Sep 17, 2023

Can 6,000 Cr Ixigo Pull Off Travel's Biggest Rollercoaster to IPO?

Profile

Series E-G

B2C

Transportation

Ixigo recently created history by crossing INR 10,000 crore GTV with over 50 million bookings, as it gets ready to IPO

Boarding a One Way Startup Ticket

Aloke Bajpai was a bright student with a great academic record.

He completed his graduation from IIT Kanpur and was in Europe working for a French travel tech company. He was always known for thinking out of the box, and the 35-hour working weeks in this nice, well-paying job was not something he enjoyed.

He started thinking and could see it was not Europe but India growing faster than most economies. It was 2006, and Aloke could see that the future belongs to India and to those who will build this future of India.

He wanted to take a bet on India. But it took a lot of work and required a lot of soul-searching. He had yet to repay the loan he took to do his MBA, which made the decision tricky.

He was not alone.

Rajnish Kumar, who was also an IIT Kanpur alum and working for the same travel tech firm, was also doing some soul-searching and could relate to the entrepreneurial itch that Aloke was feeling.

Maybe Shahrukh Khan’s character in Swades (2004) or this speech by Steve Jobs (2005) gave the final push. Aloke finally decided to take a decision he would never regret.

By 2006, Aloke and Rajnish had resigned and returned to India. The duo rented an apartment in Gurgaon to work on their startup with a small investment of 6 lakh rupees.

Having worked with a travel tech company they had some frustrating personal experiences they started building a travel meta-search website for travel in India. For almost one year, they worked, without any salaries, to develop this product.

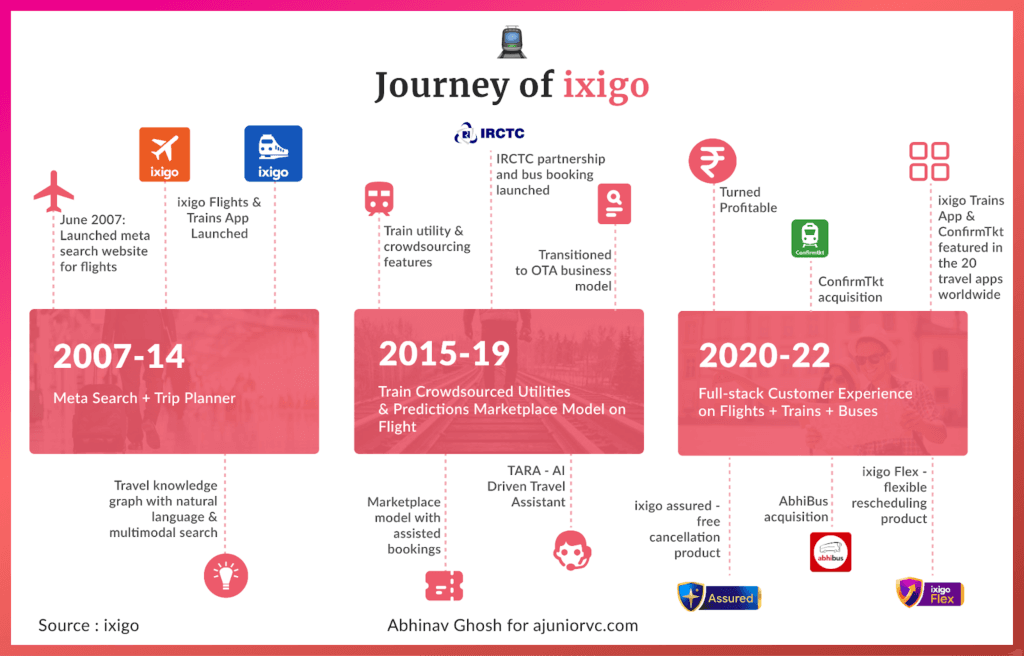

In 2007 Ixigo was born, before the internet was even a thing. The ride began with turbulence.

Investors felt this space was too crowded with players like Make My Trip, Yatra, Cleartrip and other travel websites already fighting in the online travel agency (OTA) space. One investor even challenged Aloke that they wouldn't be able to raise even 100K in funding.

