Apr 3, 2022

Is Navi an Instant Disruptor or on Borrowed Time?

Profile

Lending

Insurance

Finance

Platform

B2C

Series B-D

Last fortnight, Navi announced a 4,000 Cr IPO, which would be one of India’s biggest

Hunted by Tiger, Fired up Ambitions

Sachin Bansal was just about to be crowned as the king of India’s startup ecosystem.

From his time at IIT Delhi to working with Amazon and launching a highly Indian e-commerce company Flipkart, in 2007 with his friend Binny Bansal and finally selling it to Walmart, Sachin had been the poster-child of Indian startup ecosystem. Flipkart symbolized India tech entrepreneurship, and Sachin was its face.

With Flipkart in the process of being acquired for an incredible amount, Sachin’s position would be cemented for good.

But life had other plans.

Following Walmart's announcement in May 2018 that it will pay $16 billion for 77% in Flipkart, Sachin surprisingly decided to sell his 5.5% stake in the company as well for $1.2Bn. People close to him shared that Sachin was not aligned with the operating structure that was being proposed post-Walmart coming on board

Due to the massive interest, more speculation swirled

During the discussions with Walmart, it appeared Sachin Bansal was an integral part and was confident he would get a bigger role at Flipkart after the sale. He wanted stronger rights and guarantees that would provide more say in Flipkart’s operations.

However, this was strongly refuted by Krishnamurthy, whom Walmart wanted to retain as CEO. Dealing with Bansal’s demands would have delayed the deal. Tiger Global’s Fixel sided with Krishnamurthy and, suddenly, Sachin Bansal found himself cut out.

The prince had his kingdom snatched.

Immediately after exiting Flipkart, Sachin got busy re-purposing the Flipkart capital to build a robust portfolio and back other entrepreneurs in the country. He set up BAC Acquisitions (Renamed to Navi Technologies later) in December 2018 for investments and acquisitions purposes

Sachin confessed that he never imagined he would leave Flipkart. The vision to build Flipkart into a global behemoth had been tantalizingly close but snatched. Wth Navi the hunger to outdo reigned dominant.

The OG of the Indian startup ecosystem was ready to start the roller coaster again. The question was where would it go.

$100 Billion Dream, 2.0

In December 2018, armed with his over $1-billion fortune from the sale of Flipkart, Bansal chose fintech.

He relied on his belief that financial services present a large opportunity and by bringing a consumer tech thought process, new-age companies were well-positioned to tap into underpenetrated segments like insurance, mutual funds and capital market.

As India moved up Maslow’s hierarchy of needs, making money work would become increasingly important.

The middle-class Indian was still under-tapped and does not get quality service from banks and other financial service institutions because of the cost of operations

