Nov 28, 2021

Can Chargebee Charge the Global RevOps Revolution?

Profile

Revenue

Finance

SaaS

B2B

Series B-D

Last fortnight Chargebee appointed its Chief Financial Officer, a few months after turning unicorn in an incredible year for Indian SaaS

Creating the Current

Krish Subramaniam was born into a family of entrepreneurs.

In his early engineering days, Krish would sit with his uncles and see how they ran their restaurant business. While other kids would read books or play sports, Krish would spend his time observing how they managed customers, operations, and cash flows.

To Krish’s astonishment, customers would walk into the restaurant, eat their meal, and ask at the counter to bill them for the food they had. He was amazed by the level of trust that existed between the consumers and restaurateurs.

In 2002, he was working at a startup in Bangalore that created software products in an Application Services Provider Model. They would host the software built for clients on their own website.

In his second job, he used to implement Ariba, a product to help companies manage their revenue spend. He worked as a consultant and implementer.

Navigating through professional life, Krish reconnected with Rajaraman Santhanam, a prior classmate. Krish and Rajaraman would often meet up to discuss ideas from websites like Hackernews and JoelonSoftware.com.

Krish and Rajaraman were inspired by a company called Fog Creek Software, which is now Atlassian, from where they got the idea of bringing smarter people in the same room together.

At this point, it was early 2010 and Krish was working in the US with the chance to stay there for good. Inspired by the opportunity that India presented, he didn’t stay in the US and committed to starting something of his own.

Cloud businesses were taking off and that meant you could build from any geography to ship to any other part of the world.

An idea was beginning to take shape.

Building a Circuit

Krish and Rajaraman started exploring different ideas to build and launch a new product. Without any viable idea, they incorporated Bubblepath Inc. in 2010.

The incorporation was made to ensure that they stick together with a long-term commitment to building something.

They also added two more team members from rising Indian SaaS company Zoho, Thiyagarajan Thiyagu and Saravanan JP to bolster the leadership team.

The team zeroed down on three themes based on market research and their common background.

First, it was never easier to build a technology company given the number of resources available online. Second, all SaaS companies had a set of products or solutions that they had to build internally. Finally, they set a goal to create a truly global product serving customers anywhere SaaS companies existed.

The three themes brought them to solving recurring billing and payment subscriptions. They found that each startup was utilising individual bandwidth in building in-house products for SaaS billing which were nowhere near perfect.

Since subscriptions business was picking up in the US but not in India, they found their target customer market.

The spark had been generated, with the team having to focus on a specific problem.

Collecting the Conductors

The four co-founders each with their own skillset were focused on investing in people.

Krish believed that great businesses don't find ideas to solve for but bring together a smart group of people who can brainstorm on existing problems and find out solutions.

There were several market tailwinds and repeat patterns that they had observed to come to a product-market fit.

Since cloud computing was on the rise, thanks to AWS, they knew that their infrastructure costs could be minimised if they built a cloud-based software.

The team was also quickly able to identify repeat problems in every SaaS startup and hence could identify a common solution.

They looked at a really boring problem and tried to solve it in an interesting way. This theme would be a powerful one, one that resonates with multiple large tech companies.

While the market would have been working on building SaaS startups, they decided to make things easy for existing and upcoming SaaS Startups.

In a gold rush, sell shovels, as they said.

The first idea they had was for building a Site monitoring software similar to Appdynamics. Another idea was to enable single sign-on for users to authenticate themselves and sign on hassle-free.

But the third idea (third time’s a charm), the invoicing system stuck and they eventually solved it.

KPS and Rajaraman had seen that even Zoho was doing it on its own for every product. Similarly, Freshdesk had also built something of their own when they had launched.

The team decided that for an MVP if they somehow build a product with more features than Freshworks, they could find a customer.

The idea was simple: if you can help customers earn, you can charge them for it.

But the journey wasn’t as simple as it might seem.

Finding the Frequency

In 2011, Chargebee was at a crucial juncture after building the core team and the initial product idea and market fit.

The question they were asking themselves was, how big could this become?

It was very pertinent because the product offering was very straightforward - manage the recurring billing system for companies.

The potential customers always felt that they can manage this. The engineering team within the company can code and make this a feature.

Potential customers used to ask, and rightly so, why they needed Chargebee. Bear in mind that “SaaS” was not even a trend, and it was simply billing for recurring use cases.