The rollercoaster had begun with a steep drop.

But against all odds, by December 2007, it reached 100,000 users per month. Ixigo reached $10,000 monthly revenue within 6 months of launch with zero marketing spend.

Derailed with a Crisis

By early 2008, the traction started showing early signs of product market fit (PMF) and the handful of investors in India were ready to bet on Ixigo.

Ixigo raised a $1.5 M seed round from investors, including Make My Trip, a leading online travel agency founded in 2000. Ixigo founders always had the thought process to focus on the product and the customer's core problem.

When they started building Ixigo they had a unique insight that most of the portals focussed on the booking, where transactions happened. But for customers, the most anxious period of any travel plan is the time before and after the booking.

That’s why it started with the flight meta-search website providing all the information a customer may need before and after the booking. While customers started loving Ixigo as a product, real monetisation would take a while.

Ixigo founders and early team were well aware of the tradeoffs this long-term bet will bring and they were ready to make short-term sacrifices to build an enduring company.

2008 was one such year that started on a high, and by August, everything changed in a blink. By the time Lehmann Brothers collapsed, Ixigo was a 15-member team

With an almost closed $5M round promise, they started burning some money to drive growth. But as travel collapsed, they were in for a shock as the round never happened, and the founders suggested laying off 50% of the team unless someone had a different solution.

The ixigo rollercoaster had dropped hard again.

Ixigo’s team took a voluntary pay cut until they did not have enough cash to pay salaries instead of letting go of their colleagues. They stuck together in difficult times and worked to bring out industry-changing products by focusing on customers and their problems.

They could see that Mobile was getting traction, and if they had to truly stay ahead of the competition, they must start investing in a mobile app.

Getting on the Mobile Track

In 2010, Ixigo launched its mobile app, making it one of India's pioneers in mobile travel solutions.

With a primary use case in place and continuous customer feedback, Ixigo knew they needed to expand to cover the larger travel space related to train, hotel and bus booking.

With its mobile app gaining traction and a rapidly expanding user base, Ixigo focused on strategic partnerships. The company formed alliances with major airlines, hotel chains, and travel agencies to offer exclusive discounts and deals to its users.

This approach provided added value to customers and fueled Ixigo's growth as it began to earn commissions from bookings.

This team then built and launched many products in the next two years, taking the average number of visitors from 200K to almost a million by April 2010.

By April 2010, Ixigo registered its first profitable month by expanding into different verticals and keeping the expenses bare minimum. The Ixigo rollercoaster was going up.

Investors were slowly coming back to look for the survivors after the recession of 2008.

They started taking a keen interest in Ixigo, which had crossed monthly traffic of more than 1 million users by then. Ixigo had become a one-stop portal for anyone who was planning to travel

This was a significant number given that in April 2011, around 18 million users visited travel-related websites. Of them, Indian Railways had the highest number of visitors at 8.4 million, followed by Make MyTrip with 3.9 million visitors. In contrast, Yatra had 3.5 million, ClearTrip.com had 2.1 million and US-based Expedia Inc. saw 1.8 million visitors.

Ixigo at that point, was an informational website and not a transactional website or OTA like Make My Trip, which customers used to make the booking.

The competition was tough, and Make My Trip was looking for ways to beat the competition and explore inorganic growth opportunities. Make My Trip, could see synergies with Ixigo’s informational business.

In almost an exact parallel, MakeMyTrip did fulfilment like Swiggy when it started, while Ixigo did the informational discovery like Zomato. But unlike Swiggy and Zomato, here MakeMyTrip was much bigger

The idea was not to acquire but to let both businesses co-exist and grow. let the Ixigo founders run the business and formulate a win-win strategy.

By 2011, they partnered with other investors and funded a Series-A round of $18.5 Million, taking up 75% of the business. While it helped keep Ixigo alive, selling a huge chunk of the business to a competitor was not necessarily a win.

It would be another twist in Ixigo’s unique story as it survived for another day.