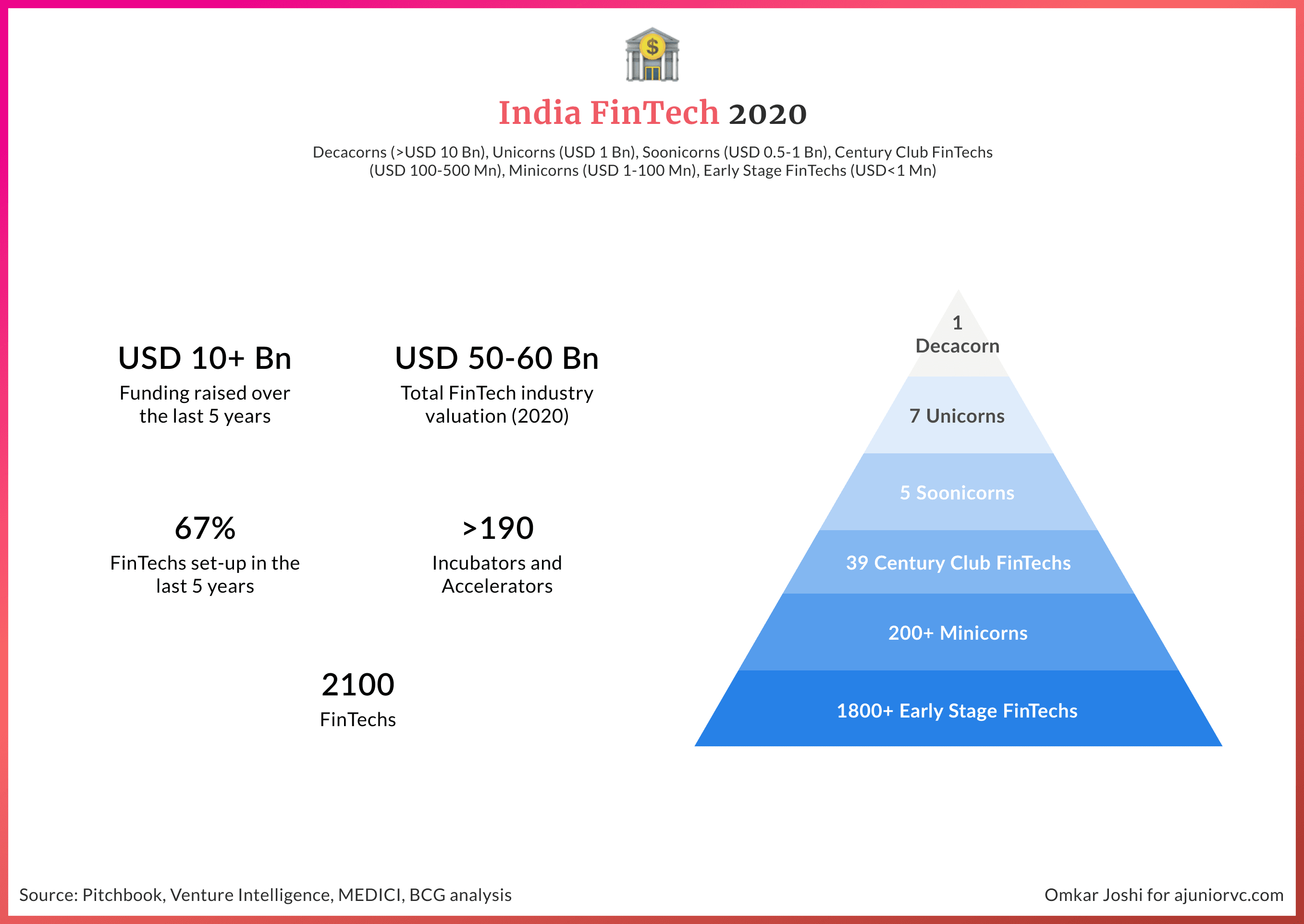

India was one of the world’s largest and fastest-growing FinTech markets, thanks to 500Mn smartphone users and a significant gap that is poised to be filled in terms of insurance, lending and mutual funds adoption as compared to peer averages.

On top of that, India’s world-class public digital infrastructure—IndiaStack, enabling regulatory environment and the fast-growing affluent middle class is the wind beneath India FinTechs’ wings.

With the right belief that India's financial services still working in web 1.0 era, Sachin launched Navi.

The aim was to simplify financial services and improve affordability for suite of financial products.

