lunch.

Soon after, they charged their CTO with building a restaurant application that people could access on their smartphones. Zomato was now an application on Google’s Android operating system.

It helped that the smartphone wave was around the corner and mobile apps had become all the rage. The application began to take off.

By 2012, the company had around 35K menus on its app and was clocking in revenues of roughly INR 60 lakhs a month, which were doubling every quarter. Although most of the revenue was coming from the website, Goyal saw the app as a marketing tool and way to increase stickiness with customers.

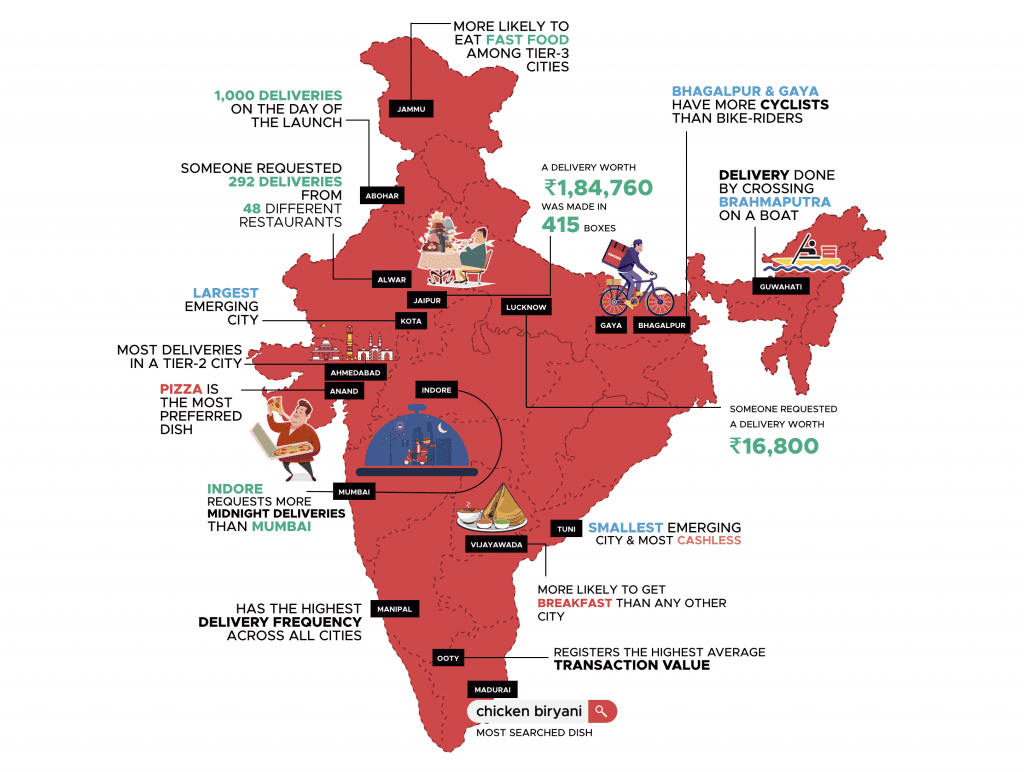

Goyal and Chaddah coincidentally launched FoodieBay in the city which had the highest dining out frequency in India. Delhiites, it turns out, eat at an average of 6 times a month and Mumbaikars 4.2 times.

The dining out numbers, however, are paltry when compared to several other Asian economies such as Singapore (30), Bangkok (45), and Shanghai (60), yet the markets remain attractive.

Mumbai had the largest organised food service markets pegged at nearly INR 40K crore ($6Bn), Delhi came second at INR 31K crore ($5Bn), followed by Bengaluru at INR 20K crore ($3Bn)

However, people in Bengaluru, on average, spent the most per month on eating out—INR 3.5K ($50), followed by Mumbaikars who spent Rs 3K ($40), while Delhiites spent Rs 1.4K ($20)

Seeing its growth, and the size of the market at hand, its seed investor continued to back the company. By 2012, having invested a total of USD$17MM, the investor owned 58% of the company.

A bet on two young foodies, who incidentally became entrepreneurs, was begin to show promise.