Riding the High Ticket Volume Train

While Ixigo had built a substantially large information portal for all sorts of travels, it began to see there was an opportunity waiting to be taken.

Millions of people travelled via trains in India, making it the largest chunk of traffic.

In 2013, Ixigo had launched its first mobile application focused exclusively on mitigating the information asymmetry for rail travellers.

By the end of 2014, Ixigo had launched a total of 6 applications - with use cases ranging from finding eateries for road trips to offline Goa travel guides.

As expected, the Railways app was by far the most popular amongst these. It witnessed over a million downloads in its first four months and continued to see more than 100,000 monthly downloads throughout November.

By 2015, Ixigo’s portfolio had grown to offer travel meta-search functions across flights, hotels, buses and trains.

Its varied portfolio and innovative social media marketing tactics involving ‘travel hacks’ articles and videos served over 2.5 million travellers per month.

But underneath these strong metrics, a storm was brewing.

Ixigo struggled with monetising its user bases, with its losses amounting to approximately half its revenues. The money raised from MakeMyTrip four years ago had run out.

Ixigo was mortgaging its financial assets just to stay afloat. The rollercoaster had turned yet again.

In June 2015, a white knight appeared in the form of Micromax, an indigenous mobile manufacturer, which bought an undisclosed minority share in Ixigo.

Infused with new dry powder, Ixigo continued its diversification spree by launching a meta-search app for intra-city cabs, which soon became the fastest-growing product in Ixigo’s offerings. Boosting the app’s organic growth, Ixigo acqui-hired Rutago, an inter-city cab aggregator, in August 2015, to help scale its offerings in this space.

It also acqui-hired ‘IndiaBackpacker.com’, which provided information on backpacking hotspots and had formed a community of enthusiasts.

There were clear reasons for Ixigo’s efforts towards horizontal diversification.

The meta-search model heavily relied on advertisement revenue, which in turn depended on user traffic. To attract the most users possible, Ixigo wanted to become the first stop for anyone researching travel options online.

The other reason was the changing nature of the travel aggregator industry. Historically, most travel aggregators focused predominantly on reducing information asymmetry for airline bookings, driving down margins in this space.

This meant that for Ixigo, while airline bookings fetched margins of 4-5 per cent, hotel bookings could yield margins as high as 15 per cent. But trade-offs existed when it came to volumes. While Ixigo was facilitating 2,000 airline bookings per day, hotel bookings were limited to one-fourth the amount.

Ixigo’s ace-in-the-hole, however, was its deep understanding of the pain points faced by railway travellers. At that time, it was the only travel meta-search platform offering to only provide real-time seat availability PNR status to its customers and offer highly accurate predictions of wait-list conversions.

Ixigo was soon serving 60 million travellers by 2016, making it the largest meta-search travel platform in the country. It had an astonishing 70 per cent market share in the space.

Half its customer base resided in tier 2 and tier 3 cities due to the moat it built around its railway offering.

The twist of financial fate had again helped Ixigo focus, as it stayed alive to win.

Jumping on Online High-Speed

Learning from its brief period of financial stress, Ixigo sought to deepen its customer funnel to improve its user monetisation potential.

It introduced instant one-click booking for flights and hotels in March 2016, preventing the need for its users to be directed to its partner’s websites.

Doubling down on the moat built around its railway app, it added various value-added offerings in this segment, including coach and seat maps, alarms to notify users of station shops, and an AI-assisted chatbot to help users resolve their queries.

It introduced a Hindi-only app to expand its user base in tier 2 and 3 cities and the rural hinterlands. Partnering with Uber, BlaBla car and Red Bus on its railway app, it sought to offer its users last-mile connectivity.

Meanwhile, India’s travel industry was witnessing an online evolution.