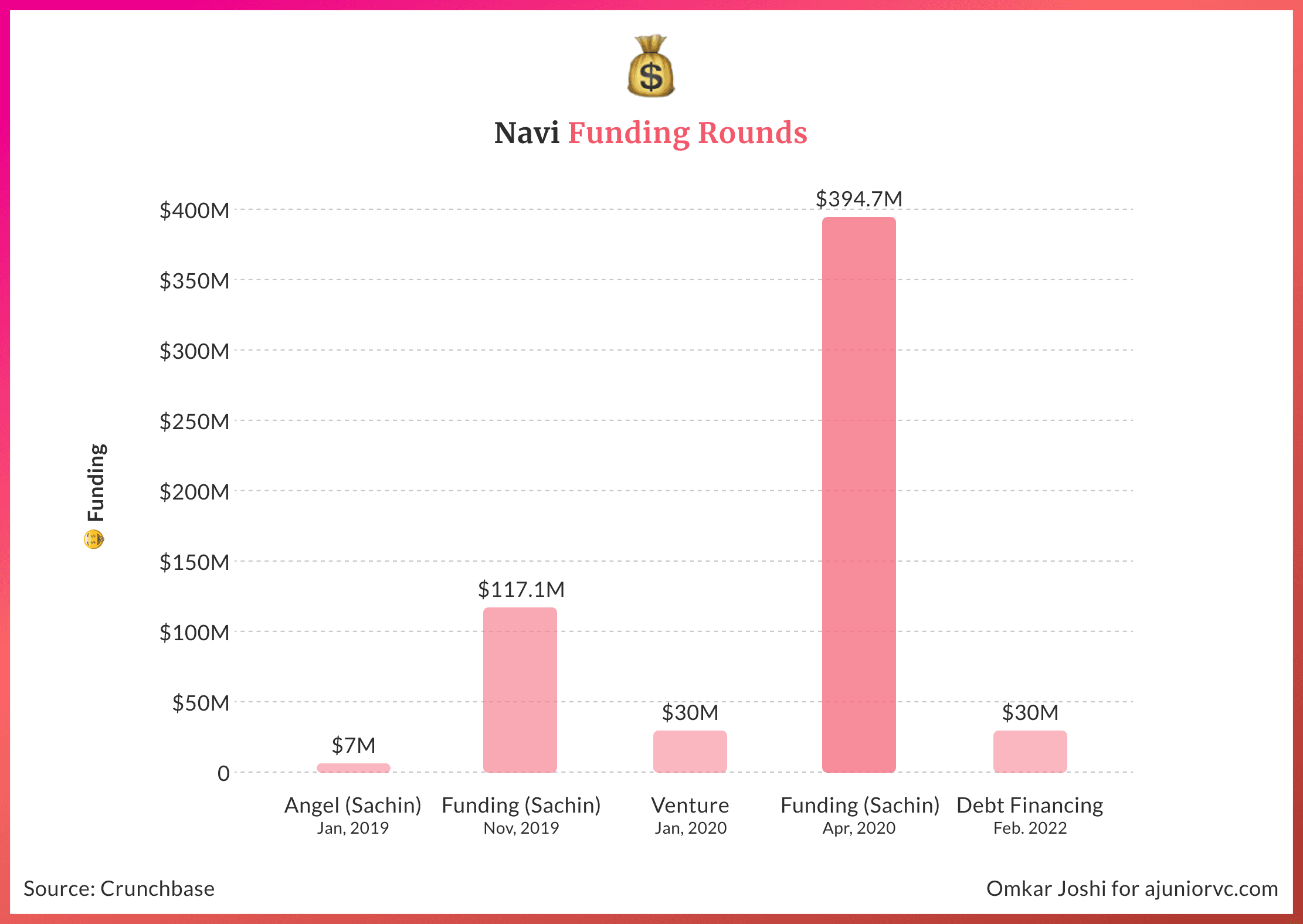

Sachin put nearly $390 Mn of his own money into the company within the next 2 years. Ankit Agarwal, his friend at IIT Delhi, and a veteran banker became a cofounder of the firm who invested around $5 Mn back then.

Unlike his previous journey of raising capital from investors, Sachin became the investor and founder of his own company.

He wanted ownership and control, to avoid what happened at Flipkart. The plan was to create a $100 Bn company with Navi.

Making Money Make Money Profitably

Navi started as a digital-first microfinance loan platform

Like any another fintech, Navi began to scale rapidly and generate revenue. More importantly, by 2019, it managed to do something that Flipkart was never able to achieve.