Binge Eating

Zomato exploded out of the gates in 2012

The company soared from 1MM monthly unique visitors in 2011 to 8MM unique visitors by end of 2012. With sufficient capital and a fast growing business, Zomato decided took its service global.

Innovation, experimentation and evolution as a way to grow would become Zomato’s hallmark.

As the company marked its first expansion outside India to Dubai, it detailed a blog highlighting its thinking.

2012 saw its foray into South Africa, UK, UAE, Philippines, Sri Lanka and Qatar while 2013 saw it entering Brazil, Turkey and New Zealand. The company expanded to as many as 11 countries and established a presence in 35 cities in the year.

The end of the year also marked a $37MM Series-D round with 15MM MAU

To quickly establish its presence in new markets, it went on a monthly acquisition spree. In Jun 2014 it acquired New Zealand based search service MenuMania, restaurant guides Lunchtime in Jul, Obedovat in Czech Republic in Aug and Poland based restaurant search service provider Gastronauci in Sep.

By Nov 2014, it had raised a Series E round of $60MM with a valuation of $660MM, and the acquisitions didn’t stop. In early 2015 it acquired Urbanspoon to foray into the US market and marked its sixth acquisition in as many months.

With a presence in 22 countries and 1MM restaurants globally, it became a unicorn with a Series F round in Apr 2015.

In Sep 2015, it also entered the last-mile delivery business through Zomato Order seeing the rapid rise in last mile as a market.

It appeared a well-timed move and a big opportunity since only 40% of restaurants were delivering food at home. Moreover, the demand for home delivery of food outstripped the restaurant’s delivery capabilities for most of the small and mid-sized restaurants.

But in this backdrop of happy decision making, there were winds of change blowing.

Food-tech Going Bad

Foodtech exploded and early signs of something crazy became evident in mid-late 2015.

The investing was so frenzied that if as an entrepreneur you even mentioned that you were starting up in food tech, someone would be willing to cut a check.

The hype burst as the Indian venture ecosystem saw its first big collapse. As the funding tap dried, corpses of various food tech startups lay strewn across. Dazo, Spoonjoy, Eatlo, TinyOwl shut down operations.

As the food tech bubble burst, food delivery businesses were rapidly written off.

Challenges cited, that were earlier opportunities, were managing hyperlocal operations, low average order value and cash burning customer discounts.

Such poor unit economies could turn into profits only if they could reach massive scale at hyperlocal level. Zomato with their huge user base would have seemed the best bet, not having to acquire so many customers at scale.

But there was a problem.

Zomato from the start had been an information sharing platform. It helped people discover information about any restaurant in any area of their choice. With Zomato’s asset light model and limiting the use case to discovery, they could scale it up rapidly in India and outside.

It felt almost natural that they could have turned on a switch, got into food delivery and leveraged on their existing user base.

However, food delivery is a very different animal in itself.

It involves operation-fleet management, standardization of restaurant SOPs, quality assurance, prompt customer support and other operationally heavy activities. As an asset light listings player, Zomato had none of this.

Food delivery was a massive opportunity but the chance of going wrong might mean loss of trust, which Zomato has built after years of hard work.

Could they risk it to win, or should they learn from the debacle of Tiny Owl and pull back now? As a big player, Zomato had access to capital and a massive company built up with growth and acquisitions. Pulling back may not be necessary.

But they say that businesses die of indigestion, not starvation.

Indigestion's Medicine is Fasting

Zomato had been bingeing, and as startups went belly up, the indigestion began to show.

The breakneck expansion through acquisitions and hiring meant that its expenses had jumped 2.7x in FY16 to ~INR 700Cr ($100MM) from INR 260Cr ($37MM) in FY15

As a bigger player, its chances of survival hinged on how quickly it was able to control costs. It laid off 10% of its workforce (~300 employees) and doubled down on its revenue spinning verticals such as reservations.

Zomato would need to pull back, and fast.

2016 was the year of survival and it began to implement deep cost cuts. It pulled back from 14 of the 23 countries it had expanded to during the previous years. The burn rate was brought down from $9MM to $1.5MM

Zomato also focused on critical levers which would make it resilient and help survive the funding drought. With a focus on strengthening its tech backbone and diversify beyond restaurant reviews, it acquired Maple OS in Apr 2015 to build a world-class cloud based PoS system.