To-be customers felt that Chargebee provided just the transaction layer as a part of their overall subscription business. In that case, the scalability didn’t come in for Chargebee because when the customer scaled, they can potentially replace what Chargebee offers.

But that was the opportunity for Chargebee.

If Chargebee answered why customers needed them even if they scaled, then Chargebee could scale.

Chargebee always knew though the core offering is to manage the recurring billing, the product could provide a lot more.

Chargebee found their answer in the form of use cases.

The core team at Chargebee started to capture all the use cases which the SaaS subscription business goes through—like onboarding the subscriber, cancelling the subscription, refund process and regulatory framework.

The outcome of this process was that Chargebee found the path to scalability. They now felt that they could scale from here.

With that, Chargebee secured Series A of funding of USD 800k, when it was smaller than a seed round.

The funding helped Chargebee to fast track customer acquisition.

Post funding, Chargebee focused on the sales and marketing efforts in and on APIs for smooth integrations with any system.

By 2014 end, Chargebee had around 500 paying customers from 10 countries, including Australia, US, UK and Canada. Chargebee was able to process monthly transactions worth $1.6 million.

The stage was set for Chargebee, which was evolving at a rapid pace.

I Got the Power!

The world of technology was changing.

In 2014, a global technology giant decided to change its pricing model to improve experiences.

Adobe realized that piracy was rampant for their products as the one-time license was very high. Similar issues were faced by product companies.

There was only one option to stop this leakage of revenue, offer subscriptions.

As a company, they decided to shift focus from one time licensing fees for a product to a recurring subscription business.

The decision changed industry dynamics, and almost gave birth to subscriptions.

But the decision had an impact on Adobe's business. Revenue stalled entirely between 2014 and 2016, net margin fell from 20% to just around 6%, and net income fell by 70%.

The subscription business is a tricky business. It encapsulates the concept of operating leverage.

The company incurs all the fixed costs at the beginning. Whether a company gets 100 subscribers or 1000 subscribers, the overall cost doesn't increase exponentially.

The more paying subscribers, the better it was.

One more inherent component of the subscription business is to provide constant value, which means a product has to evolve.

Only then the subscribers will continue; else, they will churn. The churn means the company needs to get more subscribers to generate the same amount of cash flow.

These changed industry dynamics were tailwinds for Chargebee, which began to see lesser queries on why it should be used.

Chargebee focused on early-stage startups. It was difficult for the newer startups to manage the complexity of the subscription business as it was not core.

For Chargebee, it was a situation where they could help any company with subscription management with their product offering.

This helped Chargebee gain market share and help them hone the product because they were now getting exposed to a variety of use cases.

By the end of 2015, Chargebee was processing $100MM in annual transactions.

The insane growth resulted in a Series B funding of $5M. As a SaaS company serving other SaaS companies, Chargebee was faced with a big conundrum.

Increase clients or increase ARPU?

Resisting Resistance

Chargebee focused on increasing the clients first.

The rationale was that it had to first widen the base before it could show value. Additionally, it had money in the bank which could be used for these free trials.

In 2016, Chargebee decided to move upmarket and into traditional verticals.

Providing solutions to SMEs was an easy strategy to enter the business. But Chargebee had a product that could be used by mature companies in various sectors, which were now thinking of offering subscriptions to their consumers.

Expanding to traditional business helped Chargebee acquire some internationally known and publicly listed companies as customers. Within a short period of next year, they had clients from the petrochemical, automotive, security, beverage industries.

In addition to this, Chargebee introduced the Freemium Model. Under which, the clients will not pay anything to Chargebee unless they cross a cumulative sales of USD 50,000.

This gave customers a chance to experience the product and Chargebee a buffer time to evaluate the customer potential.

The above created a new situation for Chargebee.

The pricing strategy increased the number of clients, but the conversions went down because many new customers didn’t take the paid plan. After all, the free plan was now available.

The classic issue with all subscription businesses was playing out for Chargebee.

The solution was to provide more enhanced features to make it difficult for the customers to leave the ecosystem. Chargebee's core team and engineering team did exactly the same.

Chargebee introduced features that can manage accounting and taxation compliance in more than 50 countries, besides subscription features like lead management, cancellations, and churn rate analysis.

