Nov 12, 2023

Can 2,000 Cr Astrotalk Manifest a Spiritual Unicorn?

Profile

Bootstrapped

B2C

Religion

Last fortnight, largely bootstrapped Astrotalk clocked its highest-ever daily revenue of INR 1.8 crores, inching closer to its FY24 target of INR 600 crores.

Puneet’s Test of Faith

Puneet Gupta came from a middle-class family in Punjab.

A shopkeeper’s son, Puneet, was average at studies and had few friends. However, he could see patterns which others often missed.

After completing his B. Tech from Chandigarh, in 2011, he joined Nomura in Mumbai.

Puneet was happy to have a job that paid him a salary of INR 37K and made him financially independent. He was content with his earnings and his life.

As he began his career, the stars aligned and he found love. Everything was going well except for one problem.

Puneet’s girlfriend came from a wealthy family with a very different outlook. It soon led to a life-changing incident.

In 2013, Puneet made her ride a pillion on his bike instead of hailing a cab as she had suggested. She furiously remarked that her family cruised in a Mercedes while Puneet’s had yet to see a car.

It broke the young man’s heart.

The incident made Puneet introspect on his life. He decided to resign from Nomura. He returned to his hometown to rebuild and work with his grandfather in the field of Ayurveda.

It turned out to be a false start. He slipped into depression shortly after that. A friend supported him, helping him figure his way back and find a job in Mumbai.

After an initial struggle to survive in the maximum city, Puneet secured a job with BNP Paribas at a pay cut.

By 2015, Puneet was in touch with an old school friend who had studied at IIT Delhi. They contemplated starting an IT services company. It was time for Puneet to put down his papers again.

The baggage of his failed venture, the travails he experienced after that and the crippling doubts ahead of a major life decision made him visibly anxious.

While drafting his resignation letter, a colleague noticed Puneet’s restlessness and checked on him. He shared his plans, hopes and fears with her.

Puneet could do with guidance, and his colleague seemed to have all the answers. She knew something about astrology while she was an SQL developer.

Even though his parents were firm believers in astrology, Puneet never took it seriously, let alone be guided by it. He was amused that someone as educated as his colleague suggested astrology to address his troubles.

Nevertheless, he let her make a few bold predictions based on his birth chart. According to her, Puneet would start an IT company. It would shut down two years later as his partner would leave the business.

Buoyed more by his colleague’s persistence than her predictions, Puneet rolled the dice, resigned from his job and moved to Noida.

From Agnostic to Faithful

In April of that year, Puneet started an IT services company named CodeYeti.

He managed to scale it up quickly to 45 employees, serving about 15 to 20 clients and booked revenue of $500K in the first year. CodeYeti counted big enterprises such as Yamaha and GreenPly, along with startups in its clientele

Things were going well until his partner told him he wanted to switch from their services business to a tech product. They spent the next six months developing two such products.

The whimsical experiment turned out to be a failure and burnt precious capital.

CodeYeti’s operations now seemed doomed. After his partner exited, Puneet shut down the venture for good in March 2017

The turn of events reminded Puneet of his former colleague who had predicted his short-lived success accurately.

He called her up, no longer as a sceptic. This time, Puneet sought genuine answers and not just friendly advice. He explained how things had unfolded and wanted to know the ideal course of action.

As she proposed looking up his birth chart again, Puneet had a Eureka moment. Astrology was not just a means to the answer anymore, but the answer itself.

Astrotalk was born.

Fresh out of CodeYeti, Puneet had a ready team to build a competent tech product quickly. They shipped the first version of the app within a few days.

Puneet sought to understand the market better. A quick scan of his competitors’ regulatory filings left him underwhelmed. Most of them were generating just a few crores in revenue.

He went deeper to understand the fragmented market beyond the organised players. As he spoke to more astrologers and customers, he gleaned that the market was much bigger than his initial estimates.

It also helped him discover the three key problems in this market.

First, there were many fake astrologers. Customers found it difficult to separate the genuine ones from the pretenders. Second, offline players did not have the tech expertise to increase their reach or scale their business efficiently.

Finally, the Indian consumer was moving online with the adoption of mobile phones and rising internet penetration.

Puneet foresaw an ecosystem where seekers could search for a reliable astrologer and obtain guidance online. This was while making it all convenient and private.

A minimum viable product was launched in 2017. It helped the team to gain insights and learn from the feedback to improve the product.

In Cheap Data We Trust

Astrotalk started as a video call platform for astrologers to chat with customers.