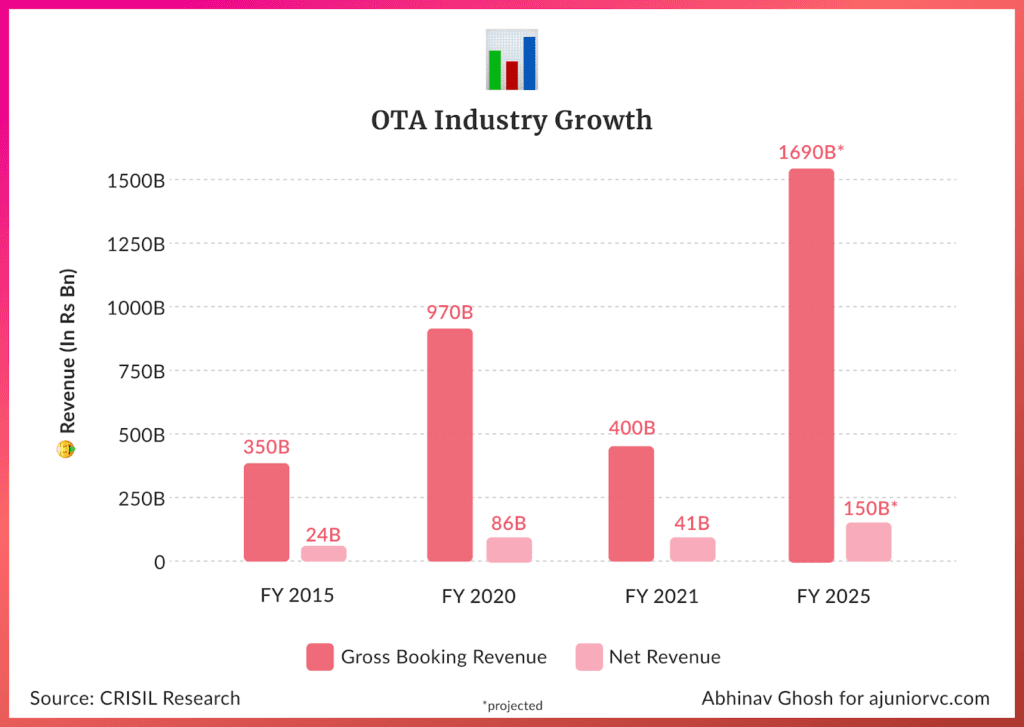

Gross online bookings aggregated up to a staggering $5.5 billion – accounting for 60-70 per cent of the total e-commerce transactions by the end of 2015. Of this, air travel bookings accounted for an outsized 60 per cent, followed by railways at 15 per cent and hotels at 13 per cent.

Spurred by the low prices following Reliance Jio’s disruption, India’s internet user base of ~300 million was on track to witness double-digit growth over the next five years to reach ~700 million by 2020.

Macroeconomic factors, coupled with Jio’s disruption, solved customer accessibility. Online travel portals are now needed to solve retention and monetisation.

Therein lay Ixigo’s challenge.

While excellent for acquiring users, its travel meta-search business model needed help with retention and monetization.

Users were attracted to Ixigo’s platform because of its diverse portfolio offering comprehensive solutions to information asymmetry across price, dates, bookings etc.

However, once identified their desired route and transportation, the bulk of their wallet value was captured by Ixigo’s OTA partners and end-suppliers that Ixigo’s platform linked to. In essence, Ixigo was enabling the cannibalisation of its users.

Once the booking was done, Ixigo could not offer any further value-added services, such as booking alteration or cancellation.

Recognising the limitations of its travel meta-search model, Ixigo began its journey to becoming a full-fledged OTA.

A $15 million fundraising round helped sustain this expansion. Things were looking up.

Meta-search platforms redirect users to bookings on partner websites, their margins are earned on a ‘pay-per-click’ model - each visit sent to a partner site earns a small margin amount for meta-search businesses.

On the other hand, OTA’s take full ownership of a user’s booking journey and can earn significantly higher margins for each completed booking on their websites.