In the race to survive it identified that building a supply moat through getting restaurants on their platform would be critical. Base’s launch in Nov 2015 was dubbed as ‘absolutely everything one needs to run a restaurant’

To improve and retain brand recall Zomato continued to innovate on its advertising and marketing strategies. While it started with SMS and direct mailers it kept on adding different channels as its user base evolved. Monthly newsletters, distribution of weekly pamphlets was used to generate brand recall.

It also cleverly deployed social media, and its tongue in cheek would take birth.

Its blog Munchies acquired a loyal following of its own. It ran quirky campaigns such as Foodie Fridays and Yummy Yatra on Twitter to improve user engagement while Facebook was used to improve brand awareness.

They say that scarcity breeds innovation, and perhaps that began to show for Zomato. But there was a bigger threat looming that was rapidly closing in on Zomato’s undisputed numero uno status.

This threat was roaming the streets of Koramangala.

Playing Ketch-Up in Koramangala

Koramangala’s Swiggy was a logistics company first and a food tech platform later.

Swiggy took a full stack approach with a completely inhouse delivery fleet. This allowed them to launch features like live food tracking, reliable quick delivery and most importantly, no minimum order for any restaurant.

The contrarian asset heavy model resulted in high customer retention. The new kid on the block raised $16MM to fund expansion to other cities.

In 2016, both Zomato and Swiggy were in their early days of the food delivery business. Today they might look similar but back then that’s where the similarity ended.

Zomato was already a 7 year old unicorn with a global footprint. Its forte was a huge network of restaurant partners and a loyal user base of more than 400K daily users inIndia section alone.

While customer acquisition was never a challenge for Zomato, they started the fight by committing a massive 50MM just for the food delivery business.

Who seemed to be winning? The Indian consumer, of course.

“Customer is King” became true in every sense for the next few years as Zomato and Swiggy got caught in a fierce battle to the top (or bottom?). This tango was while wooing Indian consumers with never heard before offers and discounts.

Zomato, while protecting its territory in the dining business, had to fight battle on multiple fronts with Swiggy.