Navi had managed to become profitable

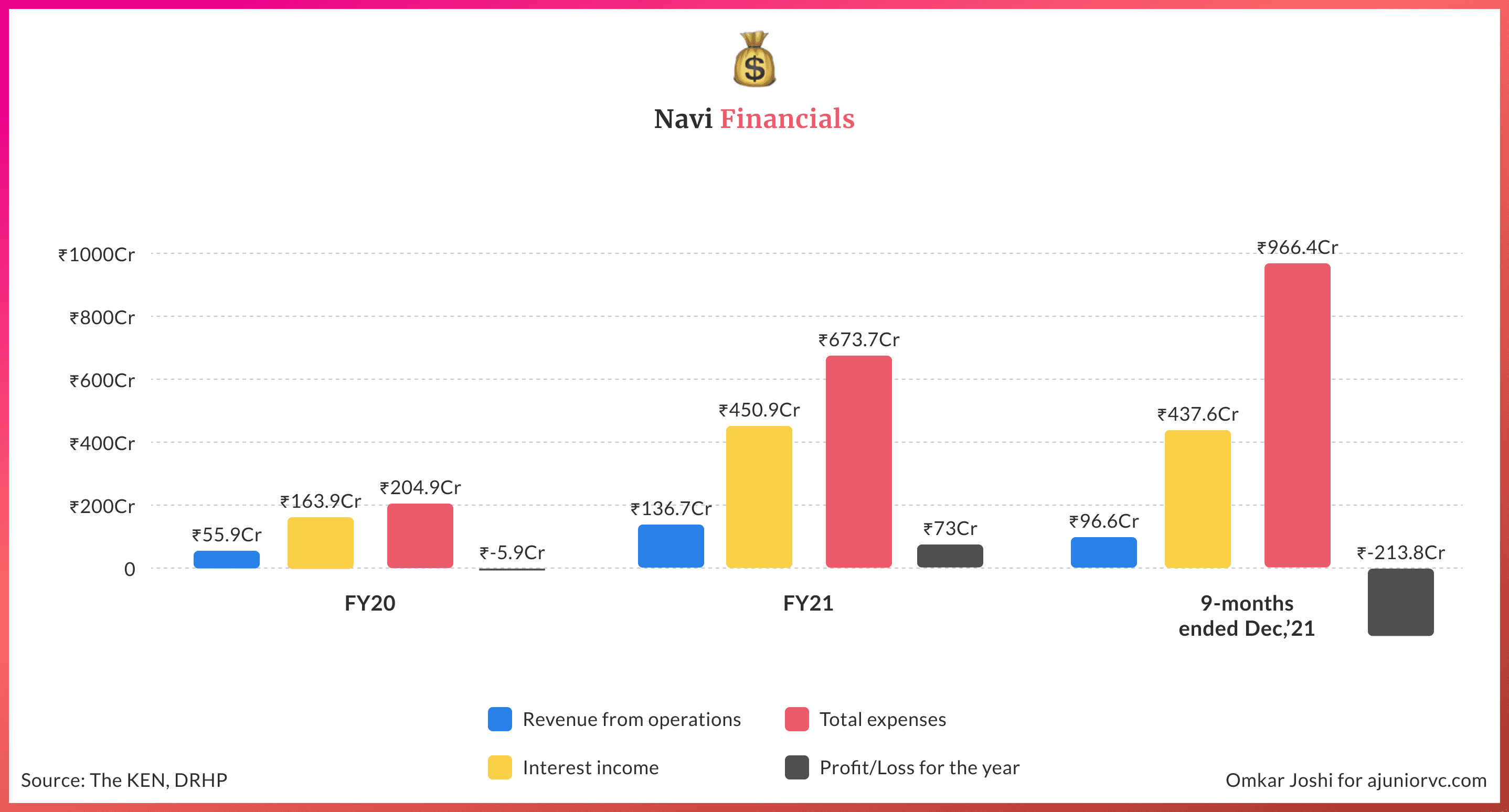

On a standalone basis, it reported INR 9 Cr profit after tax for 2019 with a total income of INR 64 Cr, The revenue for FY2020 was higher than expenses, but Navi ended up with a loss of INR 8 Cr in the fiscal after tax.

While Navi seemed like a fintech, it operated more like Indian financial giants.

Sachin believed that fintech were less serious about banking and also don’t have their own books. Spending money on shiny marketing campaigns was a bigger priority over building a strong business.

While many new-age startups have been advertising their services through elaborate marketing campaigns and during the IPL, Navi has tried a different tack in reaching its target customers, with ads plastered on the backs of autos in Bangalore.

The company always compared itself with banks and NBFCs. Navi was clearly a financial services company that happened to be good in technology.

It now wanted to get big, very fast

Inorganic Wings to Move Fast and Build Things

From the start, Navi wished to be a full-stack finance company, manufacturing financial products and not just distributing them.

To be a full-stack finance firm, one needed licenses from the regulators. It is hard, complex and cumbersome to get approval from one regulator, let alone three. Navi had the option of waiting out years to build its capabilities in the distribution space and then convince the regulators that it was a suitable candidate for the licenses.

The other way was to acquire companies that already had licenses but were in financial difficulties and turn them around. Navi chose this option as it systematically bought out firms that had existing regulatory licenses but were poorly run.

Regulatory arbitrage, but of a very different kind.

In Sep 2019, Navi bought Chaitanya Rural Intermediation Development Services Ltd (CRIDS). This firm operating under an NBFC license was primarily involved in microfinance (through another microfinance NBFC Chaitanya India Fin Credit Private Limited), though it also provided loans for two-wheelers, housing, and small business, and education.

Acquiring Chaitanya provided NAVI with an NBFC lending license which enabled Navi to offer loan products without the need to tie up with other NBFCs for capital. Over time, CRIDS was renamed Navi Finserv Ltd.

In Dec 2020, Navi saw an opportunity to enter the mutual fund space by acquiring the struggling Essel Mutual Fund. Acquiring this Asset Management Company gave Navi the license to operate as an NBFC as well as an AMC.

The regulator (SEBI) had previously relaxed the regulations which had earlier mandated that the sponsor firm should have a track record of profitable operations for the past 5 years before applying for an AMC license.