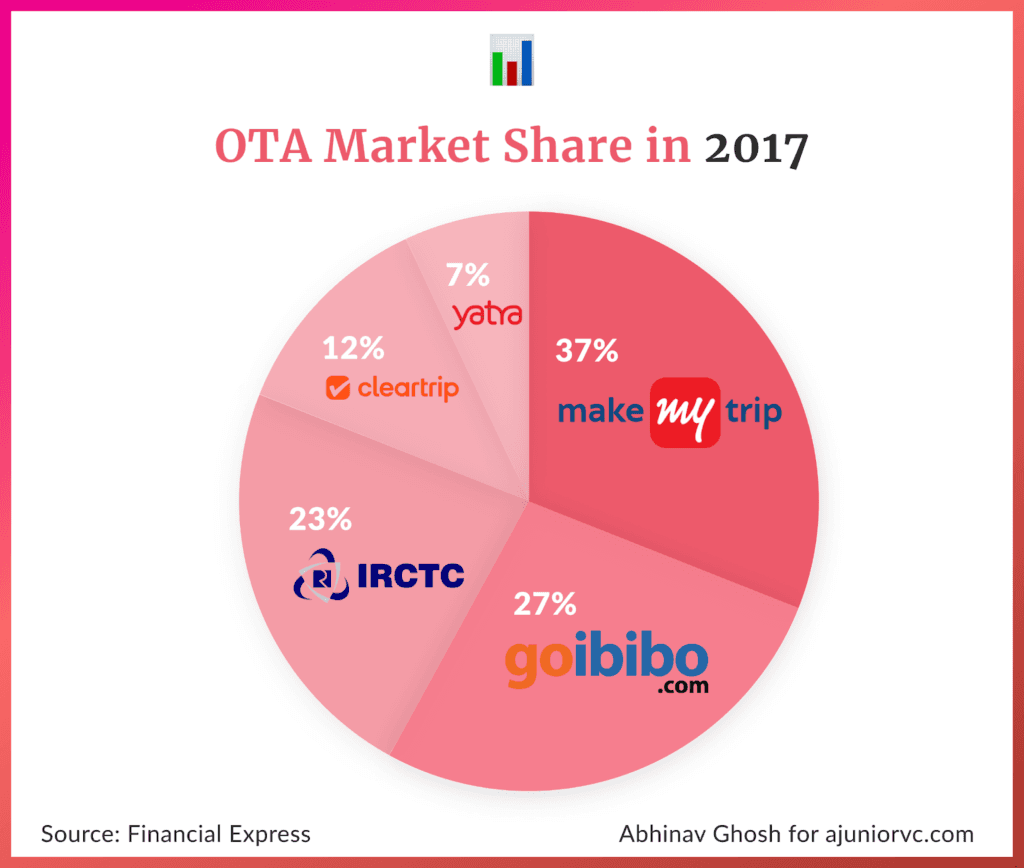

Ixigo was now directly competing with its investor-partner MakeMyTrip.

Reading Competitive Signals

In 2017, the OTA industry was amidst a consolidation.

MakeMyTrip, the most significant player with a market share of 31 per cent, had just acquired Goibibo, the second largest player with a market share of ~27 per cent, allowing the combined entity to dominate the industry.

Interestingly, the government-owned IRCTC captured the third largest chunk (~23 per cent) of online travel bookings, despite offering only railway offerings. The rest of the space was divided between Cleartrip and Yatra.

To succeed in a space dominated by its investor-partner, Ixigo played to its competitive advantage.

Ixigo’s railways app, focused on resolving multiple customer pain points, had long been an outperformer in its portfolio. Ixigo’s railways app had ~15 million monthly active users. Ixigo’s flight app had around one-third of that amount.

Mapping its competitive advantage against the wave of exploding internet users outside of tier 1 cities, who were also the most significant users of railways, gave Ixigo its key target customer segment – “The Next Billion”.

This segment consisted of the population's huge swathes who first obtained internet access as a utility in the past decade. They did not reside in tier 1 cities and preferred to converse in local languages over English. They accounted for an overwhelming 90 percent of rail users.

Ixigo partnered with IRCTC to become the first OTA to sell rail tickets on its own application. Ixigo’s rail app soon began to process 500,000 transactions monthly, growing 10 per cent month-on-month.

