Nov 26, 2023

Can 3,500 Cr Zudio Be Bharat's Fashion Diamond?

Profile

Fashion

Brand

IPO

B2C

Retail

Zudio, the Tata Group’s value fashion chain, recently launched its biggest store in Jaipur, after an incredible year of surging revenue.

Making A Statement

The Tata group has for long been India Inc.’s bellwether.

With its deep history, the group has created startups inside its wings from day one. Before starting up was even a thing, the Tata group bred entrepreneurs across verticals.

With its expanse ranging from salt to sea and from coffee to cars, it is symbolic of the Indian consumption story. The business group’s appetite mirrors the ambition of the populace and its big moves are a marker for people’s preferences.

Yet fashion retail was a relatively late priority for the Mumbai-based conglomerate, 130 years after its storied origins in 1868.

In 1998, the Mumbai-based conglomerate sold its 50% stake in Lakme to Hindustan Unilever for INR 200 Cr. The group foresaw a much bigger opportunity in multi-format retail than in scaling a cosmetics brand in India.

The sale proceeds from Lakme were quickly deployed to set up Trent, Tata’s retail arm.

It opened the first Westside store in Bangalore. It offered branded fashion apparel, home furnishings and decor.

In 2004, Trent entered a joint venture with the UK retail giant, Tesco, to set up Star Bazaar. The hypermarket chain dealt in staples, beverages, and daily supplies among various products.

Later in 2010, it partnered with Spanish fashion major Inditex to open the first Zara store in India.

By 2016, Westside had scaled up to around 100 stores, under the watchful stewardship of Noel Tata. It seemed imperative to take the brand beyond tier-I cities

Much to the senior management’s surprise, Westside’s aspirational positioning found few takers even in tier-II cities, let alone tier-III and tier-IV India. The brand struggled to take off in small towns like Salem in Tamil Nadu.

The entrenched problem called for original thinking and a stroke of luck. Fashion at Star prices was floated as an idea. It soon became a mandate and an internal tagline for a new offering.

Zudio was born.

It was designed as a fast fashion brand, offering trendy apparel styles at affordable prices. The plan was to utilise Trent’s vast distribution network and partnerships to quickly scale up and establish a popular footprint.

Retailing The Story

The first Zudio store was opened in 2016.

Coincidentally it was at the same location as the first Westside outlet. The differentiated positioning allowed Trent to apply a calibrated one-two play.

Westside would consolidate its two-decade-old presence and increase the share of wallet. Zudio, on the other hand, would tap on newer, smaller wallets.

Zudio’s operations were EBITDA-positive from the first month itself. To validate the concept, the team undertook six more trials in smaller cities, such as Nashik and Vadodara.

The brand’s promise of everything under INR 1,000 garnered quick appeal and mass adoption. It also sold bed linen and toiletries in the first nine months. Doubling down on its frugal perception, it did away with the slightest excess and stuck to what worked.

Zudio’s styles were selling like hotcakes. The new recipe had worked wonders.

To its credit, Zudio had cracked the most discerning and fickle-minded segment. Late teens and early 20-somethings thronged its stores.

Almost three-quarters of its men’s and women’s collection was priced at under INR 600. An even bigger chunk of children’s wear retailed at below INR 300.

On the surface, Zudio appeared like a sleeper hit. Random to some while inevitable to others in hindsight.

Given that the pitch was to make high-street style accessible to a broad demographic at prices starting as low as INR 29 in a young, price-sensitive market, success seemed obvious.

But Zudio’s secret sauce was how it made the business model feasible and value accretive. To understand that, one had to look into what it did differently and what it chose not to do.

Most Zudio outlets were located next to a Star Bazaar, not by coincidence but by design. It allowed Trent higher bargaining power as it negotiated with lessors and sellers for more space, becoming an anchor tenant in most cases.

Source: The Morning Context

Further, the line between a Zudio store and an adjacent Star Bazaar would blur, quite literally, on entering the store. This gave buyers a seamless experience while maintaining two distinct storefronts.

It was a ploy to offer everything under one roof, letting the footfalls at one store benefit the other. At the same time, no Zudio shopper left the showroom thinking they had bought their apparel at a hypermarket selling groceries and vegetables.

Zudio was growing inside Star physically and on Trent’s balance sheet like a weed.

Racking Appeal

Zudio deliberately did not let its outlets resemble a makeshift warehouse.

It was imperative to keep the stores breathable to induce upwardly mobile purchase decisions. Zudio boldly took an active call to declutter its stores and replenish the stock every eight weeks instead of twelve, which was the industry norm.