By the end of 2018, Chargebee started to work with payment platforms like Stripe, PayPal, Adyen. They had more than 700 paying customers from more than 53 countries.

The new features did three things for Chargebee.

First, the number of clients on the platform increased. Second, the number of paying clients increased. Third, ARPU increased by more than 100%.

The sustainable growth attracted another investor in 2018, raising a Series C of $18M. With the growth, Chargebee was realizing it had evolved into something more.

Growth Hertz

Chargebee was no more a subscriptions company, it was doing revenue operations.

The founding team came from a services background, had firsthand witnessed Zoho transform from a startup to a powerhouse brand. It did so because it had managed the “customer services” stack.

Chargebee was helping SaaS companies manage their revenue stack.

There’s a subscription for everything and the number of subscriptions a ‘modern customer’ uses either as an individual or an institution is likely a lot higher than any of us realises.

On realising that nobody is helping early-stage companies manage their subscription revenue, Chargebee doubled down on this problem.

What is the unique value that Chargebee brings to subscription businesses? Is it just as a transaction abstraction layer, that folks will set up for their companies once and not touch again or was it something that became more complicated as the company grew?

Chargebee had realized that it was something more complex.

Even in the early days, Freshworks’ team had 6 engineers and one of them was building exclusively what Chargebee would do for it. The engineer was essentially focused on solving revenue operations.

This was the part that Chargebee was abstracting, the application layer core that they were going to replace. Not just for Freshworks, but for so many other companies.

In traditional businesses, revenue used to flow linearly – from marketing to sales and finance.

However, in subscription businesses, the revenue flow is cyclical. While the purposes of all functions remain unchanged, their revenue implications are amplified since customers need to be ‘won’ not just once but through every recurring billing cycle.

Revenue models were becoming complex and a lot of recurring revenue wasn’t even a flat recurring revenue anymore.

The new models have tiered pricing, engagement pricing, pricing based on API calls, revenue from different countries and other complex ways to price a product.

While it is a subscription, it’s a variable subscription model and managing this manually becomes impossible with scale. As more companies shifted to recurring revenue bundles and pay-as-you-go models, solutions like Chargebee become necessary to manage billing and reconciliation.

Developers in companies usually believed they could write the code for a billing system over a weekend, but there were a host of challenges like regulatory frameworks which weren’t immediately apparent to them.

By 2019, Chargebee was showcasing the invisible levels of complexity in recurring billing. Its transformation from a nice to have to a must-have was complete.

It also began to be clear who their ideal buyer was going to be

Inverting the Situation

Revenue was the focus of nobody in the company, which meant it was the founding team.

The founder and the founding team of companies were the ideal customer profile (ICP) for Chargebee. The persona was the founder-developer who falls in love with the product and makes a choice.

Once this was clear, the momentum that Chargebee as a company caught was just the start. There was no stopping Krish and the team.

A subscription business model also gave companies the opportunity to attract new customers, offer him/her/them a ‘taste’ for the product and upsell to a more premium offering with key features.

This is the develop-while-you-distribute strategy that has worked beautifully for software-led product companies in the last 2 decades or so.

Chargebee was the SaaS company helping SaaS companies come to life.