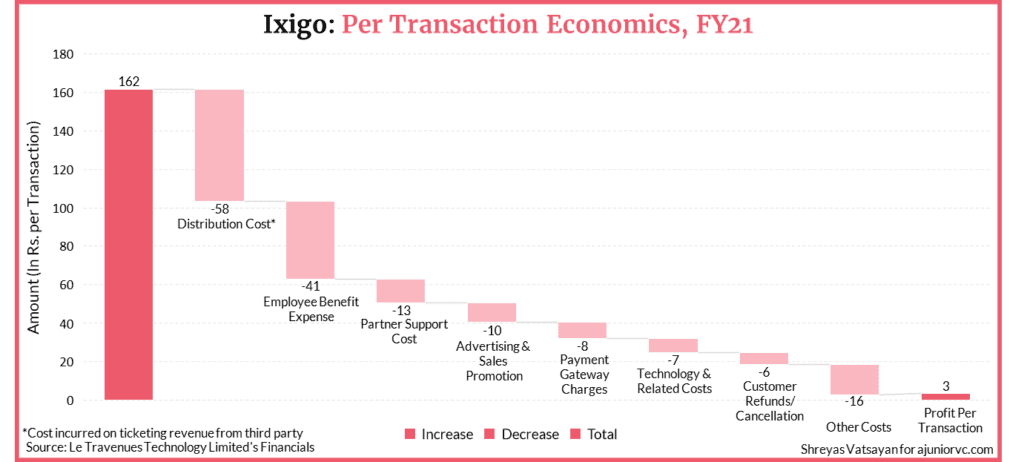

The rail ticket payment processing margins were the lowest among all segments, ranging from ₹20–40 per ticket. However, the game was of volume – almost ~66 per cent of reserved tickets were booked online in 2018.

Having built up trust with the next billion user segment for years, Ixigo envisioned its platform as its first gateway into online travel transactions.

To facilitate this, it enhanced the multilingual features of its platform. It developed non-complex and light applications with large font sizes to ensure ease of use for the new mobile internet user.

While playing a low-margin, large-volume strategy, this segment expected large portions to transition into an aspirational middle class eventually.

Train booking was like buying milk in a grocery store, a loss leader to higher margin products. Trains allow it to cross-sell and upsell higher-margin flight, hotel and tour bookings to an established, trusting customer base.

By 2019, Ixigo’s rail app had become the world’s sixth most-downloaded travel app and India’s third. It processed 4.27 million transactions valued at ₹3.8 bn per annum and had a ~90 per cent repeat transaction rate.

However, profits were still an unattainable goal for Ixigo, which it tried hard to achieve.

Pandemic Cancellation

Ixigo turned profitable in December 2019, a shining moment in their 14-year-long journey.

The future looked great and promising as the team had just embarked on a profitable journey. But, the pandemic happened in March 2020 and the travel and tourism industry came to a standstill.

Online Travel Aggregators (OTAs), including ixigo saw a massive decrease in the number of bookings matched by a huge increase in uninstalls. Suddenly, they found themselves heading towards a zero-revenue trap.

As a knee-jerk reaction, all the leading OTA players took steep-cost cutting measures, including reducing marketing spending and lay-off people.

However, ixigo’s response was different as it narrowed its focus on addressing customers’ pain points, increasing engagement on its mobile app, and did no lay-offs and exited the non-core business.

Refunds post widespread flight cancellations were the biggest pain point for consumers. Ixigo was the only OTA that proactively refunded all affected customers, sometimes even before the money was released by partner airlines.

Ixigo launched new products to keep traffic coming to its site with minimal marketing spending – a COVID Centre inside its train and flight app, and entertainment content to keep customers engaged and entertained during the toughest months of lockdown.

Some of its videos went viral.

As the travel industry started picking up post-June-2020, Ixigo introduced Assured, which enabled customers to access full refunds for cancellations up to 24 hours before the scheduled flight time by paying an extra 200 rupees.

Ixigo also worked on an internal discounting model giving users personalised deals on flights by partnering with airlines and hotels.

To focus on core business, Ixigo did a part tech, part IP deal with Spicejet for Travenues, which was built to create a Shopify airline platform. Ixigo also saw huge opportunities in ground transportation as digitisation was changing the dynamics of the industry.