World over, fashion retail was notorious for an average discount of 36 to 38% over time, no matter the price point. Despite being a value fashion player, Zudio was conscious of not over-indexing on ‘sale’ to clear its stocks and avoid undue erosion of its margins.

Likewise, despite all the buzz around e-commerce, Zudio shied away from it, much like the UK fast-fashion chain Primark, on which it was modelled. The delivery costs, including reverse logistics, and the deep discounting prevalent at that time made the shiny new thing prohibitively expensive for Zudio.

Zudio owed much of its success to Westside, its spiritual elder sibling.

Trent’s cautious, profitability-first journey with its flagship mid-range brand gave Zudio a template to follow, the freedom to innovate, and a strong foundation to take off.

By 2017, Trent conspicuously located Zudio stores far from its Westside outlets. To the uninitiated shopper, there was very little in common between the two brands, be it the look and feel of the showrooms or the apparel style they walked out with.

But a closer look at Zudio’s fast-churning merchandise revealed a signature Westside playbook – private labels.

Westside had always maintained a heavy reliance on its brands. Particularly, since 2013, there has been a marked increase in their revenue share from 80% to nearly 100%, translating into healthier margins.

Zudio followed Westside’s trail, a rare feat in an industry where seasoned players such as Aditya Birla Fashion and Retail and Reliance Trends achieved 60% to 75%.

Looking closer would reveal how Zudio mimicked and deviated from Westside’s strategy in equal measure.

You Walked So I Could Run

There was a method to the madness.

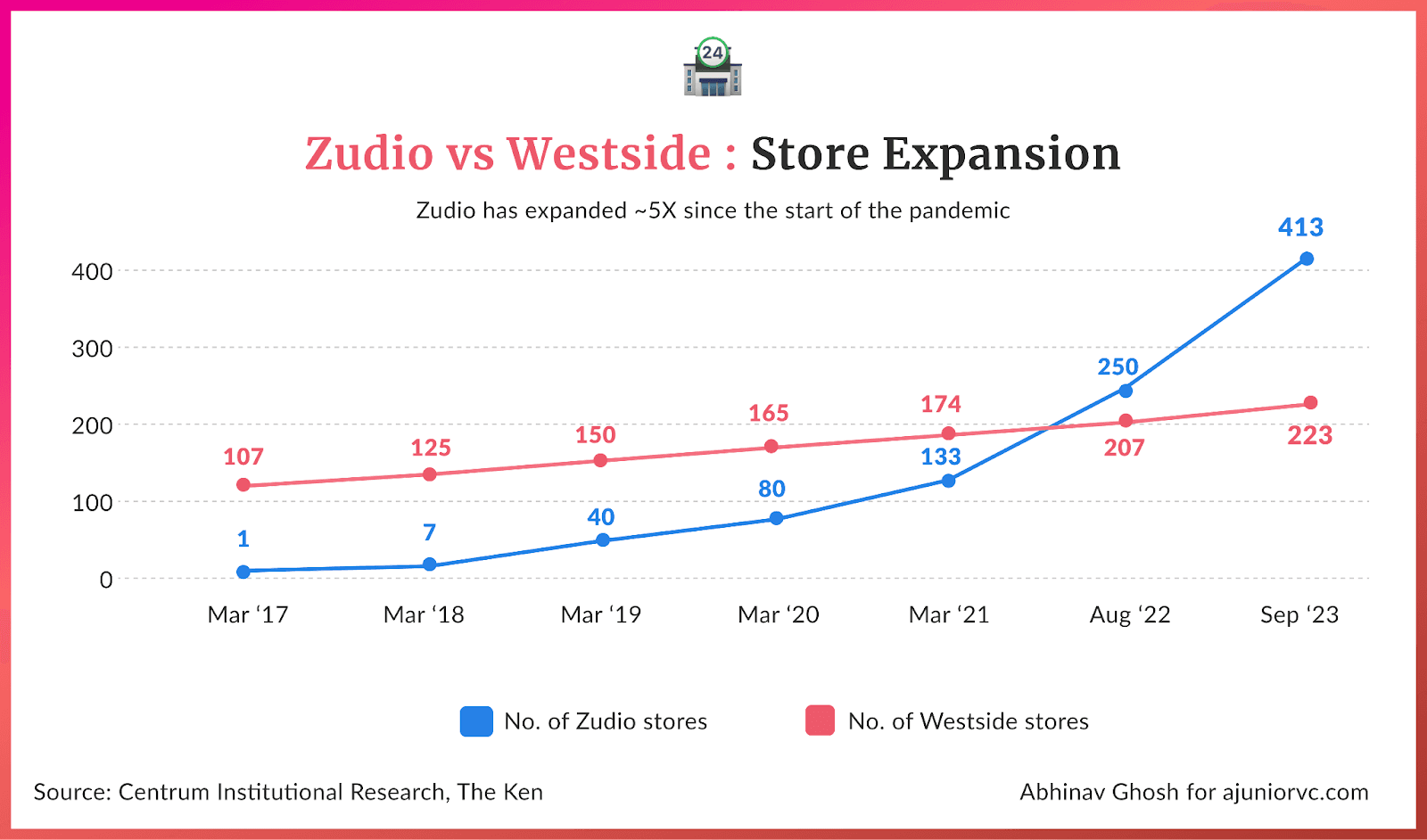

While Westside’s store increase was gradual and calculative, Zudio’s expansion appeared to be frenetic on the outside.