In Jan 2021, Navi bought out DHFL General Insurance from the Wadhawan General Group. The sale of the insurance arm was a distress sale for the DHFL group due to the bankruptcy of their home financing arm Dewan Housing Finance Ltd. According to reports, the deal was made for 100 crores for a firm that had an AUM of 400Cr at the time of acquisition.

The firm was later renamed Navi General Insurance Limited. This completed the troika of firms for Navi.

Entering the Big Money League

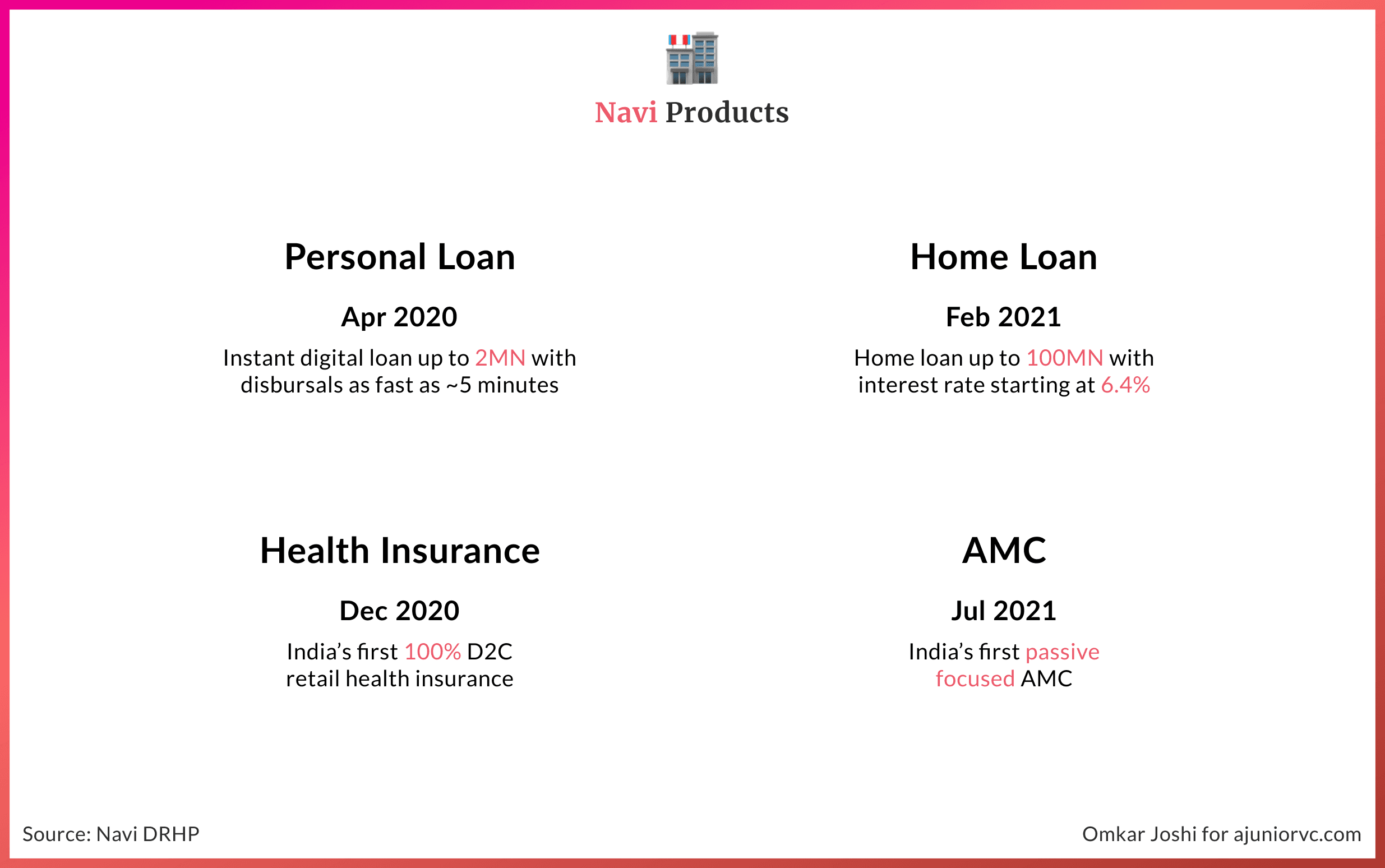

By 2021, Navi was now operating in 3 businesses of loans, insurance and mutual funds, all within barely 3 years.

It wasn’t easy for Navi to straddle such different products.

Traditionally these were three different businesse with three different regulators (RBI, IRDAI, and SEBI respectively). The financial and operational structures of these businesses were quite different and needed different skill sets.