Early adopters of the platform voiced their preference for an audio call over video to speak to the astrologer. Astrotalk quickly adjusted to their users’ need for physical privacy while feeling heard, much like a confessional at a church.

The introduction of the audio calling feature had an immediate effect. User engagement took off. Similarly, users exhibited a general inhibition on being seen consulting an astrologer. Customer privacy was given top priority.

They put a strict onboarding process in place to tackle the menace of fake astrologers. It involved a four-level check, over five to seven interviews, to validate the skill set of an incoming astrologer.

The shortlisted ones were also provided with soft skill training to handle tough questions or predictions difficult to convey to the customers.

Further, an in-house team monitored newly onboarded astrologers for the first thirty days, and skill gaps were again plugged in.

Backend tools and specialised software checks ranked all profiles, serving as a natural filter. Puneet was helped in no small measure by his former colleague, who had accurately predicted his business journey.

Heena Gokhru was now a sought-after astrologer on the platform herself.

Astrotalk also built a frictionless payment method. They offered an e-wallet that customers could recharge before speaking to an astrologer on the platform.

The charge was based on session length. Customers could end the session at any time or continue it until their wallet balances were exhausted.

Another UX innovation they did was offer a five-minute free consultation with an astrologer to all new users. This unlocked an aha moment for most users, conveying the app’s value proposition much faster and making them more willing to pay.

They also diversified and looked at multiple monetisation models, such as offering a detailed report from the astrologer for a charge. Users could get an online puja (offering) performed, buy a gemstone, Rudraksha or a Yantra on the platform.

Astrotalk had a quiet start till about August of 2018.