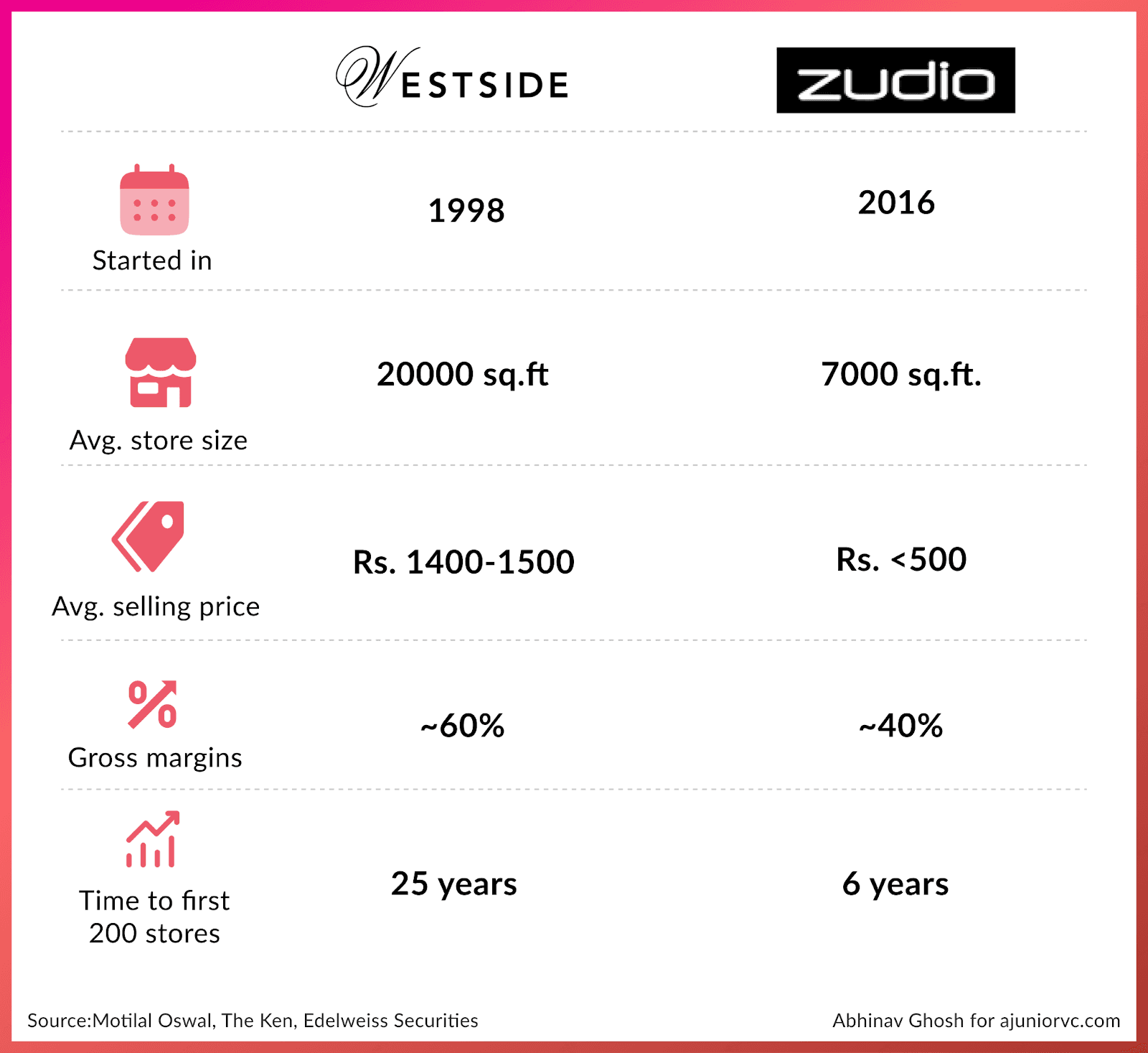

Zudio’s store size averaged 7,000 sq. ft., almost a third of Westside's. At the latter’s price point, its footprint was unlikely to extend beyond 200 cities. On the other hand, Zudio had a long tail of cities and towns to enter.