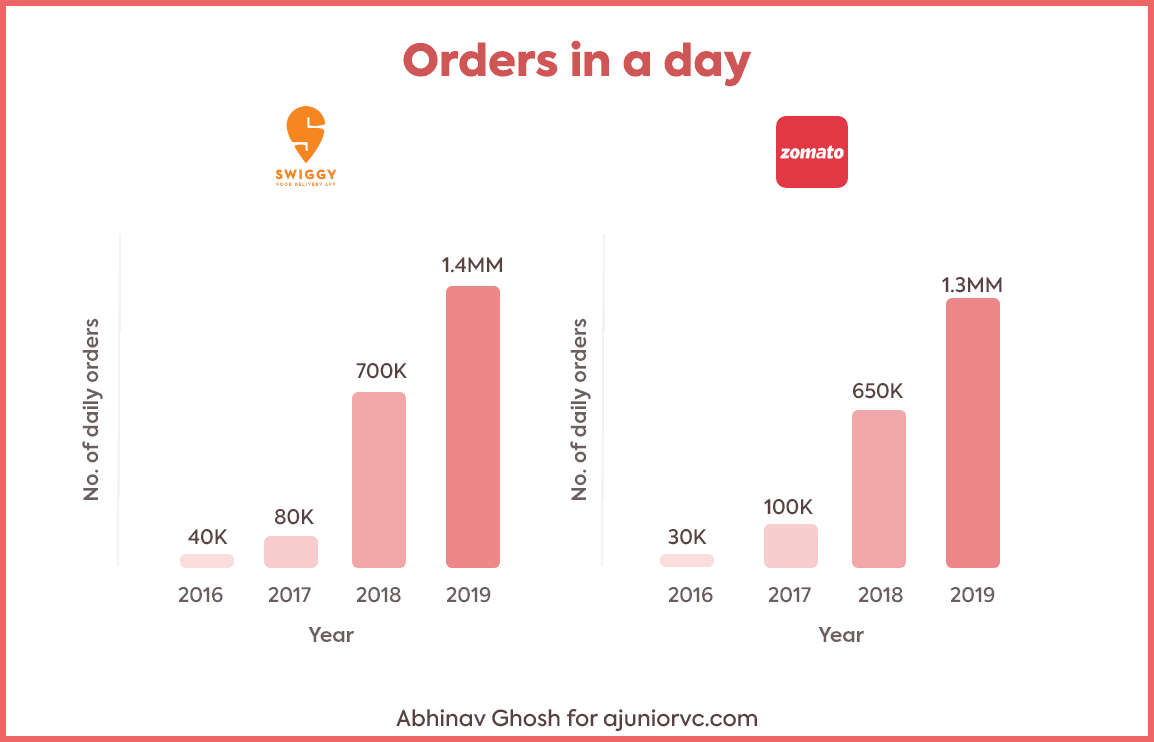

Orders per day grew exponentially for both and the gap reducing, with Swiggy in the lead. Swiggy had dramatically flipped the food tech narrative to make delivery the holy grail, using its strategy to win.

But other small battles like building a strong delivery fleet of more than 180K riders and expanding to 500 plus cities launching a city a day in 2018 were also being played.

From just a few thousand orders in 2015, Zomato and Swiggy scaled up to 1.25MM and 1.4MM order respectively.

It became so competitive that companies like FoodPanda, even with the backing of deep pocketed investors could not survive. Opportunity was so big that even ride-hailing companies tried their luck but had to raise a white flag eventually.

It was a bloodbath, a natural duopoly, with only two to survive.

Swiggy was winning the game, with it accelerating beyond Zomato’s valuation to reach $3.6Bn. The decade old unicorn was now number two, after years of dominance.

But the resilient old dog had more than a few new tricks up its sleeve.

Glutton's Gold

If Swiggy’s strength was its tight operations, Zomato’s was deep restaurant data.

It had till date monetized its rich data only through listings, but there was a bigger opportunity to be unlocked. Customers who visited these restaurants binged on menus even before visiting, deciding if they could visit a particular restaurant.

As the perennial innovator, Zomato decided to try to unlock this customer value through Zomato Gold. Its beauty was in its simplicity, an annual subscription to get a free dish/beverage at a partner restaurant.

To say it caught on like wildfire is an understatement.

Active subscribers on the platform, as of Sep 2019 was 1.4MM globally, up from 1MM on 31 Mar 2019, 170K on 31 Mar 2018, and zero in Jan.

Why did Gold work?

Gold monetized Zomato’s matchmaking capabilities to full use. It creates a harmonic win-win-win for the three stakeholders- the user gets a meal at a lower cost, the restaurant gets more demand for its high margin meals and Zomato makes (almost) pure profit via Gold.