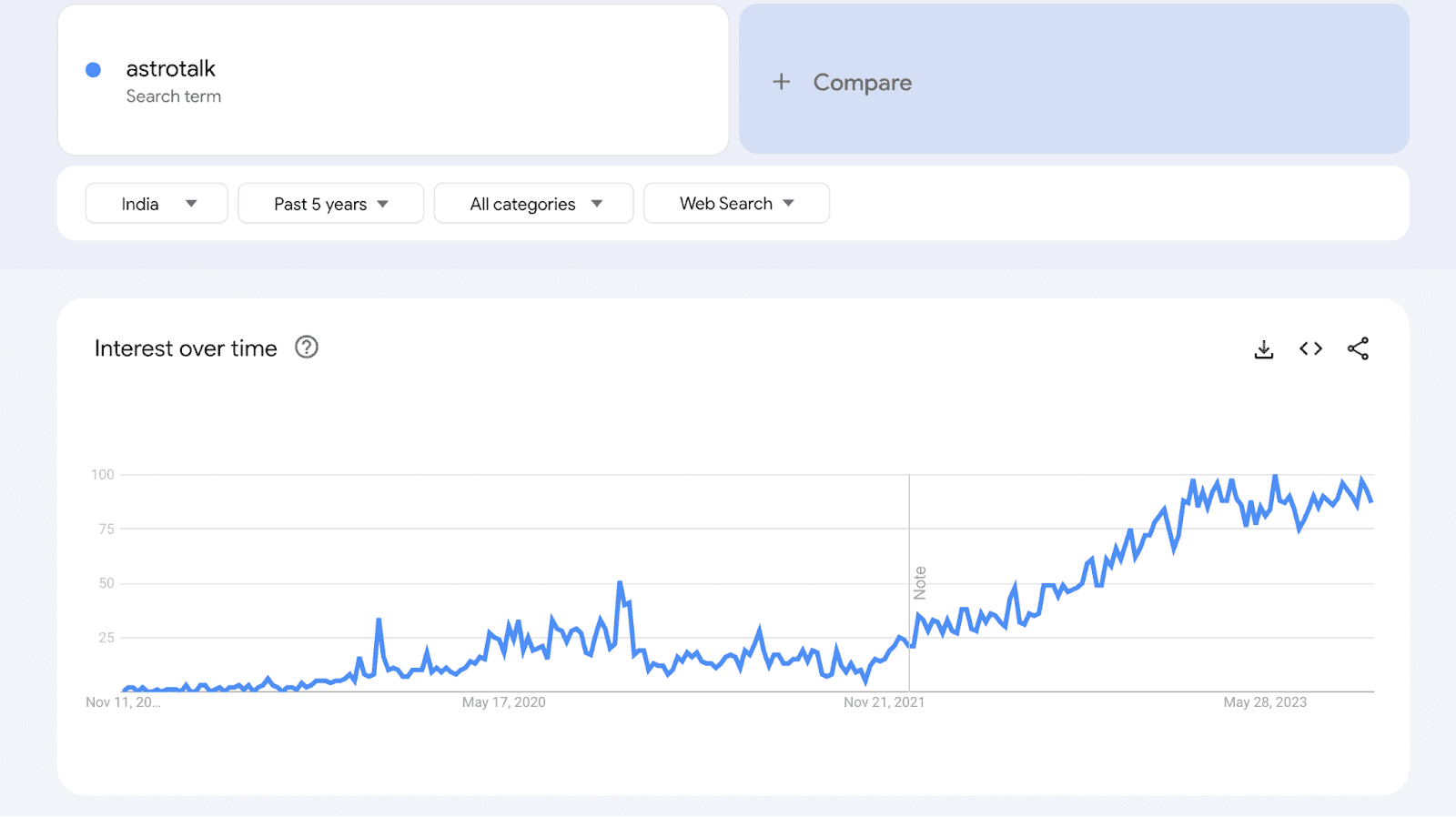

The adoption was pushed up by the rising penetration of smartphones, subsidised mobile internet in the post-Jio era and the fast adoption of UPI. Astrotalk had now achieved product market fit.

By 2019 they had scaled from one to 125 astrologers, their app had more than 1 Million downloads and was growing at 25% month on month.

All this without any marketing, a team size of 20, and no external funding.

A Divine Intervention

By 2020, the bootstrapped rocket ship was clocking INR 8 crores in annual profit by building a product that customers loved.

Things came to a sudden halt with the onset of the pandemic. As the world locked down, like many other businesses, Astrotalk also saw a slump in revenues.

Within two weeks of the lockdown, their customers started reaching out again. This time, as opposed to the typical questions on romance and marriage, the new questions were driven by the anxiety around COVID-19: layoffs, the shrinking economy, and a desperate need for hope that things would get better soon.

By the first week of April 2020, Astrotalk had recovered and was logging business worth INR 25 lakhs a day as compared to INR 10 lakhs a day before COVID-19.

They also noticed that users often asked the same questions repeatedly, stretching a potential five-minute session into thrice as long, indicating the need for a counsellor.

In a country with limited mental health services and even more limited awareness, the founders realised that their users were treating astrology services as therapy.

Astrotalk introduced new features like free birth charts, live sessions and astrology lessons on the platform to fill the void, albeit partially.

AstroTalk's revenue surged to INR 10 crores each month by August 2021. Despite its scale, the company then raised just INR 6 crores. Clearly, few investors had faith in astrology.