Navi’s customer-centric view meant that it considered itself as a single financial firm that offered multiple products to its customers.

On the mutual fund side, Navi had 6 funds. Out of these 4 are index funds based on NIFTY Midcap 150, NIFTY Bank Index, NIFTY 50, and NIFTY NEXT 50. The remaining two mutual funds are funds of funds for the US market (Nasdaq and US total stock market). The expense ratios of the domestic index funds vary between 0.06%-0.26% which are pretty low.

On the insurance side, Navi offered health, motor, home, and travel insurance.

As discussed in our piece on Digit, it was difficult for a new insurance company to build trust among the client regarding long-term solvency. Customers were very circumspect to take long-duration insurance products such as life insurance from newly established firms.

An additional problem with newly established firms is that the metrics used for measuring the customer-centricity of firms such as claims ratio, percentage of claims paid, etc. had not stabilized yet.

This became a challenge for customers to buy even moderately longer products such as health insurance

Hence, like Navi, newly established firms started with shorter duration products such as vehicle insurance, travel insurance.

On the loans side, Navi offered unsecured personal loans as they had the highest market size.

The disbursal of personal loans is much more amenable to digitization than other types of loans. Obviously, higher digitization leads to lower costs of operations which adds to Navi’s bottom line.

These advantages of offering personal loans offset the higher risks of this market segment. As an example, the NPAs in personal loans for the entire industry was 5% during FY2020-21 whereas it was only 1-2% for collateral-based loans such as housing loans or 4-6% for auto loans.