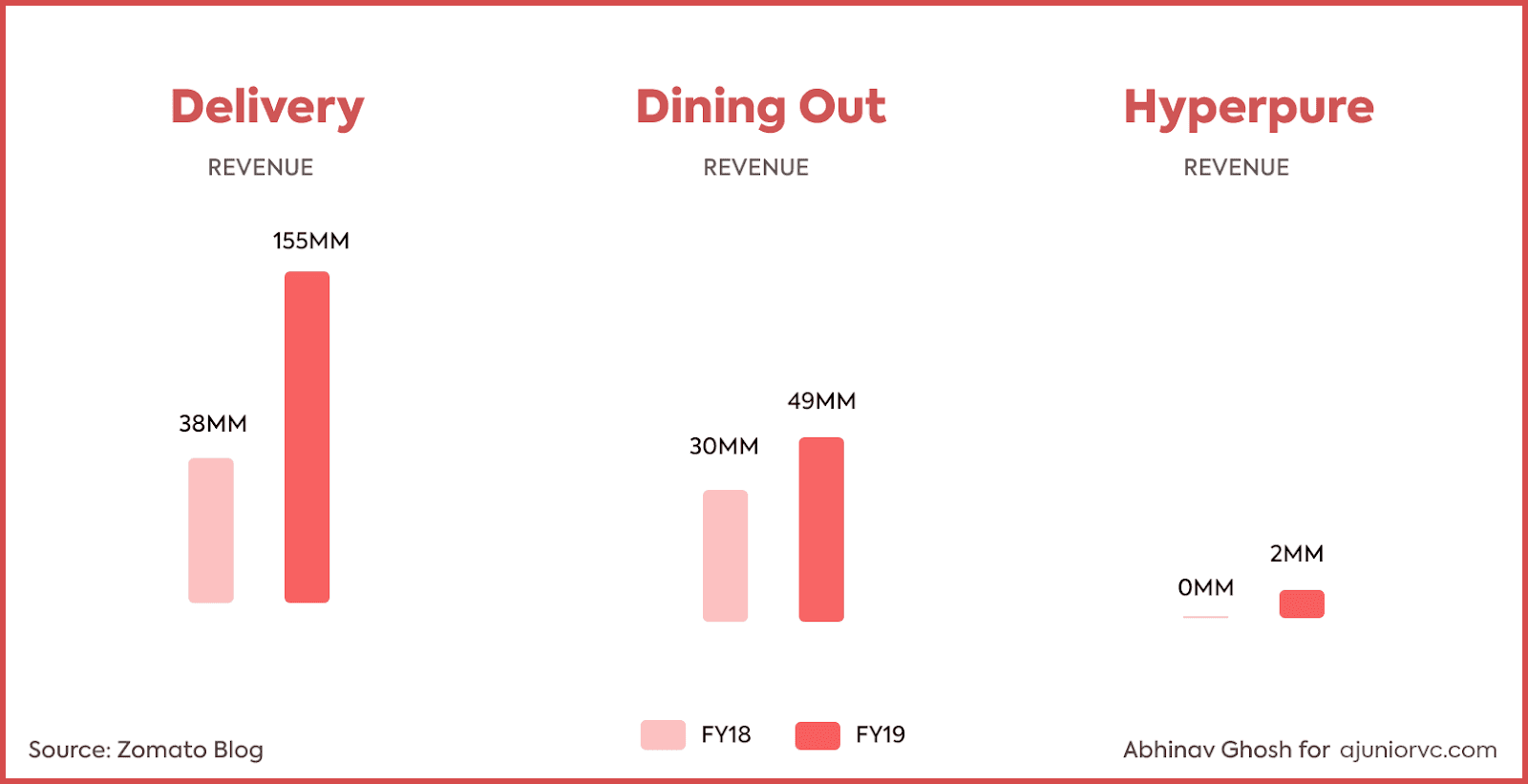

Our snoopy math predicted, that Zomato would be raking in ~$2.25MM in quarterly revenue from Gold, totalling almost $9MM in the inaugural year. Indeed, Zomato revealed in its Annual Report that Gold accounted for 12% of its revenue of $66MM (₹466 Cr) for FY18, standing at $8MM.

As with all good things, Zomato faced severe pushback from restaurants. The reason may not have been that they were not seeing any benefit, but they felt Zomato was seeing too much of it.

If Gold unlocked value from restaurant data, Hyperpure unlocked value from restaurant relationships.

The unlock was launched in August 2018 to supply fresh, clean ingredients to restaurants, without the usual middlemen.

To lock in restaurants, Zomato took a step towards backward integrating the supply chain, enabling restaurants to buy fresh and high-quality produce.

Restaurants buying ingredients through Hyperpure were recognised through a ‘Hyperpure Inside’ tag on Zomato, allowing users to trust that the food they are eating is made using fully-traceable, high quality ingredients.

Retrospectively, this seal of quality addressed a lot of health issues arising from food, especially palpable as CoVID19 pandemic ravages through the world.

Since Hyperpure’s launch, restaurants place 5-7 orders a month on average, with an AOV of $100. After garnering $2MM in the first year of its launch, Hyperpure revenues are projected to have a 10X growth in FY20.

The new tricks were working.

Eat with UberEats

By 2020, TinyOwl had folded its shop, FoodPanda was acquired by Ola and Swiggy was serving 1.4MM daily orders, 100K more than Zomato’s 1.3MM orders.

What made this duopoly so natural? The answer lies in the three sided network that accrued to the biggest players.

Supply (restaurants), distributors (delivery guys) and demand (consumers) were the three participants. Building a transacting relationship with both the customer and restaurant would be key.

Swiggy built its moat around consumers, by delivering a differentiated and superior user experience. In food delivery business, it is all about the ‘delivery’, and less about the ‘food’.