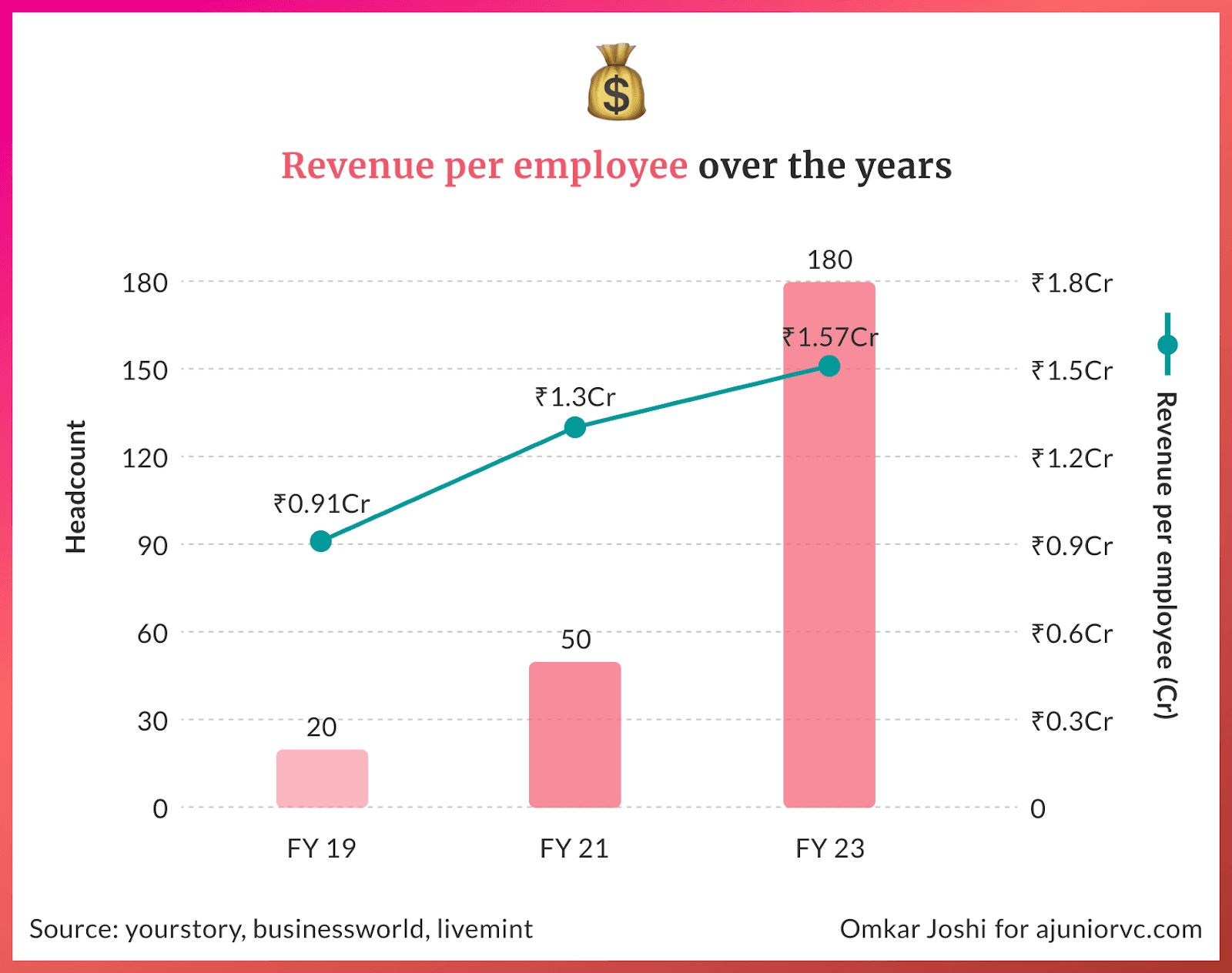

Using this capital, AstroTalk expanded its team size from 50 to 180 members by 2022, driving its ongoing growth. This development occurred in the backdrop of the COVID-19 pandemic, which prompted a significant shift from offline to online practices.

During this period, Puneet roped in Anmol Jain to join the upstart as the Chief Business Officer and eventually, as Co-Founder.

Astrotalk was taking off.

Building the Universe on Numbers

Astrotalk’s user interface could be strictly utilitarian for a discerning user. However, it did not take away from its credentials as a tech-enabled business.