In February 2021, the firm acquired ConfirmTkt, a fast-growing train-focused business, and together they became the number one OTA for train bookings in India, with over 42 per cent market share among OTAs by the end of FY21.

In August 2021, ixigo added another essential leg to its next billion user growth story, through the acquisition of the bus business of AbhiBus with a focus on strengthening its market share across travel categories

Ixigo’s response to the COVID crisis was different than other OTA players and the result was sweet, as it became an outlier in the OTA industry charting growth and profits in FY21 despite the challenges of the COVID.

It had to complete what it had started with MakeMyTrip 7 years ago.

Reaching the IPO Station

Ixigo’s evolution from a meta-search platform into an OTA had organically outgrown MakeMyTrip’s investment, and the intended synergies had long depleted.

The two had collaborated on content and international flights in Ixigo’s earlier avatar.

However, there was now an unmistakable overlap and unavoidable competition between their businesses.

MakeMyTrip’s presence on the cap table felt passive and was no longer the protective shadow for Ixigo to grow under. In August 2021, the two separated, with the former making close to an 8x return on its investment of ~$5 million, and the latter filing for a Rs. 1,600 crore IPO.

SEBI had approved the public issue in December that year. By then, however, the red-hot IPO market, which had also seen the successful listing of EaseMyTrip in March, had begun to mellow. Ixigo postponed the IPO and doubled down on operations instead.

By March 2022, Ixigo touched 5 million daily active users and 55.5 million monthly active users across all its platforms – Trains, Flights, Confirmtkt and AbhiBus. The multi-app strategy made it relevant to affluent travellers and aspiring Tier II, III & IV India users.

New habits learnt during the pandemic also meant that smaller towns and cities increasingly turned to online modes to book bus and train tickets. Ixigo saw 84%, 87.5% and 93% of its transactions with either the origin or the destination being a non-tier-I city in FY19, ’20 and ’21, respectively.

Ixigo’s economics had also improved dramatically, with a gross margin of ~65%. Its viral and thoughtful marketing combined with a strong product made marketing fall to 6% of overall AOV. Excluding employee spending and technology costs, it made a 30% contribution margin.

Even including employees, it was making a profit on every transaction.

Ixigo’s model of making small monies from a very large user base had found resounding validation from its assiduously acquired user base. Counting Patna and Lucknow as its biggest markets, Ixigo was also one of the first anomalies in the Indian tech space, built for Bharat before it expanded to India.

Its headcount of just over 500 was between a tenth and a third of its peers. Ixigo had also leveraged data science and machine learning to translate travel information and crowd-sourced data into actionable business intelligence, thereby operating efficiently.

Further, a repeat transaction rate of 85% also meant declining annual customer acquisition spending, which stood at Rs. 84 per customer in FY22, falling by over 11% since FY20.

Ixigo’s frugal positioning was thus built into its way of doing business.

Getting Confirmed for Greatness

Travel has always been a browse, and not a search, category.

The user typically looks for ideas and options rather than a specific result. The widespread adoption of ChatGPT in late 2022 means that travellers now want an LLM to act as a friendly neighbourhood travel agent.

Ixigo was the first to launch a GPT-powered plugin named PLAN to offer personalised recommendations and itineraries to users.

In 2023, Indian travellers are on the lookout for shorter vacations, flexible plans and thematic packages built around adventure, heritage, wellness and spirituality.

Riding the wave, Ixigo has launched its own independent hotel booking platform, collaborating with Booking.com earlier. It has joined hands with a travel-tech startup called Pick Your Trail to offer packages and tours.

Revenge tourism was one of the mega narratives in the aftermath of the pandemic. The vengeance is visible in Ixigo’s business performance.