Swiggy owned delivery, assuring users of faster delivery times, and hence a much better experience than what Zomato Order could initially offer. Zomato, with its listings model, could hardly build any transacting relationships with anyone.

In fact, this food-delivery rivalry had much in common with a war that took place in the 2000s, when the logistics first challenger Amazon fought it out with an established listings first eBay.

What would it take Zomato to change the narrative and not meet eBay’s fate?

A $350MM all-stock deal to acquire UberEats India, and acquire missing customers and restaurants, and Zomato was already pulling ahead.

Zomato gained access to Uber Eats’ extensive network of delivery partners, without much cash burn. Zomato strengthened its presence in South, potentially reaching 14-15 MM orders a month, giving it a foothold against Swiggy’s 30MM orders. Zomato was already strong in the North, which accounts for almost 70 percent of the 36 MM orders it gets in a month.

Lunch and dinner counted for the bulk of Zomato orders but UberEats was strong in the breakfast and snacks segments. South India loves its breakfast, especially when it is ordered online.

As we pointed out, UberEats made Zomato whole.

The other trick that Zomato had pulled was Hyperpure, its initiative of connecting the value chain from farm to restaurant kitchen. Where could be the gold that it had been building towards all these years?

Groceries in bulk, coupled with an unprecedented pandemic, of course.

Glittering Groceries

Staying locked down turned more people towards online grocery shopping than ever.

Grofers had seen a spike in their order numbers, and so had BigBasket. After an initial phase of turmoil, last mile delivery partners seem to have chosen their partners.

Zomato tied up with Grofers, Uber partnered with Spencer's Retail & bigbasket.com and Domino's with ITC Limited.

Zomato has claimed that grocery delivery has always been on our long-term radar since it fits their vision of ‘better food for more people’. Unsurprisingly, food delivery and grocery are the two highest repeat cases for urban consumers.

It is little wonder that the space has seen so much acquisition talk (or even gossip?)

Acquisition talks between Amazon and BigBasket fell apart in 2017. BigBasket and Grofers had come to the discussion table to evaluate a potential merger, again turning out to be eventually fruitless. MilkBasket is reported to be in talks with Amazon for a potential acquisition, after discussions with BigBasket did not materialise into a deal.

But why is this happening?

Putting on a critical thinking hat, in every sense of the word, eating-out or ordering-in directly competes with grocery purchases for cooking at home. If you are going out, then you will not be cooking. Or you might choose to do both, if you love Swiggy. But essentially, those are your choices. As a business, can one create a hedged, minimal risk portfolio?

Yes, have both of those eggs in one basket.

In terrible times like CoVID19 lockdown, people would tend to shy away from dining out or ordering in food owing to safety concerns. What if the same situation that closed the door, opens up another one for you.

People stocking up on groceries, while choosing to not venture out of their house, would naturally turn to online grocers.

All this may seem like it makes sense for Zomato to just go all the way and acquire Grofers, but the real truth lies in the DNA of Zomato’s continuous innovation, experimentation and ambition.

Zomato has continuously reinvented itself to tap bigger, and bigger, and bigger markets.

From free menus ($0MM), to listings ($1Bn), to food delivery ($10Bn), to eating out ($50Bn), to groceries ($500Bn). There is a clear pattern as Zomato builds its full stack, and more users bring on more restaurants.

Zomato has been slowly, but steadily, building its full stack to lock in customers through quality and restaurants through revenue,

Right from working with farmers to produce organic vegetables, to getting users hooked on to the app by offering content, Zomato has been building a moat to safeguard its position. This has been demonstrated by the 3x increase in NPS (Net Promoter Score, an indicator of customer satisfaction) as reported on Sep 2019, compared to that a year ago.

As more and more users hop on to Zomato, creating additional transactions on the platform, restaurant availability on the platform will increase, spurring a virtuous cycle in favour of Zomato.

Zomato’s addition of groceries in its full stack could be its gold, and win foodtech's gold.

With Abhinay, Abhinav, Keshav, Raj, Rohan and Aviral

Note at 12:30 PM IST 19/04: We changed the title to be more reflective of the piece. The initial title was "Is Grocery Zomato's Gold?", but it was only covered at the end. Apologies.