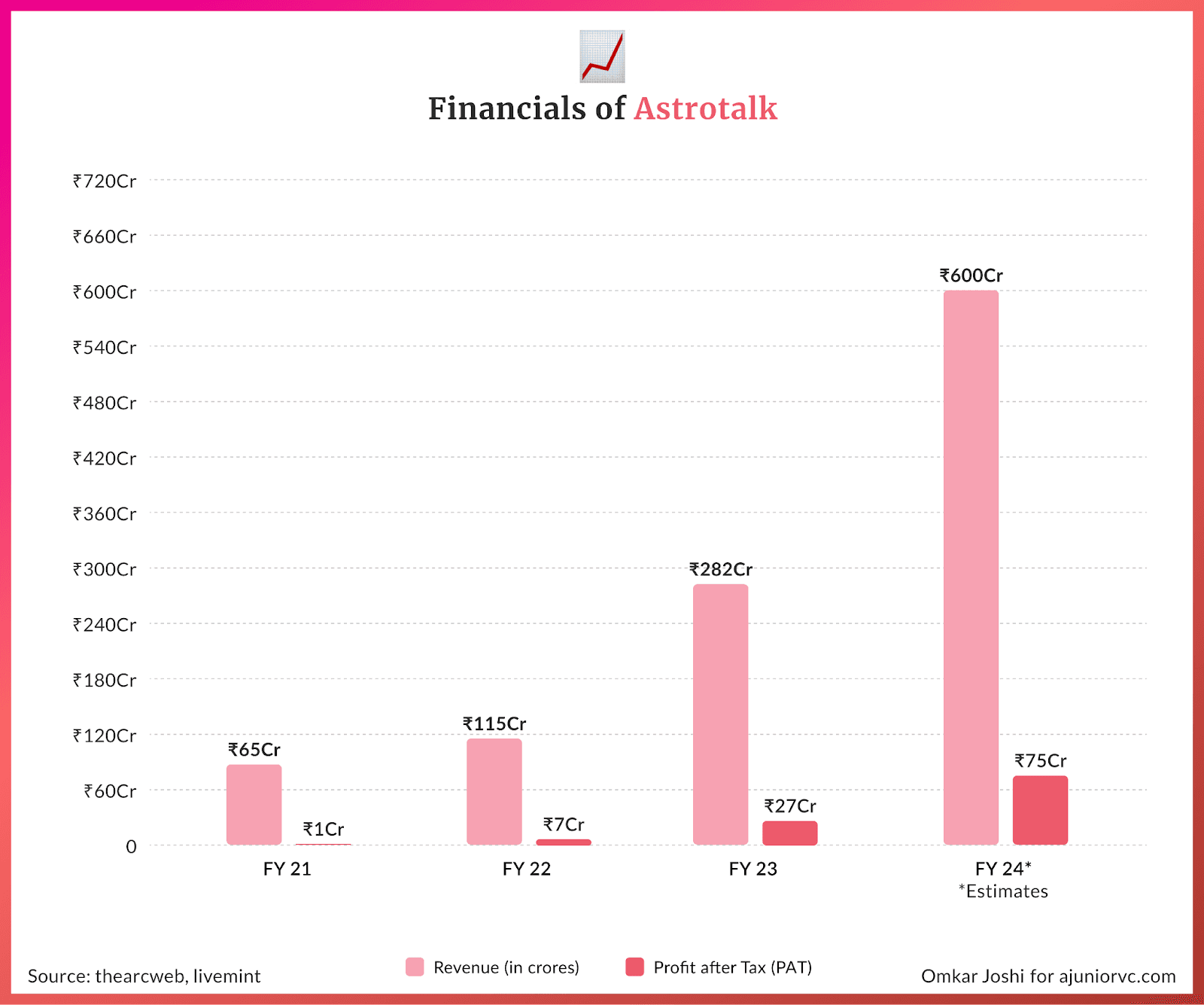

For all the crystal gazing that its trusted astrologers perform, Astrotalk’s financial performance left little room for uncertainty.

The top line had grown at 100% over the last three years, closing at INR 282 crores for FY23. Profit after tax for the period stood at INR 27 crores.

The sustainability of the scale-up could be assessed by the steady, ascending trend in revenue per employee, the litmus test for a tech startup.

Astrotalk had more than 15,500 astrologers listed on its platform, with around half of the base active.

Beyond the first five free minutes, sessions could be booked at anywhere between INR 10 to 250 per minute. Users also had the option to purchase a membership pass, which covers a daily session for 10 days, priced at INR 99 per day.

Astrotalk’s freemium model made it easier to upsell low-paying customers to premium options than to convince free users to start paying.

Consultation calls and chats with astrologers generated 90% of the revenue, with e-commerce and live streams accounting for the rest. Astrologer charges, marketing and employee salaries were the biggest expense heads, cumulating to INR 230 crores in FY23.

Astrotalk kept up a high-decibel marketing strategy, with a new celebrity endorsing the platform monthly to attract users. Ranbir Kapoor, Bipasha Basu, Shraddha Kapoor, Mouni Roy, Virender Sehwag, Shweta Tiwari and Vaani Kapoor are among the 40 celebrities that it has partnered with, apart from sponsoring a reality show featuring singer Mika Singh.

Astrotalk could give the illusion of a simple business model, which harnesses the easy appeal of astrology and is fueled by heavy advertising spending.

But a closer look reveals its secret sauce – a stringent vetting process for its astrologer network, with an acceptance rate of just 5%.

It wasn’t as easy as it looked.

Blessed be the User Base

Like any platform business, Astrotalk’s key challenge was simultaneously scaling up both ends – charging astrologers and paying users.

Given the level of intimacy, astrology involved higher stickiness as compared to say, food delivery, ride-hailing hailing or real money gaming. However, the frequency of use tends to be event-based, sporadic and hence, significantly lower than comparable behaviours.

The Astrotalk team painstakingly engaged a large transacting base and kept their ears to the ground to develop a meaningful core set.

By mid-2023, Astrotalk had close to 3 crores registered users. 50 lakhs use the app monthly. The daily active base stands at just over 4 lakhs, indicating the wide funnel typical to this business.

New users spent, on average, INR 200 to 500 in a month on the platform, while a repeat customer spent up to thrice of that amount.

Users between the age of 18 and 35 flock to the platform, implying that while the elderly in India prayed openly, the youth was prone to worries and prefer to find solutions privately.