Besides, its exclusively offline presence meant that its early promise could be unlocked only by rapidly scaling up its store count.

Zudio’s average selling price was around INR 500, a third of Westside's. This translated into gross margins of ~40% against Westside, which pushed 60%. For the upstart to match the heavyweight in terms of profits, Zudio had to one-up Westside on revenue by a distance.

Westside continued to account for a majority of Trent’s consolidated revenue. But Zudio had become the growth engine and the centre of gravity for business.

This was in line with a broader shift in Indian fashion retail. Lifestyle International, one of Trent’s rivals, had witnessed something similar. It operated Lifestyle, a Westside peer, and Max Fashion, which competed with Zudio.

Max Fashion, the nimble mass player, had overtaken Lifestyle’s mainstay brand. It offered a window into the mind of the Indian shopper – discerning but fiercely money-minded.

Zooming out, while Zudio was trying to disrupt India’s apparel market, India was disrupting the world.

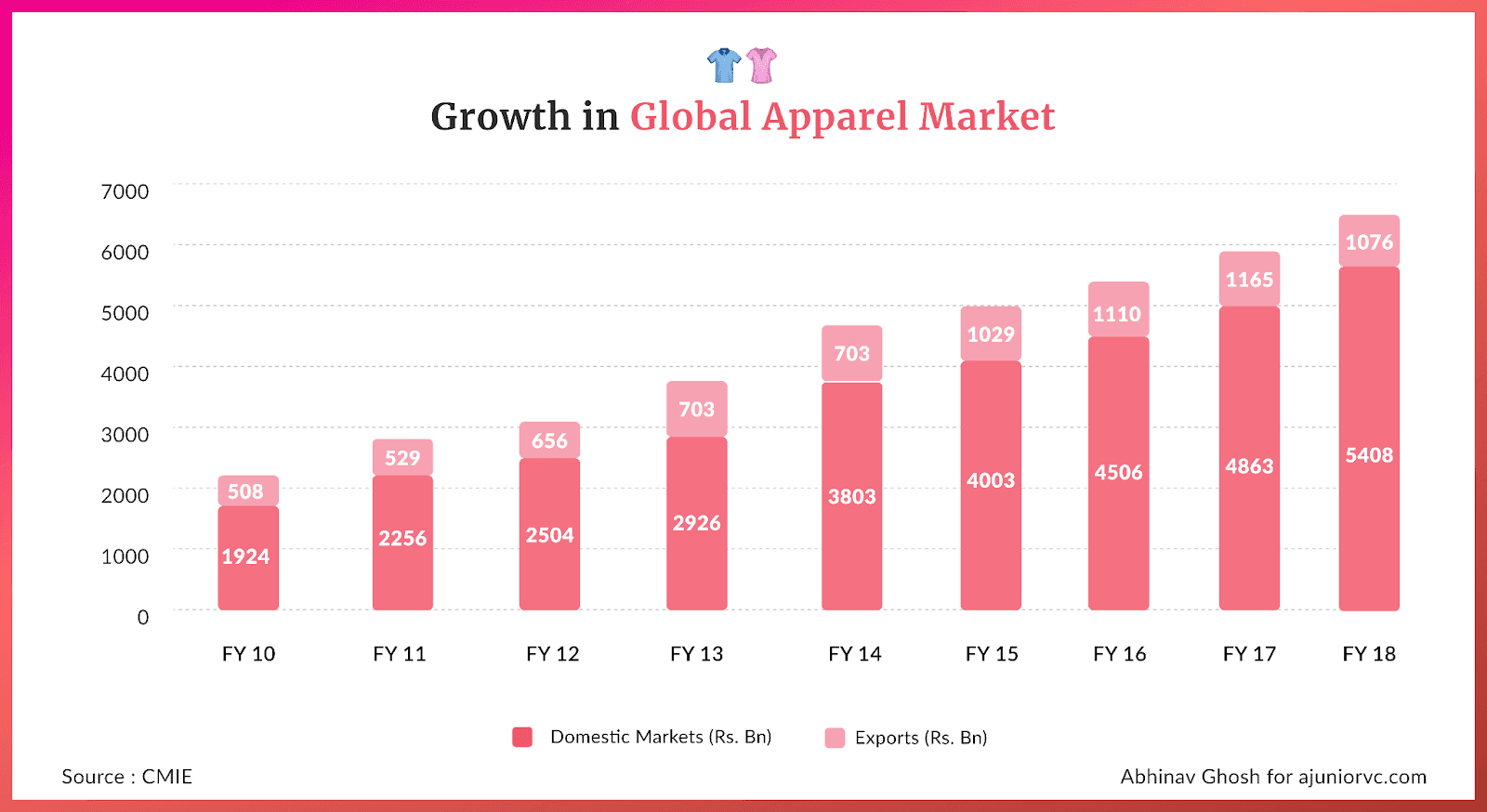

The 2010s marked the first decade since the 1960s when India displaced China to become the fastest-growing economy in the world. The world’s largest population and an increasingly aspirational and sophisticated middle class propelled this growth.