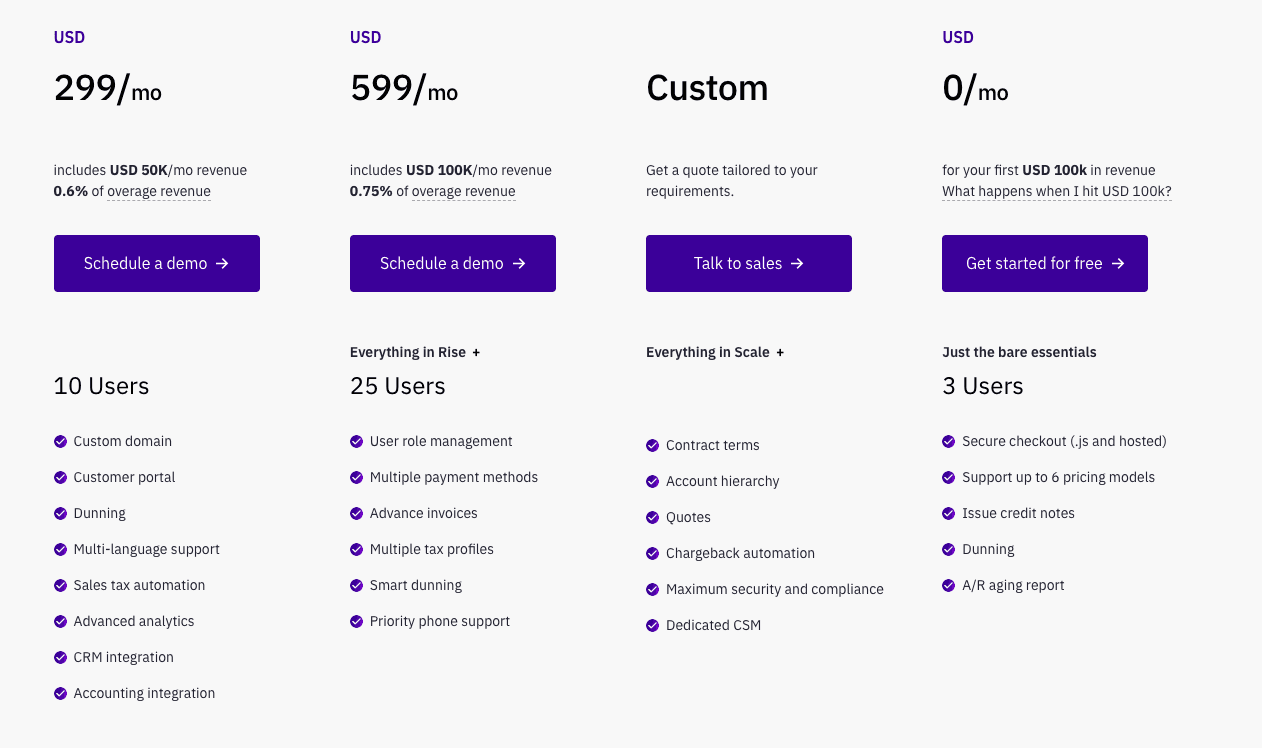

To its customers, Chargebee offers tiered pricing, quantity or volume pricing, flat pricing, and more.

Their fixed pricing plans have undergone numerous changes over the years and by 2020 they offered a free tier for up to 3 users that went up to $599/month for 25 users in the Scale plan.

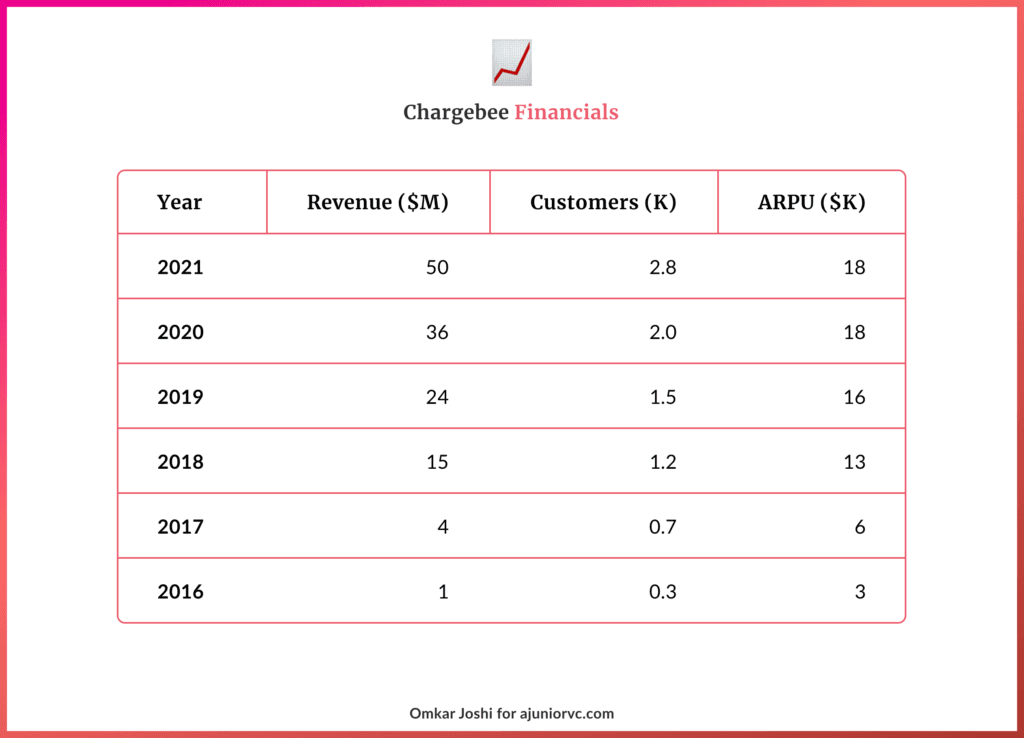

The company was making a revenue of $36M while processing subscriptions of $2Bn, ~1.8% of take rate. For a global SaaS revenue of $250Bn in 2020, that implied the market was ~$4.5Bn