Astrotalk and the wider industry’s big opportunity was to help them address the same. This was minus the perceived stigma of visiting a shrink but with the virtue signalling associated with divine planetary bodies.

Women generated 57% of the business, mainly seeking advice on relationships and marriage which, in turn, accounted for 60% of all the consultations. Career, business and finances contributed another 30%.

Astrotalk’s focused marketing had resulted in 85% of revenue originating in metros, tier-I cities and abroad. 17% of the total came from NRIs in the USA, Canada, UK and Australia.

As such, astrology continued to divide opinions on whether it was a nuanced celestial science or a pseudo-domain masquerading as something more. But then again, spirituality is extremely personal, as Prashant Sachan, the founder of AppsForBharat, told us.

His pithy advice of serving customers without judging them is key. Astrotalk appears to have done well in a relatively crowded market, with hardly any entry barrier.

Many in India are Called, but Few are Chosen

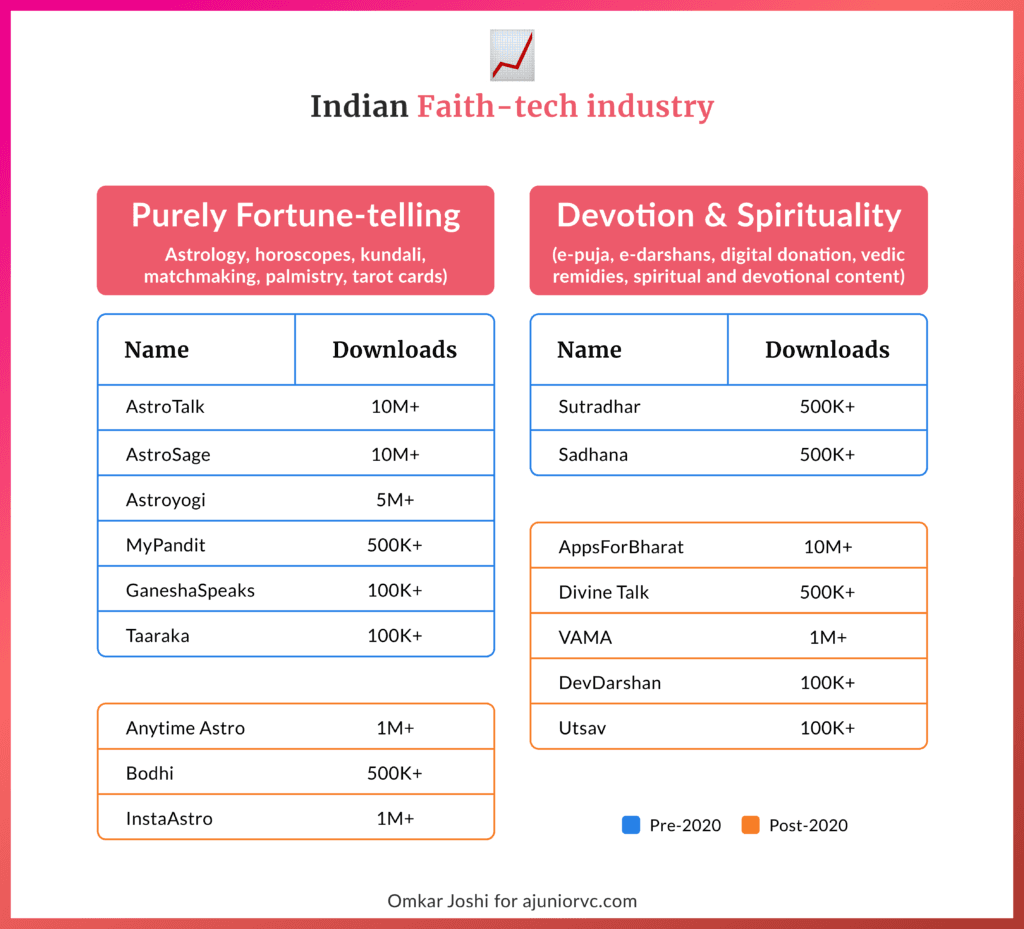

The Indian Faith Tech industry can be classified into two categories

The likes of Astrotalk limit themselves mainly to fortune-telling, in the form of astrology. A host of players also offer services like e-pujas and devotional content.

A broader set of offerings is amenable to higher differentiation and faster monetization.

The Indian spirituality, religion and devotion market is estimated at $58.56B in 2023, with astrology contributing over $10B. The overall market is estimated to grow at a CAGR of 10% from 2024 to 2032.