Throw the above ingredients together, and you have an apparel market growing nearly threefold in 8 years, reaching a market size comparable to the likes of Germany and the United Kingdom.

But India was destined to overtake them, for it had a unique trump card - its demographic dividend with around half the population under 25.

Out of this demographic emerged a youthful consumer base, with marked differences in requirements and changes vis-à-vis the older generations.

Everyone was following the world’s largest millennial population of 440M

Who Wears The Pants In The House?

Contributing almost 40% of the overall apparel market, women’s wear remained dominated by ethnic wear.

But by 2019, denim emerged as its fastest-growing segment. This was attributable to the rise in college-going and working women.

Exploding internet and smartphone penetration rates exacerbated the changes in consumer preferences, providing tech-savvy youth with easy access to the latest fashion trends around the globe.

Social media amplified their reach.

Global brands like H&M, Zara, and Forever 21 moved in to capitalize on these changing tastes through the 2010s. Parfait, Under Armor, and Uniqlo entered the country in 2019.

Alongside these changes, the barriers between the metros and tier II/III cities were also being broken with rise of e-commerce companies like Amazon and Myntra. For the Indian youth, the role of apparel was slowly evolving from mere utility to true fashion.

However, the apparel space retained several of its traditional characteristics.

Almost ~70% of apparel sales happened through unorganised retail channels, dominating tier II/III cities and small towns.

Rising demand for trendy fashion induced by demographic change, the indomitable price-conscious consumer mindset, and the limited presence of organised apparel chains in tier II/III cities and towns – Zudio had found its whitespace.

The behind-the-scenes strategy to operate at such low margins is a case study in business strategy.

Manufacturing was outsourced, and research and development costs were kept low - Zudio’s designs were trendy but plain and simple to manufacture in bulk. Focusing only on casual wear and lacking product lines like formals also helped reduce costs.

Finally, Zudio’s clothes were manufactured with a higher blend ratio of poly-viscose to cotton, vis-à-vis Westside.

Transport and distribution enjoyed significant synergies with the existing supply chain for Westside, with the latter being established over two and a half decades. Trent’s fine-tuned supply chain allowed Zudio to take a product from the design stage to being sold in its stores, within just 12 days.