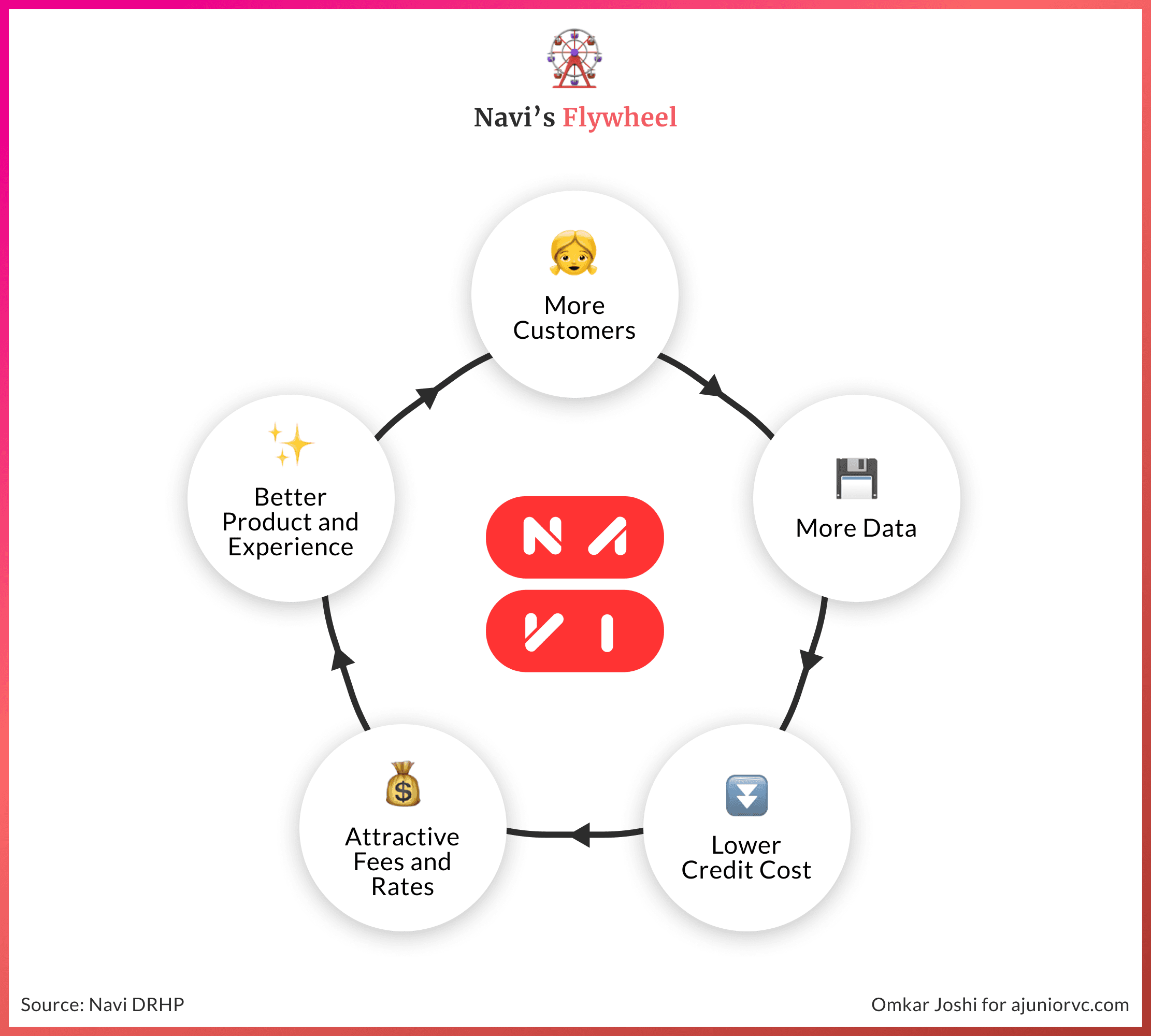

Navi’s deep tech and data analysis allowed it to disburse loans effectively.

As Navi began to scale by mid 2021, its hypothesis showed that India was a hugely underpenetrated market for financial services

Only 2% of Indians had insurance, less than 5% of Indians had investments in the equity market and only 10% had access to formal credit.

Any financial services firm in India, operating at a lower cost of operations than traditional banks could offer profitable products at lower ticket sizes which led to tremendous growth.

But growth has costs.

Big Money Ocean with Big Sharks

Navi’s breakneck growth started hurting it.

In the digital domain, the personal data protection of users did not rank very high on the list of priorities for firms.

In Dec 2021, Navi suffered user backlash when the firm sent SMSes to people along with their full PAN card details unmasked. Some of these users had never downloaded the Navi app nor had any transactions with Navi.

RBI had reached out to Navi about this incident

Further issues were raised with regard to home loan products. A home loan is a long duration product and the terms and conditions of the loan from Navi, mention that the user cannot uninstall the application from his phone till the loan is paid off.

Furthermore, the app requests permission to read SMS messages, contacts, and location data which also cannot be disabled by the user.

Along with Navi, other fintech players have also seen complaints lately related to aggressive collection agents, poor KYC standards before giving loans and loans being given in the name of PAN cards of users who never applied for them.

These constant hiccups and challenges in these operations are never good for the business.

Navi’s vision as a financial conglomerate necessitates it to get access to a universal banking license. The last two banks to be granted this license was Bandhan bank and IDFC first bank in 2015. However, both these entities had a long history of operations of at least one and a half decades before receiving this license.

Before 2015, Yes Bank and Kotak Mahindra bank had received their licenses way back in 2004 and 2003 respectively.

Navi would not like to wait for over 15 years to get this license. This license allows an entity to accept deposits from the public. Known in the banking industry as CASA (Current Account, Savings Accounts) deposits, these are the cheapest funds that are available for a bank/financial institution.

Any other type of borrowing is considerably expensive. This is obviously a coveted license.

Apart from these issues, there are other issues that Navi would need to tackle.

RBI’s 2015 licensing rules require the promoter of a private bank to reduce the holding to 40% within three years, 20% within 10 years and 15% within 15 years of operations starting. In addition, SEBI needs listed firms to have a minimum public holding of 25 per cent.

These regulations were likely to throw a spanner in Sachin’s plans to create a digital financial conglomerate, with him as a sole proprietor.

Navi kept marching on.

Innovating to Delight Consumers since 2008

For a new entrant in the financial services industry, it is essential to stay relevant.

Distribution is one way to stay relevant and build moats, but the overall market position can be strengthened when the distribution is combined with the in-house product offering.

The digital-only route to offer products and inorganic acquisition worked in favour of Navi.

As 2021 ended, Navi's personal loans business had an AUM of ~Rs. 1500 crore in a year.

Awareness around health insurance was gaining momentum because of the pandemic. Navi grabbed the opportunity.

Navi General Insurance introduced an option for customers to buy health insurance via a monthly subscription (EMI) instead of paying the annual premium upfront. The health insurance covered COVID-19 related hospitalization benefits.

As a result, ~30,000 policies were sold in 6 months between Jun21 and Dec21, and the share of retail health insurance policies rose to 15.7% from just 4.2% - a jump of 4x.

Navi was relentless to innovate further.

After the success of personal loans and health insurance products, they decided to use stock market liquidity and rising investor knowledge and intent to invest in the market.

Navi decided to launch its first passive mutual fund in Jul 2021- Navi Nifty 50 Index Fund.