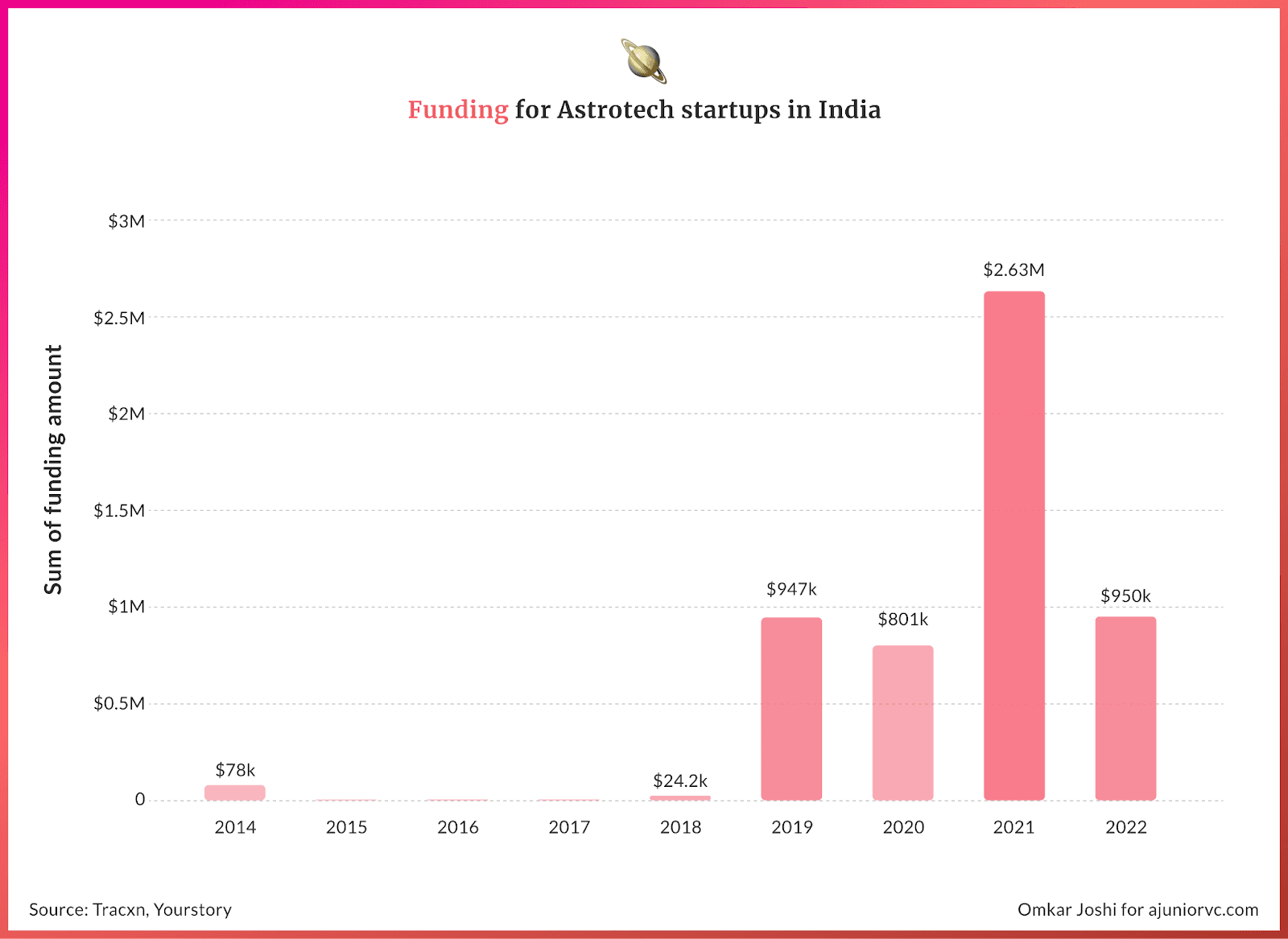

Despite this large size, tech companies have struggled to scale.

The pandemic marked a watershed moment for India’s Faith Tech, with 18 companies launched in 2021 alone. The sudden interest was attributed to awareness and willingness among millennials to experiment, apart from heightened anxiety.

Startups, on their part, were using tech to make predictions.

Faith Tech has its share of risks and scepticism. Long-term value creation, consistent monetisation and urban youth’s fidelity towards the sector remain unproven.

Premiumisation and the feasibility of a subscription model continue to be challenging. Sustaining the growth would mean keeping up with the marketing treadmill while balancing a relatively small average transaction value.