This was a market for only a few players, which was Chargebee’s biggest challenge.

The company, since its inception, has survived against behemoths like Stripe, and other giants like Chargify, Zuora [NYSE: ZUO], Braintree, ReCharge, and Recurly a few names from a long list of companies that create and maintain software subscription-based service solutions for businesses.

One thing that has helped the company sail through these competition-heavy waters is a clear understanding of its purpose and what the customer is expecting from the other end.

What has always helped Chargebee to compete with such big firms was the fact that they started working with very few overheads because of AWS. Chargebee’s entire server load was zero in its first year and cost $100 per month.

Even today, it has been fairly capital efficient. Its sustainable growth was rewarded as it entered 2021, becoming a unicorn at a $1.4Bn valuation.

It has raised a total of $200M. Assuming $50M is still in the bank, it has burnt $150K. It has generated $100M of revenue in the last 5 years, which implies a total burn of $250M.

With a team of ~800, we can assume an average annual compensation of $500K, or a $40M team cost today. Assuming a ramp-up of costs, we can estimate that 3x this cost has been spent over the last 5 years. $120M has been spent on the team, leaving $120M more to be accounted for.

This indicates $120M was spent on sales and marketing, to acquire 3K customers. This implies a customer acquisition cost of $40K. On an average revenue of $20K per customer, per our computation, that means it takes two years to break even.

Everything beyond that is pure profit, indicating the power of SaaS models. From being a “niche” business, Chargebee is now powering the powerhouses.

Mutual Induction

Chargebee is evidently doing something right.

Its customers include Okta, Freshworks (their first customer), Calendly, and Study.com. Chargebee claims to have a net retention rate exceeding 150%, which is the ratio of retained revenue to original revenue when a customer was onboarded.

A number greater than 100% indicates that an average customer is generating more revenue than when it was onboarded.

In fact, Chargebee claims to have the largest footprint of any revenue management provider in its segment, with businesses in 160 countries across North America, Europe, Asia, and Australia processing billions of dollars in revenue.

Krish and team wanted to focus a lot on customer success, and even in the early days were discussing 24*7 support.

They talked about what they called fanatic customer support. They have actually been able to execute on this. Even now, Chargebee consistently has a customer or two sweet-talking them on Twitter or LinkedIn.

Their strategy of first going after early-stage startups followed the model of disruptive innovation. That was an easy way to enter the market, but after developing a mature product for SaaS, Media, Services, and e-commerce, they decided to move upmarket and into traditional verticals that were just opening up to subscription models.

Chargebee started selling to industries like petrochemical, automotive, security and beverages. This move helped them acquire some internationally known and publicly listed companies as customers.

Realigning their pricing tiers to the value offered by the product helped make Chargebee more credible to the mid-market and enterprise segments.

The proof of the pudding is in the awards.

Chargebee is the winner of the 2019 Cloud Award for Best Payment, Finance, or Billing Solution. In 2020, the customer reviews ranked Chargebee the number one finance software.

But the journey is not over, it’s just getting started.

Chargebee’s biggest challenge will be to remain number one or two in this category. The largest player Zuora has a revenue of $300M, approximately 6x our estimate of Chargebee’s revenue.

The reason for being the largest is that the market itself is not $100Bn+, but likely to be $5-10Bn. With SaaS revenue multiples at 12-15x, Chargebee needs to get to ~$1Bn of revenue to become a decacorn.

Its focus on building a team with the scrappy Indian spirit could help it win.

From the very beginning, Chargebee’s founders believed that a strong team and attractive end market were indispensable ingredients to build a generational company.

Built in Chennai for the world, Chargebee will charge the global Revops revolution.

Authors: Shelley, Parth, Rohan, Shiraz Design: Muskan, Omkar