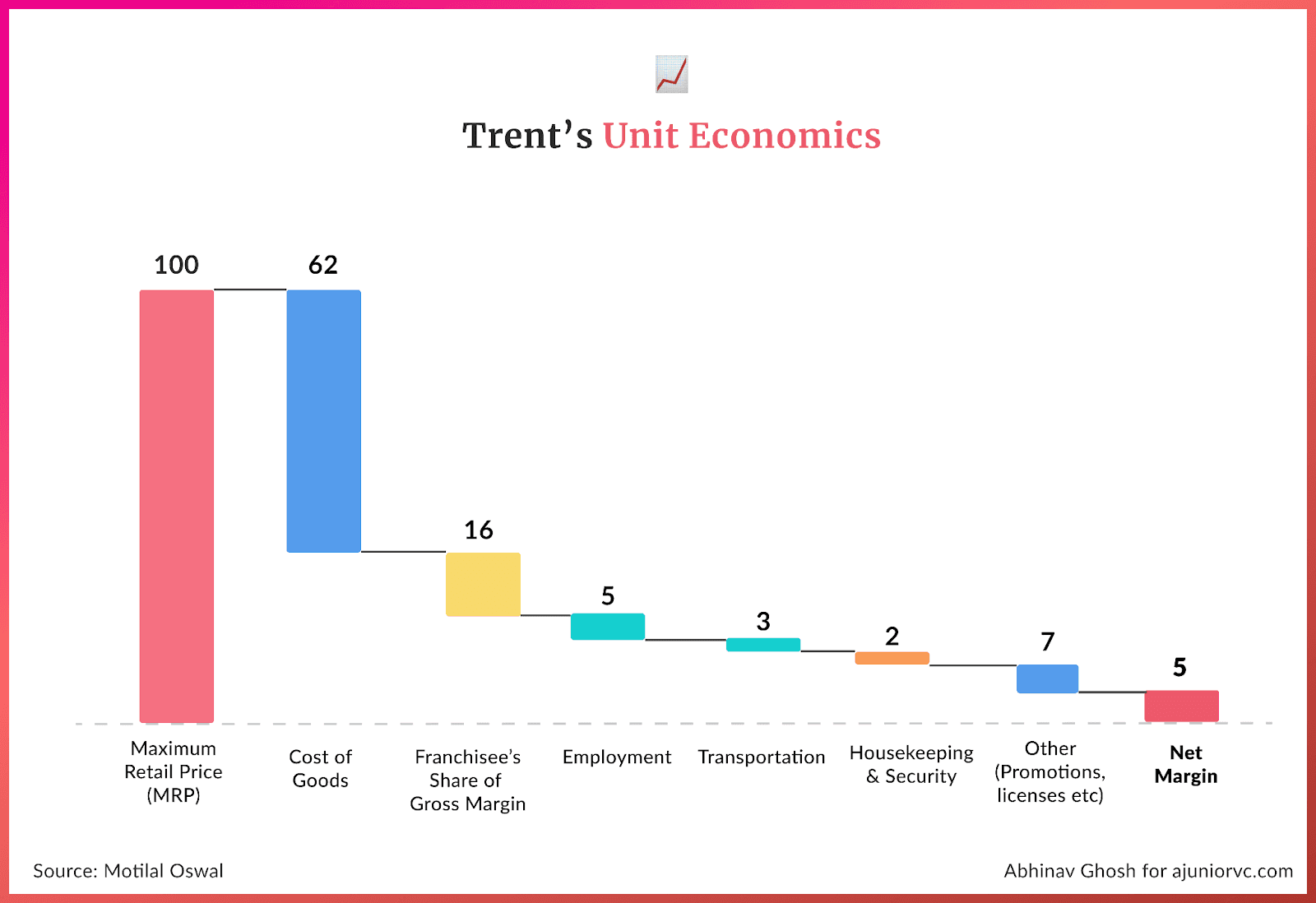

For the stores, Trent opted for a franchisee-owned-company-operated model. Trent franchised Zudio’s brand, with franchisees taking care of the capital expenditure in setting up a store and bearing rent and electricity costs.

As the franchisor, Trent covered the operating costs of employees, inventory management, transportation, etc. In return, Trent received a neat franchise fee, a 22% share of the gross margins (out of a total gross margin of 38%), and quality control over their stores.

The formula for blitzcaling was ready, for the upstart brand.

Healthy Margins

Zudio leveraged its large umbrella, while learning what would work for it

Zudio’s stores were smaller – around 6,000 to 8,000 sq. ft - almost half as compared to Westside. Locations were picked strategically.

By 2020, Zudio had 10 stores in Mumbai, and Westside had 13. Most of Westside’s stores were in southern or central Mumbai, the relatively more expensive parts of town. None of Zudio’s were.

For marketing, the answer is simple - nobody seems to have seen a big bang Zudio ad.

No advertisements, no celebrity endorsements. Limited promotions, no season sales and no discounts.

Just plain, simple, word-of-mouth.

Their strategy worked – besides high footfalls, they enjoy a customer conversion rate twice that of industry margins.

Having crafted a business model that solved for the trendy yet value-conscious Indian consumer, Zudio went all-in on its store expansion program, growing from 7 stores to 80 in three years.

Fast but carefully strategised.

Zudio placed stores in the biggest and most expensive cities like Delhi and Mumbai, seeking to target wallet-light college students and young professionals, but not too many – often just shy of the number of Westside stores in these cities.