As advertising budgets rationalise over time, the industry could witness a wave of consolidation.

There has been cheating and unethical behaviour, which could mar user sentiment. Despite the sector’s drawbacks, investors began to spot opportunities in a conventionally unsexy industry.

2021 witnessed a record funding of over $15M, marking a sharp increase from $1.8M in the previous year. Astrology alone attracted $5.5M in 15 funding rounds over 4 years.

Beyond India, the annual revenue of the top 10 astrology platforms in USA grew by nearly 65% in 2020.

Astrotalk had a large but enormously difficult market to take.

Crystal Gazing into Fund Raising

Amidst the funding frenzy, AstroTalk’s ambitious climb could have gone unnoticed with just one angel on their cap table.

But Rahu-Ketu seems to be aligned for them now.

Astrotalk is courting various funds to raise $40 million valuing the company at $220 million. The company claims to have a market share of 80% in the astrology tech space and is experiencing rapid growth.

What separates it from the competition is a set of nuances and finer details.

The initial pricing for each astrologer is determined at the onset, which is then dynamically adjusted based on factors like customer demand, reviews, and other quality metrics.

AstroTalk diverges from its peers by not imposing platform fees for astrologers to join their marketplace. Instead, it earns commissions on transactions between customers and astrologers, charging a commission of ~20% on each transaction.

The entire onboarding and training process for astrologers is also free. They have been adding around 200 astrologers every week, given the growing demand they are witnessing.

These astrologers actively promote themselves by enhancing their visibility on the platform and leveraging their personal social media channels and affiliate networks to attract customers.

About half of the monthly transacting customers come from paid marketing campaigns, making it the biggest expense after the astrologer charges, which leads to a high acquisition cost. It takes 8 months for them to recover the acquisition cost basis the contribution margin, possibly the only mangal dosh.

For the user experience side, they were able to nail one key thing. When you enter the product, it is built like a WhatsApp chat experience. This requires no habit change from the user’s point of view.

Witnessing various startups solving different problems in the space, AstroTalk has tried experimenting with multiple other services.

E-puja has been one of the segments growing rapidly, allowing devotees to request specific pujas on their behalf. The landscape suggests this is a natural extension of Astrotalk.

Even though the astrology business of AstroTalk does not see a major uptick during festivals, its recently launched e-puja service is expected to drive traffic.

Creating the Future of Spirituality

AstroTalk's daily earnings from consultations reaching nearly INR 1.8 crores has charted an auspicious financial horoscope for FY23, totaling INR 282 crores.

The company is poised to conclude the fiscal year with a robust topline of about INR 600 crores, with an EBITDA of around INR 100 crores, growing 100% year-on-year.

In India, faith has always been a profitable line of work.

The company targets a revenue of INR 2,000 Cr before aligning its stars with the public market by FY26 with a one-of-its-kind IPO. The numbers are ambitious, as it could also be signalling for the impending fundraise.

AstroTalk has simultaneously targeted India 2 - through sachetization, and the wealthy Indian diaspora abroad - with premiumisation.

Users can pay as little as INR 20 per minute to solve their biggest problems. They plan to expand deeper into the Indian market by producing more localised vernacular content and advertising problems that the tier 2 population could relate to, given that most of their existing user base is from metros and tier 1.

Astrotalk now wants to expand in South India by partnering with local superstars and launching ads in regional languages.

The platform has also broken into the NRI audience abroad and is expected to contribute to a remarkable revenue of INR 100 crores in FY 24, ~15% of the total revenue.

The company aims to penetrate this lucrative NRI market, which currently generates 50% of their online traffic. This expansion plan involves increased marketing efforts and diversifying into mental wellness, tarot cards, and psychic readings.

The mental wellness and psychic readings sectors have been gaining traction recently, with several psychic readings like Kasamba and Purple Garden successfully raising funds and thriving in the European and North American markets.

AstroTalk's foray into these areas represents a strategic move to tap into this growing global interest.

Astrotalk’s journey has unlocked the fortunes of the oft-overlooked Indian spirituality market, awakening the giant and making astrology a sleeper hit category. It will still have to go through the challenges associated with space.

In hindsight, Puneet and the team were lucky to be at the right place and time. However, their success has resulted from customer obsession, putting a premium on the user experience while keeping their core offering simple.

Astrotalk proves that the best way to predict the future is to create it.

Writing: Nikhil, Abhinay, Abhinav, Chandra, Tanish and Aviral Design: Chandra and Omkar