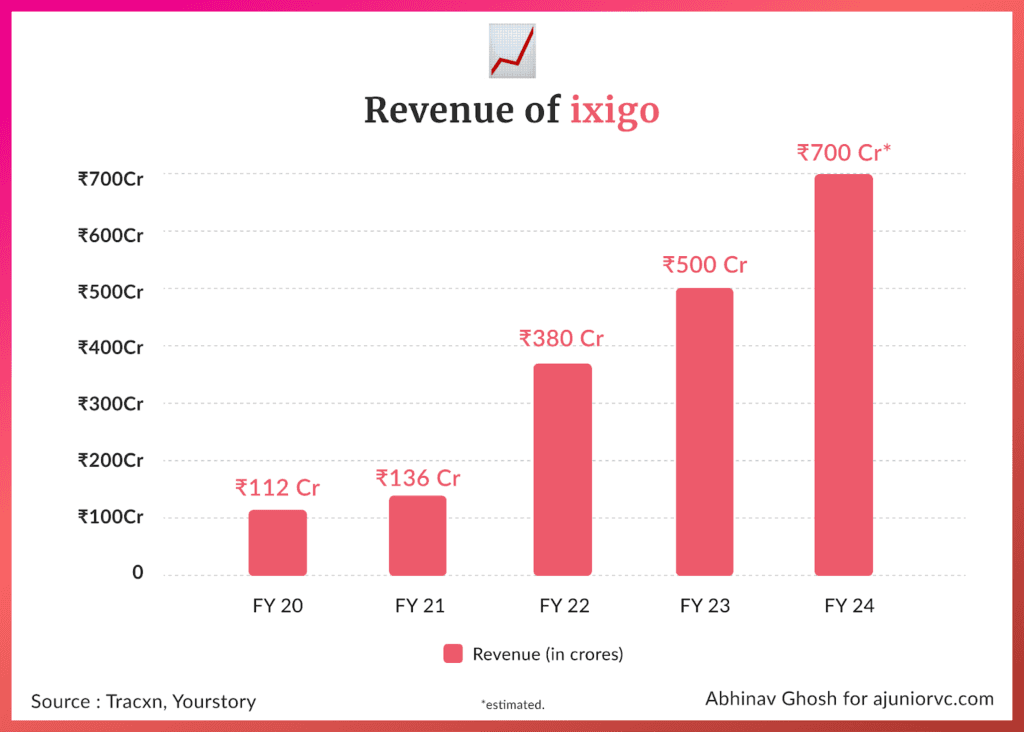

The company has seen 5x growth in 3 years, with an emphasis on being self-sustaining and cash flow positive. Revenue for FY23 is estimated to have clocked in at north of Rs. 500 crores, with an EBITDA margin of more than 7% and is expected to grow to ~Rs. 700 crores in FY24.

The platform now oversees 50 million yearly bookings totalling Rs. 10,000 crores and has set a steep target of doubling it over the next two years. Cumulative app downloads currently stand at 8 million every month.

Ixigo’s performance augurs well in a revenue-first reality, marked by a tempered funding environment and widespread layoffs, which it has appreciably avoided.

The upcoming public offer of Yatra.com would offer a peek into the public market’s appetite for tech startups in general and OTAs in particular.

Regardless of its next act, Ixigo’s painstaking rise to become one of India’s leading OTAs is a shining example of perseverance and the triumph of the entrepreneurial spirit. It has repeatedly survived the course to create an archetype for consumer tech startups looking to scale.

Therein also lies a lesson for internet companies coming out of India – that the consumer is money-minded yet discerning. She needs to be understood, catered to, and customised for as one of a kind. Absolute trust, hence, precedes successful monetisation.

Aloke and Rajnish took an established Western business model and Indianised it at every step of their journey. The founders, who have as much talent for survival in their DNA as business pluck, take pride in having built a cockroach enterprise.

The official sponsorship of the ongoing Men’s Asia Cup 2023 is yet another sign of Ixigo’s arrival. The platform had its genesis in accurately tracking PNR status for rail travellers.

Despite its ‘Waitlisted’ IPO and multiple near-instances of its existence getting ‘Cancelled’, Ixigo’s relevance in the new-age, tech-savvy, internet-consuming Indian mind space seems ‘Confirmed’.

Writing: Abhinay, Ajeet, Nikhil, Shreyas and Aviral Design: Abhinav