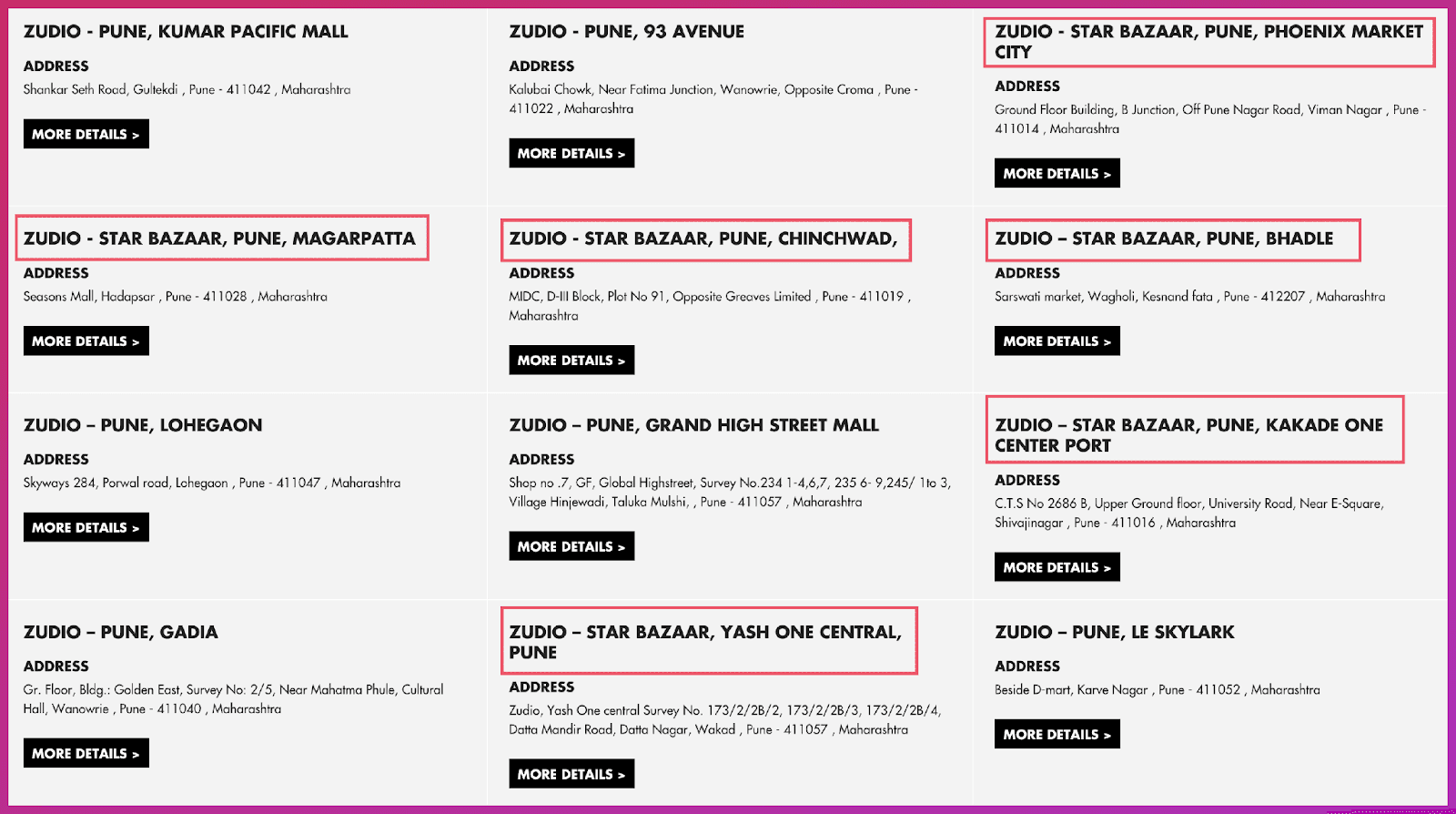

On the other hand, relatively less expensive cities, including the likes of Pune, Thane, and Ahmedabad, saw Zudio overtaking Westside stores by a factor of 2-3x.

However, Zudio hardly opened any stores in North India. This was done to avoid stocking winter clothing and reduce inventory risk and costs owing to their limited shelf life.

Zudio meticulously avoided incurring costs wherever it could and instead maximised its efforts and resources that would maximise customer footfalls and conversions.

A minimalist black-and-white aesthetic for its store ambience appealed to the youth and its target customer base and reduced overhead costs. Zudio also organised its racks by price ranges, as opposed to by style or size.

New styles, sourced from social media trends, were added regularly and quickly, given Trent’s fast design-to-store cycle.

They even launched a website – which, fascinatingly, does not sell online. Again, this aligned with their strategy of adding unnecessary cost elements to their value chain. Given Zudio’s low price point and slim profit margins, delivery costs would force Trent to increase product prices.

Instead, their website showcased their fast-changing product lines, acting as a low-cost customer acquisition funnel for their stores. Consequently, average revenue/sq.ft. reached INR 14,000, versus an industry average of INR 8,000-10,000.

The explosive success of these stores attracted even more franchisors keen on setting up Zudio stores.

Buckling Up

The capital expenditure required to set up a Zudio store ranged from INR 1.2 to 1.8 Cr

This was less than half of what is required to set up a Westside store, given the former’s lower size and inexpensive locations.

In exchange, the franchisee would get a 16% share of the gross margins, of the total gross margins of 38%. After accounting for rent and electricity costs, the franchisee would be left with a net margin of 5%.

Stores can earn anywhere between INR 70 lakh to INR 1 Crore in monthly revenue, yielding a monthly profit range of INR 3.5 - 5 lakh.

The math worked out for Trent too.