The reason behind launching a passive mutual fund was simple. Focus on simple yet effective products.

Launching a passive fund made perfect sense for Navi, due to the interest in passive funds. Navi Nifty 50 Index Fund has an expense ratio of 0.06%, the lowest in the index schemes category.

With a digital-first and product innovation approach, Navi was making big strides and winning customer love.

But unlike Flipkart's money burning journey, Navi was making money.

Numbers Speak Louder than Words

From the beginning, the focus of the company was to make profits.

Navi had utilized its first year to learn the trade tricks and understand how best the resources can be used. Navi can't afford to burn a lot of money as it is not competing against the FinTechs, but it is competing against the established NBFCs and Banks. In the first year, Navi spent less than 1 Cr. in marketing!

By FY21, Navi fine-tuned the product offering and primarily focused on the lending business. Navi took the contrarian route for growth.

When the lenders (NBFCs primarily) focused on collections and restructuring their books during the pandemic, Navi decided to disburse loans to low-income groups. In 2021, Navi witnessed ~2 mn app downloads in just four months. Navi's average loan size hovered between Rs. 30,000 to Rs. 35,000.

The year was profitable despite the pandemic, with a revenue jump of ~4X over the previous year; the company posted a profit of Rs. 71.2 Cr. in the second year of operations. However, the marketing expense jumped by 38X (Rs. 38 Cr. from Rs. 1 Cr.), but the amount compared to other established FinTechs was still lower.

In FY22, the company launched multiple products and spent a considerable amount on marketing those products. As a result, ad and marketing expenses jumped by 10X (Rs. 400 Cr. from Rs. 38 Cr.) in the first nine months of FY22.

FY22 is still a loss-making year for Navi. The in-house products are getting traction, but the income from those products was still not significant. Navi is utilizing this year to push the products to increase the overall adoption of in-house products across segments.

Another interesting thing to consider was the asset-light operations.

Navi was primarily digital-only and wishes to continue like that, the fixed asset requirement for the company is still hovering around ~4% of the total revenue, which is in line with established players already.

In times to come, a digital-only play approach, sharp focus on collections in lending, risk control in insurance and innovative market-beating products in wealth would be instrumental for Navi to scale faster.

Conquered a Hill, A Mountain to Climb

The growth so far has been phenomenal for Navi.

In just over two years, Navi has built a loan AUM portfolio of Rs. 3,000 Cr.+ with a presence in the Insurance and Asset Management segment and 4 mm+ active app users.

The cherry on the top is the NPA for personal loans is 0.03% and for microfinance loans at 0.98%. These NPA numbers will make many marquee Indian Banks and NBFCs jealous. Maintaining that at scale will be crucial for Navi to win in the aggressive market.

But for Sachin Bansal, Navi had to be a USD 100B entity.

In March 2022, Navi filed for an IPO with market regulator SEBI. As per the IPO document, Navi is looking to raise Rs. 3,350 crore via a fresh equity issue and may consider fundraising up to Rs. 670 crore via pre-IPO placement.

It is interesting to note that funds will be used to expand two specific lines of business 1. Navi Finserv (NFPL) and 2. Navi General Insurance (NGIL).

The idea is clear - focus on strengthing the core segments through which money can be made and make them ‘cash cows’. Simultaneously, introduce newer segments and in-house manufactured products to strengthen the market leadership and improve consumers' stickiness.

But what next after lending, general insurance, and passive mutual fund business?

Navi is likely to foray into full-fledged banking and other financial services segments where the up-selling and cross-selling opportunities are much more.

Navi wants to replicate in asset management what Zerodha did with discount broking. If Navi can pull it off, it will see a lot of traction on its platform, which will reduce the customer acquisition cost (CAC), which is a pain point for many FinTechs.

Lesser cost with more active customers can take Navi into different orbit altogether. Navi can then expand into a Small Finance Bank, where it can source funds at a much lower cost, allowing it to strengthen its core lending portfolio.

Sachin Bansal is very optimistic, and he is not making the mistake of diluting his stake as he did in Flipkart. He wants to play this long and build it at least for the next two decades. A healthy stake of ~98.0% gives him a lot of rope to experiment with many new initiatives.

If Navi can replicate what they have achieved in two years, it can become a formidable force in India's core financial services ecosystem.

Will the original OG have the last laugh or is it running on borrowed time? Only time will tell but the story will definitely be popcorn crunchy epic.

By: Keshav, Ramandeep, Nilesh, Parth and Aviral