For every unit sold, Trent made 5% as its margin. While that may not sound spectacular, Trent’s capital investment was limited to its inventory since the franchisee manages the store investment. The 5% margin translated to a whopping ~60% return on capital

Fuelled by a fast-growing brand presence, customer loyalty, strategic product placement, and a franchisee model, Zudio reached an inflection point just three years after its launch.

Programs like ‘Zudio Zenn’ turned shopping into a rewards game for millennials with points, badges, referrals and birthday/anniversary bonuses driving engagement.

User-generated campaigns like ZudioStyle and reposting customer-style photos fostered user participation and a sense of community.

Zudio set up sampling shops and kiosks at major universities to interact with students on-site and acquire new customers. It recruited campus student brand ambassadors and built organic evangelism and micro-influencer networks.

Organising fan meetups in different cities fostered local communities and personal connections with the brand. Specialised festival collections and style tips timed around occasions like Navratri and Diwali connected to cultural moments relevant for youth.

All this led to explosive growth, reflecting heavily in their metrics wherever one chose to look.

170x increase in organic site traffic over 2 years attributed to content and SEO optimization, 43% lift in overall conversion rate from localizing UX and checkout, 2.6x more engagement generated by micro-influencer posts compared to branded content, and 20% higher average order value for customers acquired via influencer collaborations.

It was an incredibly explosive story about to enter a world-shaking disruption.

Belting The Competition

In the face of a pandemic, Zudio defied odds, opening 50+ outlets in FY21, signaling untapped market potential

Once it figured out the store economics, Trent put Zudio on gasoline and increased its store count by 6X (40 to 233) between March 2019 and 2022, helping it surpass Westside for the first time.

In September 2023, Zudio was present in 120+ cities and boasted a store count of 413 outlets.

Backed by strong store addition, Zudio’s revenue grew at a staggering growth rate of 94% between FY20-23 from INR 478 crore to INR 3,537 crore, and its revenue share in Trent’s overall revenue increased to 37% in FY23

In FY23, its sales per store jumped ~2x YoY to INR 12 crore with sales/sqft of ~INR17,300, the best in the fashion industry and almost 1.7x of the industry’s average. Improved sales productivity had a rub-off effect on gross margins and EBITDA.

Higher sales/sqft assisted Zudio in offsetting the low gross margin and generating ~INR6,000/sqft gross profit, similar to Westside’s gross profit/sqft despite being one-third of Westside’s average selling price.

Its EBITDA margin also improved by 100 bps in FY23 vs FY22. The asset turnover of 5X and a pay-back period of 1.5 years has made Zudio a preferred bet for franchise partners.

With a run rate of selling 2 million garments per week in FY 2023 has propelled Tata to shift gears and accelerate the brand’s expansion even further.

Timeless Fashion

Zudio’s achieved almost 4,000 crore in revenue in just 7 years, an astonishing feat for any unit.

Zudio has been able to successfully ride on the wave of fast fashion and bring the ‘fashion street’ affordability & trendiness to the consumer in its vibrant stores in a more convenient way, mainly led by word-of-mouth marketing

The Indian fashion market, the fourth largest in the world with a market size of USD ~69 Bn in 2023, will continue to evolve, and its consumers will continue to upgrade from the large unorganised segment to the organised segment.

Retailer-owned brands will play a pivotal role as they offer shoppers value for money while earning higher margins for retailers, with the potential to develop into autonomous propositions.

There is massive headroom for Zudio to grow, and it also plans to add ~200 stores in FY24 and 125 stores in FY25 and FY26 each.

These could double its already burgeoning revenue.

In addition to footprint expansion, innovation in the product portfolio, scaling up of the supply chain, 100 per cent contribution from own brands and leveraging digital presence will be key growth drivers.

One of the key challenges for Zudio, in addition to competing with mammoth retailers like Reliance Trends, ABFRL etc., would be its ability to drive premiumisation and do price hikes to counter inflation.

Given its easy-to-recall price ceiling, price hikes would be hard to navigate as a value fashion brand, even to counter inflation. Till now, Zudio has been able to counter the pressure by positioning itself as an aspirational brand.

Despite these challenges, Zudio will remain the most visible retail brand within Tata’s stable. The asset-light model allows it to grow rapidly like a tech company. Despite not being a founder-led firm, it's a remarkable story of entrepreneurship in a large conglomerate with an insane revenue growth

The diamond in the rough looks on track to achieve its monumental revenue target of INR 10,000 crore in the next three years. Zudio could be the dream fashion company that nobody thought would succeed.

Writing: Bhoomika, Ajeet, Nikhil, Jayanth, Shreyas and Aviral Design: Abhinav and Stable Diffusion